UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report

of Foreign Private Issuer

Pursuant

to Rules 13a-16 or 15d-16 under

the

Securities Exchange Act of 1934

For the month of March 2024

Commission File Number: 001-37909

AZURE

POWER GLOBAL LIMITED

8th Floor, Tower A, DLF Infinity Towers, DLF

Cyber City

DLF Phase – II

Gurugram – 122002, India

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

EXHIBIT INDEX

The following exhibits

are furnished as part of this Current Report on Form 6-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: March 4, 2024 |

| |

| |

AZURE POWER GLOBAL LIMITED |

| |

| |

By: |

/s/ Sugata Sircar |

| |

Name: |

Sugata Sircar |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

Nothing

in this electronic transmission constitutes or contemplates an offer to buy or the solicitation of an offer to sell securities in the

United States or in any other jurisdiction.

This

does not constitute and should not be considered as an advertisement, invitation, sale, an offer to sell, offer to purchase, or a solicitation

to sell or solicitation to purchase or subscribe for securities (whether to the public or by way of private placement) within the meaning

of the (Indian) Companies Act, 2013, as amended from time to time or other applicable laws, regulations and guidelines of India, nor

shall it or any part of it form basis of or relied on in connection with any contract, commitment or any investment decision in relation

thereto in India. The notes will not be offered or sold, and have not been offered or sold in India by means of any offering document

or other document or material relating to the notes, directly or indirectly, to any person or to the public in India. This is not an

offer document or an OM or a “private placement offer cum application letter” or a “prospectus” under the (Indian)

Companies Act, 2013, as amended from time to time, the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements)

Regulations, 2018, as amended from time to time or any other applicable law in India and no such document will be circulated or distributed

to any person in India. This has not been and will not be registered as a “prospectus” or a statement in lieu of prospectus

in respect of a public offer, information memorandum or “private placement offer cum application letter” or any other offering

material with any registrar of companies in India, the Reserve Bank of India, the Securities and Exchange Board of India or any other

statutory or regulatory body of like nature in India, save and except for any information relating to the notes which is mandatorily

required to be disclosed or filed in India under any applicable Indian laws.

Singapore

Exchange Securities Trading Limited (“SGX-ST”) takes no responsibility for the contents of this announcement, makes no representation

as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance

upon the whole or any part of the contents of this announcement.

Announcement

by

Azure

Power Solar Energy Private Limited

(incorporated

in Mauritius with limited liability)

March

4, 2024

Azure

Power Solar Energy Private Limited, a limited liability company incorporated in the Mauritius (the “Company”), hereby

announces the early results of its previously announced offer to purchase for cash (the “Tender Offer”), upon terms

and subject to the conditions set forth in the Tender Offer Memorandum dated February 16, 2024 (the “Tender Offer Memorandum”),

its outstanding 5.65% Senior Notes due 2024 issued by the Company (the “Notes”) issued under the indenture dated September

24, 2019, as supplemented on December 8, 2023 (the “Indenture”). Capitalised terms used but not defined herein shall

have the meanings given to them in the Tender Offer Memorandum, which is available on the Tender Offer Website (https://projects.morrowsodali.com/azurepower),

subject to eligibility and registration.

Early

Results of the Tender Offer

The

Tender Offer commenced on February 16, 2024. The Early Tender Deadline expired at 5:00 p.m. (New York City time) on March 1, 2024.

As

at the Early Tender Deadline, the Company received valid tenders under the Tender Offer which had not been validly withdrawn in respect

of the Notes with an aggregate principal amount outstanding of US$329,231,000, representing approximately 94.04% of the total principal

amount outstanding of the Notes.

Tender

Consideration

The

Tender Consideration for Notes validly tendered and not validly withdrawn at or prior to the Early Tender Deadline is US$1,000 for each

US$1,000 in principal amount of the Notes.

As

the Maximum Acceptance Amount was exceeded at the Early Tender Deadline, the Company will accept for purchase the Notes validly tendered

and not validly withdrawn at or prior to the Early Tender Deadline in the amount of US$40,000,000 by applying a Scaling Factor of 12.4173%.

The principal amount of each Noteholder’s validly tendered Notes in the Tender Offer to be accepted for purchase by the Company

will be determined by multiplying such Noteholder’s tendered Notes by the Scaling Factor, rounded down to the nearest U.S.$1,000.

If after applying such Scaling Factor and rounding down to the nearest U.S.$1,000, any Noteholder would be entitled to a return of a

portion of tendered Notes that is less than the minimum denomination of U.S.$200,000, then the Company has decided in its sole discretion

and in accordance with the terms of the Tender Offer to reject all of the Notes tendered by such Noteholder without applying the Scaling

Factor. All Notes not accepted as a result of scaling will be returned to the Noteholder on the Early Settlement Date.

Settlement

and Notes Remaining Outstanding

Early

Settlement Date is expected to be on or about March 8, 2024. Following the Early Settlement Date, US$310,101,000 in aggregate principal

amount of the Notes will remain outstanding.

As

the Maximum Acceptance Amount was exceeded at the Early Tender Deadline, the Company will not accept for purchase any Notes tendered

after the Early Tender Deadline.

The

Tender Offer will expire at 5:00 p.m. (New York City time) on March 18, 2024, unless, at the sole discretion of the Company, extended,

re-opened, or amended, subject to applicable laws and as provided in the Tender Offer Memorandum.

All

correspondence sent to the Information and Tender Agent should be directed to the contact information below. Requests for additional

copies of documentation may be directed to the Information and Tender Agent at the e-mail address and telephone number specified on below.

Electronic copies of all documents related to the Tender Offer will be made available online at https://projects.morrowsodali.com/azurepower,

subject to eligibility and registration.

Requests

for information in relation to the Tender Offer should be directed to: |

| DEALER

MANAGER |

The

Hongkong and Shanghai Banking Corporation Limited

Level 17, HSBC Main Building

1 Queen’s Road Central

Hong Kong

Phone: +852 3941 0223 (Hong Kong)

+44 207 992 6237 (London)

+1

212 525 5552 (New York)

US

Toll Free: 1-888-HSBC-4LM

Email: liability.management@hsbcib.com |

| |

| Requests

for information in relation to the procedures for tendering Notes and participating in the Tender Offer and the submission of an

electronic instruction or submission should be directed to: |

| INFORMATION

AND TENDER AGENT |

| Morrow

Sodali Limited |

| In

Hong Kong: |

In

London: |

In

Stamford: |

29/F

No.

28 Stanley Street Central

Hong Kong

Telephone:

+852 2319 4130 |

103

Wigmore Street

London

W1U

1QS

United

Kingdom

Telephone:

+44 20 4513 6933 |

333

Ludlow Street

South

Tower, 5th Floor

Stamford,

CT 06902

United

States

Telephone:

+1 203 658 9457 |

Email:

azurepower@investor.morrowsodali.com

Tender

Offer Website: https://projects.morrowsodali.com/azurepower

Should

you have any questions, please contact the Information and Tender Agent at the contact details above. |

This

notice is given by:

Azure

Power Solar Energy Private Limited

Exhibit 99.2

Nothing

in this electronic transmission constitutes or contemplates an offer to buy or the solicitation of an offer to sell securities in the

United States or in any other jurisdiction.

This

does not constitute and should not be considered as an advertisement, invitation, sale, an offer to sell, offer to purchase, or a solicitation

to sell or solicitation to purchase or subscribe for securities (whether to the public or by way of private placement) within the meaning

of the (Indian) Companies Act, 2013, as amended from time to time or other applicable laws, regulations and guidelines of India, nor

shall it or any part of it form basis of or relied on in connection with any contract, commitment or any investment decision in relation

thereto in India. The notes will not be offered or sold, and have not been offered or sold in India by means of any offering document

or other document or material relating to the notes, directly or indirectly, to any person or to the public in India. This is not an

offer document or an OM or a “private placement offer cum application letter” or a “prospectus” under the (Indian)

Companies Act, 2013, as amended from time to time, the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements)

Regulations, 2018, as amended from time to time or any other applicable law in India and no such document will be circulated or distributed

to any person in India. This has not been and will not be registered as a “prospectus” or a statement in lieu of prospectus

in respect of a public offer, information memorandum or “private placement offer cum application letter” or any other offering

material with any registrar of companies in India, the Reserve Bank of India, the Securities and Exchange Board of India or any other

statutory or regulatory body of like nature in India, save and except for any information relating to the notes which is mandatorily

required to be disclosed or filed in India under any applicable Indian laws.

Singapore

Exchange Securities Trading Limited (“SGX-ST”) takes no responsibility for the contents of this announcement, makes no representation

as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance

upon the whole or any part of the contents of this announcement.

Announcement

by

Azure

Power Energy Ltd

(incorporated

in Mauritius with limited liability)

March

4, 2024

Azure

Power Energy Ltd, a limited liability company incorporated in the Mauritius (the “Company”), hereby announces the

early results of its previously announced offer to purchase for cash (the “Tender Offer”), upon terms and subject

to the conditions set forth in the Tender Offer Memorandum dated February 16, 2024 (the “Tender Offer Memorandum”),

its outstanding 3.575% Senior Notes due 2026 issued by the Company (the “Notes”) issued under the indenture dated

April 19, 2021, as supplemented on December 8, 2023 (the “Indenture”). Capitalised terms used but not defined herein

shall have the meanings given to them in the Tender Offer Memorandum, which is available on the Tender Offer Website (https://projects.morrowsodali.com/azurepower),

subject to eligibility and registration.

Early

Results of the Tender Offer

The

Tender Offer commenced on February 16, 2024. The Early Tender Deadline expired at 5:00 p.m. (New York City time) on March 1, 2024.

As

at the Early Tender Deadline, the Company received valid tenders under the Tender Offer which had not been validly withdrawn in respect

of the Notes with an aggregate principal amount of US$403,290,000, representing approximately 97.41% of the total principal amount of

the Notes before application of the Pool Factor of 0.8289.

Increase

of Maximum Acceptance Amount

The

Company hereby in its sole discretion has decided to increase the Maximum Acceptance Amount to US$14,477,000 (the “Amended Maximum

Acceptance Amount”), such that the principal amount of Notes to be purchased pursuant to the Tender Offer following application

of the Pool Factor will not exceed US$12,000,000.

Tender

Consideration

The

Tender Consideration for Notes validly tendered and not validly withdrawn at or prior to the Early Tender Deadline is US$1,000 for each

US$1,000 in principal amount of the Notes.

As

the Amended Maximum Acceptance Amount was exceeded at the Early Tender Deadline, the Company will accept for purchase the Notes validly

tendered and not validly withdrawn at or prior to the Early Tender Deadline in the amount of US$14,477,000 (before application of the

Pool Factor) by applying a Scaling Factor of 3.6569%. The principal amount of each Noteholder’s validly tendered Notes in the Tender

Offer to be accepted for purchase by the Company will be determined by multiplying such Noteholder’s tendered Notes by the Scaling

Factor, rounded down to the nearest U.S.$1,000. If after applying such Scaling Factor and rounding down to the nearest U.S.$1,000, any

Noteholder would be entitled to a return of a portion of tendered Notes that is less than the minimum denomination of U.S.$200,000, the

Company has decided in its sole discretion and in accordance with the terms of the Tender Offer to reject all of the Notes tendered by

such Noteholder without applying the Scaling Factor. All Notes not accepted as a result of scaling will be returned to the Noteholder

on the Early Settlement Date.

Settlement

and Notes Remaining Outstanding

Early

Settlement Date is expected to be on or about March 8, 2024. Following the Early Settlement Date, approximately US$331,165,000 in aggregate

principal amount of the Notes will remain outstanding (following application of the Pool Factor).

As

the Amended Maximum Acceptance Amount was exceeded at the Early Tender Deadline, the Company will not accept for purchase any Notes tendered

after the Early Tender Deadline.

The

Tender Offer will expire at 5:00 p.m. (New York City time) on March 18, 2024, unless, at the sole discretion of the Company, extended,

re-opened, or amended, subject to applicable laws and as provided in the Tender Offer Memorandum.

Subsequent

Tender Offer

Following

the completion of this Tender Offer, the Company will separately make an offer to purchase an aggregate principal amount of U.S.$8,000,000

of the Notes by a date that is on or prior to August 26, 2024 in order to satisfy the Section 3.12 of the Indenture.

All

correspondence sent to the Information and Tender Agent should be directed to the contact information below. Requests for additional

copies of documentation may be directed to the Information and Tender Agent at the e-mail address and telephone number specified on below.

Electronic copies of all documents related to the Tender Offer will be made available online at https://projects.morrowsodali.com/azurepower,

subject to eligibility and registration.

Requests

for information in relation to the Tender Offer should be directed to: |

| DEALER

MANAGER |

The

Hongkong and Shanghai Banking Corporation Limited

Level 17, HSBC Main Building

1 Queen’s Road Central

Hong Kong

Phone: +852 3941 0223 (Hong Kong)

+44 207 992 6237 (London)

+1

212 525 5552 (New York)

US

Toll Free: 1-888-HSBC-4LM

Email: liability.management@hsbcib.com |

| |

| Requests

for information in relation to the procedures for tendering Notes and participating in the Tender Offer and the submission of an

electronic instruction or submission should be directed to: |

| INFORMATION

AND TENDER AGENT |

| Morrow

Sodali Limited |

| In

Hong Kong: |

In

London: |

In

Stamford: |

29/F

No.

28 Stanley Street Central

Hong Kong

Telephone:

+852 2319 4130 |

103

Wigmore Street

London

W1U

1QS

United

Kingdom

Telephone:

+44 20 4513 6933 |

333

Ludlow Street

South

Tower, 5th Floor

Stamford,

CT 06902

United

States

Telephone:

+1 203 658 9457 |

Email:

azurepower@investor.morrowsodali.com

Tender

Offer Website: https://projects.morrowsodali.com/azurepower

Should

you have any questions, please contact the Information and Tender Agent at the contact details above. |

This

notice is given by:

Azure

Power Energy Ltd

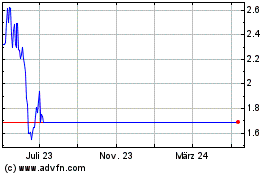

Azure Power Global (NYSE:AZRE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Azure Power Global (NYSE:AZRE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024