false

0001860543

0001860543

2024-02-20

2024-02-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United States

Securities and

Exchange Commission

Washington,

D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 20, 2024

CADRE

HOLDINGS, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-40698 |

38-3873146 |

| (State or other jurisdiction |

(Commission File Number) |

(IRS Employer |

| of incorporation) |

|

Identification Number) |

| 13386

International Pkwy |

|

| Jacksonville,

Florida |

32218 |

| (Address

of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (904) 741-5400

N/A

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

| Title

of each class |

Trading

Symbol |

Name

of each exchange on which

registered |

| Common

Stock, par value $.0001 |

CDRE |

New

York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

x |

Emerging

growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 7.01 |

Regulation FD Disclosure. |

On February 20, 2024, Cadre

Holdings, Inc. (the “Company”) reviewed a slide presentation at a conference call and a webcast held to discuss its entry

into a definitive agreement to acquire Alpha Safety Intermediate, LLC, the operating parent of Alpha Safety, a leading nuclear safety

solutions company. The slide presentation is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information included

in Exhibit 99.1 attached hereto is “furnished” pursuant to Item 7.01 of Form 8-K and shall not be deemed to be “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise

subject to the liabilities of that Section, unless the Company specifically incorporates the information included in this Item 7.01 or

Exhibit 99.1 by reference in a document filed under the Securities Act of 1933, as amended, or the Exchange Act. In addition, the Company

undertakes no duty or obligation to publicly update or revise the information included in this Item 7.01 or Exhibit 99.1.

| Item 9.01. |

Financial Statements and Exhibits |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 20, 2024

| CADRE HOLDINGS, INC. |

| | | |

| | By: | /s/ Blaine Browers |

| | Name: | Blaine Browers |

| | Title: | Chief Financial Officer |

Exhibit 99.1

Acquisition Overview: Alpha Safety February 2024 T OGETHER , W E S AVE L IVES

2 FORWARD - LOOKING STATEMENTS Please note that in this presentation Cadre Holdings, Inc. (the "Company" or "Cadre") may use words such as “appears,” “anticipates,” “believes,” “plans,” “expects,” “intends,” “future,” and similar expressions which constitute forward - looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward - looking statements include but are not limited to all projections and anticipated levels of future performance. Forward - looking statements involve risks, uncertainties and other factors that may cause our actual results to differ materially from those discussed herein. Any number of factors could cause actual results to differ materially from those expressed or implied by forward - looking statements in this presentation, including without limitation, the possibility that the Company’s contemplated acquisition of Alpha Safety will not be completed on the terms and conditions, or on the timing, currently contemplated, and tha t it may not be completed at all, due to a failure to obtain or satisfy, in a timely manner or otherwise, required conditions t o t he closing of the transaction or for other reasons, the failure to complete the transaction which could negatively impact the pr ice of the Company’s shares of commons stock or the business, results of operations, and financial condition of the Company, and the Company’s ability to successfully integrate the operations of Alpha Safety, as well as those risks and uncertainties more fully described from time to time in the Company’s public reports filed with the Securities and Exchange Commission, includin g under the section titled “Risk Factors” in the Company's Annual Report on Form 10 - K, and/or Quarterly Reports on Form 10 - Q, as well as in the Company’s Current Reports on Form 8 - K. All forward - looking statements included in this presentation are based upon information available to the Company as of the date of this presentation, and speak only as of the date hereof. We assume no obligation to update any forward - looking statements to reflect events or circumstances after the date of this presentation. T OGETHER , W E S AVE L IVES

3 3 Source: Internal Company forecasts ACQUISITION OVERVIEW T OGETHER , W E S AVE L IVES Alpha Safety Provides an Entrance Into a New Vertical with Multiple Growth Levers Across Nuclear Products and Services B USINESS O VERVIEW & S TRATEGIC R ATIONALE • Leading market position • High cost of substitution • Leading and defensible technology • Strong brand recognition • Attractive ROIC • Niche market • Resiliency thru market cycles C ADRE ’ S K EY M&A C RITERIA M ET • Alpha Safety is a provider of highly engineered, technical products and services spanning the nuclear value chain • Highly - visible, recurring revenue driven by long - term contracts, commitments and recurring purchases from entrenched customer base • Leading positions across all its key product lines and service offerings • Large TAM with long - term industry tailwinds supported by 20 - 30+ year project timelines • $44 million in revenue for FY2023; EBITDA margin in excess of 20% • Acquisition represents an opportunity to integrate a leading, niche protective products manufacturer, reinforcing Cadre’s focus on mission - critical safety and survivability • Customer overlap with the Department of Energy and key nuclear sites

4 Alpha Safety’s Products/Services Span the Nuclear Value Chain; Supporting Commercial and Government Missions with Radioactive El ements T OGETHER , W E S AVE L IVES PRODUCT AND SERVICE OVERVIEW Engineered Containers Ventilation and Containment Overview : Equipment and systems to contain and control radioactive and potentially hazardous contaminants Products / Services : Air filtration and carbon adsorber systems modular containment systems and nuclear shielding Specialty Filters / Consumable Products Radiometric Instrumentation Advanced Transportation Containers Field Services and Maintenance Overview : Proprietary containers for handling and storing plutonium oxides, metals, powders and by products Products / Services : Container system enabled by proprietary filter technology co - developed with DoE / NNSA with all IP owned by Alpha Overview: Leader in nuclear material non - destructive assay testing services, flammable gas analysis for testing nuclear waste, and other maintenance Products / Services : Technical services for waste / radioactive material characterization, flammable gas analysis, contracted on annual container maintenance, and other technical onsite services Overview : Solutions for transporting and long - term storage of radioactive materials and nuclear waste Products / Services : Leading U . S . manufacturer of certain advanced containers for transporting and safe disposal of plutonium and related hazardous materials Overview : Products and solutions built for the handling and transportation of radioactive material and release of flammable gases from waste drums Products / Services : Filters, containers, bags and other consumables Overview : Products for monitoring radioactive material and assessing its composition and characteristics Products / Services : systems include standard and custom non - destructive assay solutions and criticality accident and alarm systems

5 5 Source: Internal Company forecasts T OGETHER , W E S AVE L IVES ACQUISITION EXPANDS ADDRESSABLE MARKET Source: (1) See Management estimates from 10 - K for additional detail. “Existing SAM” is calculated as: EoD Equipment ($245mm) + Safety Holsters ($380mm) + Blast Sensors ($500mm) + Soft Body Armor ($870mm) = ~$2bn. (2) Oliver Wyman analysis. ~$2B A NNUAL SAM C ADRE ’ S E XISTING SAM (1) C ADRE ’ S E XPANDED O PPORTUNITY S ET ~$5 - 8B Annual Core SAM + Domestic Nuclear TAM C OMBINED ~$3 - 6B A NNUAL TAM D OMESTIC N UCLEAR P RODUCTS M ARKET (2) Alpha Safety’s large, total addressable market for domestic nuclear products and services immediately expands Cadre’s TAM and already well - developed serviceable addressable market (SAM) in its core categories

6 MACRO TAILWINDS SUPPORT LONG - TERM SUSTAINABLE GROWTH OPPORTUNITY T OGETHER , W E S AVE L IVES DoE Budget Supports Long - Term Growth for the Federal Nuclear Market Growing DoE Environmental Liability Across Multiple Sites Requiring Remediation Spend Spanning 60+ Years Stable U.S. Nuclear Power Market Positioned for Late - Decade Growth as Advanced Nuclear Reactors are Commercialized

7 7 Source: Internal Company forecasts T OGETHER , W E S AVE L IVES MACROECONOMIC ENVIRONMENT SUPPORTS NUCLEAR SECTOR The nuclear sector offers multiple lucrative opportunities driven by enduring demand growth, supported by long - term federal directives and commercial initiatives “The U.S. hasn't manufactured pits regularly since 1989. The National Nuclear Security Administration has been directed to develop the capacity to make at least 80 pits a year by 2030 ” – U.S. Government Accountability Office January 2023 “The Civil Nuclear Credit Program is a $6 billion strategic investment through the Bipartisan Infrastructure Law (BIL) to help preserve the existing U.S. reactor fleet ” – U.S. Department of Energy: Civil Nuclear Credit Program “It is clear that nuclear is one of the lowest emitting sources of power . Nuclear power emits just 10 - 15g/CO2 equivalent per kWh, which is competitive with both wind and solar and substantially better than coal and natural gas. Nuclear power is also the second largest source of low carbon energy after hydro power, more than wind and solar combined ” – Schroders | Nuclear Power: A Viable Option in an Energy Transition August 2023 “DOE’s environmental and disposal liabilities also include the estimated cleanup…for a period of 75 years after the balance sheet date, i.e., through 2097 in FY 2022 and through 2096 in FY 2021 . While some post - cleanup monitoring and other long - term stewardship activities post - 2097 ” – Bureau of Fiscal Service “With today’s passage of the bipartisan ADVANCE Act , we are one step closer to reestablishing America’s preeminence as the global leader in nuclear energy in the twenty - first century” – Senate Passes Bipartisan Nuclear Energy Bill from Capito, Carper, Whitehouse July 2023

8 8 Source: Internal Company forecasts T OGETHER , W E S AVE L IVES ATTRACTIVE MARKET AND PLATFORM FOR M&A T URNKEY M&A P LATFORM Proven track record of executing M&A and strong sector relationships Consolidated platform offers high synergy potential 100+ acquisition targets in M&A pipeline Historical acquisitions have proven ability to scale and strengthen customer relationships S PECIFIC A CQUISITION C RITERIA … …L ARGE P IPELINE OF A TTRACTIVE G LOBAL M&A T ARGETS …W ITH P ROVEN T RACK R ECORD OF S UCCESSFUL A CQUISITIONS Strengthen Relationship With Key Customers and Added Capabilities Vertical Integration of Critical Production Capability Added Number of Strategic Customers and Product / Service Capabilities (2013) (2021) (2023) New Capabilities Nuclear Safety Focused New Customers / Increased Wallet Share Value - Added, Protected Products and Services 12 Priority Targets 5 Target in Active Dialogue 100+ Identified Potential Targets Tracked

9 INVESTMENT HIGHLIGHTS 9 T OGETHER , W E S AVE L IVES Leading, Niche Protective Products Manufacturer that Syncs with Cadre’s Focus on Mission - Critical Safety and Survivability Protected Market Position Due to Technology Moat and Entrenched Customer Relationships Highly - visible and Predictable Revenue Supported by Long - term Contracts, Commitments and Recurring Purchase Orders Large TAM with Long - Term Industry Tailwinds Supported by 20 - 30+ Year Project Timelines Financial Profile Highlighted by EBITDA Margin Greater Than 20% Platform for Robust M&A Pipeline with 100+ Identified Targets to Grow Customer Wallet Share and Expand Geographically Customer Overlap with Cadre’s Armor Business Serving Key Commercial Nuclear Sites

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

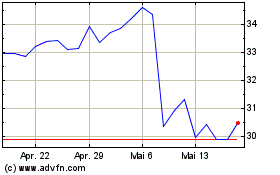

Cadre (NYSE:CDRE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Cadre (NYSE:CDRE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024