Finishing Touches on Earnings Season - Earnings Preview

02 März 2012 - 1:00AM

Zacks

Earnings Preview 3/2/12

Earnings season is just about over. While there will be 273

firms reporting, only three of them will be members of the S&P

500.

Firms reporting this week include

Brown Foreman

(BF.B),

H&R Block (HRB) and

Pall

Corp. (PLL).

It will also be a busy week for economic data. Key reports

include Durable Goods, Personal Income and Spending, The ISM

Manufacturing Index, Auto Sales and the second look at fourth

quarter GDP.

Monday

- The ISM non-manufacturing or service index is expected to fall

to 56.0 from 56.8 in January. As any reading over 50

indicates expansion, that is still a healthy reading, indicating

fairly robust growth, just not quite as robust as last month.

However, the ISM manufacturing index delivered a big disappointment

for February, so the market is likely to be on guard for a weaker

services reading as well.

- Factory Orders are expected to have fallen 1.5% in January

after rising 1.5% in December. This would be consistent with

the weak Durable goods report last week.

Tuesday

- Nothing of particular significance.

Wednesday

- We get the appetizer for the big jobs report in the form of the

ADP Employment report. As the biggest payroll processor for

private sector companies, ADP is in a good position to gauge job

growth. However, its numbers and those of the BLS do not

always line up exactly, although they do tend to converge after all

the revisions are in. Last month, ADP said that 170,000

private sector jobs were created, well below the 243,000 reported

by the BLS. However, for months before that ADP was

noticeably more upbeat than the BLS. For February, the

Consensus is that ADP will show 220,000 jobs created.

- We get the second look at Productivity and Unit Labor Costs in

the fourth quarter. The consensus is looking for a slight

upward revision to productivity, with growth of 0.8% rather than

the 0.7% growth in the first look. Unit Labor costs are

expected to be revised slightly lower, to 1.1% growth from

1.2%.

- Consumer Credit, not counting real estate related loans like

mortgages, is expected to have increased by $12.0 billion,

noticeably slower than the $19.3 billion increase in

December.

Thursday

- Weekly Initial Claims for Unemployment Insurance were down

2,000 to 351,000 last week, but the prior week was revised up by

2000, so effectively unchanged. The consensus is looking for

a slight rebound to 355,000. The drop in weekly claims well

below the key 400,000 level was the first clue that the jobs

situation was getting significantly better. If claims fall

again it would be a powerful sign that the momentum is

continuing. The big seasonal adjustments are all in the

rearview mirror, so last week’s level is probably about right, but

we have recently seen a lot of volatility in the weekly

numbers. Thus the four-week average is the thing to focus on

(at 354,000 last week). We are actually now well below the

average level of claims for the last 35 years. Keep an eye on

the prior week’s revision as well as the change from the revised

number.

- Continuing Jobless Claims have been in a downtrend of late, but

the road down has been bumpy. Last week they fell by 2,000 to 3.402

million. That is down 443,000, or 11.5% from a year ago. The

consensus is looking for a slight bounce to 3.405 million. Some

(most?) of the longer-term decline is due to people simply

exhausting their regular state benefits which run out after 26

weeks. Those, however, don’t last forever either. Federally paid

extended claims fell by 17,000 to 3.376 million last week and are

down 1.127 million, or 25.0% over the last year. Looking at just

the regular continuing claims numbers is a serious mistake. They

only include a little over half of the unemployed now, given the

unprecedentedly high duration of unemployment figures. A better

measure is the total number of people getting unemployment benefits

-- currently at 7.499 million. The total number of people getting

benefits is now 1.337 million below year-ago levels. What is not

known is how many people have left the extended claims via the road

to prosperity -- finding a new job -- and how many have left on the

road to poverty, having simply exhausted even the extended

benefits. Unless the program is renewed, all extended benefits will

end at the start of March. Make sure to look at both sets of

numbers! Many of the press reports will not, but we will here at

Zacks.

Friday

- The big report of the week is the Employment report. Last

month was much better than expected at 243,000 total jobs added,

with 257,000 coming from the private sector offset by the loss of

14,000 government jobs. For February, the consensus is

looking for 220,000 private sector jobs added and the loss of

11,000 government jobs for a total of 209,000. Given the

excellent behavior of the initial claims reports, I am expecting

even better results, more in line with January. The

unemployment rate will depend on if the civilian participation rate

rebounds. There is a secular decline in that going on as the

baby boomers retire, but we should also see a bit of a cyclical

rise. The consensus is looking for the unemployment rate to

be unchanged at 8.3%, which along with the job creation totals

would suggest a slight rise in the participation rate, although the

unemployment rate is derived from the separate household

survey. Average hourly earnings are expected to rise by 0.2%,

the same rate as last month, and the average work week is expected

to be unchanged at 34.5 hours.

- The Trade Deficit is expected to fall slightly to $48.1 billion

for January from $48.8 billion in December. We have seen

doing a good job of increasing exports of late, but imports have

also been rising. Higher oil prices make it more difficult to

bring down the Trade Deficit.

Potential Positive or Negative Surprises

The best indicators of firms likely to report positive surprises

are a recent history of positive surprises and rising estimates

going into the report. The Zacks Rank is also a good indicator of

potential surprises. Similarly, a recent history of earnings

disappointments, cuts in the average estimate for the quarter in

the month before the report is due and a poor Zacks Rank (#4 or #5)

are often red flags pointing to a potential disappointing earnings

report. Given how few companies are reporting we omit this

section this week.

In the Earnings Calendar below, $999.00 should be read as N.A.

Earnings Calendar

| Company |

Ticker |

Qtr End |

EPS Est |

Year Ago

EPS |

Last EPS

Surprise % |

Next EPS Report Date |

Time |

Daily Price |

| AMBOW EDUCATION |

AMBO |

201112 |

0.22 |

0.18 |

10 |

20120304 |

AMC |

$7.22 |

| ABM INDUSTRIES |

ABM |

201201 |

0.22 |

0.22 |

2.78 |

20120305 |

AMC |

$23.00 |

| AGENUS INC |

AGEN |

201112 |

-0.28 |

-0.18 |

-3.7 |

20120305 |

BTO |

$3.23 |

| AIR TRANSPT SVC |

ATSG |

201112 |

0.2 |

0.19 |

22.22 |

20120305 |

AMC |

$5.62 |

| AIRMEDIA GP-ADR |

AMCN |

201112 |

0.06 |

0.09 |

80 |

20120305 |

AMC |

$2.95 |

| AMAG PHARMA INC |

AMAG |

201112 |

-1.07 |

-0.87 |

21 |

20120305 |

AMC |

$15.56 |

| ARCOS DORADOS-A |

ARCO |

201112 |

0.23 |

0.17 |

-100 |

20120305 |

BTO |

$20.87 |

| ASIA ENTMNT&RES |

AERL |

201112 |

0.52 |

0.36 |

3.64 |

20120305 |

AMC |

$6.49 |

| ASSET ACCEPTNCE |

AACC |

201112 |

0.09 |

-0.01 |

75 |

20120305 |

AMC |

$4.65 |

| ASTEX PHARMACT |

ASTX |

201112 |

-0.01 |

0.11 |

20 |

20120305 |

AMC |

$1.83 |

| BANCOLOMBIA-ADR |

CIB |

201112 |

1.15 |

1.14 |

-0.88 |

20120305 |

|

$64.82 |

| BLACK DIAMOND |

BDE |

201112 |

0.14 |

0.03 |

100 |

20120305 |

AMC |

$8.37 |

| CASEYS GEN STRS |

CASY |

201201 |

0.44 |

0.37 |

0 |

20120305 |

AMC |

$52.05 |

| CHARM COMM-ADR |

CHRM |

201112 |

0.41 |

0.33 |

-3.03 |

20120305 |

AMC |

$9.44 |

| CROSS COUNTRY |

CCRN |

201112 |

0.05 |

0.02 |

50 |

20120305 |

AMC |

$5.80 |

| DAQO NEW ENERGY |

DQ |

201112 |

-0.06 |

0.95 |

-22.73 |

20120305 |

BTO |

$2.90 |

| DUCOMMUN INC DE |

DCO |

201112 |

0.38 |

0.39 |

-36.54 |

20120305 |

AMC |

$15.30 |

| FIRST MAJESTIC |

AG |

201112 |

0.27 |

0.14 |

-21.05 |

20120305 |

BTO |

$20.81 |

| GIANT INTERACTV |

GA |

201112 |

0.17 |

0.17 |

25 |

20120305 |

AMC |

$4.35 |

| HFF INC-A |

HF |

201112 |

0.31 |

0.12 |

31.82 |

20120305 |

AMC |

$14.55 |

| ISOFTSTONE LTD |

ISS |

201112 |

0.11 |

0.03 |

11.11 |

20120305 |

BTO |

$10.07 |

| JIAYUAN.COM INT |

DATE |

201112 |

0.03 |

-0.02 |

71.43 |

20120305 |

AMC |

$7.06 |

| MPG OFFICE TRST |

MPG |

201112 |

-0.18 |

0.02 |

71.43 |

20120305 |

AMC |

$2.17 |

| NETQIN MOBILE |

NQ |

201112 |

0.06 |

-0.33 |

50 |

20120305 |

AMC |

$7.74 |

| NUTRI/SYSTEM |

NTRI |

201112 |

-0.03 |

0.25 |

-16 |

20120305 |

AMC |

$11.29 |

| PERFECT WORLD |

PWRD |

201112 |

0.54 |

0.36 |

-28.57 |

20120305 |

AMC |

$12.41 |

| QUANEX BLDG PRD |

NX |

201201 |

-0.03 |

-0.04 |

-29.17 |

20120305 |

AMC |

$16.79 |

| RRSAT GLBL COMM |

RRST |

201112 |

0.1 |

0.06 |

-60 |

20120305 |

BTO |

$4.01 |

| SANTARUS INC |

SNTS |

201112 |

0.02 |

-0.03 |

0 |

20120305 |

AMC |

$4.50 |

| STEINWAY MUSIC |

LVB |

201112 |

0.37 |

0.28 |

-50 |

20120305 |

AMC |

$24.91 |

| STEREOTAXIS INC |

STXS |

201112 |

-0.14 |

-0.05 |

7.14 |

20120305 |

AMC |

$0.76 |

| TRAVELCENTERS |

TA |

201112 |

-0.38 |

-0.81 |

23.33 |

20120305 |

BTO |

$5.21 |

| TRINITY BIOTECH |

TRIB |

201112 |

0.19 |

0.17 |

5.88 |

20120305 |

BTO |

$10.03 |

| VERENIUM CORP |

VRNM |

201112 |

-0.06 |

-0.36 |

142.86 |

20120305 |

BTO |

$3.10 |

| VERIFONE HLDGS |

PAY |

201201 |

0.46 |

0.35 |

0 |

20120305 |

AMC |

$47.90 |

| ACADIA PHARMA |

ACAD |

201112 |

-0.1 |

0.74 |

0 |

20120306 |

AMC |

$1.65 |

| ACCELRYS INC |

ACCL |

201112 |

0.06 |

0.07 |

0 |

20120306 |

AMC |

$7.93 |

| AEGERION PHARMA |

AEGR |

201112 |

-0.54 |

-0.92 |

-6.67 |

20120306 |

BTO |

$17.12 |

| AEROVIRONMENT |

AVAV |

201201 |

0.41 |

0.52 |

50 |

20120306 |

AMC |

$28.72 |

| AKORN INC |

AKRX |

201112 |

0.08 |

0.04 |

60 |

20120306 |

BTO |

$12.93 |

| ALLOS THERAPEUT |

ALTH |

201112 |

-0.08 |

-0.17 |

26.67 |

20120306 |

AMC |

$1.46 |

| AMER ASSETS TR |

AAT |

201112 |

0.27 |

999 |

0 |

20120306 |

AMC |

$21.26 |

| AMER SAFETY INS |

ASI |

201112 |

-0.68 |

0.97 |

5.88 |

20120306 |

AMC |

$19.05 |

| ANALOGIC CORP |

ALOG |

201201 |

0.56 |

0.38 |

-6.82 |

20120306 |

AMC |

$56.63 |

| APOLLO RES MTGE |

AMTG |

201112 |

0.31 |

999 |

N/A |

20120306 |

AMC |

$18.00 |

| BANK OF NOVA SC |

BNS |

201201 |

1.17 |

1.1 |

-1.82 |

20120306 |

BTO |

$54.58 |

| BLOUNT INTL |

BLT |

201112 |

0.33 |

0.25 |

-24.14 |

20120306 |

BTO |

$17.29 |

| BRIDGEPOINT EDU |

BPI |

201112 |

0.37 |

0.45 |

36.84 |

20120306 |

BTO |

$24.04 |

| CEDAR SHOPN CTR |

CDR |

201112 |

0.11 |

0.15 |

9.09 |

20120306 |

AMC |

$4.75 |

| CHEFS WAREHOUSE |

CHEF |

201112 |

0.25 |

-0.44 |

-25 |

20120306 |

AMC |

$20.71 |

| CHESAPEAKE UTIL |

CPK |

201112 |

0.75 |

0.77 |

-14.29 |

20120306 |

AMC |

$40.42 |

| CHINA NEW BORUN |

BORN |

201112 |

0.43 |

0.41 |

0 |

20120306 |

AMC |

$3.44 |

| CHINA XINIYA FS |

XNY |

201112 |

0.23 |

0.27 |

-14.29 |

20120306 |

BTO |

$1.80 |

| CHINACACHE INTL |

CCIH |

201112 |

0.04 |

0.08 |

-50 |

20120306 |

AMC |

$7.83 |

| COLONY FINL INC |

CLNY |

201112 |

0.39 |

0.45 |

N/A |

20120306 |

AMC |

$16.68 |

| DICKS SPRTG GDS |

DKS |

201201 |

0.88 |

0.76 |

23.08 |

20120306 |

BTO |

$45.34 |

| DUSA PHARM INC |

DUSA |

201112 |

0.13 |

0.12 |

250 |

20120306 |

BTO |

$4.83 |

| EMERITUS CORP |

ESC |

201112 |

-0.36 |

-0.37 |

-63.89 |

20120306 |

AMC |

$18.20 |

| ENERGY CONV DEV |

ENERQ |

201112 |

-0.49 |

-0.21 |

-12.2 |

20120306 |

BTO |

$0.14 |

| EXCEL MARITIME |

EXM |

201112 |

-0.25 |

0.14 |

-25 |

20120306 |

AMC |

$1.79 |

| FOCUS MEDIA HLD |

FMCN |

201112 |

0.51 |

0.36 |

26.32 |

20120306 |

AMC |

$24.52 |

| FUEL TECH INC |

FTEK |

201112 |

0.07 |

0.04 |

175 |

20120306 |

BTO |

$5.89 |

| GLOBAL CASH ACS |

GCA |

201112 |

0.13 |

0.07 |

-50 |

20120306 |

AMC |

$5.57 |

| HICKORY TECH |

HTCO |

201112 |

0.17 |

0.16 |

37.5 |

20120306 |

AMC |

$10.75 |

| HILL INTL INC |

HIL |

201112 |

0 |

0.1 |

100 |

20120306 |

AMC |

$5.30 |

| IRIDIUM COMMUN |

IRDM |

201112 |

0.09 |

0.14 |

-11.76 |

20120306 |

BTO |

$7.56 |

| JOHN BEAN TECH |

JBT |

201112 |

0.53 |

0.58 |

-6.67 |

20120306 |

AMC |

$17.28 |

| KRONOS WORLDWD |

KRO |

201112 |

0.5 |

0.33 |

-7.5 |

20120306 |

BTO |

$23.50 |

| MAKO SURGICAL |

MAKO |

201112 |

-0.14 |

-0.26 |

-4.35 |

20120306 |

AMC |

$39.10 |

| MCEWEN MINING |

MUX |

201112 |

-0.14 |

-0.06 |

5.88 |

20120306 |

BTO |

$5.46 |

| MEDIDATA SOLUTN |

MDSO |

201112 |

0.29 |

0.56 |

22.22 |

20120306 |

BTO |

$19.98 |

| METABOLIX INC |

MBLX |

201112 |

-0.3 |

-0.35 |

6.67 |

20120306 |

AMC |

$2.76 |

| METRO HLTH NET |

MDF |

201112 |

0.19 |

0.14 |

0 |

20120306 |

BTO |

$8.02 |

| MID-CON ENERGY |

MCEP |

201112 |

0.31 |

999 |

N/A |

20120306 |

AMC |

$24.30 |

| NCI BLDG SYSTEM |

NCS |

201201 |

-0.69 |

-0.99 |

40.63 |

20120306 |

AMC |

$12.17 |

| ONCOTHYREON INC |

ONTY |

201112 |

-0.18 |

-0.17 |

0 |

20120306 |

AMC |

$8.45 |

| OUTDOOR CHANNEL |

OUTD |

201112 |

0.11 |

0.06 |

14.29 |

20120306 |

AMC |

$6.65 |

| PANDORA MEDIA |

P |

201201 |

-0.02 |

999 |

100 |

20120306 |

AMC |

$13.59 |

| PARK OHIO HLDNG |

PKOH |

201112 |

0.5 |

0.3 |

105.88 |

20120306 |

BTO |

$18.55 |

| PHOENIX NEW MED |

FENG |

201112 |

0.05 |

999 |

120 |

20120306 |

AMC |

$7.44 |

| PHYSICIANS FORM |

FACE |

201112 |

-0.03 |

-0.07 |

33.33 |

20120306 |

AMC |

$3.03 |

| POST HOLDINGS |

POST |

201112 |

0.32 |

999 |

N/A |

20120306 |

AMC |

$31.49 |

| RIGEL PHARMCTCL |

RIGL |

201112 |

-0.28 |

-0.33 |

16.67 |

20120306 |

BTO |

$9.85 |

| SHUFFLE MASTER |

SHFL |

201201 |

0.1 |

0.09 |

5.88 |

20120306 |

AMC |

$14.90 |

| STAAR SURGICAL |

STAA |

201112 |

0.02 |

-0.02 |

-50 |

20120306 |

AMC |

$11.00 |

| STAGE STORES |

SSI |

201201 |

1.07 |

0.86 |

-12.5 |

20120306 |

BTO |

$14.99 |

| SUNOPTA INC |

STKL |

201112 |

0.07 |

0.08 |

-25 |

20120306 |

AMC |

$5.05 |

| SYNTROLEUM CORP |

SYNM |

201112 |

-0.04 |

-0.06 |

0 |

20120306 |

BTO |

$1.21 |

| TNS INC |

TNS |

201112 |

0.56 |

0.51 |

-15.09 |

20120306 |

AMC |

$18.45 |

| UTD NATURAL FDS |

UNFI |

201201 |

0.44 |

0.39 |

0 |

20120306 |

BTO |

$46.01 |

| VAIL RESORTS |

MTN |

201201 |

1.5 |

1.48 |

0 |

20120306 |

BTO |

$41.64 |

| WARREN RSRCS |

WRES |

201112 |

0.07 |

0.07 |

175 |

20120306 |

BTO |

$3.96 |

| ZELTIQ AESTHETC |

ZLTQ |

201112 |

-0.09 |

999 |

N/A |

20120306 |

BTO |

$11.03 |

| ZIPREALTY INC |

ZIPR |

201112 |

-0.08 |

-0.2 |

87.5 |

20120306 |

AMC |

$1.32 |

| A123 SYSTEMS |

AONE |

201112 |

-0.43 |

-0.43 |

-37.84 |

20120307 |

AMC |

$1.90 |

| ACADIA HEALTHCR |

ACHC |

201112 |

0.13 |

999 |

N/A |

20120307 |

AMC |

$13.89 |

| ALLIANCE HEALTH |

AIQ |

201112 |

-0.08 |

-0.06 |

66.67 |

20120307 |

AMC |

$1.30 |

| AMER EAGLE OUTF |

AEO |

201201 |

0.34 |

0.44 |

0 |

20120307 |

BTO |

$14.74 |

| BLOCK H & R |

HRB |

201201 |

0.06 |

0.06 |

-8.57 |

20120307 |

AMC |

$16.44 |

| BON-TON STORES |

BONT |

201201 |

3.14 |

4.41 |

-11.25 |

20120307 |

BTO |

$5.12 |

| BROWN FORMAN B |

BF.B |

201201 |

1 |

0.96 |

0 |

20120307 |

BTO |

$81.75 |

| BROWN SHOE CO |

BWS |

201201 |

0.2 |

0.11 |

-1.96 |

20120307 |

BTO |

$10.67 |

| CALAVO GROWERS |

CVGW |

201201 |

0.25 |

0.16 |

19.05 |

20120307 |

BTO |

$27.42 |

| CANADIAN SOLAR |

CSIQ |

201112 |

-0.4 |

0.58 |

-143.14 |

20120307 |

BTO |

$3.67 |

| CAPITAL SR LIVG |

CSU |

201112 |

0.06 |

0.08 |

20 |

20120307 |

AMC |

$8.51 |

| CELLCOM ISRAEL |

CEL |

201112 |

0.56 |

1.08 |

-25 |

20120307 |

BTO |

$13.23 |

| CHILDRENS PLACE |

PLCE |

201201 |

0.89 |

1.24 |

4.72 |

20120307 |

BTO |

$52.57 |

| CHINA KANGH-ADR |

KH |

201112 |

0.26 |

0.17 |

5.88 |

20120307 |

AMC |

$18.64 |

| CHINA LODGING |

HTHT |

201112 |

0.08 |

0.09 |

25 |

20120307 |

AMC |

$15.11 |

| CHINAEDU CP-ADR |

CEDU |

201112 |

0.01 |

0.07 |

-12.5 |

20120307 |

AMC |

$6.30 |

| CIENA CORP |

CIEN |

201201 |

-0.17 |

-0.14 |

-40 |

20120307 |

BTO |

$14.87 |

| COCA COLA BOTTL |

COKE |

201112 |

0.43 |

0.46 |

-37.21 |

20120307 |

AMC |

$64.50 |

| COLDWATER CREEK |

CWTR |

201201 |

-0.21 |

-0.37 |

3.13 |

20120307 |

AMC |

$0.99 |

| COMPASS DIVERSF |

CODI |

201112 |

0.38 |

0.48 |

-33.33 |

20120307 |

AMC |

$14.85 |

| COMVERGE INC |

COMV |

201112 |

0.05 |

0.02 |

50 |

20120307 |

BTO |

$1.42 |

| CPI AEROSTRUCTR |

CVU |

201112 |

0.38 |

-0.44 |

31.58 |

20120307 |

BTO |

$14.82 |

| DELEK US HLDGS |

DK |

201112 |

-0.17 |

-0.14 |

2.5 |

20120307 |

AMC |

$13.57 |

| ENTRAVISION COM |

EVC |

201112 |

0 |

0.08 |

-100 |

20120307 |

AMC |

$1.63 |

| EXPRESS INC |

EXPR |

201201 |

0.68 |

0.55 |

5.71 |

20120307 |

BTO |

$24.22 |

| FLOTEK INDU INC |

FTK |

201112 |

0.15 |

0.09 |

133.33 |

20120307 |

AMC |

$11.52 |

| FRESH MARKET |

TFM |

201201 |

0.39 |

0.33 |

-5 |

20120307 |

BTO |

$45.09 |

| GENL COMMS INC |

GNCMA |

201112 |

0.07 |

-0.03 |

-6.25 |

20120307 |

AMC |

$10.58 |

| GERON CORP |

GERN |

201112 |

-0.2 |

-0.24 |

11.11 |

20120307 |

AMC |

$2.00 |

| HOT TOPIC INC |

HOTT |

201201 |

0.2 |

0.12 |

0 |

20120307 |

AMC |

$9.12 |

| HOVNANIAN ENTRP |

HOV |

201201 |

-0.47 |

-0.64 |

-20 |

20120307 |

BTO |

$2.80 |

| INTEST CORP |

INTT |

201112 |

0.1 |

0.13 |

37.5 |

20120307 |

AMC |

$3.40 |

| JAMBA INC |

JMBA |

201112 |

-0.14 |

-0.17 |

66.67 |

20120307 |

AMC |

$2.03 |

| KOPIN CORP |

KOPN |

201112 |

0.05 |

0.04 |

-83.33 |

20120307 |

BTO |

$3.48 |

| KORN/FERRY INTL |

KFY |

201201 |

0.29 |

0.3 |

-5.88 |

20120307 |

BTO |

$16.09 |

| KRATOS DEFENSE |

KTOS |

201112 |

0 |

0.09 |

-1600 |

20120307 |

AMC |

$6.23 |

| LIHUA INTL INC |

LIWA |

201112 |

0.4 |

0.45 |

7.5 |

20120307 |

BTO |

$6.12 |

| LINCOLN EDUCATL |

LINC |

201112 |

0.23 |

1.32 |

18.18 |

20120307 |

BTO |

$8.34 |

| LITTLEFIELD CP |

LTFD |

201112 |

-0.01 |

-0.01 |

50 |

20120307 |

|

$0.30 |

| MAIDENFORM BRND |

MFB |

201112 |

0.01 |

0.29 |

-20 |

20120307 |

BTO |

$21.20 |

| MENS WEARHOUSE |

MW |

201201 |

-0.12 |

-0.19 |

21.54 |

20120307 |

AMC |

$39.70 |

| MMODAL INC |

MODL |

201112 |

0.29 |

0.23 |

13.33 |

20120307 |

AMC |

$10.21 |

| MYR GROUP INC |

MYRG |

201112 |

0.26 |

0.29 |

-20 |

20120307 |

AMC |

$20.56 |

| NAVISTAR INTL |

NAV |

201201 |

-0.17 |

0.16 |

6.31 |

20120307 |

BTO |

$41.76 |

| NEW MOUNTN FIN |

NMFC |

201112 |

0.3 |

999 |

0 |

20120307 |

AMC |

$13.25 |

| NORDION INC |

NDZ |

201201 |

0.13 |

0.34 |

47.06 |

20120307 |

AMC |

$10.25 |

| OPTIMER PHARMAC |

OPTR |

201112 |

0 |

-0.31 |

-9.62 |

20120307 |

AMC |

$13.09 |

| PALL CORP |

PLL |

201201 |

0.74 |

0.68 |

13.85 |

20120307 |

AMC |

$63.28 |

| POINTS INTL LTD |

PCOM |

201112 |

0.14 |

0.06 |

22.22 |

20120307 |

AMC |

$9.30 |

| PRIMERO MINING |

PPP |

201112 |

0.06 |

999 |

-33.33 |

20120307 |

BTO |

$2.88 |

| QUAKER CHEMICAL |

KWR |

201112 |

0.79 |

0.69 |

33.77 |

20120307 |

AMC |

$40.44 |

| RELM WIRELESS |

RWC |

201112 |

0 |

-0.08 |

600 |

20120307 |

BTO |

$1.25 |

| RESOURCE CAPITL |

RSO |

201112 |

0.23 |

0.33 |

N/A |

20120307 |

AMC |

$5.78 |

| RIGNET INC |

RNET |

201112 |

0.19 |

0.09 |

100 |

20120307 |

AMC |

$17.00 |

| SCHAWK INC-CL A |

SGK |

201112 |

0.26 |

0.3 |

-15.38 |

20120307 |

AMC |

$11.09 |

| SEMTECH CORP |

SMTC |

201201 |

0.24 |

0.42 |

28.95 |

20120307 |

AMC |

$28.70 |

| SEQUENOM INC |

SQNM |

201112 |

-0.19 |

-0.19 |

0 |

20120307 |

AMC |

$4.36 |

| SIGMA DESIGNS |

SIGM |

201201 |

-0.44 |

0.22 |

51.43 |

20120307 |

AMC |

$5.66 |

| SIMCERE PHARMAC |

SCR |

201112 |

0.09 |

0.16 |

-33.33 |

20120307 |

BTO |

$8.38 |

| SPEEDWAY MOTORS |

TRK |

201112 |

0.02 |

0.09 |

13.73 |

20120307 |

BTO |

$15.26 |

| STANDARD PKG CP |

STAN |

201112 |

0.31 |

0.29 |

19.35 |

20120307 |

AMC |

$18.86 |

| TRANSGENOMIC |

TBIO |

201112 |

-0.02 |

-0.02 |

33.33 |

20120307 |

BTO |

$1.30 |

| UNITEK GLOBAL |

UNTK |

201112 |

0.03 |

-6.93 |

87.5 |

20120307 |

AMC |

$4.00 |

| WALTER INV MGMT |

WAC |

201112 |

0.1 |

0.34 |

N/A |

20120307 |

BTO |

$19.98 |

| WI-LAN INC |

WILN |

201112 |

0.14 |

-0.11 |

12.5 |

20120307 |

BTO |

$5.25 |

| 3SBIO INC-ADS |

SSRX |

201112 |

0.14 |

0.11 |

0 |

20120308 |

AMC |

$11.94 |

| 7 DAYS GRP-ADR |

SVN |

201112 |

0.09 |

0.07 |

-11.76 |

20120308 |

AMC |

$15.62 |

| AEROPOSTALE INC |

ARO |

201201 |

0.37 |

0.95 |

11.11 |

20120308 |

AMC |

$18.39 |

| ALIMERA SCIENCE |

ALIM |

201112 |

-0.25 |

-0.2 |

4.55 |

20120308 |

AMC |

$3.80 |

| ALON USA ENERGY |

ALJ |

201112 |

-0.11 |

-0.37 |

28.57 |

20120308 |

AMC |

$9.82 |

| AMBEV-PR ADR |

ABV |

201112 |

0.55 |

0.49 |

27.27 |

20120308 |

BTO |

$39.94 |

| AMER CARESOURCE |

ANCI |

201112 |

-0.04 |

0 |

-25 |

20120308 |

AMC |

$0.50 |

| AMERIGON INC |

ARGN |

201112 |

0.07 |

0.15 |

-30 |

20120308 |

BTO |

$15.00 |

| AMN HLTHCR SVCS |

AHS |

201112 |

0.04 |

-0.01 |

66.67 |

20120308 |

AMC |

$5.40 |

| ANACOR PHARMACT |

ANAC |

201112 |

-0.35 |

-0.73 |

58.97 |

20120308 |

BTO |

$5.85 |

| ANHEUSER-BU ADR |

BUD |

201112 |

0.98 |

0.77 |

11.22 |

20120308 |

BTO |

$68.42 |

| APPROACH RESRCS |

AREX |

201112 |

0.21 |

0.13 |

10.53 |

20120308 |

AMC |

$35.06 |

| ASSISTED LVG CN |

ALC |

201112 |

0.25 |

0.23 |

4.35 |

20120308 |

BTO |

$15.96 |

| BIOLASE TECH |

BLTI |

201112 |

-0.01 |

0.01 |

-200 |

20120308 |

AMC |

$2.73 |

| BODY CENTRAL CP |

BODY |

201112 |

0.37 |

0.25 |

12.5 |

20120308 |

AMC |

$28.90 |

| BUCKLE INC |

BKE |

201201 |

1.14 |

1.05 |

0 |

20120308 |

BTO |

$48.01 |

| CAMBIUM LEARNG |

ABCD |

201112 |

-0.03 |

0.04 |

-50 |

20120308 |

AMC |

$2.92 |

| CANTEL MED CORP |

CMN |

201201 |

0.31 |

0.22 |

9.37 |

20120308 |

BTO |

$19.37 |

| CDN IMPL BK |

CM |

201201 |

1.91 |

1.97 |

-2.69 |

20120308 |

BTO |

$78.07 |

| CDN NTRL RSRCS |

CNQ |

201112 |

0.9 |

0.36 |

10.17 |

20120308 |

BTO |

$37.96 |

| CECO ENVIRNMNTL |

CECE |

201112 |

0.13 |

0.05 |

7.69 |

20120308 |

|

$7.24 |

| CHEMBIO DIAGNOS |

CEMI |

201112 |

0.01 |

0.03 |

0 |

20120308 |

BTO |

$0.50 |

| CHINA RE IN-ADR |

CRIC |

201112 |

0.04 |

0.1 |

-30 |

20120308 |

BTO |

$5.48 |

| CLOVIS ONCOLOGY |

CLVS |

201112 |

-0.79 |

999 |

N/A |

20120308 |

BTO |

$24.74 |

| COLUMBIA LABS |

CBRX |

201112 |

-0.01 |

0.05 |

900 |

20120308 |

BTO |

$0.67 |

| COMTECH TELECOM |

CMTL |

201201 |

0.22 |

0.52 |

41.38 |

20120308 |

AMC |

$32.04 |

| COOPER COS |

COO |

201201 |

1.03 |

0.85 |

20.66 |

20120308 |

AMC |

$79.57 |

| CORE-MARK HLDG |

CORE |

201112 |

0.56 |

0.53 |

7.07 |

20120308 |

BTO |

$40.58 |

| CYTORI THERAPEU |

CYTX |

201112 |

-0.15 |

-0.18 |

6.25 |

20120308 |

AMC |

$3.17 |

| DENISON MINES |

DNN |

201112 |

-0.03 |

-0.04 |

200 |

20120308 |

AMC |

$1.93 |

| DESCARTES SYS |

DSGX |

201201 |

0.13 |

0.11 |

-30.77 |

20120308 |

BTO |

$8.27 |

| DIXIE GRP INC |

DXYN |

201112 |

-0.03 |

0.09 |

100 |

20120308 |

BTO |

$4.28 |

| DOUBLE EAGLE PE |

DBLE |

201112 |

0 |

-0.3 |

0 |

20120308 |

|

$6.71 |

| DYNEGY INC |

DYN |

201112 |

-0.35 |

-0.48 |

-10.53 |

20120308 |

BTO |

$1.26 |

| E-HOUSE CHINA |

EJ |

201112 |

-0.05 |

0.21 |

-300 |

20120308 |

BTO |

$6.61 |

| EMERGENT BIOSOL |

EBS |

201112 |

0.72 |

0.76 |

-60 |

20120308 |

AMC |

$15.31 |

| ENERGY PARTNERS |

EPL |

201112 |

0.41 |

0.08 |

-20 |

20120308 |

BTO |

$16.87 |

| ENERGY RECOVERY |

ERII |

201112 |

-0.04 |

-0.04 |

-62.5 |

20120308 |

AMC |

$2.19 |

| FLY LEASING LTD |

FLY |

201112 |

0.4 |

0.39 |

-40.91 |

20120308 |

BTO |

$12.66 |

| FUEL SYSTEM SOL |

FSYS |

201112 |

0.14 |

0.08 |

-60 |

20120308 |

BTO |

$26.42 |

| FULL HOUSE RESO |

FLL |

201112 |

0.06 |

0.11 |

0 |

20120308 |

BTO |

$3.15 |

| FUSHI COPPERWLD |

FSIN |

201112 |

0.22 |

0.32 |

-30.3 |

20120308 |

BTO |

$7.99 |

| GENMARK DIAGNST |

GNMK |

201112 |

-0.27 |

-0.44 |

9.38 |

20120308 |

AMC |

$4.11 |

| GLOBAL PARTNERS |

GLP |

201112 |

0.39 |

0.32 |

245.45 |

20120308 |

BTO |

$22.31 |

| GOL LINHAS-ADR |

GOL |

201112 |

0.07 |

0.29 |

-373.91 |

20120308 |

AMC |

$8.51 |

| HECKMANN CORP |

HEK |

201112 |

0.02 |

0 |

300 |

20120308 |

AMC |

$5.16 |

| HI TECH PHARMA |

HITK |

201201 |

0.89 |

0.79 |

35.06 |

20120308 |

BTO |

$42.08 |

| HOME INNS&HOTEL |

HMIN |

201112 |

0.22 |

0.3 |

18.92 |

20120308 |

AMC |

$30.68 |

| HUDBAY MINERALS |

HBM |

201112 |

0.14 |

0.16 |

-122.73 |

20120308 |

BTO |

$12.09 |

| HUDSON PAC PPTY |

HPP |

201112 |

0.25 |

0.21 |

-4.17 |

20120308 |

AMC |

$15.03 |

| INFUSYSTEM HLDG |

INFU |

201112 |

0.01 |

-0.11 |

-1200 |

20120308 |

|

$2.00 |

| INTERVAL LEISUR |

IILG |

201112 |

0.1 |

0.12 |

42.86 |

20120308 |

AMC |

$13.27 |

| JINKOSOLAR HLDG |

JKS |

201112 |

-0.56 |

2.36 |

-468.18 |

20120308 |

BTO |

$7.21 |

| JINPAN INTL LTD |

JST |

201112 |

0.33 |

0.35 |

70 |

20120308 |

BTO |

$8.55 |

| KIRKLANDS INC |

KIRK |

201201 |

0.74 |

0.66 |

50 |

20120308 |

BTO |

$16.45 |

| MAC-GRAY CORP |

TUC |

201112 |

0.05 |

0.01 |

-28.57 |

20120308 |

BTO |

$13.69 |

| MAIN STREET CAP |

MAIN |

201112 |

0.41 |

0.34 |

12.82 |

20120308 |

AMC |

$23.88 |

| MICROMET INC |

MITI |

201112 |

-0.24 |

-0.11 |

22.73 |

20120308 |

BTO |

$11.00 |

| NATURAL GAS SVC |

NGS |

201112 |

0.22 |

0.16 |

0 |

20120308 |

BTO |

$13.24 |

| NEUROGESX INC |

NGSX |

201112 |

-0.41 |

-0.69 |

2.27 |

20120308 |

BTO |

$0.59 |

| NGP CAP RSRCS |

NGPC |

201112 |

0.1 |

0.15 |

17.65 |

20120308 |

|

$7.51 |

| OBAGI MEDICAL |

OMPI |

201112 |

0.19 |

0.24 |

47.06 |

20120308 |

AMC |

$11.34 |

| OMEGA PROTEIN |

OME |

201112 |

0.11 |

0.44 |

-48.94 |

20120308 |

AMC |

$8.35 |

| ONCOGENEX PHARM |

OGXI |

201112 |

-0.59 |

0.31 |

16.67 |

20120308 |

AMC |

$16.20 |

| PLUG POWER INC |

PLUG |

201112 |

-0.22 |

-0.9 |

37.5 |

20120308 |

BTO |

$2.10 |

| POSTROCK ENERGY |

PSTR |

201112 |

0.14 |

0.35 |

-428.57 |

20120308 |

|

$3.78 |

| POWERSECURE INT |

POWR |

201112 |

0.02 |

-0.03 |

183.33 |

20120308 |

AMC |

$6.08 |

| QUIKSILVER INC |

ZQK |

201201 |

-0.1 |

-0.05 |

0 |

20120308 |

AMC |

$4.67 |

| RADNET INC |

RDNT |

201112 |

0.03 |

0.06 |

-100 |

20120308 |

BTO |

$2.95 |

| RENREN INC-ADR |

RENN |

201112 |

-0.01 |

0.06 |

500 |

20120308 |

AMC |

$5.48 |

| SAFETY INS GRP |

SAFT |

201112 |

0.59 |

0.86 |

3.57 |

20120308 |

|

$42.70 |

| SAUL CENTERS |

BFS |

201112 |

0.55 |

0.48 |

-8.33 |

20120308 |

|

$38.00 |

| SMITH & WESSON |

SWHC |

201201 |

0.04 |

-0.08 |

125 |

20120308 |

AMC |

$5.31 |

| SMITHFIELD FOOD |

SFD |

201201 |

0.66 |

0.84 |

10.14 |

20120308 |

BTO |

$23.45 |

| SOMAXON PHARMAC |

SOMX |

201112 |

-0.21 |

-0.42 |

-16.13 |

20120308 |

AMC |

$0.60 |

| STANDARD MOTOR |

SMP |

201112 |

0.16 |

0.11 |

22.92 |

20120308 |

BTO |

$24.64 |

| STEWART ENTRP A |

STEI |

201201 |

0.12 |

0.09 |

-10 |

20120308 |

|

$6.10 |

| SUNTECH PWR HLD |

STP |

201112 |

-0.32 |

0.32 |

-161.9 |

20120308 |

BTO |

$3.04 |

| THL CREDIT INC |

TCRD |

201112 |

0.3 |

0.17 |

7.41 |

20120308 |

AMC |

$12.71 |

| THOR INDS INC |

THO |

201201 |

0.27 |

0.08 |

-2.38 |

20120308 |

AMC |

$32.50 |

| TICC CAPITAL CP |

TICC |

201112 |

0.25 |

0.24 |

44 |

20120308 |

BTO |

$9.77 |

| TPC GROUP INC |

TPCG |

201112 |

-1.34 |

0.07 |

-18.31 |

20120308 |

AMC |

$35.50 |

| TRANS1 INC |

TSON |

201112 |

-0.13 |

-0.22 |

31.82 |

20120308 |

AMC |

$3.23 |

| TRANSACT TECH |

TACT |

201112 |

0.07 |

0.11 |

-10 |

20120308 |

AMC |

$6.81 |

| TRIANGLE CAP CP |

TCAP |

201112 |

0.49 |

0.42 |

15.56 |

20120308 |

BTO |

$19.51 |

| ULTA SALON COSM |

ULTA |

201201 |

0.68 |

0.49 |

10.53 |

20120308 |

AMC |

$85.31 |

| UNION DRILLING |

UDRL |

201112 |

0.06 |

-0.01 |

400 |

20120308 |

BTO |

$6.82 |

| US PHYSICAL THR |

USPH |

201112 |

0.28 |

0.28 |

-2.86 |

20120308 |

BTO |

$18.80 |

| VISIONCHINA MDA |

VISN |

201112 |

0.04 |

0.05 |

50 |

20120308 |

AMC |

$1.79 |

| WALKER & DUNLOP |

WD |

201112 |

0.42 |

0.41 |

-15.15 |

20120308 |

BTO |

$11.97 |

| WILLIAMS-SONOMA |

WSM |

201201 |

1.13 |

1.08 |

7.89 |

20120308 |

BTO |

$38.97 |

| WIRELESS RONIN |

RNIN |

201112 |

-0.07 |

-0.09 |

0 |

20120308 |

|

$0.86 |

| WORLD ENERGY SL |

XWES |

201112 |

-0.01 |

0.04 |

N/A |

20120308 |

BTO |

$4.85 |

| WUXI PHARMATECH |

WX |

201112 |

0.25 |

0.24 |

12 |

20120308 |

AMC |

$12.96 |

| ZOGENIX INC |

ZGNX |

201112 |

-0.34 |

-0.17 |

-10.91 |

20120308 |

AMC |

$2.48 |

| ZUMIEZ INC |

ZUMZ |

201201 |

0.59 |

0.49 |

9.76 |

20120308 |

AMC |

$32.81 |

| AFC ENTERPRISES |

AFCE |

201112 |

0.24 |

0.18 |

-4.35 |

20120309 |

|

$15.96 |

| ANN INC |

ANN |

201201 |

0.08 |

0.19 |

7.02 |

20120309 |

BTO |

$24.56 |

| ARENA PHARMA |

ARNA |

201112 |

-0.15 |

-0.23 |

-14.29 |

20120309 |

BTO |

$1.80 |

| BIOSCRIP INC |

BIOS |

201112 |

0.09 |

0.11 |

11.11 |

20120309 |

BTO |

$6.35 |

| BPZ RESOURCES |

BPZ |

201112 |

-0.06 |

-0.09 |

133.33 |

20120309 |

BTO |

$3.23 |

| CHINDEX INTL |

CHDX |

201112 |

0.05 |

0.14 |

-81.82 |

20120309 |

AMC |

$9.44 |

| CITI TRENDS INC |

CTRN |

201201 |

-0.2 |

0.64 |

-2.7 |

20120309 |

BTO |

$11.25 |

| FED SIGNAL CP |

FSS |

201112 |

0.05 |

0.02 |

-62.5 |

20120309 |

BTO |

$4.65 |

| FERRELLGAS -LP |

FGP |

201201 |

0.78 |

0.82 |

-44.83 |

20120309 |

BTO |

$18.19 |

| HALOZYME THERA |

HALO |

201112 |

-0.15 |

-0.17 |

266.67 |

20120309 |

BTO |

$11.39 |

| HIBBET SPORTS |

HIBB |

201201 |

0.57 |

0.44 |

15.69 |

20120309 |

BTO |

$50.96 |

| KMG CHEMICALS |

KMGB |

201201 |

0.21 |

0.21 |

3.33 |

20120309 |

BTO |

$17.44 |

| LMI AEROSPACE |

LMIA |

201112 |

0.43 |

0.26 |

-18.6 |

20120309 |

BTO |

$20.95 |

| NOVAVAX INC |

NVAX |

201112 |

-0.04 |

-0.06 |

40 |

20120309 |

BTO |

$1.28 |

| OCEAN POWER TEC |

OPTT |

201201 |

-0.34 |

-0.33 |

-18.75 |

20120309 |

BTO |

$3.35 |

| PEREGRINE PHARM |

PPHM |

201201 |

-0.13 |

-0.14 |

-23.08 |

20120309 |

AMC |

$0.95 |

| STAG INDUSTRIAL |

STAG |

201112 |

0.25 |

999 |

0 |

20120309 |

AMC |

$12.42 |

| US CONCRETE INC |

USCR |

201112 |

-0.34 |

-0.53 |

-25 |

20120309 |

BTO |

$4.17 |

| POST HOLDINGS |

POST |

201112 |

0.32 |

999 |

N/A |

20120306 |

AMC |

$31.49 |

| RIGEL PHARMCTCL |

RIGL |

201112 |

-0.28 |

-0.33 |

16.67 |

20120306 |

BTO |

$9.85 |

| SHUFFLE MASTER |

SHFL |

201201 |

0.1 |

0.09 |

5.88 |

20120306 |

AMC |

$14.90 |

| STAAR SURGICAL |

STAA |

201112 |

0.02 |

-0.02 |

-50 |

20120306 |

AMC |

$11.00 |

| STAGE STORES |

SSI |

201201 |

1.07 |

0.86 |

-12.5 |

20120306 |

BTO |

$14.99 |

| SUNOPTA INC |

STKL |

201112 |

0.07 |

0.08 |

-25 |

20120306 |

AMC |

$5.05 |

| SYNTROLEUM CORP |

SYNM |

201112 |

-0.04 |

-0.06 |

0 |

20120306 |

BTO |

$1.21 |

| TNS INC |

TNS |

201112 |

0.56 |

0.51 |

-15.09 |

20120306 |

AMC |

$18.45 |

| UTD NATURAL FDS |

UNFI |

201201 |

0.44 |

0.39 |

0 |

20120306 |

BTO |

$46.01 |

| VAIL RESORTS |

MTN |

201201 |

1.5 |

1.48 |

0 |

20120306 |

BTO |

$41.64 |

| WARREN RSRCS |

WRES |

201112 |

0.07 |

0.07 |

175 |

20120306 |

BTO |

$3.96 |

| ZELTIQ AESTHETC |

ZLTQ |

201112 |

-0.09 |

999 |

N/A |

20120306 |

BTO |

$11.03 |

| ZIPREALTY INC |

ZIPR |

201112 |

-0.08 |

-0.2 |

87.5 |

20120306 |

AMC |

$1.32 |

| A123 SYSTEMS |

AONE |

201112 |

-0.43 |

-0.43 |

-37.84 |

20120307 |

AMC |

$1.90 |

| ACADIA HEALTHCR |

ACHC |

201112 |

0.13 |

999 |

N/A |

20120307 |

AMC |

$13.89 |

| ALLIANCE HEALTH |

AIQ |

201112 |

-0.08 |

-0.06 |

66.67 |

20120307 |

AMC |

$1.30 |

| AMER EAGLE OUTF |

AEO |

201201 |

0.34 |

0.44 |

0 |

20120307 |

BTO |

$14.74 |

| BLOCK H & R |

HRB |

201201 |

0.06 |

0.06 |

-8.57 |

20120307 |

AMC |

$16.44 |

| BON-TON STORES |

BONT |

201201 |

3.14 |

4.41 |

-11.25 |

20120307 |

BTO |

$5.12 |

| BROWN FORMAN B |

BF.B |

201201 |

1 |

0.96 |

0 |

20120307 |

BTO |

$81.75 |

| BROWN SHOE CO |

BWS |

201201 |

0.2 |

0.11 |

-1.96 |

20120307 |

BTO |

$10.67 |

| CALAVO GROWERS |

CVGW |

201201 |

0.25 |

0.16 |

19.05 |

20120307 |

BTO |

$27.42 |

BROWN FORMAN B (BF.B): Free Stock Analysis Report

BLOCK H & R (HRB): Free Stock Analysis Report

PALL CORP (PLL): Free Stock Analysis Report

To read this article on Zacks.com click here.

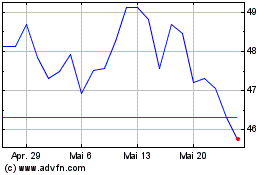

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024