STZ Improves Financial Flexibility - Analyst Blog

09 Mai 2012 - 6:16PM

Zacks

Leading wine and spirits distributor, Constellation

Brands Inc. (STZ), took a step forward in enhancing the

flexibility of its finances by signing up for an additional credit

facility with maturities ranging from five to seven years.

Constellation Brands has acquired a new senior credit facility,

including a revolving credit facility and two-term loan agreements.

The company’s new $850 million revolving credit facility has a

maturity date after five years and currently remains undrawn. The

two term loan agreements, A and A-1, worth $550 million and $250

million, respectively, extend over periods of five and seven years.

Constellation Brands used the funds from the two term loans to

pay back the outstanding amounts under the company’s previous

senior credit facility.

The company’s new credit arrangement follows a $600 million

worth senior notes issued on April 16, 2012. Bearing a coupon rate

of 6%, these notes have a maturity date of May 1, 2022.

These transactions indicate that Constellation Brands is

strictly focused on strengthening its financial position while also

emphasizing on its future growth plans. These new credit

arrangements significantly improve the company’s credit profile,

providing ample liquidity and free cash flows to meet its capital

needs over the next several years.

This along with a favorable interest rate environment will also

accelerate the company’s strategic initiative of expanding foothold

in the U.S wine industry.

Borrowing costs have gone down significantly, marking a record

low, and in turn, facilitating the companies to obtain easy

financing at compelling prices. Corporate bonds are in high demand

as U.S. treasuries are yielding low rates, driving investors toward

the bonds issued by the sound companies.

Debt offers of big companies are being oversubscribed, providing

corporation’s the option to price their offerings at lower rates.

Hence, several companies are coming up with debt offerings to

generate interest expense savings by refinancing their outstanding

borrowings.

Constellation Brands ended its fiscal 2012 with a healthy

balance sheet and cash flows. During the fiscal, Constellation

generated $784.1 million of cash from operations compared with

$619.7 million in the previous year.

Apart from this, the company achieved a record free cash flow of

$715.7 million. This enabled the company to reduce debt, as well as

fund stock repurchases and acquisitions. Moreover, the company

anticipates generating a free cash flow in the range of $425

million to $475 million during fiscal 2013.

Our Recommendation

Constellation Brands is the largest wine company in the world

and commands a dominant position in the premium wine segment in the

U.S. The company is also a leading producer of wines in Canada and

New Zealand. This provides a competitive edge to the company and

bolsters its well-established position in the market.

Moreover, we believe that the company’s strategic initiative of

expanding footholds in the U.S wine industry along with focus on

brand building and promotion will accelerate its growth

opportunities while strengthening its market position. Moreover, in

an effort to generate strong margins, Constellation Brands is also

focusing on higher priced segment across all key categories.

However, the company faces intense competition from other

well-established players in the industry, including Beam

Inc. (BEAM), Brown-Forman Corporation

(BF.B) and Diageo plc (DEO). Moreover,

Constellation Brands also encounters competition from local and

regional players in the respective countries. Consequently, this

may dent the company’s future operating performance.

We currently have a Zacks #3 Rank (short-term Hold rating) on

the stock. Our long-term recommendation on the stock remains

Neutral.

BEAM INC (BEAM): Free Stock Analysis Report

BROWN FORMAN B (BF.B): Free Stock Analysis Report

DIAGEO PLC-ADR (DEO): Free Stock Analysis Report

CONSTELLATN BRD (STZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

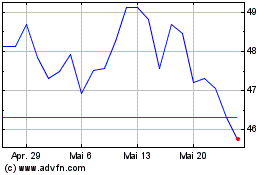

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024