0001835378False00018353782023-08-082023-08-080001835378us-gaap:CommonStockMember2023-08-082023-08-080001835378us-gaap:WarrantMember2023-08-082023-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 8, 2023

Innovid Corp.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Delaware | | 001-40048 | | 87-3769599 |

(State or other jurisdiction

of incorporation or organization) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

30 Irving Place, 12th Floor

New York, NY 10003

(Address of principal executive offices) (Zip Code)

(212) 966-7555

(Registrant’s telephone number, include area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | | | | | | | | | | |

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common stock, par value $0.0001 per share | | CTV | | New York Stock Exchange |

| Warrants to purchase one share of common stock, each at an exercise price of $11.50 per share | | CTVWS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 8, 2023, Innovid Corp. issued a press release announcing its financial results for the quarter ended June 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein to this item 2.02.

In accordance with General Instruction B.2 of Form 8-K, the information included under Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 3, 2023, Jonathan Saacks notified the Innovid Corp. of his resignation for personal reasons from the Board of Directors (the “Board”) and Nominating and Corporate Governance Committee of the Board, effective from close of business on August 9, 2023. Mr. Saacks’ retirement does not relate to any disagreement on matters related to the Company’s operations, policies or practices or an other matter.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | INNOVID CORP. |

| | | | |

| Date: August 8, 2023 | | By: | | /s/ Tanya Andreev-Kaspin |

| | Name: | | Tanya Andreev-Kaspin |

| | Title: | | Chief Financial Officer |

Innovid Reports Q2 2023 Financial Results

•Q2 revenue increased to $34.5 million, up 4% year-over-year

•Q2 measurement revenue contributed $7.8 million, up 10% year-over-year, representing 23% of total Q2 revenue

•Innovid raises full year 2023 revenue and Adjusted EBITDA* guidance

NEW YORK, August 8, 2023 /PRNewswire/ -- Innovid Corp. (NYSE:CTV) (the "Company"), an independent advertising platform for delivery, personalization, and measurement of converged TV across linear, connected TV (CTV), and digital, today announced financial results for the second fiscal quarter ended June 30, 2023.

“We exceeded our guidance for the second quarter, and delivered strong results fueled by CTV and measurement growth," said Zvika Netter, Co-Founder and CEO. "Our dedication to driving profitable growth this quarter resulted in double-digit Adjusted EBITDA margins and a raised full year 2023 outlook. As our core products drive robust margins, our execution resulted in a significant flow through of incremental revenue to the bottom line.

“Innovid continues to benefit from the shift from linear TV to CTV. We are having a great deal of success adding new customers and are focused on deepening our relationships with customers to activate more products. We remain confident in our position as a clear leader in building critical technology infrastructure for the future of TV advertising, and specifically CTV.”

Second Quarter 2023 Financial Summary

•Revenue increased to $34.5 million, reflecting year-over-year growth of 4%.

•US revenue grew to $31.6 million, up 7% year-over-year.

•Measurement contributed $7.8 million, up 10% year-over-year, representing 23% of revenue.

•CTV revenue, excluding TVSquared, increased to $13.6 million, up 9% year-over-year.

•Net loss was $(19) million, compared to a net profit of $4.3 million for the same period in 2022. Q2 net loss was impacted by a one time non-cash goodwill impairment expense of $14.5 million, resulting from a decline in our share price during Q2 2023.

•Adjusted EBITDA* increased to $4.5 million, representing 13% Adjusted EBITDA margin.

•Cash and cash equivalents as of June 30, 2023 were $43.4 million.

Recent Business Highlights

•CTV accounted for 51% of all video impressions served in Q2 2023, up from 50% of all video impressions served in Q2 2022.

•Our measurement growth is being fueled by some of our announced wins in Q2, including our partnerships with NBCUniversal and Disney.

•We continue to win and expand more accounts including some of the largest auto brands such as Mazda U.S. and American Honda and some of the biggest global advertisers including Microsoft, Otsuka Pharmaceutical U.S. and Pluto TV.

Financial Outlook

Innovid is providing the following financial guidance for Q3 and full year 2023:

•Q3 2023 revenue in a range between $33 million and $35 million.

•Q3 2023 Adjusted EBITDA* in a range between $3 million and $5 million.

•FY 2023 revenue in a range between $132 million and $136 million.

•FY 2023 Adjusted EBITDA* positive for the full year, Adjusted EBITDA margin* at least 10% for the full year.

Governance Update

On August 3, 2023, Jonathan Saacks notified the Company of his resignation for personal reasons from the Board of Directors (the “Board”) and Nominating and Corporate Governance Committee of the Board, effective from close of business on August 9, 2023.

*See Use of Non-GAAP Financial Information and Reconciliation of GAAP to Non-GAAP Financial Measures table.

Conference Call

The Company will host a conference call and webcast to discuss second quarter 2023 financial

results today at 8:30 a.m. Eastern Time. Hosting the call will be Zvika Netter, Co-founder

and Chief Executive Officer and Tanya Andreev-Kaspin, Chief Financial Officer. The conference call will be available via webcast at investors.innovid.com. To participate via telephone, please dial 888-645-4404 (toll free) or 862-298-0702 (international). Following the call, a replay of the webcast will be available for 90 days on the Innovid Investor Relations website.

Non-GAAP Measures and Certain Operational Metrics

Innovid prepares unaudited interim condensed consolidated financial statements in accordance with U.S. generally accepted accounting principles ("GAAP"). Innovid also discloses and discusses non-GAAP financial measures such as Adjusted EBITDA and Adjusted EBITDA margin.

We use Adjusted EBITDA and Adjusted EBITDA margin as measures of operational efficiency to understand and evaluate our core business operations. We believe that these non-GAAP financial measures are also useful to investors for period-to-period comparisons of our core business. Additionally, these figures provide an understanding and evaluation of our trends when comparing our operating results, on a consistent basis, by excluding items that we do not believe are indicative of our core operating performance.

These non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as substitutes for an analysis of our results as reported under GAAP. Some of the limitations of these measures are:

•they do not reflect changes in, or cash requirements for, our working capital needs;

•Adjusted EBITDA does not reflect our capital expenditures or future requirements for capital expenditures or contractual commitments;

•they do not reflect costs of acquiring and integrating businesses, which will continue to be a part of our growth strategy;

•they do not reflect one-time, non-recurring, bonus costs and third party costs associated with the SPAC merger transaction and regulatory filings;

•they do not reflect goodwill impairment;

•they do not reflect severance costs;

•they do not reflect income tax expense or the cash requirements to pay income taxes;

•they do not reflect our interest expense or the cash requirements necessary to service interest or principal payments on our debt; and

•although depreciation and amortization are non-cash charges related mainly to intangible assets and amortization of software development costs, certain assets being depreciated and amortized will have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements.

Other companies in our industry may calculate these non-GAAP financial measures differently than we do, limiting their usefulness as a comparative measure. You should compensate for these limitations by relying primarily on our US GAAP results and using the non-GAAP financial measures only supplementally.

Adjusted EBITDA is defined as net (loss) income attributable to Innovid, excluding (1) depreciation and amortization, (2) goodwill impairment, (3) stock-based compensation, (4) finance income, net, (5) transaction related expenses, (6) acquisition related expenses, (7) retention bonus expenses, (8) legal claims, (9) severance cost, (9) other, and (10) taxes on income. We calculate Adjusted EBITDA margin as Adjusted EBITDA divided by total revenue.

Innovid has provided a reconciliation of Adjusted EBITDA and Adjusted EBITDA margin to net (loss) income, the most directly comparable GAAP measure, for historical period in the appendix hereto but is not able to provide a reconciliation of the projected Adjusted EBITDA or Adjusted EBITDA margin to expected net (loss) income attributable to Innovid for the third quarter of 2023 or the full-year 2023, without unreasonable effort, due to the unknown effect, timing, and potential significance of the effects of taxes on income in multiple jurisdictions, finance (income)/expenses including valuations, among others. These items have in the past, and may in the future, significantly affect GAAP results in a particular period.

Forward Looking Statements

This press release includes "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1996. The Company's actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," "may," "will," "could," "should," "believes," "predicts," "potential," "continue," "aim," and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company's expectations regarding its future financial results and expected growth. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results, including Innovid's ability to achieve and, if achieved, maintain profitability, decrease and/or changes in CTV audience viewership behavior, Innovid's failure to make the right investment decisions or to innovate and develop new solutions, inaccurate estimates or projections of future financial performance, Innovid's failure to manage growth effectively, the dependence of Innovid's revenues and business on the overall demand for advertising and a limited number of advertising agencies and advertisers, the rejection of digital advertising by consumers, future restrictions on Innovid's ability to collect, use and disclose data, market pressure resulting in a reduction of Innovid's revenues per impression, Innovid's failure to adequately scale its platform infrastructure, exposure to fines and liability if advertisers, publishers and data providers do not obtain necessary and requisite consents from consumers for Innovid to process their personal data, competition for employee talent, seasonal fluctuations in advertising activity, payment-related risks, interruptions or delays in services from third parties, errors, defects, or unintended performance problems in Innovid's platform, intense market competition, failure to comply with the terms of third party open source components, changes in tax laws or tax rulings, failure to maintain an effective system of internal controls over financial reporting, failure to comply with data privacy and data protection laws, infringement of third-party intellectual property rights, difficulty in enforcing Innovid's own intellectual property rights, system failures, security breaches or cyberattacks, additional financing if required may not be available, the volatility of the price of Innovid's common stock and warrants, and other important factors discussed under the caption "Risk Factors" in Innovid's Annual Report on Form 10-K filed with the SEC on March 3, 2023, as such factors may be updated from time to time in its other filings with the SEC, accessible on the SEC's website at www.sec.gov and the Investors Relations section of Innovid's website at investors.innovid.com. You should carefully consider the risks and uncertainties described in the documents filed by the Company from time to time with the U.S. Securities and Exchange Commission. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Most of these factors are outside the Company's control and are difficult to predict. The Company cautions not to place undue reliance upon any forward-looking statements, including projections, which speak only as of the date made. The Company does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

About Innovid

Innovid (NYSE: CTV) powers advertising delivery, personalization, and measurement across linear, connected TV (CTV) and digital for the world's largest brands. Through a global infrastructure that enables cross-platform ad serving, data-driven creative, and measurement, Innovid offers its clients always-on intelligence to optimize advertising investment across channels, platforms, screens, and devices. Innovid is an independent platform that

leads the market in converged TV innovation, through proprietary technology and exclusive partnerships designed to reimagine TV advertising. Headquartered in New York City, Innovid serves a global client base through offices across the Americas, Europe, and Asia Pacific. To learn more, visit innovid.com or follow us on LinkedIn or Twitter.

Contacts

Investors:

Brinlea Johnson

IR@innovid.com

Media:

Caroline Yodice

cyodice@daddibrand.com

INNOVID, CORP. AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except stock and per stock data)

| | | | | | | | | | | |

| June 30, 2023 |

| December 31, 2022 |

| (Unaudited) | | |

| ASSETS |

| |

|

Cash and cash equivalents | $ | 43,384 | | | $ | 37,541 | |

| Short-term bank deposits | — | | | 10,000 | |

| Trade receivables, net (allowance for credit losses of $330 and $65 at June 30, 2023, and December 31, 2022, respectively) | 43,238 | | | 43,653 | |

Prepaid expenses and other current assets | 4,123 | | | 2,640 | |

Total current assets | 90,745 | | | 93,834 | |

Long-term deposit | 260 | | | 277 | |

Long-term restricted deposits | 396 | | | 430 | |

Property and equipment, net | 18,959 | | | 14,322 | |

Goodwill | 102,473 | | | 116,976 | |

| Intangible assets, net | 27,659 | | | 29,918 | |

| Operating lease right of use asset | 2,008 | | | 2,910 | |

| Other non-current assets | 834 | | | 938 | |

Total non-current assets | 152,589 | | | 165,771 | |

TOTAL ASSETS | $ | 243,334 | | | $ | 259,605 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Trade payables | 4,421 | | | 3,361 | |

| Employees and payroll accruals | 10,969 | | | 10,165 | |

| Lease liabilities - current portion | 1,611 | | | 2,186 | |

| Accrued expenses and other current liabilities | 5,194 | | | 5,474 | |

Total current liabilities | 22,195 | | | 21,186 | |

| Long-term debt | 20,000 | | | 20,000 | |

| Lease liabilities - non-current portion | 1,081 | | | 1,636 | |

| Other non-current liabilities | 9,461 | | | 6,554 | |

| Warrants liability | 1,022 | | | 4,301 | |

Total non-current liabilities | 31,564 | | | 32,491 | |

TOTAL LIABILITIES | 53,759 | | | 53,677 | |

| COMMITMENTS AND CONTINGENT LIABILITIES | | | |

| Common stock: $0.0001 par value - Authorized: 500,000,000 at June 30, 2023, and December 31, 2022; Issued and outstanding: 138,737,104 and 133,882,414 at June 30, 2023, and December 31, 2022, respectively | 13 | | | 13 | |

| Additional paid-in capital | 367,970 | | | 356,801 | |

| Accumulated deficit | (178,408) | | | (150,886) | |

| Total stockholders’ equity | 189,575 | | | 205,928 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 243,334 | | | $ | 259,605 | |

INNOVID, CORP. AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except stock and per stock data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (Unaudited) | | (Unaudited) | | (Unaudited) | | (Unaudited) |

| Revenues | $ | 34,546 | | | $ | 33,088 | | | $ | 65,031 | | | $ | 58,950 | |

| Cost of revenues (1) | 8,591 | | | 7,351 | | | 16,856 | | | 13,277 | |

| Research and development (1) | 6,876 | | | 9,710 | | | 13,993 | | | 16,964 | |

| Sales and marketing (1) | 11,460 | | | 14,320 | | | 23,097 | | | 24,671 | |

| General and administrative (1) | 8,924 | | | 9,955 | | | 18,574 | | | 21,410 | |

| Depreciation and amortization | 2,064 | | | 926 | | | 4,094 | | | 1,599 | |

| Goodwill impairment | 14,503 | | | — | | | 14,503 | | | — | |

| Operating loss | (17,872) | | | (9,174) | | | (26,086) | | | (18,971) | |

| Finance income, net | (248) | | | (13,306) | | | (2,723) | | | (15,617) | |

Loss before taxes | (17,624) | | | 4,132 | | | (23,363) | | | (3,354) | |

| Taxes on income | 1,335 | | | (168) | | | 4,159 | | | (205) | |

| Net (loss) income | (18,959) | | | 4,300 | | | (27,522) | | | (3,149) | |

| | | | | | | |

| Net (loss) income attributable to common stockholders | $ | (18,959) | | | $ | 4,300 | | | $ | (27,522) | | | $ | (3,149) | |

| Net (loss) income per stock attributable to common stockholders | | | | | | | |

| Basic | $ | (0.14) | | | $ | 0.03 | | | $ | (0.20) | | | $ | (0.02) | |

| Diluted | $ | (0.14) | | | $ | 0.03 | | | $ | (0.20) | | | $ | (0.02) | |

| Weighted-average number of stock used in computing net (loss) income per stock attributable to common stockholders | | | | | | | |

| Basic | 137,643,910 | | | 132,152,652 | | | 134,296,569 | | | 128,220,893 | |

| Diluted | 137,643,910 | | | 139,988,123 | | | 134,296,569 | | | 128,220,893 | |

(1) Exclusive of depreciation, amortization and goodwill impairment presented separately.

INNOVID, CORP. AND ITS SUBSIDIARIES CONDENSED STATEMENTS OF CHANGES IN TEMPORARY EQUITY AND STOCKHOLDERS’ EQUITY

(In thousands, except stock data)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Common stock | | Additional paid-in capital | Accumulated deficit | Total stockholders’ equity |

| | | | | Number | Amount | | |

| Balance as of December 31, 2021 | | | | | 119,017,380 | | $ | 12 | | | | $ | 293,719 | | $ | (132,476) | | $ | 161,255 | |

| Common stock and equity awards issued for acquisition of TVS | | | | | 11,549,465 | | 1 | | | | 47,151 | | — | | 47,152 | |

| Stock-based compensation | | | | | — | | — | | | | 1,496 | | — | | 1,496 | |

| Stock options exercised | | | | | 1,521,927 | | — | | | | 462 | | — | | 462 | |

| Net loss | | | | | — | | — | | | | — | | (7,449) | | (7,449) | |

| Balance as of March 31, 2022 (unaudited) | | | | | 132,088,772 | | $ | 13 | | | | $ | 342,828 | | $ | (139,925) | | $ | 202,916 | |

| Stock-based compensation | | | | | — | | — | | | | 4,628 | | — | | 4,628 | |

| Stock options exercised | | | | | 322,943 | | — | | | | 174 | | — | | 174 | |

| Net income | | | | | — | | — | | | | — | | 4,300 | | 4,300 | |

| Balance as of June 30, 2022 (unaudited) | | | | | 132,411,715 | | $ | 13 | | | | $ | 347,630 | | $ | (135,625) | | $ | 212,018 | |

| | | | | | | | | | | |

| | | Common stock | | Additional paid-in capital | Accumulated deficit | Total stockholders’ equity |

| | | | | Number | Amount | | |

| Balance as of December 31, 2022 | | | | | 133,882,414 | | $ | 13 | | | | $ | 356,801 | | $ | (150,886) | | $ | 205,928 | |

| Stock-based compensation | | | | | — | | — | | | | 4,897 | | — | | 4,897 | |

| Stock options exercised and RSUs vested | | | | | 2,734,320 | | — | | | | 250 | | — | | 250 | |

| Net loss | | | | | — | | — | | | | — | | (8,563) | | (8,563) | |

| Balance as of March 31, 2023 (unaudited) | | | | | 136,616,734 | | $ | 13 | | | | $ | 361,948 | | $ | (159,449) | | $ | 202,512 | |

| Stock-based compensation | | | | | — | | — | | | | 5,658 | | — | | 5,658 | |

| Stock options exercised and RSUs vested | | | | | 2,120,370 | | — | | | | 364 | | — | | 364 | |

| Net loss | | | | | — | | — | | | | — | | (18,959) | | (18,959) | |

| Balance as of June 30, 2023 (unaudited) | | | | | 138,737,104 | | $ | 13 | | | | $ | 367,970 | | $ | (178,408) | | $ | 189,575 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

INNOVID, CORP. AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands, except stock and per stock data)

| | | | | | | | | | | |

| Six Months Ended June 30, 2023 |

| 2023 |

| 2022 |

| Cash flows from operating activities: | (Unaudited) | | (Unaudited) |

| Net loss | $ | (27,522) | | | $ | (3,149) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization | 4,094 | | | 1,599 | |

| Goodwill impairment | 14,503 | | | — | |

| Stock-based compensation | 9,865 | | | 5,634 | |

| Change in fair value of warrants | (3,279) | | | (15,946) | |

| Changes in operating assets and liabilities | | | |

| Decrease / (increase) in trade receivables, net | 415 | | | (4,624) | |

| Increase in prepaid expenses and other current assets | (1,390) | | | (747) | |

| Decrease in operating lease right of use assets | 902 | | | 872 | |

| Increase / (decrease) in trade payables | 1,060 | | | (321) | |

| Increase in employees and payroll accruals | 804 | | | 1,044 | |

| Decrease in operating lease liabilities | (1,130) | | | (1,208) | |

| Increase in accrued expenses and other current liabilities | 2,626 | | | 945 | |

Net cash provided by / (used in) operating activities | 948 | | | (15,901) | |

| Cash flows from investing activities: | | | |

| Acquisition of business, net of cash acquired | — | | | (99,568) | |

| Internal use software capitalization | (5,591) | | | (3,516) | |

| Purchase of property and equipment | (189) | | | (221) | |

| Withdrawal of short-term bank deposits | 10,000 | | | — | |

| Increase in deposits | 27 | | | 32 | |

Net cash provided by / (used in) investing activities | 4,247 | | | (103,273) | |

| Cash flows from financing activities: | | | |

| Proceeds from loans | 10,000 | | | 9,000 | |

| Repayment of loans | (10,000) | | | — | |

| Payment of SPAC merger transaction costs | — | | | (3,185) | |

| Proceeds from exercise of options | 614 | | | 636 | |

Net cash provided by financing activities | 614 | | | 6,451 | |

| Increase (decrease) in cash, cash equivalents, and restricted cash | 5,809 | | | (112,723) | |

| Cash, cash equivalents, and restricted cash at the beginning of the period | 37,971 | | | 157,158 | |

| Cash, cash equivalents, and restricted cash at the end of the period | $ | 43,780 | | | $ | 44,435 | |

| Supplemental disclosure of cash flows activities: | | | |

| (1) Cash paid during the period for: | | | |

| Income taxes paid, net of tax refunds | $ | 879 | | | $ | 363 | |

| Interest | $ | 782 | | | $ | 137 | |

| (2) Non-cash transactions: | | | |

| Business combination consideration paid in stock | $ | — | | | $ | 47,152 | |

| Reconciliation of cash, cash equivalents, and restricted cash reported within the condensed consolidated balance sheets | | | |

| Cash and cash equivalents | 43,384 | | | 44,024 | |

| Long-term restricted deposits | 396 | | | 411 | |

| Total cash, cash equivalents, and restricted cash shown in the condensed consolidated statements of cash flows | $ | 43,780 | | | $ | 44,435 | |

Key Metrics and Non-GAAP Financial Measures

Adjusted EBITDA

In addition to our results determined in accordance with US GAAP, we believe that certain non-GAAP financial measures, including Adjusted earnings before interest, taxes, depreciation and amortization (“EBITDA”) and Adjusted EBITDA Margin are useful in evaluating our business. The following table presents a reconciliation of Adjusted EBITDA, a non-GAAP financial measure, to the most directly comparable financial measure prepared in accordance with GAAP.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Net (loss) income | $ | (18,959) | | | $ | 4,300 | | | $ | (27,522) | | | $ | (3,149) | |

| Net (loss) income margin | (55) | % | | 13 | % | | (42) | % | | (5) | % |

| Depreciation and amortization | 2,064 | | | 926 | | | 4,094 | | | 1,599 | |

| Goodwill impairment | 14,503 | | | — | | | 14,503 | | | — | |

| Stock-based compensation | 5,334 | | | 4,138 | | | 9,958 | | | 5,730 | |

| Finance income, net (a) | (248) | | | (13,306) | | | (2,723) | | | (15,617) | |

| Transaction related expenses (b) | — | | | 164 | | | — | | | 392 | |

| Acquisition related expenses (c) | — | | | 768 | | | — | | | 4,971 | |

| Retention bonus expenses (d) | 148 | | | 1,000 | | | 445 | | | 1,000 | |

| Legal claims | 342 | | | 435 | | | 656 | | | 435 | |

| Severance cost (e) | — | | | — | | | 845 | | | — | |

| Other | 23 | | | 83 | | | 272 | | | 175 | |

| Taxes on income | 1,335 | | | (168) | | | 4,159 | | | (205) | |

Adjusted EBITDA | $ | 4,542 | | | $ | (1,660) | | | $ | 4,687 | | | $ | (4,669) | |

Adjusted EBITDA margin | 13.1 | % | | (5.0) | % | | 7.2 | % | | (7.9) | % |

(a) Finance income, net consists mostly of remeasurement related to revaluation of our warrants, remeasurement of our foreign subsidiary’s monetary

assets, liabilities and operating results, and our interest expense.

(b) Transaction related expenses consist of costs related to the SPAC merger transaction.

(c) Acquisition related expenses consists of professional fees associated with the acquisition of TVS.

(d) Retention bonus expenses consists of retention bonuses for TVS employees.

(e) Severance cost is related to the personnel reductions that occurred during the first quarter of 2023.

Operational Metrics

In addition, Innovid’s management considers the number of core clients, annual core clients retention and annual core clients net revenue retention in evaluating the performance of the business. These metrics are reported annually. Prior to our acquisition of TVS in 2022, our definition of a core client included only advertisers that generated at least $100,000 revenue in a twelfth-months period. Following our acquisition of TVS, we have included publishers as core clients.

v3.23.2

Cover

|

Aug. 08, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 08, 2023

|

| Entity Registrant Name |

Innovid Corp.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40048

|

| Entity Tax Identification Number |

87-3769599

|

| Entity Address, Address Line One |

30 Irving Place

|

| Entity Address, Address Line Two |

12th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10003

|

| City Area Code |

212

|

| Local Phone Number |

966-7555

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001835378

|

| Amendment Flag |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

CTV

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase one share of common stock, each at an exercise price of $11.50 per share

|

| Trading Symbol |

CTVWS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

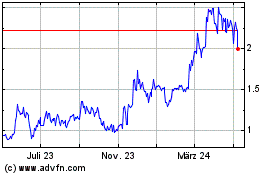

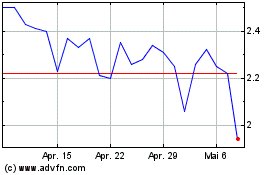

Innovid (NYSE:CTV)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Innovid (NYSE:CTV)

Historical Stock Chart

Von Apr 2023 bis Apr 2024