UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

Filed by the Registrant ☐ Filed

by a Party other than the Registrant x

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting material Pursuant to §240.14a-12 |

Masimo Corporation

(Name of Registrant as Specified In Its Charter)

POLITAN CAPITAL MANAGEMENT LP

POLITAN CAPITAL MANAGEMENT GP LLC

POLITAN CAPITAL PARTNERS GP LLC

POLITAN CAPITAL NY LLC

POLITAN INTERMEDIATE LTD.

POLITAN CAPITAL PARTNERS MASTER FUND LP

POLITAN CAPITAL PARTNERS LP

POLITAN CAPITAL OFFSHORE PARTNERS LP

QUENTIN KOFFEY

MATTHEW HALL

AARON KAPITO

WILLIAM JELLISON

DARLENE SOLOMON

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee paid previously with preliminary

materials. |

| ¨ | Fee computed on table in exhibit

required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

On September 17, 2024, Politan Capital Management LP, together with

its affiliates, issued the following press release:

Leading Proxy

Advisory Firm Glass Lewis Reiterates Recommendation That Masimo Shareholders Vote FOR Both of Politan’s Independent Director Nominees

Glass Lewis States That Politan’s Nominees

Represent a “Clear, Reasoned and Compelling Alternative to the Status Quo”

Believes Investors Should Have “Little

Confidence” in Existing Board’s Ability to Advance Review of Strategic Alternatives

Stresses that Politan’s Nominees “Would

Go a Long Way to Ensuring the Interests of All Investors Are Clearly and Consistently Represented”

NEW YORK – September

17, 2024 – Politan Capital Management (together with its affiliates, “Politan”), an 8.9% shareholder of Masimo Corporation

(“Masimo” or the “Company”) (NASDAQ: MASI), today highlighted that leading proxy advisory firm Glass, Lewis &

Co. (“Glass Lewis”) has updated its earlier report to reiterate its recommendation that shareholders vote FOR the election

of Politan’s nominees, Darlene Solomon and Bill Jellison, to the Company’s Board of Directors (the “Board”) at

the Annual Meeting of Stockholders (the “Annual Meeting”), set for September 19.

In its reaffirmation

that urgent change is needed at the Annual Meeting, Glass Lewis writes:1

Reiterating Its Recommendation for Politan’s

Nominees

| · | “[W]e remain decidedly concerned with the efficacy of Masimo's status quo oversight architecture. We further maintain

investors should have exceedingly limited confidence in the existing board's ability to credibly advance a thoughtful and independent

review of key strategic alternatives, including a separation of Masimo's much maligned consumer millstone.” |

| · | “As an important bookend to the foregoing perspectives, we also continue to believe Politan's nominees — both of whom

we consider credible and independent — represent a sound substitute here, and would go a long way to ensuring the interests of all

investors are clearly and consistently represented at a particularly critical juncture for the Company.” |

Refuting Masimo’s Claims That Politan

Wants Control

| · | “Indeed, we consider the only evident change of control contemplated here is a tilt away from a board governed by the preferences

of CEO Joe Kiani and toward one populated by a majority of independent directors.” |

Dismissing Mr. Kiani’s Threats of Disruption

| · | “[A]s it relates to the possible departure of a wider swathe of Masimo employees, we find it rather disconcerting that the board continues to rely on a speculative

letter which subsequent filings — including, among others, an internal Masimo email — suggest was viewed as compulsory and

coercive by an indeterminate number of Masimo staff members.” |

Rejecting Masimo’s Argument That Politan

Has Not Presented a Plan

| · | “[W]e consider the board's determination to reference the prospectively harmful implications of ‘uncertainty around ...

Masimo's strategy’ to be a decidedly bold angle, given long-term Masimo investors are still reeling from the legacy board's willingness

to endorse a costly non-core boondoggle from which the Company has not yet recovered … Perhaps more alarming in this context, Mr.

Kiani has remained largely unrepentant regarding the arrangement…” |

1 Permission to quote Glass Lewis was neither sought nor

obtained. Underlining added.

| · | “[W]e would emphasize our view that the board's position on the matter remains disingenuous in any case. In particular,

we consider Politan's materials have regularly espoused an intended direction for Masimo, including: (i) an orderly exit from the Company's

consumer business … (ii) reviewing Masimo's extant portfolio to identify potentially failed or mismanaged products … and

drive growth; and (iii) reviewing Masimo's cost architecture to improve margins toward long-stated but never achieved targets, in all

cases while supporting strong R&D spend girded by enhanced procedural architecture.” |

Rebutting Masimo’s Argument That 2nd

Quarter Performance Is Validation

| · | “For the avoidance of doubt, we consider Masimo's recent quarterly results and updated guidance continue to leave no credible

space for mixed messaging, as the consumer health business — which, more two years on from the SU deal and notwithstanding the

central premise underpinning the original value-destroying transaction, is expected to have $0 in revenue impact in connection with a

prospective separation — remains in an unchecked tailspin. We thus do not see that an uptick in quarterly performance by a core

segment which Politan has regularly argued should be Masimo's central focus proves to be a particularly impressive bastion for the status

quo here.” |

Noting the California Litigation Has Further

Highlighted the Governance Failings of Masimo’s Board

| · | “Just as notably, our original position is arguably reinforced with reference to a litany of positions taken by Masimo in

the related proceeding which clearly failed to gain traction.” |

| · | “Among other things, we note the following: (i) Masimo failed to establish the spin-off was the idea of Mr. Koffey, rather

than Mr. Kiani, undermining a key defensive narrative; (ii) Masimo failed to establish Politan misrepresented the selection of advisors

by the special committee; (iii) Masimo failed to establish Mr. Koffey attempted to expand his committee powers beyond the bounds

of the committee's authority to purposely craft a non-viable term sheet; (iv) the Court concluded members of the committee were ‘made

aware’ of the terms underpinning the early February 2024 term sheet, and that evidence shows such members, ‘even without being

provided the term sheet, comprehended the proposed terms of the spin-off’; (v) Masimo failed to convincingly support the claim

that Politan sought to secretly secure information damaging to Masimo, which claim Masimo continues to make, including as recently

as September 15, 2024; (vi) the prior presentation of certain materials by CFO Micah Young to the board ‘[did] not appear to be

a budget’, reinforcing concern that board-level information flows are atypical and inadequate.; (vii) Mr. Kiani failed to provide

the name of the prospective joint venture partner to Mr. Koffey and Ms. Brennan, despite having provided it to the remaining members of

the board weeks prior; and (viii) ‘from the Court's perspective, a reasonable shareholder would be more concerned with [Mr.]

Kiani signing a term sheet, albeit a non-binding one, with a potential joint-venture partner without consulting Masimo's

complete Board’ (emphasis added).” |

Politan encourages

shareholders to visit www.AdvanceMasimo.com for more information.

Your vote is important, no matter how many shares

of Common Stock you own. We urge you to sign, date, and return the WHITE universal proxy card today to vote FOR the election of the Politan

Nominees and in accordance with the Politan Parties’ recommendations on the other proposals on the agenda for the 2024 Annual Meeting.

If you have any questions, require assistance

in voting your

WHITE universal proxy card or

voting instruction form,

or need additional copies of Politan’s

proxy materials,

please contact D.F. King using the contact information

provided here:

D.F. King & Co., Inc.

48 Wall Street

New York, New York 10005

Stockholders call toll-free: (888) 628-8208

Banks and Brokers call: (212) 269-5550

By Email: MASI@dfking.com

Additionally, on September 17, 2024, Politan filed the following Motion

To Leave to File a Second Amended and Supplemented Verified Complaint:

In addition, on the evening of September 17, 2024,

Politan updated its website, www.AdvanceMasimo.com (the “Site”), in connection with the solicitation of stockholders of Masimo.

Copies of the materials posted to the Site are filed herewith.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

The information herein contains “forward-looking

statements.” Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or

current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,”

“anticipates,” “plans,” “estimates,” “projects,” “potential,” “targets,”

“forecasts,” “seeks,” “could,” “should” or the negative of such terms or other variations

on such terms or comparable terminology. Similarly, statements that describe our objectives, plans or goals are forward-looking. Forward-looking

statements are subject to various risks and uncertainties and assumptions. There can be no assurance that any idea or assumption herein

is, or will be proven, correct. If one or more of the risks or uncertainties materialize, or if any of the underlying assumptions of Politan

Capital Management LP (“Politan”) or any of the other participants in the proxy solicitation described herein prove to be

incorrect, the actual results may vary materially from outcomes indicated by these statements. Accordingly, forward-looking statements

should not be regarded as a representation by Politan that the future plans, estimates or expectations contemplated will ever be achieved.

Certain statements and information included herein

may have been sourced from third parties. Politan does not make any representations regarding the accuracy, completeness or timeliness

of such third party statements or information. Except as may be expressly set forth herein, permission to cite such statements or information

has neither been sought nor obtained from such third parties. Any such statements or information should not be viewed as an indication

of support from such third parties for the views expressed herein.

Politan disclaims any obligation to update the

information herein or to disclose the results of any revisions that may be made to any projected results or forward-looking statements

herein to reflect events or circumstances after the date of such information, projected results or statements or to reflect the occurrence

of anticipated or unanticipated events.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Politan and the other Participants (as defined

below) have filed a definitive proxy statement and accompanying WHITE universal proxy card or voting instruction form with the Securities

and Exchange Commission (the “SEC”) to be used to solicit proxies for, among other matters, the election of its slate of director

nominees at the 2024 annual stockholders meeting (the “2024 Annual Meeting”) of Masimo Corporation, a Delaware corporation

(“Masimo”). Shortly after filing its definitive proxy statement with the SEC, Politan furnished the definitive proxy statement

and accompanying WHITE universal proxy card or voting instruction form to some or all of the stockholders entitled to vote at the 2024

Annual Meeting.

The participants in the proxy solicitation are

Politan, Politan Capital Management GP LLC (“Politan Management”), Politan Capital Partners GP LLC (“Politan GP”),

Politan Capital NY LLC (the “Record Stockholder”), Politan Intermediate Ltd., Politan Capital Partners Master Fund LP (“Politan

Master Fund”), Politan Capital Partners LP (“Politan LP”), Politan Capital Offshore Partners LP (“Politan Offshore”

and, collectively with Politan Master Fund and Politan LP, the “Politan Funds”), Quentin Koffey, Matthew Hall, Aaron Kapito

(all of the foregoing persons, collectively, the “Politan Parties”), William Jellison and Darlene Solomon (such individuals,

collectively with the Politan Parties, the “Participants”).

As of the date hereof, the Politan Parties in

this solicitation collectively own an aggregate of 4,713,518 shares (the “Politan Group Shares”) of common stock, par value

$0.001 per share, of Masimo (the “Common Stock”). Mr. Koffey may be deemed to own an aggregate of 4,714,746 shares of Common

Stock (the “Koffey Shares”), which consists of 1,228 restricted stock units that vested on June 26, 2024 as well as the Politan

Group Shares. Politan, as the investment adviser to the Politan Funds, may be deemed to have the shared power to vote or direct the vote

of (and the shared power to dispose or direct the disposition of) the Politan Group Shares, and, therefore, Politan may be deemed to be

the beneficial owner of all of the Politan Group Shares. The Record Stockholder is the direct and record owner of 1,000 shares of Common

Stock that comprise part of the Politan Group Shares. Both the Politan Group Shares and the Koffey Shares represent approximately 8.9%

of the outstanding shares of Common Stock based on 53,478,694 shares of Common Stock outstanding as of August 12, 2024, as reported in

Masimo’s revised definitive proxy statement filed on August 15, 2024. As the general partner of Politan, Politan Management may

be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) all of

the Politan Group Shares and, therefore, Politan Management may be deemed to be the beneficial owner of all of the Politan Group Shares.

As the general partner of the Politan Funds, Politan GP may be deemed to have the shared power to vote or to direct the vote of (and the

shared power to dispose or direct the disposition of) all of the Politan Group Shares, and therefore Politan GP may be deemed to be the

beneficial owner of all of the Politan Group Shares. Mr. Koffey, including by virtue of his position as the Managing Partner and Chief

Investment Officer of Politan and as the Managing Member of Politan Management and Politan GP, may be deemed to have the shared power

to vote or direct the vote of (and the shared power to dispose or direct the disposition of) all of the Koffey Shares.

IMPORTANT INFORMATION AND WHERE TO FIND IT

POLITAN STRONGLY ADVISES ALL STOCKHOLDERS OF MASIMO

TO READ ITS DEFINITIVE PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS TO SUCH PROXY STATEMENT AND OTHER PROXY MATERIALS FILED BY POLITAN

WITH THE SEC AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE

ON THE SEC’S WEBSITE AT WWW.SEC.GOV. THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS ARE ALSO AVAILABLE ON THE SEC WEBSITE,

FREE OF CHARGE, OR BY DIRECTING A REQUEST TO THE PARTICIPANTS’ PROXY SOLICITOR, D.F. KING & CO., INC., 48 WALL STREET, 22ND

FLOOR, NEW YORK, NEW YORK 10005 STOCKHOLDERS CAN CALL TOLL-FREE: (888) 628-8208.

Investor Contact

D.F. King & Co., Inc.

Edward McCarthy

emccarthy@dfking.com

Media Contacts

Dan Zacchei / Joe Germani

Longacre Square Partners

dzacchei@longacresquare.com / jgermani@longacresquare.com

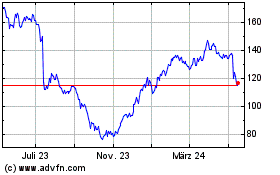

Masimo (NASDAQ:MASI)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

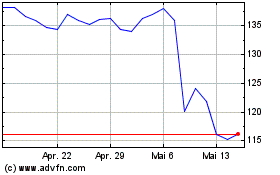

Masimo (NASDAQ:MASI)

Historical Stock Chart

Von Dez 2023 bis Dez 2024