Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

10 Juli 2023 - 3:54PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

F O R M 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2023

TAT TECHNOLOGIES LTD.

(Name of Registrant)

Gibori Israel 7, Netanya 4250407 Israel

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of

Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether by furnishing the information contained in this Form, the

registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If "Yes" is marked, indicate below the file number assigned to the registrant in connection

with Rule 12g3-2(b): 82- ____________

TAT Technologies Ltd.

6-K Exhibits:

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report

to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

TAT TECHNOLOGIES LTD. |

|

| |

(Registrant) |

|

| |

|

|

|

|

|

By:

|

/s/ Ehud Ben-Yair |

|

| |

|

Ehud Ben-Yair |

|

| |

|

Chief Financial Officer |

|

| |

|

|

|

| Date: July 10, 2023 |

|

|

|

3

Exhibit 99.1

TAT Technologies Announces Certain Amendments to the Proxy Statement for its

Annual and Special General Shareholders’ Meeting Scheduled for July 13, 2023

GEDERA, Israel, July 10 2023 – TAT Technologies Ltd. (Nasdaq: TATT – News), a leading provider of services and products to the

commercial and military aerospace and ground defense industries, today announced that it has amended its proxy statement originally filed on June 7, 2023 and the related appendixes (the “Proxy Statement” and "Proxy Card"), as follows:

|

1) |

Certain amendments to the proposed updated compensation policy for the Company's office holders (the "Compensation Policy"), which was originally attached Appendix B, under Item 5 - “ Renewing and amendment of the

Company's Compensation Policy for an additional three (3) years”, to the Proxy Statement as detailed hereunder:

|

| |

a) |

Section 9.6 of the Compensation Policy was added in order to limit the amount of

equity based compensation granted via restricted share units and restricted shares;

|

| |

b) |

Section 9.12 of the Compensation Policy was resived in order to include a

mechanism of acceleration of vesting.

|

Attached to this press release is the amended and marked Compensation Policy.

Please note that the date and time of the Meeting have not changed, and that you may use the form of proxy card and written

ballot previously provided with respect to the Meeting.

The Company shall deem the votes submitted in connection with the Meeting as incorporating the items amended herewith.

If you have already submitted your proxy card or written ballot and wish to revise your vote in view of this announcement,

please act in accordance with the instructions set forth under the title "Revocability of Proxies/Written Ballots" in the original Proxy Statement for the Meeting.

* * * * *

TAT’s executive offices are located in the Gibori Israel 7, Netanya 4250407 Israel and TAT’s telephone number.

For more information of TAT Technologies, please visit our

web-site: www.tat-technologies.com

Contact:

Ehud Ben Yair

CFO

Tel: +972-88628500

Ehudb@tat-technologies.com

* * * * *

Executives & Directors Compensation Policy

|

Company

|

TAT TECHNOLOGIES LTD.

|

| |

|

|

Law

|

The Israeli Companies Law 5759-1999 and any regulations promulgated under it, as amended from time to time.

|

| |

|

|

Amendment 20

|

Amendment to the Law which was entered into effect on December 12, 2012.

|

| |

|

|

Compensation Committee

|

A committee appointed in accordance with section 118A of the Law.

|

| |

|

|

Office Holder

|

Director, CEO, any person filling any of these positions in a company, even if he holds a different title, and any other

excutive subordinate to the CEO, all as defined in section 1 of the Law.

|

| |

|

|

Executive

|

Office Holder, excluding a director.

|

| |

|

|

Terms of Office and Employment

|

Terms of office or employment of an Executive or a Director, including the grant of an exemption, an undertaking to

indemnify, indemnification or insurance, separation package, and any other benefit, payment or undertaking to provide such payment, granted in light of such office or employment, all as defined in section 1 of the Law.

|

|

Total Cash Compensation

|

The total annual cash compensation of an Executive, which shall include the total amount of: (i) the annual base salary; and

(ii) the On Target Cash Plan.

|

| |

|

|

Equity Value

|

The annual total equity value will be calculated on a linear basis, based on the equity value (valued using the same

methodology used in the financial statements of the Company on the date of approval of the Equity Based Components by the Company's Board of Directors) divided by the number of vesting years.

|

| |

|

|

Total Compesation

|

The Total Cash Compensation and the annual Equity Value.

|

| |

|

| |

2.1.

|

This compensation policy ("the

Policy"), was formulated during an internal process conducted at the Company in compliance with the provision of Amendment 20, and is based on the Company's will to properly balance between its will to reward Office Holders for

their achievements and the need to ensure that the Total Compensation is in line with the Company's benefit and overall strategy over time.

|

| |

2.2.

|

The purpose of the Policy is to set guidelines for the compensation manner of the Company's Officer Holders. The Company's

management and its Board of Directors deem all of the Office Holders of the Company as partners in the Company's success and consequently, derived a comprehensive view with respect to the Company's Office Holders' Compensation. This

document presents the indices that derived from the principles of the formulated Policy, as specified hereunder.

|

| |

2.3.

|

It is hereby clarified that no statement in this document is intended to vest any right to the Office Holders to whom the

principles of the Policy apply, or to any other third party, and not necessarily will use be made of all of the components and ranges presented in this Policy.

|

| |

2.4.

|

The indices presented in the Policy are intended to prescribe an adequately broad framework that shall enable the

Compensation Committee and Board of Directors of the Company to formulate a personal Compensation Plan for each office Holder or a particular compensation component according to individual circumstances (including unique circumstances)

and according to the Company's needs, in a manner that is congruent with the Company's benefit and the Company's overall strategy over time.

|

| |

2.5.

|

The Policy is intended to align between the importance of incentivizing Executives to reach personal targets and the need

to assure that the overall compensation meets our Company's long term strategic performance and financial objectives. The policy provides our Compensation Committee and our Board of Directors with adequate measures and flexibility, to

tailor each of our Executive's compensation package based, among others, on geography, tasks, role, seniority, and capability.

|

| |

2.6.

|

The Policy shall provide the Board of Directors with guidelines for exercising discretion under the Company’s equity

plans.

|

| |

2.7.

|

For the avoidance of doubt, it is clarified that in case of any amendment made to provisions of the Law and any other

relevant rules and regulations in a manner that will facilitate the Company regarding its actions related to Officer compensation, the Company may be entitled to follow these provisions even if they contradict the principles of this

Compensation Policy.

|

| |

2.8.

|

This Compensation Policy does not derogate from any agreements or compensation terms approved prior to the approval of

this Compensation Policy. It is hereby clarified that if the Company shall acquire another company or new activity, then the compensation terms of mangers of such acquired company or activity that become, after the acquisition Office

Holders in the Company, shall not change for a period of six (6) months after the acquisition (even if their compensation terms exceed the limitations on compensation set forth in this Policy). During such six-month period, the Company

will make reasonable efforts to revise their compensation terms in accordance with applicable law. Notwithstanding the foregoing, if the compensation terms of such mangers exceed the limitations on compensation set forth in this Policy,

and the Company cannot amend such compensation after making reasonable efforts to do so, then the compensation of such managers of the acquired entity may not be amended in accordance with the terms of the Policy.

|

|

3.

|

Principles of the Policy

|

| |

3.1.

|

The Policy shall guide the Company’s management, Compensation Committee and Board of Directors with regard to the Office

Holders' compensation.

|

| |

3.2.

|

The Policy shall be reviewed from time to time by the Compensation Committee and the Board of Directors, to ensure its

compliance with applicable laws and regulations as well as market practices, and its conformity with the Company’s targets and strategy. As part of this review, the Board of Directors will analyze the appropriateness of the Policy in

advancing achievement of its goals, considering the implementation of the Policy by the Company during previous years.

|

| |

3.3.

|

Any proposed amendment to the Policy shall be brought up to the approval of the Shareholders of the Company and the Policy

as a whole shall be re-approved by the Shareholders of the Company at least once every three years, or as otherwise required by Law. However, to the extent permitted by law, if the shareholders shall oppose approving the Policy, the

Compensation Committee and Board of Directors shall be able to approve the Policy, after having held another discussion of the Policy and after having determined, on the basis of detailed reasoning, that, notwithstanding the opposition

of the shareholders, the adoption of the Policy is for the benefit of the Company.

|

| |

3.4.

|

The compensation of each Office Holder shall be subject to mandatory or customary deductions and withholdings, in

accordance with the applicable local laws.

|

|

II.

|

Executive Compensation

|

|

4.

|

When examining and approving Executives’ Terms of Office and Employment, the Compensation Committee and Board members

shall review the following factors and shall include them in their considerations and reasoning:

|

| |

4.1.

|

Executive’s education, skills, expertise, professional experience and specific achievements.

|

| |

4.2.

|

Executive’s role and scope of responsibilities and in accordance with the location in which such Executive is placed.

|

| |

4.3.

|

Executive’s previous compensation.

|

| |

4.4.

|

The Company’s performance and general market conditions.

|

| |

4.5.

|

The ratio between Executives' compensation, including all components of the Executives' Terms of Office and Employment,

and the salary of the Company’s employees, in particular with regard to the average and median ratios, and the effect of such ratio on work relations inside the Company, as defined by the Law.

The annual Total Compensation (or annualized, for other than a full time position) of the Company's CEO, active Chairman1

and Executive in terms of full time position shall not exceed 15 times, 30 times and 15 times, respectively, the average annual salary and the median annual salary of the Company's employees.

|

| |

4.6.

|

Comparative information, as applicable, as to former Executives in the same position or similar positions, as to other

positions with similar scopes of responsibilities inside the Company, and as to Executives in peer companies. The peer group for the purpose detailed below shall include not less than 4 public companies listed on the Tel Aviv Stock

Exchange ("TASE") similar in parameters such as total revenues, market cap, industry and number of employees. The comparative

information, as applicable, shall address the base salary, target cash incentives and equity and will rely, as much as possible, on reputable industry surveys.

The Company may use such comparative information in the event a new Executive is offered a Total Compensation

exceeding 25% of its predecessor in the Company.

Notwithstanding the foregoing, a non-material change in the terms of employment of an Officer who is subordinate

to the Company's CEO shall not require the approval of the Compensation Committee and Board (if applicable), if it was approved by the Company's CEO and all the following conditions are met: (1) a non-material change in the terms of

employment of an Officer as stated in section 272(c) of the Law, within a limit of up to 10% per year, relative to the year before, of the Officer's terms, shall be approved by the Company's CEO and by any other organ as required by

law; and (2) the terms of employment conform to this Compensation Policy.

|

1 Should one be appointed.

|

5.

|

The compensation of each Executive shall be composed of, some or all, of the following components:

|

| |

5.1.

|

Fixed components, which shall include, among others: base salary and benefits as may be customary under local customs.

|

| |

5.2.

|

Variable components, which may include: cash incentives and equity based compensation.

|

| |

5.4.

|

Directors & Officers (D&O) Insurance, indemnification and exemption; and

|

| |

5.5.

|

Other components, which may include: change in control, relocation benefits, special bonus, etc.

|

|

6.

|

Our philosophy is that our Executives’ compensation mix shall comprise of, some or all, of the following components:

annual base salary, performance-based cash incentives and long-term equity based compensation, all in accordance with the position and responsibilities of each Executive, and taking into account the purposes of each component, as

presented in the following table:

|

|

|

|

Purpose

|

|

Compensation Objective Achieved

|

| |

|

|

|

Annual base salary

|

|

Provide annual cash income based on the level of responsibility, individual qualities, past performance inside the Company,

past experience inside and outside the Company.

|

|

• Individual role, scope and capability based compensation

• Market competitiveness in attracting Executives.

|

| |

|

|

|

Performance-based cash

incentive compensation

|

|

Motivate and incentivize individual towards reaching Company, department and individual's periodical and long-term goals and

targets.

|

|

• Reward periodical accomplishments

• Align Executive’ objectives with Company, department and individual's objectives

• Market competitiveness in attracting Executives

|

| |

|

|

|

Long-term equity-based

Compensation

|

|

Align the interests of the individual with the Shareholders of the Company, by creating a correlation between the Company’s

success and the value of the individual holdings

|

|

• Company performance based compensation

• Reward long-term objectives

• Align individual's objectives with shareholders’ objectives

|

|

7.

|

The compensation package shall be reviewed with each Executive at least once a year, or as may be required from time to

time.

|

|

8.

|

Fixed compensation

Base Salary:

|

| |

8.1.

|

The base salary shall be determined in accordance with the criterias and considerations as detailed in Section 4 above and

shall be approved by the Compensation Committee.

|

| |

8.2.

|

The base salary shall not be automatically linked.

|

| |

8.3.

|

The maximum monthly base salary for an Office Holder shall be as follows:

|

|

Executive Level

|

Maximum

|

| |

|

|

Active Chairman

|

NIS 75K 50K (for 35% of a full time position and a proportion of this amount to a different

percentage of services).

|

| |

|

|

CEO

|

NIS 120K 105K (for a full time position)

|

| |

|

|

Other Executives

|

NIS 66K (for a full time position); and with respect to a Chief Executive Officer and or Presidents of a subsidiary of the

Company and Executives outside of Israel - US$ 27.5K (for a full time position).

|

|

|

The above maximum base salary shall be examined annualy.

Any deviation from the detailed above with regard to the CEO and/or Active Chairman, shall be brought for the

approval of the Compensation Committee, the Board of Directors and the General Meeting of the Company prior to entering into a binding agreement (unless specified otherwise in the Law).

A deviation exceeding 15% of the detailed above with regard to an Executive (excluding CEO and Active Chairman)

shall be brought for the approval of the Compensation Committee and the Board of Directors prior to entering into a binding agreement.

Without derogating from the above, a maximum annual raise of up to 5% with regard to an Executive's base salary

in a particular year, excluding variable compensation, shall not be deemed a material change of his/her terms of employement, and therefore, shall require the approval of the Compensation Committee only.

|

| |

8.4.

|

In the event an Office Holder provides services to the Company as an independent contractor or via a management company

controlled by said Office Holder, and get paid through the issuance of an invoice, then the provisions of the Policy shall apply to him/her mutatis mutandis and for all purposes in this policy, the base salary for such an Office Holder shall be extracted from actual payment based on normal rate of employment cost. In order to ensure allignment of all

components of the Total Compensation, the appropriate ratio between the Fixed compensation of Office Holders' and their Variable Compensation, in terms of full time position for a given year, are as detailed below:

|

|

Executive Level

|

Variable Compensation

|

|

Cash incenstive compensation

|

Long term equity based compensation

|

|

Active Chairman

|

Up to 9 3 monthly base salaries or the equivalent thereof.

|

Up to 9 monthly base salaries or the equivalent thereof.

|

|

CEO

|

Up to 9 monthly base salaries or the equivalent thereof.

|

Up to 9 monthly base salaries or the equivalent thereof.

|

|

Directors

|

NONE.

|

0-10% See section 9.9. below

|

|

Other Executives

|

Up to 7 monthly base salaries or the equivalent thereof.

|

Up to 7 monthly base salaries or the equivalent thereof.

|

| |

|

The actual Variable Compensation ratios shall not exceed from the ratios in the above table (which represent the desired

optimal combination of compensation as the actual ratio may vary according to the performance of the Company in a given year.

|

Benefits:

| |

8.5.

|

Benefits granted to Executives shall include any mandatory benefit under applicable law, as well as, part or all, of the

following components:

|

| |

8.5.1

|

Pension plan/ Executive insurance as customary.

|

| |

8.5.2.

|

Benefits which may be offered as part of the general employee benefits package (such as: pension fund, study fund) in

accordance with the local practice of the Company.

|

| |

8.5.3.

|

An Executive will be entitled to sick days and other special vacation days (such as recreation days), as required under

local standards and practices.

|

| |

8.5.4.

|

An Executive will be entitled to vacation days, in correlation with the Executive’s seniority and position in the Company

(generally up to 30 days annualy), and subject to the minimum vacation days requirements per country of employment as well as -the local national holidays.

|

| |

8.5.5.

|

Reasonable expenses, including vehicle, daily newspaper, cellphone and meals.

|

| |

9.1.

|

When determining the variable components as part of an Executive's compensation package, the contribution of the Executive

to the achievement of the Company’s goals, revenues, profitability and other key performance indicators ("Targets") shall be

considered, taking into account Company and department’s long term perspective and the Executive’s position.

|

| |

9.2.

|

Variable compensation components shall be comprised of (i) cash components which shall be mostly based on measurable

criteria or non-measurable targets; and (ii) equity components, all taking into consideration periodical and a long term perspective.

|

| |

9.3.

|

The Board of Directors shall have the absolute discretion to reduce or cancel any cash incentive.

|

Cash Incentives

| |

9.4.

|

Variable Cash Incentive Plan

|

| |

9.4.1.

|

The Compensation Committee and Board of Directors may adopt, from time to time, a Cash Incentive Plan, which will set

forth for each Executive targets which form such Executive's on target Cash payment (which shall be referred to as the “On Target Cash Plan”)

and the rules or formula for calculation of the On Target Cash Plan payment once actual achievements are known.

|

| |

9.4.2.

|

The Compensation committee and Board of Directors may include, inter- alia, in the On Target Cash Plan predetermined

thresholds and caps, to corelate an Executive’s On Target Cash Plan payments with actual achievements.

|

| |

9.4.3.

|

The annual On Target Cash Plan actual payment for the Active Chairman, the CEO and other Executives in a given year shall

be capped as determined by our Board of Directors, but in no event shall exceed the ratio set forth in the table in clause 8.4 above.

|

| |

9.4.4.

|

The CEO, Active Chairman and other Executives' individual On Target Cash Plan may be composed based on the mix of -(i) the Company Target (as defined below); (ii) Personal Target; and (iii) Personal

Evaluation. The weight to be assigned to each of the components per each of the executives shall be as set forth in the table below.

|

| |

Active Chairman

|

CEO

|

Other Executives

|

| |

|

|

|

|

Company Target

|

100%

|

75% - 100%

|

50% - 100%

|

| |

|

|

|

|

Personal Target

|

NONE

|

NONE

|

0% - 30%

|

| |

|

|

|

|

Personal Evaluation

|

NONE

|

0% - 25%

|

0% - 20%

|

| |

|

The Company’s Target shall be determined in accordance with all or part of the following pre-determined targets:

(1) Sales budget, in accordance with the Company’s annual budget; (2) Gross Profit, in accordance with the Company’s budget; (3) Operating Profit, in accordance with the Company’s annual budget; (4) Net Income, in accordance with the

Company’s annual budget; (5) EBITDA; and (6) Net cash from operating activities,, in accordance with the Copany’s annual budget ("the Company Target"). If a Company Target shall apply to a Chief Executive Officer or a President of a

subsidiary of the Company, such target may be applied up to 100% with respect to the financial results of the relevant subsidiary, and the remaining bonus with respect to the financial results of the Company and its subsidiaries on a

consolidated basis.

Notwithstanding the foregoing, the Board may determine to exclude certain profits or loss items from the Company

Target including, but not limited to, ceratin expenses related to acquisition of a new company, certain expenses related to distribution of dividend, certain items of revenue or any other items per the Board’s sole discretion.

With regard to each one of the Company's measurable targets, reference points shall be determined in terms of

numerical values, so that compliance with the precise numerical target as determined in the On Target Cash Plan shall constitute compliance with 100% of the target, and also, numerical values shall be determined which will constitute

the lower threshold for compliance with the target. The actual rate of compliance with the targets shall be calculated in accordance with the said reference points.

It is clarified that failure to comply with the minimum threshold of at least 75% of a specific target shall not

entitle the Executive to payment of a bonus in respect of the said target.

In the event of compliance at a rate of 75% or more with a specific target, the annual On Target Cash Plan shall

be calculated in accordance with a key (i.e. Linear, Steps, etc.) which shall determine – in relation to the point of compliance with the target – the amount of the bonus in terms of a percentage of the Executive annual base salary,

all as shall be set forth in the On Target Cash Plan. In this respect, the Compensation Committee and the Board of Directors shall have the right to determine a higher (but not lower) entitltlement threshold.

|

| |

9.4.5.

|

Without derogating from the foregoing, the annual bonus may be conditional on financial or other threshold conditions

in accordance with a list of measurable targets that will be determined by the board of directors of the Company from time to time, such as sales turnover, gross profit, operating profit, pre-tax profit, net profit and relevant

operating targets, as determined for the Other Executives, such as compliance with budgetary targets, level of inventory, collections and profitability targets, and so forth (If such threshold condition is determined), failure to meet

the lower threshold for the distribution of an annual bonus will mean that an annual bonus will not be earned (the "Annual Bonus Threshold").

|

| |

9.4.6.

|

Notwithstanding the foregoing, the board of directors may, in exceptional cases, following the recommendation of the

CEO of the Company, approve the grant of a partial bonus, notwithstanding that the Annual Bonus Threshold has not been met in an amount of up to 3 salaries. This will be under special circumstances in which, in light of the efforts of

the Executive and his great investment in his position in the previous year, it is decided that it is appropriate to award the Executive with the bonus in the framework of the Executive’s compensation, notwithstanding the failure to

meet the Annual Bonus Threshold so as to incentivize him and compensate him in respect of his investment in the Company.

|

The annual bonus shall be paid to the office Holder in the following manner:

80% of the amount of the annual bonus will be paid following the approval by

the Board of Directors of the Company, of the financial statements of the relevant year (“Current Year Bonus”). 20% of the amount of the annual bonus shall be deferred by one year, and shall be paid following the approval by the Board of

Directors of the Company of the financial statements of such year (“Deferred Bonus”).

The

Office Holder's eligibility to the payment of the Deferred Bonus shall be subject to the following cumulative conditions: (i) the Company

recorded a positive EBITDA for the following year; and (ii) the Office Holder had not ceased to provide services to the Company during the year in which the Deferred Bonus

is paid resulting from the Company terminating the engagement with the Office Holder for "Cause" (as defined in section 9.4.10 below) .

For the avoidance of

doubt, it is hereby clarified that the payment of the Deferred Bonus shall be in addition to any payment of compensation to which the Office Holder shall be entitled with respect to the relevant following year, and the payment of the Deferred Bonus shall not have any effect on the manner of calculation of the compensation for the relevant following year.

With regard to the Company's Executives, excluding its Active Chairman and the CEO, their Personal

Targets for the On Target Cash Plan shall be determined annualy by the Compensation Committee and the Board of Directors ("the Personal Target"). Such targets may include compliance -with the Company's budget, operational efficiency, inventory

management, new sales, existing customers, financial management, collection, etc.

With regard to each one of the Personal measurable targets, reference points shall be determined in terms

of numerical values, so that compliance with the precise numerical target as determined in the On Target Cash Plan shall constitute compliance with 100% of the target, and also, numerical values shall be determined which will constitute the lower

threshold for compliance with the target. The actual rate of compliance with the targets shall be calculated in accordance with the said reference points.

It is clarified that failure to comply with the minimum threshold of at least 75% of a specific target

shall not entitle the Executive to payment of a bonus in respect of the said target. In the event of compliance at a rate of 75% or more with a specific target, the annual On Target Cash Plan shall be calculated in accordance with a key (i.e.

Linear, Steps, etc.) which shall determine – in relation to the point of compliance with the target – the amount of the bonus in terms of a percentage of the Executive annual base salary, all as shall be set forth in the On Target Cash Plan.

|

9.4.5.

|

9.4.7. Personal evaluation: the Company's CEO shall present his personal evaluation of

Executive reporting to the CEO to the Company's Compensation Committee and to the Board of Directos. This evaluation shall relate, inter alia, to nonfinancial indices, including the Executive's long term contribution and his/her long

term performance. The CEO's personal evaluation shall be presented to the Compensation Committee and to the Board of Directors by the Chairman of the Board, according to the evaluation principles set above with relation to all other

Executives.

|

| |

9.4.6.

|

9.4.8. It is hereby clarified that the aggregate weight to be assigned to all five of the aforesaid

categories in a cash incentives formula shall be 100% and in no event shall exceed the ratio set forth in the table in clause 8.4 above.

The breakdown of the targets in each measurable category and the relative weight of each of the measurable

categories shall be tailored to each Executive individually, no later than approval of the Company's annual consolidated audited financial reports, depending on the seniority of the Executive and the organizational division to which

the Executive is assigned or that is under his purview.

It is hereby clarified, that a maximum change of 10% of the relative weight of each of the measurable categories

shall not be deemed a material change in the terms of employement.

|

| |

9.4.7.

|

9.4.9. In the event that the Company's strategic targets shall be amended by the Board of Directors

during a particular year and/or there is a change to the Executive’s responsibilities and/or scope of employment -- the Board of Directors shall have the authorization to determine whether, and in which manner, such amendment shall

apply to the On Target Cash Plan.

|

| |

9.4.8.

|

9.4.10. The Board of Directors will be authorized to define certain events as exceptional and

extra-ordinary to the Company’s ordinary course of business, in which case the compensation committee will have the ability to adjust their impact when calculating any of the Company’s targets and Personal Targets. It shall be noted

that Company’s Targets and/or Personal Targets impacted by this section with respect to the Active Chairman and CEO, shall be brought for the approval of the General Meeting in accordance with the Law.

|

| |

9.4.9.

|

9.4.11. The entitlement to the On Target Cash Plan in respect of a particular year shall be

conferred on an Executive where such Executive rendered services or was employed with the Company for a period of at least 6 months during that particular year - and the amount thereof shall be relative to the period of employment

with the Company during that particular year.

|

| |

9.4.10.

|

9.4.12. In the event of termination of the relationship following "Cause" as defined below, such

Executive shall not be entitled to any payments in accordance with his/her On Target Cash Plan which have not yet been paid prior to the date of said termination, unless otherwise determined by the Board of Directors.

"Cause" means the following: termination due to: (i) an Executive's conviction of, or plea of guilty or nolo contendere

to, a felony (ii) performance by an Executive of an illegal act, dishonesty, or fraud which could cause significant economic injury to the Company; (iii) an Executive's insubordination, refusal to perform his or her duties or

responsibilities for any reason other than illness or incapacity or materially unsatisfactory performance of his or her duties for the Company; (iv) continuing willful and deliverate failure by the Executive to perform the Executive's

duties in any material respect, provided that the Executive is given notice and an opportunity to effectuate a cure as determined by the Company; or (v) an Executive's willful misconduct with regard to the Company that could have a

material adverse effect on the Company.

|

| |

9.4.11.

|

9.4.13. For the avoidance of doubt, it is hereby clarified that payments under the On Target Cash

Plan shall not be deemed to be a salary, for all intents and purposes, and it shall not confer any social rights.

|

| |

9.4.12.

|

9.4.14. The Company will include in its year-end filings (i.e. Annual 20F), with respect to the

Active Chairman and the CEO, an explanation as to how their On Target Cash Plan was calculated, including: their predetermined Company Targets, Personal Targets and Personal Evaluation for that particular year; the mix and weights;

and the extent of achieving them

|

Equity Based Compensation

| |

9.5.

|

The Company may grant its Executives, from time to time, equity based compensation, which may include any type of equity,

including, without limitation, any type of shares, options, restricted share units (RSUs), share appreciation rights, restricted shares or other shares based awards (“Equity Based Components”), either under the Company's existing 2012

Stock Option Plan or future equity plan (as may be adopted by the Company), and subject to any applicable law.

|

| |

9.5.

|

9.6. The amount of equity based compensation granted via RSUs units and restricted shares, will not exceed the amount

of 25% of the equity based compensation or the maximum Annual Value equal to the cost of three (3) Base Salaries of the officer to which the equity based compensation was granted.

|

| |

9.6.

|

9.7. The Company believes that it is not in its best interest to limit the exercise value of Equity

Based Components.

|

| |

9.7.

|

9.8. Equity Based Components for Executives shall be in accordance with and subject to

the terms of our existing or future equity plan and shall vest in installments throughout a period which shall not be shorter than 3 years with at least a 1 year cliff taking into account adequate incentives in a long term perspective.

|

| |

9.9.

|

The total yearly Equity Value granted shall not exceed with respect to the Active Chairman, the CEO and each other

Executive, at the time of approval by the Board of Directors the appropriate ratio set forth in clause 8.4 above.

|

| |

9.10.

|

-The total yearly Equity Value granted to any non-executive Directors (determined based on generally accepted

accounting principles applicable to the Company) shall not exceed (based on accepted valuation methods), 50% of the total value of the fixed directors’ compensation, incuding per meeting compensation, per vesting annum.

|

| |

9.8.

|

9.11. The maximum dilution as a result of grant of the equity based compensation to Executives shall

not exceed 15%.

|

| |

9.12.

|

The Board may determine a mechanism of acceleration of vesting:

|

| |

9.12.1.

|

A full acceleration will be permitted in the event of death, disability, medical reasons or a change in control of

the Company followed by the delisting of the Company's shares;

|

| |

9.12.2.

|

An acceleration of the next unvested period will be permitted in the event of change in control of the Company following a resignation or termination of employment of the officer (except in the case of Termination for Cause).

"Termination for Cause" means a termination of the employment of

an officer following one or more of the following: embezzlement; theft; criminal offence; act involving moral turpitude; severe disciplinary breach; breach of fiduciary duties; other fundamental breach of the officer's

employment agreement; or any other event which under applicable law enables terminating an employee's employment and entirely or partially denying severance payments or prior notice redemption.

|

| |

9.9.

|

The terms of Equity Based Components may include provisions regarding vesting acceleration as a result of

change of control in the Company.

|

| |

9.10.

|

9.13. The exercise price of the options granted shall be determined by the Company and shall not be

less than the higher of (a) 5% above the average closing price of the Company's share in the 30 trading days preceding the date of the Board of Directors' approval of the equity grant; (b) 5% above the share price on the date of the

Board of Directors' approval of the equity grant.

|

| |

9.11.

|

9.14. In the event of the termination of the employer – employee relationship or

rendering services to the Company's group during the relevant year, the grantee shall be entitled to the options which were allocated in his/her regard, where the date of entitlement in respect of the said options occurred prior to the

date of the actual termination, and to exercise them into shares of the Company up until the earlier of: (1) 90 days from the date of the actual termination; (2) the expiration of their exercise period. The grantee shall be entitled to

count the shares which were allocated for him only if the date of entitlement in respect thereof occurred prior to the date of the actual termination.

|

| |

9.12.

|

9.15. In the event of the termination of the relationship following Cause– and even if

the date of entitlement to the options has fallen due, in whole or in part, and they have not yet been exercised into shares, the options which have not yet been exercised prior to the expiration of the exercise period shall expire.

|

| |

9.13.

|

9.16. For the avoidance of doubt, it is hereby clarified that the annual equity

compensation shall not be deemed to be a salary, for all intents and purposes, and it shall not confer any social rights.

|

| |

10.1.

|

The following criteria shall be taken into consideration when determining Separation Package: the duration of employment

of the Active Chairman or the Executive, the terms of employment, the Company’s performance during such term, the Executive’s contribution to achieving the Company’s goals and revenues and the retirement’s circumstances.

|

| |

10.2.

|

Other than payments required under any applicable law, local practices, transfer or release of pension funds,

manager's insurance policies, etc. - the maximum Separation Package of each Executive, CEO or the Active Chairman shall not exceed the value of 25% the Total Compensation of such an Executive, CEO or Active Chairman, respectively.

|

|

11.

|

Notice Period in Termination

|

| |

|

As a guideline, the notice period for the termination of an Executive shall not exceed six months or payment in lieu of

such notice. During the notice period, the Executive shall be required to continue his services or employment with the Company, unless otherwise determined by the Board of Directors.

|

| |

12.1.

|

Relocation– additional compensation pursuant to local practices and law may be granted to an Executive

under relocation circumstances. Such benefits shall include reimbursement for out of pocket one time payments and other ongoing expenses, such as housing allowance, schooling allowance, car or transportation allowance, home leave visit,

health insurance for executive and family, etc, all as reasonable and customary for the relocated country and in accordance with the Company's relocation practices, as shall be approved by the Compensation Committee and Board of

Directors.

|

| |

12.2.

|

Special Bonus - Our

Compensation Committee and our Board of Directors may approve, from time to time, with respect to any Executive, if they deem required under special circumstances or in case of an exceptional contribution to the Company, including,

among others, in cases of retention or attraction of a new Executive or consummation of an acquisition by or of the Company or the sale or spin off of any material asset of the Company, the grant of a onetime cash incentive, of up to

three monthly salaries or the equivalent thereof.

|

| |

13.1. |

In the event of a restatement of the Company’s financial results, we shall seek reimbursement from our Office Holders of

any payment made due to erroneous restated data, with regards to each Office Holder’s Terms of Office and Employment that would not otherwise have been paid. The reimbursement shall be limited to such payments made during the 3-years

period preceding the date of restatement. The above shall not apply in case of restatements that reflect the adoption of new accounting standards, transactions that require retroactive restatement (e.g., discontinued operations),

reclassifications of prior year financial information to conform to the current year presentation, or discretionary accounting changes.

|

| |

13.2.

|

Our Compensation Committee and Board of Directors shall be authorized to seek recovery to the extent that (i) to do so

would be unreasonable or impracticable; or (ii) there is low likelihood of success under governing law versus the cost and effort involved.

|

|

III.

|

Director Remuneration:

Our directors may be entitled to remuneration composed of cash

compensation which includes annual fee and meeting participartion fee, as well as equity based compensation, as an incentive for their contribution and efforts as directors of the Company.

|

| |

14.1.

|

The Company’s non-executive directors may be entitled to receive an annual cash fee and a participation fee for each

meeting in accordance with the amounts set forth in the Companies Regulations (Rules Regarding Compensation and Expense

Reimbursement of External Directors) -2000 ("the Compensation Regulations"), and taking into account their definition as "expert

director" according to the Compensation Regulations.

|

| |

14.2

|

The Company’s directors may be reimbursed for their reasonable expenses incurred in connection with attending meetings of

the Board of Directors and of any Committees of the Board of Directors, all in accordance with the Compensation Regulations.

|

|

15.

|

Equity Based Compensation:

The Company’s non-executive directors, i.e. excluding external and independent, may be entitled to receive equal annual

equity based compensation, which value shall not exceed at the time of grant 10% of the total annual cash fee detailed in section 14.1 14.1 above . |

|

16.

|

Active Chairman

Compensation:

The Active Chairman may be entitled to a compensation in accordance with the criterias as detailed in Section 4, 8 and 9

above, in accordance with his/her scope of employment and relative maximum compensation. The Active Chairman's compensation shall be determined in accordance with his scope of activity, areas of responsibilities in the Company, as well

as his experience and expertise. In any event, the total compensation of the Active Chairman shall not be less than the monthly compensation paid to a director in the Company.

|

|

IV.

|

Indemnification & Insurance

|

|

17.

|

The Office Holders shall be entitled to a directors and officers indemnification up to the maximum amount permitted by

law, D&O insurance as shall be approved at the Board of Director's discretion, all in accordance with any applicable law and the Company’s articles of association.

|

|

18.

|

With respect to the D&O policy-

|

| |

18.1.

|

The D&O insurance may provide group insurance to the Company and its affiliates (only in respect of D&Os serving

as such on behalf of the Company) and alongside the Company's D&O Insurance it is possible that D&Os of the affiliates may also be insured. In the event the D&O insurance shall provide such group insurance, the annual

premium shall be relatively divided between the different companies based on the decision of the Company's management taking into account the recommendation of the Company's external insurance advisors.

|

| |

18.2.

|

The limits of liability shall not exceed USD 35 million.

|

| |

18.3.

|

The deductible shall not exceed USD 3,500,000.

|

| |

18.4.

|

The annual premium for the D&O policy shall be in accordance with market conditions. The Company shall retain the

assistance of the Company's external isurance advisors in determining market conditions.

|

| |

18.5.

|

Any purchase of D&O insurance or its renewal during the term of this Policy shall not be brought to additional

approval of the General Meeting provided that the Compensation Committee has approved that the purchased D&O insurance meets the conditions detailed above.

|

|

19.

|

Each of our Office Holders shall be entitled to the same indemnification terms and insurance policy coverage, all as may

be approved from time to time.

|

***

21

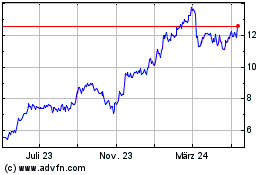

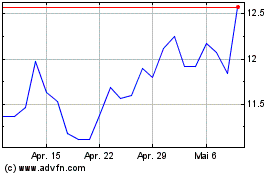

TAT Technologies (NASDAQ:TATT)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

TAT Technologies (NASDAQ:TATT)

Historical Stock Chart

Von Apr 2023 bis Apr 2024