0001689923false00016899232023-11-062023-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

________________________________________________________________

FORM 8-K

________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 6, 2023

________________________________________________________________

ALTERYX, INC.

(Exact Name of the Registrant as Specified in its Charter)

________________________________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-38034 | | 90-0673106 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | | | | |

| 17200 Laguna Canyon Road, | Irvine, | California | | 92618 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(888) 836-4274

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

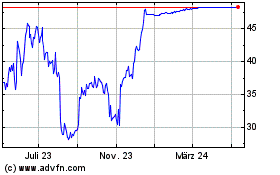

| Class A Common Stock, $0.0001 par value per share | | AYX | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 2.02. Results of Operations and Financial Condition.

On November 6, 2023, Alteryx, Inc., a Delaware corporation (the “Company”), issued a press release and a stockholder letter announcing the Company’s financial results for the quarter ended September 30, 2023. The press release and the stockholder letter are furnished as Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated herein by reference.

The information furnished with this Item 2.02, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | ALTERYX, INC. |

| Date: | November 6, 2023 | | By: | | /s/ Christopher M. Lal |

| | | Name: | | Christopher M. Lal |

| | | Title: | | Chief Legal Officer and Corporate Secretary |

Alteryx Announces Third Quarter 2023 Financial Results

Annualized Recurring Revenue up 21% Year-Over-Year to $914 million

Raises 2023 Non-GAAP Operating Income Outlook

IRVINE, Calif. – November 6, 2023 – Alteryx, Inc. (NYSE: AYX), the Analytics Automation company, today announced financial results for its third quarter ended September 30, 2023.

“Alteryx delivered a solid Q3, with key growth and profitability metrics exceeding our prior outlook, driven by improved execution and cost discipline,” said Mark Anderson, CEO of Alteryx, Inc. “Gross retention held at a healthy level as customers continued to demonstrate their commitment to the Alteryx Analytics Platform and we remain focused on the vision we have set forth with Alteryx AiDIN, our generative AI and machine learning technologies, as well as our growing portfolio of cloud-connected offerings.”

Third Quarter 2023 Financial Highlights

•Revenue: Revenue for the third quarter of 2023 was $232 million, an increase of 8%, compared to revenue of $215 million in the third quarter of 2022.

•Gross Profit: GAAP gross profit for the third quarter of 2023 was $198 million, or a GAAP gross margin of 85%, compared to GAAP gross profit of $183 million, or a GAAP gross margin of 85%, in the third quarter of 2022. Non-GAAP gross profit for the third quarter of 2023 was $207 million, or a non-GAAP gross margin of 89%, compared to non-GAAP gross profit of $192 million, or a non-GAAP gross margin of 89%, in the third quarter of 2022.

•Income (Loss) from Operations: GAAP loss from operations for the third quarter of 2023 was $(37) million, compared to GAAP loss from operations of $(65) million for the third quarter of 2022. Non-GAAP income from operations for the third quarter of 2023 was $36 million, compared to non-GAAP income from operations of $5 million for the third quarter of 2022.

•Net Income (Loss): GAAP net loss attributable to common stockholders for the third quarter of 2023 was $(50) million, compared to GAAP net loss attributable to common stockholders of $(75) million for the third quarter of 2022. GAAP net loss per diluted share for the third quarter of 2023 was $(0.70), based on 71.3 million GAAP weighted-average diluted shares outstanding, compared to GAAP net loss per diluted share of $(1.09), based on 68.7 million GAAP weighted-average diluted shares outstanding for the third quarter of 2022.

Non-GAAP net income and non-GAAP net income per diluted share for the third quarter of 2023 were $20 million and $0.29, respectively, compared to non-GAAP net loss of $(3) million and non-GAAP net loss per diluted share of $(0.05) for the third quarter of 2022. Non-GAAP net income per diluted share for the third quarter of 2023 was based on 76.0 million non-GAAP weighted-average diluted shares outstanding, compared to 68.7 million non-GAAP weighted-average diluted shares outstanding for the third quarter of 2022.

•Balance Sheet and Cash Flow: As of September 30, 2023, we had cash, cash equivalents, and short-term and long-term investments of $682 million, compared to $432 million as of December 31, 2022. This reflects a $441 million cash inflow primarily related to the issuance of our 8.75% senior notes due 2028, net of debt issuance costs paid as of September 30, 2023, partially offset by an $85 million cash outflow related to principal payments on our 0.5% convertible senior notes due 2023 in settlement of conversions and payments at maturity. Cash used in operating activities for the first nine months of 2023 was $(51) million, compared to cash used in operating activities of $(113) million for the first nine months of 2022.

A reconciliation of GAAP to non-GAAP financial measures has been provided in the tables included in this press release. An explanation of these measures is also included below under the heading “Non-GAAP Financial Measures and Operating Measures.”

During the three months ended June 30, 2023, management elected to change the presentation of our financial statements and accompanying footnote disclosures from thousands to millions. The change in presentation had no material impact on previously reported financial information, but certain amounts reported for prior periods may differ by insignificant amounts due to the nature of rounding relative to the change in presentation. In addition, historical percentages and per share amounts presented may not add to their respective totals or recalculate due to rounding.

Third Quarter 2023 and Recent Business Highlights

•Ended the third quarter of 2023 with $914 million in ARR, an increase of 21% year-over-year.

•Achieved a dollar-based net expansion rate (ARR-based) of 119% for the third quarter of 2023.

•Appointed Mark Dorsey as Senior Vice President of Sales for the Americas. Dorsey joins Alteryx with extensive experience building and leading high-performing sales teams at top global brands, including Oracle, Bank of America Merchant Services and IBM.

•Appointed Scott Van Valkenburgh as Senior Vice President, Global Alliances and Channels, to lead Alteryx's global partner strategy and execution. Van Valkenburgh joins Alteryx with over 25 years of leadership experience, most recently from Genpact, a leading professional services firm that runs digitally enabled business operations for Fortune Global 500 companies.

•Announced new Alteryx AiDIN innovations, including Alteryx AI Studio, one of the industry's first deployment-agnostic interfaces that is purpose-built for no-code users to leverage generative AI, as well as Playbooks, a new feature for Alteryx Auto Insights currently available on a limited basis and designed to automate the initial stages of the analytics delivery process using generative AI.

•Expanded partnership with Google Cloud to provide Looker Studio users with native access to a free limited version of Alteryx Designer Cloud's AI-powered data preparation capabilities and enhanced connectivity.

•Introduced Alteryx Marketplace, a place for customers to easily discover Alteryx-verified, creator-supported solutions that expand the functionality, usage, and power of Alteryx to drive further business growth.

•Released our inaugural Global Impact Report, which describes Alteryx's progress on environmental, social and governance topics during 2022.

Workforce Management

During the nine months ended September 30, 2023, we substantially completed a workforce reduction plan, or the Workforce Reduction Plan, intended to reduce operating costs, improve operating margins, and continue advancing our ongoing commitment to profitable growth, primarily impacting our sales and marketing organization. In connection with the Workforce Reduction Plan, during the third quarter, we incurred $5 million in charges related to the statutory notice period and severance payments, employee benefits, and job placement services. For the nine months ended September 30, 2023, we have incurred $17 million in total charges and made $16 million of related payments, with the remaining $1 million included in accrued payroll and payroll related liabilities in the condensed consolidated balance sheets as of September 30, 2023.

Financial Outlook

We provide the financial guidance below based on current market conditions and expectations. Our guidance is subject to various important cautionary factors described below. Based on information available as of November 6, 2023, guidance for the fourth quarter of 2023 and full year 2023 is as follows:

•Fourth Quarter 2023 Guidance:

◦Revenue is expected to be in the range of $334 million to $340 million, representing year-over-year growth of 11% to 13%.

◦ARR is expected to be in the range of $942 million to $948 million, representing year-over-year growth of 13% to 14%.

◦Non-GAAP income from operations is expected to be in the range of $112 million to $118 million.

◦Non-GAAP net income per share is expected to be in the range of $1.10 to $1.17 based on approximately 77.2 million non-GAAP weighted-average diluted shares outstanding.

•Full Year 2023 Guidance:

◦Revenue is expected to be in the range of $953 million to $959 million, representing year-over-year growth of 11% to 12%.

◦ARR is expected to be in the range of $942 million to $948 million, representing year-over-year growth of 13% to 14%.

◦Non-GAAP income from operations is expected to be in the range of $100 million to $106 million.

◦Non-GAAP net income per share is expected to be in the range of $0.94 to $1.01 based on approximately 76.5 million non-GAAP weighted-average diluted shares outstanding, and an effective tax rate of 20%.

The financial outlook above for non-GAAP income from operations and non-GAAP net income per share excludes estimates for stock-based compensation and related payroll tax expense and acquisition-related adjustments. A reconciliation of the non-GAAP financial guidance measures to corresponding GAAP measures is not available on a forward-looking basis primarily because of the uncertainty regarding, and the potential variability of, stock-based compensation and related payroll tax expense and acquisition-related adjustments. In particular, stock-based compensation and related payroll tax expense is impacted by our future hiring and retention needs, as well as the future fair market value of our Class A common stock, all of which is not within our control, is difficult to predict, and is subject to constant change. The actual amount of these expenses during 2023 will have a significant impact on our future GAAP financial results. Accordingly, a reconciliation of the non-GAAP financial guidance measures to the corresponding GAAP measures is not available without unreasonable effort.

Quarterly Conference Call

Alteryx will host a conference call today at 5:00 p.m. Eastern Time to discuss the company’s financial results and financial guidance. To access this call, dial 877-407-9716 (domestic) or 201-493-6779 (international). A live webcast of this conference call will be available on the “Investors” page of the company’s website at https://investor.alteryx.com.

Following the conference call, a telephone replay will be available through November 20, 2023, at 844-512-2921 (domestic) or 412-317-6671 (international). The replay passcode is 13741676. An archived webcast of this conference call will also be available on the “Investors” page of the company’s website at https://investor.alteryx.com.

Non-GAAP Financial Measures and Operating Measures

Non-GAAP Financial Measures. To supplement our condensed consolidated financial statements, which are prepared and presented in accordance with GAAP, we use the following non-GAAP financial measures: non-GAAP gross profit, non-GAAP gross margin, non-GAAP income (loss) from operations, non-GAAP operating margin, non-GAAP net income (loss), non-GAAP net income (loss) per diluted share, and non-GAAP weighted-average diluted shares outstanding. The presentation of these financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP.

We use non-GAAP measures to internally evaluate and analyze financial results. We believe these non-GAAP financial measures provide investors with useful supplemental information about the financial performance of our business, enable comparison of financial results between periods where certain items may vary independent of business performance, and enable comparison of our financial results with other public companies, many of which present similar non-GAAP financial measures. We exclude the following items from one or more of our non-GAAP financial measures:

Stock-based compensation expense. We exclude stock-based compensation expense, which is a non-cash expense, from certain of our non-GAAP financial measures because we believe that excluding this item provides meaningful supplemental information regarding operational performance. In particular, companies calculate stock-based compensation expense using a variety of valuation methodologies and subjective assumptions.

Payroll tax expense related to stock-based compensation. We exclude employer payroll tax expense related to stock-based compensation to present the full effect that excluding stock-based compensation expense has on operating results. These expenses are tied to the exercise or vesting of underlying equity awards and the price of our common stock at the time of vesting or exercise, which may vary from period to period independent of the operating performance of the business.

Acquisition-related adjustments. We exclude amortization of intangible assets, which is non-cash and related to business combinations, from certain of our non-GAAP financial measures. In addition, we exclude acquisition and integration expenses, such as transaction costs and costs associated with the applicable retention, restructuring and successful integration of operational activities of the acquired company, as they are related to a business combination and have no direct correlation to the operation of our business.

Impairment of long-lived assets. We exclude non-cash charges for impairment of long-lived assets from certain of our non-GAAP financial measures. Impairment charges can vary significantly in terms of amount and timing, and we do not consider these charges indicative of our current or past operating performance.

Cost optimization charges. We exclude other cost optimization charges, which primarily include compensation costs for the impacted workforce and additional non-impairment office exit costs. Although office exits are non-recurring in nature, certain costs associated with the exits will be incurred in future periods. We exclude cost optimization charges as they do not contribute to a meaningful evaluation of our current or past operating performance.

Income tax adjustments. We utilize a fixed annual projected long-term non-GAAP tax rate in order to provide better consistency across reporting periods by eliminating the effects of items such as changes in the tax valuation allowance, excess tax benefits associated with stock options, and tax effects of acquisition-related costs, since each of these can vary in size and frequency. When projecting this rate, we exclude the direct impact of the following non-cash items: stock-based compensation expenses, amortization and impairment of purchased intangibles, and the amortization of debt discount and issuance costs. The projected rate also assumes no new acquisitions, and considers other factors including our expected tax structure, our tax positions in various jurisdictions and key legislation in major jurisdictions where we operate. We used a projected non-GAAP tax rate of 20% for both 2023 and 2022. The non-GAAP tax rate could be subject to change for a variety of reasons, including the rapidly evolving global tax environment, significant changes in our geographic earnings mix including due to acquisition activity, or other changes to our strategy or business operations. We will re-evaluate our long-term rate as appropriate.

Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. In particular, we exclude stock-based compensation and related payroll tax expense and amortization of intangible assets which are recurring and will be reflected in our financial results for the foreseeable future. The non-GAAP measures we use may be different from non-GAAP financial measures used by other companies, limiting their usefulness for comparison purposes. We compensate for these limitations by providing specific information regarding the GAAP items excluded from these non-GAAP financial measures.

Annualized Recurring Revenue (ARR). Annualized recurring revenue, or ARR, represents the annualized recurring value of all active subscription contracts at the end of a reporting period, and excludes the value of non-recurring revenue streams that are recognized at a point in time, such as certain professional services. We use ARR as one of our operating measures to assess the health and trajectory of our business. ARR is a performance metric and should be viewed independently of revenue and deferred revenue, and is not intended to be a substitute for, or combined with, any of these items. Both multi-year contracts and contracts with terms less than one year are annualized by dividing the total committed contract value by the number of months in the subscription term and then multiplying by twelve. Annualizing contracts with terms less than one year results in amounts being included in our ARR calculation that are in excess of the total contract value for those contracts at the end of the reporting period.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the federal securities laws that involve risks and uncertainties, including statements regarding our expectations with respect to annualized recurring revenue, guidance for the fourth quarter and the full year 2023, non-GAAP operating margin, and assumptions related to the foregoing; macroeconomic conditions and related impacts, including the impact to our competitive landscape, customer purchasing behavior, sales cycle, and contract duration; our workforce reduction plans and related impacts; our ability to execute our long-term growth, go-to-market, operations, and product strategies, including with respect to our cloud and AI offerings; our ability to achieve and improve profitability and cash flow; the anticipated value, customer adoption and acceptance, and continued innovation and availability of our products and services, including our cloud and AI offerings; the success of our sales activities; demand for data analytics products and our expectations regarding customer engagement, initiatives, and purchasing behavior; our non-GAAP tax rate for 2023; and other future events. These forward-looking statements are only predictions and may differ materially from actual results due to a variety of factors including, but not limited to: our history of losses; volatile and significantly weakened global economic conditions; our ability to develop, release, and gain market acceptance of product and service enhancements and new products and services to respond to rapid technological change in a timely and cost-effective manner; our dependence on our software platform for substantially all of our revenue; our ability to manage our growth and the investments made to grow our business effectively; our ability to develop a successful business model to sell products and services acquired or to integrate such products or services into our existing products and services; our ability to attract new customers and retain and expand sales to existing customers; our ability to establish and maintain successful relationships with our channel partners; intense and increasing competition in our market; the rate of growth in the market for analytics products and services; our dependence on technology and data licensed to us by third parties; risks associated with our international operations; our ability to develop, maintain, and enhance our brand and reputation cost-effectively; litigation and related costs; security breaches; the success of our AI initiatives; our indebtedness and risks related to our outstanding notes; and other general market, political, economic, and business conditions, including, but not limited to, impacts related to weakened global economic conditions, regional conflicts, governmental shutdowns, inflationary pressures, rising interest rates, and disruptions in access to bank deposits or lending commitments due to bank failures. Additionally, these forward-looking statements, particularly our guidance, involve risk, uncertainties and assumptions, many of which relate to matters that are beyond our control and changing rapidly.

Additional risks and uncertainties that could affect our financial results are included under the caption “Risk Factors” in our filings with the U.S. Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K for the year ended December 31, 2022, which are available on the “Investors” page of our website at https://investor.alteryx.com and on the SEC website at http://www.sec.gov. Additional information will also be set forth in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. All forward-looking statements contained herein are based on information available to us as of the date hereof and we do not assume any obligation to update these statements as a result of new information or future events.

About Alteryx, Inc.

Alteryx (NYSE: AYX) powers analytics for all by providing our leading Analytics Automation Platform. With Alteryx, enterprises can make intelligent decisions across their organizations with automated, AI-driven insights. More than 8,000 customers globally rely on Alteryx to democratize analytics across use cases and deliver high-impact business outcomes. To learn more, visit http://www.alteryx.com.

Alteryx is a registered trademark of Alteryx, Inc. All other product and brand names may be trademarks or registered trademarks of their respective owners.

Media Contact

Alteryx, Inc.

Ana Gabriel

pr@alteryx.com

Investor Contact

Alteryx, Inc.

Ryan Goodman

ir@alteryx.com

Alteryx, Inc.

Condensed Consolidated Statements of Operations

(in millions, shares in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | |

| Subscription-based software license | $ | 117 | | | $ | 111 | | | $ | 284 | | | $ | 255 | |

| PCS and services | 115 | | | 104 | | | 335 | | | 299 | |

| Total revenue | 232 | | | 215 | | | 619 | | | 554 | |

| Cost of revenue: | | | | | | | |

| Subscription-based software license | 1 | | | 3 | | | 5 | | | 8 | |

| PCS and services | 33 | | | 29 | | | 92 | | | 78 | |

| Total cost of revenue | 34 | | | 32 | | | 97 | | | 86 | |

| Gross profit | 198 | | | 183 | | | 522 | | | 468 | |

| Operating expenses: | | | | | | | |

| Research and development | 53 | | | 55 | | | 169 | | | 162 | |

| Sales and marketing | 133 | | | 136 | | | 446 | | | 385 | |

| General and administrative | 49 | | | 57 | | | 146 | | | 173 | |

| Impairment of long-lived assets | — | | | — | | | 2 | | | 8 | |

| Total operating expenses | 235 | | | 248 | | | 763 | | | 728 | |

| Loss from operations | (37) | | | (65) | | | (241) | | | (260) | |

| Interest expense | (12) | | | (2) | | | (30) | | | (7) | |

| Other income (expense), net | 1 | | | (7) | | | 19 | | | (16) | |

| | | | | | | |

| Loss before provision for income taxes | (48) | | | (74) | | | (252) | | | (283) | |

| Provision for income taxes | 2 | | | 1 | | | 7 | | | 4 | |

| Net loss | $ | (50) | | | $ | (75) | | | $ | (259) | | | $ | (287) | |

| Net loss per share attributable to common stockholders, basic | $ | (0.70) | | | $ | (1.09) | | | $ | (3.67) | | | $ | (4.20) | |

| Net loss per share attributable to common stockholders, diluted | $ | (0.70) | | | $ | (1.09) | | | $ | (3.67) | | | $ | (4.20) | |

| Weighted-average shares used to compute net loss per share attributable to common stockholders, basic | 71,305 | | | 68,673 | | | 70,615 | | | 68,273 | |

| Weighted-average shares used to compute net loss per share attributable to common stockholders, diluted | 71,305 | | | 68,673 | | | 70,615 | | | 68,273 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Alteryx, Inc.

Stock-Based Compensation Expense

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Cost of revenue | $ | 5 | | | $ | 5 | | | $ | 13 | | | $ | 13 | |

| Research and development | 15 | | | 14 | | | 43 | | | 40 | |

| Sales and marketing | 22 | | | 22 | | | 69 | | | 56 | |

| General and administrative | 20 | | | 20 | | | 58 | | | 55 | |

| Total | $ | 62 | | | $ | 61 | | | $ | 183 | | | $ | 164 | |

Alteryx, Inc.

Condensed Consolidated Balance Sheets

(in millions)

(unaudited)

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 463 | | | $ | 105 | |

| Short-term investments | 172 | | | 237 | |

| Accounts receivable, net | 130 | | | 260 | |

| Prepaid expenses and other current assets | 162 | | | 145 | |

| Total current assets | 927 | | | 747 | |

| Property and equipment, net | 68 | | | 69 | |

| Operating lease right-of-use assets | 42 | | | 51 | |

| Long-term investments | 47 | | | 90 | |

| Goodwill | 398 | | | 398 | |

| Intangible assets, net | 51 | | | 61 | |

| Other assets | 135 | | | 141 | |

| Total assets | $ | 1,668 | | | $ | 1,557 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 12 | | | $ | 14 | |

| Accrued payroll and payroll related liabilities | 55 | | | 81 | |

| Accrued expenses and other current liabilities | 53 | | | 56 | |

| Deferred revenue | 179 | | | 276 | |

| Convertible senior notes, net | 399 | | | 85 | |

| Total current liabilities | 698 | | | 512 | |

| Long-term debt, net | 838 | | | 793 | |

| | | |

| Operating lease liabilities | 49 | | | 61 | |

| Other liabilities | 16 | | | 17 | |

| Total liabilities | 1,601 | | | 1,383 | |

| Stockholders’ equity: | | | |

| | | |

| Common stock | — | | | — | |

| Additional paid-in capital | 774 | | | 623 | |

| Accumulated deficit | (702) | | | (443) | |

| Accumulated other comprehensive loss | (5) | | | (6) | |

| Total stockholders’ equity | 67 | | | 174 | |

| Total liabilities and stockholders’ equity | $ | 1,668 | | | $ | 1,557 | |

Alteryx, Inc.

Condensed Consolidated Statements of Cash Flows

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Cash flows from operating activities: | | | | | | | |

| Net loss | $ | (50) | | | $ | (75) | | | $ | (259) | | | $ | (287) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | |

| Depreciation and amortization | 8 | | | 10 | | | 27 | | | 27 | |

| Non-cash operating lease cost | 3 | | | 5 | | | 9 | | | 15 | |

| Stock-based compensation | 62 | | | 61 | | | 183 | | | 164 | |

| Amortization (accretion) of discounts and premiums on investments, net | (2) | | | — | | | (4) | | | 1 | |

| Amortization of debt discount and issuance costs | 1 | | | — | | | 3 | | | 2 | |

| Deferred income taxes | 1 | | | 1 | | | 4 | | | 2 | |

| | | | | | | |

| | | | | | | |

| Impairment of long-lived assets | — | | | — | | | 2 | | | 8 | |

| Other non-cash operating activities, net | 7 | | | 8 | | | 3 | | | 21 | |

| Changes in operating assets and liabilities: | | | | | | | |

| Accounts receivable | (10) | | | 2 | | | 127 | | | 83 | |

| Deferred commissions | (4) | | | (5) | | | (12) | | | (9) | |

| Prepaid expenses and other current assets and other assets | — | | | (53) | | | 6 | | | (94) | |

| Accounts payable | (15) | | | (5) | | | (1) | | | 15 | |

| Accrued payroll and payroll related liabilities | (21) | | | (11) | | | (27) | | | (23) | |

| Accrued expenses, other current liabilities, operating lease liabilities, and other liabilities | (14) | | | (6) | | | (18) | | | (13) | |

| Deferred revenue | (24) | | | 10 | | | (94) | | | (25) | |

| Net cash used in operating activities | (58) | | | (58) | | | (51) | | | (113) | |

| Cash flows from investing activities: | | | | | | | |

| Capitalized software development costs | (4) | | | (3) | | | (15) | | | (8) | |

| | | | | | | |

| Purchases of property and equipment | — | | | (7) | | | (2) | | | (20) | |

| Cash paid in acquisitions, net of cash acquired | — | | | 3 | | | — | | | (387) | |

| Purchases of investments | (39) | | | (33) | | | (143) | | | (115) | |

| Sales and maturities of investments | 88 | | | 81 | | | 245 | | | 608 | |

| Net cash provided by investing activities | 45 | | | 41 | | | 85 | | | 78 | |

| Cash flows from financing activities: | | | | | | | |

| Proceeds from issuance of senior notes, net of issuance costs | — | | | — | | | 441 | | | — | |

| | | | | | | |

| | | | | | | |

| Principal payments on 2023 convertible senior notes | — | | | — | | | (85) | | | — | |

| | | | | | | |

| | | | | | | |

| Proceeds from exercise of stock options and issuance of shares from employee stock purchase plan | 4 | | | 5 | | | 13 | | | 10 | |

| Minimum tax withholding paid on behalf of employees for restricted stock units | (8) | | | (11) | | | (48) | | | (37) | |

| Other financing activity | 1 | | | — | | | 1 | | | — | |

| Net cash provided by (used in) financing activities | (3) | | | (6) | | | 322 | | | (27) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | — | | | (1) | | | — | | | (3) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | (16) | | | (24) | | | 356 | | | (65) | |

| Cash, cash equivalents and restricted cash—beginning of period | 482 | | | 114 | | | 110 | | | 155 | |

| Cash, cash equivalents and restricted cash—end of period | $ | 466 | | | $ | 90 | | | $ | 466 | | | $ | 90 | |

Alteryx, Inc.

Reconciliation of GAAP Measures to Non-GAAP Measures

(in millions, shares in thousands, except percentages and per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Reconciliation of non-GAAP gross profit: | | | | | | | |

| GAAP gross profit | $ | 198 | | | $ | 183 | | | $ | 522 | | | $ | 468 | |

| GAAP gross margin | 85 | % | | 85 | % | | 84 | % | | 84 | % |

| Add back: | | | | | | | |

| Stock-based compensation and related payroll tax expense | 6 | | | 5 | | | 14 | | | 13 | |

| | | | | | | |

| Amortization of intangible assets | 3 | | | 4 | | | 9 | | | 10 | |

| Cost optimization charges | — | | | — | | | 2 | | | — | |

| Non-GAAP gross profit | $ | 207 | | | $ | 192 | | | $ | 547 | | | $ | 491 | |

| Non-GAAP gross margin | 89 | % | | 89 | % | | 88 | % | | 89 | % |

| Reconciliation of non-GAAP income (loss) from operations: | | | | | | | |

| GAAP loss from operations | $ | (37) | | | $ | (65) | | | $ | (241) | | | $ | (260) | |

| GAAP operating margin | (16) | % | | (30) | % | | (39) | % | | (47) | % |

| Add back: | | | | | | | |

| Stock-based compensation and related payroll tax expense | 63 | | | 62 | | | 189 | | | 168 | |

| | | | | | | |

| Amortization of intangible assets | 3 | | | 4 | | | 10 | | | 11 | |

| | | | | | | |

| Impairment of long-lived assets | — | | | — | | | 2 | | | 8 | |

| Cost optimization charges | 6 | | | — | | | 25 | | | — | |

| Acquisition transaction and integration costs | 1 | | | 4 | | | 3 | | | 18 | |

| Non-GAAP income (loss) from operations | $ | 36 | | | $ | 5 | | | $ | (12) | | | $ | (55) | |

| Non-GAAP operating margin | 16 | % | | 2 | % | | (2) | % | | (10) | % |

| Reconciliation of non-GAAP net income (loss): | | | | | | | |

| GAAP net loss attributable to common stockholders | $ | (50) | | | $ | (75) | | | $ | (259) | | | $ | (287) | |

| Add back: | | | | | | | |

| Stock-based compensation and related payroll tax expense | 63 | | | 62 | | | 189 | | | 168 | |

| | | | | | | |

| Amortization of intangible assets | 3 | | | 4 | | | 10 | | | 11 | |

| Impairment of long-lived assets | — | | | — | | | 2 | | | 8 | |

| Cost optimization charges | 6 | | | — | | | 25 | | | — | |

| | | | | | | |

| Acquisition transaction and integration costs | 1 | | | 4 | | | 3 | | | 18 | |

| | | | | | | |

| | | | | | | |

| Income tax adjustments | (3) | | | 2 | | | 11 | | | 20 | |

| Non-GAAP net income (loss) | $ | 20 | | | $ | (3) | | | $ | (19) | | | $ | (62) | |

Convertible debt interest expense, after-tax (1) | 2 | | | — | | | — | | | — | |

Adjusted non-GAAP net income (loss) (1) | $ | 22 | | | $ | (3) | | | $ | (19) | | | $ | (62) | |

| Non-GAAP income (loss) per diluted share: | | | | | | | |

Adjusted non-GAAP net income (loss) (1) | $ | 22 | | | $ | (3) | | | $ | (19) | | | $ | (62) | |

Non-GAAP weighted-average shares used to compute net income (loss) per share attributable to common stockholders, diluted (2) | 76,018 | | | 68,673 | | | 70,615 | | | 68,273 | |

| Non-GAAP net income (loss) per diluted share | $ | 0.29 | | | $ | (0.05) | | | $ | (0.27) | | | $ | (0.91) | |

| Reconciliation of non-GAAP net income (loss) per diluted share: | | | | | | | |

| GAAP net loss per share attributable to common stockholders, diluted | $ | (0.70) | | | $ | (1.09) | | | $ | (3.67) | | | $ | (4.20) | |

| Add back: | | | | | | | |

| Non-GAAP adjustments to net income (loss) per share | 0.99 | | | 1.04 | | | 3.40 | | | 3.29 | |

| Non-GAAP net income (loss) per diluted share | $ | 0.29 | | | $ | (0.05) | | | $ | (0.27) | | | $ | (0.91) | |

| Reconciliation of non-GAAP weighted-average shares outstanding, diluted: | | | | | | | |

| GAAP weighted-average shares used to compute net income (loss) per share attributable to common stockholders, diluted | 71,305 | | | 68,673 | | | 70,615 | | | 68,273 | |

| Add back: | | | | | | | |

| Effect of potentially dilutive shares | 4,713 | | | — | | | — | | | — | |

| Non-GAAP weighted-average shares used to compute non-GAAP net income (loss) per share, diluted | 76,018 | | | 68,673 | | | 70,615 | | | 68,273 | |

(1) Following the adoption of ASU 2020-06, effective as of January 1, 2022, we utilize the “if-converted” method for calculating diluted net income per share, which assumes conversion of our convertible senior notes as of the beginning of the period or at the time of issuance, if later. As a result, for the three months ended September 30, 2023, we added back after-tax interest expense related to our convertible senior notes to the numerator of our calculation of diluted net income per share.

(2) The denominator of our calculation of diluted net income per share for the three months ended September 30, 2023 includes potential shares issued related to our convertible senior notes pursuant to the “if-converted” method for calculating diluted net income per share.

Alteryx, Inc.

Other Business Metrics

(unaudited)

Annualized Recurring Revenue (ARR). ARR represents the annualized recurring value of all active subscription contracts at the end of a reporting period and excludes the value of non-recurring revenue streams that are recognized at a point in time, such as certain professional services. Both multi-year contracts and contracts with terms less than one year are annualized by dividing the total committed contract value by the number of months in the subscription term and then multiplying by twelve. Annualizing contracts with terms less than one year results in amounts being included in our ARR calculation that are in excess of the total contract value for those contracts at the end of the reporting period (in millions).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Mar. 31, | | Jun. 30, | | Sep. 30, | | Dec. 31, | | Mar. 31, | | Jun. 30, | | Sep. 30, |

| | 2022 | | 2022 | | 2022 | | 2022 | | 2023 | | 2023 | | 2023 |

| Annualized recurring revenue | | $ | 684 | | | $ | 727 | | | $ | 758 | | | $ | 834 | | | $ | 857 | | | $ | 890 | | | $ | 914 | |

Dollar-Based Net Expansion Rate. Our dollar-based net expansion rate is a trailing four-quarter average of the ARR from a cohort of customers in a quarter as compared to the same quarter in the prior year. To calculate our dollar-based net expansion rate, we first identify a cohort of customers, or the Base Customers, in a particular quarter, or the Base Quarter. A customer will not be considered a Base Customer unless such customer has an active subscription on the last day of the Base Quarter. We then divide the ARR in the same quarter of the subsequent year attributable to the Base Customers, or the Comparison Quarter, including Base Customers from which we no longer derive ARR in the Comparison Quarter, by the ARR attributable to those Base Customers in the Base Quarter. Our dollar-based net expansion rate in a particular quarter is then obtained by averaging the result from that particular quarter with the corresponding result from each of the prior three quarters.

To better align our reported business metrics, beginning in the first quarter of 2023, we revised our dollar-based net expansion calculation to utilize ARR instead of annual contract value, which, if applied to prior periods presented, would have had no more than a 1% impact on any such prior period. As a result, we have not recast prior period dollar-based net expansion rates to conform to the current definition because the impact is immaterial.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Mar. 31, | | Jun. 30, | | Sep. 30, | | Dec. 31, | | Mar. 31, | | Jun. 30, | | Sep. 30, |

| | 2022 | | 2022 | | 2022 | | 2022 | | 2023 | | 2023 | | 2023 |

| Dollar-based net expansion rate | | 119 | % | | 120 | % | | 121 | % | | 121 | % | | 121 | % | | 120 | % | | 119 | % |

Number of Customers with ARR of $250,000 or Greater. As we have grown, and as part of our enterprise-focused sales strategy, our ability to grow our base of larger customers while increasing penetration with those customers has increasingly become a key indicator of our market expansion, the growth of our business, and our future potential business opportunities. In particular, we believe that the number of customers with ARR of $250,000 or greater at the end of a reporting period is a useful indicator of the scale of customer adoption and expansion of our platform and the success of our enterprise-focused sales strategy.

Accordingly, beginning in the three months ended June 30, 2023, we will report the number of customers with ARR of $250,000 or greater instead of our total number of customers. We define a customer at the end of any particular period as an entity with a subscription agreement that runs through the current or future period as of the measurement date. A single organization with separate subsidiaries, segments, or divisions that use our platform may represent multiple customers, and we treat each identified entity with a unique nine-digit identification number provided by Dun & Bradstreet as a single customer. In cases where customers subscribe to our platform through our channel partners, each end customer is counted separately.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Mar. 31, | | Jun. 30, | | Sep. 30, | | Dec. 31, | | Mar. 31, | | Jun. 30, | | Sep. 30, |

| | 2022 | | 2022 | | 2022 | | 2022 | | 2023 | | 2023 | | 2023 |

| Customers with ARR of $250,000 or greater | | 530 | | | 566 | | | 586 | | 643 | | 660 | | 689 | | 706 |

Remaining Performance Obligations. Remaining performance obligations represent amounts from contracts with customers allocated to unsatisfied or partially unsatisfied performance obligations that are not yet recorded in revenue in our condensed consolidated statements of operations (in millions).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Mar. 31, | | Jun. 30, | | Sep. 30, | | Dec. 31, | | Mar. 31, | | Jun. 30, | | Sep. 30, |

| | 2022 | | 2022 | | 2022 | | 2022 | | 2023 | | 2023 | | 2023 |

| Remaining performance obligations | | $ | 445 | | | $ | 495 | | | $ | 488 | | | $ | 592 | | | $ | 509 | | | $ | 502 | | | $ | 517 | |

Contract Assets. Contract assets primarily relate to unbilled amounts for contracts with customers for which the amount of revenue recognized exceeds the amount billed to the customer. Contract assets are transferred to accounts receivable when the right to invoice becomes unconditional in our condensed consolidated balance sheets (in millions).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Mar. 31, | | Jun. 30, | | Sep. 30, | | Dec. 31, | | Mar. 31, | | Jun. 30, | | Sep. 30, |

| | 2022 | | 2022 | | 2022 | | 2022 | | 2023 | | 2023 | | 2023 |

| Contract assets | | $ | 54 | | | $ | 76 | | | $ | 130 | | | $ | 131 | | | $ | 132 | | | $ | 127 | | | $ | 135 | |

Q3 FY2023 Shareholder Letter November 6, 2023

Chief Executive Officer M AR K AN D E R S O N From Our CEO Q3 was a solid quarter for Alteryx across the board. Our product team made significant progress with our generative AI infused offerings that we believe will bring high value to our customers. Our business execution improved from the prior quarter, with key financial metrics above the high-end of our guided ranges. These results reflect improved sales execution despite consistent demand trends relative to Q2. Our customers continue to demonstrate a deep, growing commitment to the Alteryx platform. We believe the quest to digitize government entities and businesses around the world is intensifying as we hear our customers look for ways to improve efficiencies and drive automation and analytics across their user communities. We also believe Alteryx is uniquely positioned as the data analytics orchestration layer of an increasingly fragmented data ecosystem. Customers are leveraging our solutions to automate analytic processes to do more with less, and our easy-to-use solutions enable this with improved governance and security features. These are substantial competitive moats that have enabled us to win for years! Fellow Shareholders, 2 • Annualized recurring revenue, or ARR, came in at $914 million, up 21% year-over-year. This includes a currency headwind of approximately $6 million due to rate changes since we established the outlook. • Revenue came in at $232 million, up 8% year-over-year. • And non-GAAP operating income1 of $36 million exceeded the high-end of our guided range by $30 million, driven by both the revenue upside and disciplined cost management. I am so proud of our R&D team as they work to incorporate generative AI throughout our cloud-connected platform, reinforcing this differentiated market position to customers and prospects alike. Alteryx AiDIN, our brand of generative AI and machine learning technologies, is uniquely suited for this time and place. We recently announced several new Alteryx AiDIN capabilities – more on that shortly. Shareholder Letter 1See pages 15-16 for reconciliations of GAAP to non-GAAP financial measures.

Enhanced Go-To-Market Execution I’m also encouraged with the progress we’re making with our sales strategy. On our Q2 earnings call, we committed to improving our sales execution and enhancing the visibility of our business, particularly in the context of the tougher macro environment. We quickly adapted with some personnel and process changes to do just that. 3 We have more work ahead of us, but we’re pleased to see an early impact from our efforts. We saw our best pipe conversion in recent quarters, plus delivered meaningful improvement in sales and marketing efficiency. As discussed on last quarter’s call, we’re excited to welcome two new senior leaders to the sales organization, both reporting directly to Paula Hansen. I’m excited to welcome both Mark and Scott to the mission and look forward to building on recent progress in our go-to-market strategy. • First, we made significant progress enhancing our pipeline management. Paula Hansen has driven more rigor and discipline into deal qualification, stage assessment and forecast management. With visibility improving, we are better able to optimize our go-to-market resources. • Second, we improved our in-quarter linearity. The nature of our renewal cycle leads to a back-end weighted quarter, but we did much better capitalizing on opportunities to secure wins earlier in the quarter. • And third, we incorporated these changes into our sales enablement capabilities. We are providing new training programs and tools to sales leaders throughout the organization to help them better monitor opportunities and deliver coaching actions needed to drive success with their teams. Shareholder Letter Our new SVP of Global Alliances and Channels, Scott Van Valkenburgh, brings over 25 years of partner leadership experience working with global channel organizations. Scott joins us from Genpact, where he ran their global channel and alliance business, prior to which he led a high- performing global alliance team at SAS Institute where he managed over 1,400 partners. Our new SVP of Sales for the Americas, Mark Dorsey, joins us from Oracle, where he served as SVP of Enterprise Cloud sales, growing Oracle’s cloud business and transforming the sales team into a skilled cloud sales organization. Mark has held several leadership positions at Oracle, and most recently was the SVP of the Retail Vertical for North America. Mark Dorsey SVP, Sales for the Americas Scott Van Valkenburgh SVP, Global Alliances & Channels

Enterprise-Focused Strategy On that note, we continue to see strong validation that our executive facing, enterprise-focused sales motion is working. Our ELA strategy has provided a streamlined land and expand motion that is resonating with larger organizations. ELAs simplify pricing, bundle features, and often include a component of trial seats – what we refer to as burst licenses. This flexibility encourages exploration and removes the friction that software vendors often impose on customers. Of course, we support these projects with our customer success team and partners, which we believe accelerates upsell opportunities. And we are selling more and more ELAs every quarter. In Q3, we more than doubled the number of ELAs sold versus the same quarter last year. More than 2x Y/Y Number of ELAs sold • Global 2000 penetration came in at 49%. That’s up three points from Q3 last year; • Global 2000 net expansion rate held strong at 130% and remains well above our overall net expansion rate of 119%; and • We continue to attract marquee additions to our growing partner ecosystem – we announced a great new partnership with SADA, a leading business and technology consultancy and Google Cloud’s top global partner. Adopted its first burstable ELA with Alteryx in 2022. Early users quickly generated significant cost savings by automating time- consuming tasks across finance and operations teams. This resulted in a strategic push to broaden user engagement with the burst licenses. We saw dramatic use case expansion. In Q3 2023, the customer signed on for a new larger ELA with burst to drive momentum into next year. Fortune 500 Biopharmaceutical Company Signed on for a 1,000 seat ELA with 500 burst seats. This customer is establishing a flexible framework for increased engagement and automation across finance, tax, accounting, and HR, plus is exploring use cases in manufacturing and supply chain management. Our Snowflake partnership and integration were key differentiators for this customer. One of the Largest Private Companies in America Adopted a new multi-year ELA as they expand their usage of Alteryx Designer. After using Alteryx Designer for years to enhance marketing analytic processes for their clients, the customer is now exploring opportunities to automate financial processes and unlock savings within their own organization. Fortune 500 Global Marketing & Communications Company Shareholder Letter 4

Customer Showcase 5 NVIDIA Avalara Pacific Dental WestRock Company KeyBank National Association NVIDIA, the leader in accelerated computing and AI, is leveraging Alteryx to automate tasks and orchestrate data within finance and beyond. Avalara, a leading provider of tax compliance automation software, meaningfully expanded with an ELA as they are finding incremental opportunities to save cost by automating more within finance. After beginning with a relatively small implementation of Alteryx Designer a few years ago, we established multiple workflows that generated significant time savings throughout the finance organization. With the ROI potential well- established and strong executive engagement and support, Pacific Dental, a leading national dental and medical support organization, expanded to a much more comprehensive burstable ELA package this quarter as they look to empower new users and introduce Alteryx to adjacent teams. In collaboration with our customer success team and a partner, WestRock Company, a Fortune 500 packaging solutions company, identified opportunities to create value through automation across a broad range of use cases. We found we were able to best meet the needs of new users by meaningfully expanding the Alteryx Designer implementation with a new Alteryx Designer and Alteryx Server ELA bundle, plus add a new Cloud ELA to enable use cases across Alteryx Designer Cloud, Alteryx Machine Learning, and Alteryx Auto Insights. KeyBank National Association, one of the nation’s largest bank-based financial services companies, selected Alteryx Designer Cloud as a foundational component to accelerate their analytics program. Alteryx Designer Cloud’s ease-of-use, scalability, and native integration with Google Cloud Platform were key differentiating factors in KeyBank’s decision to expand with Alteryx. We now have a foothold in nearly half of the Global 2000, many of which remain early in bringing scale and accessibility to their data stack. With our top-down executive-level engagement, we believe these companies are establishing Alteryx as a key pillar of their data analytics journeys. Shareholder Letter

Cloud-Connected Innovation We’re also seeing traction with the technical executive leadership teams of our customers – Chief Information Officers, Chief Technology Officers, and Chief Data Analytics Officers. This dynamic is most prominent with our larger customers, and we believe is validation of the governance and enterprise- readiness of the Alteryx platform. Additionally, CIO endorsement is often an important milestone on the path to broader cloud adoption. On that note, our platform-focused strategy of creating a cloud- connected data analytics experience is resonating. We provide customers the ability to design analytic workflows anywhere, and then implement and automate workflows in the Alteryx Analytics Cloud Platform. Some users will create workflows in Alteryx Designer on a desktop, some will leverage our analytics cloud offering for model creation, and some will tap into adjacent offerings with Alteryx Machine Learning, Alteryx Auto Insights, and Alteryx Location Intelligence. This multi-faceted democratization of data analytics all built on a single, unified platform is what we mean when we say cloud is an ‘and,’ not an ‘or.’ We’re seeing many of our early Alteryx Analytics Cloud Platform adopters also expanding their flagship Alteryx Designer implementations, in parallel. Cloud is also opening up access to new customer opportunities. ALT E RY X AN ALY T I C S C L O U D P L AT F O R M Shareholder Letter 6

Alteryx + Generative AI Advancing the cloud-connected analytics experience is certainly an important R&D priority for Alteryx. Another top innovation focus is generative AI. We envision a world where generative AI influences all aspects of software and see opportunities to incorporate AI throughout our entire platform and breadth of offerings. Earlier this year, we introduced Alteryx AiDIN, and we’re already seeing great traction with Alteryx AiDIN features by existing Alteryx Auto Insights customers. Over the last three months, more than half of active Auto Insights accounts have leveraged Magic Documents – that’s strong engagement for a solution we introduced less than six months ago. At our Inspire user conference in Europe, we had several exciting AI announcements: • First, AI Studio, previously code-named AI Workbench, is designed to enable Alteryx platform users to securely manage, tune, and consume customized large language models based on their proprietary data. A seamless integration with Alteryx Designer will enable customers to use those LLMs in existing Alteryx Designer workflows and construct applications with a conversational interface. • Second, Playbooks is a new AI feature planned for Auto Insights that automatically recommends high-value use cases tailored to a customers’ industry vertical, job function, or company. This will enable users to quickly generate synthetic datasets and build proof-of-concept deliverables. • And third, AI-powered Brushing is a new Alteryx Designer Cloud feature that is designed to provide predictive transformation suggestions for workflows as users explore workflow results real-time. This allows users to automate the creation of data pipelines and get from data to insights faster. We envision a world where generative AI influences all aspects of software.” 7Shareholder Letter

Introducing Alteryx Marketplace 8 One more platform launch I want to highlight is the Alteryx Marketplace. Launched in early October, the Alteryx Marketplace has already gained significant traction with over 2,000 add-on downloads and a rapidly expanding collection of verified, expert-built, and supported add-ons, including connectors and macros. The Alteryx Marketplace is designed to provide our users with a platform for extending their analytic capabilities with confidence. Again, it’s about helping our users increase efficiency with their analytics and get to insights faster. Shareholder Letter

Closing Remarks In conclusion, we’re encouraged with the Q3 operational performance and results relative to our expectations entering the quarter. Our differentiated, easy-to-use platform enables our customers to rapidly scale a data-driven culture throughout their organizations. And with new cloud-connected experiences and our generative AI Alteryx AiDIN innovations, we’re finding ways to further enhance and accelerate the analytic journey. We certainly faced some challenges in Q2, and I’m so proud of how quickly the team adapted and improved execution this quarter. And we did it while maintaining our focus, vision, and disciplined cost management. I believe the business and this team is on a strong foundation, and we are hard at work to carry forward the momentum as we close out the year. Chief Executive Officer M AR K AN D E R S O N 9Shareholder Letter

Alteryx Inaugural Global Impact Report This report provides an overview of our key environmental, social and governance (ESG) initiatives: how we are protecting and fostering diversity and wellbeing on our teams, engaging our customers in giving back, and building sustainability into our development strategy with an aim towards a greener, brighter future for everyone. 10Shareholder Letter

Financial Update We are pleased with the improved execution in the quarter, which enabled us to deliver key Q3 financial metrics above our prior outlook ranges. • ARR came in at $914 million, up 21% year-over-year and $9 million above the high-end of our guided range. While we don’t provide constant currency, I would note that currency rate changes since we established our guidance in early August resulted in a headwind of approximately $6 million. Removing the impact of this currency headwind, our Q3 ARR outperformed the high-end of our guided range by $15 million. Better than expected conversion rates on expansion opportunities plus durable, robust gross retention contributed to our total Q3 bookings tracking above our assumptions for the quarter. • Revenue came in at $232 million, or $20 million above the high-end of our guided range. This reflects the bookings upside and slightly higher contract duration. • Finally, our non-GAAP operating income was $36 million, $30 million above the high-end of our guided range. We have been closely managing incremental spend and optimizing internal processes, which enabled the revenue upside to fall through to the bottom line. Key Metric Summary Chief Financial Officer K E V I N R U B I N 11 $914 million, +21% YoY Annualized Recurring Revenue Q3 2023 Summary $232 million, +8% YoY Revenue ($37) million GAAP Loss from Operations $36 million Non-GAAP Income from Operations1 130% (G2K) / 119% (Overall) Dollar-Based Net Expansion Rate Shareholder Letter 1See pages 15-16 for reconciliations of GAAP to non-GAAP financial measures.

Balancing Growth and Profitability In recent years, we decided to uplevel our go-to- market strategy to target the largest organizations in the world. In doing this, we hired experienced, enterprise sales reps and leaders, enhanced our partner programs, and built out an enterprise- quality customer success team. Over the past year, we’ve seen progress on this strategy in our financial results, and that continued in Q3. • We’re winning with larger organizations, as evidenced by our growing Global 2000 penetration, now at 49% - that’s an increase of 10 points from two years ago; • We’re winning larger deals. Our average deal size for Q3 expansion wins increased meaningfully year-over-year; and • We’re seeing our average customer size expand, as customers are increasing Alteryx Designer and Alteryx Server implementations, as well as exploring new use cases with our cloud-connected offerings. We grew our $250,000-plus ARR customers by 20% year- over-year to 706, and our $1 million-plus ARR customer count increased over 30% year-over- year. We are constantly working to optimize and refine our go-to-market strategy. And now, as we’re moving beyond the heavier investment phase from earlier last year, we are starting to see improved leverage and profitability in the model. • Sales rep productivity, as defined by new bookings per rep, improved year-over-year, a function of both performance management and go-to-market enhancing efforts; • Both GAAP and non-GAAP sales & marketing expense came down as a percentage of revenue by over five points versus Q3 of last year; and • We’ve effectively decreased GAAP and non- GAAP general and administrative spend while increasing ARR by more than 20% year-over- year. This underlying financial leverage is enabling us to improve profitability, while still investing in a healthy level of research and development to fuel product innovation around generative AI, cloud- connected offerings, and Alteryx platform integrations with adjacent enterprise systems. 12 20%49% Global 2000 Penetration YoY Growth in $250K+ ARR Customers Shareholder Letter

2023 and Beyond As we think longer-term, many of the profit drivers for this business are still ahead of us: First, while landing large enterprise new logos is costly, expanding with an existing enterprise customer can carry a much lower go-to-market cost; Second, our recent cost optimization initiatives have resulted in an organizational structure that we believe is more aligned with the current macro environment. This means we expect to enter 2024 with a leaner cost structure than we’ve had for several quarters; Third, we’ve established a strong partner ecosystem, and now, under the leadership of Scott Van Valkenburgh, we look to expand our partner-sourced contributions to drive additional scale and efficiency; Fourth, our portfolio of cloud-connected offerings creates new opportunities to cross-sell and engage with new types of users; and Finally, as we’ve demonstrated throughout 2023, we are approaching our cost structure with greater discipline, and expect to unlock additional efficiencies with scale, going forward. I’d like to share how we are thinking about the near-term opportunity and our guidance philosophy. We have a lot to be excited about in Q4: • We have significant upsell opportunities given our large renewal base; • We’re lapping Q4 2022 ELAs, which creates opportunities for additional expansions as burst licenses expire; and • We have our ramping portfolio of cloud-connected solutions that are increasingly gaining customer interest. And while our Q3 performance demonstrated solid progress in improving our execution, we’re still cognizant of the macro dynamics that we encountered in Q2, as well as the time required to continue improving sales execution. As such, we’re largely maintaining the prudent assumptions we incorporated in our prior guidance as it relates to customer buying behavior, conversion rates, and renewal rates. Shareholder Letter 13

Financial Outlook 14Shareholder Letter Q4 2023 Guidance Summary $942M – $948M ARR 13% – 14% ARR Growth YoY $334M – $340M Revenue 11% – 13% Revenue Growth YoY $112M – $118M Non-GAAP Operating Income1 $1.10 – $1.17 Non-GAAP Net Income per Share1 FY 2023 Guidance Summary $942M – $948M ARR 13% – 14% ARR Growth YoY $953M – $959M Revenue 11% – 12% Revenue Growth YoY $100M – $106M Non-GAAP Operating Income1 $0.94 – $1.01 Non-GAAP Net Income per Share1 The team is focused on building on recent improvements and closing the year with strength, which we believe will put us in position for a productive and profitable 2024. 1See pages 15-16 for reconciliations of GAAP to non-GAAP financial measures.

Three Months Ended September 30, Nine Months Ended September 30, $ in millions1 2023 2022 2023 2022 GAAP research & development expense $53 $55 $169 $162 GAAP research & development margin 23% 25% 27% 29% Stock-based compensation and related payroll taxes 15 15 44 41 Acquisition transaction and integration costs 1 2 2 4 Cost optimization charges 1 - 4 - Non-GAAP research & development expense $36 $38 $119 $117 Non-GAAP research & development margin 16% 18% 19% 21% GAAP sales & marketing expense $133 $136 $446 $385 GAAP sales & marketing margin 57% 63% 72% 69% Stock-based compensation and related payroll taxes 22 22 72 58 Amortization of intangible assets - - 1 1 Cost optimization charges 4 - 15 - Non-GAAP sales & marketing expense $107 $114 $358 $326 Non-GAAP sales & marketing margin 46% 53% 58% 59% GAAP general & administrative expense $49 $57 $146 $173 GAAP general & administrative margin 21% 26% 24% 31% Stock-based compensation and related payroll taxes 20 20 59 56 Acquisition transaction and integration costs - 2 1 14 Cost optimization charges 1 - 4 - Non-GAAP general & administrative expense $28 $35 $82 $103 Non-GAAP general & administrative margin 12% 16% 13% 19% Three Months Ended September 30, Nine Months Ended September 30, $ in millions1 2023 2022 2023 2022 GAAP gross profit $198 $183 $522 $468 GAAP gross margin 85% 85% 84% 84% Stock-based compensation and related payroll taxes 6 5 14 13 Amortization of intangible assets 3 4 9 10 Cost optimization charges - - 2 - Non-GAAP gross profit $207 $192 $547 $491 Non-GAAP gross margin 89% 89% 88% 89% GAAP loss from operations ($37) ($65) ($241) ($260) GAAP operating margin (16%) (30%) (39%) (47%) Stock-based compensation and related payroll taxes 63 62 189 168 Amortization of intangible assets 3 4 10 11 Impairment of intangible and long-lived assets - - 2 8 Cost optimization charges 6 - 25 - Acquisition transaction and integration costs 1 4 3 18 Non-GAAP income (loss) from operations $36 $5 ($12) ($55) Non-GAAP operating margin 16% 2% (2%) (10%) GAAP to Non-GAAP Operating Income (Loss) Reconciliation 15 1 Beginning with the quarter ended June 30, 2023, management elected to change the presentation of our financial statements and accompanying footnote disclosures from thousands to millions. The change in presentation had no material impact on previously reported financial information, but certain amounts reported for prior periods may differ by insignificant amounts due to the nature of rounding relative to the change in presentation. In addition, historical percentages and per share amounts presented may not add to their respective totals or recalculate due to rounding. Shareholder Letter

Three Months Ended September 30, Nine Months Ended September 30, $ in millions, shares in thousands, except per share data1 2023 2022 2023 2022 GAAP net loss attributable to common stockholders ($50) ($75) ($259) ($287) Stock-based compensation and related payroll taxes 63 62 189 168 Amortization of intangible assets 3 4 10 11 Impairment of intangible and long-lived assets - - 2 8 Cost optimization charges 6 - 25 - Acquisition transaction and integration costs 1 4 3 18 Income tax adjustments (3) 2 11 20 Non-GAAP net income (loss) $20 ($3) ($19) ($62) Convertible debt interest expense, after-tax2 2 - - - Adjusted non-GAAP net income (loss)2 $22 ($3) ($19) ($62) GAAP net loss per share attributable to common stockholders, diluted ($0.70) ($1.09) ($3.67) ($4.20) Non-GAAP adjustments to net loss per share 0.99 1.04 3.40 3.29 Non-GAAP net income (loss) per diluted share $0.29 ($0.05) ($0.27) ($0.91) GAAP weighted-average shares used to compute net loss per share attributable to common stockholders, diluted 71,305 68,673 70,615 68,273 Effect of potentially dilutive shares 4,713 - - - Non-GAAP weighted-average shares used to compute non-GAAP net income (loss) per share, diluted 76,018 68,673 70,615 68,273 GAAP to Non-GAAP Net Income (Loss) Reconciliation 16 1 Beginning with the quarter ended June 30, 2023, management elected to change the presentation of our financial statements and accompanying footnote disclosures from thousands to millions. The change in presentation had no material impact on previously reported financial information, but certain amounts reported for prior periods may differ by insignificant amounts due to the nature of rounding relative to the change in presentation. In addition, historical percentages and per share amounts presented may not add to their respective totals or recalculate due to rounding. 2 Following the adoption of ASU 2020-06, effective as of January 1, 2022, we utilize the “if-converted” method for calculating diluted net income per share, which assumes conversion of our convertible senior notes as of the beginning of the period or at the time of issuance, if later. As a result, for the three months ended September 30, 2023, we added back after-tax interest expense related to our convertible senior notes to the numerator of our calculation of diluted net income per share. Shareholder Letter

Disclosures Alteryx, the Alteryx logo and other registered or common law trade names, trademarks, or service marks of ours appearing in this letter are our property. The letter contains additional trade names, trademarks, and service marks of other companies, including, but not limited to, certain of our customers, technology partners, and competitors, that are the property of their respective owners. Except as otherwise expressly stated, we do not intend our use or display of other companies' trade names, trademarks, or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies. Forward-Looking Statements This letter includes “forward-looking statements” within the meaning of the federal securities laws that involve risks and uncertainties, including statements regarding our expectations with respect to annualized recurring revenue, guidance for the fourth quarter and the full year 2023, non- GAAP operating margin, and assumptions related to the foregoing; macroeconomic conditions and related impacts, including the impact to our competitive landscape, customer purchasing behavior, sales cycle, and contract duration; our workforce reduction plans and related impacts; our ability to execute our long-term growth, go-to-market, operations, and product strategies, including with respect to our cloud and AI offerings; our ability to achieve and improve profitability and cash flow; the anticipated value, customer adoption and acceptance, and continued innovation and availability of our products and services, including our cloud and AI offerings; the success of our sales activities; demand for data analytics products and our expectations regarding customer engagement, initiatives, and purchasing behavior; and other future events. These forward-looking statements are only predictions and may differ materially from actual results due to a variety of factors, including, but not limited to: our history of losses; volatile and significantly weakened global economic conditions; our ability to develop, release, and gain market acceptance of product and service enhancements and new products and services to respond to rapid technological change in a timely and cost- effective manner; our dependence on our software platform for substantially all of our revenue; our ability to manage our growth and the investments made to grow our business effectively; our ability to develop a successful business model to sell products and services acquired or to integrate such products or services into our existing products and services; our ability to attract new customers and retain and expand sales to existing customers; our ability to establish and maintain successful relationships with our channel partners; intense and increasing competition in our market; the rate of growth in the market for analytics products and services; our dependence on technology and data licensed to us by third parties; risks associated with our international operations; our ability to develop, maintain, and enhance our brand and reputation cost- effectively; litigation and related costs; security breaches; the success of our AI initiatives; our indebtedness and risks related to our outstanding notes; and other general market, political, economic, and business conditions, including, but not limited to, impacts related to weakened global economic conditions, regional conflicts, governmental shutdowns, inflationary pressures, rising interest rates, and disruptions in access to bank deposits or lending commitments due to bank failures. Additionally, these forward-looking statements, particularly our guidance, involve risk, uncertainties and assumptions, many of which relate to matters that are beyond our control and changing rapidly. Additional risks and uncertainties that could affect our financial results are included under the caption “Risk Factors” in our filings with the U.S. Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K for the year ended December 31, 2022, which are available on the “Investors” page of our website at http://investor.alteryx.com and on the SEC website at http://www.sec.gov. Additional information will also be set forth in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. All forward-looking statements contained herein are based on information available to us as of the date hereof and we do not assume any obligation to update these statements as a result of new information or future events. Non-GAAP Financial Measures and Operating Measures To supplement our consolidated financial statements, which are prepared and presented in accordance with U.S. generally accepted accounting principles (GAAP), we use certain non-GAAP financial measures. The presentation of these financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. We use non-GAAP measures to internally evaluate and analyze financial results. We believe these non-GAAP financial measures provide investors with useful supplemental information about the financial performance of our business, enable comparison of financial results between periods where certain items may vary independent of business performance, and enable comparison of our financial results with other public companies, many of which present similar non-GAAP financial measures. The non-GAAP financial measures have limitations as analytical tools and you should not consider them in isolation or as a substitute for the most directly comparable financial measures prepared in accordance with GAAP. Other companies, including companies in our industry, may calculate non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. A reconciliation of GAAP to non-GAAP financial measures has been provided in the tables included in our earnings press release. Additional information regarding our non-GAAP financial measures is included under the caption “Non-GAAP Financial Measures and Operating Measures” in our earnings press release. 17Shareholder Letter

Alteryx powers analytics for all by providing our leading Analytics Automation Platform. With Alteryx, enterprises can make intelligent decisions across their organizations with automated, AI-driven insights. More than 8,000 customers globally rely on Alteryx to democratize analytics across use cases and deliver high- impact business outcomes. To learn more, visit www.alteryx.com. Alteryx is a registered trademark of Alteryx, Inc. All other product and brand names may be trademarks or registered trademarks of their respective owners. 18 17200 Laguna Canyon Rd | Irvine | CA 92618

v3.23.3

Cover Page

|

Nov. 06, 2023 |

| Document Information [Line Items] |

|

| Document Period End Date |

Nov. 06, 2023

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 06, 2023

|

| Entity Registrant Name |

ALTERYX, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38034

|

| Entity Tax Identification Number |

90-0673106

|

| Entity Address, Address Line One |

17200 Laguna Canyon Road,

|

| Entity Address, City or Town |

Irvine,

|