UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 11-K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK PURCHASE, SAVINGS

AND SIMILAR PLANS PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Mark One)

(X) ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2008

OR

( ) TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Commission File Number 002-26821

A. Full Title of Plan:

Brown-Forman Corporation Savings Plan

for Collectively Bargained Employees

B. Name of Issuer of the Securities held Pursuant to the Plan and

the Address of its Principal Executive Office:

Brown-Forman Corporation

850 Dixie Highway

Louisville, Kentucky 40210

INDEX

Pages

Report of Independent Registered Public Accounting Firm 2

Financial Statements

Statement of Net Assets Available for Benefits,

December 31, 2008 and 2007 3

Statement of Changes in Net Assets Available for Benefits

Year Ended December 31, 2008 4

Notes to Financial Statements 5-11

Supplemental Schedule

Form 5500 Schedule H, Line 4i -

Schedule of Assets (Held at End of Year), December 31, 2008 12

Note: Other schedules required by Section 2520.103-10 of the

Department of Labor's Rules and Regulations for Reporting

and Disclosure under ERISA have been omitted because they

are not applicable.

Signatures 13

Exhibit 23 Consent of Independent Registered Public Accounting Firm 14

|

Report of Independent Registered Public Accounting Firm

To the Participants and Administrator of the

Brown-Forman Corporation Savings Plan

for Collectively Bargained Employees

In our opinion, the accompanying statements of net assets available for benefits

and the related statements of changes in net assets available for benefits

present fairly, in all material respects, the net assets available for benefits

of the Brown-Forman Corporation Savings Plan for Collectively Bargained

Employees (the Plan) at December 31, 2008 and 2007, and the changes in net

assets available for benefits for the year ended December 31, 2008 in conformity

with accounting principles generally accepted in the United States of America.

These financial statements are the responsibility of the Plan's management. Our

responsibility is to express an opinion on these financial statements based on

our audits. We conducted our audits of these statements in accordance with the

standards of the Public Company Accounting Oversight Board (United States).

Those standards require that we plan and perform the audit to obtain reasonable

assurance about whether the financial statements are free of material

misstatement. An audit includes examining, on a test basis, evidence supporting

the amounts and disclosures in the financial statements, assessing the

accounting principles used and significant estimates made by management, and

evaluating the overall financial statement presentation. We believe that our

audits provide a reasonable basis for our opinion.

Our audits were conducted for the purpose of forming an opinion on the basic

financial statements taken as a whole. The supplemental Schedule of Assets (Held

at End of Year) at December 31, 2008 is presented for the purpose of additional

analysis and is not a required part of the basic financial statements but is

supplementary information required by the Department of Labor's Rules and

Regulations for Reporting and Disclosure under the Employee Retirement Income

Security Act of 1974. This supplemental schedule is the responsibility of the

Plan's management. The supplemental schedule has been subjected to the auditing

procedures applied in the audits of the basic financial statements and, in our

opinion, is fairly stated in all material respects in relation to the basic

financial statements taken as a whole.

/s/ PricewaterhouseCoopers LLP

Louisville, Kentucky

June 26, 2009

|

2

Brown-Forman Corporation Savings Plan for Collectively Bargained Employees

Statements of Net Assets Available for Benefits

December 31, 2008 and 2007

2008 2007

----------- -----------

Investments, at fair value $ 6,619,716 $ 9,471,040

Employers' contributions receivable 117,601 120,391

Employees' contributions receivable 12,124 16,147

------------- -------------

Net assets available for benefits

at fair value 6,749,441 9,607,578

------------- -------------

Adjustment from fair value to contract

value for interest in collective

trust relating to fully benefit-

responsive investment contracts 27,434 3,770

----------- -----------

Net assets available for benefits $ 6,776,875 $ 9,611,348

=========== ===========

|

The accompanying notes are an integral part of the financial statements.

3

Brown-Forman Corporation Savings Plan for Collectively Bargained Employees

Statement of Changes in Net Assets Available for Benefits

Year Ended December 31, 2008

Additions

Contributions

Employer $ 459,913

Employee 924,279

-----------

1,384,192

Interest income 28,781

Dividend income 92,881

-----------

Total additions 1,505,854

-----------

Deductions

Withdrawals by participants 716,982

Net depreciation in investments 3,622,636

Administrative expenses 709

-----------

Total deductions 4,340,327

-----------

Net decrease (2,834,473)

-----------

Net assets available for benefits

Beginning of year 9,611,348

-----------

End of year $ 6,776,875

===========

|

The accompanying notes are an integral part of the financial statements.

4

Brown-Forman Corporation Savings Plan for Collectively Bargained Employees

Notes to Financial Statements

December 31, 2008 and 2007

1. Description of Plan

The sponsor of the Brown-Forman Corporation Savings Plan for Collectively

Bargained Employees (the Plan), Brown-Forman Corporation (the Company or

the Sponsor), is a diversified producer and marketer of fine quality

consumer products in domestic and international markets. The Company's

operations include the production, importing, and marketing of wines and

distilled spirits.

The following brief description of the Plan is provided for general

information purposes only. Participants should refer to the plan agreement

for more complete information.

General

The Plan is a defined contribution plan covering substantially all union

hourly employees of the Company at the Louisville Production Operations,

Early Times Distillery, and Bluegrass Cooperage Company. An employee

becomes eligible to participate in the Plan, including receipt of Company

matching contributions, after the completion of twelve consecutive months

of employment, provided the employee works a minimum of 1,000 hours within

the twelve-month period. The Plan is subject to the provisions of the

Employee Retirement Income Security Act of 1974 (ERISA).

Contributions

Effective January 1, 2006 and June 1, 2006, employees at the Louisville

Production Operations and Early Times Distillery who are members of Local

Unions 1089 or 320 and 110 or 369, respectively, may contribute between 1%

and 50% of their weekly compensation. Effective January 1, 2007, employees

at the Bluegrass Cooperage Company may contribute between 1% and 50% of

their weekly compensation. Employee contributions are not to exceed the

Section 402(g) Internal Revenue Code (the IRC) limitation for the calendar

year of $15,500 for both 2008 and 2007. New employees may transfer assets

from their former employers' qualified plans to the Plan, but cannot make

any further contributions to the Plan until they meet the eligibility

requirements to participate in the Plan.

Effective January 1, 2006 and June 1, 2006, employees at the Louisville

Production Operations and Early Times Distillery who are members of Local

Unions 1089 or 320 and 110 or 369, respectively, and who have completed one

year of service shall be automatically enrolled at a 1% effective deferral

of their compensation unless they elect otherwise. Effective January 1,

2007, employees at the Bluegrass Cooperage Company who are members of Local

Unions 110, 320 or 2309 and who have completed one year of service shall be

automatically enrolled at a 1% effective deferral of their compensation

unless they elect otherwise.

Effective January 1, 2006 and June 1, 2006, eligible participants of the

Local Unions 1089 or 320 and 110 or 369, respectively, who have attained

age 50 before the close of the plan year may make catch-up contributions in

an amount of 1% to 50% of the employee's compensation, subject to the

limitations of the IRC. Effective January 1, 2007, eligible participants of

the Bluegrass Cooperage Company Local Unions 110, 320 or 2309 who have

attained age 50 before the close of the plan year may make catch-up

contributions in an amount of 1% to 50% of the employee's compensation,

subject to the limitations of the IRC.

5

Effective January 1, 2006 and June 1, 2006, for employees at the Louisville

Production Operations and Early Times Distillery that are members of Local

Unions 1089 or 320 and 110 or 369, respectively, the Company shall

contribute quarterly an amount equal to 100% of the participant's elective

deferral for the first 3% of deferred compensation and 50% of the next 2%

of deferred compensation. Effective January 1, 2007, for employees at the

Bluegrass Cooperage Company that are members of Local Unions 110, 320 or

2309, the Company shall contribute quarterly an amount equal to 100% of the

participant's elective deferral for the first 3% of deferred compensation

and 50% of the next 2% of deferred compensation.

Each participant's account is credited with the participant's contribution

on a semi-monthly basis and an allocation of (i) the Company's contribution

on a quarterly basis, and (ii) plan earnings on a daily basis. Participants

that are paid weekly shall have their accounts credited with the

participants' contributions on a weekly basis. Allocations are based on the

participants' contributions and compensation as defined in the Plan. The

total annual contributions, as defined by the Plan, credited to a

participant's account in a plan year may not exceed the lesser of (i)

$46,000, or (ii) 100% of the participant's compensation in the plan year.

Additional maximum limits exist if the participating employee also

participates in a qualified defined benefit plan maintained by the Company.

Participants can allocate contributions among various investment options in

1% increments. The Plan currently offers participants several different

investment choices, including mutual funds, a common collective trust fund,

an asset allocation fund, and a Brown-Forman Corporation Class B common

stock fund.

Vesting

Participants are immediately vested in their employee contributions plus

actual earnings thereon. Vesting in the Company's contributions and

earnings thereon is 25% per year of continuous service with the Company.

Participants will become 100% vested in their Company contributions account

in case of death, normal retirement, or total and permanent disability.

6

Withdrawals

Upon termination of service, a participant can elect to transfer his vested

interest in the Plan to the qualified plan of his new employer, roll over

his funds into an Individual Retirement Account (IRA), or receive his

vested interest in the Plan in a lump-sum amount or in the form of

installment payments over a period of time not to exceed his life

expectancy. If the vested account balance is $1,000 or less, an automatic

lump sum distribution will be made. If the vested account balance is

greater than $1,000 up to $5,000, and the participant does not direct

otherwise, it will be rolled over into an IRA with Fidelity Management

Trust Company (Fidelity), the trustee and recordkeeper as described in the

Plan. In the event of death, the participant's beneficiary will receive the

vested interest in a lump-sum payment or in the form of an installment

payment. A participant may also withdraw their vested interest in the case

of financial hardship under guidelines promulgated by the Internal Revenue

Service. The participant's contributions shall be suspended for six months

after the receipt of a hardship distribution.

Forfeited Accounts

Forfeited balances of terminated participants' non-vested accounts are used

first to reinstate previously forfeited account balances of re-employed

participants, if any, and the remaining amounts are used to reduce future

Company contributions. The forfeited balances totaled $557 and $886 at

December 31, 2008 and 2007, respectively. In 2008, $1,300 from forfeited

non-vested accounts were used to reinstate previously forfeited account

balances of re-employed participants and/or reduce Company contributions.

2. Summary of Significant Accounting Policies

Basis of Accounting

The financial statements of the Plan are prepared under the accrual method

of accounting.

Investment Valuation and Income Recognition

The Plan's investments are stated at fair value. Shares of mutual funds are

valued at the net asset value of shares held by the Plan at year end based

on the unadjusted quoted market value of the underlying assets. The

Brown-Forman Corporation Stock Fund, a unitized employer stock fund, is

comprised of Brown-Forman Corporation Class B shares, which are valued at

the unadjusted quoted closing market price, and a cash component. The value

of a unit reflects the combined market value of the underlying Sponsor

stock and market value of the short-term cash position. The Plan's interest

in the Fidelity Managed Income Portfolio (a common collective trust) and

the Fidelity Retirement Money Market Portfolio (money market fund) are

valued based on information reported by the investment advisor using the

audited financial statements of the common collective trust and money

market fund at year-end.

7

As described in Financial Accounting Standards Board Staff Position, FSP

AAG INV-1 and SOP 94-4-1, Reporting of Fully Benefit-Responsive Investment

Contracts Held by Certain Investment Companies Subject to the AICPA

Investment Company Guide and Defined-Contribution Health and Welfare and

Pension Plans (the FSP), investment contracts held by a

defined-contribution plan are required to be reported at fair value.

However, contract value is the relevant measurement attribute for that

portion of the net assets available for benefits of a defined-contribution

plan attributable to fully benefit-responsive investment contracts because

contract value is the amount participants would receive if they were to

initiate permitted transactions under the terms of the Plan. The Plan

invests in investment contracts through a collective trust. As required by

the FSP, the statement of net assets available for benefits presents the

fair value of the investment in the collective trust as well as the

adjustment of the investment in the collective trust from fair value to

contract value relating to the investment contracts. The statement of

changes in net assets available for benefits is prepared on a contract

value basis.

The Plan presents in the accompanying statement of changes in net assets

available for benefits the net appreciation or depreciation in the value of

its investments which consists of the realized gains or losses, the

unrealized appreciation or depreciation on those investments, and capital

gains distributions.

Purchases and sales of securities are recorded on a trade-date basis.

Dividends are recorded on the ex-dividend date. Interest income is recorded

on the accrual basis

Recent Accounting Pronouncements

In September 2006, the Financial Accounting Standards Board (FASB) issued

Statement of Financial Accounting Standard No. 157 "Fair Value Measurement"

(SFAS 157). The standard defines fair value, outlines a framework for

measuring fair value, and details the required disclosures about fair value

measurements. The adoption of SFAS 157 in 2008 did not have a material

impact on the Statement of net assets available for benefits or statement

of changes in net assets available for benefits. Refer to Note 7 of the

Notes to Financial Statements for the Plan's SFAS 157 disclosures.

Management Estimates

The preparation of financial statements in conformity with generally

accepted accounting principles requires management to make estimates and

assumptions that affect the reported amounts of net assets available for

benefits and disclosure of contingent assets and liabilities at the dates

of the financial statements and the reported amounts of additions to and

deductions from net assets during the reporting period. Actual results

could differ from those estimates.

Risks and Uncertainties

The Plan invests in various investment securities. Investment securities

are exposed to various risks such as interest rate, market, and credit

risks. Due to the level of risk associated with certain investment

securities, it is at least reasonably possible that changes in the values

of investment securities will occur in the near term and that such changes

could materially affect participants' account balances and the amounts

reported in the statement of net assets available for benefits.

Payment of Benefits

Benefits are recorded when paid.

8

3. Investments

The Plan's investments are held by a custodian trust company. The following

table presents the fair value of investments with investments that

represent 5% or more of Plan net assets at one or both year ends separately

identified.

December 31

--------------------------------------------------------------

2008 2007

---------------------------- ----------------------------

Number of Number of

Shares, Units Shares, Units

or Principal or Principal

Amount Fair Value Amount Fair Value

------------- ---------- ------------- ----------

Investments at fair value:

Fidelity Money Market Trust

Retirement Money Market Portfolio 532,888 $ 532,888 431,370 $ 431,370

Fidelity Managed Income Portfolio 536,021 508,587 350,689 346,918

Fidelity Growth Company Fund 7,586 371,421 8,331 691,286

Brown-Forman Corporation Class B

common stock 16,001 823,909 11,090 821,902

Fidelity Diversified

International Fund K 21,253 456,729 - -

Fidelity Equity-Income

Fund K 17,531 541,003 - -

Fidelity Magellan Fund - - 33,993 3,190,939

Fidelity Equity-Income Fund - - 17,101 943,298

Fidelity Diversified

International Fund - - 20,005 798,215

Fidelity Magellan Fund K 35,065 1,606,671 - -

Other investments

individually less than 5% 167,885 1,778,508 115,004 2,247,112

---------- ----------

$ 6,619,716 $ 9,471,040

========== ==========

|

During 2008, the Plan's investments, including gains on investments bought

and sold, as well as held during the year, depreciated in value as follows:

2008

-----------

Mutual funds $(3,508,101)

Brown-Forman Corporation

Class B common stock (114,535)

------------

$(3,622,636)

============

|

4. Tax Status

The Internal Revenue Service has determined, and informed the Company by a

letter dated April 16, 2003, that the Plan and related trust are designed

in accordance with the applicable sections of the IRC. The Plan has been

amended since receiving the determination letter. However, the Plan

administrator believes that the Plan is designed and is currently being

operated in compliance with the applicable provisions of the IRC.

9

5. Plan Termination

Although it has not expressed any intent to do so, the Company has the

right under the Plan to discontinue its contributions at any time and to

terminate the Plan subject to the provisions of ERISA. In the event of plan

termination, participants will become 100% vested in their accounts.

6. Related Party Transactions

Certain Plan investments are shares of mutual funds managed by Fidelity.

Fidelity is the trustee as described in the Plan and, therefore, these

transactions qualify as party-in-interest transactions.

Certain administrative costs incurred by the Plan are paid by the Sponsor.

Participant recordkeeping fees were waived by Fidelity. In addition, other

administrative services are provided by the Sponsor but not charged to the

Plan. Administrative expenses totaled $709 in 2008.

The Brown-Forman Corporation Class B Common Stock Fund is a unitized

employer stock fund comprised of Brown-Forman Corporation Class B shares

and a cash component. The participants of the Plan, as well as participants

in other Sponsor plans, may invest in this employer stock fund. The total

fund was comprised of $23,012,050 of Brown-Forman Corporation Class B

Common Stock and a $469,631 cash component as of December 31, 2008. During

2008, purchases and sales of 275,233 and 206,334 shares of Brown-Forman

Corporation Class B stock, respectively, were made by the employer stock

fund.

7. Fair Value Measurements

Statement of Financial Accounting Standards No. 157, Fair Value

Measurements (SFAS 157), defines fair value, establishes a framework for

measuring fair value in accordance with accounting principles generally

accepted in the United States, and expands disclosures regarding fair value

measurements. Fair value is defined under SFAS 157 as the exit price

associated with the sale of an asset or transfer of a liability in an

orderly transaction between market participants at the measurement date.

The Plan has adopted the provisions of SFAS 157 as of January 1, 2008.

Valuation techniques used to measure fair value under SFAS 157 must

maximize the use of observable inputs and minimize the use of unobservable

inputs. A description of the valuation methodologies used for assets

measured at fair value is included in Note 2. SFAS 157 establishes a

three-tier fair value hierarchy, which prioritizes the inputs used in

measuring fair value. The hierarchy gives the highest priority to

unadjusted quoted prices in active markets for identical assets or

liabilities (level 1 measurements) and the lowest priority to unobservable

inputs (level 3 measurements). The three levels of the fair value hierarchy

under SFAS 157 are described below:

10

Level 1 - Unadjusted quoted prices in active markets for identical assets.

The Plan's investments with active markets include its investment in the

Brown-Forman Corporation Class B common stock as well as its investments in

mutual funds which are reported at fair value utilizing Level 1 inputs. For

these investments, quoted current market prices are readily available.

Level 2 - Inputs other than Level 1 that are observable, either directly or

indirectly, such as quoted prices for similar assets in active markets;

quoted prices for identical or similar assets in markets that are not

active; or inputs other than quoted prices that are observable, or that are

derived principally from or corroborated by observable market data by

correlation or other means for substantially the full term of the assets.

The Plan has concluded that the investments in the common collective trust

and money market funds represent a Level 2 valuation.

Level 3 - Unobservable inputs (i.e. projections, estimates,

interpretations, etc.) that are supported by little or no market activity

and that are significant to the fair value of the assets.

In accordance with SFAS 157, the following table represents the Plan's fair

value hierarchy for its financial assets measured at fair value on a

recurring basis as of December 31, 2008:

Fair Value Measurements at December 31, 2008

------------------------------------------------------------------------------------

Quoted Market Significant

Prices in Active Other Significant

Markets for Observable Unobservable

Identical Assets Inputs Inputs

Total (Level 1) (Level 2) (Level 3)

------------- ------------- ------------ -----------

------------- ------------- ------------ -----------

Mutual funds $ 4,737,649 $ 4,737,649 $ - $ -

Brown-Forman Corporation

Class B common stock 823,909 823,909 - -

Money market fund 549,571 - 549,571 -

Common collective trust fund 508,587 - 508,587 -

------------- ------------- ------------ -----------

Total Investments $ 6,619,716 $ 5,561,558 $ 1,058,158 $ -

============= ============= ============ ===========

|

11

Brown-Forman Corporation Savings Plan for Collectively Bargained Employees

Plan #016 EIN #61-0143150

Schedule H, Line 4i --

Schedule of Assets (Held at End of Year)

December 31, 2008

Description of Investment Including

Identity of Issue, Borrower, Maturity Date, Rate of Interest, Current

Lessor or Similar Party Collateral, Par or Maturity Value Value

---------------------------- ----------------------------------- -----------

Janus Enterprise Fund 4,928 Mutual Fund Shares $ 161,981

PIMCO Total Return Fund 18,714 Mutual Fund Shares 189,760

Royce Low Priced Stock Fund 5,824 Mutual Fund Shares 53,462

Hartford Capital

Appreciation Fund 7,826 Mutual Fund Shares 198,308

Fidelity Magellan Fund K* 35,065 Mutual Fund Shares 1,606,671

Fidelity Equity-Income Fund K* 17,531 Mutual Fund Shares 541,003

Fidelity Growth Company Fund* 7,586 Mutual Fund Shares 371,421

Fidelity Low Priced Stock Fund K* 8,987 Mutual Fund Shares 207,701

Fidelity Diversified

International Fund K* 21,253 Mutual Fund Shares 456,729

Fidelity Freedom Income* 463 Mutual Fund Shares 4,429

Fidelity Freedom 2000* 13 Mutual Fund Shares 127

Fidelity Freedom 2010* 7,113 Mutual Fund Shares 73,691

Fidelity Freedom 2020* 19,168 Mutual Fund Shares 192,635

Fidelity Freedom 2030* 3,884 Mutual Fund Shares 37,904

Fidelity Freedom 2040* 10,638 Mutual Fund Shares 59,466

Fidelity Freedom 2005* 193 Mutual Fund Shares 1,618

Fidelity Freedom 2015* 20,693 Mutual Fund Shares 177,129

Fidelity Freedom 2025* 17,398 Mutual Fund Shares 143,187

Fidelity Freedom 2035* 8,821 Mutual Fund Shares 70,834

Fidelity Freedom 2045* 2,881 Mutual Fund Shares 18,956

Fidelity Freedom 2050* 2,230 Mutual Fund Shares 14,406

Fidelity Money Market Trust

Retirement Money Market Portfolio* 532,888 Money Market Shares 532,888

Fidelity Managed Income Portfolio* 536,021 Common collective trust

fund units 536,021**

Allegiant Mid Cap Value I* 7 Mutual Fund Shares 62

Spartan International Index Fund* 359 Mutual Fund Shares 9,599

Spartan Extended Market Index Fund* 249 Mutual Fund Shares 5,624

Spartan U.S. Equity Index

Fund* 4,418 Mutual Fund Shares 140,946

Brown-Forman Corporation

Stock Fund:

Brown-Forman Corporation* 16,001 shares Class B common stock 823,909

Institutional Money Market Money market deposit account,

Portfolio - Class 1* interest rate 2.37% 16,683

-----------

$ 6,647,150

===========

*Party-in-interest to the Plan

** This represents contract value for the Fidelity Managed Income Portfolio

At Fair Value this investment is $508,587.

|

12

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the

Brown-Forman Corporation Savings Plan for Collectively Bargained Employees has

duly caused this report to be signed by the undersigned thereunto duly

authorized.

BROWN-FORMAN CORPORATION SAVINGS PLAN

FOR COLLECTIVELY BARGAINED EMPLOYEES

BY:

/s/ Lisa Steiner

Lisa Steiner

Member, Employee Benefits Committee

(Plan Administrator)

Brown-Forman Corporation

June 26, 2009

|

13

EXHIBIT 23

Consent of Independent Registered Public Accounting Firm

We hereby consent to the incorporation by reference in the Registration

Statement on Form S-8 (No. 333-74567) of Brown-Forman Corporation of our report

dated June 26, 2009 relating to the financial statements and supplemental

schedule of the Brown-Forman Corporation Savings Plan for Collectively Bargained

Employees, which appears in this Form 11-K.

/s/ PricewaterhouseCoopers LLP

Louisville, Kentucky

June 26, 2009

|

14

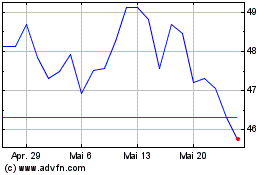

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024