0000921299false00009212992023-07-212023-07-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): July 21, 2023 |

FIBROGEN, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36740 |

77-0357827 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

409 Illinois Street |

|

San Francisco, California |

|

94158 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 415 978-1200 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.01 par value |

|

FGEN |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Interim Chief Executive Officer

On July 25, 2023, FibroGen, Inc. (the “Company”), announced that the Board of Directors (the "Board") has appointed Thane Wettig, age 58, to the position of Interim Chief Executive Officer (“Interim CEO”), effective July 23, 2023. He succeeds Enrique Conterno, who has resigned as Chief Executive Officer and from the Board, and who will remain with the Company as Special Advisor to the Interim CEO through August 8, 2023. Mr. Conterno’s resignation on July 21, 2023 was not the result of any disagreement with the Company. The Company would like to thank Mr. Conterno for his service as Chief Executive Officer and on the Board.

Mr. Wettig, who has served as the Company’s Chief Commercial Officer since June 2020, has more than 30 years of global biopharmaceutical leadership and commercial experience. Mr. Wettig previously served as Chief Commercial Officer and Metabolic Franchise Head at Intarcia Therapeutics. Prior to joining Intarcia in 2018, Mr. Wettig served as Chief Marketing Officer (Vice President of Global Marketing, Strategy and Alliance Management) for Lilly Diabetes, leading the development and launch of multiple blockbuster diabetes medicines during a period of unprecedented growth of Lilly’s diabetes business. Mr. Wettig began his career at Lilly in 1990. He was promoted to Vice President of Global Marketing for Diabetes Brands in 2004, and assumed the role as Chief Marketing Officer for Lilly Diabetes when it was formed in 2009. Mr. Wettig also played an integral role in the design and management of Lilly’s highly successful diabetes alliance between Lilly and Boehringer-Ingelheim. He is recognized throughout the industry as a seasoned executive with extensive brand building and launch experience. Mr. Wettig received his M.B.A. and B.A. in biology from Washington University in St. Louis.

Thane Wettig Offer Letter

The Company has entered into an employment offer letter, dated July 23, 2023 (the “Offer Letter”), with Mr. Wettig. The Offer Letter has no specified term and Mr. Wettig’s employment with the Company will be on an at-will basis. The material terms of the Agreement are summarized below.

Base Salary and Bonus. Mr. Wettig will receive an additional monthly salary enhancement of $10,000 on top of his annualized base salary of $545,000. He will remain eligible for an annual bonus under the Company’s Non-Equity Incentive Plan with a target amount of 50% of his base salary for the period he has served as Chief Commercial Officer and a target amount of 75% of his base salary (as enhanced) for the period he serves as Interim CEO. His base salary, additional salary stipend and bonus are subject to annual review.

Severance Terms. While serving as Interim CEO, in the event Mr. Wettig’s employment with the Company terminates for any reason, he will be entitled to certain unpaid and accrued payments and benefits. However, if Mr. Wettig’s employment is terminated by the Company for “cause,” he will be entitled only to limited payments and benefits consisting primarily of earned but unpaid salary and earned but unused paid time off.

Change-in-Control Severance Terms. As part of his service as Chief Commercial Officer, the Company entered into its form of change-in-control severance agreement with Mr. Wettig, dated as of June 22, 2023 (the “CIC Severance Agreement”). This CIC Severance Agreement was amended for the term of his service as Interim CEO by the Offer Letter. Under the terms of the Offer Letter, if Mr. Wettig’s employment is terminated by the Company without “cause” and other than due to death or disability, or he resigns for “good reason,” in either case, in connection with or within 12 months following the effective date of a change in control of the Company (“CIC Termination”), or if Mr. Wettig’s employment is terminated by the Company without “cause” and other than due to death or disability outside the foregoing circumstances (“Ordinary Course Termination”), he will be entitled to receive the severance payments and benefits set forth below, subject to his timely execution (and non-revocation) of a release of claims in our favor within 60 days following the date of such termination of employment. Mr. Wettig’s relinquishment of the Interim CEO role and resumption of duties as Chief Commercial Officer will not be deemed either a termination by the Company without “cause” or a voluntary resignation by him for “good reason.”

CIC Termination

• a cash severance payment equal to 24 months of his base salary then in effect;

• a cash severance payment equal to 1.5 times his current target bonus;

• subject to his timely election of continuation coverage under the Consolidated Omnibus Budget Reconciliation Act of 1985, as

amended, or another state law equivalent (“COBRA”), payment by us of COBRA premiums for him and his eligible dependents

for a period of up to 18 months following the date of his termination of employment; and

• all outstanding equity awards, including all outstanding stock options, restricted stock unit awards, and performance restricted

stock unit awards held by him will become fully vested and exercisable as of a date immediately prior to the date of his

termination of employment.

Ordinary Course Termination

• a cash severance payment equal to 18 months of his base salary then in effect; and

• subject to his timely election of continuation coverage under COBRA, payment by us of COBRA premiums for him and his

eligible dependents for a period of up to 18 months following the date of his termination of employment.

Except as described above, the terms and conditions applicable to his existing CIC Severance Agreement will remain in full force and effect.

Notwithstanding the foregoing, to the extent that Mr. Wettig would be entitled to a greater level of severance payments and benefits under the terms and conditions of a severance plan or policy provided by us or our successor to the Company’s other employees being terminated in connection with or within 12 months following a change in control of the Company but for the existence of the change in control severance agreement, he will be entitled to receive the greater of the severance payments and benefits provided under such plan or policy or the change in control severance agreement.

The foregoing descriptions of the Offer Letter and the Company’s form of CIC Severance Agreement are qualified in their entirety by reference to the full text of the Offer Letter, which is filed as Exhibit 10.1, to this Current Report on Form 8-K and is incorporated by reference herein, and the Company’s form of CIC Severance Agreement which was filed as Exhibit 10.4 to the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, filed with the Securities and Exchange Commission (the “SEC”) on May 8, 2023, and is incorporated by reference herein. The Company also previously entered into its standard form indemnification agreement with Mr. Wettig, which was filed as Exhibit 10.27 to the Company’s Registration Statement on Form S-1 (File No. 333-199069) filed with the SEC on October 23, 2014, and is incorporated by reference herein.

There are no arrangements or understandings between Mr. Wettig and any other persons pursuant to which he was selected as Interim CEO. There are also no family relationships between Mr. Wettig and any director or executive officer of the Company and he has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Enrique Conterno Consulting Agreement

In connection with the resignation of Mr. Conterno, the Company entered into a Consulting with Mr. Conterno, dated July 23, 2023 (the “Consulting Agreement”), and effective August 9, 2023, to provide services relating to the Company’s business at the direction of Mr. Wettig and the Company’s Board Chair, Mr. Schoeneck. In accordance with the Consulting Agreement, Mr. Conterno will receive $35,000 per month, prorated for partial months, and his stock awards will continue to vest in accordance with the existing terms applicable to such awards. The Consulting Agreement will continue until September 30, 2023, and may be extended by mutual agreement. The preceding summary of the Consulting Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Consulting Agreement which is filed as Exhibit 10.2 to this Current Report on Form S-K and incorporated by reference herein.

Item 8.01 Other Information.

On July 25, 2023, the Company issued a press release announcing the appointment of Thane Wettig as the Interim CEO and the resignation of Mr. Conterno as CEO and as a member of the Board, as described above. A copy of this press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

FIBROGEN, INC. |

|

|

|

|

Date: |

July 25, 2023 |

By: |

/s/ Michael Lowenstein |

|

|

|

Michael Lowenstein

Chief Legal Officer |

Exhibit 10.1

July 23, 2023

Thane Wettig

915 Oak Terrace Road

Westfield, IN 46074

Dear Thane,

FibroGen, Inc. (“FibroGen” or the “Company”) is pleased to offer you the position of Interim Chief Executive Officer (“Interim CEO”), reporting to the Board of Directors (the “Board”), effective July 23, 2023 (the "Effective Date"). The terms of your employment will remain as currently in effect, with the exception of the changes set forth below.

1.Compensation. FibroGen will continue to pay you an annual salary of $545,000.00, payable in bi-monthly installments on our regular paydays in accordance with FibroGen's standard payroll policies. In addition, you will receive a $5,000 stipend per pay period, less applicable withholdings, in recognition of your additional responsibilities as Interim CEO. Your stipend will begin as of the Effective Date. The position is classified as exempt and therefore not eligible for overtime pay. The first and last payment by FibroGen to you will be adjusted, if necessary, to reflect a commencement or termination date other than the first or last working day of a pay period. During your employment at FibroGen you may not be employed by, or consult with, any other company without the express written authorization of the Chairman of the Board of FibroGen.

2.Equity Awards. You will continue to be eligible for equity incentive grants, as authorized by the FibroGen Compensation Committee from time to time and pursuant to the terms and conditions of the FibroGen Equity Plan effective on the date of acceptance of this letter (the “Equity Plan”), as may be amended or modified from time to time. Your existing equity awards will continue to vest on the terms and conditions applicable to such awards.

3.Bonus Plan. You will continue to be eligible to participate in FibroGen’s Incentive Compensation Plan (the “Bonus Plan”), adopted by FibroGen for its employees on such terms as the Board may determine in its discretion.

Under the terms of the Bonus Plan, both corporate and individual performance is assessed annually and subject to final approval by the Board. The target amount, prorated for the periods you have served (or will serve) as Chief Commercial Officer and Interim CEO, shall be 50% and 75%, respectively based on your aggregate annualized pay for each such period, respectively (i.e. including the stipend for the period of your service as Interim CEO). To remain eligible, employees must maintain satisfactory performance and be in an active status on the day of payment. Payments are expected to occur no later than 15th of March in the year following the performance cycle.

4.Severance. As you know, you are a party to a Change in Control and Severance Agreement dated June 22, 2023 (the “CIC Agreement”) that provides for defined severance benefits upon certain events, subject to terms and conditions set forth in the CIC Agreement. During the period of time that you are serving as Interim CEO, the following amendments to your CIC Agreement will be in effect:

a)References to “base salary” shall refer to aggregate salary including the stipend for service as

b)Section 3(a)(i) – All references to eighteen (18) shall be changed to twenty-four (24) and the reference to one (1) shall be changed to one-and-a-half (1.5).

c)Section 3(b)(i) – All references to twelve (12) shall be changed to eighteen (18).

d)Section 3(b)(i) – The reference to twelve (12) shall be changed to eighteen (18).

When you cease serving as Interim CEO, these terms will cease, and you will again be subject to the terms of the CIC Agreement that were in effect as of the effective date of the CIC Agreement. You further acknowledge and agree that the end of your service as Interim CEO and return to serving as a bona fide Executive Vice President, Chief Commercial Officer will not constitute “Good Reason” as defined in the CIC Agreement and will not be treated as termination by the Company without “Cause” (as defined in the CIC Agreement).

In the event of conflict between the terms contained in this offer letter and any other document, the terms of this offer letter (including any amendment to this letter) shall control. FibroGen reserves the right to amend the terms contained in this offer letter from time to time.

Thank you for your continued service to FibroGen.

Sincerely,

_______________________________

Jim Schoeneck

Chairman of the Board

ACCEPTED AND AGREED TO this

_______Day of _______________, 2023

Exhibit 10.2

Consulting Agreement

This Consulting Agreement (“Agreement”) dated as of July 23, 2023, is effective as of August 9, 2023 (“Effective Date”), by and between FibroGen, Inc., a Delaware corporation with its principal offices located at 409 Illinois Street, San Francisco, California 94158 and its subsidiaries (collectively “FibroGen”) and Enrique Conterno, an individual residing at 3014 Breakers Drive, Corona del Mar, CA 92625 (“Consultant”).

The Parties hereby agree as follows:

1.CONSULTANCY. FibroGen hereby retains Consultant and Consultant hereby accepts such retention, commencing on the Effective Date of this Agreement and continuing until September 30, 2023 thereafter at which time this agreement will be completed (“Term”), unless such Term is extended by the Parties by mutual written consent.

2.SERVICES. Consultant shall provide consultation services to FibroGen relating to FibroGen business, including support to the Interim CEO and Board Chairperson and such other services as requested by FibroGen (“Services”). All Services to be provided by Consultant under this Agreement shall be initiated on behalf of FibroGen by Thane Wettig or Jim Schoeneck (as the coordinators of all requests) or their designated representatives or successor. The Consultant has no arrangement or relationship with any other party that is competitive with the interests of FibroGen in the subject matter of this Agreement and will not enter into any such arrangement or relationship during the Term of this Agreement. All deliverables to be delivered by Consultant (“Deliverables”) under this Agreement shall be delivered in a manner suitable for its intended use.

3.EMPLOYMENT OF ASSISTANTS; ASSIGNMENT. This Agreement is for the personal services of Consultant based on Consultant’s unique expertise and assistants may not be utilized, and the Agreement may not be assigned by Consultant, nor shall it be assignable by operation of law without the prior written consent of FibroGen.

4.COMPENSATION; EQUITY AWARD VESTING. FibroGen agrees to pay to Consultant and Consultant agrees to accept for Consultant’s Services under this Agreement $35,000.00 USD per month for Services, pro-rated for partial months.

FibroGen agrees to pay Consultant within ten (10) days of the end of each month, provided that Consultant has submitted a properly completed, signed and dated IRS Form W-9 to FibroGen. If travel is required to perform Services, all travel expenses must be pre-approved in writing by FibroGen and in compliance with FibroGen’s then-current travel policy, and FibroGen shall reimburse Consultant’s reasonable out-of-pocket travel expenses, in accordance with such travel policy. All such invoices relating to this Agreement must be sent to.

Accounts Payable (L: )

FibroGen Inc.

409 Illinois Street

San Francisco, CA 94158

AP@FibroGen.com

Consultant shall continue to vest in Consultant’s outstanding equity awards with the Company in accordance with the terms thereof for the term of this Agreement.

5.TIMES AND PLACES OF PROVIDING SERVICES. Consultant shall generally have the discretion to determine the times and places of rendering Services as well as the method of accomplishing Consultant’s Services. FibroGen may reasonably request that Consultant perform some Services at FibroGen’s principal office or other locations, which request should be reasonably considered by Consultant.

6.EQUIPMENT, DOCUMENTATION AND SPECIFICATIONS.

(a) Consultant shall supply all equipment and instruments required to perform the Services under this Agreement on location at FibroGen, except when such equipment (including computer, printer, record storage cabinets, telephone, Fax machine, and related information technology equipment) or supplies are unique to FibroGen, in which case FibroGen shall provide Consultant with such equipment, instruments, documentation and specifications as may be reasonably required by Consultant for the performance of Services. Such equipment, instruments, documentation and specifications shall at all times remain the property of FibroGen. Consultant shall use all such provided equipment and instruments for its intended purpose in a safe manner and in strict compliance with FibroGen’s or its vendors’ instructions and all applicable laws, rules, and regulations.

(b) Upon expiration or termination of this Agreement, Consultant shall promptly deliver to FibroGen all equipment and instruments furnished by FibroGen hereunder, documentation and specifications, as well as all records, manuals, books, blank forms, letters, notes, notebooks, reports, data, schematics, drawings, designs, or copies of the foregoing, and all other trade secrets, property, and confidential information of FibroGen including, but not limited to, all documents that in whole or in part contain any trade secret or Confidential Information (as defined in Section 7) of FibroGen which are in Consultant’s possession or under Consultant’s control, and further including any of the above stored in electromagnetic media such as ROMs, discs, tapes or cards, and Consultant shall not retain in Consultant’s possession or control any such materials or copies or embodiments thereof without the prior express written consent of FibroGen in each instance.

(a) “Confidential Information” means information disclosed to Consultant or is generated or becomes known to Consultant as a consequence of or through performance of Services for FibroGen, and includes trade secrets and any other proprietary information relating to the business and/or field of interest of FibroGen or of any entity which controls, is controlled by, or under common control with FibroGen including, but not limited to, information relating to inventions, disclosures, processes, systems, methods, formulas, patent applications, machinery, materials, manufacturing techniques, research activities and plans, costs of production, contract forms, prices, volume of sales, promotion methods, business secrets, financial information, lists of names or classes of customers, and information of third parties to whom FibroGen owes a duty of confidentiality. For clarity, Inventions, Data, and Deliverables are deemed part of Confidential Information. Information shall not be considered Confidential Information to the extent Consultant can demonstrate upon competent written proof that such

2

Consulting Agreement

Ref:

CONFIDENTIAL

information (i) is already known to the Consultant at the time of disclosure and such information was not acquired directly or indirectly from FibroGen, (ii) is in the public domain prior to or becomes part of the public domain after disclosure other than through breach of this Agreement by Consultant or unauthorized acts or omissions of Consultant; or (iii) is disclosed in good faith to Consultant by an independent third party lawfully entitled to make such disclosure.

(b) Consultant shall protect and keep all Confidential Information in strict confidence and trust and use the same standard of care used by Consultant to protect her own confidential information, but in any event, shall use at least a reasonable standard of care to protect FibroGen’s Confidential Information. Consultant may use Confidential Information solely for the purpose of providing Services under this Agreement. Consultant shall not disclose any Confidential Information to any third party without FibroGen’s prior written consent. Except to the extent required in the performance of Services for FibroGen, or as otherwise pre-approved by FibroGen in writing, Consultant will not directly, indirectly or otherwise, use, permit others to use, disseminate, disclose, lecture upon or publish articles containing any Confidential Information. The Consultant hereby agrees that for any violation of this Section 6, FibroGen shall be entitled, in addition to any other remedies it may have, to specific performance, injunctions or other appropriate orders to correct or restrain any such breach by Consultant. Upon expiration of this Agreement or termination of this Agreement, or otherwise upon the request of FibroGen, Consultant will promptly return all Confidential Information to FibroGen (including copies and embodiments thereof) in Consultant’s possession or under Consultant’s control or, if so requested by FibroGen, destroy such information (and provide certification of such destruction to FibroGen), except that one (1) secure copy thereof may be retained in her archives solely to demonstrate compliance with the terms of this Agreement. Consultant will not withhold from FibroGen any Confidential Information as a means of resolving any dispute. Consultant will not utilize Confidential Information for any purpose except to render the Services.

8.OWNERSHIP; INTELLECTUAL PROPERTY.

(a) “Inventions” means any and all intellectual property which: (i) are conceived, reduced to practice or made by Consultant for FibroGen under this Agreement, or (ii) result from Services performed by Consultant, individually or in conjunction with others, for FibroGen; or (iii) are made, conceived or reduced to practice with FibroGen’s equipment, supplies, facilities or Confidential Information. Inventions shall include, without limitation: (x) discoveries, inventions, concepts and ideas, whether patentable or not, processes, methods, formulas, compositions, techniques, articles and machines, as well as improvements thereof; and (y) trade secrets, trademarks, copyrights and know-how relating to the business and/or field of interest of FibroGen or any entity which controls, is controlled by or under common control with FibroGen. In additional consideration of the fees paid to Consultant, the parties hereby expressly agree that any and all copyrights relating to any and all works of authorship created by Consultant under this Agreement that are protectable under the copyright laws of the United States are and shall be the sole property of FibroGen.

(b) All Inventions shall be the sole and exclusive property of FibroGen.

(c) Except as otherwise expressly provided herein, Consultant hereby agrees to, without royalty or other further consideration to Consultant therefor, but at the reasonable expense of FibroGen:

3

Consulting Agreement

Ref:

CONFIDENTIAL

(i) As promptly as known or possessed by Consultant, disclose to FibroGen all information with respect to any Invention conceived, reduced to practice or made by Consultant or of which Consultant becomes aware;

(ii) Assign all right, title and interest in and to any such Inventions to FibroGen. Whenever requested to do so by FibroGen, Consultant shall promptly execute assignments and other related instruments to effect the assignment of all proprietary interests in and to such Inventions to FibroGen as FibroGen shall deem reasonably necessary to apply for and obtain letters patent, trademark and/or copyright registrations of the United States and of foreign countries for said Inventions and to assign and convey to FibroGen or FibroGen’s nominee the sole and exclusive right, title and interest in and to the Inventions or any applications, patents and registrations thereon;

(iii) Whenever requested to do so by FibroGen, deliver to FibroGen evidence for interference purposes or other legal proceedings. FibroGen shall reimburse Consultant’s reasonable pre-approved out-of-pocket expenses, including travel expenses for such delivery; and

(iv) Do such other acts as may be reasonably necessary in FibroGen’s sole opinion to obtain and maintain United States and foreign letters patents, trademark and/or copyright registrations for Inventions. If Consultant should be required to perform such acts after the termination or expiration of this Agreement, FibroGen shall reimburse Consultant’s reasonable out-of-pocket expenses, including travel expenses and pay Consultant at a reasonable rate for performing such other acts so long as such performance does not also include Services included in Subsection (b) above.

(d) All Data and Deliverables under this Agreement are and shall be the sole property of FibroGen.

(e) Consultant hereby (i) acknowledges and agrees that Consultant has no interests in Confidential Information, Data, Deliverables or Inventions, and (ii) covenants that she will not lien or encumber, or otherwise cause, permit or consent to the granting of a lien or encumbrance of the Confidential Information, Data, Deliverables or Inventions.

10.INDEPENDENT CONTRACTOR STATUS. It is the express intention of the Parties that Consultant is an independent contractor and not an employee, agent, joint venturer or partner of FibroGen. Nothing in this Agreement shall be interpreted or construed as creating or establishing the relationship of employer and employee between FibroGen and Consultant. Both Parties acknowledge that Consultant is not an employee for state or federal tax purposes. Consultant shall retain the right to perform Services for others during the Term of this Agreement, provided such service does not constitute a conflict of interest as set forth in Section 1 or violate or threaten the confidentiality and non-use provisions set forth in Section 8 above. Neither party hereto shall be liable for any act or omission of the other party or for any obligation or debt incurred by the other.

Consultant shall be obligated to pay any and all applicable social security taxes and federal, state and local income taxes, unemployment insurance and other charges and shall be responsible for making appropriate filings and payments to the applicable taxing authorities, including payments of all withholding and payroll taxes due on compensation received hereunder. It is Consultant’s responsibility to comply with all laws relating to workers’ compensation insurance, and it is expressly understood that

4

Consulting Agreement

Ref:

CONFIDENTIAL

FibroGen shall not provide workers’ compensation insurance for Consultant or for any of Consultant’s employees or agents. Consultant shall indemnify, defend and hold FibroGen harmless for any and all claims arising out of injury, disability, or death of Consultant and Consultant’s employees or agents resulting from the performance of the Services.

11.LIMITATION OF LIABILITY. The entire liability of the parties with respect to the performance by Consultant of the duties hereunder is set forth in this Agreement. In no event shall either party be liable for any indirect, incidental, special or consequential damages arising out of or in connection with the Services, whether or not FibroGen has been advised or is otherwise on notice of such possibility. Moreover, in no event shall either party be liable for any claims for personal injury or for property damage arising out of or resulting from Services rendered by Consultant hereunder. In any event, except to the extent of a party’s gross negligence, willful misconduct, each party’s liability pursuant to this Section 13 shall be limited to the aggregate amounts paid under this Agreement and further disclaims any liability for incidental, collateral, special or consequential damages, losses or expenses.

12.NO EXPORT. Consultant acknowledges that Confidential Information or other information disclosed in connection with the Services may be considered technical data that is subject to compliance with the export control laws and regulations of the United States, and hereby agrees to comply with such laws.

13.NOTICE. Any notice required or permitted to be given hereunder shall be mailed by registered or certified mail, with return receipt requested, overnight courier, or delivered by hand to the party to whom such notice is required or permitted to be given when mailed. If mailed, any such notice shall be deemed to have been given when mailed, as evidenced by the postmark at the point of mailing. If delivered by hand, any such notice shall be deemed to have been given when received by the party to whom notice is given, as evidenced by written and dated receipt of the receiving party.

Any notice to FibroGen shall be addressed to:

FibroGen Inc.

Legal Department

409 Illinois Street

San Francisco, CA 94158

Any notice to the Consultant shall be addressed to:

Enrique Conterno

3014 Breakers Drive,

Corona del Mar

CA 92625

Either Party may change the address to which notice to it is to be addressed by notice as provided herein.

14.TERMINATION. Notwithstanding any other provision of the Agreement, FibroGen may terminate this Agreement upon written notice to Consultant. Consultant may terminate this Agreement upon thirty (30) days written notice to FibroGen.

5

Consulting Agreement

Ref:

CONFIDENTIAL

15.SURVIVAL OF CERTAIN AGREEMENTS. The covenants and agreements set forth in Sections 7-12, 14, and 18-21 shall survive termination of this Agreement and Consultant’s Services hereunder and remain in full force and effect regardless of the cause of such termination.

16.BINDING EFFECT. This Agreement shall be binding upon and shall inure to the benefit of the Parties hereto and their successors and assigns.

17.SEVERABILITY. If any provision of this Agreement shall be held to be invalid, illegal or unenforceable, the validity, legality or enforceability of the remaining provisions shall not be in any way affected or impaired thereby.

18.GOVERNING LAW. This Agreement shall be governed by the laws of the State of California and the United States of America, without reference to conflict of laws principles. All actions or proceedings relating to this Agreement shall be maintained in a court located in the City and County of San Francisco, California and the Parties hereto consent to the jurisdiction of said court and waive any objection to said venue.

19.ENTIRE AGREEMENT. This Agreement contains the entire agreement of the Parties relating to the subject matter hereof, and supersedes all prior and contemporaneous negotiations, correspondence, understandings and agreements of the Parties, except as otherwise provided herein, relating to the subject matter hereof. It may be amended only by an agreement in writing signed by the Parties.

20.THIRD PARTY BENEFICIARIES. The provisions set forth in this Agreement are for the sole benefit of the Parties hereto and their successors and assigns, and shall not be construed as conferring any rights on any other persons.

21.COUNTERPARTS. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. Counterparts may be signed and delivered by facsimile and/or via portable document format (pdf), each of which shall be binding when sent.

IN WITNESS WHEREOF, the Parties have executed this Consulting Agreement as of the Effective Date.

|

|

|

|

|

FibroGen, Inc. |

|

Enrique Conterno |

By: |

|

|

By: |

|

Name: |

|

|

Name: |

|

Title: |

|

|

Title: |

|

6

Consulting Agreement

Ref:

CONFIDENTIAL

Exhibit 99.1

FibroGen Announces Leadership Transition

Appoints Thane Wettig as Interim Chief Executive Officer

Wettig succeeds Enrique Conterno and brings over 30 years of global pharmaceutical leadership

SAN FRANCISCO, July 25, 2023 (GLOBE NEWSWIRE) -- FibroGen, Inc. (NASDAQ: FGEN), today announced the appointment of Thane Wettig as the Company’s interim Chief Executive Officer effective as of July 23, 2023. Mr. Wettig has served as FibroGen’s Chief Commercial Officer and a key member of the senior leadership team since June 2020. Mr. Wettig succeeds Chief Executive Officer Enrique Conterno, who resigned due to personal reasons. To support Mr. Wettig, Mr. Conterno will serve as a Special Advisor to the CEO during a transition period.

“Thane has been a highly effective leader for the Company over the last three years, and we have full confidence he will deliver as our Interim CEO. I look forward to working closely with him as we advance the Company’s strategic priorities,” said Jim Schoeneck, Chairman of the FibroGen Board of Directors.

“I am energized to have the opportunity to lead FibroGen and create value for shareholders and patients through our pamrevlumab phase 3 readouts, advancing our innovative pipeline, and continuing to build on our success with roxadustat in China and the nearly 30 other countries in which it is approved,” said Wettig. “We have a strong cash position, and have built a great team at FibroGen, including a highly experienced and collaborative leadership team. I am grateful to have the opportunity to continue our work as we apply groundbreaking science with the goal of helping patients around the world.”

“I have worked with Thane for many years and am confident that he will lead our world-class management team in continuing to execute on our late stage pamrevlumab programs, expand our rapidly growing roxadustat business in China and other territories, and accelerate development of our early-stage oncology pipeline,” said Conterno.

“On behalf of the board, I would like to thank Enrique for his commitment to patients and to FibroGen over the past three and a half years,” said Schoeneck. “Enrique has been key in building the Company’s strong team and culture, enhancing the product pipeline, and driving both late-stage clinical execution and roxadustat commercial success in China.”

Mr. Wettig, who has served as the Company’s Chief Commercial Officer since June 2020, has more than 30 years of global biopharmaceutical leadership and commercial experience. Mr. Wettig previously served as Chief Commercial Officer and Metabolic Franchise Head at Intarcia Therapeutics. Prior to joining Intarcia in 2018, Mr. Wettig served as Chief Marketing Officer (Vice President of Global Marketing, Strategy and Alliance Management) for Lilly Diabetes, leading the development and launch of multiple blockbuster diabetes medicines during a period of unprecedented growth of Lilly’s diabetes business. Mr. Wettig began his career at Lilly in 1990, and served in multiple leadership roles of increasing responsibility during his Lilly tenure. He is recognized throughout the industry as a seasoned

executive with extensive strategy, brand building and leadership experience. Mr. Wettig received his M.B.A. and B.A. in biology from Washington University in St. Louis.

About FibroGen

FibroGen, Inc. is a biopharmaceutical company committed to discovering, developing, and commercializing a pipeline of first-in-class therapeutics. The Company applies its pioneering expertise in connective tissue growth factor (CTGF) biology and hypoxia-inducible factor (HIF) to advance innovative medicines for the treatment of unmet needs. Pamrevlumab, an anti-CTGF human monoclonal antibody, is in clinical development for the treatment of locally advanced unresectable pancreatic cancer (LAPC), metastatic pancreatic cancer, and ambulatory Duchenne muscular dystrophy (DMD). Roxadustat (爱瑞卓®, EVRENZOTM) is currently approved in China, Europe, Japan, and numerous other countries for the treatment of anemia in CKD patients on dialysis and not on dialysis. Roxadustat is in clinical development for chemotherapy-induced anemia (CIA) in China. FibroGen recently expanded its research and development portfolio to include product candidates in the immuno-oncology space along with an exclusive license for FOR46. For more information, please visit www.fibrogen.com.

Forward-Looking Statements

This release contains forward-looking statements regarding FibroGen’s strategy, future plans and prospects, and the development and commercialization of the company’s product candidates. These forward-looking statements include, but are not limited to, statements about FibroGen’s plans and objectives and typically are identified by use of terms such as “may,” “will”, “should,” “on track,” “could,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue” and similar words, although some forward-looking statements are expressed differently. FibroGen’s actual results may differ materially from those indicated in these forward-looking statements due to risks and uncertainties related to the continued progress and timing of its various programs, including the enrollment and results from ongoing and potential future clinical trials, and other matters that are described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, each as filed with the Securities and Exchange Commission (SEC), including the risk factors set forth therein. Investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this release, and FibroGen undertakes no obligation to update any forward-looking statement in this press release, except as required by law.

Contacts: FibroGen, Inc.

Investors:

Meichiel Keenan

mkeenan@fibrogen.com

Media:

Michael Szumera

mszumera@fibrogen.com

v3.23.2

Document And Entity Information

|

Jul. 21, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 21, 2023

|

| Entity Registrant Name |

FIBROGEN, INC.

|

| Entity Central Index Key |

0000921299

|

| Entity Emerging Growth Company |

false

|

| Securities Act File Number |

001-36740

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

77-0357827

|

| Entity Address, Address Line One |

409 Illinois Street

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94158

|

| City Area Code |

415

|

| Local Phone Number |

978-1200

|

| Entity Information, Former Legal or Registered Name |

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

FGEN

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

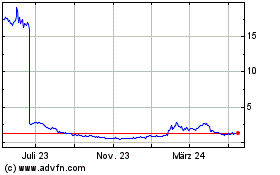

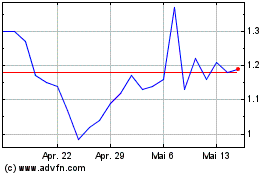

FibroGen (NASDAQ:FGEN)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

FibroGen (NASDAQ:FGEN)

Historical Stock Chart

Von Mai 2023 bis Mai 2024