UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the Month of February 2024

_______________________

Commission File Number 000-28998

ELBIT SYSTEMS LTD.

(Translation of Registrant’s Name into English)

Advanced Technology Center, P.O.B. 539, Haifa 3100401, Israel

(Address of Principal Corporate Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

x Form 20-F o Form 40-F

Attached hereto as Exhibit 1 and incorporated herein by reference is the Registrant’s proxy statement to be mailed to the Registrant's shareholders on or about March 5, 2024.

Attached hereto as Exhibit 2 and incorporated herein by reference is the Registrant’s proxy card to be mailed to the Registrant's shareholders on or about March 5, 2024.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| ELBIT SYSTEMS LTD. (Registrant) |

| By: /s/ Pinchas Confino Adi |

| Name: | Pinchas Confino Adi |

| Title: | Corporate Secretary |

Dated: February 21, 2024

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | Description | |

| 1. | | February 21, 2024 |

| 1.A | | |

| 2. | | February 21, 2024 |

February 21, 2024

Dear Fellow Shareholder,

You are cordially invited to attend the Elbit Systems Ltd. Extraordinary General Meeting of Shareholders to be held at our offices at the Advanced Technology Center, Haifa, Israel, on Tuesday, April 9, 2024, at 2:00 p.m. Israel time.

The agenda of the meeting and the proposals to be voted on are described in the accompanying Proxy Statement. For the reasons described in the Proxy Statement, the Board of Directors recommends that you vote “FOR” the proposals as specified in the enclosed proxy card.

We look forward to greeting all the shareholders who attend the meeting. However, whether or not you are able to attend, it is important that your shares be represented at the meeting. Therefore, at your earliest convenience, please complete, date and sign the enclosed proxy card and return it promptly in the provided pre-addressed envelope so that it is received at least twenty-four (24) hours before the meeting (i.e., before 2:00 p.m. Israel time, on April 8, 2024). If your shares are held in “street name” (i.e., through a broker or other nominee), please follow the instructions on your voting instruction form in order to submit it to your broker or nominee. If your shares are registered with a member of the Tel-Aviv Stock Exchange Ltd. (the “TASE”), you may vote through means of an electronic vote as further detailed in the proxy statement, no later than twenty-four (24) hours before the meeting (i.e., before 2:00 p.m. Israel time, on April 8, 2024).

Thank you for your cooperation.

Very truly yours,

DAVID FEDERMANN

Chair of the Board of Directors

BEZHALEL MACHLIS

President and Chief Executive Officer

ELBIT SYSTEMS LTD.

NOTICE OF THE COMPANY’S EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

Haifa, Israel

February 21, 2024

This is notice that the Extraordinary General Meeting of Shareholders (the “Meeting”) of Elbit Systems Ltd. (the “Company” or “Elbit Systems”) will be held at the Company’s offices at the Advanced Technology Center, Haifa, Israel, on Tuesday, April 9, 2024, at 2:00 p.m. Israel time.

It is proposed that at the Meeting the shareholders adopt resolutions for the following purposes (each referred to as the “Proposal” and collectively the “Proposals”):

1.to approve the amended compensation policy of the Company, substantially in the form attached as Exhibit A to the accompanying Proxy Statement; and

2.to approve the amended employment agreement of the Company’s President and Chief Executive Officer, Mr. Bezhalel Machlis.

Further details with respect to the Proposals are included in the accompanying Proxy Statement.

The approval of each Proposal is subject to the majority requirements as set forth in the enclosed Proxy Statement.

Only shareholders of record at the close of business on Monday, March 4, 2024 (the “Record Date”) have the right to receive notice of, and to vote at, the Meeting and any adjournments or postponements of the Meeting. All shareholders are cordially invited to attend the Meeting in person.

Shareholders may vote their shares by attending the Meeting and voting their shares in person, by completing the enclosed proxy card or a voting instruction form (if applicable) or in some cases by casting an electronic vote, as described below. A form of proxy card for use at the Meeting and a return envelope for the proxy card are enclosed. In order to be counted for purposes of voting at the Meeting, a properly signed proxy card must be received by the Company at least twenty-four (24) hours before the Meeting (i.e., before 2:00 p.m. Israel time, on April 8, 2024). Shareholders who hold their shares in “street name” may either direct the record holder of their shares how to vote their shares (by completing a voting instruction form) or obtain a legal proxy from the record holder to vote at the Meeting on behalf of the record holder together with proof of such record holder’s shares ownership on the Record Date.

A shareholder whose shares are registered with a member of the Tel-Aviv Stock Exchange Ltd. (the “TASE”) is required to prove share ownership in order to vote their shares in person at the Meeting or by proxy. Each such shareholder must provide the Company with an ownership certificate (as of the Record Date) from that TASE member. Each such shareholder is entitled to receive the ownership certificate at a branch of the TASE member or by mail (in consideration of mailing fees only), and is also entitled to receive, at no charge, a link to the text of the proxy card and to any Position Statement (as defined below) posted on the website of the Israel Securities Authority (the “ISA”) (unless the shareholder has notified the TASE member prior to the Record Date that the shareholder is not so interested with respect to a particular securities account).

The ISA has set up an electronic voting system for shareholder meetings of Israeli companies whose shares are listed on the TASE via its online platform. Shareholders are able to vote their shares through this system, following a registration process, no later than twenty-four (24) hours before the Meeting, i.e., by Monday, April 8, 2024, at 2:00 p.m., Israel time.

Shareholders are permitted to express their position on the Proposals by submitting a written statement (a “Position Statement”), through the Company, to the other shareholders. Position Statements should be submitted to the Company at its registered offices, at Elbit Systems Ltd., Advanced Technology Center, Haifa 3100401, Israel, to the attention of Mrs. Adi Pinchas Confino, Corporate Secretary, no later than the close of business on Sunday, March 31, 2024.

A form of the proxy card and a copy of each Position Statement submitted will be available to the public on the distribution website of the ISA at www.magna.isa.gov.il, on the website of the TASE at https://maya.tase.co.il/ and on the website of the Securities and Exchange Commission (the "SEC") at https://www.sec.gov/. A shareholder may apply to the Company directly in order to receive a copy of the proxy card and any Position Statement submitted.

A copy of the accompanying Proxy Statement, which includes the full version of the Proposals, may be reviewed at the Company’s offices at the Advanced Technology Center, Haifa, Israel, after coordinating in advance with the Corporate Secretary (Tel: 972-77-2945358) between 9:00 a.m. and 4:00 p.m., Israel time, Sunday – Thursday. The Proxy Statement may also be reviewed at the distribution website of the ISA at www.magna.isa.gov.il, on the website of the TASE at https://maya.tase.co.il/, on the website of the SEC at https://www.sec.gov/ and on our website at www.elbitsystems.com.

By Order of the Board of Directors,

DAVID FEDERMANN

Chair of the Board of Directors

BEZHALEL MACHLIS

President and Chief Executive Officer

ELBIT SYSTEMS LTD.

Advanced Technology Center

P.O. Box 539

Haifa 3100401, Israel

PROXY STATEMENT

This Proxy Statement is provided to the holders of ordinary shares, nominal value 1.00 New Israeli Shekel (“NIS”) per share (the “Shares”), of Elbit Systems Ltd. (the “Company” or “Elbit Systems”), in connection with the solicitation by the Company’s Board of Directors (the “Board”) of proxies for use at the Company’s Extraordinary General Meeting of Shareholders to be held at the Company’s offices at the Advanced Technology Center, Haifa, Israel, on Tuesday, April 9, 2024 at 2:00 p.m., Israel time (the “Meeting”), or at any adjournment or postponement of the Meeting, as specified in the accompanying Notice of the Company’s Extraordinary General Meeting of Shareholders.

It is proposed that at the Meeting the shareholders adopt resolutions for the following purposes (each referred to as a “Proposal” and, collectively, as the “Proposals”):

1.to approve the amended compensation policy of the Company, substantially in the form attached as Exhibit A to the Proxy Statement (the “Amended Compensation Policy”); and

2.to approve the amended employment agreement of the Company’s President and Chief Executive Officer, Mr. Bezhalel Machlis.

Shares represented by properly signed and unrevoked proxies will be voted in the manner directed by the persons designated as proxies.

QUORUM AND VOTING REQUIREMENTS

Only shareholders of record at the close of business on Monday, March 4, 2024 (the “Record Date”) have the right to receive notice of, and to vote at, the Meeting, and any adjournments or postponements of the Meeting. Mailing of this Proxy Statement and the accompanying materials will commence on or about Tuesday, March 5, 2024.

On February 12, 2024, the Company had forty-four million, four hundred fifty-three thousand eight hundred and fifty (44,453,850) Shares outstanding. Each Share is entitled to one vote on each of the matters presented to our shareholders at the Meeting.

The Meeting will be properly convened with a quorum if at least two (2) shareholders are present in person, by proxy or by a voting instrument, holding or representing, in the aggregate, at least one-third (1/3) of the issued voting Shares. If a quorum is not present within one-half (1/2) hour after the time set for the Meeting, the Meeting will be adjourned and will be reconvened one (1) week later at the same time and place unless other notice is given to the shareholders by the Board. If at such adjourned meeting a quorum is not present within one-half (1/2) hour of the time for the adjourned meeting, then any two (2) shareholders who together represent at least ten percent (10%) of the shareholders’ voting power, present in person, by proxy or by a voting instrument, will be considered a quorum.

Joint holders of Shares should note that, according to the Company’s Articles of Association, the vote, whether in person, by proxy or by a voting instrument, of the senior of the joint holders of any voted Share will be accepted over any vote(s) of the other joint holders of that Share. For this purpose, seniority will be determined by the order in which the joint holders’ names appear in the Company’s Register of Shareholders.

The approval of each Proposal requires the affirmative vote of a majority of the voting power in the Company present at the Meeting either in person, by proxy or by a voting instrument, and voting on the Proposal, provided that either: (i) such majority includes a majority of the Shares voted at the Meeting by shareholders who are not Controlling Shareholders (as defined below) and do not have a Personal Interest (as defined below) in the approval of the Proposal, disregarding abstentions; or (ii) the total number of Shares voted against the approval of the Proposal by shareholders referred to in sub-section (i) does not exceed two percent (2%) of the total voting rights in the Company.

The approval of each Proposal requires the affirmative vote of a majority of the voting power in the Company present at the Meeting either in person, by proxy or by a voting instrument, and voting on the Proposal, provided that either: (i) such majority includes a majority of the Shares voted at the Meeting by shareholders who are not Controlling Shareholders (as defined below) and do not have a Personal Interest (as defined below) in the approval of the Proposal, disregarding abstentions; or (ii) the total number of Shares voted against the approval of the Proposal by shareholders referred to in sub-section (i) does not exceed two percent (2%) of the total voting rights in the Company.

Under the Israeli Companies Law 5759-1999 (the “Companies Law”):

“Personal Interest” means a shareholder’s personal interest in an act or a transaction of a company, including the personal interest of his or her Relatives (as defined below) or of an entity in which such shareholder or his or her Relative is an Interested Party (as defined below). Personal Interest excludes a personal interest arising solely from holding a company’s shares and includes a Personal Interest of any person voting pursuant to a proxy provided to him or her by another person with respect to the proposal, even if the person providing the proxy does not have a Personal Interest. The vote of a person who is voting by a proxy provided to him or her on behalf of another who has a Personal Interest will also be seen as a vote of a person with a Personal Interest, whether the discretion to vote is in the hands of the voter or not.

“Relative” means a person’s (a) brother, sister, parent, grandparent or descendant, (b) spouse, or (c) the spouse’s brother, sister, parent or descendant (or in each case the spouse thereof).

“Interested Party” means any person that either:

(a) holds five percent (5%) or more of an entity’s issued share capital or voting rights;

(b) has the right to appoint a director to an entity’s board of directors or the chief executive officer thereof; or

(c) is a member of an entity’s board of directors or serves as the chief executive officer thereof.

“Controlling Shareholder” means, for purposes of each Proposal and elsewhere as specifically referenced in this proxy statement, any shareholder who has the ability to direct the Company’s activity, including any shareholder holding 50% or more of the “means of control” of the Company. “Means of control” is defined under Israeli law as any one of the following: (i) the right to vote at a general meeting of the Company, or (ii) the right to appoint directors of the Company or its chief executive officer. In addition, solely for purpose of the voting requirement of each Proposal, “Controlling Shareholders” includes any shareholder holding 25% or more of the Company's voting rights at the General Meeting, so long as there is no other person who holds more than 50% of the voting rights in the Company. For the purpose of this definition, two or more persons who hold rights in the Company, and each of whom has a personal interest in approval of the same transaction by the Company, shall be considered as a single holder.

In connection with the above and for the purpose of each Proposal, each shareholder who attends the Meeting in person, by proxy or by a voting instrument will advise the Company or indicate in the proxy card or the voting instrument, as the case may be, whether or not that shareholder is a Controlling Shareholder or has a Personal Interest in the approval of such Proposal. Failure to advise or indicate as described above will require the Company to assume that such shareholder has a Personal Interest in the approval of such Proposal, and disqualify such shareholder’s vote on the Proposal. The Company may not assume that a shareholder who signs and returns a proxy card without a specific indication as to the lack of Personal Interest of such shareholder, has no Personal Interest with respect to each of the Proposals.

VOTING BY PROXY AND ELECTRONIC VOTING

Shareholders may vote their Shares by attending the Meeting and voting their Shares in person, by completing the enclosed proxy card or a voting instruction form (if applicable), or in some cases by casting an electronic vote, as described below.

A form of proxy card for use at the Meeting is enclosed. By appointing a “proxy” or, with respect to “street name” beneficial owners, by returning a properly completed voting instruction form, shareholders may have their Shares voted at the Meeting whether or not they attend. If a properly executed proxy card in the attached form is received by the Company at least twenty-four (24) hours prior to the Meeting (i.e., before 2:00 p.m. Israel time, on April 8, 2024), the Shares represented by the proxy will be voted in the manner directed by the persons designated as proxies. “Street name” beneficial owners of Shares should return their voting instruction form by the date and time set forth therein. Shareholders who, at the close of business on the Record Date, either (i) hold Shares through a bank, broker or other holder of record that itself is a Company shareholder or (ii) appear on a participant list of a securities depository with respect to Shares, are considered to be beneficial owners of Shares held in “street name.”

Shareholders who hold their Shares in “street name” may either direct the record holder of their Shares how to vote their Shares (by completing a voting instruction form), or obtain a legal proxy from the record holder to vote at the Meeting on behalf of the record holder together with proof of such record holder’s Share ownership on the Record Date. Shareholders who hold their Shares through a member of the Tel Aviv Stock Exchange (the “TASE”) and intend to vote their Shares at the Meeting in person or by proxy must deliver to the Company, via messenger or registered mail, proof of ownership issued by the applicable bank or broker, confirming their ownership of the Shares as of the Record Date, prepared in accordance with the requirements of the Israeli Companies Regulations (Proof of Ownership of Shares for Voting at General Meetings), 5760-2000.

Shareholders are requested to complete, date and sign the enclosed proxy card or (as applicable) the voting instruction form, and return them promptly. Even if you plan to attend the Meeting, we recommend that you also submit your proxy card or voting instruction form as described in this Proxy Statement so that your vote will be counted if you later decide not to attend the Meeting.

If you receive a proxy card and provide specific instructions (by marking a box on the proxy card) with regard to a Proposal, your Shares will be voted as you instruct. Unless otherwise indicated on the proxy card or in the electronic vote, and to the extent permitted by law and applicable stock exchange requirements, Shares represented by a properly signed and received proxy card in the enclosed form or in an electronic form will be voted in favor of the Proposals. Abstentions will not be treated as either a vote “for” or “against” a Proposal, although they will be counted to determine if a quorum is present. Thus, if you sign and return your proxy card (or complete your electronic vote) without giving specific instructions with respect to a Proposal, your Shares will be voted in favor of such Proposal.

If you are a “street name” holder and you sign and return your voting instruction form without giving specific instructions with respect to a Proposal, your broker will not be permitted to vote your Shares with respect to such Proposal (commonly referred to as a “broker non-vote”). In such circumstances, your Shares will be included in determining the presence of a quorum at the Meeting but will not be considered “present” for the purpose of voting on such Proposal. Such Shares have no impact on the outcome of the voting on such Proposal.

If you sign and return your proxy card or voting instruction form, the persons named as proxies will vote on the Proposals as instructed.

The Israel Securities Authority (the “ISA”) has set up an electronic voting system for shareholder meetings of Israeli companies whose shares are listed on the TASE via its online platform. Shareholders are able to vote their Shares through the system, following a registration process, no later than twenty-four (24) hours before the Meeting (i.e., before 2:00 p.m. Israel time, on April 8, 2024).

Shareholders may revoke any proxy card or electronic vote prior to their exercise by filing with the Company a written notice of revocation or a properly signed proxy card of a later date (if received by the Company at least twenty-four (24) hours prior to the Meeting), or by voting through the electronic voting system on a later date (if done at least twenty-four (24) hours prior to the Meeting), or by voting in person at the Meeting. If you hold your Shares in “street name,” you may change your voting instructions by following the directions provided to you by your broker, bank or other nominee.

Solicitation of proxies will be made primarily by mail; however, in some cases proxies may be solicited by telephone or other personal contact. The Company will pay for the cost of the solicitation of proxies, including the cost of preparing, assembling and mailing the proxy materials, and will reimburse the reasonable expenses of brokerage firms and others for forwarding proxy materials to shareholders.

This Proxy Statement and the accompanying proxy card also constitute a “voting deed” (Ktav Hatzba’a) for the purpose of Regulation 3(c) of the Israeli Companies Regulations (Concessions for Companies Whose Shares are Listed on a Stock Exchange Outside of Israel), 5760-2000 (the “Concessions Regulations”).

POSITION STATEMENTS

Shareholders are permitted to express their position on the Proposals by submitting a written statement (a “Position Statement”), through the Company, to the other shareholders. Position Statements should be submitted to the Company at its registered offices, at Elbit Systems Ltd., Advanced Technology Center, Haifa 3100401, Israel, to the attention of Mrs. Adi Pinchas Confino, Corporate Secretary, no later than the close of business on Sunday March 31, 2024. Reasonable costs incurred by the Company in connection with a Position Statement will be borne by the submitting shareholder.

Currently, the Company is not aware of any other matters that will come before the Meeting. If any other matters properly come before the Meeting, the persons designated as proxies in the proxy card intend to vote in accordance with their best judgment on such matters. One or more shareholders holding at least one percent (1%) of the Company’s total voting rights may present proposals for consideration at the Meeting by submitting their proposals to the Company at its registered offices, at Elbit Systems Ltd., Advanced Technology Center, Haifa 3100401, Israel, to the attention of Mrs. Adi Pinchas Confino, Corporate Secretary, no later than the close of business on Wednesday, February 28, 2024. If the Company determines that a shareholder’s proposal is appropriate for inclusion in the Meeting agenda, a revised agenda will be published by the Company.

BENEFICIAL OWNERSHIP OF SECURITIES

BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of February 12, 2024, we had forty-four million four hundred fifty-three thousand eight hundred and fifty (44,453,850) Shares outstanding. The following table sets forth specific information as of February 12, 2024, to the best of our knowledge, concerning:

•beneficial ownership of more than 5% of our outstanding Shares; and

•the number of Shares beneficially owned by all of our executive officers and directors as a group. Shares that a person has the right to acquire within 60 days of February 12, 2024 through the exercise of options under the 2018 Equity Plan (see footnote (5) below) are deemed outstanding for purposes of computing the percentage ownership of the person holding such rights, but are not deemed outstanding for purposes of computing the percentage ownership of any other person, except with respect to the percentage ownership of all executive officers and Board members as a group.

| | | | | | | | |

Name of Shareholder | Number of Shares Beneficially Owned | Percentage of Ownership(1) |

|

Federmann Enterprises Ltd. 99 Hayarkon Street Tel-Aviv, Israel | 19,580,342(2) | 44.05% |

|

Clal Insurance Enterprises Holdings Ltd.

36 Raul Walenberg St.

Tel-Aviv, Israel | 2,234,996(3) | 5.03% |

|

|

|

All executive officers and directors as a group (23 persons) | 106,275(4)(5) | less than 1% |

(1) Based on 44,453,850 Shares outstanding as of February 12, 2024.

(2) Includes 3,836,458 Shares held by Heris Aktiengesellschaft (Heris). Heris is owned, directly and indirectly, by Federmann Enterprises Ltd. (FEL). FEL is controlled by Beit Federmann Ltd. (BFL). BFL is controlled by Beit Bella Ltd. (BBL) and Beit Yekutiel Ltd. (BYL). Michael Federmann is the controlling shareholder of BBL and BYL. He is also a member of the Company’s Board and the chair of the board and the chief executive officer of FEL. Therefore, Mr. Federmann controls, directly and indirectly, the vote of Shares owned by Heris and FEL (approximately 44.05% of our outstanding Shares). In addition, Michael Federmann is the trustee of a trust on behalf of his sister, Irith Federmann-Landeau, that holds an indirect non-voting economic interest of approximately 7.7% in our outstanding Shares through an indirect approximately 17.5% non-voting interest in FEL. Michael Federmann and his sons, David (who also serves as chair of the Company’s Board), Gideon and Daniel Federmann, collectively hold an indirect economic interest equivalent to approximately 27.3% of our outstanding Shares, with Michael Federmann holding an approximately 7.6% economic interest and each of his sons an approximately 6.5% economic interest. In connection with loans obtained from time to time by FEL from two Israeli banks, FEL has pledged to the banks an aggregate of 3,000,000 of our Shares as security for the loans.

(3) Pursuant to a Schedule 13G filed by Clal Insurance Enterprises Holdings Ltd. (“Clal”) with the SEC on January 25, 2023, the Shares beneficially owned by Clal include (i) 55,075 Shares beneficially held for

Clal's own account and (ii) 2,179,921 Shares held for members of the public through, among others, provident funds and/or pension funds and/or insurance policies, which are managed by subsidiaries of Clal. These subsidiaries operate under independent management and make independent voting and investment decisions.

(4) This amount (i) does not include any Shares that may be deemed to be beneficially owned by Michael Federmann or David Federmann as described in footnote (2) above and (ii) includes Shares held by the spouse of a director, but the director disclaims beneficial ownership over the spouse's Shares.

(5) The Company’s 2018 Equity Incentive Plan for Executive Officers, as amended from time to time, (the “2018 Equity Plan”) includes a “Net Exercise Mechanism” that entitles the recipients to exercise options for the number of shares determined based on the excess, if any, of the fair market value of the shares underlying such options over the exercise price of such options, calculated based on the date of exercise. The number of Shares reflected above as owned by all executive officers and directors as a group was calculated based on a hypothetical exercise on February 12, 2024, which is a theoretical date. The number of Shares that will actually be issued will vary, depending on the date of exercise and the market price of the Shares on such date. The aggregate number of options granted to executive officers that are exercisable on or within 60 days following February 12, 2024 is 312,821 options.

PROPOSAL 1 - APPROVAL OF THE COMPANY’S AMENDED COMPENSATION POLICY

As required by the Companies Law, the Company has adopted a compensation policy regarding the terms of office and employment of its “office holders” (as such term is defined in the Companies Law). The members of the Board (the “Directors”), the Company’s Chief Executive Officer (the “CEO”) and the Company’s Executive Vice Presidents (the “EVPs”) (the CEO and the EVPs are collectively referred to as the “Executive Officers”) are considered “office holders”. The Company's current compensation policy was approved by the Company’s shareholders at the Extraordinary General Meeting of Shareholders held on April 7, 2021 (the “Current Compensation Policy”).

Pursuant to the Companies Law, a compensation policy of a publicly traded company such as the Company needs to be periodically reviewed by the compensation committee and the board of directors and needs to be re-approved every three years by (i) the board of directors, following the recommendation of the compensation committee and (ii) by the applicable majority of the company’s shareholders. In the event that the compensation policy is not approved by shareholders, the board of directors may nonetheless approve it, provided that the compensation committee and the board of directors, following further discussion of the matter and for specified reasons, determine that the approval of the compensation policy is in the best interests of the company.

The Compensation Committee and the Board considered a variety of factors in preparing the amended compensation policy (which is substantially in the form attached as Exhibit A to the Proxy Statement, the “Amended Compensation Policy”), including strong recent Company financial growth, developments at the Company and in industries in which the Company operates since 2021, a comparison of executive compensation with peer group companies in Israel and the U.S. and investor feedback.

Note that exchange rates used in this Proxy Statement to convert NIS to dollar amounts are based on the rate of one dollar to 3.68 NIS as of February 12, 2024. This exchange rate may change from time to time. Exchange rates relating to costs recorded with respect to the year ended December 31, 2022 are based on the exchange rate of 3.38, which represents the average weighted dollar - NIS exchange rate for the date of payments for each of the months during 2022.

Strong Company Financial Growth

Company revenues in 2022 were approximately $5.5 billion, growing from approximately $4.7 billion in 2020, an increase of approximately 18%. This revenue growth was mainly organic and also included a contribution from acquisitions during the period. At the end of 2022, the Company reported a record order backlog of approximately $15.1 billion, compared to an order backlog of $11.0 billion at the end of 2020, an increase of approximately 37%. The order backlog further increased to $16.6 billion as of September 30, 2023, providing the Company with good visibility regarding its future revenues.

The Company's financial growth continued in the first nine months of 2023, with Company revenues increasing by approximately 32% compared to the first nine months of 2020. During this period, the Company also reported an improvement in additional financial parameters. For further information as to the Company’s financial parameters in recent years, see the Investor Overview as of November 2023, at: https://elbitsystems.com/ir-category/investor-relations/presentation-webcasts/.

The Compensation Committee and the Board believe that the growth in revenues and order backlog was due in significant part to successful marketing efforts led by the Company’s senior management and a relevant portfolio of solutions developed under management guidance. The growth in revenues and order backlog were also supported by acquisitions in the period, also led by senior management.

Principal Developments since Approval of the Current Compensation Policy

The sustained financial growth of the Company has been accompanied by several other relevant developments at the Company and in the industries in which it operates since 2021, including:

Increasingly complex Company operations and macroeconomic environment.

Along with growth in business activities, the total number of Company employees increased from approximately 16,676 at the end of 2020 to approximately 18,407 at the end of 2022, an increase of approximately 10%.

During the period, the macro-economic environment has presented a series of challenges, including the COVID-19 pandemic, supply chain disruptions and shortages of critical electronic components following the pandemic, changing labor markets and the surge in demand for our solutions following the outbreak of the Russia-Ukraine conflict in February 2022 and, most recently, the “Swords of Iron” war in Israel following a series of brutal attacks by the Hamas terrorist organization on towns and communities in southern Israel on October 7, 2023.

Despite these challenges, there were no material disruptions in Company operations during this period. Senior management implemented a variety of mitigation strategies to successfully address supply chain disruptions and reduce risks to the Company from inflationary pressures that arose following the COVID-19 pandemic and as part of the ongoing conflict between Russia and Ukraine. In the months following the start of the war in Israel, the Company's CEO and senior managers have made significant efforts to maintain business continuity as well as protect the safety of Company employees, all while facing challenges related to mobilization of personnel for reserve duty, relocation of certain production lines and supply chain disruptions, among others.

The Company has continued its strategic investments in R&D, building new and expanding existing facilities and the rollout of an enterprise resource planning (ERP) system. These investments are critical to delivering a variety of new Company projects, including a considerable number of large-scale programs that the Compensation Committee and Board believe are essential to providing the foundation for value creation over the longer term and transforming Elbit Systems into a larger and more profitable company.

Since approval of the Current Compensation Policy in 2021, the Company has also made strategic acquisitions, including the purchase of Sparton Corporation ("Sparton"), which was acquired by Elbit Systems of America in 2021. The acquisition of Sparton, a premier developer, producer and supplier of systems supporting undersea warfare for the U.S. Navy and allied military forces, is significant to the Company's long-term growth strategy, with a particular focus on expansion in the U.S. and global maritime markets.

The Board believes that the Company will be required to continue making investments and strategic acquisitions in the future in order to expand its global engineering and manufacturing footprint, leverage the growth in defense budgets and address increasing requirements for localization of Israeli defense procurement.

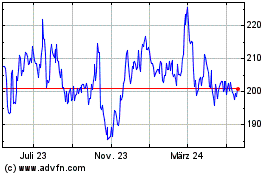

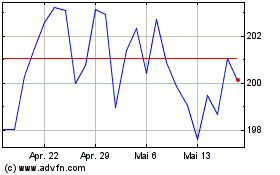

Since approval of the Current Compensation Policy, Company shareholders have benefitted from both share price appreciation and regular quarterly dividends, which increased from 44 cents a quarter in the fourth quarter of 2020 to 50 cents a quarter in the third quarter of 2023. As of December 31, 2023, the Company's market capitalization was NIS 34.4 billion on the TASE and $9.4 billion on Nasdaq, compared to NIS 18.7 billion at the TASE and $5.8 billion on Nasdaq in December 31, 2020.

In its 2022 annual report on Form 20-F (the “2022 Annual Report”), the Company introduced disclosure of five distinct operating segments, four product focused divisions in Israel and one geographic segment in the U.S. The Compensation Committee and the Board believe that the new disclosure structure will increase transparency, accountability and visibility of our divisional general managers, improve CEO oversight and increased focus on execution within each of our divisions.

Changes in the defense and security markets in which the Company operates.

The ongoing conflict between Russia and Ukraine has led to a noticeable increase in defense budgets around the world and particularly in Europe. During the first nine months of 2023, the Company’s European revenues increased by approximately 139% relative to the first nine months of 2020, and Europe has become the Company's most significant geography by revenues. The Compensation Committee and Board believe that the growth in European revenues was made possible by a decade long effort led by our President and CEO and the executive team to invest significant resources in developing a presence in multiple European countries.

In addition, the Abraham Accords signed since September 2020 between Israel, UAE, Morocco, Sudan and Bahrain have opened new markets for the Company that were historically inaccessible. These markets present significant potential for the Company but also require an investment of effort and resources, including significant management attention, to realize the potential.

More recently with the start of the “Swords of Iron” war in Israel on October 7, 2023, the Company has provided increased support to the Israel Ministry of Defense, which has materially increased its demand for our products and solutions.

Changes in labor market, globally and in Israel, following the COVID-19 pandemic and the increasing scope and scale of global technology companies with facilities in Israel.

In recent years, and particularly following the COVID-19 pandemic, the Company has witnessed an increase in competition for highly skilled, technologically capable employees and executives in countries in which it operates around the world. In Israel this competition was exacerbated by significant inflows of capital into public and private technology companies in 2021 and 2022, resulting in a series of public offerings and capital raises that increased the number of multi-billion-dollar global technology companies with facilities in Israel employing Israeli executives. This has resulted in increased demand for executives with a technological background and experience working in global companies such as Elbit Systems. The benchmarking analysis described below comparing executive compensation with peer group companies demonstrates this growing demand for high quality executive talent and the value our peer group companies ascribe to their executives.

To date, the Company has been successful in its efforts to retain and even increase the quality of its workforce, despite elevated competition for talent driven by buoyant capital markets and an increase in demand for technology sector workers. The Compensation Committee and Board believe that the ability to recruit and maintain key and highly qualified management remains one of the Company's ongoing challenges that the Amended Compensation Policy is designed to help address.

Benchmark Analysis

In order to develop the Amended Compensation Policy, the Compensation Committee conducted a thorough review of the Current Compensation Policy and evaluated various potential adjustments required to adapt it to the evolving competitive environment for senior executives in the principal markets where the Company operates, and especially in Israel where there is growing demand for executives capable of managing global companies. The process was carried out with the assistance of legal and financial expertise, and also included an analysis of benchmark information comparing the Company’s executive compensation with that of peer group companies in 2022, conducted by PricewaterhouseCoopers Advisory Ltd. (PWC Israel) (the “Benchmark Analysis”).

The Benchmark Analysis included information relating to two sample groups. Sample A included eight Israeli-based companies listed on the TASE and/or U.S. stock exchanges with the majority of their revenues and/or business activities outside of Israel, each with a market capitalization (“market cap“) of up to approximately 200% of the Company’s market cap – four companies with a market cap higher than that of the Company, and four companies with a market cap lower than that of the Company.1 Sample B included nine defense and defense services companies listed on U.S. stock exchanges that the Company considers competitors for its products and solutions, each with a market cap of up to approximately 200% of the Company’s market cap – four of the companies had a market cap higher than that of the Company, and five had a market cap lower than that of the Company.2 None of the companies in Sample B are incorporated in Israel.

The companies in Sample A are based in Israel, but at the same time are global companies conducting a majority of their business outside of Israel, as does the Company. For this reason, the Compensation Committee believes that the companies in Sample A are especially relevant from an executive employment perspective. The inclusion of Sample B was designed in part to take into account that approximately 27% of Elbit Systems’ revenues in 2022 and approximately 24% of its revenues in the first nine months of 2023 were derived from sales to North America, the largest single target market for the Company's products and solutions.

The Benchmark Analysis (including the information regarding market cap) was based on information published by the various companies in each sample group for fiscal year 2022 with respect to the following three compensation components: annual cost of salary, annual bonus and long-term incentive for the applicable vesting year. This peer group information was compared to corresponding compensation information for the Company’s Executive Officers in 2022.

1 Sample A included the following companies: Check Point Software Technologies Ltd., NICE Ltd., Teva Pharmaceutical Industries Limited, Amdocs Limited (according to PWC Israel, no detailed information on executive compensation was available), monday.com Ltd., ICL Group Ltd., SolarEdge Technologies, Inc. and CyberArk Software Ltd. Market cap was calculated by PWC Israel as of October 9, 2023.

2 Sample B included the following companies: Teledyne Technologies Inc., Booz Allen Hamilton Holding Corporation, Textron Inc., Leidos Holdings, Inc., Huntington Ingalls Industries, Inc., CACI International Inc., BWX Technologies, Inc., Science Applications International Corporation and Leonardo DRS, Inc. Market cap was calculated by PWC Israel as of October 9, 2023.

Based on these comparisons, the Compensation Committee and Board noted that the CEO’s total compensation in 2022 (comprised of all three of the components mentioned above) was lower than both the average and median of the Company peer group in both samples – indeed, the CEO pay was in the first quartile of the peer group companies in Sample A, and lower than any of the peer group companies in Sample B.

The Compensation Committee and the Board further noted, based on the comparison of peer group companies, that the total compensation (comprised of all three of the components mentioned above) of the Company’s EVPs in 2022 was below both the average and median of the peer group companies in both Sample A and Sample B – lower than any of the peer group companies in Sample A and in the first quartile of the peer group companies in Sample B. Total compensation of the Company’s EVPs in 2022 was calculated using the average of the total compensation for the Company’s four most highly compensated EVPs, as set forth in our 2022 Annual Report, after reducing a one-time retroactive provision made in 2022. With respect to peer group companies, in each case where comparative information about more than one VP was available, the average amount of compensation to such VPs was used.

Note that some peer group companies did not publish adequate information regarding all three components, and therefore in such cases the comparisons described above were made only to those companies that did publish such information (limiting the number of relevant companies in the sample group). For this reason, the Compensation Committee and the Board concluded that the parameter of “average” was more appropriate for comparison with peer group companies than “median”. The Benchmark Analysis used for the Compensation Committee and the Board’s review included further details regarding methodology which are not detailed in this Proxy Statement.

Following their development based on the factors described above, the Compensation Committee and the Board compared the proposed new ceilings under the Amended Compensation Policy for annual cost of salary, annual bonus and long-term incentive to the actual compensation of the three peer group samples for 2022. This comparison was done to assess whether the proposed new ceilings were reasonable in light of market practices at peer group companies, and is further detailed under “Benchmark Forward-Looking Comparison” below.

Investor Feedback

We value our shareholders and the ongoing feedback they provide to the Company about its operations and practices. In the process of developing the Amended Compensation Policy, the Compensation Committee and Board took into consideration a wide variety of feedback received from Company investors at regular meetings and quarterly earnings calls, as well as from policies regarding executive compensation available from certain institutional investors. In addition, the process included engagement with consultants in Israel and the U.S. and a review of various proxy voting guidelines from proxy advisor firms where applicable to the Company.

Corporate Governance Highlights

We place significant importance on our ESG (Environmental, Social and Governance) practices, including environmental, health and safety; corporate governance, ethics and anti-corruption; fair labor practices and human rights; supply chain compliance; and social responsibility to the communities in which we live and work. Our ESG policies, which are overseen by our Board and managed by our senior management, are consistent with our policy of emphasizing responsible and ethical business practices. Further information is available in our latest sustainability report available on the Company’s website.

We conduct our business activities and develop Company policies based on a firm commitment to ethical practices and corporate governance best practices. Our Board complies with leading corporate governance practices as set forth in our Board committee charters published on our website. We also promote gender diversity among our Board members and have adopted a policy of having at least 25% gender-diverse members on our Board. Our company-wide ethics compliance program incorporates a range of policies and procedures including a policy of zero tolerance for corruption. In recognition of our ESG policies and activities, we were awarded a “Platinum” rating in 2022 by Maala, a leading standards-setting organization in Israel for corporate social responsibility. Elbit Systems of America was recognized by Ethisphere as one of the World’s Most Ethical Companies.

None of our directors serves as an executive officer of the Company and a majority of our directors is “independent” as defined in applicable Nasdaq rules and under the Companies Law. Each of our Board committees, including our Compensation Committee and our Corporate Governance and Nominating Committee, is composed exclusively of directors who are independent. Nominees for appointment or election as a director are recommended by the Board’s Corporate Governance and Nominating Committee. The chair of our Compensation Committee is an External Director.

Compensation Committee and Board Conclusions

Considering all relevant information available to it, the Compensation Committee and the Board find that the Amended Compensation Policy is appropriate, among other reasons, due to:

(a)the Company’s unique character as a multi-billion-dollar global technology company that is publicly traded on Nasdaq and the TASE;

(b)the Company’s accomplishments in recent years, including revenue and order backlog growth, strategic acquisitions and successfully investing in key Company initiatives vital for future growth, each achieved while addressing the macro-economic challenges posed by the COVID-19 pandemic, the Russia-Ukraine conflict and the war in Israel;

(c)the growing responsibilities, duties and burdens imposed on the Company’s Executive Officers from the increasing complexity of the Company's business as a result of its recent financial growth and macro-economic challenges;

(d)the growing competition for talented executives in the technology sector and the Company’s desire to continue to attract, retain, reward and motivate over time highly skilled individuals with the necessary capabilities to manage the Company’s long-term business and worldwide operations and execute the Company’s strategy in the best interests of the Company and its employees, shareholders and other stakeholders;

(e)experience with the Current Compensation Policy;

(f)a comparison of compensation provided to Executive Officers in 2022 with that of peer group companies, which showed that both the CEO and EVPs total compensation (comprised of annual cost of salary, annual bonus and long-term incentive for the applicable vesting year) were below average and median in both sample groups surveyed;

(g)the desire to provide the Company’s Executive Officers with a balanced compensation package, including salaries, performance-motivating compensation and equity-based incentive programs and benefits that are competitive with peer group companies, reflecting both short and long-term incentives; and

(h)the goal of aligning Executive Officers’ compensation with the Company’s long-term goals and risk management strategy.

Proposed Amended Compensation Policy

After taking into consideration the matters described above and in view of our experience implementing the Current Compensation Policy, the Board, with the recommendation of the Compensation Committee, determined that it is desirable to retain the Current Compensation Policy, with certain amendments. Below is a summary of the principal changes proposed to the Current Compensation Policy as contained in the Amended Compensation Policy, the description of which is qualified in its entirety to the text of the Amended Compensation Policy itself, which is attached as Exhibit A to this Proxy Statement:

Variable Compensation Ratio: Pursuant to the Current Compensation Policy, “Variable Compensation” (cash bonuses and equity-based awards) will not exceed eighty percent (80%) of an Executive Officer’s total compensation package, on an annual basis. In order to allow greater flexibility in structuring the performance-based compensation of the Company’s Executive Officers and to further strengthen the alignment with shareholder interests, the Amended Compensation Policy proposes to amend this ratio so that Variable Compensation will not exceed eighty five percent (85%) of an Executive Officer’s total compensation package, on an annual basis.

Monthly Base Salary: The Current Compensation Policy establishes maximum monthly gross base salaries for Executive Officers as follows: (i) for the CEO, two hundred and fifty thousand shekels (NIS 250,000) (equal to approximately sixty eight thousand dollars ($68,000), with such amount subject to annual adjustment to reflect any increase in the Israeli Consumer Price Index (the “CPI”), and (ii) for an EVP, one hundred eighty thousand shekels (NIS 180,000) (equal to approximately forty nine thousand dollars ($49,000), subject to annual CPI adjustment.

In the year ended December 31, 2022, the Company recorded salary costs with respect to the CEO of approximately one million and three hundred thirty-eight thousand dollars ($1,338,000). As of February 12, 2024, the CEO’s monthly gross base salary is approximately two hundred sixty-five thousand and seventy shekels (NIS 265,070) (equal to approximately seventy-two thousand dollars ($72,000). The Amended Compensation Policy would raise the maximum monthly gross base salary payable to the CEO to three hundred thousand shekels (NIS 300,000) (equal to approximately eighty one thousand five hundred dollars ($81,500), with such amount subject to annual adjustment to reflect any increases in the CPI, and the monthly gross base salary payable to an EVP to two hundred thousand shekels (NIS 200,000) (equal to approximately fifty four thousand five hundred dollars ($54,500), subject to annual CPI adjustment.

The Compensation Committee and the Board considered that the monthly gross salary of the Company’s President and CEO, Mr. Bezhalel Machlis, has not changed since 2021 (other than due to increases in the CPI), and that his Existing Employment Terms (as defined in Proposal 2 of this Proxy Statement) require a review of those terms every three years. The Compensation Committee and Board also noted that, unlike certain other peer group companies, Elbit Systems does not have a full-time, highly-compensated chair of the Board. Rather, full management of the Company is vested in Elbit Systems' CEO, with the support of the Company's EVPs.

The Compensation Committee and the Board also considered the fact that the Company’s EVPs represent a relatively small and exclusive group of senior managers with substantial experience and expertise, most of whom have been employed by the Company for many years.3 The EVPs’ salaries are individually determined, taking into account their specific roles, responsibilities, backgrounds and other characteristics. Review of the EVPs’ salaries is usually conducted on a periodic basis and changes are made gradually with specific approvals as required by law.

In light of this analysis, the Compensation Committee and the Board believe that the proposed changes to base salary in the Amended Compensation Policy are necessary to take into account the increased complexity of managing a larger and more diverse business portfolio and the increasing responsibilities and challenges faced by the Executive Officers, as well as to attract and retain talented, qualified and experienced managers essential for the Company’s future growth. The proposed new ceilings for monthly base salary are intended to apply for a period of three years.

Annual Bonus:

Annual Bonus – CEO

The Current Compensation Policy provides that, subject to certain pre-conditions, the Company will pay to the CEO an annual bonus in an amount equal to the aggregate of the following: (i) zero point four percent (0.4%) of the Company’s Non-GAAP Net Profit attributable to shareholders (“Non-GAAP Net Profit”) as reflected in Elbit Systems’ annual financial results for the relevant fiscal year, and (ii) if both the Company’s Operating Cash Flow Goal and the Actual Operating Cash Flow (as both terms are defined below) are positive – zero point one percent (0.1%) of the Company’s Non-GAAP Net Profit multiplied by the Operating Cash Flow Factor (as defined below). Furthermore, the Current Compensation Policy sets forth a ceiling amount of two million dollars ($2,000,000) for an annual bonus payable to the CEO.

The “Operating Cash Flow Factor” is defined as the amount of net cash provided by operating activities (the “Operating Cash Flow”) as reflected in the Company’s annual financial results for the relevant fiscal year (the “Actual Operating Cash Flow”), divided by the Operating Cash Flow in Elbit Systems’ annual budget as approved by the Board for such fiscal year (the “Operating Cash Flow Goal”).

In the year ended December 31, 2022, the Company recorded total bonus costs with respect to the CEO of approximately one million, seven hundred and fourteen thousand dollars ($1,714,000).

The Compensation Committee and the Board determined that the existing quantitative objectives of Non-GAAP Net Profit and Operating Cash Flow are an effective and appropriate way to determining the CEO's annual bonus, since these quantitative measures closely align the CEO's compensation with the long-term performance of the Company. However, the formula for calculating such annual bonus was modified compared to the Current Compensation Policy, as follows:

•In light of significant inflationary pressures and rising interest rates in recent years and to reflect the Company’s enhanced efforts to improve profit margins and cash flow, it was determined to increase the

3 For information regarding the Executive Officers' experience and seniority, please see the Company's 2022 Annual Report, Item 6. – Directors, Senior Management and Employees – Directors and Executive Officers - Executive Officers.

weight of both components of the annual bonus formula: the component dependent upon Company profits and the component dependent upon cash flow.

•The condition in the cash flow component requiring positive cash flow was removed in order to allow for a situation where, for example, the Board decides to incur certain cash outflows in a specific year to support future growth, thereby potentially eliminating any positive cash flow.

•Instead, it was determined to impose minimum and maximum values to the cash flow component, with the minimum value also serving as a pre-condition for receipt of any portion of the cash flow component.

•The Compensation Committee and Board further determined to increase the bonus ceiling (which would remain in effect for the three years period of the Amended Compensation Policy) in view of the increasing complexity in managing the Company and desired growth in Company Non-GAAP Net Profit during the period. It was stressed however, that because of the linkage between the annual bonus to be paid to the CEO and the Company’s Non-GAAP Net Profit, if the Company’s growth in this respect is limited, the CEO’s annual bonus will be limited as well.

Specifically, under the Amended Compensation Policy, subject to certain pre-conditions, the Company will pay to the CEO an annual bonus in an amount equal to the aggregate of the following:

(i) zero point five percent (0.5%) of the Company’s Non-GAAP Net Profit as reflected in Elbit Systems’ annual financial results for the relevant fiscal year; plus

(ii) zero point two percent (0.2%) of the Company’s Non-GAAP Net Profit as reflected in Elbit Systems’ annual financial results for the relevant fiscal year, multiplied by the Operating Cash Flow Factor (as defined below), conditional on such Operating Cash Flow Factor being equal to or higher than 0.8.

Furthermore, the Amended Compensation Policy sets forth a ceiling amount of three million dollars ($3,000,000) for an annual bonus payable to the CEO (“Maximum CEO's Annual Bonus”).

“Operating Cash Flow” shall mean the amount of net cash provided by operating activities as reflected in Elbit Systems’ annual financial results.

“Operating Cash Flow Goal” shall mean the Operating Cash Flow in Elbit Systems’ annual budget as approved by the Board for the relevant fiscal year.

“Operating Cash Flow Factor” shall be equal to 1 (100%) if the Operating Cash Flow for the relevant fiscal year is equal to the Operating Cash Flow Goal. In case the Operating Cash Flow for the relevant fiscal year is lower or higher than the Operating Cash Flow Goal, the Operating Cash Flow Factor will be adjusted on a relative basis to reflect the percentage of the Operating Cash Flow compared to the Operating Cash Flow Goal, however the Operating Cash Flow Factor may not be lower than 0.8 (80%) nor higher than 1.2 (120%).

Accordingly, the Amended Compensation Policy provides that the advance payment on account of the CEO annual bonus that may be provided to the CEO upon approval of the Company’s financial results for the first half of the fiscal year (which must be returned to the Company in case such amount exceeds the CEO annual bonus for the full fiscal year), will be in an amount which shall not exceed 0.5% of the Company’s Non-GAAP Net Profit as reflected in such semi-annual financial results (as opposed to 0.4% in the Current Compensation Policy).

The following is an example of how the CEO’s annual bonus would be calculated under the Amended Compensation Policy given the following hypothetical financial results:

Non-GAAP Net Profit: $269,000,000

Operating Cash Flow Goal: $240,000,000

Operating Cash Flow: $230,000,000

Operating Cash Flow Factor: $230,000,000 / $240,000,000 = 0.958

Annual Bonus:

(i) 0.5% * $269,000,000 = $1,345,000; plus

(ii) 0.2% * $269,000,000 * 0.958 = $515,583

Total Annual Bonus: $1,860,583

In the example above, if the Operating Cash Flow was less than $192,000,000 (0.8 of the Operating Cash Flow Goal), the annual bonus would not include the additional 0.2% component at all. In addition, if the Operating Cash Flow was $288,000,000 (1.2 of the Operating Cash Flow Goal) or more, the Operating Cash Flow Factor would be limited to 1.2.

Below are additional examples of how the CEO’s annual bonus would be calculated under the Amended Compensation Policy given different hypothetical financial results (one with an Operating Cash Flow Factor less than 0.8 and one with an Operating Cash Flow Factor more than 1.2):

| | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP Net Profit | 0.5% of Non-GAAP Net Profit | Operating Cash Flow Goal | Operating Cash Flow | Operating Cash Flow Factor | Operating Cash Flow Factor after applying min/max | 0.2% of Non-GAAP Net Profit multiplied by Operating Cash Flow Factor | Total annual bonus ($) |

| 269,000,000 | 1,345,000 | 240,000,000 | 180,000,000 | 0.75 | - | - | 1,345,000 |

| 269,000,000 | 1,345,000 | 240,000,000 | 350,000,000 | 1.46 | 1.20 | 645,600 | 1,990,600 |

The Compensation Committee and Board developed these proposed changes to the CEO’s annual bonus considering the Company’s ambitious targets for its growth and operational improvement in the coming years and considering feedback from Company shareholders. The Compensation Committee and Board believe that the proposed changes will create a proper incentive for the CEO to meet these goals, closely aligning pay with performance and shareholder value. The Compensation Committee and Board also noted that the CEO’s annual bonus would be determined in accordance with clear financial parameters rather than based on the Board’s general discretion.

Annual Bonus – EVPs

Under the Current Compensation Policy, a target annual bonus is determined for each EVP, which is paid pursuant to the achievement of personally tailored performance measures, comprised of financial, business, operating and other objectives. The financial objectives account for 50% - 100% of the performance measurements, and the business, operating and other objectives account for the remainder thereof.

The Amended Compensation Policy retains the same arrangement for determining the annual bonus for EVPs, but provides an exception for EVPs at the Company’s headquarters (such as the Chief Legal Officer and Chief Human Resources Officer), for whom financial objectives may account for 25% - 100% of the performance measures, and the business, operating and other objectives may account for the remainder thereof. The Amended Compensation Policy also adds ESG and compliance measures as examples for other objectives.

The Compensation Committee and Board decided that business, operating and other objectives may be given greater emphasis in determining the annual bonus for EVPs at the Company’s headquarters in order to recognize the special role they play as “gate keepers” at the Company, and also to reflect the importance the Company places on ESG and compliance.

Neutralization of Extraordinary Events

In reviewing the annual bonus under the Amended Compensation Policy, the Compensation Committee and Board may adjust annual bonus objectives or pre-conditions for Executive Officers, when applicable, to neutralize the effects of material events that were not taken into account for purposes of determining the annual budget and/or the Executive Officer’s annual bonus objectives or pre-conditions (“Events”) as follows: changes in applicable accounting standards, laws or regulations, or in the interpretation thereof by a competent authority; material changes in interest or exchange rates; material acquisitions, restructuring or divestment of entities, businesses or assets; and material events out of the Company’s control with a broad effect on the market. In each case, the effect of such Events on annual bonus objectives and pre-conditions may only be neutralized to the extent they were not included in the annual budget and/or annual bonus objectives or pre-conditions.

Such adjustments may only relate to the impact of the Events on the various performance criteria underlying the annual bonus and pre-conditions, and such impact may be full or partial as determined by the Compensation Committee and Board. Such adjustments may either increase or decrease the paid annual bonus.

The Compensation Committee and Board may also approve an adjustment of such objectives or pre-conditions in case of the occurrence of an Event which is not listed above, or decide not to make any adjustments in case of an Event; however if any such decision results in an increase to the annual bonus, such increase will be considered a discretionary bonus and be subject to the ceilings set out under the “Special Bonus” section in the Amended Compensation Policy. In any case, the total annual bonus amount to be paid including any increase as aforementioned shall not exceed the Maximum CEO’s Annual Bonus or EVP's Maximum Annual Bonus (as defined in the Amended Compensation Policy), as the case may be.

The Compensation Committee and Board determined to add the neutralization provision to the Amended Compensation in order to better achieve the overall goal of the annual bonus program, which is to incentivize Executive Officers to achieve both personal objectives in their area of responsibility and the Company’s overall financial objectives. By permitting material exogenous Events to be neutralized and not taken into account for the purpose of determining the annual bonus objectives, the annual bonus program will be more closely aligned with the actual performance and achievements of Executive Officers and less affected by material events that are out of their control. The Compensation Committee and the Board also considered evolving market practice in Israel, where compensation policies of various companies surveyed include similar provisions.

Compensation Recovery (“Clawback”):

The Current Compensation Policy allows the Company, in case of an accounting restatement and subject to certain conditions, to recover from its Executive Officers any bonus compensation, net of taxes, which exceeded the amount that would have been paid under the financial statements, as restated, provided that such restatement occurs within 36 months of the bonus payment.

In addition to the clawback provision of the Current Compensation Policy, the Amended Compensation Policy would allow the Company, in the event of a dismissal for cause of an Executive Officer due to his or her breach of fiduciary duty to the Company, to recover from such Executive Officer the bonus compensation paid to him or her in the preceding 12-month period, net of taxes, subject to applicable law.

The Amended Compensation Policy also clarifies that the clawback provisions thereunder will not derogate from any other clawback or similar provisions by virtue of applicable laws, listing rules or under any other applicable clawback policy approved by the Board, including without limitation the Policy Regarding Recovery of Erroneously Awarded Compensation approved by the Board in November 2023 pursuant to Nasdaq requirements.

While the additional clawback provisions are not required by law and were not prompted by a specific event or occurrence at the Company, the Compensation Committee and Board determined that the addition is appropriate from a corporate governance point of view.

Equity-Based Compensation:

The Current Compensation Policy provides that the aggregate value of the benefit embedded in the granted equity-based awards, calculated on the date of grant in accordance with an acceptable valuation method (such as the Monte Carlo, Black-Scholes or Binominal options pricing models), will not exceed: (i) with respect to the CEO - one million eight hundred thousand dollars ($1,800,000) per year (the “Maximum CEO’s Equity Amount”), and (ii) with respect to an EVP - nine hundred thousand dollars ($900,000) per year.

The Amended Compensation Policy proposes to amend these amounts so that the aggregate value of the benefit embedded in the granted equity-based awards, calculated on the date of grant in accordance with an acceptable valuation method (such as the Monte Carlo, Black-Scholes or Binominal options pricing models), will not exceed:(i) with respect to the CEO – three million dollars ($3,000,000) per year (the “Maximum CEO’s Equity Amount”), and (ii) with respect to an EVP – one million one hundred thousand dollars ($1,100,000) per year.

In the year ended December 31, 2022, the Company recorded stock options costs with respect to the CEO of approximately one million six hundred and twelve thousand dollars ($1,612,000).

The Compensation Committee and Board have proposed several other changes to the award of equity-based compensation, as follows:

•Under the Current Compensation Policy, equity-based awards grants to Executive Officers vest over a minimal period of five (5) years. The Amended Compensation Policy amends the minimum vesting period to four (4) years.

•Under the Current Compensation Policy, Company equity-based compensation plans may include, among others, terms and conditions allowing acceleration of equity-based awards, subject to approval of the Compensation Committee and Board. The Amended Compensation Policy limits the circumstances in which acceleration would be permitted such that, for options granted after the Amended Compensation Policy enters into effect, acceleration would be permitted only in the following circumstances only, subject to Board approval: (i) death, disability or medical condition of an Executive Officer; (ii) change of control of the Company as a result of which the Company's shares are no longer listed on a stock exchange; (iii) acceleration of the next unvested portion in case of termination of employment of an Executive Officer, provided that either: (a) the termination of employment results from a change of control of the Company; or (b) the termination results from a retirement of an Executive Officer who has served the Company (including any of the Company’s subsidiaries) for at least ten (10) years and provided that no more than one (1) year of the vesting period remains.

•The Amended Compensation Policy also provides that the “Date of the Board Resolution” that serves as the basis for calculating the exercise price and grant date, among others, shall mean the date of the Board resolution with regards to the grant, unless otherwise determined by the Board. The Amended Compensation Policy also provides that the grant date and vesting may be conditioned upon additional terms to be determined by the Board. These changes from the Current Compensation Policy are intended to provide the Board with flexibility in setting additional conditions on a grant, including delaying a grant, or vesting of an equity-based award, as necessary to achieve the Company’s goals.

•The Amended Compensation Policy also provides that the Compensation Committee and Board may approve a one-time increase in the Maximum CEO’s Equity Amount by up to 50%, in the event of an exceptional significant strategic achievement which is expected to benefit the Company, as may be determined by the Compensation Committee and Board.

In recommending these changes, the Compensation Committee and Board considered among other things ongoing investor feedback and the Company’s goals of enhancing alignment between incentives provided by Executive Officers compensation and the long-term interests of the Company and its shareholders, strengthening the motivation and retention of Executive Officers over the long term and providing Executive Officers with a competitive compensation package relative to the market.

In addition, the Compensation Committee and Board also took into consideration that the maximum dilution as a result of equity-based awards granted to Executive Officers during the three-year term of the Amended Compensation Policy will remain as it is under the Current Compensation Policy and not exceed three percent (3%) of the Company’s issued and outstanding share capital, on a fully-diluted basis. In addition, the Compensation Committee and Board considered that the existing Company equity-based compensation plan (i) includes a “Net Exercise Mechanism,” under which the number of underlying shares to be issued upon exercise of options reflects only the benefit amount embedded in the option, (ii) allows for option grants, which unlike RSUs do not reward under performance, as the benefit to recipients embedded in such options is subject to share price appreciation and (iii) does not include an "evergreen" mechanism, under which additional shares are automatically available to the Company each year for grant under the plan.

Regarding the proposed increase in the maximum aggregate annual value of equity-based awards that may be granted to the CEO and EVPs, the Compensation Committee and Board determined that an increase was required in order for the Company to remain competitive and capable of attracting and retaining qualified and experienced Executive Officers able to contribute to the continued growth and success of the Company. In making this determination, the Compensation Committee and Board considered the Benchmark Analysis, which found that the long-term equity incentive provided to our CEO in 2022 was lower than any of the peer group companies in either sample group. Even in view of the Benchmark Forward-Looking Comparison (as described below), it was noted that the revised equity-based awards ceiling in the Amended Compensation Policy with respect to the CEO remains relatively low – in the first quartile of Sample A, and lower than any of the peer group companies in Sample B (with the information regarding peer group companies relating to historical compensation paid in 2022). This remains true even when considering an increase in the Maximum CEO's Equity Amount (which may be approved once by the Compensation Committee and Board under exceptional circumstances as described above). Even with such increase, the Maximum CEO's Equity Amount is below the average and median of Samples A and B.

In addition, the Compensation Committee and Board considered that options granted to Executive Officers in 2021 and 20224 have a vesting period of five years, which means a portion of these option will still be vesting when additional option grants are made under the Amended Compensation Plan. As a result, a portion of the value of options granted in 2021 and 2022 will be included when calculating the maximum annual aggregate value of equity-based awards that may be granted under the Amended Compensation Policy. For this reason, the Compensation Committee and Board determined that it was necessary to increase the annual maximum ceiling in order to allow for adequate additional grants of equity to be made during the term of the Amended Compensation Policy. For example, our CEO was granted 150,000 options in 2021, with an aggregated value of the benefit embedded in the options equal to approximately $870,000 per year, with a vesting period of five years, calculated in accordance with the Binominal valuation method. As of April 7, 2024, 60% of those options will have already vested. Nevertheless, in case of additional grants within the five-year period between 2021 and 2026, the value of the new grants will be added to the annualized value of the 2021 grant when applying the annual maximum ceiling under the Amended Compensation Policy.

Another factor considered by the Compensation Committee and Board in proposing to increase the maximum annual ceiling of equity-based awards is the considerable increased accounting value of Company options since approval of the Current Compensation Policy in 2021, calculated according to an accepted valuation method. This has resulted in part because of changes in the market price of the Company's share. The annual value of one option granted to the CEO in 2021 under the Binominal valuation method was approximately $5.80 (with a five-year vesting period), while the annual value of one option to be granted under the Amended Compensation Policy according to a valuation conducted with respect to a hypothetical option grant on February 14, 2024, would be approximately $11.11 (with a four-year vesting period).

The Compensation Committee and Board also noted that over the period since approval of the Current Compensation Policy, the Company has evolved into a larger and more substantial company in the global defense industry, as discussed above. The Compensation Committee and the Board believe that the geopolitical environment and increase in global defense spending present the potential for the Company to accelerate growth and expand its position as a leading global supplier to defense and security markets, which if achieved could be incrementally beneficial for the Company and its stakeholders. Therefore, the Compensation Committee and Board determined that it would be appropriate to define an extraordinary strategic achievement that would have the potential to accelerate the growth of the Company over and above the normal growth of the Company, and to properly compensate the CEO for its attainment. Accordingly, the Compensation Committee and Board believe it is necessary for the Amended Compensation Policy to allow a one-time increase of up to 50% to the Maximum CEO’s Equity Amount, subject to the approval of the Compensation Committee and Board, in the event of an exceptional significant strategic achievement.