Hedge Fund Trian Partners Is Down Nearly 10% This Year

20 Januar 2016 - 2:00AM

Dow Jones News

Nelson Peltz's Trian Partners Ltd. hedge fund is down nearly 10%

in the first two weeks of the year, according to an investor update

reviewed by The Wall Street Journal.

Trian manages about $11 billion firmwide, making it one of the

largest activist hedge-fund firms in the world. Last year, its

Trian Partners fund gained more than 4%, according to a separate

investor document.

Trian is among many stock-focused hedge funds feeling pain in a

historically poor start for equity markets this year. Its largest

positions include the conglomerate General Electric Co., down more

than 8% this year, and c hemical giant DuPont Co., down 20%.

A Trian representative didn't immediately respond to a request

for comment.

Write to Rob Copeland at rob.copeland@wsj.com

(END) Dow Jones Newswires

January 19, 2016 19:45 ET (00:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

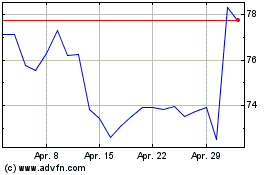

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024