Quarterly gross crypto services revenues of

$199.4 million and associated crypto costs and execution, clearing

and brokerage fees of $197.8 million

Quarterly total revenues of $214.5 million

include gross crypto revenues and net loyalty revenues; full year

total revenues of $780.1 million

Quarterly total operating expenses of $293.0

million. Quarterly operating expenses excluding crypto costs,

execution, clearing and brokerage fees and goodwill, intangible and

long-lived assets impairments were $27.8 million, down 55%

year-over-year

Recently completed initial closing of $42.4

million of gross proceeds from concurrent registered direct

offerings with third-party investors and Intercontinental Exchange

(“ICE”) to strengthen liquidity and balance sheet position

Expansion of institutional crypto capabilities

with recent launch of Collaborative Custody and expected launch of

institutional trading services in Q3 2024

Updated expected full year 2024 outlook. Total

revenues for full year 2024 expected to grow significantly

year-over-year to $3,292 million - $5,114 million. Operating cash

flow usage for full year 2024 expected to decline ~70%

year-over-year to $58 million - $72 million

Bakkt Holdings, Inc. (“Bakkt”) (NYSE: BKKT) announced its

financial and operational results for the quarter and full year

ended December 31, 2023.

“Bakkt has built a robust foundation and we are in a prime

position as we enter the next phase of our journey to commercialize

our platform and scale our business,” said Andy Main, incoming

President and Chief Executive Officer of Bakkt. “Our focus for 2024

is on a set of strategic initiatives that will provide our business

with efficient scale, including broadening our client network,

expanding our product set and prudently managing expenses. With our

newly strengthened balance sheet which helped put us in a position

to alleviate the conditions that raised doubt about our ability to

continue as a going concern, and improving crypto market

conditions, we are excited about the opportunities in 2024 to

execute on our key priorities and drive our company towards

profitability. It is an honor to become the Chief Executive Officer

of Bakkt and have the opportunity to lead the organization at this

pivotal moment in the company’s journey.”

Our 2024 key priorities include:

1. Broaden client network and deepen

existing relationships – continue recent momentum in expanding

and activating our client network. Our recently signed new retail

and institutional clients include Bitcoin ETF providers, crypto

native companies, neobanks and fintechs. Continue to execute on

international “land and expand” strategy, including Latin America,

Spain, Hong Kong, Singapore and Taiwan where our crypto

capabilities are currently live.

2. Expand our products and solutions –

we plan to leverage our newly enhanced secure, compliant and

trusted institutional-grade custody platform as a secure foundation

to build incremental higher margin complementary institutional

crypto solutions. We recently launched Collaborative Custody and

expect to launch institutional trading in Q3 2024. These

complementary products are expected to provide attractive

opportunities to significantly grow revenue with minimal costs. We

will be able to efficiently bring new institutional capabilities to

market by leveraging our strategic partnerships, while requiring

minimal internal technology development work and resources.

- Collaborative Custody - we are partnering with Unchained

Capital, a prominent player in collaborative custody, to provide

multi-signature wallets and key management services, contributing

to enhanced security for digital asset storage; and

- Institutional trading - we plan to launch a high-performance,

low-cost, institutional trading venue. This trading venue will be

in the form of an Electronic Communication Network (“ECN”), which

is a technology-based solution that automatically matches and

executes trades with best available pricing and high-speed

performance. We expect to deliver an institutional-grade trading

experience for our clients with this new offering.

3. Prudent expense management –

continue to reduce our operating expenses through prudent firmwide

expense management initiatives. Our second half 2023 operating

expenses excluding crypto costs, execution, clearing and brokerage

fees and goodwill, intangible and long-lived assets impairments

were down 42% from the first half of 2023. We expect full year 2024

operating expenses to decline 13-18% year-over-year as we remain

focused on preserving our strong balance sheet with prudent expense

management and judicious capital allocation decisions.

Full Year 2024 Outlook

- Full year 2024 revenues expected to be $3,292 million - $5,114

million; includes gross crypto revenues of $3,239 million -$5,057

million and net loyalty revenues of $53 million - $57 million.

- Full year 2024 crypto costs expected to be $3,220 million -

$5,027 million, in line with gross crypto revenues.

- Full year 2024 total operating expenses excluding crypto costs,

execution, clearing and brokerage fees and goodwill, intangible and

long-lived assets impairments expected to be $160 million - $170

million.

- Full year 2024 net cash used in operating activities expected

to be ($58 million) – ($72 million).

- Full year 2024 free cash flow usage (non-GAAP) expected to be

($65 million) - ($79 million).

- End of year cash, cash equivalents and available-for-sale

securities of $35 million - $50 million.

Fourth Quarter Financial Highlights (unaudited)

Fourth quarter 2023 results include Bakkt Crypto (f/k/a Apex

Crypto, LLC), which we acquired on April 1, 2023. In accordance

with GAAP, we are presenting crypto services revenue and crypto

costs and execution, clearing and brokerage fees on a gross basis

since we are a principal in those transactions.

$ in millions

4Q23

4Q22

Increase/ (decrease)

Total revenues

$214.5

$15.9

N.M.

Crypto costs and execution, clearing and

brokerage fees

197.8

0.3

N.M.

Goodwill, intangible and long-lived assets

impairments

67.4

285.9

(76%)

Operating expenses, excluding crypto

costs, execution, clearing and brokerage fees and goodwill,

intangible and long-lived assets impairments

27.8

61.7

(55%)

Total operating expenses

293.0

347.9

(16%)

Operating loss

(78.5)

(332.0)

(76%)

Net loss

(78.7)

(326.4)

(76%)

Adjusted EBITDA loss (non-GAAP)

$(19.0)

$(30.5)

(38%)

Note: “N.M” denotes Not Meaningful

- Key performance indicators (including historical Bakkt Crypto

data for comparison purposes):

- Crypto enabled accounts of 6.2 million have continued to

increase steadily year-over-year.

- Transacting accounts of 915,000 decreased 39% year-over-year,

due to industrywide slowdown in crypto activity.

- Notional traded volume of $442 million decreased 35%

year-over-year, primarily due to lower activity levels from Webull

Pay customers and lower loyalty redemption activity in merchandise,

travel and gift cards.

- Assets under custody of $702 million increased 41%

year-over-year, due to higher coin prices.

- Total revenues of $214.5 million reflect a significant increase

in gross crypto services revenues driven by our acquisition of

Bakkt Crypto. Net loyalty revenues of $15.1 million decreased 4%

year-over-year driven by lower service revenue.

- Total operating expenses of $293.0 million reflect a

significant increase in crypto costs and execution, clearing and

brokerage fees driven by our acquisition of Bakkt Crypto. Fourth

quarter expenses included non-cash intangible assets impairments of

$37.2 million and non-cash long-lived assets impairments of $30.2

million. These charges were recognized in accordance with U.S.

generally accepted accounting principles and a result of various

analyses, including fair valuing our intangible assets, lower

growth expectations for the loyalty business and cash flow

analyses.

- Operating loss of $78.5 million decreased year-over-year due to

larger goodwill and intangible assets impairments recorded in the

prior year.

- Net loss of $78.7 million decreased year-over-year.

- Adjusted EBITDA loss (non-GAAP) of $19.0 million decreased 38%

year-over-year primarily due to a reduction in compensation and

benefits costs.

Full Year Financial Highlights

$ in millions

FY23

FY22

Increase/ (decrease)

Total revenues

$780.1

$56.2

N.M.

Crypto costs and execution, clearing and

brokerage fees

722.3

1.7

N.M.

Goodwill, intangible and long-lived assets

impairments

90.8

1,833.6

(95%)

Operating expenses, excluding crypto

costs, execution, clearing and brokerage fees and goodwill,

intangible and long-lived assets impairments

195.0

239.9

(19%)

Total operating expenses

1,008.0

2,075.1

(51%)

Operating loss

(227.9)

(2,018.9)

(89%)

Net loss

(225.8)

(1,989.9)

(89%)

Adjusted EBITDA loss (non-GAAP)

$(93.9)

$(119.7)

(22%)

- Key performance indicators (including historical Bakkt Crypto

data for comparison purposes):

- Notional traded volume of $1,974.3 million decreased 49%

year-over-year, primarily due to lower industrywide volume and

lower activity levels from Webull Pay customers.

- Total revenues of $780.1 million reflect a significant increase

in gross crypto services revenues driven by our acquisition of

Bakkt Crypto. Net loyalty revenues of $53.1 million decreased 2%

year-over-year driven by lower service revenue.

- Total operating expenses of $1,008.0 million reflect a

significant increase in crypto costs and execution, clearing and

brokerage fees driven by our acquisition of Bakkt Crypto.

- Operating loss of $227.9 million decreased year-over-year due

to larger goodwill and intangible assets impairments recorded in

the prior year.

- Net loss of $225.8 million decreased year-over-year.

- Adjusted EBITDA loss (non-GAAP) of $93.9 million decreased 22%

year-over-year primarily due to a reduction in compensation and

benefits costs.

Webcast and Conference Call Information

Bakkt will host a conference call at 5:00 PM ET, March 25, 2024.

The earnings conference call will be webcast live and archived on

the on the investor relations section of Bakkt’s corporate website

under the ‘Events & Presentations’ section, along with any

related earnings materials.

Investors and analysts interested in participating in the call

are invited to dial (833) 470-1428 or (404) 975-4839, and reference

participant access code 563811 approximately ten minutes prior to

the start of the call.

About Bakkt

Founded in 2018, Bakkt builds solutions that enable our clients

to grow with the crypto economy. Through institutional-grade

custody, trading, and onramp capabilities, our clients leverage

technology that’s built for sustainable, long-term involvement in

crypto.

Bakkt is headquartered in Alpharetta, GA. For more information,

visit: https://www.bakkt.com/ | X (Formerly Twitter) @Bakkt |

LinkedIn https://www.linkedin.com/company/bakkt/.

Bakkt-E Source: Bakkt Holdings, Inc.

Note on Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Such statements include, but are not limited to, Bakkt’s

guidance and outlook, including for the full fiscal year 2024, and

the trends and assumptions underlying such guidance and outlook,

Bakkt’s preliminary financial results and the timing for Bakkt

announcing its audited financial results, Bakkt’s plans and

expectations for fiscal year 2024, including statements about new

products and features, growth, Bakkt’s expectations regarding the

crypto economy market growth, and Bakkt’s beliefs regarding its

future goals, among others. Forward-looking statements can be

identified by words such as “will,” “likely,” “expect,” “continue,”

“anticipate,” “estimate,” “believe,” “intend,” “plan,”

“projection,” “outlook,” “grow,” “progress,” “potential” or words

of similar meaning. Such forward-looking statements are based upon

the current beliefs and expectations of Bakkt’s management and are

inherently subject to significant business, economic and

competitive uncertainties and contingencies, many of which are

difficult to predict and beyond Bakkt’s control. Actual results and

the timing of events may differ materially from the results

anticipated in such forward-looking statements as a result of the

following factors, among others: the Company’s ability to continue

as a going concern; the Company’s ability to grow and manage growth

profitably; changes in the Company’s business strategy; the

Company’s ability to integrate its acquisitions and achieve desired

synergies; the Company’s future capital requirements and sources

and uses of cash, including funds to satisfy its liquidity needs;

the Company’s inability to maintain the listing of its securities

on the New York Stock Exchange; changes in the market in which the

Company competes, including with respect to its competitive

landscape, technology evolution or changes in applicable laws or

regulations; changes in the markets that the Company targets;

disruptions in the crypto market that subject the Company to

additional risks, including the risk that banks may not provide

banking services to the Company; the possibility that the Company

may be adversely affected by other economic, business, and/or

competitive factors; the inability to launch new services and

products or to profitably expand into new markets and services; the

inability to execute the Company’s growth strategies, including

identifying and executing acquisitions and the Company’s

initiatives to add new clients; the Company’s failure to comply

with extensive government regulation, oversight, licensure and

appraisals; uncertain regulatory regime governing blockchain

technologies and crypto; the inability to develop and maintain

effective internal controls and procedures; the exposure to any

liability, protracted and costly litigation or reputational damage

relating to the Company’s data security; the impact of any goodwill

or other intangible assets impairments on the Company’s operating

results; and other risks and uncertainties indicated in the

Company’s filings with the Securities and Exchange Commission. You

are cautioned not to place undue reliance on such forward-looking

statements. Such forward-looking statements relate only to events

as of the date on which such statements are made and are based on

information available to us as of the date of this press release.

Unless otherwise required by law, we undertake no obligation to

update any forward-looking statements made in this press release to

reflect events or circumstances after the date of this press

release or to reflect new information or the occurrence of

unanticipated events.

Definitions

Crypto-enabled accounts: total

crypto accounts open.

Transacting accounts: unique

accounts that perform at least one transaction across crypto

buy/sell and loyalty redemption each month. Monthly figures are

de-duped for the month. Quarterly figure represents sum of all

months in the quarter.

Notional traded volume: total

notional volume of transactions across crypto buy/sell and loyalty

redemption. Figures represent gross values recorded as of order

date.

Assets under custody: the sum of

coin quantities held by customers multiplied by the final quote for

each coin on the last day of the quarter.

Non-GAAP Financial Measures

Adjusted EBITDA is a non-GAAP financial measure, which we define

as earnings before interest, income taxes, depreciation,

amortization, acquisition-related expenses, share-based and

unit-based compensation expense, goodwill and intangible assets

impairments, restructuring charges, changes in the fair value of

our warrant liability and certain other non-cash and/or

non-recurring items that do not contribute directly to our

evaluation of operating results and are not components of our core

business operations. Adjusted EBITDA provides management with an

understanding of earnings before the impact of investing and

financing transactions and income taxes, and the effects of

aforementioned items that do not reflect the ordinary earnings of

our operations. This measure may be useful to an investor in

evaluating our performance. Adjusted EBITDA is not a measure of our

financial performance under GAAP and should not be considered as an

alternative to net income (loss) or other performance measures

derived in accordance with GAAP. Our definition of Adjusted EBITDA

may not be comparable to similarly tied measures used by other

companies.

Non-GAAP financial measures like Adjusted EBITDA have

limitations, should be considered as supplemental in nature and are

not meant as a substitute for the related financial information

prepared in accordance with GAAP. The non-GAAP financial measures

should be considered alongside other financial performance

measures, including net loss and our other financial results

presented in accordance with GAAP.

Reconciliation of GAAP Net Loss to

Non-GAAP Adjusted EBITDA Loss (unaudited)

$ in millions

4Q23

4Q22

FY23

FY22

Net loss

$(78.7)

$(326.4)

$(225.8)

$(1,989.9)

Depreciation and amortization

3.1

7.0

13.9

25.4

Interest (income) expense, net

(0.8)

(1.0)

(4.3)

(1.9)

Income tax expense (benefit)

0.0

(2.5)

0.4

(11.3)

EBITDA

$(76.4)

$(322.9)

$(215.8)

$(1,977.8)

Acquisition-related expenses

(12.8)

4.5

4.3

5.7

Share-based and unit-based compensation

expense

1.2

2.9

16.8

32.1

Cancellation of common units

---

---

(0.0)

(0.2)

Loss (gain) from change in fair value of

warrant liability

0.7

(3.5)

1.6

(16.6)

Goodwill and intangible assets

impairments

37.2

274.4

60.5

1,822.1

Impairment of long-lived assets

30.2

11.5

30.3

11.5

Restructuring expenses

0.1

2.3

4.6

2.3

Transition services expense

0.8

0.3

3.9

1.2

Adjusted EBITDA loss

$(19.0)

$(30.5)

$(93.9)

$(119.7)

Free Cash Flow is a non-GAAP financial measure. Free Cash Flow

is cash flow from operations adjusted for “capitalized internal use

software development costs and other capital expenditures” and

“interest income.” We adjust for capitalized expenses associated

with internally developed software for our technology platforms

given they are a large component of our ongoing expense base given

our position as a technology platform company.

Information reconciling forward-looking Free Cash Flow to the

comparable GAAP financial measure is unavailable to us without

unreasonable effort. We are not able to provide a reconciliation of

forward-looking Free Cash Flow to the comparable GAAP financial

measure because certain items required for such reconciliations are

outside of our control and/or cannot be reasonably predicted, such

as timing of customer payments for account receivables and payment

terms for operating expenses. Preparation of such reconciliations

would require a forward-looking statement of income and statement

of cash flow, prepared in accordance with GAAP, and such

forward-looking financial statements are unavailable to us without

unreasonable effort (as specified in the exception provided by Item

10(e)(1)(i)(B) of Regulation S-K). We provide a range for our Free

Cash Flow forecast that we believe will be achieved, however we

cannot accurately predict all the components of the Free Cash Flow

calculation. We provide a Free Cash Flow because we believe that

Free Cash Flow, when viewed with our results under GAAP, provides

useful information for the reasons noted above. However, Free Cash

Flow is not a measure of liquidity under GAAP and, accordingly,

should not be considered as an alternative to net cash used in

operating activities as an indicator of liquidity.

Reconciliation of Operating Cash Flow

to Non-GAAP Free Cash Flow ($ in millions) (unaudited)

FY

2024E

$ in

millions

Low

High

Net cash used in operating activities

($58)

($72)

Capex

(4)

(4)

Interest income, net

(3)

(3)

Free Cash Flow

($65)

($79)

Consolidated Balance Sheets

$ in

millions

As

of 12/31/23

As

of 12/31/22

Assets

Current assets

Cash and cash equivalents

$52.9

$98.3

Restricted cash

31.8

16.5

Customer funds

32.9

0.6

Available-for-sale securities

17.4

141.1

Accounts receivable, net

29.7

25.3

Prepaid insurance

13.0

22.8

Safeguarding asset for crypto

701.6

15.8

Other current assets

3.3

6.1

Total current assets

880.6

326.5

Property, equipment and software, net

0.1

19.7

Goodwill

68.0

15.9

Intangible assets, net

2.9

55.8

Deposits with clearinghouse

0.2

15.2

Other assets

13.1

22.5

Total assets

$964.9

$455.5

Liabilities and stockholders'

equity

Current liabilities

Accounts payable and accrued

liabilities

$55.4

$66.8

Customer funds payable

32.9

0.6

Deferred revenue, current

4.3

4.0

Due to related party

3.2

1.2

Safeguarding obligation for crypto

701.6

15.8

Other current liabilities

4.7

3.8

Total current liabilities

802.1

92.1

Deferred revenue, noncurrent

3.2

3.1

Warrant liability

2.4

0.8

Other noncurrent liabilities

23.5

23.4

Total liabilities

831.2

119.4

Stockholders' equity

Class A common stock ($0.0001 par value,

750,000,000 shares authorized, 94,845,942 shares issued and

outstanding as of 12/31/23 and 80,926,843 shares outstanding as of

12/31/22)

0.0

0.0

Class V common stock ($0.0001 par value,

250,000,000 shares authorized, 180,001,606 shares issued and

outstanding as of 12/31/23 and 183,482,777 shares outstanding as of

12/31/22)

0.0

0.0

Additional paid-in capital

799.7

773.0

Accumulated other comprehensive loss

(0.1)

(0.3)

Accumulated deficit

(751.3)

(676.4)

Total stockholders' equity

48.3

96.3

Noncontrolling interest

87.4

239.8

Total equity

135.7

336.1

Total liabilities and stockholders'

equity

$966.9

$455.5

Consolidated Statements of Operations

(unaudited)

$ in

millions

4Q23

4Q22

FY23

FY22

Revenues:

Crypto services

$199.4

$0.3

$727.0

$1.7

Loyalty services, net

15.1

15.6

53.1

54.5

Total revenues

214.5

15.9

780.1

56.2

Operating expenses:

Crypto costs

196.9

0.3

718.5

1.7

Execution, clearing and brokerage fees

0.9

---

3.8

---

Compensation and benefits

16.2

31.9

102.0

139.0

Professional services

3.2

2.2

10.4

11.5

Technology and communication

5.2

4.4

20.8

17.1

Selling, general and administrative

11.7

8.4

33.4

35.4

Acquisition-related expenses

(12.8)

4.5

4.3

5.7

Depreciation and amortization

3.1

7.0

13.9

25.4

Related party expenses

0.8

0.3

3.9

1.2

Goodwill and intangible assets

impairments

37.2

274.4

60.5

1,822.1

Impairment of long-lived assets

30.2

11.5

30.3

11.5

Restructuring expenses

0.1

2.3

4.6

2.3

Other operating expenses

0.4

0.6

1.6

2.3

Total operating expenses

293.0

347.9

1,008.0

2,075.1

Operating loss

(78.5)

(332.0)

(227.9)

(2,018.9)

Interest income, net

0.8

1.0

4.3

1.9

(Loss) gain from change in fair value of

warrant liability

(0.7)

3.5

(1.6)

16.6

Other expense, net

(0.3)

(1.5)

(0.2)

(0.9)

Loss before income taxes

(78.7)

(328.9)

(225.4)

(2,001.3)

Income tax (expense) benefit

(0.0)

2.5

(0.4)

11.3

Net loss

(78.7)

(326.4)

(225.8)

(1,989.9)

Less: Net loss attributable to

noncontrolling interest

(52.0)

(229.1)

(151.0)

(1,411.8)

Net loss attributable to Bakkt

Holdings, Inc.

$(26.7)

$(97.2)

$(74.9)

$(578.1)

Net loss per share attributable to Class A

common stockholders

Basic

$(0.29)

$(1.23)

$(0.84)

$(8.12)

Diluted

$(0.29)

$(1.25)

$(0.84)

$(8.12)

Consolidated Statements of Cash Flows

(unaudited)

$ in

millions

4Q23

4Q22

FY23

FY22

Cash flows from operating

activities:

Net loss

$(78.7)

$(326.4)

$(225.8)

$(1,989.9)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

3.1

7.0

13.9

25.4

Change in fair value of contingent

consideration liability

(13.1)

---

(3.0)

---

Non-cash lease expense

0.8

0.8

3.1

2.7

Share-based compensation expense

1.2

2.7

15.5

31.6

Unit-based compensation expense

0.0

0.2

1.3

0.6

Forfeiture and cancellation of common

units

---

---

(0.0)

(0.2)

Deferred income taxes

---

(2.7)

---

(11.6)

Impairment of long-lived assets

30.2

11.5

30.3

11.5

Goodwill and intangible assets

impairments

37.2

274.4

60.5

1,822.1

Loss on disposal of assets

0.0

3.8

0.1

3.8

Loss (gain) from change in fair value of

warrant liability

0.7

(3.5)

1.6

(16.6)

Other

0.0

0.1

0.0

0.3

Changes in operating assets and

liabilities:

Accounts receivable

(6.9)

(3.2)

(10.0)

(7.2)

Prepaid insurance

(1.0)

(2.2)

9.8

9.4

Deposits with clearinghouse

---

---

15.0

---

Accounts payable and accrued

liabilities

6.3

11.4

(8.0)

0.7

Due to related party

1.5

0.3

2.1

0.6

Deferred revenue

0.3

(0.3)

0.4

(2.4)

Operating lease liabilities

(0.9)

(0.1)

(3.0)

4.2

Customer funds payable

4.7

---

32.3

---

Other assets and liabilities

4.6

2.7

3.4

(2.4)

Net cash used in operating activities

(10.2)

(23.7)

(60.7)

(117.6)

Cash flows from investing

activities:

Capitalized internal-use software

development costs and other capital expenditures

(1.5)

(8.0)

(9.4)

(30.5)

Purchase of available-for-sale

securities

(17.2)

(117.8)

(61.8)

(306.6)

Proceeds from the maturity of

available-for-sale securities

22.6

90.5

185.8

165.2

Acquisition of Bumped Financial, LLC

---

---

(0.6)

---

Acquisition of Bakkt Crypto LLC, net of

cash acquired

---

---

(47.9)

---

Net cash provided by (used in) investing

activities

3.8

(35.4)

66.0

(172.0)

Cash flows from financing

activities:

Repurchase and retirement of Class A

common stock

(0.1)

(2.6)

(2.6)

(2.6)

Proceeds from the exercise of warrants

---

---

---

0.0

Net cash used in financing activities

(0.1)

(2.6)

(2.6)

(2.6)

Effect of exchange rate changes

0.5

0.1

0.4

(0.9)

Net (decrease) increase in cash, cash

equivalents, restricted cash, deposits and customer funds

(6.0)

(61.5)

3.1

(293.0)

Cash, cash equivalents, restricted cash,

deposits and customer funds at the beginning of the period

124.5

177.0

115.4

408.4

Cash, cash equivalents, restricted cash,

deposits and customer funds at the end of the period

$118.5

$115.4

$118.5

$115.4

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240325401287/en/

Investor Relations Ann DeVries, Head of Investor

Relations Ann.DeVries@bakkt.com Media press@bakkt.com

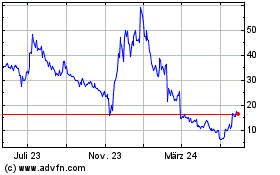

Bakkt (NYSE:BKKT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

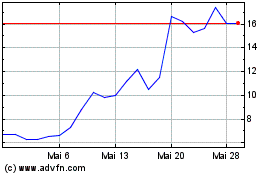

Bakkt (NYSE:BKKT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024