Revenue of $79.1 Billion for the Fourth

Quarter, a 14.7 Percent Year-Over-Year Increase

Fourth Quarter GAAP Diluted EPS of $0.02 and

Adjusted Diluted EPS of $3.34

Revenue of $294.0 Billion for Fiscal Year 2024,

a 12.1 Percent Year-Over-Year Increase

Fiscal Year 2024 GAAP Diluted EPS of $7.53 and

Adjusted Diluted EPS of $13.76

Company increases its quarterly dividend by 8

percent

Cencora, Inc. (NYSE: COR) today reported that in its fiscal year

2024 fourth quarter ended September 30, 2024, revenue increased

14.7 percent to $79.1 billion. Revenue increased 12.1 percent to

$294.0 billion for the fiscal year. On the basis of U.S. generally

accepted accounting principles (GAAP), diluted earnings per share

(EPS) was $0.02 for the September quarter of fiscal 2024, compared

to $1.72 in the prior year quarter. Adjusted diluted EPS, which is

a non-GAAP measure that excludes items described below, increased

16.8 percent to $3.34 in the fiscal fourth quarter. For fiscal year

2024, diluted EPS decreased 11.7 percent to $7.53. For fiscal year

2024, adjusted diluted EPS increased 14.8 percent to $13.76.

“Cencora took important steps forward in fiscal 2024 as we

continued to evolve our global enterprise through the advancement

of our pharmaceutical distribution capabilities and execute on our

strategy,” said Bob Mauch, President and Chief Executive Officer of

Cencora. “This morning's announcement of our acquisition of Retina

Consultants of America furthers our ability to build on our

leadership in specialty and deliver on our strategic imperatives.

The strength of our business, value of our strategy and

unparalleled expertise of our team members continues to drive

Cencora's performance and results.”

“As we move into fiscal 2025, we are leading with a

customer-centric approach, embracing an enterprise-powered mindset

and a focus on learning to ensure we remain a differentiated

healthcare solutions provider, both now and into the future,” Mr.

Mauch continued. “Cencora is well positioned for continued growth

and committed to long-term value creation for all our stakeholders

as we continue to build on the critical role we play at the center

of healthcare.”

Fourth Quarter Fiscal Year 2024 Summary

Results

GAAP

Adjusted (Non-GAAP)

Revenue

$79.1B

$79.1B

Gross Profit

$2.5B

$2.5B

Operating Expenses

$2.4B

$1.6B

Operating Income

$127M

$851M

Interest Expense, Net

$21M

$21M

Effective Tax Rate

94.0%

20.3%

Net Income Attributable to

Cencora

$3M

$662M

Diluted Earnings Per Share

$0.02

$3.34

Diluted Shares Outstanding

198.1M

198.1M

Below, Cencora presents descriptive summaries of the Company’s

GAAP and adjusted (non-GAAP) quarterly and fiscal year results. In

the tables that follow, GAAP results and GAAP to non-GAAP

reconciliations are presented. For more information related to

non-GAAP financial measures, including adjustments made in the

periods presented, please refer to the Supplemental Information

Regarding Non-GAAP Financial Measures following the tables.

Fourth Quarter GAAP

Results

- Revenue: In the fourth quarter of

fiscal 2024, revenue was $79.1 billion, up 14.7 percent compared to

the same quarter in the previous fiscal year, reflecting a 15.7

percent increase in revenue within U.S. Healthcare Solutions and a

5.5 percent increase in revenue within International Healthcare

Solutions.

- Gross Profit: Gross profit in the

fourth quarter of fiscal 2024 was $2.5 billion, a 10.6 percent

increase compared to the same period in the previous fiscal year

primarily due to an increase in gross profit in the U.S. Healthcare

Solutions segment, a decrease in LIFO expense, and a lower Turkey

highly inflationary impact on inventory in the current year

quarter. Gross profit as a percentage of revenue was 3.15 percent,

a decline of 12 basis points from the prior year quarter due to the

decline of U.S. Healthcare Solutions' gross profit margin primarily

due to increased sales of products labeled for diabetes and/or

weight loss in the GLP-1 class, which have lower profit margins,

and a lack of exclusive COVID-19 therapy sales, which had higher

gross profit margins.

- Operating Expenses: In the fourth

quarter of fiscal 2024, operating expenses were $2.4 billion, up

33.2 percent from the same period last fiscal year, primarily due

to: (i) a $418 million goodwill impairment charge related to

PharmaLex; (ii) an increase in distribution, selling, and

administrative expenses to support our continued business growth;

and (iii) an increase in litigation and opioid-related expense.

Operating expenses as a percentage of revenue in the fiscal 2024

fourth quarter was 2.99 percent compared to 2.58 percent for the

same period in the previous fiscal year.

- Operating Income: In the fourth

quarter of fiscal 2024, operating income was $126.6 million, a 73.4

percent decrease compared to the same period in the previous fiscal

year primarily due to the increase in operating expenses, offset in

part by the increase in gross profit. Operating income as a

percentage of revenue was 0.16 percent in the fourth quarter of

fiscal 2024 compared to 0.69 percent for the same period in the

previous fiscal year.

- Interest Expense, Net: In the

fourth quarter of fiscal 2024, net interest expense of $21.0

million decreased 65.6 percent versus the prior year quarter due to

an increase in interest income as a result of higher investment

interest rates and higher average investment cash balances, and a

decrease in interest expense driven by a decrease in interest

expense at our European distribution business primarily due to

decreased borrowings in Turkey and the September 2023 divestiture

of our less-than-wholly-owned subsidiary in Egypt.

- Effective Tax Rate: The effective

tax rate was 94.0 percent for the fourth quarter of fiscal 2024

primarily due to the PharmaLex goodwill impairment, which is

largely not deductible for income tax purposes. The effective tax

rate was 21.8 percent in the prior year quarter.

- Diluted Earnings Per Share:

Diluted earnings per share was $0.02 in the fourth quarter of

fiscal 2024, a 98.8 percent decrease compared to the previous

fiscal year's fourth quarter.

- Diluted Shares Outstanding:

Diluted weighted average shares outstanding for the fourth quarter

of fiscal 2024 were 198.1 million, a decrease of 2.6 percent versus

the prior fiscal year fourth quarter primarily due to share

repurchases.

Fourth Quarter Adjusted (non-GAAP)

Results

- Revenue: No adjustments were made

to the GAAP presentation of revenue. In the fourth quarter of

fiscal 2024, revenue was $79.1 billion, up 14.7 percent compared to

the same quarter in the previous fiscal year, reflecting a 15.7

percent increase in revenue within U.S. Healthcare Solutions and a

5.5 percent increase in revenue within International Healthcare

Solutions.

- Adjusted Gross Profit: Adjusted

gross profit in the fourth quarter of fiscal 2024 was $2.5 billion,

a 6.6 percent increase compared to the same period in the previous

fiscal year primarily due to an increase in gross profit in the

U.S. Healthcare Solutions segment. Adjusted gross profit as a

percentage of revenue was 3.10 percent in the fiscal 2024 fourth

quarter, a decline of 24 basis points when compared to the prior

year quarter due to the decline of U.S. Healthcare Solutions' gross

profit margin primarily due to increased sales of products labeled

for diabetes and/or weight loss in the GLP-1 class, which have

lower profit margins, and a lack of exclusive COVID-19 therapy

sales, which had higher gross profit margins.

- Adjusted Operating Expenses: In

the fourth quarter of fiscal 2024, adjusted operating expenses were

$1.6 billion, a 6.8 percent increase compared to the same period in

the previous fiscal year primarily due to an increase in

distribution, selling, and administrative expenses to support our

continued business growth. Adjusted operating expenses as a

percentage of revenue in the fiscal 2024 fourth quarter was 2.03

percent, a decline of 15 basis points when compared to the prior

year quarter.

- Adjusted Operating Income: In the

fourth quarter of fiscal 2024, adjusted operating income was $851.1

million, a 6.3 percent increase compared to the same period in the

prior fiscal year, driven by a 10.2 percent increase in U.S.

Healthcare Solutions, partially offset by an 8.6 percent decrease

in International Healthcare Solutions. Adjusted operating income as

a percentage of revenue was 1.08 percent in the fiscal 2024 fourth

quarter, a decline of 8 basis points when compared to the prior

year quarter.

- Interest Expense, Net: No

adjustments were made to the GAAP presentation of net interest

expense. In the fourth quarter of fiscal 2024, net interest expense

of $21.0 million decreased 65.6 percent versus the prior year

quarter due to an increase in interest income as a result of higher

investment interest rates and higher average investment cash

balances, and a decrease in interest expense driven by a decrease

in interest expense at our European distribution business primarily

due to decreased borrowings in Turkey and the September 2023

divestiture of our less-than-wholly-owned subsidiary in Egypt.

- Adjusted Effective Tax Rate: The

adjusted effective tax rate was 20.3 percent for the fourth quarter

of fiscal 2024 compared to 21.6 percent in the prior year

quarter.

- Adjusted Diluted Earnings Per

Share: Adjusted diluted earnings per share was $3.34 in the

fourth quarter of fiscal 2024, a 16.8 percent increase compared to

$2.86 in the previous fiscal year fourth quarter.

- Diluted Shares Outstanding: No

adjustments were made to the GAAP presentation of diluted shares

outstanding. Diluted weighted average shares outstanding for the

fourth quarter of fiscal 2024 were 198.1 million, a decrease of 2.6

percent versus the prior fiscal year fourth quarter primarily due

to share repurchases.

Segment Discussion

The Company is organized geographically based upon the products

and services it provides to its customers under two reportable

segments: U.S. Healthcare Solutions and International Healthcare

Solutions.

U.S. Healthcare Solutions

Segment

U.S. Healthcare Solutions revenue was $71.7 billion in the

fourth quarter of fiscal 2024, an increase of 15.7 percent compared

to the same quarter in the previous fiscal year primarily due to

overall market growth primarily driven by unit volume growth,

including increased sales of products labeled for diabetes and/or

weight loss in the GLP-1 class, and increased sales of specialty

products to physician practices and health systems. Segment

operating income of $697.4 million in the fourth quarter of fiscal

2024 was up 10.2 percent compared to the same period in the

previous fiscal year due to an increase in gross profit, offset in

part by an increase in operating expenses.

International Healthcare Solutions

Segment

International Healthcare Solutions revenue was $7.4 billion in

the fourth quarter of fiscal 2024, an increase of 5.5 percent

compared to the same period in the prior fiscal year. Segment

operating income in the fourth quarter of fiscal 2024 was $153.7

million, a decrease of 8.6 percent, primarily due to higher

information technology expenses in our European distribution

business and lower operating income at our Canadian business,

partially offset by the higher operating income at our global

specialty logistics business. On a constant currency basis,

International Healthcare Solutions revenue increased by 7.9 percent

and operating income decreased by 8.0 percent.

Fiscal Year 2024 Summary

Results

GAAP

Adjusted (non-GAAP)

Revenue

$294.0B

$294.0B

Gross Profit

$9.9B

$9.7B

Operating Expenses

$7.7B

$6.1B

Operating Income

$2.2B

$3.6B

Interest Expense, Net

$157M

$157M

Effective Tax Rate

24.2%

20.8%

Net Income Attributable to

Cencora

$1.5B

$2.8B

Diluted Earnings Per Share

$7.53

$13.76

Diluted Shares Outstanding

200.3M

200.3M

Summary Fiscal Year GAAP

Results

In fiscal year 2024, GAAP diluted EPS was $7.53 compared to

$8.53 in the prior fiscal year. Revenue increased 12.1 percent from

the prior fiscal year to $294.0 billion. Gross profit increased

10.6 percent to $9.9 billion due to increases in gross profit in

both reportable segments, and a LIFO credit in the current fiscal

year in comparison to a LIFO expense in the prior fiscal year,

offset in part by lower gains from antitrust litigation

settlements. Operating expenses increased 16.9 percent largely due

to a $418.0 million goodwill impairment related to PharmaLex and

increases in (i) distribution, selling, and administrative

expenses, (ii) litigation and opioid-related expenses, which was a

credit in the prior year fiscal year due to the receipt of funds

previously held in an opioid indemnity escrow account, and (iii)

amortization expense. Operating income decreased 7.1 percent due to

the increase in operating expenses, offset in part by the increase

in gross profit. Diluted weighted average shares outstanding in

fiscal 2024 were 200.3 million, down 2.1 percent from the prior

fiscal year primarily due to share repurchases.

Summary Fiscal Year Adjusted (non-GAAP)

Results

In fiscal year 2024, adjusted diluted EPS was $13.76 compared to

$11.99 in the prior fiscal year. Revenue increased 12.1 percent to

$294.0 billion. Adjusted gross profit increased 8.1 percent to $9.7

billion due to the increases in gross profit in both reportable

segments. Adjusted operating expenses increased 6.5 percent to $6.1

billion primarily due to an increase in distribution, selling, and

administrative expenses. Adjusted operating income increased 10.9

percent to $3.6 billion due to the increase in gross profit, offset

in part by increased operating expenses. Adjusted operating income

margin decreased by 1 basis point to 1.24 percent.

Recent Company Highlights &

Milestones

- Cencora today announced that it has entered into a definitive

agreement to acquire Retina Consultants of America (“RCA”), a

leading management services organization (MSO) of retina

specialists.

- Cencora completed its leadership succession plan on October 1,

2024. Robert P. Mauch, PharmD, PhD assumed the role of President

and Chief Executive Officer and joined the Company’s Board of

Directors. Steven H. Collis, who retired from his role as President

and Chief Executive Officer of the Company, has transitioned to

Executive Chairman of the Cencora Board of Directors.

- Cencora announced the appointment of Francois Mandeville to its

executive team as Executive Vice President, Strategy and

M&A.

- Cencora announced the appointment of Pawan Verma to its

executive team as Executive Vice President and Chief Data and

Information Officer.

- Cencora celebrated its third annual Global Inclusion Day and

re-committed its promise to disability inclusion with Robert Mauch

signing the Disability:IN CEO Letter on Disability Inclusion for

the second consecutive year.

Dividend Declaration

On November 5, 2024, the Company's Board of Directors declared a

quarterly dividend of $0.55 per common share, an 8 percent increase

in its quarterly dividend rate from $0.51 per common share. The

quarterly dividend of $0.55 per common share is payable November

29, 2024, to stockholders of record at the close of business on

November 15, 2024.

Fiscal Year 2025

Expectations

The Company does not provide forward-looking guidance on a GAAP

basis as certain financial information, the probable significance

of which cannot be determined, is not available and cannot be

reasonably estimated. Please refer to the Supplemental Information

Regarding Non-GAAP Financial Measures following the tables for

additional information.

Fiscal Year 2025 Expectations on an

Adjusted (non-GAAP) Basis

Cencora has introduced its full fiscal year 2025 financial

guidance, which reflects adjusted operating income growth of 5

percent to 6.5 percent and adjusted diluted EPS growth of 8 percent

to 10 percent. Since the Company’s preliminary fiscal 2025 guidance

provided on its Form 8-K filed on September 5, 2024, Cencora has

executed on opportunistic share repurchases in September and

October and had continued momentum in the business. The Company

expects:

- Revenue growth to be in the range of 7 to 9 percent;

- U.S. Healthcare Solutions segment revenue growth to be in the

range of 7 to 9 percent;

- International Healthcare Solutions segment revenue growth to be

in the range of 7 to 9 percent;

- Adjusted diluted earnings per share to be in the range of

$14.80 to $15.10.

Additional expectations include:

- Adjusted operating income growth to be in the range of 5 to 6.5

percent;

- U.S. Healthcare Solutions segment operating income growth to be

in the range of 5 to 6.5 percent;

- International Healthcare Solutions segment operating income

growth to be in the range of 5 to 6.5 percent;

- Interest expense to be in the range of $150 million to $170

million;

- Adjusted effective tax rate of approximately 21 percent;

- Adjusted free cash flow to be in the range of $2.0 billion to

$3.0 billion;

- Capital expenditures to be approximately $600 million; and

- Weighted average diluted shares outstanding to be approximately

196 million.

Cencora’s fiscal 2025 guidance does not currently include the

impact of the RCA acquisition, which will be incorporated into

expectations following the transaction close.

For additional details regarding guidance expectations on a

constant currency basis, please refer to our slide presentation for

investors.

Conference Call & Slide

Presentation

The Company will host a conference call to discuss the results

at 8:30 a.m. ET on November 6, 2024. A slide presentation for

investors has also been posted on the Company's website at

investor.cencora.com. The dial-in number for the live call will be

(833) 470-1428. From outside the United States and Canada, dial +1

(404) 975-4839. The access code for the call will be 272044. The

live call will also be webcast via the Company’s website at

investor.cencora.com. Users are encouraged to log on to the webcast

approximately 10 minutes in advance of the scheduled start time of

the call.

Replays of the call will be made available via telephone and

webcast. A replay of the webcast will be posted on

investor.cencora.com approximately one hour after the completion of

the call and will remain available for one year. The telephone

replay will also be available approximately one hour after the

completion of the call and will remain available for seven days. To

access the telephone replay from within the U.S. and Canada, dial

(866) 813-9403. From outside the U.S. and Canada, dial +1 (929)

458-6194. The access code for the replay is 260569.

Upcoming Investor Events

Cencora management will be attending the following investor

events in the coming months:

- Evercore ISI Healthcare Conference, December 3-5, 2024;

- Citi Global Healthcare Conference, December 3-6, 2024; and

- J.P. Morgan Healthcare Conference, January 13-16, 2025.

Please check the website for updates regarding the timing of the

live presentation webcasts, if any, and for replay information.

About Cencora

Cencora is a leading global pharmaceutical solutions

organization centered on improving the lives of people and animals

around the world. We partner with pharmaceutical innovators across

the value chain to facilitate and optimize market access to

therapies. Care providers depend on us for the secure, reliable

delivery of pharmaceuticals, healthcare products, and solutions.

Our 46,000+ worldwide team members contribute to positive health

outcomes through the power of our purpose: We are united in our

responsibility to create healthier futures . Cencora is ranked #10

on the Fortune 500 and #24 on the Global Fortune 500 with more than

$290 billion in annual revenue. Learn more at

investor.cencora.com.

Cencora’s Cautionary Note Regarding Forward-Looking

Statements

Certain of the statements contained in this press release are

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Securities

Exchange Act”). Words such as "aim," "anticipate," "believe,"

"can," "continue," "could," "estimate," "expect," "intend," "may,"

"might," "on track," "opportunity," "plan," "possible,"

"potential," "predict," "project,” "seek," "should," "strive,"

"sustain," "synergy," "target," "will," "would" and similar

expressions are intended to identify such forward-looking

statements, but the absence of these words does not mean the

statement is not forward-looking. These statements are based on

management’s current expectations and are subject to uncertainty

and changes in circumstances and speak only as of the date hereof.

These statements are not guarantees of future performance and are

based on assumptions and estimates that could prove incorrect or

could cause actual results to vary materially from those indicated.

A more detailed discussion of the risks and uncertainties that

could cause our actual results to differ materially from those

indicated is included (i) in the "Risk Factors" and "Management's

Discussion and Analysis" sections in the Company’s Annual Report on

Form 10-K for the fiscal year ended September 30, 2023 and

elsewhere in that report and (ii) in other reports filed by the

Company pursuant to the Securities Exchange Act. The Company

undertakes no obligation to publicly update or revise any

forward-looking statements, except as required by the federal

securities laws.

CENCORA, INC. FINANCIAL SUMMARY

(in thousands, except per share data) (unaudited)

Three Months Ended

September 30, 2024

% of Revenue

Three Months Ended

September 30, 2023

% of Revenue

% Change

Revenue

$

79,050,106

$

68,922,331

14.7%

Cost of goods sold

76,557,689

66,668,879

14.8%

Gross profit 1

2,492,417

3.15%

2,253,452

3.27%

10.6%

Operating expenses:

Distribution, selling, and

administrative

1,490,343

1.89%

1,393,828

2.02%

6.9%

Depreciation and amortization

277,044

0.35%

276,226

0.40%

0.3%

Litigation and opioid-related expenses

2

65,517

13,890

Acquisition-related deal and integration

expenses

33,570

40,291

Restructuring and other expenses

81,304

52,276

Goodwill impairment 3

418,000

—

Total operating expenses

2,365,778

2.99%

1,776,511

2.58%

33.2%

Operating income

126,639

0.16%

476,941

0.69%

(73.4)%

Other income, net 4

(19,507)

(30,424)

Interest expense, net

20,969

60,942

(65.6)%

Income before income taxes

125,177

0.16%

446,423

0.65%

(72.0)%

Income tax expense

117,711

97,443

20.8%

Net income

7,466

0.01%

348,980

0.51%

(97.9)%

Net (income) loss attributable to

noncontrolling interests

(4,084)

1,585

Net income attributable to Cencora,

Inc.

$

3,382

—%

$

350,565

0.51%

(99.0)%

Earnings per share:

Basic

$

0.02

$

1.74

(98.9)%

Diluted

$

0.02

$

1.72

(98.8)%

Weighted average common shares

outstanding:

Basic

196,270

201,338

(2.5)%

Diluted

198,082

203,395

(2.6)%

________________________________________

1

Includes a $62.3 million gain from

antitrust litigation settlements, a $12.3 million LIFO expense, and

Turkey foreign currency remeasurement expense of $10.2 million in

the three months ended September 30, 2024. Includes a $70.6 million

gain from antitrust litigation settlements, a $90.3 million LIFO

expense, and Turkey foreign currency remeasurement expense of $27.9

million in the three months ended September 30, 2023.

2

Includes a $49.1 million litigation

accrual in the three months ended September 30, 2024.

3

Represents a goodwill impairment charge

related to PharmaLex in the three months ended September 30,

2024.

4

Includes a $40.7 million gain on the

divestiture of non-core businesses in the three months September

30, 2023.

CENCORA, INC. FINANCIAL SUMMARY

(in thousands, except per share data) (unaudited)

Fiscal Year Ended

September 30, 2024

% of Revenue

Fiscal Year Ended

September 30, 2023

% of Revenue

% Change

Revenue

$

293,958,599

$

262,173,411

12.1%

Cost of goods sold

284,048,570

253,213,918

12.2%

Gross profit 1

9,910,029

3.37%

8,959,493

3.42%

10.6%

Operating expenses:

Distribution, selling, and

administrative

5,661,106

1.93%

5,309,984

2.03%

6.6%

Depreciation and amortization

1,091,974

0.37%

963,904

0.37%

13.3%

Litigation and opioid-related expenses

(credit), net 2

227,070

(24,693)

Acquisition-related deal and integration

expenses

103,001

139,683

Restructuring and other expenses

233,629

229,884

Goodwill impairment 3

418,000

—

Total operating expenses

7,734,780

2.63%

6,618,762

2.52%

16.9%

Operating income

2,175,249

0.74%

2,340,731

0.89%

(7.1)%

Other loss (income), net 4

14,283

(49,036)

Interest expense, net

156,991

228,931

(31.4)%

Income before income taxes

2,003,975

0.68%

2,160,836

0.82%

(7.3)%

Income tax expense

484,702

428,260

13.2%

Net income

1,519,273

0.52%

1,732,576

0.66%

(12.3)%

Net (income) loss attributable to

noncontrolling interests

(10,153)

12,717

Net income attributable to Cencora,

Inc.

$

1,509,120

0.51%

$

1,745,293

0.67%

(13.5)%

Earnings per share:

Basic

$

7.60

$

8.62

(11.8)%

Diluted

$

7.53

$

8.53

(11.7)%

Weighted average common shares

outstanding:

Basic

198,503

202,511

(2.0)%

Diluted

200,284

204,591

(2.1)%

________________________________________

1

Includes a $170.9 million gain from

antitrust litigation settlements, a $52.2 million LIFO credit, and

Turkey foreign currency remeasurement expense of $54.1 million in

the fiscal year ended September 30, 2024. Includes a $239.1 million

gain from antitrust litigation settlements, a $204.6 million LIFO

expense, and Turkey foreign currency remeasurement expense of $87.0

million in the fiscal year ended September 30, 2023.

2

The fiscal year ended September 30, 2024

includes $263.1 million of litigation accruals, offset in part by a

$92.2 million opioid settlement accrual reduction primarily as a

result of the Company's prepayment of the net present value of a

future obligation as permitted under its opioid settlement

agreements. The fiscal year ended September 30, 2023 includes the

receipt of $83.4 million from the H.D. Smith opioid litigation

indemnity escrow.

3

Represents a goodwill impairment charge

related to PharmaLex in the fiscal year ended September 30,

2024.

4

Includes a $40.7 million gain on the

divestiture of non-core businesses in the fiscal year ended

September 30, 2023.

CENCORA, INC. GAAP TO NON-GAAP

RECONCILIATIONS (in thousands, except per share data)

(unaudited)

Three Months Ended September

30, 2024

Gross Profit

Operating Expenses

Operating Income

Income Before Income

Taxes

Income Tax Expense

Net Income Attributable

to Cencora

Diluted Earnings Per

Share

GAAP

$

2,492,417

$

2,365,778

$

126,639

$

125,177

$

117,711

$

3,382

$

0.02

Gains from antitrust litigation

settlements

(62,337)

—

(62,337)

(62,337)

(11,013)

(51,324)

(0.26)

LIFO expense

12,273

—

12,273

12,273

4,369

7,904

0.04

Turkey highly inflationary impact

10,172

—

10,172

10,645

—

10,645

0.05

Acquisition-related intangibles

amortization

—

(165,919)

165,919

165,919

24,045

141,441

0.71

Litigation and opioid-related expenses

—

(65,517)

65,517

65,517

2,670

62,847

0.32

Acquisition-related deal and integration

expenses

—

(33,570)

33,570

33,570

5,649

27,921

0.14

Restructuring and other expenses

—

(81,304)

81,304

81,304

14,858

66,446

0.34

Goodwill impairment

—

(418,000)

418,000

418,000

3,705

414,295

2.09

Gain on remeasurement of equity

investment

—

—

—

(8,551)

—

(8,551)

(0.04)

Other, net

—

—

—

5,804

1,634

4,170

0.02

Tax reform 1

—

—

—

(11,706)

5,822

(17,528)

(0.09)

Adjusted Non-GAAP

$

2,452,525

$

1,601,468

$

851,057

$

835,615

$

169,450

$

661,648

$

3.34

Adjusted Non-GAAP % change vs. prior year

quarter

6.6%

6.8%

6.3%

12.8%

5.6%

13.9%

16.8%

Percentages of Revenue:

GAAP

Adjusted

Non-GAAP

Gross profit

3.15%

3.10%

Operating expenses

2.99%

2.03%

Operating income

0.16%

1.08%

________________________________________

1

Includes tax expense relating to 2020

Swiss tax reform and the currency remeasurement of the related

deferred tax assets, the latter of which is recorded within Other

Income, Net.

Note: For more information related to non-GAAP financial

measures, refer to the section titled "Supplemental Information

Regarding Non-GAAP Financial Measures" of this release.

CENCORA, INC. GAAP TO NON-GAAP

RECONCILIATIONS (in thousands, except per share data)

(unaudited)

Three Months Ended September

30, 2023

Gross Profit

Operating Expenses

Operating Income

Income Before Income

Taxes

Income Tax Expense

Net Income Attributable

to Cencora

Diluted Earnings Per

Share

GAAP

$

2,253,452

$

1,776,511

$

476,941

$

446,423

$

97,443

$

350,565

$

1.72

Gains from antitrust litigation

settlements

(70,582)

—

(70,582)

(70,582)

(16,719)

(53,863)

(0.26)

LIFO expense

90,323

—

90,323

90,323

21,264

69,059

0.34

Turkey highly inflationary impact

27,948

—

27,948

29,916

—

29,916

0.15

Acquisition-related intangibles

amortization

—

(169,900)

169,900

169,900

40,214

128,718

0.63

Litigation and opioid-related expenses

—

(13,890)

13,890

13,890

3,305

10,585

0.05

Acquisition-related deal and integration

expenses

—

(40,291)

40,291

40,291

9,548

30,743

0.15

Restructuring and other expenses

—

(52,276)

52,276

52,276

12,452

39,824

0.20

Gain on divestiture of non-core

businesses

—

—

—

(40,665)

1,035

(41,700)

(0.21)

Other, net

—

—

—

4,310

781

3,529

0.02

Tax reform 1

—

—

—

4,824

(8,931)

13,755

0.07

Adjusted Non-GAAP

$

2,301,141

$

1,500,154

$

800,987

$

740,906

$

160,392

$

581,131

$

2.86

Percentages of

Revenue:

GAAP

Adjusted Non-GAAP

Gross profit

3.27%

3.34%

Operating expenses

2.58%

2.18%

Operating income

0.69%

1.16%

______________________________________

1

Includes tax expense relating to Swiss tax

reform and the currency remeasurement of the related deferred tax

assets, the latter of which is recorded within Other Income,

Net.

Note: For more information related to non-GAAP financial measures,

refer to the section titled "Supplemental Information Regarding

Non-GAAP Financial Measures" of this release.

CENCORA, INC. GAAP TO NON-GAAP

RECONCILIATIONS (in thousands, except per share data)

(unaudited)

Fiscal Year Ended September

30, 2024

Gross Profit

Operating Expenses

Operating Income

Income Before Income

Taxes

Income Tax Expense

Net Income Attributable to

Cencora

Diluted Earnings Per

Share

GAAP

$

9,910,029

$

7,734,780

$

2,175,249

$

2,003,975

$

484,702

$

1,509,120

$

7.53

Gains from antitrust litigation

settlements

(170,904)

—

(170,904)

(170,904)

(37,823)

(133,081)

(0.66)

LIFO credit

(52,168)

—

(52,168)

(52,168)

(11,545)

(40,623)

(0.20)

Turkey highly inflationary impact

54,087

—

54,087

55,309

—

55,309

0.28

Acquisition-related intangibles

amortization

—

(660,292)

660,292

660,292

146,131

512,426

2.56

Litigation and opioid-related expenses,

net

—

(227,070)

227,070

227,070

46,546

180,524

0.90

Acquisition-related deal and integration

expenses

—

(103,001)

103,001

103,001

22,795

80,206

0.40

Restructuring and other expenses

—

(233,629)

233,629

233,629

48,480

185,149

0.92

Goodwill impairment

—

(418,000)

418,000

418,000

3,705

414,295

2.07

Loss on remeasurement of equity

investment

—

—

—

16,201

—

16,201

0.08

Other, net

—

—

—

16,814

3,261

13,553

0.07

Tax reform and discrete tax items 1

—

—

—

(15,697)

20,811

(36,508)

(0.18)

Adjusted Non-GAAP

$

9,741,044

$

6,092,788

$

3,648,256

$

3,495,522

$

727,063

$

2,756,571

$

13.76

2

Adjusted Non-GAAP % change vs. prior

year

8.1%

6.5%

10.9%

14.0%

17.0%

12.4%

14.8%

Percentages of Revenue:

GAAP

Adjusted

Non-GAAP

Gross profit

3.37%

3.31%

Operating expenses

2.63%

2.07%

Operating income

0.74%

1.24%

________________________________________

1

Includes a tax benefit attributable to an

adjustment of the Swiss valuation allowance (due to an increase in

projected Swiss income and DTA utilization), tax expense relating

to 2020 Swiss tax reform, and the currency remeasurement of the

related deferred tax assets, the latter of which is recorded within

Other Loss (Income), Net.

2

The sum of the components does not equal

the total due to rounding.

Note: For more information related to non-GAAP financial measures,

refer to the section titled "Supplemental Information Regarding

Non-GAAP Financial Measures" of this release.

CENCORA, INC. GAAP TO NON-GAAP

RECONCILIATIONS (in thousands, except per share data)

(unaudited)

Fiscal Year Ended September

30, 2023

Gross Profit

Operating Expenses

Operating Income

Income Before Income

Taxes

Income Tax Expense

Net Income Attributable

to Cencora

Diluted Earnings Per

Share

GAAP

$

8,959,493

$

6,618,762

$

2,340,731

$

2,160,836

$

428,260

$

1,745,293

$

8.53

Gains from antitrust litigation

settlements

(239,092)

—

(239,092)

(239,092)

(55,894)

(183,198)

(0.90)

LIFO expense

204,595

—

204,595

204,595

47,830

156,765

0.77

Turkey highly inflationary impact

86,967

—

86,967

95,938

—

95,938

0.47

Acquisition-related intangibles

amortization

—

(551,046)

551,046

551,046

128,823

418,144

2.04

Litigation and opioid-related credit,

net

—

24,693

(24,693)

(24,693)

13,717

(38,410)

(0.19)

Acquisition-related deal and integration

expenses

—

(139,683)

139,683

139,683

32,655

107,028

0.52

Restructuring and other expenses

—

(229,884)

229,884

229,884

53,742

176,142

0.86

Gain on divestiture of non-core

businesses

—

—

—

(40,665)

1,035

(41,700)

(0.20)

Other, net

—

—

—

(5,501)

781

(6,282)

(0.03)

Tax reform 1

—

—

—

(6,638)

(29,287)

22,649

0.11

Adjusted Non-GAAP

$

9,011,963

$

5,722,842

$

3,289,121

$

3,065,393

$

621,662

$

2,452,369

$

11.99

2

Percentages of Revenue:

GAAP

Adjusted

Non-GAAP

Gross profit

3.42%

3.44%

Operating expenses

2.52%

2.18%

Operating income

0.89%

1.25%

________________________________________

1

Tax expense relating to 2020 Swiss tax

reform and the currency remeasurement of the related deferred tax

assets, the latter of which is recorded within Other Loss (Income),

Net.

2

The sum of the components does not equal

the total due to rounding.

Note: For more information related to non-GAAP financial measures,

refer to the section titled "Supplemental Information Regarding

Non-GAAP Financial Measures" of this release.

CENCORA, INC. SUMMARY SEGMENT

INFORMATION (dollars in thousands) (unaudited)

Three Months Ended September

30,

Revenue

2024

2023

% Change

U.S. Healthcare Solutions

$

71,671,130

$

61,928,984

15.7%

International Healthcare Solutions

7,382,054

6,994,689

5.5%

Intersegment eliminations

(3,078)

(1,342)

Revenue

$

79,050,106

$

68,922,331

14.7%

Three Months Ended September

30,

Operating income

2024

2023

% Change

U.S. Healthcare Solutions

$

697,384

$

632,830

10.2%

International Healthcare Solutions

153,673

168,157

(8.6)%

Total segment operating income

851,057

800,987

6.3%

Gains from antitrust litigation

settlements

62,337

70,582

LIFO expense

(12,273)

(90,323)

Turkey highly inflationary impact

(10,172)

(27,948)

Acquisition-related intangibles

amortization

(165,919)

(169,900)

Litigation and opioid-related expenses

(65,517)

(13,890)

Acquisition-related deal and integration

expenses

(33,570)

(40,291)

Restructuring and other expenses

(81,304)

(52,276)

Goodwill impairment

(418,000)

—

Operating income

$

126,639

$

476,941

(73.4)%

Percentages of revenue:

U.S. Healthcare Solutions

Gross profit

2.27%

2.38%

Operating expenses

1.29%

1.36%

Operating income

0.97%

1.02%

International Healthcare Solutions

Gross profit

11.22%

11.84%

Operating expenses

9.14%

9.43%

Operating income

2.08%

2.40%

Cencora, Inc. (GAAP)

Gross profit

3.15%

3.27%

Operating expenses

2.99%

2.58%

Operating income

0.16%

0.69%

Cencora, Inc. (Non-GAAP)

Adjusted gross profit

3.10%

3.34%

Adjusted operating expenses

2.03%

2.18%

Adjusted operating income

1.08%

1.16%

Note: For more information related to

non-GAAP financial measures, refer to the section titled

"Supplemental Information Regarding Non-GAAP Financial Measures" of

this release.

CENCORA, INC. SUMMARY SEGMENT

INFORMATION (dollars in thousands) (unaudited)

Fiscal Year Ended September

30,

Revenue

2024

2023

% Change

U.S. Healthcare Solutions

$

265,339,427

$

234,759,218

13.0%

International Healthcare Solutions

28,627,542

27,418,679

4.4%

Intersegment eliminations

(8,370)

(4,486)

Revenue

$

293,958,599

$

262,173,411

12.1%

Fiscal Year Ended September

30,

Operating income

2024

2023

% Change

U.S. Healthcare Solutions

$

2,934,877

$

2,596,559

13.0%

International Healthcare Solutions

713,379

692,562

3.0%

Total segment operating income

3,648,256

3,289,121

10.9%

Gains from antitrust litigation

settlements

170,904

239,092

LIFO credit (expense)

52,168

(204,595)

Turkey highly inflationary impact

(54,087)

(86,967)

Acquisition-related intangibles

amortization

(660,292)

(551,046)

Litigation and opioid-related (expenses)

credit, net

(227,070)

24,693

Acquisition-related deal and integration

expenses

(103,001)

(139,683)

Restructuring and other expenses

(233,629)

(229,884)

Goodwill impairment

(418,000)

—

Operating income

$

2,175,249

$

2,340,731

(7.1)%

Percentages of revenue:

U.S. Healthcare Solutions

Gross profit

2.42%

2.48%

Operating expenses

1.31%

1.37%

Operating income

1.11%

1.11%

International Healthcare Solutions

Gross profit

11.60%

11.64%

Operating expenses

9.11%

9.11%

Operating income

2.49%

2.53%

Cencora, Inc. (GAAP)

Gross profit

3.37%

3.42%

Operating expenses

2.63%

2.52%

Operating income

0.74%

0.89%

Cencora, Inc. (Non-GAAP)

Adjusted gross profit

3.31%

3.44%

Adjusted operating expenses

2.07%

2.18%

Adjusted operating income

1.24%

1.25%

Note: For more information related to

non-GAAP financial measures, refer to the section titled

"Supplemental Information Regarding Non-GAAP Financial Measures" of

this release.

CENCORA, INC. CONDENSED

CONSOLIDATED BALANCE SHEETS (in thousands) (unaudited)

September 30,

2024

2023

ASSETS

Current assets:

Cash and cash equivalents

$

3,132,648

$

2,592,051

Accounts receivable, net

23,871,815

20,911,081

Inventories

18,998,833

17,454,768

Right to recover assets

1,175,871

1,314,857

Prepaid expenses and other

538,646

526,069

Total current assets

47,717,813

42,798,826

Property and equipment, net

2,181,410

2,135,171

Goodwill and other intangible assets

13,319,073

14,005,900

Deferred income taxes

246,348

200,667

Other assets

3,637,023

3,418,182

Total assets

$

67,101,667

$

62,558,746

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

50,942,162

$

45,836,037

Accrued expenses and other

2,758,560

2,353,817

Short-term debt

576,331

641,344

Total current liabilities

54,277,053

48,831,198

Long-term debt

3,811,745

4,146,113

Accrued income taxes

291,796

310,676

Deferred income taxes

1,643,746

1,657,944

Accrued litigation liability

4,296,902

5,061,795

Other liabilities

1,993,683

1,884,733

Total equity

786,742

666,287

Total liabilities and stockholders'

equity

$

67,101,667

$

62,558,746

CENCORA, INC. CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands)

(unaudited)

Fiscal Year Ended September

30,

2024

2023

Operating Activities:

Net income

$

1,519,273

$

1,732,576

Adjustments to reconcile net income to net

cash provided by operating activities

1,666,724

1,304,216

Changes in operating assets and

liabilities, excluding the effects of acquisitions and

divestitures:

Accounts receivable

(2,784,339)

(2,711,786)

Inventories

(1,479,599)

(2,183,368)

Accounts payable

4,968,093

6,103,451

Other, net

(405,467)

(333,755)

Net cash provided by operating

activities

3,484,685

3,911,334

Investing Activities:

Capital expenditures

(487,173)

(458,359)

Cost of acquired companies, net of cash

acquired 1

(69,771)

(1,409,835)

Cost of equity investments 2

(30,430)

(743,275)

Non-customer note receivable

(50,000)

—

Other, net

19,278

9,004

Net cash used in investing activities

(618,096)

(2,602,465)

Financing Activities:

Net debt repayments

(385,452)

(623,258)

Purchases of common stock

(1,491,367)

(1,180,728)

Exercises of stock options

37,840

61,152

Cash dividends on common stock

(416,168)

(398,752)

Employee tax withholdings related to

restricted share vesting

(63,500)

(71,279)

Other, net

(12,347)

(9,413)

Net cash used in financing activities

(2,330,994)

(2,222,278)

Effect of exchange rate changes on cash,

cash equivalents, and restricted cash

9,396

72,759

Increase (decrease) in cash, cash

equivalents, and restricted cash

544,991

(840,650)

Cash, cash equivalents, and restricted

cash at beginning of fiscal year 3

2,752,889

3,593,539

Cash, cash equivalents, and restricted

cash at end of fiscal year 3

$

3,297,880

$

2,752,889

________________________________________

1

Includes $1,406.5 million for the

acquisition of PharmaLex in the fiscal year ended September 30,

2023.

2

Includes a $718.4 million investment in

OneOncology in the fiscal year ended September 30, 2023.

3

The following represents a reconciliation

of cash and cash equivalents in the Condensed Consolidated Balance

Sheets to cash, cash equivalents, and restricted cash in the

Condensed Consolidated Statements of Cash Flows:

September 30,

(amounts in thousands)

2024

2023

2022

Cash and cash equivalents

$

3,132,648

$

2,592,051

$

3,388,189

Restricted cash (included in Prepaid

Expenses and Other)

98,596

97,722

144,980

Restricted cash (included in Other

Assets)

66,636

63,116

60,370

Cash, cash equivalents, and restricted

cash

$

3,297,880

$

2,752,889

$

3,593,539

SUPPLEMENTAL INFORMATION REGARDING

NON-GAAP FINANCIAL MEASURES

To supplement the financial measures prepared in accordance with

U.S. generally accepted accounting principles (GAAP), the Company

uses the non-GAAP financial measures described below. The non-GAAP

financial measures should be viewed in addition to, and not in lieu

of, financial measures calculated in accordance with GAAP. These

supplemental measures may vary from, and may not be comparable to,

similarly titled measures by other companies.

The non-GAAP financial measures are presented because management

uses non-GAAP financial measures to evaluate the Company’s

operating performance, to perform financial planning, and to

determine incentive compensation. Therefore, the Company believes

that the presentation of non-GAAP financial measures provides

useful supplementary information to, and facilitates additional

analysis by, investors. The presented non-GAAP financial measures

exclude items that management does not believe reflect the

Company’s core operating performance because such items are outside

the control of the Company or are inherently unusual,

non-operating, unpredictable, non-recurring, or non-cash. We have

included the following non-GAAP earnings-related financial measures

in this release:

- Adjusted gross profit and adjusted gross profit margin:

Adjusted gross profit is a non-GAAP financial measure that excludes

gains from antitrust litigation settlements, Turkey highly

inflationary impact and LIFO expense (credit). Adjusted gross

profit margin is the ratio of adjusted gross profit to total

revenue. Management believes that these non-GAAP financial measures

are useful to investors as a supplemental measure of the Company’s

ongoing operating performance. Gains from antitrust litigation

settlements, Turkey highly inflationary impact, and LIFO expense

(credit) are excluded because the Company cannot control the

amounts recognized or timing of these items. Gains from antitrust

litigation settlements relate to the settlement of lawsuits that

have been filed against brand pharmaceutical manufacturers alleging

that the manufacturer, by itself or in concert with others, took

improper actions to delay or prevent generic drugs from entering

the market. LIFO expense (credit) is affected by changes in

inventory quantities, product mix, and manufacturer pricing

practices, which may be impacted by market and other external

influences.

- Adjusted operating expenses and adjusted operating expense

margin: Adjusted operating expenses is a non-GAAP financial measure

that excludes acquisition-related intangibles amortization;

litigation and opioid-related expenses (credit);

acquisition-related deal and integration expenses; restructuring

and other expenses; and goodwill impairment. Adjusted operating

expense margin is the ratio of adjusted operating expenses to total

revenue. Acquisition-related intangibles amortization is excluded

because it is a non-cash item and does not reflect the operating

performance of the acquired companies. We exclude

acquisition-related deal and integration expenses and restructuring

and other expenses that relate to unpredictable and/or

non-recurring business activities. We exclude the amount of

litigation and opioid-related expenses (credit), and the impairment

of goodwill, that are unusual, non-operating, unpredictable,

non-recurring or non-cash in nature because we believe these

exclusions facilitate the analysis of our ongoing operational

performance.

- Adjusted operating income and adjusted operating income margin:

Adjusted operating income is a non-GAAP financial measure that

excludes the same items that are described above and excluded from

adjusted gross profit and adjusted operating expenses. Adjusted

operating income margin is the ratio of adjusted operating income

to total revenue. Management believes that these non-GAAP financial

measures are useful to investors as a supplemental way to evaluate

the Company’s performance because the adjustments are unusual,

non-operating, unpredictable, non-recurring or non-cash in

nature.

- Adjusted income before income taxes: Adjusted income before

income taxes is a non-GAAP financial measure that excludes the same

items that are described above and excluded from adjusted operating

income. In addition, the gain (loss) on the currency remeasurement

of the deferred tax asset relating to 2020 Swiss tax reform, the

gain on the divestiture of non-core businesses, and the gain (loss)

on the remeasurement of an equity investment are excluded from

adjusted income before income taxes because these amounts are

unusual, non-operating, and/or non-recurring. Management believes

that this non-GAAP financial measure is useful to investors because

it facilitates the calculation of the Company’s adjusted effective

tax rate.

- Adjusted effective tax rate: Adjusted effective tax rate is a

non-GAAP financial measure that is determined by dividing adjusted

income tax expense by adjusted income before income taxes.

Management believes that this non-GAAP financial measure is useful

to investors because it presents an effective tax rate that does

not reflect unusual, non-operating, unpredictable, non-recurring,

or non-cash amounts or items that are outside the control of the

Company.

- Adjusted income tax expense: Adjusted income tax expense is a

non-GAAP financial measure that excludes the income tax expense

associated with the same items that are described above and

excluded from adjusted income before income taxes. Certain discrete

tax items primarily attributable to foreign valuation allowance

adjustments are also excluded from adjusted income tax expense.

Further, certain expenses relating to 2020 Swiss tax reform are

excluded from adjusted income tax expense. Management believes that

this non-GAAP financial measure is useful to investors as a

supplemental way to evaluate the Company’s performance because the

adjustments are unusual, non-operating, unpredictable,

non-recurring or non-cash in nature.

- Adjusted net income/loss attributable to noncontrolling

interest: Adjusted net income/loss attributable to noncontrolling

interest excludes the non-controlling interest portion of the same

items described above. Management believes that this non-GAAP

financial measure is useful to investors because it facilitates the

calculation of adjusted net income attributable to the

Company.

- Adjusted net income attributable to the Company: Adjusted net

income attributable to the Company is a non-GAAP financial measure

that excludes the same items that are described above. Management

believes that this non-GAAP financial measure is useful to

investors as a supplemental way to evaluate the Company's

performance because the adjustments are unusual, non-operating,

unpredictable, non-recurring or non-cash in nature.

- Adjusted diluted earnings per share: Adjusted diluted earnings

per share excludes the per share impact of adjustments including

gains from antitrust litigation settlements; Turkey highly

inflationary impact; LIFO expense (credit); acquisition-related

intangibles amortization; litigation and opioid expenses (credit);

acquisition-related deal and integration expenses; restructuring

and other expenses; impairment of goodwill; the gain on the

divestiture of non-core businesses; the gain (loss) on the currency

remeasurement related to 2020 Swiss tax reform; and the gain (loss)

on the remeasurement of an equity investment, in each case net of

the tax effect calculated using the applicable effective tax rate

for those items. In addition, the per share impact of certain

discrete tax items primarily attributable to an adjustment of a

foreign valuation allowance, and the per share impact of certain

expenses related to 2020 Swiss tax reform are also excluded from

adjusted diluted earnings per share. Management believes that this

non-GAAP financial measure is useful to investors because it

eliminates the per share impact of the items that are outside the

control of the Company or that we consider to not be indicative of

our ongoing operating performance due to their inherent unusual,

non-operating, unpredictable, non-recurring, or non-cash

nature.

- Adjusted Free Cash Flow: Adjusted free cash flow is a non-GAAP

financial measure defined as net cash provided by operating

activities, excluding significant unpredictable or non-recurring

cash payments or receipts relating to legal settlements, minus

capital expenditures. Adjusted free cash flow is used internally by

management for measuring operating cash flow generation and setting

performance targets and has historically been used as one of the

means of providing guidance on possible future cash flows. For the

fiscal year ended September 30, 2024, adjusted free cash flow of

$3,064.3 million consisted of net cash provided by operating

activities of $3,484.7 million plus $237.7 million for the

prepayment of a future obligation as permitted under our opioid

settlement agreements, minus capital expenditures of $487.2 million

and the gains from antitrust litigation settlements of $170.9

million. The Company does not provide forward looking guidance on a

GAAP basis for free cash flow because the timing and amount of

favorable and unfavorable settlements excluded from this metric,

the probable significance of which cannot be determined, are

unavailable and cannot be reasonably estimated.

In our slide presentation for investors, the Company also

presents revenue and operating income on a “constant currency”

basis, which are non-GAAP financial measures. These amounts are

calculated by translating current period GAAP results at the

foreign currency exchange rates used in the comparable period in

the prior year. The Company presents such constant currency

financial information because it has significant operations outside

of the United States reporting in currencies other than the U.S.

dollar and management believes that this presentation provides a

framework to assess how its business performed excluding the impact

of foreign currency exchange rate fluctuations. For the fourth

quarter of fiscal 2024, (i) revenue of $79.1 billion was negatively

impacted by foreign currency translation of $164.5 million,

resulting in revenue on a constant currency basis of $79.2 billion,

and (ii) operating income of $851.1 million was negatively impacted

by foreign currency translation of $1.1 million, resulting in

operating income on a constant currency basis of $852.2 million.

For the fourth quarter of fiscal 2024 in the International

Healthcare Solutions segment, (i) revenue of $7.4 billion was

negatively impacted by foreign currency translation of $164.5

million, resulting in revenue on a constant currency basis of $7.5

billion, and (ii) operating income of $153.7 million was negatively

impacted by foreign currency translation of $1.1 million, resulting

in operating income on a constant currency basis of $154.8 million.

For fiscal 2024, (i) revenue of $294.0 billion was negatively

impacted by foreign currency translation of $995.9 million,

resulting in revenue on a constant currency basis of $295.0

billion, and (ii) operating income of $3.6 billion was negatively

impacted by foreign currency translation of $38.8 million,

resulting in operating income on a constant currency basis of $3.7

billion. For fiscal 2024 in the International Healthcare Solutions

segment, (i) revenue of $28.6 billion was negatively impacted by

foreign currency translation of $995.9 million, resulting in

revenue on a constant currency basis of $29.6 billion, and (ii)

operating income of $713.4 million was negatively impacted by

foreign currency translation of $38.8 million, resulting in

operating income on a constant currency basis of $752.2

million.

In addition, the Company has provided non-GAAP fiscal year 2025

guidance for diluted earnings per share, operating income,

effective income tax rate and free cash flow that excludes the same

or similar items as those that are excluded from the historical

non-GAAP financial measures, as well as significant items that are

outside the control of the Company or inherently unusual,

non-operating, unpredictable, non-recurring or non-cash in nature.

The Company does not provide forward looking guidance on a GAAP

basis for such metrics because certain financial information, the

probable significance of which cannot be determined, is not

available and cannot be reasonably estimated. For example, LIFO

expense/credit is largely dependent upon the future inflation or

deflation of brand and generic pharmaceuticals, which is out of the

Company’s control, and acquisition-related intangibles amortization

depends on the timing and amount of future acquisitions, which

cannot be reasonably estimated. Similarly, the timing and amount of

favorable and unfavorable settlements, the probable significance of

which cannot be determined, are unavailable and cannot be

reasonably estimated.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106645310/en/

Bennett S. Murphy Senior Vice President, Head of

Investor Relations and Treasury 610-727-3693

bennett.murphy@cencora.com

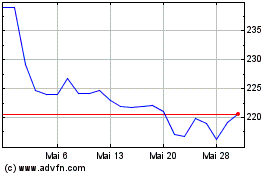

Cencora (NYSE:COR)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Cencora (NYSE:COR)

Historical Stock Chart

Von Nov 2023 bis Nov 2024