false

0001593548

0001593548

2024-02-05

2024-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 5, 2024

PLAYAGS, INC.

(Exact name of Registrant as specified in its charter)

|

Nevada

|

001-38357

|

46-3698600

|

|

(State

of incorporation)

|

(Commission

File No.)

|

(IRS Employer

Identification No.)

|

6775 S. Edmond St., Suite #300

Las Vegas, Nevada 89118

(Address of principal executive offices) (Zip Code)

(702) 722-6700

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common stock, $0.01 par value

|

|

AGS

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement. |

On February 5, 2024, AP Gaming I, LLC (the “Borrower”), a Delaware limited liability company and wholly owned indirect subsidiary of PlayAGS, Inc. (the “Company”), and AP Gaming Holdings, LLC (“Holdings”), a Delaware limited liability company and wholly owned indirect subsidiary of the Company, entered into an amendment (the “Seventh Amendment”) to amend that certain First Lien Credit Agreement, dated as of June 6, 2017 (as amended on December 6, 2017, as amended and restated on February 7, 2018, as amended and restated as of October 5, 2018, as amended as of August 30, 2019, as amended and restated on May 1, 2020, as amended as of August 4, 2021, as amended and restated as of February 15, 2022), among the Borrower, Holdings, the lenders party thereto from time to time, Jefferies Finance LLC, as administrative agent, and the other parties named therein (as so amended, the “Amended Credit Agreement”).

Among other things, the Seventh Amendment (i) removes the credit spread adjustment with respect to term loan borrowings in Term SOFR (as defined in the Amended Credit Agreement) and (ii) reduces the Applicable Margin (as defined in the Amended Credit Agreement) on the Borrower’s existing term loan to 3.75% for Term SOFR borrowings and 2.75% for ABR (as defined in the Amended Credit Agreement) borrowings. Additionally, in conjunction with entry into the Seventh Amendment, the Company elected to repay $15 million of its total debt outstanding.

The foregoing description of the Seventh Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Seventh Amendment.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth in Item 1.01 is incorporated into this Item 2.03 by reference.

|

Item 7.01

|

Regulation FD Disclosure.

|

On February 5, 2024, the Company issued a press release announcing entry into the Seventh Amendment, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 7.01 is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Item 7.01 shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 5, 2024

| |

PLAYAGS, INC. |

|

| |

|

|

| |

|

|

| |

By: |

/s/ Kimo Akiona |

|

| |

Name: Kimo Akiona |

|

| |

Title: Chief Financial Officer |

|

Exhibit 99.1

AGS SUCCESSFULLY COMPLETES TERM LOAN REPRICING; VOLUNTARILY REPAYS $15 MILLION OF ITS TOTAL DEBT OUTSTANDING

LAS VEGAS, February 5, 2024 - PlayAGS, Inc. (NYSE: AGS) ("AGS" or the "Company") today announced it has successfully completed a repricing of its term loan credit facility. Among other things, the repricing removes the credit spread adjustment with respect to term loan borrowings and reduces the interest rate applied to such borrowings to the Secured Overnight Financing Rate (“SOFR”) plus 3.75%. Additionally, in conjunction with the repricing transaction, the Company elected to repay $15 million of its total debt outstanding. At today’s SOFR, the Company estimates the repricing and voluntary repayment will produce annualized cash interest expense savings of over $3 million.

In addressing the repricing and repayment activity, AGS Chief Financial Officer, Kimo Akiona, commented, “As an organization, we remain singularly focused on reducing net leverage through a combination of consistent Adjusted EBITDA growth and improving free cash flow conversion. To that end, today’s announced transactions should help to expedite the achievement of our near and intermediate-term deleveraging objectives.”

Company Overview

AGS is a global company focused on creating a diverse mix of entertaining gaming experiences for every kind of player. Our roots are firmly planted in the Class II tribal gaming market, but our customer-centric culture and remarkable growth have helped us branch out to become one of the most all-inclusive commercial gaming equipment suppliers in the world. Powered by high-performing Class II and Class III slot products, an expansive table products portfolio, highly rated social casino, real-money gaming solutions for players and operators, and best-in-class service, we offer an unmatched value proposition for our casino partners. Learn more at playags.com.

AGS Investor & Media Contacts:

Brad Boyer, Senior Vice President Corporate Operations and Investor Relations

investors@playags.com

Julia Boguslawski, Chief Marketing Officer

jboguslawski@playags.com

©2024 PlayAGS, Inc. Products referenced herein are sold by AGS LLC or other subsidiaries of PlayAGS, Inc. Solely for convenience, marks, trademarks and trade names referred to in this press release appear without the ® and TM and SM symbols, but such references are not intended to indicate, in any way, that PlayAGS, Inc. will not assert, to the fullest extent under applicable law, its rights or the rights of the applicable licensor to these marks, trademarks and trade names.

Forward-Looking Statements

This release contains, and oral statements made from time to time by our representatives may contain, forward-looking statements based on management's current expectations and projections, which are intended to qualify for the safe harbor of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding the proposed public offering and other statements identified by words such as "believe," "will," "may," "might," "likely," "expect," "anticipates," "intends," "plans," "seeks," "estimates," "believes," "continues," "projects," "targets" and similar references to future periods, or by the inclusion of forecasts or projections. All forward-looking statements are based on current expectations and projections of future events.

These forward-looking statements reflect the current views, models, and assumptions of AGS, and are subject to various risks and uncertainties that cannot be predicted or qualified and could cause actual results in AGS's performance to differ materially from those expressed or implied by such forward looking statements. These risks and uncertainties include, but are not limited to, the ability of AGS to maintain strategic alliances, unit placements or installations, grow revenue, garner new market share, secure new licenses in new jurisdictions, successfully develop or place proprietary product, comply with regulations, have its games approved by relevant jurisdictions, the effects of COVID-19 on the Company's business and results of operations and other factors set forth under Item 1.

v3.24.0.1

Document And Entity Information

|

Feb. 05, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

PLAYAGS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 05, 2024

|

| Entity, Incorporation, State or Country Code |

NV

|

| Entity, File Number |

001-38357

|

| Entity, Tax Identification Number |

46-3698600

|

| Entity, Address, Address Line One |

6775 S. Edmond St., Suite #300

|

| Entity, Address, City or Town |

Las Vegas

|

| Entity, Address, State or Province |

NV

|

| Entity, Address, Postal Zip Code |

89118

|

| City Area Code |

702

|

| Local Phone Number |

722-6700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock

|

| Trading Symbol |

AGS

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001593548

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

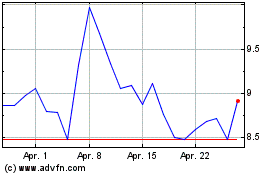

PlayAGS (NYSE:AGS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

PlayAGS (NYSE:AGS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024