969 BroadwaySuite 200OaklandCaliforniaThe Nasdaq Stock Market LLCFALSE000148477800014847782024-03-042024-03-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 4, 2024

ThredUp Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-40249 | 26-4009181 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

969 Broadway, Suite 200 Oakland, California | 94607 |

| (Address of principal executive offices) | (Zip Code) |

(415) 402-5202

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 per share | | TDUP | | The Nasdaq Stock Market LLC Long-Term Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On March 4, 2024, ThredUp Inc. (the “Company”) held a conference call to discuss its financial results for the quarter and full year ended December 31, 2023 (the “Conference Call”). A recorded replay of the Conference Call is available on the Company’s investor relations website at ir.thredup.com on the “Events and Presentations” page. In conjunction with the Conference Call, the Company also made available an investor presentation of results for the quarter and full year ended December 31, 2023 (the “Investor Presentation”). The Investor Presentation is available under the “Events and Presentations” section of the Company’s investor relations website at ir.thredup.com. Information on the Company’s website is not, and will not be deemed to be, a part of this Current Report on Form 8-K or incorporated into any other filings the Company may make with the Securities and Exchange Commission.

A written transcript of the Conference Call is attached hereto as Exhibit 99.1. In addition, a copy of the Investor Presentation is attached hereto as Exhibit 99.2. The written transcript of the Conference Call and Investor Presentation are incorporated herein by reference.

The information in this Current Report on Form 8-K and the exhibits attached hereto is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits

(d)Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| THREDUP INC. |

| | |

| By: | /s/ SEAN SOBERS |

| | Sean Sobers |

| | Chief Financial Officer |

| | (Principal Financial and Accounting Officer) |

Date: March 7, 2024

ThredUp Inc.

Q4 2023 Earnings Call

ThredUp Inc.

Q4 2023 Earnings Call

CORPORATE SPEAKERS:

Lauren Frasch

ThredUp Inc.; Head of Investor Relations

James Reinhart

ThredUp Inc.; Chief Executive Officer and Co-Founder

Sean Sobers

ThredUp Inc.; Chief Financial Officer

PARTICIPANTS:

Irwin Boruchow

Wells Fargo; Analyst

Anna Andreeva

Needham & Company; Analyst

Tom Nikic

Wedbush; Analyst

Edward Yruma

Piper Sandler; Analyst

Alexandra Steiger

Goldman Sachs; Analyst

Dana Telsey

Telsey Group; Analyst

PRESENTATION:

Operator^ Good afternoon. My name is Jenny and I will be your conference operator today. At this time, I would like to welcome everyone to the ThredUp Fourth Quarter 2023 Earnings Conference Call. (Operator Instructions)

I would now like to hand the conference over to Lauren Frasch, Head of Investor Relations. Please go ahead.

Lauren Frasch^ Good afternoon. Thank you for joining us on today's Conference Call to discuss ThredUp's fourth quarter and full year 2023 financial results.

With me are James Reinhart, ThredUp CEO and co-Founder; and Sean Sobers, CFO.

We posted our press release and supplemental financial information on our Investor Relations website at ir.thredup.com.

This call is being webcast on our IR website. And a replay of this call will be available shortly.

Before we begin, I'd like to remind you that we will make forward-looking statements during the course of this call, including but not limited to statements regarding our earnings guidance for the first fiscal quarter and full year of 2024, future financial performance, including our goal of reaching adjusted EBITDA breakeven on a consolidated annual basis, our expectations for capital expenditures and other

ThredUp Inc.

Q4 2023 Earnings Call

developments in our business in the U.S. and Europe; market demand, growth prospects, business strategies and plans and our ability to cost effectively attract new buyers. Words such as anticipate, believe, estimate and expect as well as similar expressions are intended to identify forward-looking statements.

These forward-looking statements are not guarantees of future performance, involve known and unknown risks and uncertainties, including our ability to effectively deploy new and evolving technologies, such as artificial intelligence and machine learning in our offerings and the effects of inflation, increased interest rates, changing consumer habits, climate change and general global economic uncertainty.

Our actual results could differ materially from any projections of future performance or results expressed or implied by such forward-looking statements.

You can find more information about these risks, uncertainties and other factors that could affect our operating results in our SEC filings, earnings press release and supplemental information posted on our IR website.

Any forward-looking statements that we make on this call are based on assumptions as of today and we undertake no obligation to update these statements as a result of new information or future events.

In addition, during the call, we will present certain non-GAAP financial measures.

These non-GAAP financial measures should be considered in addition to, not as a substitute for or in isolation from GAAP measures.

You can find additional disclosures regarding these non-GAAP measures, including reconciliations of comparable GAAP measures in our earnings press release and supplemental information posted on our IR website.

Now, I'd like to turn the call over to James Reinhart.

James Reinhart^ Good afternoon, everyone. I'm James Reinhart, CEO and Co-Founder of ThredUp. Thank you for joining ThredUp's fourth quarter 2023 and fiscal year 2023 earnings call.

As we head into a new fiscal year, we're pleased to share ThredUp's financial results and key business highlights from our fourth quarter. In addition to the financial results, we will also reflect on the progress we made in 2023, as well as provide an update on key strategic initiatives that we expect will drive growth and margin expansion in 2024.

I'm particularly excited to share how we're leveraging AI across our business and how we believe we are uniquely positioned to benefit from advancements in this technology. I will then hand it over to Sean Sobers, our Chief Financial Officer, to talk through our fourth quarter 2023 and fiscal year 2023

ThredUp Inc.

Q4 2023 Earnings Call

financials in more detail. He will also provide our outlook for the first quarter of 2024 and fiscal year 2024. We'll close out today's call with a question-and-answer session.

Let me start with our Q4 results. We closed out 2023 with another quarter of strong financial performance, demonstrating healthy top line growth and bottom line leverage.

Our revenue exceeded the high end of our guidance at $81.4 million, representing a year-over-year increase of 14%. We reached 1.8 million active buyers in Q4, up 9% compared to the same quarter last year. Orders reached a record high of $1.8 million, a 17% year-over-year increase.

In Q4, gross margins came in at 62%, the midpoint of our range. But note, this includes our decision to do a onetime write-off of $1.9 million of aged and unproductive inventory in Europe that we had acquired in early 2023. This action had a 230 basis point impact to our consolidated gross margins.

Excluding this onetime impact, our consolidated gross margin exceeded our guidance at 64%, representing gross profit growth of 16%.

The onetime write-off in Europe also impacted our adjusted EBITDA in Q4, which totaled negative $2.1 million or minus 2.6%. Excluding the onetime inventory write-off, we're proud to deliver an adjusted EBITDA loss of just $200,000. This 790 basis point improvement over last year represents a significant progress we made toward breakeven in 2023 and indicates our clear line of sight towards full year adjusted EBITDA breakeven in 2024, which Sean will talk about more in a bit. I'm particularly proud to report that despite a highly competitive Q4, the US business posted expanded gross margins of 78%, while generating positive adjusted EBITDA for the second consecutive quarter.

Stepping back, 2023 was a very strong year for our business. Despite a challenging discretionary environment caused by compounded inflation and elevated interest rates, we delivered consolidated net revenue growth of 12%, active buyer growth of 9%, while expanding adjusted EBITDA margin 960 basis points.

We're extremely pleased with how well our US business continues to scale and believe that this year has demonstrated the growth and earnings opportunity of a managed resell business model. Our European business demonstrated strong growth and accelerated its transformation to becoming a leading resale marketplace in Europe.

Finally, we finished the last phases of our distribution network build-out and expect minimal maintenance CapEx until at least 2026. With limited CapEx needs over the next few years, we expect our cash flows from operations to move in line with our adjusted EBITDA.

Now let's turn to the year ahead. Let me start with profitability on a consolidated basis. The good news is that we are already there in the U.S., which makes up 80% of our overall business.

ThredUp Inc.

Q4 2023 Earnings Call

We believe we've demonstrated the strength of our unit economics and our bottom line discipline, having delivered positive adjusted EBITDA in the U.S. in both Q3 and Q4 of 2023. We expect that the U.S. business will continue to expand gross margins and generate positive adjusted EBITDA this year, as we grow, continue to automate and leverage our expenses.

Our next task is to do this in Europe. We've nearly doubled revenue in Europe since our acquisition in 2021 and continue to progress towards positive adjusted EBITDA in that market. To give you a sense of how we evaluate our European business, we apply the Rule of 40 to the EU's gross profit growth and adjusted EBITDA rate. We believe gross profit is the best indicator of its growth, when normalized for the consignment transition.

And we expect that business to be well above 40 in the year ahead. I'm confident that we are on the right track, tackling the large opportunity in Europe with a proven playbook from the US.

We expect to see continued improvement in Europe each quarter driven by three core initiatives. Some of these may sound familiar if you followed us since our IPO. First, we are accelerating the transition to consignment. This process began in mid-'23 and we expect Europe to be approximately 20% consignment revenue in 2024.

As I've shared on previous calls, this change presents a short-term headwind to revenue due to the accounting treatment, but we believe that it will yield the business with a superior margin profile and provide us with more levers to flex margins and growth investments.

Second, we are migrating our dynamic data-driven pricing system from the U.S. to Europe to improve sell-through rates. The faster items sell, the more we maximize average selling prices and minimize our aged inventory, which yields better margins. This work is already starting to pay off, as we are seeing some of the fastest sell-throughs in history year-to-date in 2024.

And third, we're introducing inventory sculpting. Using the U.S. item acceptance model as a guide, we recently implemented a similar system in the EU to determine which items are listed in our marketplace at any given time.

By leveraging data science, we are segmenting inventory to better identify what types of items sell quickly and which items maximize gross profit.

The goal is a marketplace with an overall assortment that's more desirable to buyers and expands Europe's gross margin profile.

To summarize, the U.S. has already posted two consecutive quarters of positive adjusted EBITDA. And as we continue to apply U.S. strategies and tactics to Europe to improve our gross margins in that market, we expect to achieve positive consolidated adjusted EBITDA on an annual basis in 2024.

ThredUp Inc.

Q4 2023 Earnings Call

Next, I'd like to share an overview of strategic initiatives that are designed to drive business growth in 2024. Let me start with the ways we're deploying artificial intelligence to improve the customer experience and reduce cost in our distribution network. First, we recently debuted an AI-powered search experience that makes it easy and intuitive to find any secondhand item on ThredUp. Our vast selection of inventory is one of our biggest assets, but it also creates challenges for buyers, as they shop up to four million unique secondhand items at any given time.

This new search functionality significantly enhances the secondhand shopping experience in our marketplace by combining visual language with personal style, by enabling buyers to curate style inspirations effortlessly whether it's by searching for a popular item like a satin cocktail dress or a descriptive trend or look like Sunday brunch dress or a phrase that evokes emotion like Academy Award seek, ThredUp can help shoppers find exactly what they want. It's not only fun to use, but it also has that sense of magic to it. Sometimes you just can't believe how good the technology is at delivering relevant results. Early indicators show an increase in searches per session, a higher add-to-cart conversion of items from search and higher click-through for individual product pages.

Second, we have begun to leverage Generative AI technology that will soon give customers the ability to create outputs they love using just a text description. For example, a friend is looking for an outfit to wear a fancy lūʻau on an upcoming trip to Hawaii, using natural language prompts are Generative AI tool, created enough to composed of a beautiful floral crop top, a slowly white maxi skirt with a side slit, paired with highly embellish sandals.

Want to create an outfit from popular magazines or style influencers or runway trends? We can now easily do that while delivering shoppable secondhand product up to 70% off when a consumer might pay new. The list of outfits that can be generated through this tool is endless, restricted only by the imagination of our buyers. We'll be leading these style inspiration touch points throughout the product experience over the year ahead and look forward to sharing more soon.

I want to emphasize that AI is an enormous leap forward for us in bringing emotion and storytelling to the millions of unique shopping journeys that regularly happen on ThredUp. Given the breadth of our offering and the limitation of not having on-model photography in our core product experience, we believe Generative AI technology disproportionately benefits a managed marketplace like ThredUp compared to other apparel or peer-to-peer marketplaces.

Now, let me turn to AI and operations.

We're also implementing AI across more operations in our distribution center network to enhance the customer experience and improve throughput and productivity. Once the garment has been photographed, we employ advanced AI technologies to extract a wide range of detailed characteristics of the item from its image. This capability not only enriches our inventory database, but also streamlines the categorization and processing of items. This has improved operational efficiency and the accuracy of our product listings, resulting in better search and personalization in our marketplace. We see near-term opportunities

ThredUp Inc.

Q4 2023 Earnings Call

for Generative AI to improve visual merchandising and add more engaging content to the shopping journey without us having to use expensive on model photography.

Eventually, you can imagine a world where AI not only supplements manual photography, but replaces it.

These AI-driven initiatives have enabled us to set new standards for efficiency and accuracy and are paving the way for continuous innovation and potential margin expansion. So much of what we believe, we could achieve over the next few years through our own software and industrial engineering development has now become readily available, and it's cheaper and faster than we imagined.

Beyond AI, we're seeing continued improvements across a number of areas. For example, our delivery promise and thrift promise initiatives, which aim to deliver purchase to doorstep shipping in four days or less and do right by the customer with every order continue to make progress. Orders delivered within this timeframe have increased more than 150% year-over-year in the quarter to date. Our return rate decreased by 700 basis points in Q4 compared to the same quarter last year.

We've also put a renewed focus on our loyalty program, as a way to reduce broad-based promotions, and we expect to see continued benefits, as we invest in customer retention efforts with more attractive rewards.

Early signals show a double-digit increase in orders with loyalty rewards, and we believe creating a fun and easy rewards loop will encourage all customers to shop like our best customers do today.

Our Resell as a Service business, or RaaS, continues to provide brands and retailers with the fastest and easiest way to deliver customizable and scalable resell experiences to their customers. Across our 50-plus brand customers, we now estimate that we power six of the 10 largest brand resale shops online, power more than 50% of total branded resale listings that are sold online and you can pick up a co-branded ThredUp Clean Out Kit in more than 800 stores nationwide.

As a reminder by leveraging ThredUp marketplace infrastructure, RaaS amplifies our supply advantage, increases our sell-through and return on assets, drives brand awareness and expand our long-term profitability metrics.

As I often do on these calls, I'd like to take a moment to remind you of ThredUp's steadfast commitment to balancing purpose and profit. Our mission of inspiring the world to think secondhand first remains the cornerstone of our strategy. Since our founding, we've now processed more than 172 million unique pieces of clothing, keeping clothes in circulation and out of landfills, while delivering incredible value to our millions of customers.

At the center of every decision we make is our business in brand-aligned, environmental, social and governance strategy, which guides us and helps fuel our success. At ThredUp, purpose and profits are inextricably linked.

ThredUp Inc.

Q4 2023 Earnings Call

We were recently named a winner in Good Housekeeping's 2024 Sustainable Innovation Awards, which recognize products and services that have embraced a people, purpose and planet approach to sustainability. As we head into another year, I'm excited about our path forward and the impact we'll make globally on our people, our communities and the planet.

With that, I will now turn it over to Sean to go through our financial results and guidance in more detail.

Sean Sobers^ Thanks, James. I'll begin with an overview of our results and follow up with guidance for the first quarter and the full year. I will discuss non-GAAP results throughout my remarks. Our GAAP financials and a reconciliation between GAAP and non-GAAP are found in our earnings release, supplemental financials and our 10-K filing.

We are very proud of our Q4 results. For the fourth quarter of 2023, revenue totaled $81.4 million, an increase of 14% year-over-year.

Consignment revenue grew 49% year-over-year, while product revenue shrank by 25%. We are pleased with the growth in consignment revenue, driven by the transition of our RaaS clients and our European business to the consignment model. We would expect to continue to see outsized growth in consignment and declines in product revenue throughout 2024.

While the transition of these businesses to consignment should be a tailwind to gross margins over time, we expect it to mute revenue growth simply due to the accounting treatment.

As a reminder consignment payoffs reduce net revenue. We expect consignment revenue will be an increasingly larger part of our business throughout 2024.

Owned payouts are in COGS and reduce gross margin.

We expect owned revenue to be a smaller part of our business. As a result, we look to gross profit as the most relevant measure to evaluate the underlying growth rate of our business. We're happy to report that we accelerated our active buyer growth and achieved a record number of active buyers for the second consecutive quarter, reaching $1.8 million, up 9% year-over-year. Orders growth also accelerated to 17% year-over-year to $1.8 million.

For the fourth quarter of 2023, reported gross margin was 61.9%, as we implement our resale playbook in Europe, we made the strategic decision to take a onetime $1.9 million inventory write-off in Q4, a 230 basis point impact to gross margin. We expect that clearing this inventory will enable an improved customer experience, allowing shoppers to more easily access fresh inventory, while supporting a better margin profile and accelerating our shift to consignment.

We believe that this action is setting up our EU business for success in the coming year.

ThredUp Inc.

Q4 2023 Earnings Call

Excluding this impact, our gross margin came in at 64.2%, 110 basis points ahead of last year, while our gross profit grew by 16%. Our consolidated results exceeded our expectations, driven by US gross margins of 77.5% and gross profit growth of 19%. This year-over-year expansion was a result of continued improvements in how we optimize our marketplace, including pricing, promotions, returns, payouts and fees.

For the fourth quarter of 2023, net loss was $14.6 million compared to a net loss of $19.5 million in the same quarter last year. Adjusted EBITDA loss was $2.1 million or a negative 2.6% of revenue for the fourth quarter of 2023. Excluding inventory write-off, adjusted EBITDA loss was just $200,000.

We reduced our adjusted EBITDA loss in Q4 by more than half versus last year, representing an approximate 560 basis point improvement, as we tightly managed expenses and leveraged our investments on higher revenue. To this point, we are proud to report that our hard work drove a 14% year-over-year revenue increase on just a 6% increase in operating expenses, illustrating the powerful leverage of our marketplace model.

Turning to the balance sheet. We began the fourth quarter with $80.2 million in cash and marketable securities and ended the quarter with $69.6 million. We used $10.6 million in cash in Q4.

While we continue to spend maintenance levels of CapEx of just $2.2 million, the step-up in our cash usage was largely due to seasonal timing within our accounts payable.

As a reminder, in Q4 of last year, we used $19.6 million in cash, illustrating the enormous progress we've made over the last four quarters. In 2024, we expect cash flow usage to significantly decline versus 2023.

In 2023, we are proud to have reduced our consolidated adjusted EBITDA loss in every quarter, achieved quarterly positive adjusted EBITDA in our U.S. business and continue to spend only maintenance levels of CapEx. We believe we will reach breakeven on a consolidated annual basis in 2024, as we scale the U.S. and improve Europe's margin profile.

As we look to 2024, please keep in mind the following. First, though our customer continues to feel the pressure of compounded inflation and higher interest rates, we are implementing a number of tactics to improve the customer experience, as James described. As our strategic initiatives roll out in both the U.S. and Europe, we expect our revenue to improve sequentially throughout the year, weighted towards the second half.

As a reminder, also consider that we spend more marketing dollars as a percentage of revenue in the first half of the year to drive buyers whose multiple annual purchases tend to yield revenue in the second half.

Second, gross margin improvement will be primarily driven by our ongoing work in the U.S. and Europe transition to consignment. Though the consignment transition will mute revenue growth due to the accounting treatment, consignment revenue will drive gross profit and margin improvement over time. We would expect gross margins to be better in the second half than in the first half as the transition

ThredUp Inc.

Q4 2023 Earnings Call

progresses. In 2023, 66% of our consolidated revenues came from consignment, and we expect to see that percentage increase to approximately 80% in 2024.

Third, we continue to expect maintenance levels of CapEx of approximately $2 million per quarter until 2026, which provides us a high level of confidence that we can run the business with our existing cash until we reach cash flow positive. We want to reiterate that we do not anticipate our cash and marketable securities going below $50 million before reaching free cash flow positive, nor do we expect to turn to the capital markets or draw down our existing debt before them.

With all of that in mind, for the first quarter, we expect revenue in the range of $79 million to $81 million, gross margin in the range of 68.5% to 70.5% of revenue.

At the midpoint, this represents gross profit dollar growth of 9% year-over-year, adjusted EBITDA loss of 3% to 1% of revenue and basic weighted average shares outstanding of approximately 110 million shares.

For the full year of 2024, we now expect revenue in the range of approximately $340 million to $350 million; gross margin in the range of approximately 69.5% to 71.5% of revenue. At the midpoint, this represents a gross profit dollar growth of 14% year-over-year. Positive adjusted EBITDA of 0.5% to 1.5% of revenue and basic weighted average shares outstanding of approximately 114 million shares.

In closing, we are extremely proud of the progress we have made towards growth and profitability goals in 2023 and look forward to delivering steady growth and continued leverage in 2024, as we achieved positive adjusted EBITDA on a consolidated basis.

James and I are now ready for your questions.

Operator, please open the line.

Operator^ Thank you. Ladies and gentlemen, we will now begin the question-and-answer session. (Operator Instructions) One moment, please, for your first question. Your first question is from Ike Boruchow from Wells Fargo. Please ask your question.

Irwin Boruchow^ Hi guys. Good afternoon. I guess two for me, maybe one for James, one for Sean. On the active buyer growth, so James, you guys have kind of reinflected, now you're back to growth, good to see. So maybe just, can you give us a little bit more detail on what exactly you guys have done to kind of get you guys back in good shape there? Then just a second follow-up for Sean or James.

But it's just on the consignment mix is having a big impact on the margins in the model. Can you just be a little bit more specific of what you expect based on the Q1 and fiscal year guide, what you expect consignment to be as a percent of revenue? Is that way we can kind of just build it from Q1 kind of through Q4 as the transition is taking place?

ThredUp Inc.

Q4 2023 Earnings Call

James Reinhart^ Sure. Yes, on the first one, I think over the last couple of quarters, we really reoriented the customer acquisition strategy to focus on a slightly more premium customer -- a customer who we thought we had the right inventory mix for and I think you're just starting to see that strategy pay off, and that's driven the active buyer growth. We expect that to continue into 2024 to sort of refocus on the customer, real focus on retention and loyalty has driven the upside. So we feel very good about that return to growth and really how that compound as we move through 2024. I'll Sean talk a little bit about the consignment piece.

Sean Sobers^ Yes, on consignment for Q1, I think a bit about mid-70s as a total percentage of revenue, and that will grow throughout the year to be about 80% for the full year.

Irwin Boruchow^ Perfect. Thanks, guys.

Operator^ Thank you. Your next question is from Anna Andreeva from Needham & Company. Please ask your question.

Anna Andreeva^ Great. Thanks, so much. Thanks for taking our question. Two quick ones from us. So on the product revenue side of things, down 25%, was that what you guys expected for the quarter, just given the shift to consignment?

And can you also, secondly, talk about what you're seeing with the underlying demand in Europe? I remember you had talked about sluggishness as the quarter unfolded. Just curious if the trend got better and if you're seeing anything differently quarter-to-date? Thanks, guys.

Sean Sobers^ Yes. From a product revenue perspective, that is what we forecasted and what we expected. So , nothing new or surprising for us on that side.

James Reinhart^ Yes. On the demand side, I mean I think inflation in the areas that we serve in Europe has been elevated relative to the U.S., and so that's definitely affected the demand curve. But I think we've seen better year-to-date results. Certainly, some of the work that we're doing on the product mix, consignment mix in Europe is helping. So we think the selection that we have in Europe is better, and I think customers are seeing that.

So we feel pretty good about where the demand curve is in Europe and the guidance for the year reflects that.

Anna Andreeva^ Awesome. Thanks so much. Best of luck.

Operator^ Thank you. Your next question is from Tom Nikic from Wedbush. Please ask your question.

Tom Nikic^ Hi thanks for taking my question. I just wanted to ask about the write-off of inventory in Europe. I guess obviously that's something that you'd like to avoid generally speaking. I guess kind of have you sort of made any changes besides the kind of consignment mix shift that you're trying to do. But

ThredUp Inc.

Q4 2023 Earnings Call

like any kind of changes in the way you take in product in Europe to kind of ensure that you kind of are bringing in higher quality inventory and higher quality products, so that you don't go to see a situation like this again?

James Reinhart^ Yes, hi Tom, yes, I mean I think all through last year, we had been making improvements to what that mix looks like, laying the foundations for consignment. But a lot of the product that we wrote down was stuff where we were in negotiations to buy that product well over a year ago, right? And the market has changed. Our approach to the business had changed. So ultimately, it was about what's the best way to serve the customer on a go-forward basis.

And we found that, that product over a year old was crowding out, frankly, some of the best stuff in the browsing experience. So -- for us, it was, hey, we're full speed ahead on the consignment transition. We feel very good about the strategy in place to get that done. And let's not have any of that sort of legacy products holding us back, whether that's in our facility, in the browsing and search experience or even just kind of like having to move it around. So it's definitely not something we anticipate doing again but we thought it was the best thing for the customer as we move forward.

Tom Nikic^ Understood. If I could ask one more. I just wanted to ask about marketing. So , marketing obviously was kind of down in Q4. It was kind of its lowest level really since 2020.

I guess how do we kind of think about, I guess the reinvestment in marketing going forward and helping to grab the top line, drive better performance in Europe, etcetera.

James Reinhart^ Yes. I mean I think Tom, the marketing is always lower in Q4. So that's typically our playbook. I think this Q4, even in particular, we expected it to be a competitive holiday season. We expect the consumers to feel squeezed around how to spend those discretionary dollars.

And so I think we thought it was even smarter to push some of that spend in Q4 into Q1, where we thought it would be more productive. I think that's what we're seeing. So I think it fits our seasonal pattern and -- but our expectation is to continue to drive top line through marketing spend. But at the same time, moving slowly towards our long-term targets that we set out at the IPO, and we're sort of on that glide path as we think about 2024.

Tom Nikic^ Great. Thanks very much for taking my questions, and best of luck for this year.

Sean Sobers^ Thanks.

James Reinhart^ Thanks.

Operator^ Thank you. Your next question is from Edward Yruma from Piper Sandler. Please ask your question.

ThredUp Inc.

Q4 2023 Earnings Call

Edward Yruma^ Hi. Good afternoon. Thanks for taking my question. Two for me, I guess first, some very constructive comments around Gen AI. Curious kind of what the cost structure for that looks like and kind of what the uptake has been thus far?

Then second, I know, you guys have complained a little bit about the inventory situation in first price. Obviously results got better in the fourth quarter. Are you starting to see some of that industry inventory normalized? And do you think it's kind of allowing some of your price gaps to better show? Thank you.

James Reinhart^ Yes. Hi Ed, let me just hit the second one first. Yes. I mean we're definitely seeing the inventory levels across sort of our competitive set normalize. So I think that, that actually really sets up our value proposition to perform well as we get into 2024.

I would say the only counterpoint to that is, as you have seen mentioned talked about, right? There is still a squeeze on the discretionary dollar. So I think as that maybe eases throughout the year, combined with leaner inventories, I think ThredUp is positioned very well for that. But we certainly see a better competitive environment for our product.

On the Gen AI stuff, similar to my prepared remarks, I remain very bullish, on its ability to improve our business really disproportionately compared to others. Given the long tail of product, the constantly changing nature of our product, we really rely on sort of the dynamic nature of the technology to do a lot of work that would otherwise be done by inferior algorithms.

So I'm very bullish on its ability to delight the customer on the front end. I think we're working on a number of things that will start to materialize this year that I think will really change how consumers shop resale. So I'm very excited about that.

Then the last part would be on the operations side is, we've been employing AI in a number of ways in our DCs for years. But I think just in the last 12 months, you've seen the step function change in what the technology can do. I think it has real implications for how productive our operations can be.

And what the margin profile can ultimately look like. So you can probably tell from my voice, I'm quite bullish on it. I think we're uniquely positioned to benefit from it.

Edward Yruma^ Great. Thank you.

Operator^ Thank you. Your next question is from Alexandra Steiger from Goldman Sachs. Please ask your question.

Alexandra Steiger^ Great. Thank you, so much. So we have a number of e-commerce, consumer companies, calling out a very weak January this year. So I'm just like wondering, what are you seeing among your customer base that would give you confidence in your Q1 guidance, you can comment a little bit on like the month-over-month dynamics you're seeing in your business? Then, one follow-up question just on the business initiatives and leverage AI.

ThredUp Inc.

Q4 2023 Earnings Call

Can you maybe talk about the contribution or the growth contribution you expect for this year versus your assumption around a potential recovery in the broader consumer spending environment? Thank you.

James Reinhart^ Yes. Hi Alexandra, Yes. I don't think we are expecting AI to drive anything sort of in an outsized way in the results nor do we expect some big inflection later in the year on the consumer environment. I think our guidance reflects our best estimates of how the business is going to perform this year. I will say that AI is -- we've finally rolled out the new search and some of the work just in the last week or two. So we're only starting to see the benefits of the entire customer experience using it.

And so I think as we get better information, we'll sort of update those numbers.

As for Q1 and what other companies have said, I don't think Q1 is noticeably weaker than we expected. I mean I think our business tends to receive the hangover from Q4 Christmas, New Year's, holiday period, gift giving. So we see some of that normally in January. I think I don't think it's been an exceptional consumer environment, but I wouldn't characterize it as sort of dark or draconian. So -- but I think we expect the consumer to be challenged this year.

And so I think that's where we feel good about our active buyer growth and our gross profit growth in an environment like this one while we drive to positive EBITDA.

Alexandra Steiger^ Thank you.

Operator^ (Operator Instructions)+ Your next question is from Dana Telsey from Telsey Group. Please ask your question. Hello, Dana? Your line is now open.

Dana Telsey^ Hi Sorry. Hi everyone. As you -- in the fourth quarter and as you're thinking about 2024, how are you thinking about spending behavior by buyer cohort or buyer demographics and what you're seeing there? Then also, as you're thinking about the promotional environment, has the promotional environment or the competitive environment changed lately? Thank you.

James Reinhart^ Hi, Dana, on the buyer spend, I mean we continue to see very strong revenue per buyer metrics. I mean they were all-time highs in 2023. We expect them to continue to be strong. So I think our ability to drive share of wallet revenue per buyer growth. I think it continues to be -- we feel very good about.

I think as far as like the sort of nuance in the consumer environment, I don't think there's any sector in the consumer world that's immune to the sort of effects of compounded inflation and interest rates, whether you're a wealthier consumer who's dealing with higher borrowing costs or a more budget consumer that's dealing with food inflation, I think it's kind of hitting everyone.

And again I think part of why we feel good about where we're headed in 2024 is despite that environment still being able to grow the underlying growth rate to be in the teens as well as 600bps of margin

ThredUp Inc.

Q4 2023 Earnings Call

expansion, it feels like a really great place for our business to live in 2024, given the environment. On the promotional side, as I said earlier with Ed, I mean I do think that the environment has gotten better, but I still think you may have a positive tailwind from the promotional environment with a bit of a headwind in the consumer discretionary worrld. So I think net of it, that's probably, cancel each other outlook.

Dana Telsey^ Got it. Then in Europe, with the shift to consignment in Europe. Any differences that you're noticing or insights taking away that would make it be accelerate or be faster or slower than what you may have originally expected?

James Reinhart^ I mean I think that the consumer, the seller in the countries that we operate in Europe, I think has been looking for a scaled convenient solution like this for some time. So I think the customer reception has been positive. But it is a transformation of the business and how shoppers are browsing and the number of items that they're buying in their orders. But so far, as we said, sell-through rates have been strong, and I think consumers are really liking that fresh product, differentiated products to the owned business that we had more of earlier in the year.

Dana Telsey^ Thank you.

Operator^ Thank you. There are no further questions at this time.

I will now hand the call back to James Reinhart, for the closing remarks.

James Reinhart^ Well thank you everyone, for joining us for our earnings call and guidance for the year.

Very excited about the year ahead, incredibly proud of the work in 2023 that we did to drive growth and expand margins. We expect more of the same, as we head into 2024. So we'll see you next time. Thanks.

Operator^ Thank you. Ladies and gentlemen, the conference has now ended. Thank you, all for joining. You may all disconnect.

© THREDUP The following contains confidential information. Do not distribute without permission. INVESTOR PRESENTATION Fourth Quarter 2023

2© THREDUP This presentation and the accompanying oral commentary contains forward-looking statements within the meaning of the federal securities laws, which are statements that involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “shall,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements in this presentation include, but are not limited to, guidance on financial results for the first quarter and full year of 2024; statements about future operating results, capital expenditures and other developments in our business in the U.S. and Europe and our long term growth; the momentum of our business; our investments in technology and infrastructure, including our AI-powered search experience; our ability to successfully integrate and realize the benefits of our past or future strategic acquisitions, investments or restructuring activities; the success and expansion of our RaaS model and the timing and plans for future RaaS clients; and our ability to attract new Active Buyers. Forward-looking statements are neither historical facts nor assurances of future performance. Forward-looking statements involve substantial risks and uncertainties that may cause actual results to differ materially from those that we expect, including those more fully described in our filings with the Securities and Exchange Commission (“SEC”), including in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. These risks and uncertainties include, but are not limited to: our ability to attract new users and convert users into buyers and active buyers; our ability to achieve profitability; the sufficiency of our cash, cash equivalents and capital resources to meet our liquidity needs; our ability to effectively manage or sustain our growth and to effectively expand our operations; our ability to continue to generate revenue from new RaaS offerings as sources of revenue; risks from an intensely competitive market; our ability to effectively deploy new and evolving technologies, such as artificial intelligence and machine learning, in our offerings; risks arising from economic and industry trends, including the effects of foreign currency exchange rate fluctuations, inflationary pressures, increased interest rates, changing consumer habits, climate change and general global economic uncertainty; our ability to comply with applicable laws and regulations; and our ability to successfully integrate and realize the benefits of our past or future strategic acquisitions or investments. The forward-looking statements in this presentation are based on information available to us as of the date hereof, and we disclaim any obligation to update any forward-looking statements, except as required by law. These forward-looking statements should not be relied upon as representing ThredUp’s views as of any date subsequent to the date of this press release. Additional information regarding these and other factors that could affect ThredUp's results is included in ThredUp’s SEC filings, which may be obtained by visiting our Investor Relations website at ir.thredup.com or the SEC's website at www.sec.gov. This presentation also contain estimates and other statistical data made by third parties and by the Company relating to market size, growth, sustainability metrics and other industry data. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. The Company has not independently verified the statistical and other industry data generated by third parties and contained in this presentation and, accordingly, it cannot guarantee their accuracy or completeness. In addition, projections, assumptions and estimates of its future performance and the future performance of the markets in which it competes are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause results or outcomes to differ materially from those expressed in the estimates made by the third parties and by the Company. In addition to our results determined in accordance with GAAP, this presentation includes certain non-GAAP financial measures, including Adjusted EBITDA, Adjusted EBITDA margin, non-GAAP Operations, Product and Technology Expense, non-GAAP Marketing Expense and non-GAAP SG&A Expense, which we believe are useful in evaluating our operating performance. We use these non-GAAP measures to evaluate and assess our operating performance and the operating leverage in our business, and for internal planning and forecasting purposes. We believe that these non-GAAP measures, when taken collectively with our GAAP results, may be helpful to investors because they provide consistency and comparability with past financial performance and assist in comparisons with other companies, some of which use similar non-GAAP financial information to supplement their GAAP results. Theses non-GAAP measures are presented for supplemental informational purposes only, should not be considered a substitute for financial information presented in accordance with GAAP and may be different from similarly-titled non-GAAP measures used by other companies. A reconciliation is provided below for these non-GAAP measures to the most directly comparable financial measure stated in accordance with GAAP. Investors are encouraged to review our results determined in accordance with GAAP and the reconciliation of these non-GAAP measures. Safe Harbor

@ThredUp 3 ThredUp’s mission is to inspire the world to think secondhand first.

4© THREDUP Compelling investment opportunity 2 Defensible operating platform 1 Unlocking massive supply Investment thesis 3 Large, growing TAM + marketplace flywheel Our platform includes our infrastructure purpose built for single-SKU logistics, our proprietary software and systems and our deep data science expertise. All of which provide an ever-widening moat. We provide end-to-end resale services for sellers and unlock value for items with lower ASPs at scale, while providing buyers with access to high- quality items at great prices. We are in the early stages of capitalizing on a large market opportunity in secondhand clothing. Resale is the fastest growing segment in the retail clothing market. Our market lends itself to a compelling flywheel where buyers becomes sellers and vice-versa, deepening the attachment rate to our service.

5© THREDUP ThredUp at-a-glance $81M | 14% Q4 2023 revenue | annual growth $50M | 62% Q4 2023 gross profit | gross profit % $322M | 12% 2023 revenue | annual growth $214M | 66% 2023 gross profit | gross profit % 1.8M Q4 2023 active buyers 1.8M Q4 2023 orders 666M pounds of carbon emissions saved1 1.3BkWH of energy saved1 7B gallons of water saved1 Founded in 2009 Headquartered in Oakland, CA 55K+ brands 100 different categories Distribution centers in 5 strategic locations across the globe 9M unique items of capacity Note: All data as of Dec 31, 2023 unless otherwise indicated. 1As of December 31, 2022. Sustainability estimates based in part on information provided by GreenStory Inc. and represent a comparison between new and secondhand apparel carbon emission, energy and water usage estimates.

6© THREDUP ThredUp’s operating system is our competitive advantage Patented world-class infrastructure Powerful technology and software Proprietary data Managed marketplace We’ve made it easy for consumers to buy and sell secondhand clothing. Resale-as-a-ServiceⓇ (RaaSⓇ) We power resale for leading fashion brands and retailers.

7© THREDUP Operating platform designed for resale at scale Distributed processing infrastructure Proprietary systems, automation and software Data science expertise ● Tech-driven processing, storage and fulfillment; purpose-built for “single SKU” logistics ● 5 strategic global distribution centers ● Custom built applications for “single SKU” operations ● Automation processes across intelligent item acceptance and listing, visual recognition, photo selection ● Proprietary data set ● Item acceptance pricing, payouts, margin optimization, personalization, marketing automation ● Leverages machine learning algorithms, predictive analytics, and other AI technologies to provide alerts and initiate business processes Proprietary technology and processing infrastructure create significant barriers to entry

8© THREDUP Operating platform: Distributed processing infrastructure Data as of Dec 31, 2023 1 We believe we operate the 4 largest item on-hanger systems in the U.S. Distribution Centers Offices 4 U.S. distribution center locations with 9M item capacity 4 largest item on-hanger systems1 Dallas, TX distribution center will ultimately increase storage capacity by +150% 1 European distribution center Sofia, Bulgaria

9© THREDUP Managed marketplace model unlocks supply, creates buyer trust Buyers love... ● Incredible value, up to 90% off estimated retail price ● Wide selection of 55K+ brands, 100 categories ● Fresh, ever-changing assortment Sellers love... ● Convenient Clean Out Kits ● End-to-end services ● Making money, doing good with their proceeds

10© THREDUP Data science expertise Source: Company information Note: All data as of Dec 31, 2023 unless otherwise indicated. 1As of December 31, 2022. 172M+ Unique Items Processed Cumulatively1 55K+ Brands 100 Categories Millions of Data Points Target 12‐Month Payback Period Actively Managed Supplier Experience Personalization & Curation Maximize Early & Drive Velocity Item Acceptance Supply Acquisition Dynamic Pricing Ad Targeting Margin Optimization Sales & Retention Data is at the center of everything we do

11© THREDUP RaaS: How does it drive ThredUp? Start with Clean Out programs and expand into ThredUp-powered resale shops SUPPLY DEMAND RAAS Drive faster sell-through by expanding distribution to new audiences (which ↑ inventory turns and ↑ return on assets) ThredUp core marketplace DEMAND SUPPLY Grow targeted supply by leveraging clients’ channels (in-store Clean Out Kits) ● Grow ThredUp’s revenue & bottom line through high-margin fees ● Grow the pie via “free” marketing that amplifies awareness of ThredUp and resale 4 3 2 1

12© THREDUP RaaS: Go-to-market strategy Start with Clean Out programs and expand into ThredUp-powered resale shops LAND AND EXPAND ● Build quality supply from customers of specific brands ● Offer an entry point into resale with opportunity to upsell/expand over time ● Monetize unique assets and infrastructure to help brands roll out white label resale commerce ● Repeatable implementation and ROI of a SaaS modelRa aS G oa ls Ec on om ic s ● One time integration fee ● Usage-based pricing and/or ongoing service fees ● One-time integration fee ● Ongoing service fees ● ThredUp receives percentage of sales

13© THREDUP Diversified RaaS strategies to serve clients’ unique needs Trade in makes it easy for brands to get started Expand existing relationships ● Easy to launch circularity programs (no tech lift, quick two week build out lead time) for brands who want to take a meaningful step on sustainability while engaging new customers ● Over 50 active trade in programs with leading brands including J. Crew, Madewell, Kate Spade, Gap Inc., and Fabletics ● Focused on a “land and expand” strategy in which we deepen our involvement with current clients over time (Clean Out -> Resale Shops) ● After launching a Clean Out program with Athleta in 2020, we expanded with a digital resale shop in 2022, with 25K+ listed items in January 20241 ● Upgraded Vera Bradley and Fabletics Clean Out partnerships to include resale shopsSource: Company information 1ThredUp’s Recommerce 100 as of January 2024.

14© THREDUP Large and growing market opportunity U.S. Demand-Side Secondhand TAM1 U.S. secondhand market sales (2017-2027) – $ billions U.S. Supply-Side Secondhand TAM ~17 BILLION Pounds of apparel thrown away in the U.S. that could be recycled and reused3 The equivalent of ~1 BILLION ThredUp Clean Out Kits Thrift and Donation Resale 1 Source: GlobalData 2023 Market Survey 2 CAGR represents 2022 – 2027 growth in Resale Market 3 Company estimate based in part by information from the Environmental Protection Agency Clothing and Footwear Waste Estimates Online resale driving TAM growth

15© THREDUP New shoppers drive secondhand market growth in the U.S. 1 Source: GlobalData 2023 Market Survey Thrifting has universal appeal, with a healthy mix of incremental secondhand spend coming from all age groups

16© THREDUP Europe acquisition expands TAM opportunity and accelerates international strategy TAM expansion from European Markets +135% Company Office & Distribution Center +126% Source: Estimates from GlobalData 2023 Market Survey Note: Europe Markets include UK, Italy, Germany, France, Spain, Netherlands, Switzerland, Sweden, Denmark, Portugal, Finland, Austria, Belgium, Ireland, Norway, Greece, Russia, Turkey, Poland, Romania, Ukraine, Slovak Rep, Czech Rep, Hungary and Bulgaria

17© THREDUP ThredUp’s competitive advantage and landscape 1 GlobalData 2023 Market Sizing and Growth Estimates 2 GlobalData Luxury and Mass Apparel Study, January 2024 MASS PEER TO PEER MANAGED MARKETPLACE LUXURY Managed marketplace ● End-to-end processing infrastructure, unlocks supply ● Creates data-driven, liquid market ● Platform extensibility ● “Management” of supply chain enables Resale-as-a-Service Mass fashion ● U.S. resale is projected to grow to $42B in 20271 ● Mass market TAM is 6X larger than luxury2 ● Supply chain moat creates greater barriers to entry

18© THREDUP ESG Overview: Key Focus Areas thredup.com/Impact

19© THREDUP ESG: Impact Report1 includes Scope 1-3 GHG analysis and SASB/GRI disclosures 1 ThredUp's 2022 Impact Report includes activities undertaken during the reporting period from January 1, 2022 to December 31, 2022. Highlights ● Overview of our ESG strategy ● Commitment to UN Sustainable Development Goals ● Coverage of 12 material ESG factors ● Scope 1-3 Greenhouse Gas (GHG) emissions analysis Links ● Full Report ● SASB & GRI Disclosuresthredup.com/impact

20© THREDUP ESG spotlight: Environmental – ThredUp’s impact on the planet is significant Processed 172 million unique secondhand items to-date (as of year-end 2022). Displaced 666 million pounds of carbon emissions.1 Completed our 2021-2022 Greenhouse Gas (GHG) inventory assessment (including Scope 1-3 emissions). Further extended our impact at scale through Resale-as-a-Service (RaaS), closing 2022 with 42 brand clients. Improved solutions for our aftermarket program to cultivate responsible and effective paths forward for end-of-life success of unsold items. 1 As of December 31, 2022. Sustainability estimates based in part on information provided by GreenStory Inc. and represent a comparison between new and secondhand apparel carbon emission estimates.

21© THREDUP ESG Spotlight: Social - we do the right thing for our employees and communities 1 Company information as of December 31, 2022. 2 2022 ThredUp Impact Report, released July 26, 2023. Senior leadership 1 Total workforce 1 60% 26% 66% 72% Identifies as minorityIdentifies as female Leadership and workforce ● Committed to increasing diversity and representation and disclosing annually ● Created programs to attract and develop a diverse workforce Employee satisfaction ● 94% of employees say their leader supports a positive work-life balance2 ● 84% of employees say they feel empowered to make decisions at work2 Community giving & volunteerism ● Our sellers donated $217,000 to charity partners such as Feeding America and Girls, Inc. through our Clean Out service donation program, where sellers have the option to make a charitable donation in lieu of receiving a payout for sold items. ● We donated $61,000 to benefit nonprofits through the Future Fund, our employee-led social impact arm.

22© THREDUP ESG Spotlight: Governance – we foster effective leadership and resilience Corporate Social Responsibility (CSR) Committee Stewardship and participation from senior leaders across ThredUp, reporting to the Board Diversity and representative Board governance Four female directors (44% of our board), including Board Chairperson1 Board independence All directors, other than CEO, independent according to Nasdaq listing standards Upholding an ethical culture Whistleblower program for compliance, ethics and fraud, reporting to the Audit Committee 1 Company information as of Dec 31, 2023.

© THREDUP 23• CONFIDENTIAL FINANCIAL HIGHLIGHTS

24© THREDUP Quarterly Financial Snapshot $ in millions Revenue Gross Margin Adj. EBITDA1 Margin 1 Refer to Appendix for Adjusted EBITDA reconciliation Annual Growth: +14%+4%-2% +21%+8%

25© THREDUP Total Orders and Growth Quarterly Buyer and Order Growth Active Buyers and Growth Annual Growth: -8% +17%Annual Growth: -3% +9%-2% -8%-1% +5% +11%+4%

26© THREDUP Annual Financial Snapshot $ in millions Revenue Gross Margin Adj. EBITDA1 Margin 1 Refer to Appendix for Adjusted EBITDA reconciliation Annual Growth: +12%+35%+14% +15%+26%

27© THREDUP Total Orders and Growth Annual Buyer and Order Growth Active Buyers and Growth Annual Growth: +34% +34%+27%Annual Growth: +47% +36%+24% Europe acquisition in Q4 2021 -2% Europe acquisition in Q4 2021 +22%+9% +6%

28© THREDUP Long-Term Target Model Note: excludes SBC expense. Refer to Appendix for SBC GAAP Reconciliation.

APPENDIX

30© THREDUP Our Business Model $ in millions Shift to a primarily consignment model in 2019 ● Consignment Revenue: Revenue recognized net of seller payouts, discounts, incentives and returns ● Product Revenue: Revenue recognized from the sale of items that we own ● Cost of Consignment Revenue: Includes outbound shipping, outbound labor and packaging costs ● Cost of Product Revenue: Includes inventory cost, inbound shipping related to the sold merchandise, outbound shipping, outbound labor, packaging costs and inventory write-downs ● To measure growth, cost efficiencies and operating leverage, we use gross profit growth to normalize for this mix shift Key Definitions Results

31© THREDUP Our Business Model (cont.) $ in millions ● Operations, Product and Technology Expenses: Include distribution center operating costs (inbound shipping, personnel, distribution center rent, maintenance and equipment depreciation) and product and technology expenses (personnel costs for design and development of product and technology, merchandise science, website development and related expenses) ● Marketing Expense: Includes advertising, public relations expenditures and personnel costs for employees engaged in marketing ● Sales, General and Administrative Expenses: Include personnel costs for employees involved in general corporate functions, customer service and retail stores, payment processing fees and professional fees Key Definitions Results 1 Each expense item also includes an allocation of corporate facilities and information technology costs such as equipment, depreciation and rent.

32© THREDUP Adjusted EBITDA Reconciliation $ in millions

33© THREDUP SBC Expense Reconciliation $ in millions

34© THREDUP Key Definitions Active Buyers ● An Active Buyer is a ThredUp buyer who has made at least one purchase in the last 12 months. ● A ThredUp buyer is a customer who has created an account and purchased in our marketplaces, including through our RaaS clients. ● A ThredUp buyer is identified by a unique email address and a single person could have multiple ThredUp accounts and count as multiple Active Buyers. Orders ● Orders means the total number of orders placed across our marketplaces, including through our RaaS clients, in a given period, net of cancellations. Estimated Retail Price ● The Estimated Retail Price of an item is based on the estimated original retail price of a comparable item of the same quality, construction and material offered elsewhere in new condition. Our estimated original retail prices are set by our team of merchants who periodically monitor market prices for the brands and styles that we offer on our marketplace. ● Non-GAAP Adjusted EBITDA loss means net loss adjusted to exclude, where applicable in a given period, stock-based compensation expense, depreciation and amortization, interest expense, severance and other charges, provision for income taxes, impairment of non-marketable equity investment, and acquisition-related expenses. ● Non-GAAP Adjusted EBITDA loss margin represents Non-GAAP Adjusted EBITDA loss divided by Total revenue. Non-GAAP Adjusted EBITDA Loss and Margin

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

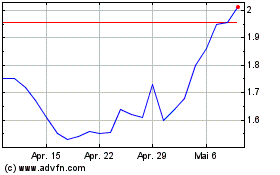

ThredUp (NASDAQ:TDUP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

ThredUp (NASDAQ:TDUP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024