false

0000899629

0000899629

2024-01-09

2024-01-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

January 9, 2024

Acadia Realty Trust

(Exact name of registrant as specified in its

charter)

| Maryland |

|

1-12002 |

|

23-2715194 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification

No.) |

411

Theodore Fremd Avenue

Suite

300

Rye,

New York 10580

(Address of principal

executive offices) (Zip Code)

(914)288-8100

(Registrant’s telephone

number, including area code)

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

| Title of class of registered securities |

|

Trading symbol |

|

Name of exchange on which registered |

| Common shares of beneficial interest, par value $0.001 per share |

|

AKR |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events.

On January 9, 2024, Acadia Realty Trust (the

“Company”) and Acadia Realty Limited Partnership, the operating partnership of the Company (the “Operating

Partnership”), entered into Amendment No. 1 (“Amendment No. 1”) to the ATM Equity Offering Sales Agreement (as

amended, the “Sales Agreement”) dated March 1, 2022, with each of BofA Securities, Inc., Barclays Capital Inc.,

Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, Jefferies LLC, TD Securities (USA) LLC, Truist Securities, Inc. and

Wells Fargo Securities, LLC, as sales agents, principals and/or forward sellers (the “Sales Agents”), and Bank of

America, N.A., Barclays Bank PLC, Citibank, N.A., Goldman Sachs & Co. LLC, Jefferies LLC, JPMorgan Chase Bank, National

Association, The Toronto-Dominion Bank, Truist Bank and Wells Fargo Securities, LLC, or one of their respective affiliates, as

forward purchasers (the “Forward Purchasers”), to sell, from time to time, common shares of beneficial interest of the

Company, par value $0.001 per share, having an aggregate sale price of up to $250,000,000 through an at-the-market equity offering

program. As of the date of Amendment No. 1, common shares having an aggregate sale price of up to $222,300,000 remain available for

issuance under the at-the-market equity offering program (the “ATM Shares”).

Amendment No. 1 was entered into in order to (i)

reflect the filing by the Company of a new shelf registration statement on Form S-3ASR (File No. 333-275356) with the Securities and Exchange

Commission (the “Commission”) on November 7, 2023 (the “2023 Shelf Registration Statement”), (ii) include TD Securities

(USA) LLC as an additional Sales Agent and Forward Seller, and The Toronto Dominion-Bank as an additional Forward Purchaser, (iii) add

Deloitte & Touche LLP as an independent registered public accounting firm for the Company, and (iv) modify certain defined terms in

the Sales Agreement, as well as certain other administrative matters.

The ATM Shares will be issued pursuant to the

Company’s 2023 Shelf Registration Statement, which became effective automatically upon filing with the Commission on November 7,

2023. The prospectus supplement reflecting Amendment No. 1 was filed with the Commission on January 9, 2024.

The foregoing description of Amendment No. 1 is

a summary and is qualified in its entirety by reference to the full text of Amendment No. 1, a copy of which is filed as Exhibit 1.1 to

this Current Report on Form 8-K and is incorporated herein by reference.

In connection with the filing of the prospectus

supplement, the Company’s counsel, Venable LLP delivered its legality opinion with respect to the ATM Shares, a copy of which is

filed as Exhibit 5.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit

Number |

|

Description |

| 1.1 |

|

Amendment No. 1, dated January 9, 2024, to the ATM Equity Offering Sales Agreement, dated March 1, 2022, among Acadia Realty Trust, Acadia Realty Limited Partnership and BofA Securities, Inc., Barclays Capital Inc., Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, Jefferies LLC, TD Securities (USA) LLC, Truist Securities, Inc. and Wells Fargo Securities, LLC, as sales agents and forward sellers, and Bank of America, N.A., Barclays Bank PLC, Citibank, N.A., Goldman Sachs & Co. LLC, Jefferies LLC, JPMorgan Chase Bank, National Association, The Toronto Dominion-Bank, Truist Bank and Wells Fargo Securities, LLC, or one of their respective affiliates, as forward purchasers |

| |

|

| 5.1 |

|

Opinion of Venable LLP |

| |

|

| 23.1 |

|

Consent of Venable LLP (included in Exhibit 5.1) |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (formatted as inline XBRL with applicable taxonomy extension information contained in Exhibits 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ACADIA REALTY TRUST |

| Dated: January 9, 2024 |

|

| |

|

|

| |

By: |

/s/ John Gottfried |

| |

Name: |

John Gottfried |

| |

Title: |

Executive Vice President and Chief Financial Officer |

Exhibit 1.1

AMENDMENT NO. 1 TO

ATM EQUITY OFFERING SALES

AGREEMENT

DATED MARCH 1, 2022

among

ACADIA REALTY TRUST,

ACADIA REALTY LIMITED PARTNERSHIP

and

BofA Securities, Inc.

BARCLAYS

CAPITAL INC.

Citigroup

Global Markets Inc.

Goldman

Sachs & Co. LLC

Jefferies

LLC

J.P. Morgan Securities LLC

TD SECURITIES

(USA) LLC

TRUIST

SECURITIES, Inc.

Wells

Fargo Securities, LLC,

as agents

and

Bank of

America, N.A.

BARCLAYS

BANK PLC

CITIBANK,

N.A.

Goldman

Sachs & Co. LLC

Jefferies

LLC

JPMorgan Chase Bank, National Association

THE TORONTO-DOMINION

BANK

TRUIST

BANK

Wells Fargo Bank, National Association,

AS FORWARD

PURCHASERS

JANUARY

9, 2024

AMENDMENT NO. 1 TO ATM EQUITY OFFERING SALES

AGREEMENT

AMENDMENT

NO. 1, dated as of January 9, 2024 (“Amendment No. 1”), by and among Acadia Realty Trust, a Maryland real

estate investment trust (the “Company”), Acadia Realty Limited Partnership, a Delaware limited partnership (the “Partnership”),

BofA Securities, Inc., Barclays Capital Inc., Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, Jefferies LLC, J.P.

Morgan Securities LLC, TD Securities (USA) LLC, Truist Securities, Inc. and Wells Fargo Securities, LLC, each as sales agent, principal

and/or forward seller (in such capacity, each an “Agent,” and together, the “Agents”) and Bank

of America, N.A., Barclays Bank PLC, Citibank, N.A., Goldman Sachs & Co. LLC, Jefferies LLC, JPMorgan Chase Bank, National Association,

The Toronto-Dominion Bank, Truist Bank and Wells Fargo Bank, National Association, each as forward purchaser (in such capacity, each

a “Forward Purchaser,” and together, the “Forward Purchasers”) to that certain ATM Equity Offering

Sales Agreement, dated March 1, 2022 (the “Agreement”).

W I T N E S S E T H:

WHEREAS, the parties hereto

are parties to the Agreement;

WHEREAS, the Company, the

Partnership, the Agents and the Forward Purchasers wish to amend the Agreement to modify certain defined terms set forth in the Agreement

and used therein and for certain other administrative matters, with effect on and after January 9, 2024 (the “Effective

Date”); and

WHEREAS, this Amendment No. 1

shall constitute an amendment to the Agreement, which shall remain in full force and effect as amended by this Amendment.

NOW, THEREFORE, in consideration

of the mutual agreement to amend the Agreement, the parties hereto, intending legally to be bound, hereby amend and modify the Agreement

as of the date hereof as follows:

Section 1. Definitions.

Unless otherwise specified

herein, capitalized terms used herein shall have the respective meanings assigned thereto in the Agreement.

Section 2. Representation

and Warranty.

Each of the Company and the

Partnership, jointly and severally, represent and warrant to the Agents and the Forward Purchasers that this Amendment No. 1 has

been duly authorized, executed and delivered by, and is a valid and binding agreement of, the Company and the Partnership.

Section 3. Amendment

of the Agreement.

(a) On

and after the Effective Date, the references to “Registration Statement” shall refer to the registration statement on Form S-3

(File No. 333-275356) filed by the Company with the Commission on November 7, 2023, that became effective upon such filing

in accordance with Rule 462(e) of the Securities Act Regulations, including the exhibits and any schedules thereto, and the

documents incorporated by reference therein pursuant to Item 12 of Form S-3 under the Securities Act.

(b) On

and after the Effective Date, the references to: (i) “Base Prospectus” shall refer to the base prospectus dated November 6,

2023 filed as part of the Registration Statement, as amended, in the form first furnished by the Company to the Agents for use in connection

with the offering of the Shares, including the documents incorporated by reference therein pursuant to Item 12 of Form S-3 under

the Securities Act at the Applicable Time; (ii) “Prospectus Supplement” shall refer to the most recent prospectus supplement

relating to the Shares, filed by the Company with the Commission pursuant to Rule 424(b) of the Securities Act Regulations,

in the form first furnished by the Company to the Agents for use in connection with the offering of the Shares, including the documents

incorporated by reference therein pursuant to Item 12 of Form S-3 under the Securities Act at the Applicable Time; and (iii) “Prospectus”

in the Agreement shall refer to the Base Prospectus and the Prospectus Supplement.

(c) Notwithstanding

anything to the contrary contained herein, this Amendment No. 1 shall not have any effect on offerings or sales of Shares that occurred

prior to the Effective Date or on the terms of the Agreement, and the rights and obligations of the parties thereunder, insofar as they

relate to such offerings or sales, including, without limitation, the representations, warranties and agreements (including the indemnification

and contribution provisions), as well as the definitions of “Registration Statement,” “Base Prospectus,” “Prospectus

Supplement” and “Prospectus,” contained in the Agreement.

(d) On

and after the Effective Date, Section 1(i) of the Agreement is deleted in its entirety and replaced with the following:

“(i) (a) BDO

USA, P.C., which delivered its audit report with respect to the consolidated financial statements of the Company, including the

related notes and schedules, if any, thereto (collectively, the “Financial Statements”), filed with the Commission and included

or incorporated by reference in the Registration Statement, the Disclosure Package and the Prospectus, is an independent registered public

accounting firm as required by the Securities Act, the Exchange Act and the rules and regulations of the Public Company Accounting

Oversight Board and (b) Deloitte & Touche LLP, is an independent registered public accounting firm as required by the Securities

Act, the Exchange Act and the rules and regulations of the Public Company Accounting Oversight Board.”

(e) On

and after the Effective Date, Section 3(l) of the Agreement is deleted in its entirety and replaced with the following:

“(l) Upon

commencement of the offering of Shares under this Agreement, and at the time Shares are delivered to the Agents as principal on a Settlement

Date, and promptly after each other Representation Date, the

Company will cause BDO USA, P.C. and Deloitte & Touche LLP, or other independent accountants reasonably satisfactory

to the Agents and the Forward Purchasers, to furnish to the Agents and the Forward Purchasers letters, dated the date of effectiveness

of such amendment or the date of filing of such supplement or other document with the Commission, as the case may be, in form reasonably

satisfactory to the Agents, the Forwards Purchasers and their counsel, of the same tenor as the letters referred to in Section 6(g) of

this Agreement, but modified as necessary to relate to the Registration Statement, the Disclosure Package and the Prospectus, as amended

and supplemented, or to the document incorporated by reference into the Prospectus, to the date of such letters. As used in this paragraph,

to the extent there shall be an Applicable Time on or following the applicable Representation Date, “promptly” shall be deemed

to be on or prior to the next succeeding Applicable Time. For the avoidance of doubt, so long as a placement notice issued by the Company

is not presently outstanding, the Company shall not be required to deliver the information required under this subsection; the information

required hereunder is only required to be delivered prior to the next issuance of a placement notice. The Company’s right to send

a placement notice following a Representation Date shall be conditioned upon the Agents’ and the Forward Purchasers’ receipt

of the deliverables required under this subsection.”

(f) On

and after the Effective Date, Section 6(g) of the Agreement is deleted in its entirety and replaced with the following:

“At

the dates specified in Section 3(l) of this Agreement (including, without limitation, on every Request Date), BDO USA, P.C.

and Deloitte & Touche LLP, the independent accountants of the Company who have certified the financial statements of the Company

and its subsidiaries included or incorporated by reference in the Registration Statement, the Disclosure Package and the Prospectus,

shall have furnished to the Agents and the Forward Purchasers letters dated as of the date of delivery thereof and addressed to the Agents

and the Forward Purchasers each in form and substance reasonably satisfactory to the Agents and the Forward Purchasers and their counsel,

containing statements and information of the type ordinarily included in accountants’ “comfort letters” to agents and

underwriters with respect to the financial statements of the Company and its subsidiaries included or incorporated by reference in the

Registration Statement, the Disclosure Package and the Prospectus.

(g) On

and after the Effective Date, all references to “BDO USA LLP” in the Agreement shall refer to “BDO USA, P.C.”

Section 4. Parties.

TD Securities (USA) LLC joins the Agreement, along with the other Agents, in its capacity as sales agent, principal and/or forward seller,

and The Toronto-Dominion Bank joins the Agreement in its capacity as a forward purchaser.

All

statements, requests, notices and agreements hereunder shall be in writing, and if to TD Securities (USA) LLC, as Agent, or The

Toronto-Dominion Bank, as Forward Purchaser, as applicable, shall be delivered or sent by mail, telex or facsimile transmission to:

TD Securities (USA) LLC

1 Vanderbilt Avenue, New

York, NY 10017

Attention: Equity Capital

Markets

| Email: | USTransactionAdvisory@tdsecurities.com;

bradford.limpert@tdsecurities.com;

michelle.martinelli@tdsecurities.com |

The Toronto-Dominion Bank

c/o TD Securities (USA) LLC,

as agent

1 Vanderbilt Avenue, New

York, NY 10017

Attention: Global Equity

Derivatives

| Email: | TDUSA-GEDUSInvestorSolutionsSales@tdsecurities.com; |

| | | bradford.limpert@tdsecurities.com; vanessa.simonetti@tdsecurities.com; |

| | | christopher.obalde@tdsecurities.com |

Section 5. Governing

Law. THIS AMENDMENT NO. 1, AND ALL MATTERS ARISING OUT OF OR RELATING TO THIS AMENDMENT NO. 1, SHALL BE GOVERNED BY AND CONSTRUED

IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK WITHOUT REFERENCE TO ITS PRINCIPLES OF CONFLICTS OF LAWS.

Section 6. Entire

Agreement. This Amendment No. 1 and the Agreement as further amended hereby contain the entire agreement and understanding among

the parties hereto with respect to the subject matter hereof and supersede all prior and contemporaneous agreements, understandings,

inducements and conditions, express or implied, oral or written, of any nature whatsoever with respect to the subject matter hereof.

Except as further amended hereby, all of the terms of the Agreement shall remain in full force and effect and are hereby confirmed in

all respects.

Section 7. Execution

in Counterparts. This Amendment No. 1 may be executed by any one or more of the parties hereto in any number of counterparts,

each of which shall be deemed to be an original, but all such respective counterparts shall together constitute one and the same instrument.

Counterparts may be delivered via facsimile, electronic mail (including any electronic signature covered by the U.S. federal ESIGN

Act of 2000, Uniform Electronic Transactions Act, the Electronic Signatures and Records Act or other applicable law, e.g., www.docusign.com)

or other transmission method and any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and

effective for all purposes.

Section 8. Headings.

The headings of the paragraphs herein are for convenience only. Such headings do not form a part hereof and are not intended to modify,

interpret or construe the meaning of this Amendment No. 1.

[Signature pages follow.]

If the foregoing is in accordance with your understanding

of our agreement, please sign and return to the Company a counterpart hereof, whereupon this instrument, along with all counterparts,

will become a binding agreement among the Agents, the Forward Purchasers and the Company in accordance with its terms.

| Title: | Executive

Vice President and Chief Legal Officer |

| | |

| | ACADIA REALTY LIMITED PARTNERSHIP |

| | |

| By: | ACADIA REALTY

TRUST |

| Title: | Executive

Vice President and Chief Legal Officer |

| | |

[Signature

Page to Amendment No. 1 to ATM Sales Agreement]

Accepted as of the date hereof:

| BOFA SECURITIES, INC. |

|

CITIGROUP GLOBAL

MARKETS INC. |

| |

|

|

| By: |

/s/ Hicham Hamdouch |

|

By: |

/s/ Kase Lawal |

| |

Name: |

Hicham Hamdouch |

|

|

Name: |

Kase Lawal |

| |

Title: |

Managing Director |

|

|

Title: |

Director |

| GOLDMAN SACHS &

CO. LLC |

|

JEFFERIES LLC |

| |

|

|

| By: |

/s/ Ryan Cunn |

|

By: |

/s/ Donald Lynaugh |

| |

Name: |

Ryan Cunn |

|

|

Name: |

Donald Lynaugh |

| |

Title: |

Managing Director |

|

|

Title: |

Managing Director |

| J.P.

Morgan Securities LLC |

|

TD SECURITIES

(USA) LLC |

| |

|

|

| By: |

/s/ Brett Chalmers |

|

By: |

/s/ Brad Limpert |

| |

Name: |

Brett Chalmers |

|

|

Name: |

Brad Limpert |

| |

Title: |

Executive Director |

|

|

Title: |

Managing Director |

| TRUIST SECURITIES, INC. |

|

WELLS FARGO

SECURITIES, LLC |

| |

|

|

| By: |

/s/ Geoffrey Fennel |

|

By: |

/s/ Elizabeth Alvarez |

| |

Name: |

Geoffrey Fennel |

|

|

Name: |

Elizabeth Alvarez |

| |

Title: |

Director |

|

|

Title: |

Managing Director |

[Signature

Page to Amendment No. 1 to ATM Sales Agreement]

As Agents

Accepted as of the date hereof:

| Bank

of America, N.A. |

|

CITIBANK,

N.A. |

| |

|

|

| By: |

/s/ Rohan Handa |

|

By: |

/s/ Eric Natelson |

| |

Name: |

Rohan Handa |

|

|

Name: |

Eric Natelson |

| |

Title: |

Managing Director |

|

|

Title: |

Authorized Signatory |

| GOLDMAN SACHS &

CO. LLC |

|

JEFFERIES LLC |

| |

|

|

| By: |

/s/ Ryan Cunn |

|

By: |

/s/ Donald Lynaugh |

| |

Name: |

Ryan Cunn |

|

|

Name: |

Donald Lynaugh |

| |

Title: |

Managing Director |

|

|

Title: |

Managing Director |

| JPMorgan Chase

Bank, National Association |

|

The

Toronto-Dominion Bank |

| |

|

|

| By: |

/s/ Brett Chalmers |

|

By: |

/s/ Vanessa Simonetti |

| |

Name: |

Brett Chalmers |

|

|

Name: |

Vanessa Simonetti |

| |

Title: |

Executive Director |

|

|

Title: |

Managing Director |

| TRUIST BANK |

|

Wells Fargo

Bank, National Association |

| |

|

|

| By: |

/s/ Michael Collins |

|

By: |

/s/ Elizabeth Alvarez |

| |

Name: |

Michael Collins |

|

|

Name: |

Elizabeth Alvarez |

| |

Title: |

Managing Director |

|

|

Title: |

Managing Director |

As Forward Purchasers, solely as the recipients

and/or beneficiaries of certain representations, warranties, covenants and indemnities set forth in the Agreement and this Amendment

No. 1.

[Signature

Page to Amendment No. 1 to ATM Sales Agreement]

Accepted as of the date hereof:

| BARCLAYS CAPITAL

INC. |

|

|

| |

|

|

| By: |

/s/ Warren Fixmer |

|

|

| |

Name: |

Warren Fixmer |

|

|

| |

Title: |

Managing Director |

|

|

As Agent

| BARCLAYS BANK

PLC |

|

|

| |

|

|

| By: |

/s/ Warren Fixmer |

|

|

| |

Name: |

Warren Fixmer |

|

|

| |

Title: |

Managing Director |

|

|

As Forward Purchaser, solely as the recipient

and/or beneficiary of certain representations, warranties, covenants and indemnities set forth in the Agreement and this Amendment No. 1.

[Signature

Page to Amendment No. 1 to ATM Sales Agreement]

Exhibit 5.1

January 9, 2024

Acadia Realty Trust

411 Theodore Fremd Avenue

Suite 300

Rye, New York 10580

Re: Registration

Statement on Form S-3 (File No. 333-275356)

Ladies and Gentlemen:

We have served as Maryland counsel

to Acadia Realty Trust, a Maryland real estate investment trust (the “Trust”), in connection with certain matters of Maryland

law relating to the sale and issuance of common shares (the “Shares”) of beneficial interest, par value $.001 per share, of

the Trust (the “Common Shares”) having an aggregate gross sales price of up to $250,000,000, which may be sold from time to

time pursuant to that certain ATM Equity Offering Sales Agreement, dated as of March 1, 2022, as amended by that certain Amendment

No. 1 to the ATM Equity Offering Sales Agreement, dated as of the date hereof (as amended, the “Agreement”), by and among

the Trust, Acadia Realty Limited Partnership, a Delaware limited partnership for which the Trust is the sole general partner, and BofA

Securities, Inc., Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, Jefferies LLC, J.P. Morgan Securities LLC, TD

Securities (USA) LLC, Truist Securities, Inc. and Wells Fargo Securities, LLC, each as sales agent, principal and/or forward seller,

and each of Bank of America, N.A., Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, Jefferies LLC, JPMorgan Chase Bank,

National Association, The Toronto Dominion Bank, Truist Bank and Wells Fargo Securities, LLC, each as forward purchaser. The Shares are

covered by the above-referenced Registration Statement, and all amendments related thereto (the “Registration Statement”),

filed by the Trust with the United States Securities and Exchange Commission (the “Commission”) under the Securities Act of

1933, as amended (the “1933 Act”). The Shares will be issued from time to time in public offerings at market or negotiated

prices pursuant to the Prospectus Supplement, dated January 9, 2024 (the “Prospectus Supplement”).

In connection with our representation

of the Trust, and as a basis for the opinion hereinafter set forth, we have examined originals, or copies certified or otherwise identified

to our satisfaction, of the following documents (hereinafter collectively referred to as the “Documents”):

1. The

Registration Statement and the related form of prospectus included therein in the form in which it was transmitted to the Commission under

the 1933 Act;

2. The

Prospectus Supplement;

Acadia Realty

Trust

January 9, 2024

Page 2

3. The

Declaration of Trust of the Trust, as amended and supplemented (the “Declaration of Trust”), certified by the State Department

of Assessments and Taxation of Maryland (the “SDAT”);

4. The

Amended and Restated Bylaws of the Trust, certified as of the date hereof by an officer of the Trust;

5. A

certificate of the SDAT as to the good standing of the Trust, dated as of a recent date;

6. The

Agreement;

7. The

letter agreement in substantially the form attached as Annex III to the Agreement (the “Confirmation”);

8. Resolutions

adopted by the Board of Trustees of the Trust, or a duly authorized committee thereof (the “Resolutions”), relating to, among

other matters, (i) the authorization of the registration, sale and issuance of the Shares and the delegation to specified trustees

and a specified officer of the Trust (the “Authorized Persons”) to determine certain terms of the Shares in accordance with

the Resolutions and (ii) the authorization of the execution and delivery by the Company of the Agreement and any Confirmation, certified

as of the date hereof by an officer of the Trust;

9. A

certificate executed by an officer of the Trust, dated as of the date hereof; and

10. Such

other documents and matters as we have deemed necessary or appropriate to express the opinion set forth below, subject to the assumptions,

limitations and qualifications stated herein.

In expressing the opinion set

forth below, we have assumed the following:

1. Each

individual executing any of the Documents, whether on behalf of such individual or another person, is legally competent to do so.

2. Each

individual executing any of the Documents on behalf of a party (other than the Trust) is duly authorized to do so.

Acadia Realty

Trust

January 9, 2024

Page 3

3. Each

of the parties (other than the Trust) executing any of the Documents has duly and validly executed and delivered each of the Documents

to which such party is a signatory, and such party’s obligations set forth therein are legal, valid and binding and are enforceable

in accordance with all stated terms.

4. All

Documents submitted to us as originals are authentic. The form and content of all Documents submitted to us as unexecuted drafts do not

differ in any respect relevant to this opinion from the form and content of such Documents as executed and delivered. All Documents submitted

to us as certified or photostatic copies conform to the original documents. All signatures on all Documents are genuine. All public records

reviewed or relied upon by us or on our behalf are true and complete. All representations, warranties, statements and information contained

in the Documents are true and complete. There has been no oral or written modification of or amendment to any of the Documents, and there

has been no waiver of any provision of any of the Documents, by action or omission of the parties or otherwise.

5. The

Shares will not be issued or transferred in violation of the restrictions on transfer and ownership contained in Article VI of the

Declaration of Trust.

6. Upon

the issuance of any of the Shares, the total number of Common Shares issued and outstanding will not exceed the total number of Common

Shares that the Trust is then authorized to issue under the Declaration of Trust.

Based upon the foregoing, and

subject to the assumptions, limitations and qualifications stated herein, it is our opinion that:

1. The

Trust is a real estate investment trust duly formed and existing under and by virtue of the laws of the State of Maryland and is in good

standing with the SDAT.

2. The

issuance of the Shares has been duly authorized and, when issued and delivered by the Trust against payment of the consideration therefor

in accordance with the Registration Statement, the Resolutions, the Agreement, any Confirmation and any instructions by the Authorized

Persons, the Shares will be validly issued, fully paid and nonassessable.

The foregoing opinion is limited

to the laws of the State of Maryland and we do not express any opinion herein concerning any other law. We express no opinion as to the

applicability or effect of federal or state securities laws, including the securities laws of the State of Maryland, or as to federal

or state laws regarding fraudulent transfers. To the extent that any matter as to which our opinion is expressed herein would be governed

by the laws of any jurisdiction other than the State of Maryland, we do not express any opinion on such matter. The opinion expressed

herein is subject to the effect of any judicial decision which may permit the introduction of parol evidence to modify the terms or the

interpretation of agreements.

Acadia

Realty Trust

January 9, 2024

Page 4

The opinion expressed herein

is limited to the matters specifically set forth herein and no other opinion shall be inferred beyond the matters expressly stated. We

assume no obligation to supplement this opinion if any applicable law changes after the date hereof or if we become aware of any fact

that might change the opinion expressed herein after the date hereof.

This opinion is being furnished

to you for submission to the Commission as an exhibit to the Trust’s Current Report on Form 8-K relating to the Shares (the

“Current Report”). We hereby consent to the filing of this opinion as an exhibit to the Current Report and to the use of the

name of our firm therein. In giving this consent, we do not admit that we are within the category of persons whose consent is required

by Section 7 of the 1933 Act.

Very truly yours,

/s/ Venable LLP

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

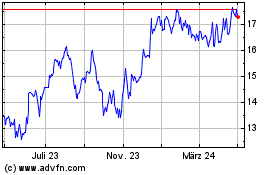

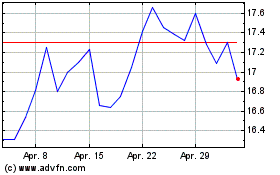

Acadia Realty (NYSE:AKR)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Acadia Realty (NYSE:AKR)

Historical Stock Chart

Von Mai 2023 bis Mai 2024