Ampco-Pittsburgh Announces Third Quarter Earnings

28 Oktober 2013 - 9:30PM

Business Wire

Ampco-Pittsburgh Corporation (NYSE: AP) announces sales for the

three and nine months ended September 30, 2013 of $64,433,000 and

$203,995,000, respectively, against $72,190,000 and $215,751,000

for the comparable prior year periods. Income from operations

approximated $20,777,000 and $24,879,000 for the three and nine

months ended September 30, 2013, respectively, and includes a

pre-tax credit of approximately $16,340,000 representing estimated

additional insurance recoveries through 2022 for asbestos

liabilities on account of insurance coverage settlement agreements

entered into during the quarter. Income from operations for the

three and nine months ended September 30, 2012 equaled $3,748,000

and $10,793,000, respectively. Net income for the three and nine

months ended September 30, 2013 was $12,705,000 or $1.23 per share

and $13,937,000 or $1.35 per share, respectively, including the

after-tax credit of approximately $10,620,000 or $1.03 per share

for the above-mentioned insurance settlements, in comparison to

$1,528,000 or $0.15 per share and $5,037,000 or $0.49 per share for

the three and nine months ended September 30, 2012.

For the Forged and Cast Rolls segment, sales for the quarter and

year-to-date periods were less than the comparable prior year

periods principally due to weak demand worldwide which is driving

margins lower and reducing earnings. The impact to operating income

was offset by receipt of insurance proceeds for lost margin on

rolls damaged during Hurricane Sandy in 2012 resulting in operating

income for the third quarter 2013 slightly better than third

quarter 2012. For the Air and Liquid Processing group, sales for

the three and nine months ended September 30, 2013 were less than

the comparable prior year periods; however, operating income

improved due to the pre-tax credit of approximately $16,340,000 for

the above-mentioned insurance settlements and changes in product

mix.

The matters discussed herein may contain forward-looking

statements that are subject to risks and uncertainties that could

cause actual results to differ materially from expectations. Some

of these risks are set forth in the Corporation's Annual Report on

Form 10-K as well as the Corporation's other reports filed with the

Securities and Exchange Commission.

AMPCO-PITTSBURGH

CORPORATION

FINANCIAL

SUMMARY

Three Months Ended Sept 30, Nine

Months Ended Sept 30, 2013

2012 2013 2012

Sales

$ 64,433,000 $

72,190,000 $

203,995,000 $

215,751,000 Income from operations (1)

20,777,000 3,748,000 24,879,000 10,793,000 Other expense – net

(565,000 )

(217,000 )

(1,669,000 )

(763,000 )

Income before income taxes 20,212,000 3,531,000 23,210,000

10,030,000 Income tax expense (7,057,000 ) (1,498,000 ) (7,958,000

) (3,643,000 )

Equity loss in Chinese joint venture

(450,000 )

(505,000 )

(1,315,000 )

(1,350,000 )

Net income (2)

$ 12,705,000

$ 1,528,000 $

13,937,000 $

5,037,000 Earnings per common share:

Basic (2)

$ 1.23 $

0.15 $ 1.35

$ 0.49 Diluted (2)

$

1.22 $ 0.15

$ 1.34 $

0.48

Weighted-average number of common shares

outstanding:

Basic

10,362,746

10,342,756 10,355,272

10,336,865 Diluted

10,407,664 10,384,291

10,404,158

10,387,839 (1)

Income from operations for the three and nine months

ended September 30, 2013 includes a pre-tax credit of approximately

$16,340,000 representing estimated additional insurance recoveries

through 2022 for asbestos liabilities on account of insurance

coverage settlement agreements entered into during the quarter.

(2) Net income for the three and nine months ended September

30, 2013 includes an after-tax credit of approximately $10,620,000

or $1.03 per share representing estimated additional insurance

recoveries through 2022 for asbestos liabilities on account of

insurance coverage settlement agreements entered into during the

quarter.

Ampco-Pittsburgh CorporationDee Ann Johnson, 412-456-4410Chief

Financial Officer and Treasurerdajohnson@ampcopgh.com

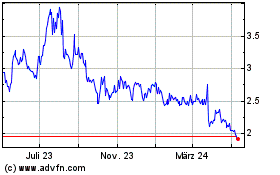

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

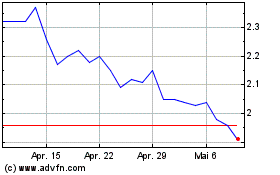

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

Von Jul 2023 bis Jul 2024