0000008947false00000089472025-01-072025-01-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

January 7, 2025

Date of Report (Date of earliest event reported)

AZZ Inc.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Texas | | 1-12777 | | 75-0948250 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

One Museum Place, Suite 500

3100 West 7th Street

Fort Worth, Texas 76107

(Address of principal executive offices) (Zip Code)

(817) 810-0095

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock | | AZZ | | New York Stock Exchange |

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 7, 2025, AZZ Inc. ("AZZ") issued a press release reporting AZZ’s third quarter financial results for the period ended November 30, 2024. A copy of this press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information in this Item 2.02 (including Exhibit 99.1) is being furnished and shall not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. Nor shall the information in this Current Report be incorporated by reference in any other filing with the U.S. Securities and Exchange Commission made by AZZ, whether made before or after the date hereof, unless specifically identified therein as being incorporated therein by reference in such filing.

Item 9.01 Financial Statements and Exhibits.

The following exhibits are filed as part of this report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | AZZ Inc. |

| | | | |

| Date: | January 7, 2025 | | By: | /s/ Jason Crawford |

| | | | Jason Crawford

Senior Vice President, Chief Financial Officer and

Principal Accounting Officer |

AZZ Inc. Reports Fiscal Year 2025 Third Quarter Results

Strong Sales Growth Drives Quarterly Results; Narrowing and Raising Fiscal Year 2025 Financial Guidance

January 7, 2025 - FORT WORTH, TX - AZZ Inc. (NYSE: AZZ), the leading independent provider of hot-dip galvanizing and coil coating solutions, today announced financial results for the third quarter ended November 30, 2024.

Fiscal Year 2025 Third Quarter Financial Results Overview (as compared to prior fiscal year third quarter(1)):

◦Total Sales of $403.7 million, up 5.8%

▪Metal Coatings sales of $168.6 million, up 3.3%

▪Precoat Metals sales of $235.1 million, up 7.6%

◦Net Income of $33.6 million, up 25.0% and Adjusted net income of $41.9 million, up 20.5%

◦GAAP diluted EPS of $1.12 per share, up 21.7%, and Adjusted diluted EPS of $1.39, up 16.8%

◦Adjusted EBITDA of $90.7 million or 22.5% of sales, versus prior year of $86.4 million, or 22.6% of sales

◦Segment Adjusted EBITDA margin of 31.5% for Metal Coatings and 19.1% for Precoat Metals

◦Debt reduction of $35 million in the quarter; fiscal year-to-date debt reduction of $80 million, resulting in net leverage ratio 2.6x

◦Cash dividend of $0.17 per share to common shareholders

◦Repriced Term Loan B which reduced the future borrowing rate by 75 basis points to SOFR+2.50%

(1) Adjusted Net Income, Adjusted EPS, Adjusted EBITDA and net leverage ratio are non-GAAP financial measures as defined and reconciled in the tables below.

Tom Ferguson, President, and Chief Executive Officer of AZZ, commented, "Third quarter results exceeded expectations as third quarter sales grew to $403.7 million, up 5.8% over the prior year, with Adjusted EPS of $1.39. Consolidated Adjusted EBITDA grew to $90.7 million, or 22.5% of sales, primarily driven by higher volume for hot-dip galvanized steel and coil-coated materials and operational productivity over the prior year. Metal Coatings benefited from lower zinc costs and improved zinc utilization, and delivered an Adjusted EBITDA margin of 31.5%. Precoat Metals' Adjusted EBITDA margin improved to 19.1%, primarily due to sales growth, favorable mix and improved operational performance.

Our fiscal year-to-date cash from operations of $185.6 million allowed us to reduce debt by $80.0 million and continue to reduce our net leverage ratio to 2.6x at the end of the third quarter. We continue to expect debt reduction to exceed $100 million in the fiscal year. Capital expenditures for the third quarter totaled $26.4 million, including $11.2 million of spending related to the new Washington, Missouri, facility, which is on budget and schedule. I want to thank all of our dedicated AZZ employees for their work during the quarter on sales volume, productivity improvements, and for their continued pride and passion for delivering outstanding quality and service to our customers, while driving operational excellence. We look forward to finishing fiscal year 2025 well as we set new profitability records moving forward," Ferguson concluded.

Fiscal Year 2025 Third Quarter Segment Performance

AZZ Metal Coatings

Sales of $168.6 million increased by 3.3% over the third quarter of last year, primarily due to increased volume supported by project spending in end markets including construction, industrial, and transmission and distribution. Galvanizing sales increased 5.2% for the quarter, partially offset by a decrease in other sales. Segment EBITDA of $53.1 million resulted in EBITDA margin of 31.5%, on increased volume and zinc productivity improvement, an increase of 150 basis points from the prior year third quarter.

AZZ Precoat Metals

Sales of $235.1 million increased by 7.6% over the third quarter of last year on increased volume driven by market share growth and improvements from mix shifts in end markets including construction, HVAC, and transportation. Segment EBITDA of $45.0 million resulted in EBITDA margin of 19.1%, an increase of 70 basis points from the prior year third quarter.

Balance Sheet, Liquidity and Capital Allocation

The Company generated significant operating cash of $185.6 million for the first nine months of fiscal year 2025 through improved earnings and disciplined working capital management. At the end of the third quarter, the Company's net leverage was 2.6x trailing twelve months EBITDA. During the first nine months of fiscal year 2025, the Company paid down debt of $80 million and returned cash to common shareholders through cash dividend payments totaling $14.4 million. Capital expenditures for the first nine months of fiscal year 2025 were $85.9 million, and full fiscal year capital expenditures are expected to be approximately $100 - $120 million.

Financial Outlook - Fiscal Year 2025 Revised Guidance

Revised Fiscal Year 2025 guidance reflects our best estimates given expected market conditions for the full year, lower interest expense, an annualized effective tax rate of 25% and excludes any federal regulatory changes that may emerge.

| | | | | | | | | | | |

| | | Revised FY25 Guidance(1) | | |

| Sales | | | $1.550 - $1.600 billion | | |

| Adjusted EBITDA | | | $340 - $360 million | | |

| Adjusted Diluted EPS | | | $5.00 - $5.30 | | |

| | | | | |

(1) FY2025 Revised Guidance Assumptions:

a.Excludes the impact of any future acquisitions.

b.Includes approximately $15 - $18 million of equity income from AZZ’s minority interest in its unconsolidated subsidiary.

c.Management defines adjusted earnings per share to exclude intangible asset amortization, acquisition expenses, transaction related. expenses, certain legal settlements and accruals, and certain expenses related to non-recurring events from the reported GAAP measure.

Conference Call Details

AZZ Inc. will conduct a live conference call with Tom Ferguson, Chief Executive Officer, Jason Crawford, Chief Financial Officer, and David Nark, Senior Vice President of Marketing, Communications, and Investor Relations to discuss financial results for the third quarter of the fiscal year 2025, Wednesday, January 8, 2025, at 11:00 A.M. ET. Interested parties can access the conference call by dialing (844) 855-9499 or (412) 317-5497 (international). A webcast of the call will be available on the Company’s Investor Relations page at http://www.azz.com/investor-relations.

A replay of the call will be available at (877) 344-7529 or (412) 317-0088 (international), replay access code: 2492585, through January 15, 2025, or by visiting http://www.azz.com/investor-relations for the next 12 months.

About AZZ Inc.

AZZ Inc. is the leading independent provider of hot-dip galvanizing and coil coating solutions to a broad range of end-markets. Collectively, our business segments provide sustainable, unmatched metal coating solutions that enhance the longevity and appearance of buildings, products and infrastructure that are essential to everyday life.

Safe Harbor Statement

Certain statements herein about our expectations of future events or results constitute forward-looking statements for purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by terminology such as "may," "could," "should," "expects," "plans," "will," "might," "would," "projects," "currently," "intends," "outlook," "forecasts," "targets," "anticipates," "believes," "estimates," "predicts," "potential," "continue," or the negative of these terms or other comparable terminology. Such forward-looking statements are based on currently available competitive, financial, and economic data and management’s views and assumptions regarding future events. Such forward-looking statements are inherently uncertain, and investors must recognize that actual results may differ from those expressed or implied in the forward-looking statements. Forward-looking statements speak only as of the date they are made and are subject to risks that could cause them to differ materially from actual results. Certain factors could affect the outcome of the matters described herein. This press release may contain forward-looking statements that involve risks and uncertainties including, but not limited to, changes in customer demand for our manufactured solutions, including demand by the construction markets, the industrial markets, and the metal coatings markets. We could also experience additional increases in labor costs, components and raw materials including zinc and natural gas, which are used in our hot-dip galvanizing process, paint used in our coil coating process; supply-chain vendor delays; customer requested delays of our manufactured solutions; delays in additional acquisition opportunities; an increase in our debt leverage and/or interest rates on our debt, of which a significant portion is tied to variable interest rates; availability of experienced management and employees to implement AZZ’s growth strategy; a downturn in market conditions in any industry relating to the manufactured solutions that we provide; economic volatility, including a prolonged economic downturn or macroeconomic conditions such as inflation or changes in the political stability in the United States and other foreign markets in which we operate; acts of war or terrorism inside the United States or abroad; and other changes in economic and financial conditions. AZZ has provided additional information regarding risks associated with the business, including in Part I, Item 1A. Risk Factors, in AZZ's Annual Report on Form 10-K for the fiscal year ended February 29, 2024, and other filings with the SEC, available for viewing on AZZ's website at www.azz.com and on the SEC's website at www.sec.gov. You are urged to consider these factors carefully when evaluating the forward-looking statements herein and are cautioned not to place undue reliance on such forward-looking statements, which are qualified in their entirety by this cautionary statement. These statements are based on information as of the date hereof and AZZ assumes no obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

Company Contact:

David Nark, Senior Vice President of Marketing, Communications, and Investor Relations

AZZ Inc.

(817) 810-0095

www.azz.com

Investor Contact:

Sandy Martin / Phillip Kupper

Three Part Advisors

(214) 616-2207 or (817) 368-2556

www.threepa.com

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| AZZ Inc. |

| Condensed Consolidated Statements of Income |

| (dollars in thousands, except per share data) |

| (unaudited) |

| | | | | | | | |

| | Three Months Ended November 30, | | Nine Months Ended November 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Sales | | $ | 403,654 | | | $ | 381,605 | | | $ | 1,225,869 | | | $ | 1,171,020 | |

| Cost of sales | | 305,876 | | | 293,456 | | | 921,907 | | | 888,606 | |

| Gross margin | | 97,778 | | | 88,149 | | | 303,962 | | | 282,414 | |

| | | | | | | | |

| Selling, general and administrative | | 39,243 | | | 35,325 | | | 108,032 | | | 103,087 | |

| | | | | | | | |

| Operating income | | 58,535 | | | 52,824 | | | 195,930 | | | 179,327 | |

| | | | | | | | |

| Interest expense, net | | (19,223) | | | (25,855) | | | (63,906) | | | (82,331) | |

| Equity in earnings of unconsolidated subsidiaries | | 7,168 | | | 8,742 | | | 12,470 | | | 11,136 | |

| Other income (expense), net | | (763) | | | (41) | | | (142) | | | 9 | |

| Income before income taxes | | 45,717 | | | 35,670 | | | 144,352 | | | 108,141 | |

| Income tax expense | | 12,114 | | | 8,780 | | | 35,728 | | | 24,397 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net income | | 33,603 | | | 26,890 | | | 108,624 | | | 83,744 | |

| Series A Preferred Stock Dividends | | — | | | (3,600) | | | (1,200) | | | (10,800) | |

| Redemption premium on Series A Preferred Stock | | — | | | — | | | (75,198) | | | — | |

| Net income available to common shareholders | | $ | 33,603 | | | $ | 23,290 | | | $ | 32,226 | | | $ | 72,944 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Basic earnings per common share | | $ | 1.12 | | | $ | 0.93 | | | $ | 1.12 | | | $ | 2.91 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Diluted earnings per common share | | $ | 1.12 | | | $ | 0.92 | | | $ | 1.11 | | | $ | 2.86 | |

| | | | | | | | |

| Weighted average shares outstanding - Basic | | 29,879 | | | 25,077 | | | 28,819 | | | 25,024 | |

| Weighted average shares outstanding - Diluted | | 30,118 | | | 29,330 | | | 29,076 | | | 29,278 | |

| | | | | | | | |

| Cash dividends declared per common share | | $ | 0.17 | | | $ | 0.17 | | | $ | 0.51 | | | $ | 0.51 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| AZZ Inc. |

| Segment Reporting |

| (dollars in thousands) |

| (unaudited) |

| | | | | | | |

| Three Months Ended November 30, | | Nine Months Ended November 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Sales: | | | | | | | |

| Metal Coatings | $ | 168,599 | | | $ | 163,186 | | | $ | 516,750 | | | $ | 501,816 | |

Precoat Metals | 235,055 | | | 218,419 | | | 709,119 | | | 669,204 | |

| Total Sales | $ | 403,654 | | | $ | 381,605 | | | $ | 1,225,869 | | | $ | 1,171,020 | |

| | | | | | | |

| Adjusted EBITDA | | | | | | | |

| Metal Coatings | $ | 53,103 | | | $ | 48,991 | | | $ | 162,113 | | | $ | 152,500 | |

Precoat Metals | 44,983 | | | 40,253 | | | 142,837 | | | 129,856 | |

| Infrastructure Solutions | 7,139 | | | 8,452 | | | 12,403 | | | 10,642 | |

Total Segment EBITDA(1) | $ | 105,225 | | | $ | 97,696 | | | $ | 317,353 | | | $ | 292,998 | |

| | | | | | | |

(1) See the non-GAAP disclosure section below for a reconciliation between the various measures calculated in accordance with GAAP to the non-GAAP financial measures. |

| | | | | | | | | | | | | | |

| AZZ Inc. |

| Condensed Consolidated Balance Sheets |

| (dollars in thousands) |

| (unaudited) |

| | As of |

| | November 30, 2024 | | February 29, 2024 |

| Assets: | | | | |

| Current assets | | $ | 394,405 | | | $ | 366,999 | |

| Property, plant and equipment, net | | 580,178 | | | 541,652 | |

| Other non-current assets, net | | 1,269,967 | | | 1,286,854 | |

| | | | |

| Total assets | | $ | 2,244,550 | | | $ | 2,195,505 | |

| | | | |

| Liabilities, Mezzanine Equity, and Shareholders’ Equity: | | | | |

| Current liabilities | | $ | 222,292 | | | $ | 194,306 | |

| Long-term debt, net | | 879,548 | | | 952,742 | |

| Other non-current liabilities | | 113,122 | | | 113,966 | |

| | | | |

| Mezzanine Equity | | — | | | 233,722 | |

| Shareholders' Equity | | 1,029,588 | | | 700,769 | |

| Total liabilities, mezzanine equity, and shareholders' equity | | $ | 2,244,550 | | | $ | 2,195,505 | |

|

| | | | | | | | | | | | | | |

| AZZ Inc. |

| Condensed Consolidated Statements of Cash Flows |

| (dollars in thousands) |

| (unaudited) |

| | | | |

| | Nine Months Ended November 30, |

| | 2024 | | 2023 |

| Net cash provided by operating activities | | $ | 185,597 | | | $ | 180,928 | |

| Net cash used in investing activities | | (85,100) | | | (66,853) | |

| Net cash used in financing activities | | (103,912) | | | (109,444) | |

| | | | |

| Effect of exchange rate changes on cash | | 550 | | | 58 | |

| Net increase (decrease) in cash and cash equivalents | | (2,865) | | | 4,689 | |

| Cash and cash equivalents at beginning of period | | 4,349 | | | 2,820 | |

| | | | |

| Cash and cash equivalents at end of period | | $ | 1,484 | | | $ | 7,509 | |

AZZ Inc.

Non-GAAP Disclosure

Adjusted Net Income, Adjusted Earnings Per Share and Adjusted EBITDA

In addition to reporting financial results in accordance with Generally Accepted Accounting Principles in the United States ("GAAP"), we provide adjusted net income, adjusted earnings per share and Adjusted EBITDA (collectively, the "Adjusted Earnings Measures"), which are non-GAAP measures. Management believes that the presentation of these measures provides investors with greater transparency when comparing operating results across a broad spectrum of companies, which provides a more complete understanding of our financial performance, competitive position and prospects for future capital investment and debt reduction. Management also believes that investors regularly rely on non-GAAP financial measures, such as adjusted net income, adjusted earnings per share and Adjusted EBITDA to assess operating performance and that such measures may highlight trends in our business that may not otherwise be apparent when relying on financial measures calculated in accordance with GAAP.

Management defines adjusted net income and adjusted earnings per share to exclude intangible asset amortization, acquisition expenses, transaction related expenses, certain legal settlements and accruals, and certain expenses related to non-recurring events from the reported GAAP measure. Management defines Adjusted EBITDA as adjusted earnings excluding depreciation, amortization, interest and provision for income taxes. Management believes Adjusted EBITDA is used by investors to analyze operating performance and evaluate the Company's ability to incur and service debt and its capacity for making capital expenditures in the future.

Management provides non-GAAP financial measures for informational purposes and to enhance understanding of the Company’s GAAP consolidated financial statements. Readers should consider these measures in addition to, but not instead of or superior to, the Company's financial statements prepared in accordance with GAAP, and undue reliance should not be placed on these non-GAAP financial measures. Additionally, these non-GAAP financial measures may be determined or calculated differently by other companies, limiting the usefulness of those measures for comparative purposes.

The following tables provides a reconciliation for the three months ended November 30, 2024 and November 30, 2023 between the non-GAAP Adjusted Earnings Measures to the most comparable measures, calculated in accordance with GAAP (dollars in thousands, except per share data):

Adjusted Net Income and Adjusted Earnings Per Share

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended November 30, | | Nine Months Ended November 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Amount | | Per Diluted Share(1) | | Amount | | Per Diluted Share(1) | | Amount | | Per Diluted Share(1) | | Amount | | Per Diluted Share(1) |

| Net income | $ | 33,603 | | | | | $ | 26,890 | | | | | $ | 108,624 | | | | | $ | 83,744 | | | |

| Less: Series A Preferred Stock dividends | — | | | | | (3,600) | | | | | (1,200) | | | | | (10,800) | | | |

| Less: Redemption premium on Series A Preferred Stock | — | | | | | — | | | | | (75,198) | | | | | — | | | |

Net income available to common shareholders(2) | 33,603 | | | $ | 1.12 | | | 23,290 | | | $ | 0.92 | | | 32,226 | | | $ | 1.11 | | | 72,944 | | | $ | 2.86 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Impact of Series A Preferred Stock dividends(2) | — | | | | | 3,600 | | | | | 1,200 | | | | | 10,800 | | | |

Net income and diluted earnings per share for Adjusted net income calculation(2) | 33,603 | | | $ | 1.12 | | | 26,890 | | | $ | 0.92 | | | 33,426 | | | $ | 1.11 | | | 83,744 | | | $ | 2.86 | |

| Adjustments: | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Amortization of intangible assets | 5,773 | | | 0.19 | | | 5,872 | | | 0.20 | | | 17,353 | | | 0.58 | | | 18,108 | | | 0.62 | |

Legal settlement and accrual(3) | 3,483 | | | 0.12 | | | 4,500 | | | 0.15 | | | 3,483 | | | 0.12 | | | 10,250 | | | 0.35 | |

Retirement and other severance expense(4) | 1,666 | | | 0.06 | | | — | | | — | | | 3,554 | | | 0.12 | | | — | | | — | |

Redemption premium on Series A Preferred Stock(5) | — | | | — | | | — | | | — | | | 75,198 | | | 2.50 | | | — | | | — | |

| Subtotal | 10,922 | | | 0.37 | | | 10,372 | | | 0.35 | | | 99,588 | | | 3.31 | | | 28,358 | | | 0.97 | |

Tax impact(6) | (2,621) | | | (0.09) | | | (2,489) | | | (0.08) | | | (5,854) | | | (0.19) | | | (6,806) | | | (0.23) | |

| Total adjustments | 8,301 | | | 0.28 | | | 7,883 | | | 0.27 | | | 93,734 | | | 3.11 | | | 21,552 | | | 0.74 | |

| Adjusted net income and adjusted earnings per share (non-GAAP) | $ | 41,904 | | | $ | 1.39 | | | $ | 34,773 | | | $ | 1.19 | | | $ | 127,160 | | | $ | 4.22 | | | $ | 105,296 | | | $ | 3.60 | |

| | | | | | | | | | | | | | | |

Weighted average shares outstanding - Diluted for Adjusted earnings per share(2) | | | 30,118 | | | | | 29,330 | | | | | 30,123 | | | | | 29,278 | |

| | | | | | | | | | | | | | | |

Adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended November 30, | | Nine Months Ended November 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $ | 33,603 | | | $ | 26,890 | | | $ | 108,624 | | | $ | 83,744 | |

| Interest expense | 19,223 | | | 25,855 | | | 63,906 | | | 82,331 | |

| Income tax expense | 12,114 | | | 8,780 | | | 35,728 | | | 24,397 | |

| Depreciation and amortization | 20,633 | | | 20,357 | | | 61,383 | | | 59,034 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Legal settlement and accrual(3) | 3,483 | | | 4,500 | | | 3,483 | | | 10,250 | |

Retirement and other severance expense(4) | 1,666 | | | — | | | 3,554 | | | — | |

| Adjusted EBITDA (non-GAAP) | $ | 90,722 | | | $ | 86,382 | | | $ | 276,678 | | | $ | 259,756 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Adjusted EBITDA by Segment

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended November 30, 2024 |

| Metal Coatings | | Precoat Metals | | Infra-

structure Solutions | | Corporate | | Total |

| Net income (loss) | $ | 46,489 | | | $ | 37,080 | | | $ | 7,139 | | | $ | (57,105) | | | $ | 33,603 | |

| Interest expense | — | | | — | | | — | | | 19,223 | | | 19,223 | |

| Income tax expense | — | | | — | | | — | | | 12,114 | | | 12,114 | |

| Depreciation and amortization | 6,614 | | | 7,903 | | | — | | | 6,116 | | | 20,633 | |

Retirement and other severance expense(4) | — | | | — | | | — | | | 1,666 | | | 1,666 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Adjusted EBITDA (non-GAAP) | $ | 53,103 | | | $ | 44,983 | | | $ | 7,139 | | | $ | (14,503) | | | $ | 90,722 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended November 30, 2024 |

| Metal Coatings | | Precoat Metals | | Infra-

structure Solutions | | Corporate | | Total |

| Net income (loss) | $ | 142,158 | | | $ | 119,703 | | | $ | 12,403 | | | $ | (165,640) | | | $ | 108,624 | |

| Interest expense | — | | | — | | | — | | | 63,906 | | | 63,906 | |

| Income tax expense | — | | | — | | | — | | | 35,728 | | | 35,728 | |

| Depreciation and amortization | 19,955 | | | 23,134 | | | — | | | 18,294 | | | 61,383 | |

Retirement and other severance expense(4) | — | | | — | | | — | | | 3,554 | | | 3,554 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Adjusted EBITDA (non-GAAP) | $ | 162,113 | | | $ | 142,837 | | | $ | 12,403 | | | $ | (40,675) | | | $ | 276,678 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended November 30, 2023 |

| Metal Coatings | | Precoat Metals | | Infra-

structure Solutions | | Corporate | | Total |

| Net income (loss) | $ | 37,813 | | | $ | 32,752 | | | $ | 8,452 | | | $ | (52,127) | | | $ | 26,890 | |

| Interest expense | — | | | — | | | — | | | 25,855 | | | 25,855 | |

| Income tax expense | — | | | — | | | — | | | 8,780 | | | 8,780 | |

| Depreciation and amortization | 6,678 | | | 7,501 | | | — | | | 6,178 | | | 20,357 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Legal settlement and accrual(3) | 4,500 | | | — | | | — | | | — | | | 4,500 | |

| Adjusted EBITDA (non-GAAP) | $ | 48,991 | | | $ | 40,253 | | | $ | 8,452 | | | $ | (11,314) | | | $ | 86,382 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended November 30, 2023 |

| Metal Coatings | | Precoat Metals | | Infra-

structure Solutions | | Corporate | | Total |

| Net income (loss) | $ | 128,353 | | | $ | 109,449 | | | $ | 4,892 | | | $ | (158,950) | | | $ | 83,744 | |

| Interest expense | — | | | — | | | — | | | 82,331 | | | 82,331 | |

| Income tax expense | — | | | — | | | — | | | 24,397 | | | 24,397 | |

| Depreciation and amortization | 19,647 | | | 20,407 | | | — | | | 18,980 | | | 59,034 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Legal settlement and accrual(3) | 4,500 | | | — | | | 5,750 | | | — | | | 10,250 | |

| Adjusted EBITDA (non-GAAP) | $ | 152,500 | | | $ | 129,856 | | | $ | 10,642 | | | $ | (33,242) | | | $ | 259,756 | |

| | | | | | | | | |

Debt Leverage Ratio Reconciliation

| | | | | | | | | | | | | | | | |

| | Trailing Twelve Months Ended |

| | November 30, | | February 29, | | |

| | 2024 | | 2024 | | |

| | | | | | |

| Gross debt | | $ | 930,250 | | | $ | 1,010,250 | | | |

| Less: Cash per bank statement | | (10,233) | | | (24,807) | | | |

| Add: Finance lease liability | | 5,110 | | | 3,987 | | | |

| Consolidated indebtedness | | $ | 925,127 | | | $ | 989,430 | | | |

| | | | | | |

| Net income | | $ | 126,487 | | | $ | 108,624 | | | |

| Depreciation and amortization | | 81,771 | | | 61,383 | | | |

| Interest expense | | 88,641 | | | 63,907 | | | |

| Income tax expense | | 39,827 | | | 35,728 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| EBITDA per Credit Agreement | | 336,726 | | | 269,642 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Cash items(7) | | 15,230 | | | 25,443 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Non-cash items(8) | | 12,634 | | | 9,510 | | | |

| | | | | | |

| | | | | | |

| Equity in earnings, net of distributions | | (6,863) | | | (12,294) | | | |

| Adjusted EBITDA per Credit Agreement | | $ | 357,727 | | | $ | 292,301 | | | |

| | | | | | |

| Net leverage ratio | | 2.6x | | 3.4x | | |

| | | | | | |

(1) Earnings per share amounts included in the "Adjusted net income and Adjusted Earnings Per Share" table above may not sum due to rounding

differences.

(2) For the nine months ended November 30, 2024, diluted earnings per share is based on weighted average shares outstanding of 29,076, as the

Series A Preferred Stock that was redeemed May 9, 2024 is anti-dilutive. The calculation of adjusted diluted earnings per share is based on

weighted average shares outstanding of 30,123, as the Series A Preferred Stock is dilutive to adjusted diluted earnings per share. Adjusted net

income for adjusted earnings per share also includes the addback of Series A Preferred Stock dividends for the periods noted above. For further

information regarding the calculation of earnings per share, see "Item I. Financial Statements—Note 3" in the Company's Form 10-Q for the

quarterly period ended November 30, 2024.

(3) For the three and nine months ended November 30, 2024, represents a legal settlement and accrual related to a non-operating entity, and is

classified as “Corporate” in our operating segment disclosure. For the three months ended November 30, 2023 represents a legal accrual related to

the Metal Coatings segment of $4.5 million. For the nine months ended November 30, 2023, consists of the $4.5 million accrual for the Metal

Coatings segment and $5.75 million for the settlement of a litigation matter related to the AIS segment that was retained following the sale of the

AIS business. See "Item I. Financial Statements—Note 16" in the Company's Form 10-Q for the quarterly period ended November 30, 2024.

(4) Related to retention and transition of certain executive management employees.

(5) On May 9, 2024, we redeemed the Series A Preferred Stock. The redemption premium represents the difference between the redemption amount

paid and the book value of the Series A Preferred Stock.

(6) The non-GAAP effective tax rate for each of the periods presented is estimated at 24.0%.

(7) Cash items includes certain legal settlements, accruals, and retirement and other severance expense, and costs associated with the AVAIL JV

transition services agreement.

(8) Non-cash items include stock-based compensation expense and other non-cash expenses.

v3.24.4

Document and Entity Information Document and Entity Information

|

Jan. 07, 2025 |

| Document & Entity Information [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 07, 2025

|

| Entity Registrant Name |

AZZ Inc.

|

| Entity File Number |

1-12777

|

| Entity Tax Identification Number |

75-0948250

|

| Entity Address, Address Line One |

One Museum Place, Suite 500

|

| Entity Address, Address Line Two |

3100 West 7th Street

|

| Entity Address, City or Town |

Fort Worth

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

76107

|

| City Area Code |

817

|

| Local Phone Number |

810-0095

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AZZ

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000008947

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

TX

|

| Document Information [Line Items] |

|

| Document Period End Date |

Jan. 07, 2025

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

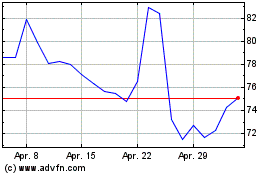

AZZ (NYSE:AZZ)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

AZZ (NYSE:AZZ)

Historical Stock Chart

Von Jan 2024 bis Jan 2025