false

0001534254

0001534254

2023-11-06

2023-11-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): November 9, 2023 (November 6, 2023)

CĪON

Investment Corporation

(Exact Name of Registrant as Specified

in Charter)

| Maryland |

|

000-54755 |

|

45-3058280 |

| (State

or Other Jurisdiction of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer Identification No.) |

| |

100 Park Avenue, 25th Floor

New York, New York 10017 |

|

| |

(Address of Principal Executive Offices) |

|

| |

(212)

418-4700 |

|

| |

(Registrant’s

telephone number, including area code) |

|

| |

Not

applicable |

|

| |

(Former

name or former address, if changed since last report) |

|

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common stock, par value $0.001 per share |

|

CION |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial

Condition.

Regular

Quarterly Distribution

The

board of directors (the “Board”) of CĪON Investment Corporation (“CION”) has delegated to CION’s executive

officers the authority to determine the amount, record dates, payment dates and other terms of distributions to shareholders, which will

be ratified by the Board on a quarterly basis.

On

November 6, 2023, CION’s co-chief executive officers declared

a regular quarterly cash distribution of $0.34 per share for the fourth quarter of 2023 payable on

December 15, 2023 to shareholders of record as of December 1, 2023. A copy of the press release announcing the

foregoing is attached hereto as Exhibit 99.1 and incorporated by reference herein.

Q3 2023

Financial Results

On November

9, 2023, CION issued a press release announcing its financial results for the third

quarter ended September 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated by

reference herein.

In

connection with its conference call to be held on November 9, 2023 to discuss its financial

results for the third quarter ended September 30, 2023, CION has provided an accompanying slide presentation in

the Investor Resources – Events and Presentations section of its website at www.cionbdc.com. A

copy of the presentation is also attached hereto as Exhibit 99.2 and incorporated by reference herein.

The

information disclosed under this Item 2.02, including Exhibits 99.1 and 99.2 hereto, is being “furnished” and shall not be

deemed “filed” by CION for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference into any filing

under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such

filing.

Item 7.01. Regulation

FD Disclosure.

The

information in Item 2.02 of this Current Report on Form 8-K is incorporated by reference into this Item 7.01.

Item 9.01.

Financial Statements and Exhibits.

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

|

CĪON Investment Corporation

|

| Date: |

November 9, 2023 |

By: /s/ Michael A. Reisner |

| |

|

Co-Chief Executive Officer |

EXHIBIT LIST

EXHIBIT

NUMBER |

|

DESCRIPTION |

Exhibit 99.1

CION INVESTMENT CORPORATION REPORTS THIRD QUARTER

2023 FINANCIAL RESULTS

Reports Another Solid Quarterly Performance,

Out Earning the Total Distribution by 41% and Achieving a $0.49 per Share Increase in NAV

Announces Fourth Quarter 2023 Base Distribution

of $0.34 per Share

For Immediate Release

NEW YORK, November 9, 2023 — CION Investment

Corporation (NYSE: CION) (“CION” or the “Company”) today reported financial results for the third quarter ended

September 30, 2023 and filed its Form 10-Q with the U.S. Securities and Exchange Commission.

CION also announced that, on November 6, 2023,

its co-chief executive officers declared a fourth quarter 2023 regular distribution of $0.34 per share payable on December 15, 2023 to

shareholders of record as of December 1, 2023.

THIRD QUARTER AND OTHER HIGHLIGHTS

| • | Net investment income and earnings

per share for the quarter ended September 30, 2023 were $0.55 per share and $0.87 per

share, respectively; |

| • | Net asset value per share was $15.80

as of September 30, 2023 compared to $15.31 as of June 30, 2023, an increase of

$0.49 per share, or 3.2%. The increase was primarily due to the Company out earning its distribution

for the period and mark-to-market adjustments to the Company’s portfolio; |

| • | As of September 30, 2023, the

Company had $1,008 million of total principal amount of debt outstanding, of which 72% was

comprised of senior secured bank debt and 28% was comprised of unsecured debt. The Company’s

net debt-to-equity ratio was 1.03x as of September 30, 2023 compared to 1.04x as of

June 30, 2023; |

| • | As of September 30, 2023, the

Company had total investments at fair value of $1,728 million in 109 portfolio companies

across 24 industries. The investment portfolio was comprised of 87.8% senior secured loans,

including 85.7% in first lien investments;1 |

| • | During the quarter, the Company funded

new investment commitments of $93 million, funded previously unfunded commitments of $10

million, and had sales and repayments totaling $96 million, resulting in a net increase to

the Company's funded portfolio of $7 million; |

| • | As of September 30, 2023, investments

on non-accrual status amounted to 1.0% and 3.8% of the total investment portfolio at fair

value and amortized cost, respectively, which are down from 1.7% and 4.8%, respectively,

as of June 30, 2023; and |

| • | During the quarter, the Company repurchased

168,023 shares of its common stock under its 10b5-1 trading plan at an average price of $10.71

per share for a total repurchase amount of $1.8 million. Through September 30,

2023, the Company repurchased a total of 2,493,645 shares of its common stock under its 10b5-1

trading plan at an average price of $9.65 per share for a total repurchase amount of $24.1

million. |

DISTRIBUTIONS

| • | For the quarter ended September 30,

2023, the Company paid a regular quarterly distribution totaling $18.6 million, or $0.34

per share, and declared supplemental distributions of (a) $2.7 million, or $0.05 per share,

which was paid on October 16, 2023 and (b) $0.05 per share, payable on January 15, 2024 to

shareholders of record as of December 29, 2023. |

SUBSEQUENT EVENTS

| • | On October 10, 2023, the Company

completed a private offering in Israel pursuant to which the Company issued approximately

$33.1 million of its additional unsecured Series A Notes due 2026, which bear interest at

a floating rate equal to SOFR plus a credit spread of 3.82% per year payable quarterly; and |

| • | On November 8, 2023, the Company

completed a private offering pursuant to which the Company issued $100 million of its unsecured

notes due 2027, which bear interest at a floating rate equal to the three-month SOFR plus

a credit spread of 4.75% per year and subject to a 2.00% SOFR floor payable quarterly. |

Michael A. Reisner, co-Chief Executive Officer

of CION, commented:

“We are pleased to have delivered another

strong quarter, supported by NII out-earning the dividends and quarterly NAV growth. Our credit performance remains robust, with a decline

in non-accruals, down to 1.03% of fair value, and 99% of our portfolio is risk-rated at 3 or higher. We continue to focus on first lien

loans to true middle-market companies and have once again demonstrated our ability to access the lending markets, expanding our unsecured

debt offering, and maintaining a conservative approach to leverage—all while delivering strong returns to our investors. As we

look ahead, CION is strategically positioned to deliver robust returns to shareholders."

SELECTED FINANCIAL HIGHLIGHTS

| | |

As of | |

| (in thousands, except per share data) | |

September 30, 2023 | | |

June 30, 2023 | |

| Investment portfolio, at fair value1 | |

$ | 1,727,943 | | |

$ | 1,687,691 | |

| Total debt outstanding2 | |

$ | 1,008,212 | | |

$ | 985,712 | |

| Net assets | |

$ | 860,760 | | |

$ | 836,364 | |

| Net asset value per share | |

$ | 15.80 | | |

$ | 15.31 | |

| Debt-to-equity | |

| 1.17 | x | |

| 1.18 | x |

| Net debt-to-equity | |

| 1.03 | x | |

| 1.04 | x |

| | |

Three Months Ended | |

| (in thousands, except share and per share data) | |

September 30, 2023 | | |

June 30, 2023 | |

| Total investment income | |

$ | 67,540 | | |

$ | 58,496 | |

| Total operating expenses and income tax expense | |

$ | 37,550 | | |

$ | 35,080 | |

| Net investment income after taxes | |

$ | 29,990 | | |

$ | 23,416 | |

| Net realized losses | |

$ | (8,123 | ) | |

$ | (18,928 | ) |

| Net unrealized gains | |

$ | 25,606 | | |

$ | 23,406 | |

| Net increase in net assets resulting from operations | |

$ | 47,473 | | |

$ | 27,894 | |

| | |

| | | |

| | |

| Net investment income per share | |

$ | 0.55 | | |

$ | 0.43 | |

| Net realized and unrealized gains per share | |

$ | 0.32 | | |

$ | 0.08 | |

| Earnings per share | |

$ | 0.87 | | |

$ | 0.51 | |

| | |

| | | |

| | |

| Weighted average shares outstanding | |

| 54,561,367 | | |

| 54,788,740 | |

| Distributions declared per share | |

$ | 0.39 | | |

$ | 0.34 | |

Total investment income for the three months ended September 30,

2023 and June 30, 2023 was $67.5 million and $58.5 million, respectively. The increase in investment income was primarily driven

by make-whole payments received on certain investments during the three months ended September 30, 2023.

Operating expenses for the three months ended

September 30, 2023 and June 30, 2023 were $37.6 million and $35.1 million, respectively. During the quarter ended September 30,

2023, the Company incurred higher advisory fees due to an increase in investment income and higher interest expense because of an increase

in SOFR and LIBOR rates as compared to the quarter ended June 30, 2023.

PORTFOLIO AND INVESTMENT ACTIVITY1

A summary of the Company's investment activity for the three months

ended September 30, 2023 is as follows:

| |

|

|

New Investment

Commitments |

|

|

|

Sales and Repayments |

|

| Investment Type |

|

|

$ in

Thousands |

|

|

|

%

of Total |

|

|

|

$ in

Thousands |

|

|

|

%

of Total |

|

| Senior secured first lien debt |

|

$ |

96,427 |

|

|

|

100 |

% |

|

$ |

96,283 |

|

|

|

100 |

% |

| Senior secured second lien debt |

|

|

— |

|

|

|

— |

|

|

|

5 |

|

|

|

— |

|

| Collateralized securities and structured products - equity |

|

|

— |

|

|

|

— |

|

|

|

86 |

|

|

|

— |

|

| Equity |

|

|

377 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Total |

|

$ |

96,804 |

|

|

|

100 |

% |

|

$ |

96,374 |

|

|

|

100 |

% |

During the three months ended September 30,

2023, new investment commitments were made across 3 new and 11 existing portfolio companies. During the same period, the Company received

the full repayment on investments in 5 portfolio companies and sold all investments in 1 portfolio company. As a result, the number of

portfolio companies decreased from 112 as of June 30, 2023 to 109 as of September 30, 2023.

PORTFOLIO SUMMARY1

As of September 30, 2023, the Company’s investments consisted

of the following:

| |

|

|

Investments at Fair Value |

|

| Investment Type |

|

|

$ in

Thousands |

|

|

|

%

of Total |

|

| Senior secured first lien debt |

|

$ |

1,481,498 |

|

|

|

85.7 |

% |

| Senior secured second lien debt |

|

|

36,114 |

|

|

|

2.1 |

% |

| Collateralized securities and structured products - equity |

|

|

1,224 |

|

|

|

0.1 |

% |

| Unsecured debt |

|

|

14,631 |

|

|

|

0.8 |

% |

| Equity |

|

|

194,476 |

|

|

|

11.3 |

% |

| Total |

|

$ |

1,727,943 |

|

|

|

100.0 |

% |

The following table presents certain selected information regarding

the Company’s investments:

| |

|

As of |

|

| |

|

September 30, 2023 |

|

|

June 30, 2023 |

|

| Number of portfolio companies |

|

|

109 |

|

|

|

112 |

|

| Percentage of performing loans bearing a floating rate3 |

|

|

92.5 |

% |

|

|

92.2 |

% |

| Percentage of performing loans bearing a fixed rate3 |

|

|

7.5 |

% |

|

|

7.8 |

% |

| Yield on debt and other income producing investments at amortized cost4 |

|

|

13.04 |

% |

|

|

12.38 |

% |

| Yield on performing loans at amortized cost4 |

|

|

13.55 |

% |

|

|

13.10 |

% |

| Yield on total investments at amortized cost |

|

|

11.81 |

% |

|

|

11.45 |

% |

| Weighted average leverage (net debt/EBITDA)5 |

|

|

4.78 |

x |

|

|

4.83 |

x |

| Weighted average interest coverage5 |

|

|

1.93 |

x |

|

|

2.00 |

x |

| Median EBITDA6 |

|

|

$33.7 million |

|

|

|

$35.0 million |

|

As of September 30, 2023, investments on

non-accrual status represented 1.0% and 3.8% of the total investment portfolio at fair value and amortized cost, respectively. As of

June 30, 2023, investments on non-accrual status represented 1.7% and 4.8% of the total investment portfolio at fair value and amortized

cost, respectively.

LIQUIDITY AND CAPITAL RESOURCES

As of September 30, 2023, the Company had

$1,008 million of total principal amount of debt outstanding, comprised of $722 million of outstanding borrowings under its senior secured

credit facilities and $286 million of unsecured notes and term loans. The combined weighted average interest rate on debt outstanding

was 8.3% for the quarter ended September 30, 2023. As of September 30, 2023, the Company had $124 million in cash and short-term

investments and $103 million available under its financing arrangements.2

EARNING CONFERENCE CALL

CION will host an earnings conference call on

Thursday, November 9, 2023 at 11:00 am Eastern Time to discuss its financial results for the third quarter ended September 30, 2023.

Please visit the Investor Resources - Events and Presentations section of the Company’s website at www.cionbdc.com for a slide

presentation that complements the earnings conference call.

All interested parties are invited to participate

via telephone or listen via the live webcast, which can be accessed by clicking the following link: CION Investment Corporation 2023

Third Quarter Conference Call. Domestic callers can access the conference call by dialing (877) 484-6065. International callers can

access the conference call by dialing +1 (201) 689-8846. All callers are asked to dial in approximately 10 minutes prior to the call.

An archived replay will be available on a webcast link located in the Investor Resources - Events and Presentations section of CION’s

website.

ENDNOTES

| 1) | The discussion of the investment

portfolio excludes short-term investments. |

| 2) | Total debt outstanding excludes

netting of debt issuance costs of $8.0 million and $9.0 million as of September 30,

2023 and June 30, 2023, respectively. |

| 3) | The fixed versus floating composition

has been calculated as a percentage of performing debt investments measured on a fair value

basis, including income producing preferred stock investments and excludes investments, if

any, on non-accrual status. |

| 4) | Computed based on the (a) annual

actual interest rate or yield earned plus amortization of fees and discounts on the performing

debt and other income producing investments as of the reporting date, divided by (b) the

total performing debt and other income producing investments (excluding investments on non-accrual

status) at amortized cost. This calculation excludes exit fees that are receivable upon repayment

of the investment. |

| 5) | For a particular portfolio company,

the Company calculates the level of contractual indebtedness net of cash (“net debt”)

owed by the portfolio company and compares that amount to measures of cash flow available

to service the net debt. To calculate net debt, the Company includes debt that is both senior

and pari passu to the tranche of debt owned by it but excludes debt that is legally and contractually

subordinated in ranking to the debt owned by the Company. The Company believes this calculation

method assists in describing the risk of its portfolio investments, as it takes into consideration

contractual rights of repayment of the tranche of debt owned by the Company relative to other

senior and junior creditors of a portfolio company. The Company typically calculates cash

flow available for debt service at a portfolio company by taking EBITDA for the trailing

twelve-month period. Weighted average net debt to EBITDA is weighted based on the fair value

of the Company's performing debt investments and excluding investments where net debt to

EBITDA may not be the appropriate measure of credit risk, such as cash collateralized loans

and investments that are underwritten and covenanted based on recurring revenue. |

For a particular portfolio company,

the Company also calculates the level of contractual interest expense owed by the portfolio company and compares that amount to EBITDA

(“interest coverage ratio”). The Company believes this calculation method assists in describing the risk of its portfolio

investments, as it takes into consideration contractual interest obligations of the portfolio company. Weighted average interest coverage

is weighted based on the fair value of the Company's performing debt investments, and excludes investments where interest coverage may

not be the appropriate measure of credit risk, such as cash collateralized loans and investments that are underwritten and covenanted

based on recurring revenue.

Portfolio company statistics, including

EBITDA, are derived from the financial statements most recently provided to the Company for each portfolio company as of the reported

end date. Statistics of the portfolio companies have not been independently verified by the Company and may reflect a normalized or adjusted

amount.

| 6) | Median EBITDA is calculated based

on the portfolio company's EBITDA as of the Company's initial investment. |

CĪON Investment Corporation

Consolidated Balance Sheets

(in thousands, except share and per share amounts)

| | |

September 30, 2023 | | |

June 30, 2023 | |

| | |

(unaudited) | | |

(unaudited) | |

| Assets |

| Investments, at fair value: | |

| | | |

| | |

| Non-controlled, non-affiliated investments (amortized cost of $1,555,700 and $1,583,865, respectively) | |

$ | 1,508,505 | | |

$ | 1,510,372 | |

| Non-controlled, affiliated investments (amortized cost of $207,222 and $204,248, respectively) | |

| 201,617 | | |

| 198,084 | |

| Controlled investments (amortized cost of $132,900 and $76,900, respectively) | |

| 134,755 | | |

| 80,006 | |

| Total investments, at fair value (amortized cost of $1,895,822 and $1,865,013, respectively) | |

| 1,844,877 | | |

| 1,788,462 | |

| Cash | |

| 6,805 | | |

| 11,515 | |

| Interest receivable on investments | |

| 40,378 | | |

| 33,200 | |

| Receivable due on investments sold and repaid | |

| 2,646 | | |

| 997 | |

| Dividends receivable on investments | |

| 82 | | |

| — | |

| Prepaid expenses and other assets | |

| 1,552 | | |

| 608 | |

| Total assets | |

$ | 1,896,340 | | |

$ | 1,834,782 | |

| | |

| | | |

| | |

| Liabilities and Shareholders' Equity | |

| | | |

| | |

| Liabilities | |

| | | |

| | |

| Financing arrangements (net of unamortized debt issuance costs of $8,001 and $8,976, respectively) | |

$ | 1,000,211 | | |

$ | 976,737 | |

| Payable for investments purchased | |

| 9,663 | | |

| — | |

| Accounts payable and accrued expenses | |

| 1,510 | | |

| 1,344 | |

| Interest payable | |

| 7,238 | | |

| 8,183 | |

| Accrued management fees | |

| 6,741 | | |

| 6,546 | |

| Accrued subordinated incentive fee on income | |

| 6,362 | | |

| 4,967 | |

| Accrued administrative services expense | |

| 1,064 | | |

| 574 | |

| Share repurchases payable | |

| 67 | | |

| 67 | |

| Shareholder distribution payable | |

| 2,724 | | |

| — | |

| Total liabilities | |

| 1,035,580 | | |

| 998,418 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Shareholders' Equity | |

| | | |

| | |

| Common stock, $0.001 par value; 500,000,000 shares authorized; 54,477,427 and

54,645,571 shares issued, and 54,464,804 and 54,632,827 shares outstanding, respectively | |

| 54 | | |

| 55 | |

| Capital in excess of par value | |

| 1,035,929 | | |

| 1,037,729 | |

| Accumulated distributable losses | |

| (175,223 | ) | |

| (201,420 | ) |

| Total shareholders' equity | |

| 860,760 | | |

| 836,364 | |

| Total liabilities and shareholders' equity | |

$ | 1,896,340 | | |

$ | 1,834,782 | |

| Net asset value per share of common stock at end of period | |

$ | 15.80 | | |

$ | 15.31 | |

CĪON Investment Corporation

Consolidated Statements of Operations

(in thousands, except share and per share amounts)

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | | |

Year Ended

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | | |

2022 | |

| | |

(unaudited) | | |

(unaudited) | | |

(unaudited) | | |

(unaudited) | | |

| |

| Investment income | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-controlled, non-affiliated investments | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

$ | 51,032 | | |

$ | 37,336 | | |

$ | 140,917 | | |

$ | 100,079 | | |

$ | 140,560 | |

| Paid-in-kind interest income | |

| 6,608 | | |

| 6,876 | | |

| 15,736 | | |

| 16,095 | | |

| 22,737 | |

| Fee income | |

| 2,447 | | |

| 4,542 | | |

| 4,744 | | |

| 8,045 | | |

| 9,019 | |

| Dividend income | |

| 82 | | |

| 57 | | |

| 82 | | |

| 103 | | |

| 103 | |

| Non-controlled, affiliated investments | |

| | | |

| | | |

| | | |

| | | |

| | |

| Paid-in-kind interest income | |

| 2,471 | | |

| 1,174 | | |

| 5,953 | | |

| 3,493 | | |

| 6,204 | |

| Interest income | |

| 1,341 | | |

| 1,949 | | |

| 5,549 | | |

| 4,517 | | |

| 5,865 | |

| Dividend income | |

| 13 | | |

| 13 | | |

| 3,946 | | |

| 66 | | |

| 79 | |

| Fee income | |

| 35 | | |

| 19 | | |

| 2,432 | | |

| 525 | | |

| 525 | |

| Controlled investments | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 1,413 | | |

| 2,197 | | |

| 5,304 | | |

| 6,066 | | |

| 6,049 | |

| Dividend income | |

| — | | |

| — | | |

| 4,250 | | |

| — | | |

| 1,275 | |

| Paid-in-kind interest income | |

| 1,048 | | |

| — | | |

| 1,048 | | |

| 409 | | |

| 2,482 | |

| Total investment income | |

| 67,540 | | |

| 54,163 | | |

| 191,011 | | |

| 139,398 | | |

| 194,898 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | | |

| | |

| Management fees | |

| 6,741 | | |

| 6,942 | | |

| 19,963 | | |

| 20,436 | | |

| 27,361 | |

| Administrative services expense | |

| 996 | | |

| 733 | | |

| 2,743 | | |

| 2,234 | | |

| 3,348 | |

| Subordinated incentive fee on income | |

| 6,362 | | |

| 5,421 | | |

| 17,662 | | |

| 13,645 | | |

| 18,710 | |

| General and administrative | |

| 1,931 | | |

| 2,027 | | |

| 5,960 | | |

| 5,961 | | |

| 7,278 | |

| Interest expense | |

| 21,757 | | |

| 13,469 | | |

| 61,533 | | |

| 32,769 | | |

| 49,624 | |

| Total operating expenses | |

| 37,787 | | |

| 28,592 | | |

| 107,861 | | |

| 75,045 | | |

| 106,321 | |

| Net investment income before taxes | |

| 29,753 | | |

| 25,571 | | |

| 83,150 | | |

| 64,353 | | |

| 88,577 | |

| Income tax (benefit) expense, including excise tax | |

| (237 | ) | |

| 14 | | |

| (114 | ) | |

| 25 | | |

| 372 | |

| Net investment income after taxes | |

| 29,990 | | |

| 25,557 | | |

| 83,264 | | |

| 64,328 | | |

| 88,205 | |

| Realized and unrealized gains (losses) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net realized (losses) gains on: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-controlled, non-affiliated investments | |

| (8,123 | ) | |

| 4,267 | | |

| (31,576 | ) | |

| 4,475 | | |

| (11,217 | ) |

| Non-controlled, affiliated investments | |

| — | | |

| (21,433 | ) | |

| — | | |

| (21,530 | ) | |

| (21,530 | ) |

| Foreign currency | |

| — | | |

| (3 | ) | |

| — | | |

| (3 | ) | |

| (3 | ) |

| Net realized losses | |

| (8,123 | ) | |

| (17,169 | ) | |

| (31,576 | ) | |

| (17,058 | ) | |

| (32,750 | ) |

| Net change in unrealized appreciation (depreciation) on: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-controlled, non-affiliated investments | |

| 26,298 | | |

| (669 | ) | |

| 8,608 | | |

| (25,646 | ) | |

| (19,807 | ) |

| Non-controlled, affiliated investments | |

| 559 | | |

| 18,966 | | |

| (9,136 | ) | |

| 13,609 | | |

| 13,523 | |

| Controlled investments | |

| (1,251 | ) | |

| 7,298 | | |

| (6,838 | ) | |

| 5,373 | | |

| 970 | |

| Net change in unrealized appreciation (depreciation) | |

| 25,606 | | |

| 25,595 | | |

| (7,366 | ) | |

| (6,664 | ) | |

| (5,314 | ) |

| Net realized and unrealized gains (losses) | |

| 17,483 | | |

| 8,426 | | |

| (38,942 | ) | |

| (23,722 | ) | |

| (38,064 | ) |

| Net increase in net assets resulting from operations | |

$ | 47,473 | | |

$ | 33,983 | | |

$ | 44,322 | | |

$ | 40,606 | | |

$ | 50,141 | |

| Per share information—basic and diluted | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net increase in net assets per share resulting from operations | |

$ | 0.87 | | |

$ | 0.60 | | |

$ | 0.81 | | |

$ | 0.71 | | |

$ | 0.89 | |

| Net investment income per share | |

$ | 0.55 | | |

$ | 0.45 | | |

$ | 1.52 | | |

$ | 1.13 | | |

$ | 1.56 | |

| Weighted average shares of common stock outstanding | |

| 54,561,367 | | |

| 56,816,992 | | |

| 54,817,855 | | |

| 56,910,773 | | |

| 56,556,510 | |

ABOUT CION INVESTMENT CORPORATION

CION Investment Corporation is a leading publicly

listed business development company that had approximately $1.9 billion in total assets as of September 30, 2023. CION seeks to

generate current income and, to a lesser extent, capital appreciation for investors by focusing primarily on senior secured loans to

U.S. middle-market companies. CION is advised by CION Investment Management, LLC, a registered investment adviser and an affiliate of

CION. For more information, please visit www.cionbdc.com.

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking

statements that involve substantial risks and uncertainties. You can identify these statements by the use of forward-looking terminology

such as “may,” “will,” “should,” “expect,” “anticipate,” “project,”

“target,” “estimate,” “intend,” “continue,” or “believe” or the negatives

thereof or other variations thereon or comparable terminology. You should read statements that contain these words carefully because

they discuss CION’s plans, strategies, prospects and expectations concerning its business, operating results, financial condition

and other similar matters. These statements represent CION’s belief regarding future events that, by their nature, are uncertain

and outside of CION’s control. There are likely to be events in the future, however, that CION is not able to predict accurately

or control. Any forward-looking statement made by CION in this press release speaks only as of the date on which it is made. Factors

or events that could cause CION’s actual results to differ, possibly materially from its expectations, include, but are not limited

to, the risks, uncertainties and other factors CION identifies in the sections entitled “Risk Factors” and “Forward-Looking

Statements” in filings CION makes with the SEC, and it is not possible for CION to predict or identify all of them. CION undertakes

no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise,

except as required by law.

OTHER INFORMATION

The information in this press release is summary

information only and should be read in conjunction with CION’s Quarterly Report on Form 10-Q, which CION filed with the SEC on

November 9, 2023, as well as CION’s other reports filed with the SEC. A copy of CION’s Quarterly Report on Form 10-Q and

CION’s other reports filed with the SEC can be found on CION’s website at www.cionbdc.com and the SEC’s website

at www.sec.gov.

CONTACTS

Media

Susan Armstrong

sarmstrong@cioninvestments.com

Investor Relations

1-800-343-3736

Analysts and Institutional Investors

James Carbonara

Hayden IR

(646)-755-7412

James@haydenir.com

Exhibit 99.2

CION Investment Corporation Third Quarter 2023 Earnings Presentation

Disclosures and Forward - Looking Statements 2 The information contained in this earnings presentation should be viewed in conjunction with the earnings conference call of CION Investment Corporation (NYSE : CION) (“CION” or the “Company”) held on November 9 , 2023 as well as the Company’s Quarterly Report on Form 10 - Q for the quarter ended September 30 , 2023 that was filed with the Securities and Exchange Commission (the “SEC”) on November 9 , 2023 . The information contained herein may not be used, reproduced or distributed to others, in whole or in part, for any other purpose without the prior written consent of the Company . This earnings presentation may contain forward - looking statements that involve substantial risks and uncertainties, including the impact of inflation, rising interest rates, supply - chain disruptions and the risk of recession on the business, future operating results, access to capital and liquidity of the Company and its portfolio companies . You can identify these statements by the use of forward - looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “target,” “estimate,” “intend,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology, including references to assumptions, forecasts of future results, shareholder diversification, institutional research coverage and availability and access to capital . You should read statements that contain these words carefully because they discuss the Company’s plans, strategies, prospects and expectations concerning its business, operating results, financial condition and other similar matters . These statements represent the Company’s belief regarding future events that, by their nature, are uncertain and outside of the Company’s control, such as the price at which the Company’s shares of common stock will trade on the NYSE . Any forward - looking statement made by the Company in this earnings presentation speaks only as of the date on which the Company makes it . Factors or events that could cause the Company’s actual results to differ, possibly materially from its expectations, include, but are not limited to, the risks, uncertainties and other factors the Company identifies in the sections entitled “Risk Factors” and “Forward - Looking Statements” in filings the Company makes with the SEC, and it is not possible for the Company to predict or identify all of them . The Company undertakes no obligation to update or revise publicly any forward - looking statements, whether as a result of new information, future events or otherwise, except as required by law . This earnings presentation does not constitute a prospectus and should under no circumstances be understood as an offer to sell or the solicitation of an offer to buy the Company’s common stock or any other securities nor will there be any sale of common stock or any other securities referred to in this earnings presentation in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction . Nothing in these materials should be construed as a recommendation to invest in any securities that may be issued by the Company or as legal, accounting or tax advice . An investment in securities of the type described herein presents certain risks . The Company is managed by CION Investment Management, LLC, an affiliate of the Company . Nothing contained herein shall be relied upon as a promise or representation whether as to past or future performance . The information contained in this earnings presentation is summary information that is intended to be considered in the context of other public announcements that the Company may make, by press release or otherwise, from time to time . The Company undertakes no duty or obligation to publicly update or revise the information contained in this earnings presentation, except as required by law . These materials contain information about the Company, certain of its personnel and affiliates and its historical performance . You should not view information related to past performance of the Company as indicative of its future results, the achievement of which cannot be assured . Past performance does not guarantee future results, which may vary . The value of investments and the income derived from investments will fluctuate and can go down as well as up . A loss of principal may occur .

3 (1) The discussion of the investment portfolio excludes short term investments. Third Quarter and Other Highlights – Ended September 30, 2023 ▪ Net investment income and earnings per share for the quarter ended September 30 , 2023 were $ 0 . 55 per share and $ 0 . 87 per share, respectively ; ▪ Net asset value per share was $ 15 . 80 as of September 30 , 2023 compared to $ 15 . 31 as of June 30 , 2023 , an increase of $ 0 . 49 per share, or 3 . 2 % . The increase was primarily due to the Company out earning its distribution for the period and mark - to - market adjustments to the Company’s portfolio ; ▪ As of September 30 , 2023 , the Company had $ 1 , 008 million of total principal amount of debt outstanding, of which 72 % was comprised of senior secured bank debt and 28 % was comprised of unsecured debt . The Company’s net debt - to - equity ratio was 1 . 03 x as of September 30 , 2023 compared to 1 . 04 x as of June 30 , 2023 ; ▪ As of September 30 , 2023 , the Company had total investments at fair value of $ 1 , 728 million in 109 portfolio companies across 24 industries . The investment portfolio was comprised of 87 . 8 % senior secured loans, including 85 . 7 % in first lien investments ; 1 ▪ During the quarter, the Company funded new investment commitments of $ 93 million, funded previously unfunded commitments of $ 10 million, and had sales and repayments totaling $ 96 million, resulting in a net increase to the Company's funded portfolio of $ 7 million ; ▪ As of September 30 , 2023 , investments on non - accrual status amounted to 1 . 0 % and 3 . 8 % of the total investment portfolio at fair value and amortized cost, respectively, which are down from 1 . 7 % and 4 . 8 % , respectively, as of June 30 , 2023 ; and ▪ During the quarter, the Company repurchased 168 , 023 shares of its common stock under its 10 b 5 - 1 trading plan at an average price of $ 10 . 71 per share for a total repurchase amount of $ 1 . 8 million . Through September 30 , 2023 , the Company repurchased a total of 2 , 493 , 645 shares of its common stock under its 10 b 5 - 1 trading plan at an average price of $ 9 . 65 per share for a total repurchase amount of $ 24 . 1 million . DISTRIBUTIONS ▪ For the quarter ended September 30 , 2023 , the Company paid a regular quarterly distribution totaling $ 18 . 6 million, or $ 0 . 34 per share, and declared supplemental distributions of (a) $ 2 . 7 million, or $ 0 . 05 per share, which was paid on October 16 , 2023 and (b) $ 0 . 05 per share, payable on January 15 , 2024 to shareholders of record as of December 29 , 2023 ; and ▪ On November 6 , 2023 , the Company’s co - chief executive officers declared a fourth quarter 2023 regular distribution of $ 0 . 34 per share payable on December 15 , 2023 to shareholders of record as of December 1 , 2023 . SUBSEQUENT EVENTS ▪ On October 10 , 2023 , the Company completed a private offering in Israel pursuant to which the Company issued approximately $ 33 . 1 million of its additional unsecured Series A Notes due 2026 , which bear interest at a floating rate equal to SOFR plus a credit spread of 3 . 82 % per year payable quarterly ; and ▪ On November 8 , 2023 , the Company completed a private offering pursuant to which the Company issued $ 100 million of its unsecured notes due 2027 , which bear interest at a floating rate equal to the three - month SOFR plus a credit spread of 4 . 75 % per year and subject to a 2 . 00 % SOFR floor payable quarterly .

4 Selected Financial Highlights (1) The discussion of the investment portfolio excludes short term investments. (2) Total debt outstanding excludes netting of debt issuance costs. Please refer to page 10 for debt net of issuance costs . (3) Includes a supplemental distribution of $0.05 per share during the quarter ended September 30, 2023 and a special distributio n o f $0.27 per share during the quarter ended December 31, 2022.

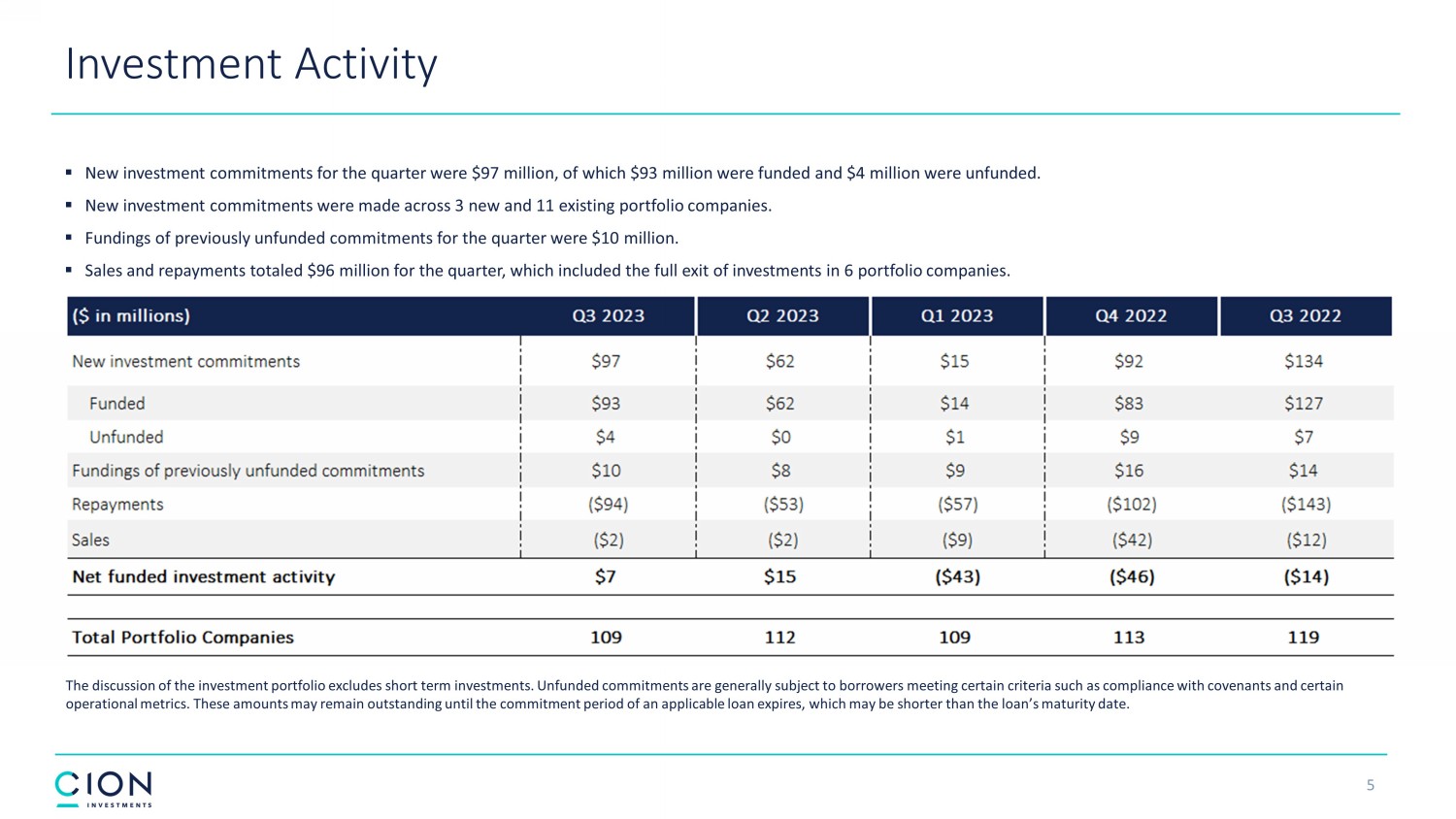

Investment Activity ▪ New investment commitments for the quarter were $97 million, of which $93 million were funded and $4 million were unfunded. ▪ New investment commitments were made across 3 new and 11 existing portfolio companies. ▪ Fundings of previously unfunded commitments for the quarter were $10 million. ▪ Sales and repayments totaled $96 million for the quarter, which included the full exit of investments in 6 portfolio companie s. The discussion of the investment portfolio excludes short term investments. Unfunded c ommitments are generally subject to borrowers meeting certain criteria such as compliance with covenants and certain operational metrics. These amounts may remain outstanding until the commitment period of an applicable loan expires, which ma y b e shorter than the loan’s maturity date. 5

6 Portfolio Asset Composition 86% 87% 89% 90% 90% 2% 2% 2% 2% 2% 0% * 0% * 0% * 0% * 0% * 1% 1% 1% 2% 2% 11% 10% 8% 6% 6% $1,728 $1,688 $1,657 $1,749 $1,797 Q3 2023 Q2 2023 Q1 2023 Q4 2022 Q3 2022 End of Period Investments (in millions) * Less than 1%. The discussion of the investment portfolio is at fair value and excludes short term investments. 100% 88% 87% 99% 84% 14% 7% 5% 13% 1% 2% $97 $62 $15 $92 $134 Q3 2023 Q2 2023 Q1 2023 Q4 2022 Q3 2022 New Investment Commitments (in millions)

7 INTERNAL INVESTMENT RISK RATINGS (1) (% of Total Portfolio, Fair Value) Q3 2023 NON - ACCRUAL % (1) Higher Credit Quality Lower Credit Quality Credit Quality of Investments 3.83% 1.03% Amortized Cost Fair Value (1) The discussion of the investment portfolio excludes short term investments. * - Less than 1%.

87.8% Senior Secured Debt Investments PORTFOLIO BY SECURITY TYPE (4) PORTFOLIO BY INTEREST RATE TYPE (4) 85.7% 2.1% 11.3% 0.1% 0.8% ▪ First Lien Debt (85.7%) ▪ Second Lien Debt (2.1%) ▪ Equity (11.3%) ▪ Collateralized Securities & Structured Products: Equity (0.1%) ▪ Unsecured Debt (0.8%) ▪ Floating Interest Rate Investments (81.2%) ▪ Fixed Interest Rate Investments (7.3%) ▪ Non - Income Producing Investments (8.4%) ▪ Other Income Producing Investments (3.1%) Portfolio Summary 8 ( 1 ) See endnote 4 in our press release filed with the SEC on November 9 , 2023 . ( 2 ) See endnote 5 in our press release filed with the SEC on November 9 , 2023 . ( 3 ) See endnote 6 in our press release filed with the SEC on November 9 , 2023 . ( 4 ) The discussion of the investment portfolio excludes short term investments . 81.2% 7.3% 8.4% 3.1%

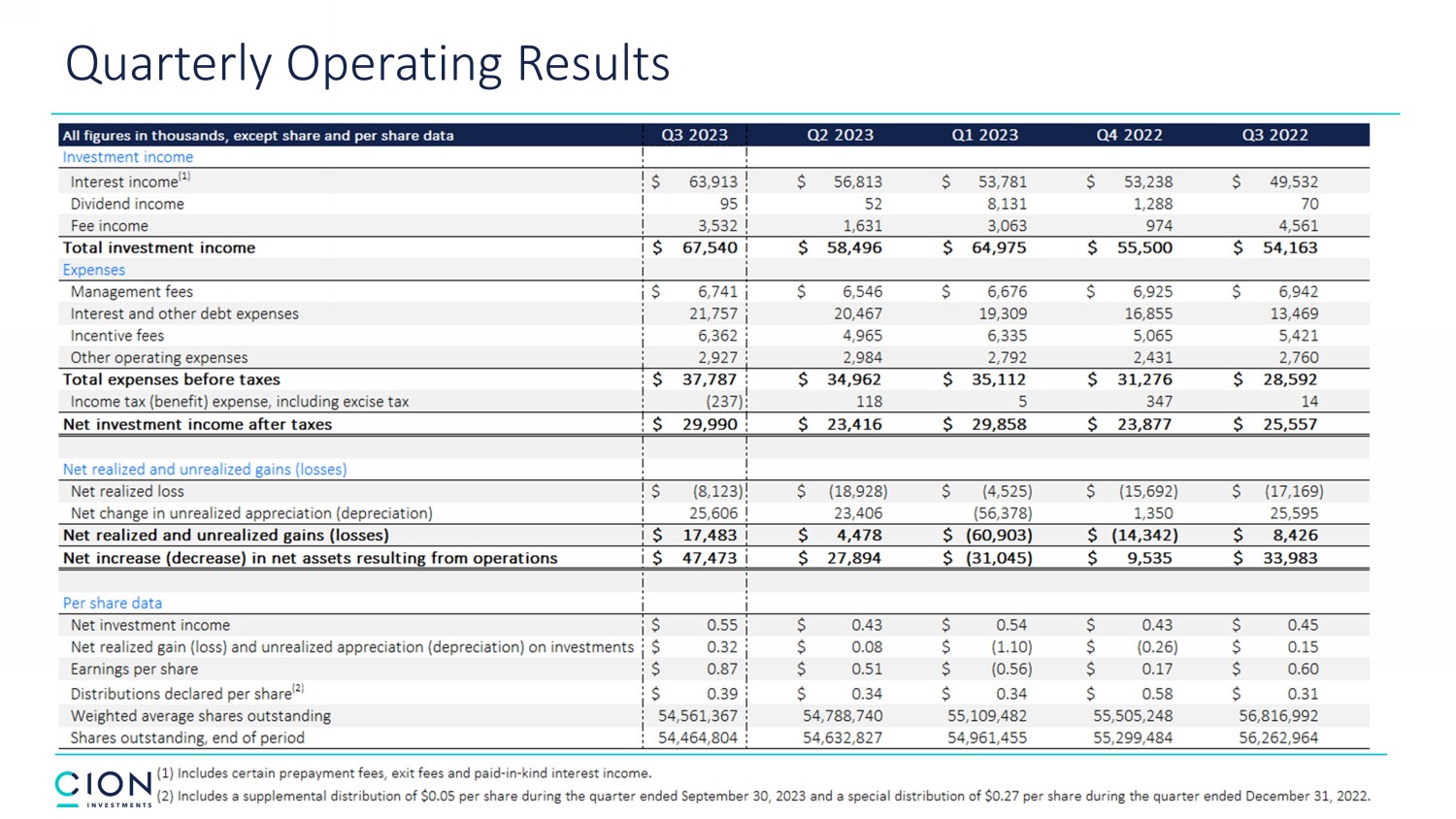

Quarterly Operating Results 9

Quarterly Balance Sheet 10

11 Q3 2023 Net Asset Value Bridge Per Share Data

12 Total Commitment Amount Principal Amount Outstanding Interest Rate Maturity Date JPM Credit Facility $675 $600 S + 3.20% (2) 5/15/2025 UBS Facility 150 122 S + 3.53% (3) 11/19/2024 Unsecured Notes, 2026 (1) 125 125 4.50% 2/11/2026 Series A Unsecured Notes, 2026 (1) 81 81 S + 3.82% 8/31/2026 2022 Unsecured Term Loan (1) 50 50 S + 3.50% 4/27/2027 2021 Unsecured Term Loan (1) 30 30 5.20% 9/30/2024 Total Debt $1,111 $1,008 8.3% Debt Summary DEBT MATURITIES ($ in millions) DEBT SCHEDULE ($ in millions) $103 million in available capacity within existing senior secured facilities (1) Investment grade credit rating. (2) Bears interest at a rate of SOFR + 3.05% and a LIBOR to SOFR credit spread adjustment of 0.15%. (3) Will bear interest at a rate of SOFR + 3.20% commencing November 19, 2023.

13 Distribution Per Share and Distribution Coverage 1 (1) Includes special/supplemental distributions of $0.20, $0.27 and $0.05 per share during Q4 2021, Q4 2022 and Q3 2023, respecti vel y.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

CION Investment (NYSE:CION)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

CION Investment (NYSE:CION)

Historical Stock Chart

Von Mai 2023 bis Mai 2024