falseAXIS CAPITAL HOLDINGS LTD0001214816Depositary shares, each representing a 1/100th interest in a 5.50% Series E preferred share00012148162024-01-232024-01-230001214816us-gaap:CommonStockMember2024-01-232024-01-230001214816us-gaap:SeriesEPreferredStockMember2024-01-232024-01-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 23, 2024

AXIS CAPITAL HOLDINGS LIMITED

(Exact Name Of Registrant As Specified In Charter)

| | | | | | | | | | | | | | |

| Bermuda | | 001-31721 | | 98-0395986 |

| (State of Incorporation) | | (Commission File No.) | | (I.R.S. Employer Identification No.) |

92 Pitts Bay Road

Pembroke, Bermuda HM 08

(Address of principal executive offices, including zip code)

(441) 496-2600

(Registrant’s telephone number, including area code)

Not applicable

(Former name or address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e(4)(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common shares, par value $0.0125 per share | AXS | New York Stock Exchange |

Depositary shares, each representing a 1/100th interest in a 5.50% Series E preferred share | AXS PRE | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition |

On January 23, 2024, AXIS Capital Holdings Limited, a Bermuda company, issued a press release announcing its preliminary 2023 full-year financial results and the conclusion of its reserve review. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The information in this Current Report on Form 8-K, including the information set forth in Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits | | | | | | | | |

| Exhibit No. | | Description |

| | Press release dated January 23, 2024 |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: January 23, 2024

| | | | | | | | | | | |

| | | |

| AXIS CAPITAL HOLDINGS LIMITED | |

| | | |

| | |

| By: | /s/ Conrad Brooks | |

| | Conrad Brooks | |

| | Chief Administrative and Legal Officer | |

| | | | | | | | |

Cliff Gallant (Investor Contact): | (415) 262-6843; | investorrelations@axiscapital.com |

Joe Cohen (Media Contact): | (973) 420-7830; | joseph.cohen@axiscapital.com |

AXIS CAPITAL ANNOUNCES PRELIMINARY 2023 FULL-YEAR FINANCIAL RESULTS AND CONCLUSION OF RESERVE REVIEW

Pembroke, Bermuda, January 23, 2024 - AXIS Capital Holdings Limited ("AXIS Capital" or "AXIS" or "the Company") (NYSE: AXS) today announced preliminary financial results for the year ended December 31, 2023, and the conclusion of its previously announced review of prior year reserves. AXIS expects to release financial results for the year ended December 31, 2023 on January 31, 2024, after the close of the financial markets, as previously announced.

For the year ended December 31, 2023, the Company anticipates reporting net income available to common shareholders of $346 million, or $4.02 per diluted common share and operating income of $486 million, or $5.65 per diluted common share, an increase in gross premiums written of $142 million, or 2%, current accident year combined ratio of 91.8%, compared to 96.3% for the prior year, and book value per diluted common share of $54.06, an increase of 15.1% over the past twelve months.

The Company strengthened its prior year reserves in the fourth quarter by $425 million, pre-tax ($361 million, post-tax) attributable to both its insurance and reinsurance segments in liability lines and professional lines predominantly related to 2019 and older accident years. This amount is equal to 4.5% of net loss reserves at September 30, 2023.

Commenting on the 2023 financial results, Vince Tizzio, President and CEO of AXIS Capital, said:

"AXIS delivered strong underlying performance in 2023 and we believe the Company is on a clear trajectory to becoming a specialty underwriting leader. This was a year where we drove consistent premium growth with double-digit increases across the vast majority of our specialty insurance lines, and continued to cultivate a diversified and resilient portfolio, further improved and streamlined our operating model, and grew the tailored products and capabilities that we provide to our customers.

"The decisive actions we are taking this quarter address reserve development that is predominantly related to 2019 and older accident years as current economic and social inflation trends impact the overall U.S. Casualty market. We undertook a rigorous review that included an examination of trend assumptions, emerging development patterns, new industry data, and current legal trends.

"AXIS concludes the year with a portfolio that is well-positioned in the market, underpinned by our strong capital position. We approach the future with confidence and our team is relentlessly committed to achieving our specialty leadership ambition."

AXIS Capital Holdings Limited 92 Pitts Bay Road Pembroke, Bermuda HM08

Tel. 441.496.2600 Fax 441.405.2600

www.axiscapital.com

- 1 -

Conference Call

We will host a conference call on Tuesday, January 23, 2024 at 5:00 p.m. (EST) to discuss our preliminary 2023 financial results. The teleconference can be accessed by dialing 1-877-883-0383 (U.S. callers), or 1-412-902-6506 (international callers), and entering the passcode 9641638 approximately ten minutes in advance of the call. A live, listen-only webcast of the call will also be available via the Investor Information section of our website at www.axiscapital.com. A replay of the teleconference will be available for two weeks by dialing 1-877-344-7529 (U.S. callers), or 1-412-317-0088 (international callers), and entering the passcode 1118144. The webcast will be archived in the Investor Information section of our website.

About AXIS Capital

AXIS Capital, through its operating subsidiaries, is a global specialty underwriter and provider of insurance and reinsurance solutions. The Company has shareholders’ equity of $5.3 billion at December 31, 2023, and locations in Bermuda, the United States, Europe, Singapore and Canada. Its operating subsidiaries have been assigned a financial strength rating of "A+" ("Strong") by Standard & Poor’s and "A" ("Excellent") by A.M. Best. For more information about AXIS Capital, visit our website at www.axiscapital.com.

Website and Social Media Disclosure

We use our website (www.axiscapital.com) and our corporate LinkedIn (AXIS Capital) and X Corp. (@AXIS_Capital) accounts as channels of distribution of Company information. The information posted through these channels may be deemed material. Accordingly, investors should monitor these channels, in addition to following our press releases, SEC filings and public conference calls and webcasts. In addition, e-mail alerts and other information about AXIS Capital may be received by those enrolled in our "E-mail Alerts" program which can be found in the Investor Information section of our website (www.axiscapital.com). The contents of our website and social media channels are not part of this press release.

Follow AXIS Capital on LinkedIn and X Corp.

LinkedIn: http://bit.ly/2kRYbZ5

AXIS Capital Holdings Limited 92 Pitts Bay Road Pembroke, Bermuda HM08

Tel. 441.496.2600 Fax 441.405.2600

www.axiscapital.com

- 2 -

AXIS CAPITAL HOLDINGS LIMITED

NON-GAAP FINANCIAL MEASURES RECONCILIATION (UNAUDITED)

OPERATING INCOME AND UNDERLYING OPERATING INCOME FOR THE QUARTERS AND YEARS ENDED DECEMBER 31, 2023 AND 2022 | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | |

| Quarters ended December 31, | | Years ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| (in thousands, except per share amounts) |

| | | | | | | |

| Net income (loss) available (attributable) to common shareholders | $ | (150,145) | | | $ | 40,928 | | | $ | 346,042 | | | $ | 192,833 | |

Net investment (gains) losses(1) | (23,041) | | | 42,558 | | | 74,630 | | | 456,789 | |

Foreign exchange losses (gains)(2) | 69,871 | | | 78,989 | | | 58,115 | | | (157,945) | |

Reorganization expenses(3) | — | | | 9,485 | | | 28,997 | | | 31,426 | |

Interest in (income) loss of equity method investments(4) | (1,328) | | | 3,045 | | | (4,163) | | | (1,995) | |

| Income tax benefit | (2,348) | | | (8,397) | | | (17,488) | | | (23,177) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Operating income (loss) (5) | (106,991) | | | 166,608 | | | 486,133 | | | 497,931 | |

Net losses and loss expenses(6) | 425,001 | | | — | | | 425,001 | | | — | |

Associated income tax benefit (6) | (64,038) | | | — | | | (64,038) | | | — | |

Underlying operating income | $ | 253,972 | | | $ | 166,608 | | | $ | 847,096 | | | $ | 497,931 | |

| | | | | | | |

| | | | | | | |

| Earnings (loss) per diluted common share | $ | (1.76) | | | $ | 0.48 | | | $ | 4.02 | | | $ | 2.25 | |

| Net investment (gains) losses | (0.27) | | | 0.50 | | | 0.87 | | | 5.33 | |

| Foreign exchange losses (gains) | 0.82 | | | 0.92 | | | 0.68 | | | (1.84) | |

| Reorganization expenses | — | | | 0.11 | | | 0.34 | | | 0.37 | |

| Interest in (income) loss of equity method investments | (0.02) | | | 0.04 | | | (0.05) | | | (0.02) | |

| Income tax benefit | (0.02) | | | (0.10) | | | (0.21) | | | (0.28) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Operating income (loss) per diluted common share (5) | (1.25) | | | 1.95 | | | 5.65 | | | 5.81 | |

| Net losses and loss expenses | 4.93 | | | — | | | 4.94 | | | — | |

| Associated income tax benefit | (0.74) | | | — | | | (0.74) | | | — | |

Underlying operating income per diluted common share | $ | 2.94 | | | $ | 1.95 | | | $ | 9.85 | | | $ | 5.81 | |

| | | | | | | |

| Weighted average common shares outstanding | 85,268 | | | 84,667 | | | 85,142 | | | 84,864 | |

Weighted average diluted common shares outstanding (5) | 85,268 | | | 85,655 | | | 86,012 | | | 85,669 | |

| Weighted average diluted common shares outstanding | 86,270 | | | 85,655 | | | 86,012 | | | 85,669 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

1Tax expense (benefit) of $(1) million and $(2) million for the quarters ended December 31, 2023 and 2022, respectively, and $(10) million and $(36) million for the years ended December 31, 2023 and 2022, respectively. Tax impact is estimated by applying the statutory rates of applicable jurisdictions, after consideration of other relevant factors including the ability to utilize capital losses.

2Tax expense (benefit) of $(1) million and $(5) million for the quarters ended December 31, 2023 and 2022, respectively, and $(3) million and $16 million for the years ended December 31, 2023 and 2022, respectively. Tax impact is estimated by applying the statutory rates of applicable jurisdictions, after consideration of other relevant factors including the tax status of specific foreign exchange transactions.

3Tax expense (benefit) of $nil and $(1) million for the quarters ended December 31, 2023 and 2022, respectively, and $(5) million and $(4) million for the years ended December 31, 2023 and 2022, respectively. Tax impact is estimated by applying the statutory rates of applicable jurisdictions.

4Tax expense (benefit) of $nil for the quarters and years ended December 31, 2023 and 2022. Tax impact is estimated by applying the statutory rates of applicable jurisdictions.

5Due to the operating loss recognized for the quarter ended December 31, 2023, the share equivalents were anti-dilutive.

6Net adverse prior year reserve development of $425 million, pre-tax ($361 million, post-tax) for the quarter ended December 31, 2023.

AXIS Capital Holdings Limited 92 Pitts Bay Road Pembroke, Bermuda HM08

Tel. 441.496.2600 Fax 441.405.2600

www.axiscapital.com

- 3 -

AXIS CAPITAL HOLDINGS LIMITED

NON-GAAP FINANCIAL MEASURES RECONCILIATION (UNAUDITED)

CURRENT ACCIDENT YEAR COMBINED RATIO FOR THE QUARTERS AND YEARS ENDED

DECEMBER 31, 2023 AND 2022 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Quarters ended December 31, | | Years ended December 31, |

| 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Current accident year combined ratio | 91.0 | % | | 94.7 | % | | (3.7 | pts) | | 91.8 | % | | 96.3 | % | | (4.5 | pts) |

| Prior year reserve development ratio | 33.6 | % | | (0.6 | %) | | 34.2 | pts | | 8.1 | % | | (0.5 | %) | | 8.6 | pts |

| Combined ratio | 124.6 | % | | 94.1 | % | | 30.5 | pts | | 99.9 | % | | 95.8 | % | | 4.1 | pts |

| | | | | | | | | | | |

AXIS Capital Holdings Limited 92 Pitts Bay Road Pembroke, Bermuda HM08

Tel. 441.496.2600 Fax 441.405.2600

www.axiscapital.com

- 4 -

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of section 27A of the Securities Act of 1933 and section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts included in this press release, including statements regarding our estimates, beliefs, expectations, intentions, strategies or projections are forward-looking statements. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the United States federal securities laws. In some cases, these statements can be identified by the use of forward-looking words such as "may", "should", "could", "anticipate", "estimate", "expect", "plan", "believe", "predict", "potential", "intend" or similar expressions. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections, and various assumptions, many of which, by their nature, are inherently uncertain and beyond management's control.

Forward-looking statements contained in this press release may include, but are not limited to, information regarding our estimates for losses and loss expenses, measurements of potential losses in the fair market value of our investment portfolio and derivative contracts, our expectations regarding the performance of our business, our financial results, our liquidity and capital resources, the outcome of our strategic initiatives including our exit from catastrophe and property reinsurance lines of business, our expectations regarding pricing and other market and economic conditions including the liquidity of financial markets, developments in the commercial real estate market, inflation, our growth prospects, and valuations of the potential impact of movements in interest rates, credit spreads, equity securities' prices, and foreign currency exchange rates.

Forward-looking statements only reflect our expectations and are not guarantees of performance. These statements involve risks, uncertainties, and assumptions. Accordingly, there are or will be important factors that could cause actual events or results to differ materially from those indicated in such statements. We believe that these factors include, but are not limited to, the following:

Insurance Risk

•the cyclical nature of the insurance and reinsurance business leading to periods with excess underwriting capacity and unfavorable premium rates;

•the occurrence and magnitude of natural and man-made disasters, including the potential increase of our exposure to natural catastrophe losses due to climate change and the potential for inherently unpredictable losses from man-made catastrophes, such as cyber-attacks;

•the effects of emerging claims, systemic risks, and coverage and regulatory issues, including increasing litigation and uncertainty related to coverage definitions, limits, terms and conditions;

•actual claims exceeding reserves for losses and loss expenses;

•losses related to the Israel-Hamas conflict, the Russian invasion of Ukraine, terrorism and political unrest, or other unanticipated losses;

AXIS Capital Holdings Limited 92 Pitts Bay Road Pembroke, Bermuda HM08

Tel. 441.496.2600 Fax 441.405.2600

www.axiscapital.com

- 5 -

•the adverse impact of inflation;

•the failure of any of the loss limitation methods we employ;

•the failure of our cedants to adequately evaluate risks;

Strategic Risk

•underwriting and investment exposure in light of the recent disruption in the banking sector, which we expect to be within our risk appetite for an event of this nature;

•changes in the political environment of certain countries in which we operate or underwrite business, including the United Kingdom's withdrawal from the European Union;

•the loss of business provided to us by major brokers;

•a decline in our ratings with rating agencies;

•the loss of one or more of our key executives;

•increasing scrutiny and evolving expectations from investors, customers, regulators, policymakers and other stakeholders regarding environmental, social and governance matters;

•the adverse impact of contagious diseases (including COVID-19) on our business, results of operations, financial condition, and liquidity;

Credit and Market Risk

•the inability to purchase reinsurance or collect amounts due to us from reinsurance we have purchased;

•the failure of our policyholders or intermediaries to pay premiums;

•general economic, capital and credit market conditions, including banking and commercial real estate sector instability, financial market illiquidity and fluctuations in interest rates, credit spreads, equity securities' prices, and/or foreign currency exchange rates;

•breaches by third parties in our program business of their obligations to us;

Liquidity Risk

•the inability to access sufficient cash to meet our obligations when they are due;

Operational Risk

•changes in accounting policies or practices;

•the use of industry models and changes to these models;

•difficulties with technology and/or data security;

•the failure of the processes, people or systems that we rely on to maintain our operations and manage the operational risks inherent to our business, including those outsourced to third parties;

AXIS Capital Holdings Limited 92 Pitts Bay Road Pembroke, Bermuda HM08

Tel. 441.496.2600 Fax 441.405.2600

www.axiscapital.com

- 6 -

Regulatory Risk

•changes in governmental regulations and potential government intervention in our industry;

•inadvertent failure to comply with certain laws and regulations relating to sanctions, foreign corrupt practices, data protection and privacy; and

Risks Related to Taxation

•changes in tax laws.

Readers should carefully consider the risks noted above together with other factors including but not limited to those described under Item 1A, 'Risk Factors' in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission ("SEC"), as those factors may be updated from time to time in our periodic and other filings with the SEC, which are accessible on the SEC's website at www.sec.gov.

We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

AXIS Capital Holdings Limited 92 Pitts Bay Road Pembroke, Bermuda HM08

Tel. 441.496.2600 Fax 441.405.2600

www.axiscapital.com

- 7 -

Rationale for the Use of Non-GAAP Financial Measures

We present our results of operations in a way we believe will be meaningful and useful to investors, analysts, rating agencies and others who use our financial information to evaluate our performance. Some of the measurements we use are considered non-GAAP financial measures under SEC rules and regulations. In this press release, we present operating income (loss) (in total and on a per share basis), underlying operating income (loss) (in total and on a per share basis) and current accident year combined ratio which are non-GAAP financial measures as defined in SEC Regulation G. We believe that these non-GAAP financial measures, which may be defined and calculated differently by other companies, help explain and enhance the understanding of our results of operations. However, these measures should not be viewed as a substitute for those determined in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP").

Operating Income (Loss)

Operating income (loss) represents after-tax operational results exclusive of net investment gains (losses), foreign exchange losses (gains), reorganization expenses and interest in income (loss) of equity method investments.

Although the investment of premiums to generate income and investment gains (losses) is an integral part of our operations, the determination to realize investment gains (losses) is independent of the underwriting process and is heavily influenced by the availability of market opportunities. Furthermore, many users believe that the timing of the realization of investment gains (losses) is somewhat opportunistic for many companies.

Foreign exchange losses (gains) in our consolidated statements of operations primarily relate to the impact of foreign exchange rate movements on net insurance-related liabilities. However, we manage our investment portfolio in such a way that unrealized and realized foreign exchange losses (gains) on our investment portfolio, including unrealized foreign exchange losses (gains) on our equity securities, and foreign exchange losses (gains) realized on the sale of our available for sale investments and equity securities recognized in net investment gains (losses), and unrealized foreign exchange losses (gains) on our available for sale investments in other comprehensive income (loss), generally offset a large portion of the foreign exchange losses (gains) arising from our underwriting portfolio, thereby minimizing the impact of foreign exchange rate movements on total shareholders' equity. As a result, we believe that foreign exchange losses (gains) in our consolidated statements of operations in isolation are not a meaningful contributor to the performance of our business. Therefore, foreign exchange losses (gains) are excluded from operating income (loss).

Reorganization expenses in 2023 include impairments of computer software assets and severance costs mainly attributable to our "How We Work" program which is focused on simplifying our operating structure. Reorganization expenses in 2022 included severance costs and impairments of computer software assets mainly attributable to our exit from catastrophe and property reinsurance lines of business which was part of an overall approach to reduce our exposure to volatile catastrophe risk. Reorganization expenses are primarily driven by business decisions, the

AXIS Capital Holdings Limited 92 Pitts Bay Road Pembroke, Bermuda HM08

Tel. 441.496.2600 Fax 441.405.2600

www.axiscapital.com

- 8 -

nature and timing of which are not related to the underwriting process. Therefore, these expenses are excluded from consolidated operating income (loss).

Interest in income (loss) of equity method investments is primarily driven by business decisions, the nature and timing of which are not related to the underwriting process. Therefore, this income (loss) is excluded from operating income (loss).

Certain users of our financial statements evaluate performance exclusive of after-tax net investment gains (losses), foreign exchange losses (gains), reorganization expenses and interest in income (loss) of equity method investments to understand the profitability of recurring sources of income.

We believe that showing net income (loss) available (attributable) to common shareholders exclusive of after-tax net investment gains (losses), foreign exchange losses (gains), reorganization expenses and interest in income (loss) of equity method investments reflects the underlying fundamentals of our business. In addition, we believe that this presentation enables investors and other users of our financial information to analyze performance in a manner similar to how our management analyzes the underlying business performance. We also believe this measure follows industry practice and, therefore, facilitates comparison of our performance with our peer group. We believe that equity analysts and certain rating agencies that follow us, and the insurance industry as a whole, generally exclude these items from their analyses for the same reasons. The reconciliation of operating income (loss) to net income (loss) available (attributable) to common shareholders, the most comparable GAAP financial measure, is presented in the 'Non-GAAP Financial Measures Reconciliation' section of this press release.

We also present operating income (loss) per diluted common share which is derived from the operating income (loss) measure and is reconciled to the most comparable GAAP financial measure, earnings (loss) per diluted common share in the 'Non-GAAP Financial Measures Reconciliation' section of this press release.

Underlying Operating Income (Loss)

Underlying operating income (loss) represents underwriting results exclusive of net adverse prior year reserve development of $425 million, pre-tax and $361 million, post-tax for the fourth quarter of 2023. We believe that the presentation of underlying operating income (loss) provides investors with an enhanced understanding of our results of operations by highlighting the profitability of our underwriting activities excluding the impact of the fourth quarter net adverse prior year reserve development. The reconciliation of underlying operating income (loss) to net income (loss) available (attributable) to common shareholders, the most comparable GAAP financial measure, is presented in the 'Non-GAAP Financial Measures Reconciliation' section of this press release.

We also present underlying operating income (loss) per diluted common share which is derived from the underlying operating income (loss) measure and is reconciled to the most comparable GAAP financial measure, earnings (loss) per diluted common share in the 'Non-GAAP Financial Measures Reconciliation' section of this press release.

AXIS Capital Holdings Limited 92 Pitts Bay Road Pembroke, Bermuda HM08

Tel. 441.496.2600 Fax 441.405.2600

www.axiscapital.com

- 9 -

Current Accident Year Combined Ratio

Current accident year combined ratio represents underwriting results exclusive of net favorable (adverse) prior year reserve development. We believe that the presentation of current accident year combined ratio provides investors with an enhanced understanding of our results of operations by highlighting the profitability of our underwriting activities excluding the impact of volatile prior year reserve development. The reconciliation of current accident year combined ratio to combined ratio, the most comparable GAAP financial measure, is presented in the 'Non-GAAP Financial Measures Reconciliation' section of this press release.

AXIS Capital Holdings Limited 92 Pitts Bay Road Pembroke, Bermuda HM08

Tel. 441.496.2600 Fax 441.405.2600

www.axiscapital.com

- 10 -

Cover

|

Jan. 23, 2024 |

| Cover page [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 23, 2024

|

| Entity File Number |

001-31721

|

| Entity Registrant Name |

AXIS CAPITAL HOLDINGS LTD

|

| Entity Central Index Key |

0001214816

|

| Entity Tax Identification Number |

98-0395986

|

| Entity Incorporation, State or Country Code |

D0

|

| Entity Address, Address Line One |

92 Pitts Bay Road

|

| Entity Address, City or Town |

Pembroke

|

| Entity Address, Country |

BM

|

| Entity Address, Postal Zip Code |

HM 08

|

| City Area Code |

441

|

| Local Phone Number |

496-2600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Listings [Line Items] |

|

| Document Period End Date |

Jan. 23, 2024

|

| Common Stock [Member] |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Common shares, par value $0.0125 per share

|

| Trading Symbol |

AXS

|

| Security Exchange Name |

NYSE

|

| Series E Preferred Stock [Member] |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Depositary shares, each representing a 1/100th interest in a 5.50% Series E preferred share

|

| Trading Symbol |

AXS PRE

|

| Security Exchange Name |

NYSE

|

| X |

- Definition

+ References

+ Details

| Name: |

axs_CoverpageAbstract |

| Namespace Prefix: |

axs_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesEPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

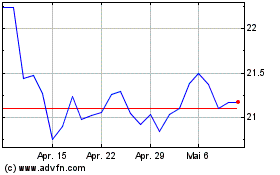

Axis Capital (NYSE:AXS-E)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Axis Capital (NYSE:AXS-E)

Historical Stock Chart

Von Mai 2023 bis Mai 2024