0001681622false1678 S. Pioneer RoadSalt Lake CityUtah8410400016816222023-08-012023-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2023

___________________________________

VAREX IMAGING CORPORATION

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | | | | |

Delaware | 001-37860 | 81-3434516 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

| | | |

1678 S. Pioneer Road, Salt Lake City, Utah | | 84104 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (801) 972-5000

Not Applicable

(Former name or former address, if changed since last report)

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | VREX | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b - 2 of the Securities Exchange Act of 1934. Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition |

On August 1, 2023, Varex Imaging Corporation (the “Company”) issued a press release announcing its preliminary results of operations for the three and nine months ended June 30, 2023 entitled: “Varex Announces Financial Results for Third Quarter Fiscal Year 2023.” A copy of the press release is furnished as Exhibit 99.1 and incorporated by reference into this item.

This information shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | VAREX IMAGING CORPORATION |

| | |

Dated: August 1, 2023 | By: | /s/ Kimberley E. Honeysett |

| | Kimberley E. Honeysett |

| | Chief Legal Officer, General Counsel, and Corporate Secretary |

VAREX ANNOUNCES FINANCIAL RESULTS FOR

THIRD QUARTER FISCAL YEAR 2023

SALT LAKE CITY, August 1, 2023 – Varex Imaging Corporation (Nasdaq: VREX) today announced its unaudited financial results for the third quarter of fiscal year 2023.

3QFY23 Summary

•Revenues $232 million

•GAAP gross margin 33% | Non-GAAP gross margin* 34%

•GAAP operating margin 10% | Non-GAAP operating margin* 13%

•GAAP net earnings $0.21 per diluted share | Non-GAAP net earnings* $0.37 per diluted share

•Cash flow from operations $38 million

“We are pleased to report another solid quarter, with revenues reaching $232 million in the third quarter of fiscal 2023, a new quarterly record for Varex, and non-GAAP gross margin of 34% exceeding our expectations. These results were helped by the continued strength in our Industrial segment.” said Sunny Sanyal, Chief Executive Officer of Varex. Sanyal added, “Our efforts to reduce inventory levels coupled with profitability resulted in an increase in overall cash position by $30 million in the quarter."

Varex’s revenue of $232 million was up 2% sequentially and 8% year-over-year. Medical segment revenue of $175 million was up 1% sequentially and 5% year-over-year. Industrial segment revenue of $57 million was up 5% sequentially and 20% year-over-year. Non-GAAP gross margin was 34% in the quarter compared to 33% in the second quarter of fiscal year 2023 and non-GAAP EPS increased to $0.37 from $0.26 in the second quarter.

Balance Sheet & Cash Flow

Cash flow from operations was $38 million in the third quarter of fiscal year 2023, due primarily to improved earnings and a reduction in inventory. Cash, cash equivalents, marketable securities and CDs increased $30 million sequentially to $152 million at the end of the third quarter.

Outlook

The following guidance is provided for the fourth quarter of fiscal year 2023:

•Revenues are expected to be between $220 million and $240 million

•Non-GAAP net earnings per diluted share is expected to be between $0.20 and $0.40

Guidance for the company's net earnings per diluted share is provided on a non-GAAP basis only. This non-GAAP financial measure is forward-looking, and the company is unable to provide a meaningful or accurate reconciliation to a GAAP forecast of net earnings per diluted share without unreasonable effort due to certain of these reconciling items being uncertain, out of our control, and the amount and timing of these items being unable to be reasonably predicted. The actual amounts of such reconciling items could have a significant impact on the company's GAAP net income (loss) per diluted share.

Non-GAAP Financial Measures

*Please refer to "Reconciliation between GAAP and non-GAAP Financial Measures" below for a reconciliation of non-GAAP items to the comparable GAAP measures.

Conference Call Information

Varex will conduct its earnings conference call for the third quarter of fiscal year 2023 today at 3:00 p.m. Mountain Time. The conference call, including a supplemental slide presentation, will be webcast live and can be accessed at Varex’s website at www.vareximaging.com/investor-relations. Access will also be available by dialing 877-524-8416 from anywhere in the U.S. or by dialing 412-902-1028 from non-U.S. locations. The webcast and supplemental slide presentation will be archived on Varex’s website at www.vareximaging.com/financial-reports. A replay of the call will be available from today through August 15th at 877-660-6853 from anywhere in the U.S. or 201-612-7415 from non-U.S. locations. The replay access code is 13739792. The listen-only webcast link is: https://event.choruscall.com/mediaframe/webcast.html?webcastid=AmdkMU2w

About Varex

Varex Imaging Corporation is a leading innovator, designer and manufacturer of X-ray imaging components, which include X-ray tubes, digital detectors and other image processing solutions that are key components of X-ray imaging systems. With a 70+ year history of successful innovation, Varex’s products are used in medical imaging as well as in industrial and security imaging applications. Global OEM manufacturers incorporate the company’s X-ray sources, digital detectors, connecting devices and imaging software in their systems to detect, diagnose, protect and inspect. Headquartered in Salt Lake City, Utah, Varex employs approximately 2,300 people located in North America, Europe, and Asia. For more information visit vareximaging.com.

Forward Looking Statements

This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements concerning unaudited financial results; supply chain diversification activities; industry or market outlook; customer demand and revenue trends; revenues, product volumes, or other expected future financial results or performance; and any statements using the terms “believe,” “expect,” “intend,” “outlook,” “future,” “anticipate,” “will,” “could,” “estimate,” “guidance,” or similar statements are forward-looking statements that involve risks and uncertainties that could cause Varex’s actual results to differ materially from those anticipated. While forward-looking statements are based on assumptions and analyses made by us that we believe to be reasonable under the circumstances, whether actual results and developments will meet our expectations and predictions depend on a number of risks and uncertainties which could cause our actual results, performance, and financial condition to differ materially from our expectations. Such risks and uncertainties include supply chain and logistical challenges; price increases from suppliers and service providers, inflation generally and expense management; shifts in product mix; the continued impact of tariffs or a global trade war on Varex’s products and customer purchasing patterns; global economic conditions and political conditions globally or regionally, including any impact due to armed conflicts (such as the conflict between Russia and Ukraine as well as governmental sanctions imposed in response and increasing tensions between China and Taiwan); demand for and delays in delivery of products of Varex or its customers; litigation costs; Varex’s ability to develop, commercialize and deploy new products; the impact of reduced or limited demand by purchasers of certain X-ray products; the impact of competitive products and pricing; and the other risks listed from time to time in our filings with the U.S. Securities and Exchange Commission, which by this reference are incorporated herein. Any forward-looking statements made by us in this news release speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. Varex assumes no obligation to update or revise the forward-looking statements in this release because of new information, future events, or otherwise.

Varex has not filed its Form 10-Q for the third quarter of fiscal year 2023. All financial results described here should be considered preliminary and are subject to change to reflect any necessary adjustments or changes in accounting estimates that are identified prior to the time Varex files its Form 10-Q.

# # #

For Information Contact:

Christopher Belfiore

Director of Investor Relations

Varex Imaging Corporation

801.973.1566 | christopher.belfiore@vareximaging.com

VAREX IMAGING CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| (In millions, except for per share amounts) | June 30, 2023 | | July 1, 2022 | | June 30, 2023 | | July 1, 2022 |

| Revenues, net | | | | | | | |

| Medical | $ | 175.4 | | | $ | 167.1 | | | $ | 509.6 | | | $ | 493.2 | |

| Industrial | 56.8 | | | 47.4 | | | 156.4 | | | 134.8 | |

| Total revenues | 232.2 | | | 214.5 | | | 666.0 | | | 628.0 | |

| | | | | | | |

| Gross profit | | | | | | | |

| Medical | 54.7 | | | 54.3 | | | 152.7 | | | 153.7 | |

| Industrial | 21.6 | | | 19.1 | | | 59.6 | | | 55.3 | |

| Total gross profit | 76.3 | | | 73.4 | | | 212.3 | | | 209.0 | |

| Operating expenses: | | | | | | | |

| Research and development | 20.0 | | | 20.2 | | | 63.0 | | | 56.8 | |

| Selling, general and administrative | 32.1 | | | 30.2 | | | 96.5 | | | 88.6 | |

| | | | | | | |

| Total operating expenses | 52.1 | | | 50.4 | | | 159.5 | | | 145.4 | |

| Operating income | 24.2 | | | 23.0 | | | 52.8 | | | 63.6 | |

| Interest income | 0.9 | | | 0.1 | | | 2.1 | | | 0.2 | |

| Interest expense | (7.3) | | | (9.4) | | | (22.1) | | | (30.4) | |

| Other expense, net | (0.7) | | | (0.2) | | | (2.5) | | | (3.0) | |

| Interest and other expense, net | (7.1) | | | (9.5) | | | (22.5) | | | (33.2) | |

| Income before taxes | 17.1 | | | 13.5 | | | 30.3 | | | 30.4 | |

| Income tax expense | 7.9 | | | 5.1 | | | 13.6 | | | 12.8 | |

| Net income | 9.2 | | | 8.4 | | | 16.7 | | | 17.6 | |

| Less: Net income attributable to noncontrolling interests | 0.1 | | | 0.2 | | | 0.4 | | | 0.4 | |

| Net income attributable to Varex | $ | 9.1 | | | $ | 8.2 | | | $ | 16.3 | | | $ | 17.2 | |

| Net income per common share attributable to Varex | | | | | | | |

| Basic | $ | 0.23 | | | $ | 0.21 | | | $ | 0.41 | | | $ | 0.43 | |

| Diluted | $ | 0.21 | | | $ | 0.20 | | | $ | 0.40 | | | $ | 0.41 | |

| Weighted average common shares outstanding | | | | | | | |

| Basic | 40.4 | | | 39.9 | | | 40.2 | | | 39.7 | |

| Diluted | 50.4 | | | 40.5 | | | 40.6 | | | 41.9 | |

VAREX IMAGING CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | |

(In millions, except share and per share amounts) | June 30, 2023 | | September 30, 2022 |

| | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 118.5 | | | $ | 89.4 | |

| Accounts receivable, net of allowance for credit losses of $0.6 million and $0.6 million at June 30, 2023 and September 30, 2022, respectively | 163.3 | | | 173.3 | |

| Inventories | 297.7 | | | 303.2 | |

Prepaid expenses and other current assets | 59.0 | | | 44.0 | |

| Total current assets | 638.5 | | | 609.9 | |

| Property, plant, and equipment, net | 142.0 | | | 141.3 | |

| Goodwill | 289.2 | | | 284.5 | |

| Intangible assets, net | 25.5 | | | 33.6 | |

| Investments in privately-held companies | 46.8 | | | 46.4 | |

| Deferred tax assets | 2.8 | | | 2.3 | |

| Operating lease assets | 28.7 | | | 23.2 | |

| Other assets | 38.2 | | | 43.2 | |

| Total assets | $ | 1,211.7 | | | $ | 1,184.4 | |

| Liabilities and stockholders' equity | | | |

| Current liabilities: | | | |

Accounts payable | $ | 74.6 | | | $ | 78.2 | |

Accrued liabilities and other current liabilities | 67.9 | | | 81.4 | |

Current operating lease liabilities | 3.4 | | | 4.0 | |

Current maturities of long-term debt | 1.8 | | | 2.1 | |

Deferred revenues | 10.9 | | | 7.4 | |

| Total current liabilities | 158.6 | | | 173.1 | |

| Long-term debt, net | 441.1 | | | 412.3 | |

| Deferred tax liabilities | — | | | 0.5 | |

| Operating lease liabilities | 23.4 | | | 18.0 | |

| Other long-term liabilities | 43.7 | | | 33.8 | |

| Total liabilities | 666.8 | | | 637.7 | |

| | | |

| | | |

| Stockholders' equity: | | | |

| Preferred stock, $.01 par value: 20,000,000 shares authorized, none issued | — | | | — | |

| Common stock, $.01 par value: 150,000,000 shares authorized | | | |

| Shares issued and outstanding: 40,387,511 and 40,085,126 at June 30, 2023 and September 30, 2022, respectively. | 0.4 | | | 0.4 | |

| | | |

| Additional paid-in capital | 444.9 | | | 469.1 | |

| Accumulated other comprehensive (loss) income | (0.3) | | | 0.1 | |

| Retained earnings | 86.5 | | | 63.8 | |

| Total Varex stockholders' equity | 531.5 | | | 533.4 | |

| Noncontrolling interests | 13.4 | | | 13.3 | |

| Total stockholders' equity | 544.9 | | | 546.7 | |

| Total liabilities and stockholders' equity | $ | 1,211.7 | | | $ | 1,184.4 | |

VAREX IMAGING CORPORATION

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL MEASURES

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended | | |

| (In millions, except per share amounts) | June 30, 2023 | | July 1, 2022 | | June 30, 2023 | | July 1, 2022 | | |

| GROSS PROFIT RECONCILIATION | | | | | | | | | |

| Revenues, net | $ | 232.2 | | | $ | 214.5 | | | $ | 666.0 | | | $ | 628.0 | | | |

| Gross profit | 76.3 | | | 73.4 | | | 212.3 | | | 209.0 | | | |

| Amortization of intangible assets | 1.8 | | | 1.9 | | | 5.4 | | | 5.5 | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Non-GAAP gross profit | $ | 78.1 | | | $ | 75.3 | | | $ | 217.7 | | | $ | 214.5 | | | |

| Gross margin % | 32.9 | % | | 34.2 | % | | 31.9 | % | | 33.3 | % | | |

| Non-GAAP gross margin % | 33.6 | % | | 35.1 | % | | 32.7 | % | | 34.2 | % | | |

| | | | | | | | | |

| SELLING, GENERAL AND ADMINISTRATIVE EXPENSE RECONCILIATION | | | | | | | | | |

| Selling, general and administrative | $ | 32.1 | | | $ | 30.2 | | | $ | 96.5 | | | $ | 88.6 | | | |

| Amortization of intangible assets | 1.6 | | | 1.9 | | | 4.8 | | | 5.7 | | | |

| | | | | | | | | |

| Restructuring charges | 0.7 | | | 1.3 | | | 2.2 | | | 5.6 | | | |

| | | | | | | | | |

| Other non-operational costs | 0.8 | | | 0.1 | | | 4.6 | | | 2.0 | | | |

| Non-GAAP selling, general and administrative expense | $ | 29.0 | | | $ | 26.9 | | | $ | 84.9 | | | $ | 75.3 | | | |

| | | | | | | | | |

| OPERATING EXPENSE RECONCILIATION | | | | | | | | | |

| Total operating expenses | $ | 52.1 | | | $ | 50.4 | | | $ | 159.5 | | | $ | 145.4 | | | |

| Amortization of intangible assets | 1.6 | | | 1.9 | | | 4.8 | | | 5.7 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Restructuring charges | 0.7 | | | 1.3 | | | 2.2 | | | 5.6 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Other non-operational costs | 0.8 | | | 0.1 | | | 4.6 | | | 2.0 | | | |

| Non-GAAP operating expense | $ | 49.0 | | | $ | 47.1 | | | $ | 147.9 | | | $ | 132.1 | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

VAREX IMAGING CORPORATION

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL MEASURES

(Unaudited) | | |

| | | | | | | | | |

| Three Months Ended | | Nine Months Ended | | |

| (In millions, except per share amounts) | June 30, 2023 | | July 1, 2022 | | June 30, 2023 | | July 1, 2022 | | |

| OPERATING INCOME RECONCILIATION | | | | | | | | | |

| Operating income | $ | 24.2 | | | $ | 23.0 | | | $ | 52.8 | | | $ | 63.6 | | | |

| Amortization of intangible assets (includes amortization impacts to cost of revenues) | 3.4 | | | 3.8 | | | 10.2 | | | 11.2 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Restructuring charges (includes restructuring impact to cost of revenues) | 0.7 | | | 1.3 | | | 2.2 | | | 5.6 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Other non-operational costs (includes other non-operational impacts to cost of revenues) | 0.8 | | | 0.1 | | | 4.6 | | | 2.0 | | | |

| Total operating income adjustments | 4.9 | | | 5.2 | | | 17.0 | | | 18.8 | | | |

| Non-GAAP operating income | $ | 29.1 | | | $ | 28.2 | | | $ | 69.8 | | | $ | 82.4 | | | |

| Operating margin | 10.4 | % | | 10.7 | % | | 7.9 | % | | 10.1 | % | | |

| Non-GAAP operating margin | 12.5 | % | | 13.1 | % | | 10.5 | % | | 13.1 | % | | |

| | | | | | | | | |

| INCOME BEFORE TAXES RECONCILIATION | | | | | | | | | |

| Income before taxes | $ | 17.1 | | | $ | 13.5 | | | $ | 30.3 | | | $ | 30.4 | | | |

| Total operating income adjustments | 4.9 | | | 5.2 | | | 17.0 | | | 18.8 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Convertible notes non-cash interest expense | — | | | 2.2 | | | — | | | 6.5 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Other non-operational costs | — | | | — | | | — | | | 1.2 | | | |

| Total income before tax adjustments | 4.9 | | | 7.4 | | | 17.0 | | | 26.5 | | | |

| Non-GAAP income before taxes | $ | 22.0 | | | $ | 20.9 | | | $ | 47.3 | | | $ | 56.9 | | | |

| | | | | | | | | |

| INCOME TAX EXPENSE RECONCILIATION | | | | | | | | | |

| Income tax expense | $ | 7.9 | | | $ | 5.1 | | | $ | 13.6 | | | $ | 12.8 | | | |

| Tax effect on non-GAAP adjustments | 3.4 | | | (0.8) | | | 3.3 | | | (3.4) | | | |

| Non-GAAP income tax expense | $ | 4.5 | | | $ | 5.9 | | | $ | 10.3 | | | $ | 16.2 | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

VAREX IMAGING CORPORATION

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL MEASURES

(Unaudited) | | |

| | | | | | | | | |

| Three Months Ended | | Nine Months Ended | | |

| (In millions, except per share amounts) | June 30, 2023 | | July 1, 2022 | | June 30, 2023 | | July 1, 2022 | | |

| NET INCOME AND DILUTED NET INCOME PER SHARE RECONCILIATION | | | | | | | | | |

| Net income attributable to Varex | $ | 9.1 | | | $ | 8.2 | | | $ | 16.3 | | | $ | 17.2 | | | |

| Total earnings before taxes adjustments | 4.9 | | | 7.4 | | | 17.0 | | | 26.5 | | | |

| Effective tax rate on non-GAAP adjustments | (69.4) | % | | 10.8 | % | | (19.4) | % | | 12.8 | % | | |

| Tax effect on non-GAAP adjustments | 3.4 | | | (0.8) | | | 3.3 | | | (3.4) | | | |

| | | | | | | | | |

| Non-GAAP net income | 17.4 | | | 14.8 | | | 36.6 | | | 40.3 | | | |

| Interest expense on Convertible Notes, net of tax | 1.4 | | | — | | | — | | | — | | | |

| Diluted Non-GAAP net income | 18.8 | | | 14.8 | | | 36.6 | | | 40.3 | | | |

| Diluted net income per share | 0.21 | | | 0.20 | | | 0.40 | | | 0.41 | | | |

| Non-GAAP diluted net income per share | $ | 0.37 | | | $ | 0.37 | | | $ | 0.90 | | | $ | 1.00 | | | |

| | | | | | | | | |

| DILUTED WEIGHTED AVERAGE SHARES OUTSTANDING RECONCILIATION | | | | | | | | | |

| GAAP weighted average common shares - dilutive | 50.4 | | | 40.5 | | | 40.6 | | | 41.9 | | | |

| Dilution offset from convertible notes hedge transaction | — | | | (0.2) | | | — | | | (1.6) | | | |

| | | | | | | | | |

| Non-GAAP dilutive shares | 50.4 | | | 40.3 | | | 40.6 | | | 40.3 | | | |

| | | | | | | | | |

| ADJUSTED EBITDA RECONCILIATION | | | | | | | | | |

| Net income attributable to Varex | $ | 9.1 | | | $ | 8.2 | | | $ | 16.3 | | | $ | 17.2 | | | |

| Interest expense | 7.3 | | | 9.4 | | | 22.1 | | | 29.2 | | | |

| Income tax expense | 7.9 | | | 5.1 | | | 13.6 | | | 12.8 | | | |

| Depreciation | 4.9 | | | 4.7 | | | 14.2 | | | 14.3 | | | |

| Amortization | 3.4 | | | 3.8 | | | 10.2 | | | 11.2 | | | |

| Stock based compensation | 3.6 | | | 3.4 | | | 10.1 | | | 10.7 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Restructuring charges | 0.7 | | | 1.3 | | | 2.2 | | | 5.6 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Other non-operational costs | 0.8 | | | 0.1 | | | 4.6 | | | 3.2 | | | |

| Adjusted EBITDA | $ | 37.7 | | | $ | 36.0 | | | $ | 93.3 | | | $ | 104.2 | | | |

Discussion of Non-GAAP Financial Measures

This press release includes non-GAAP financial measures derived from our Condensed Consolidated Statements of Operations. These measures are not presented in accordance with, nor are they a substitute for U.S. generally accepted accounting principles, or GAAP. These measures include: non-GAAP gross profit; non-GAAP gross margin; non-GAAP operating expense; non-GAAP operating earnings; non-GAAP operating earnings margin; non-GAAP earnings before taxes; non-GAAP net earnings; non-GAAP net earnings per diluted share, non-GAAP dilutive shares; and non-GAAP EBITDA. We are providing a reconciliation above of each non-GAAP financial measure used in this earnings release to the most directly comparable GAAP financial measure. We are unable to provide without unreasonable effort a reconciliation of non-GAAP guidance measures to the corresponding GAAP measures on a forward-looking basis due to the potential significant variability and limited visibility of the excluded items discussed.

We utilize a number of different financial measures, both GAAP and non-GAAP, in analyzing and assessing the overall performance of our business, in making operating decisions, and forecasting and planning for future periods. We consider the use of the non-GAAP measures to be helpful in assessing the performance of the ongoing operation of our business by excluding unusual and one-time costs. We believe that disclosing non-GAAP financial measures provides useful supplemental data that allows for greater transparency in the review of our financial and operational performance. We also believe that disclosing non-GAAP financial measures provides useful information to investors and others in understanding and evaluating our operating results and future prospects in the same manner as management and in comparing financial results across accounting periods and to those of peer companies.

Non-GAAP measures include the following items:

Amortization of intangible assets: We do not acquire businesses and assets on a predictable cycle. The amount of purchase price allocated to intangible assets and the term of amortization can vary significantly and are unique to each acquisition or purchase. We believe that excluding amortization of intangible assets allows the users of our financial statements to better review and understand the historic and current results of our operations, and also facilitates comparisons to peer companies.

Purchase price accounting charges to cost of revenues: We may incur charges to cost of revenues as a result of acquisitions. We believe that excluding these charges allows the users of our financial statements to better understand the historic and current cost of our products, our gross margin, and also facilitates comparisons to peer companies.

Restructuring charges: We incur restructuring charges that result from events, which arise from unforeseen circumstances and/or often occur outside of the ordinary course of our on-going business. Although these events are reflected in our GAAP financials, these unique transactions may limit the comparability of our on-going operations with prior and future periods.

Acquisition and integration related costs: We incur expenses or benefits with respect to certain items associated with our acquisitions, such as transaction costs, changes in fair value of acquisition related hedges, changes in the fair value of contingent consideration liabilities, gain or expense on settlement of pre-existing relationships, etc. We exclude such expenses or benefits as they are related to acquisitions and have no direct correlation to the operation of our on-going business. We also incur expenses or benefits with respect to certain items associated with our acquisitions, such as integration costs relating to acquisitions for any costs incurred prior to closing and up to 12 months after the closing date of the acquisition.

Impairment charges: We may incur impairment charges that result from events, which arise from unforeseen circumstances and/or often occur outside of the ordinary course of our on-going business and such charges may limit the comparability of our on-going operations with prior and future periods.

Other non-operational costs: Certain items may be non-recurring, unusual, infrequent and directly related to an event that is distinct and non-reflective of the company’s ongoing business operations. These may include such items as non-ordinary course litigation, legal settlements, inventory write-downs for discontinued products, cost of facilities no longer in use, extinguishment of debt and hedge costs, environmental settlements, governmental settlements including tax settlements, and other items of similar nature.

Convertible notes non-cash interest expense: We issued convertible notes in June 2020 at a discount related to the conversion feature of the notes and capitalized certain costs related to the issuance of these notes. The discount and capitalized issuance costs are amortized into interest expense over the term of the convertible notes. The amortization recognized for the convertible notes will be greater than the cash interest payments for the notes. We believe that excluding the convertible

notes non-cash interest expense allows the users of our financial statements to better understand the historic and current results of our operations. This also facilitates comparisons to peer companies.

Non-operational tax adjustments: Certain tax items may be non-recurring, unusual, infrequent and directly related to an event that is distinct and non-reflective of the company’s normal business operations. These may include such items as the retroactive impact of significant changes in tax laws, including changes to statutory tax rates and one-time tax charges.

Tax effects of operating earnings adjustments: We apply our non-GAAP adjustments to the GAAP pretax income to calculate the non-GAAP effective tax rate. This application of our non-GAAP effective tax rate excludes any discrete items, as defined in the guidance for accounting for income taxes in interim periods, or any other non-operational tax adjustments.

Dilution offset from convertible notes hedge transaction: In connection with the issuance of the company’s Convertible Senior Unsecured Notes (the Convertible Notes) in June 2020, the company entered into convertible note hedge transactions (the Hedge Transactions) to reduce the potential dilutive effect on common shares upon the eventual conversion of the Convertible Notes. GAAP diluted shares outstanding includes the incremental dilutive shares from the company’s Convertible Notes. Under GAAP, the anti-dilutive impact of the Convertible Note Hedge Transactions is not reflected in GAAP diluted shares outstanding. In periods in which the average stock price per share exceeds $20.81 and the company has GAAP net income, the non-GAAP diluted share count includes the anti-dilutive impact of the company’s Hedge Transactions, which reduces the potential dilution that otherwise would occur upon conversion of the company’s Convertible Notes. We believe non-GAAP diluted shares is a useful non-GAAP metric because it provides insight into the offsetting economic effect of the Hedge Transactions against potential conversion of the Convertible Notes.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

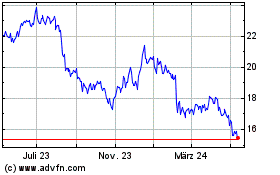

Varex Imaging (NASDAQ:VREX)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Varex Imaging (NASDAQ:VREX)

Historical Stock Chart

Von Mai 2023 bis Mai 2024