false000073025500007302552024-05-222024-05-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 22, 2024 |

CalAmp Corp.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

0-12182 |

95-3647070 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

15635 Alton Parkway Suite 250 |

|

Irvine, California |

|

92618 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (949) 600-5600 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☒Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, $0.01 per share |

|

CAMP |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

Restructuring Support Agreement

On May 31, 2024, CalAmp Corp. (“CalAmp”) and its wholly-owned subsidiaries, CalAmp Wireless Networks Corporation, LoJack Global LLC and Synovia Solutions LLC (collectively, the “Company”) entered into a Restructuring Support Agreement (the “RSA”) with Lynrock Lake Master Fund LP (together with its direct and indirect affiliates, “Lynrock”), as lender under the Secured Term Loan Facility, and the holder of Secured Notes Claims (collectively, the “Consenting Lenders”). The RSA contemplates a financial restructuring of the Company’s debts by, among other things, (i) amending and restating the Secured Term Loan Facility with a lower interest rate and longer maturity date, (ii) converting the approximately $229 million of Convertible Senior Secured Notes held by Lynrock to equity, and (iii) paying allowed unsecured claims in full in cash or such other treatment so as to render such claims unimpaired. The Company will seek to effectuate the RSA through a joint prepackaged chapter 11 plan of reorganization (as amended, restated, supplemented or otherwise modified from time to time, the “Plan”) pursuant to which, among other things, the Company will become a private company. The Plan further contemplates that existing equity interests of CalAmp, including warrants, options, restricted stock units and preferred stock units, will be cancelled.

The foregoing description of the RSA does not purport to be complete and is qualified in its entirety by reference to the full text of the RSA which is attached as Exhibit 10.1 hereto and is incorporated herein by reference. Further, the foregoing description is subject to the risks and uncertainties and other factors set forth in the “Cautionary Statement Regarding Forward Looking Statements” included under Item 8.01 below.

Item 1.03. Bankruptcy or Receivership.

Chapter 11 Filing

On June 3, 2024 (the “Petition Date”), CalAmp and its wholly-owned subsidiaries, CalAmp Wireless Networks Corporation, LoJack Global LLC and Synovia Solutions LLC (collectively, the “Debtors”) filed voluntary petitions (the “Chapter 11 Cases”) for relief under chapter 11 of title 11 (“Chapter 11”) of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”).

The Debtors continue to operate their businesses as “debtors in possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court. The Debtors sought approval of a variety of “first day” motions containing customary relief intended to assure the Company’s ability to continue its ordinary course operations and make a smooth transition into Chapter 11.

The Company will seek an order (the “NOL Order”) regarding the Company’s common stock, par value $0.01 per share (the “Common Stock”). The NOL Order, if approved by the Bankruptcy Court, will be designed to assist the Debtors in preserving certain of their tax attributes by establishing, among other things, procedures (including notice requirements) that certain stockholders and potential stockholders must comply with regarding transfers of the Common Stock, as well as certain obligations with respect to notifying the Debtors of current stock ownership.

The Debtors will seek prompt confirmation of the Plan and to emerge from the Chapter 11 proceeding a significantly de-levered company.

Additional information about the Chapter 11 Cases, including access to Bankruptcy Court documents, is available online at https://cases/stretto.com/CalAmp, a website administered by a third-party bankruptcy claims and noticing agent. The documents and other information on this website are not part of this Current Report on Form 8-K and shall not be deemed incorporated by reference herein.

The foregoing description is subject to the risks and uncertainties and other factors set forth in the “Cautionary Statement Regarding Forward Looking Statements” included under Item 8.01 below.

Item 5.02. Departure of Directors and Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On May 22, 2024, Jill Frizzley was appointed to the Company’s Board of Directors (the “Board”). Ms. Frizzley was appointed to serve for a term expiring at the Company’s 2024 annual meeting of stockholders and until her successor is duly elected and qualified or until her earlier death, resignation or removal. The Board has determined that Ms. Frizzley qualifies as an independent director.

Ms. Frizzley currently serves as President of Wildrose Partners, LLC, an independent consulting company providing governance and related advisory services to corporations, a position she has held since 2019. Ms. Frizzley served as Counsel in the Business Finance &

Restructuring Group at Weil, Gotshal & Manges LLP from 2016-2019, and previously practiced in the Business Finance Group at Shearman & Sterling LLP from 2000-2016. Ms. Frizzley has served as a director on numerous public and private boards of directors.

In connection with her appointment to the Board, Ms. Frizzley and the Company entered into an Independent Director Agreement, dated as of May 22, 2024 (the “Independent Director Agreement”), pursuant to which Ms. Frizzley agreed to serve as a director of the Company. The Independent Director Agreement provides for a monthly fee of $35,000, without proration. This compensation is in lieu of the compensation Ms. Frizzley would otherwise be eligible to receive under the Company’s compensation program for non-employee directors.

The Board further approved the appointment of Ms. Frizzley to serve as the sole member of a special committee (the “Special Committee”). The purpose of this Special Committee is to investigate, review, and evaluate any matters of conflict, including (a) certain rights, authority, and powers in connection with any matters pertaining to any claims or causes of action of the Company in which a conflict of interest exists or is reasonably likely to exist between the Company (the “Conflict Matters”); and (b) the tasks of reviewing, negotiating, evaluating, opposing, prosecuting, litigating, proposing, approving and/or entering into settlement terms and conditions in response to, arising from, in connection with or related to the Conflict Matters. Ms. Frizzley’s appointment to the Special Committee was based upon the Board determination that she has no interest in any Conflict Matters and does not possess any material business, close personal relationships, or other affiliations, or any history of any such material business, close personal relationships, or other affiliations, with the Company or any of its equity holders, affiliates, directors, managers, officers, or other stakeholders that would cause her to be unable to exercise independent judgment based on the best interests of the Company or make decisions and carry out her responsibilities as a member of the Board.

There are no arrangements or understandings between Ms. Frizzley and any other person, pursuant to which Ms. Frizzley was selected as a director of the Company. There are no familial relationships between Ms. Frizzley and any director, executive officer or other employee of the Company. Ms. Frizzley has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Item 7.01. Regulation FD Disclosure.

On June 3, 2024, the Company issued a press release in connection with the filing of the Chapter 11 Cases. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

Item 8.01. Other Events.

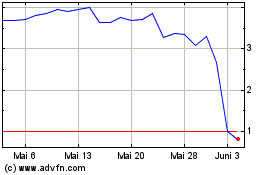

Cautionary Note Regarding the Company’s Securities

The Company cautions that trading in its securities during the pendency of the Chapter 11 Cases is highly speculative and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the actual recovery, if any, by holders of the Company’s securities in the Chapter 11 Cases. In particular, the Company believes that its equity holders could experience a complete loss on their investment, depending on the outcome of the Chapter 11 Cases.

Cautionary Statement Regarding Forward Looking Statements

This Current Report on Form 8-K, and certain materials CalAmp files with the SEC, as well as information included in oral statements or other written statements made or to be made by CalAmp, other than statements of historical fact, contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including but not limited to statements regarding the Chapter 11 Cases. These forward-looking statements are based on current expectations, estimates, assumptions, projections and management’s beliefs that are subject to change. There can be no assurance that these forward-looking statements will be achieved; these statements are not guarantees of future performance and are subject to certain risks, uncertainties, and other factors, many of which are beyond CalAmp’s control and are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Factors that could cause actual outcomes and results to differ materially from such forward-looking statements include, but are not limited to, the following: risks attendant to the Chapter 11 bankruptcy process, including the Company’s ability to obtain court approval from the Bankruptcy Court with respect to motions or other requests made to the Bankruptcy Court throughout the course of the Chapter 11 process; the effects of Chapter 11, including increased legal and other professional costs necessary to execute the Chapter 11 process and on the Company’s liquidity and results of operations (including the availability of operating capital during the pendency of Chapter 11); the length of time that the Company will operate under Chapter 11 protection and the continued availability of operating capital during the pendency of Chapter 11; the Company’s ability to continue funding operations through the Chapter 11 bankruptcy process, and the possibility that it may be unable to obtain any additional funding as needed; the Company’s ability to meet its financial obligations during the Chapter 11 process and to maintain contracts that are critical to its operations; the effect of the Chapter 11 filings on the Company’s relationships with vendors, regulatory authorities, employees and other third parties; possible proceedings that may be brought by third parties in connection with the Chapter 11 process and risks associated with third-party motions in Chapter 11; employee attrition and the Company’s ability to retain senior management and other key personnel due to the distractions and uncertainties; the impact and timing of any cost-savings

measures and related local law requirements in various jurisdictions; and the impact of litigation and regulatory proceedings. The Company’s business is subject to a number of risks, which are described more fully in CalAmp’s Annual Report on Form 10-K for the year ended February 28, 2023, as amended, its Quarterly Reports on Form 10-Q, and in its other filings with the SEC. CalAmp undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date hereof.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

CALAMP CORP. |

|

|

|

|

Date: |

June 3, 2024 |

By: |

/s/ Jikun Kim |

|

|

|

Jikun Kim

Senior Vice President and CFO

(Principal Financial Officer) |

THIS RESTRUCTURING SUPPORT AGREEMENT IS NOT AN OFFER, ACCEPTANCE OR SOLICITATION WITH RESPECT TO ANY SECURITIES, LOANS OR OTHER INSTRUMENTS OR A SOLICITATION OF ACCEPTANCES OF A CHAPTER 11 PLAN WITHIN THE MEANING OF SECTION 1125 OF THE BANKRUPTCY CODE. ANY SUCH OFFER OR SOLICITATION WILL COMPLY WITH ALL APPLICABLE SECURITIES LAWS AND/OR PROVISIONS OF THE BANKRUPTCY CODE. Nothing contained in thIS RESTRUCTURING SUPPORT AGREEMENT shall be an admission of fact or liability OR, UNTIL THE OCCURRENCE OF THE AGREEMENT EFFECTIVE DATE ON THE TERMS DESCRIBED HEREIN, DEEMED BINDING ON ANY OF THE PARTIES HERETO.

THIS RESTRUCTURING SUPPORT AGREEMENT IS THE PRODUCT OF SETTLEMENT DISCUSSIONS AMONG THE PARTIES HERETO. ACCORDINGLY, THIS RESTRUCTURING SUPPORT AGREEMENT IS PROTECTED BY RULE 408 OF THE FEDERAL RULES OF EVIDENCE AND ANY OTHER APPLICABLE STATUTES OR DOCTRINES PROTECTING THE USE OR DISCLOSURE OF CONFIDENTIAL SETTLEMENT DISCUSSIONS.

THIS RESTRUCTURING SUPPORT AGREEMENT DOES NOT PURPORT TO SUMMARIZE ALL OF THE TERMS, CONDITIONS, REPRESENTATIONS, WARRANTIES, AND OTHER PROVISIONS WITH RESPECT TO THE TRANSACTIONS DESCRIBED HEREIN, WHICH TRANSACTIONS WILL BE SUBJECT TO THE COMPLETION OF DEFINITIVE DOCUMENTS INCORPORATING THE TERMS SET FORTH HEREIN AND THE CLOSING OF ANY TRANSACTION SHALL BE SUBJECT TO THE TERMS AND CONDITIONS SET FORTH IN SUCH DEFINITIVE DOCUMENTS AND THE APPROVAL RIGHTS OF THE PARTIES SET FORTH HEREIN AND IN SUCH DEFINITIVE DOCUMENTS, IN EACH CASE, SUBJECT TO THE TERMS HEREOF.

RESTRUCTURING SUPPORT AGREEMENT

This RESTRUCTURING SUPPORT AGREEMENT (including all exhibits, annexes, and schedules hereto in accordance with Section 14.01, this “Agreement”) is made and entered into as of May 31, 2024 (the “Execution Date”), by and among the following parties, each solely in the capacity set forth on its signature page to this Agreement (each of the following described in clauses (i), (ii) and (iii) of this preamble, collectively, the “Parties”):1

(i)CalAmp Corp. (“CalAmp”) and its direct and indirect subsidiaries set forth on its signature page hereto (collectively, the “Company Parties” and each, a “Company Party”);

(ii)Lynrock Lake Master Fund LP (together with its direct and indirect affiliates (“Lynrock”), as lender under the Secured Term Loan Facility (the “Consenting Term Loan Lender”); and

(iii)the undersigned beneficial owners of, or nominees, investment advisors, sub-advisors, or managers of accounts that beneficially hold, Secured Notes Claims that have executed and delivered counterpart signature pages to this Agreement or a

1 Capitalized terms used but not defined in the preamble and recitals to this Agreement have the meanings ascribed to them in Section 1.

Joinder to counsel to the Company Parties (the Entities in this clause (iii), collectively, the “Consenting Noteholders” and, together with the Consenting Term Loan Lender, the “Consenting Lenders”).

RECITALS

WHEREAS, the Company Parties and the Consenting Lenders have in good faith and at arms’ length negotiated or been apprised of certain restructuring and recapitalization transactions with respect to the Company Parties’ capital structure on the terms and conditions set forth in this Agreement and as specified in the term sheet attached as Exhibit A hereto (the “Restructuring Term Sheet,” and such transactions as described in this Agreement, the Restructuring Term Sheet, and the Definitive Documents, in each case, as may be amended, supplemented, or otherwise modified from time to time in accordance with the terms of this Agreement, collectively, the “Restructuring Transactions”);

WHEREAS, the Restructuring Transactions shall be implemented through, among other things, voluntary prepackaged bankruptcy cases to be commenced by the Company Parties set forth on Exhibit B herein under chapter 11 of title 11 of the United States Code, 11 U.S.C. §§ 101 – 1532 (as amended, the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court,” and such cases, the “Chapter 11 Cases”);

WHEREAS, on the date hereof, the Company Parties and the Consenting Lenders have agreed to the Restructuring Term Sheet, which sets forth the principal economic terms of the Restructuring Transactions that shall be consummated upon the execution of the Definitive Documents containing terms consistent with those set forth in the Restructuring Term Sheet and such other terms as agreed to by the Parties in accordance with this Agreement, the Restructuring Term Sheet and the Plan;

WHEREAS, the Parties have agreed to support the Restructuring Transactions subject to and in accordance with the terms of this Agreement (including the Restructuring Term Sheet) and desire to work together to complete the negotiation of the terms of the Definitive Documents and the completion of each of the actions necessary or desirable to effect the Restructuring Transactions; and

WHEREAS, the Parties have agreed to take certain actions in support of the Restructuring Transactions on the terms and conditions set forth in this Agreement and the Restructuring Term Sheet.

NOW, THEREFORE, in consideration of the covenants and agreements contained herein, and for other valuable consideration, the receipt and sufficiency of which are hereby acknowledged, each Party, intending to be legally bound hereby, agrees as follows:

AGREEMENT

Section 1.Definitions and Interpretation.

1.01.Definitions. The following terms shall have the following definitions:

“Affiliate” means with respect to any specified entity, any other entity directly or indirectly controlling or controlled by or under direct or indirect common control with such specified entity. For purposes of this definition, “control” (including, with correlative meanings, the terms “controlling,” “controlled by,” and “under common control with”) as used with respect to any entity shall mean the possession, directly or indirectly, of the right or power to direct or cause the direction of the management or policies of such entity, whether through the ownership of voting securities, by agreement, or otherwise.

“Agreement” has the meaning set forth in the preamble of this Agreement and, for the avoidance of doubt, includes all the exhibits, annexes, and schedules hereto in accordance with Section 14.01 (including the Restructuring Term Sheet).

“Agreement Effective Date” means the date on which the conditions set forth in Section 2 have been satisfied or waived by the appropriate Party or Parties in accordance with this Agreement.

“Agreement Effective Period” means, with respect to a Party, the period commencing on the Agreement Effective Date and ending on the Termination Date applicable to that Party.

“Alternative Restructuring Proposal” means any written or oral plan, inquiry, proposal, offer, bid, term sheet, discussion, or agreement with respect to a sale, disposition, new-money investment, restructuring, reorganization, merger, amalgamation, acquisition, consolidation, dissolution, debt investment, equity investment, liquidation, asset sale, share issuance, consent solicitation, exchange offer, tender offer, recapitalization, plan of reorganization or liquidation, share exchange, business combination, joint venture, debt incurrence (including, without limitation, any debtor-in-possession financing or exit financing) or similar transaction involving any one or more Company Parties or the debt, equity, or other interests in any one or more Company Parties that is an alternative to one or more of the Restructuring Transactions.

“Amended and Restated Term Loan Credit Agreement” means the amended and restated Term Loan Credit Agreement, to be executed by the applicable Company Parties and the Consenting Term Loan Lender on the Plan Effective Date, which shall amend and restate the Term Loan Credit Agreement in a manner consistent with the Restructuring Term Sheet as approved by the applicable Parties in accordance with Section 3.01.

“Bankruptcy Code” has the meaning set forth in the recitals to this Agreement.

“Bankruptcy Court” has the meaning set forth in the recitals to this Agreement.

“Business Day” means any day other than a Saturday, Sunday, or other day on which commercial banks are authorized to close under the Laws of, or are in fact closed in, the State of New York.

“CalAmp” has the meaning set forth in the preamble of this Agreement.

“Cash Collateral Order” means, as applicable, the interim and final orders of the Bankruptcy Court approving the Debtors’ use of cash collateral on a consensual basis and the parties’ rights with respect thereto, as approved by the applicable Parties in accordance with Section 3.01.

“Causes of Action” means any claims, interests, damages, remedies, causes of action, demands, rights, actions, controversies, proceedings, agreements, suits, obligations, liabilities, accounts, defenses, offsets, powers, privileges, licenses, liens, indemnities, guaranties, or franchises of any kind or character whatsoever, whether known or unknown, foreseen or unforeseen, existing or hereinafter arising, contingent or non-contingent, liquidated or unliquidated, secured or unsecured, assertable, directly or derivatively, matured or unmatured, suspected or unsuspected, arising before or on the Plan Effective Date in contract, tort, law, equity, or otherwise. Causes of Action also include: (a) all rights of setoff, counterclaim, or recoupment and claims under contracts or for breaches of duties imposed by law or in equity; (b) the right to object to or otherwise contest Company Claims/Interests; (c) claims pursuant to section 362 or chapter 5 of the Bankruptcy Code; (d) such claims and defenses as fraud, mistake, duress, and usury, and any other defenses set forth in section 558 of the Bankruptcy Code; and (e) any avoidance actions arising under chapter 5 of the Bankruptcy Code or under similar local, state, federal, or foreign statutes and common law, including fraudulent transfer laws.

“Chapter 11 Cases” has the meaning set forth in the recitals to this Agreement.

“Claim” has the meaning ascribed to it in section 101(5) of the Bankruptcy Code.

“Company Claims/Interests” means any Claim against, or Equity Interest in, a Company Party, including the Term Loan Claims, the Secured Notes Claims, and the Existing Equity Interests.

“Company Parties” has the meaning set forth in the preamble of this Agreement.

“Confidentiality Agreement” means an executed confidentiality agreement, including with respect to the issuance of a “cleansing letter” or other agreement relating to public disclosure of material non-public information, in connection with any proposed Restructuring Transactions.

“Confirmation Order” means the order of the Bankruptcy Court confirming the Plan under, inter alia, section 1129 of the Bankruptcy Code, as approved by the applicable Parties in accordance with Section 3.01, which order will provide for the assumption of this Agreement upon the entry thereof and may be combined with or entered simultaneously with the Disclosure Statement Order.

“Consenting Lenders” has the meaning set forth in the preamble of this Agreement.

“Consenting Noteholders” has the meaning set forth in the preamble of this Agreement.

“Consenting Term Loan Lender” has the meaning set forth in the preamble of this Agreement.

“Debtors” means the Company Parties that commence Chapter 11 Cases set forth on Exhibit B.

“Definitive Documents” means all definitive documents, instruments, deeds, notifications, agreements, and filings related to documentation, implementation, and consummation of the Restructuring Transactions, including, without limitation: (a) the Solicitation Materials; (b) the Plan; (c) the Confirmation Order; (d) the Disclosure Statement; (e) the Disclosure Statement Order; (f) all material pleadings and motions filed by the Debtors in connection with the Chapter 11 Cases, including the First Day Pleadings, and financing or cash collateral arrangement and all orders sought pursuant thereto; (g) the Plan Supplement; (h) the New Corporate Governance Documents; (i) the Amended and Restated Term Loan Credit Agreement; (j) all filings and requests for regulatory or other authorizations, licenses, rulings, documents, or approvals from any Governmental Entity or unit necessary to be obtained by the Company Parties to implement the Restructuring Transactions; (k) such other definitive documents relating to the recapitalization or restructuring of the Company Parties as are necessary or desirable to consummate the Restructuring Transactions; and (l) any and all deeds, agreements, filings, notifications, pleadings, orders, certificates, letters, instruments or other documents related to the Restructuring Transactions; in each case, including any amendments, modifications, and supplements thereto and any related notes, certificates, agreements, documents, and instruments (as applicable), and, in each case, as approved by the applicable Parties in accordance with Section 3.01.

“Disclosure Statement” means the disclosure statement with respect to the Plan, including all exhibits, schedules, supplements, modifications, amendments, and annexes thereto, each as may be amended, supplemented, or otherwise modified from time to time, as approved by the applicable Parties in accordance with Section 3.01.

“Disclosure Statement Order” means the order of the Bankruptcy Court approving the Disclosure Statement and the other Solicitation Materials as containing, among other things, “adequate information” as required by section 1125 of the Bankruptcy Code, which order may be combined with or entered simultaneously with the Confirmation Order, and which shall be approved by the applicable Parties in accordance with Section 3.01.

“Entity” shall have the meaning set forth in section 101(15) of the Bankruptcy Code.

“Equity Interests” means, collectively, the shares (or any class thereof) of common stock, preferred stock, limited liability company interests, and any other equity, ownership, or profits interests of any Company Party, and options, warrants, rights, or other securities or agreements to acquire or subscribe for, or which are convertible into the shares (or any class thereof) (excluding, for the avoidance of doubt, the Secured Notes) of common stock, preferred stock, limited liability

company interests, or other equity, ownership, or profits interests of any Company Party (in each case whether or not arising under or in connection with any employment agreement).

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Execution Date” has the meaning set forth in the preamble of this Agreement.

“Existing Equity Interests” means the Equity Interests in CalAmp.

“Final Order” means an order or judgment of a court of competent jurisdiction that has been entered on the docket maintained by the clerk of such court, which has not been reversed, vacated, or stayed and as to which (i) the time to appeal, petition for certiorari, or move for a new trial, reargument, or rehearing has expired and as to which no appeal, petition for certiorari, or other proceedings for a new trial, reargument, or rehearing shall then be pending, or (ii) if an appeal, writ of certiorari, new trial, reargument, or rehearing thereof has been sought, such order or judgment shall have been affirmed by the highest court to which such order was appealed, or certiorari shall have been denied, or a new trial, reargument, or rehearing shall have been denied or resulted in no modification of such order, and the time to take any further appeal, petition for certiorari, or move for a new trial, reargument, or rehearing shall have expired; provided, however, that no order or judgment shall fail to be a “Final Order” solely because of the possibility that a motion under Rules 59 or 60 of the Federal Rules of Civil Procedure or any analogous Bankruptcy Rule (or any analogous rules applicable in another court of competent jurisdiction) or sections 502(j) or 1144 of the Bankruptcy Code has been or may be filed with respect to such order or judgment.

“First Day Pleadings” means the first-day motions and related pleadings that the Company Parties determine, in consultation with the Required Consenting Lenders, are necessary or desirable to file upon the commencement of the Chapter 11 Cases, and in each case, as approved by the applicable Parties in accordance with Section 3.01.

“Governmental Entity” means any applicable federal, state, local, or foreign government or any agency, bureau, board, commission, court, or arbitral body, department, political subdivision, regulatory or administrative authority, tribunal, or other instrumentality thereof, or any self-regulatory organization.

“Joinder” means an executed form of joinder, substantially in the form attached hereto as Exhibit C, providing, among other things, that such Person signatory thereto is bound by the terms of this Agreement. For the avoidance of doubt, any Person that executes a Joinder shall be a “Party” under this Agreement.

“Law” means any federal, state, local, or foreign law (including common law), statute, code, ordinance, rule, regulation, decree, injunction, order, ruling, assessment, writ, or other legal requirement, or judgment, in each case, that is validly adopted, promulgated, issued, or entered by a governmental authority of competent jurisdiction (including the Bankruptcy Court).

“Lynrock” has the meaning set forth in the preamble for this Agreement.

“Milestones” has the meaning set forth in the Restructuring Term Sheet.

“Nasdaq” has the meaning set forth in Section 6.01(p).

“New Equity Interests” means a single class of common equity interests issued by Reorganized CalAmp on the Plan Effective Date, in accordance with the terms of this Agreement, the New Corporate Governance Documents, and the Plan.

“New Corporate Governance Documents” means, in connection with the Plan Effective Date, consistent with section 1123(a)(6) of the Bankruptcy Code, as applicable, and otherwise in compliance with applicable laws, customary corporate governance documents of Reorganized CalAmp, including charters, bylaws, operating agreements, limited liability company agreements, shareholder agreements, or other Organizational Documents and in each case as approved by the applicable Parties in accordance with Section 3.01.

“Organizational Documents” means, with respect to any Person other than a natural person, the documents by which such Person was organized or formed (such as a certificate of incorporation, certificate of formation, certificate of limited partnership or articles of organization, and including any certificates of designation for preferred stock or other forms of preferred equity) or which relate to the internal governance of such Person (such as by-laws, a partnership agreement, or an operating, limited liability company, or members agreement) and in each case as approved by the applicable Parties in accordance with Section 3.01.

“Parties” has the meaning set forth in the preamble of this Agreement.

“Permitted Transferee” means each transferee of any Company Claims/Interests who meets the requirements of Section 8.01.

“Person” means an individual, a partnership, a joint venture, a limited liability company, a corporation, a trust, an unincorporated organization, a group, a Governmental Entity, or any legal entity or association.

“Petition Date” means the first date on which the Company Parties commence the Chapter 11 Cases.

“Plan” means the joint prepackaged plan of reorganization filed by the Debtors under chapter 11 of the Bankruptcy Code to implement the Restructuring Transactions in accordance with, and subject to the terms and conditions of, this Agreement, the Restructuring Term Sheet, the Definitive Documents, and related exhibits and appendices and as approved by the applicable Parties in accordance with Section 3.01.

“Plan Effective Date” means the date on which the conditions to effectiveness of the Plan have been satisfied or waived in accordance with its terms, and the Restructuring Transactions are implemented in accordance with the Definitive Documents.

“Plan Supplement” means the compilation of documents and forms of documents, schedules, and exhibits to the Plan that, subject to the terms and conditions of this Agreement, will be filed by the Debtors with the Bankruptcy Court and as approved by the applicable Parties in accordance with Section 3.01.

“Prepetition Facilities” means, collectively, the facilities established under the Term Loan Credit Agreement and the Secured Notes Indenture.

“Prepetition Facilities Documents” means, collectively, documents governing the Prepetition Facilities and any amendments, modifications, and supplements thereto, and together with any related notes, certificates, agreements, security agreements, documents, and instruments (including any amendments, restatements, supplements, or modifications of any of the foregoing) related to or executed in connection therewith.

“Qualified Marketmaker” means an Entity that (a) holds itself out to the public or the applicable private markets as standing ready in the ordinary course of business to purchase from customers and sell to customers Company Claims/Interests (or enter with customers into long and short positions in Company Claims/Interests), in its capacity as a dealer or market maker in Company Claims/Interests and (b) is, in fact, regularly in the business of making a market in claims against issuers or borrowers (including debt securities or other debt).

“Related Party” means, with respect to any Person or Entity, each of, and in each case in its capacity as such, current and former directors, managers, officers, committee members, members of any governing body, equity holders (regardless of whether such interests are held directly or indirectly), affiliated investment funds or investment vehicles, managed accounts or funds, predecessors, participants, successors, assigns, subsidiaries, Affiliates, partners, limited partners, general partners, principals, members, management companies, fund advisors or managers, employees, agents, trustees, advisory board members, financial advisors, attorneys (including any other attorneys or professionals retained by any current or former director or manager in his or her capacity as director or manager of an Entity), accountants, investment bankers, consultants, representatives, and other professionals and advisors of such Person or Entity and any such Person’s or Entity’s respective heirs, executors, estates, and nominees.

“Reorganized CalAmp” means either (a) CalAmp or any successor or assignee thereto, by merger, consolidation, reorganization, or otherwise, in the form of a corporation, limited liability company, partnership, or other form, as the case may be, on and after the Plan Effective Date or (b) a new corporation, limited liability company, or partnership that may be formed to, among other things, directly or indirectly acquire substantially all of the assets and/or stock of the Debtors and issue the New Equity Interests to be distributed in connection with the Plan, as determined by the Required Consenting Lenders in their sole discretion.

“Reorganized Debtors” means the Debtors from and after the Plan Effective Date.

“Required Consenting Lenders” means the Consenting Term Loan Lender and the Required Consenting Noteholders.

“Required Consenting Lenders’ Advisors” means (i) Akin Gump Strauss Hauer & Feld LLP, as co-counsel to Lynrock, (ii) Pashman Stein Walder Hayden P.C., as co-counsel to Lynrock, and (iii) any other attorneys, accountants, other professionals, advisors, and consultants retained by Lynrock to advise or represent Lynrock in connection with the Restructuring Transactions and the Chapter 11 Cases, if any, as may be mutually agreed to by Lynrock and the Company Parties.

“Required Consenting Noteholders” means the Consenting Noteholders holding at least 67% of the Secured Notes Claims held by all Consenting Noteholders.

“Required Parties” means the Company Parties and the Required Consenting Lenders.

“Restructuring Fees and Expenses” means all reasonable and documented fees, costs, and expenses of the Required Consenting Lenders’ Advisors, including all amounts payable or reimbursable under the applicable fee or engagement letters entered into by the applicable Company Party and applicable Required Consenting Lenders’ Advisor (which agreements shall not be terminated by the Company Parties before the termination of this Agreement).

“Restructuring Term Sheet” has the meaning set forth in the recitals to this Agreement.

“Restructuring Transactions” has the meaning set forth in the recitals to this Agreement.

“Secured Notes” means the secured notes issued under the Secured Notes Indenture.

“Secured Notes Agents” means, collectively, the Bank of New York Mellon Trust Company, N.A., as trustee and U.S. Collateral Agent and The Bank of New York Mellon, as the UK Collateral Agent, in each case, under the Secured Notes Indenture.

“Secured Notes Claims” means any Claim for obligations arising under the Secured Notes Indenture, including any Claims in respect of all principal amounts outstanding, interest, fees, redemption premiums, expenses, costs and other charges arising thereunder or related thereto, including postpetition interest, as applicable.

“Secured Notes Indenture” means that certain Indenture, dated as of July 20, 2018 (as amended and supplemented by that certain Supplemental Indenture, dated as of December 15, 2023, and as further amended, restated, amended and restated, supplemented, restructured or otherwise modified, renewed or replaced from time to time, by and among CalAmp and the Secured Notes Agents.

“Securities Act” means the Securities Act of 1933, as amended.

“Solicitation Materials” means all materials related to the solicitation of votes for the Plan pursuant to sections 1123, 1126, and 1145 of the Bankruptcy Code, including the Disclosure Statement, as approved by the applicable Parties in accordance with Section 3.01.

“Terminating Party” has the meaning set forth in Section 12.01 of this Agreement.

“Termination Date” means the date on which this Agreement is terminated in accordance with Section 12.

“Termination Event” means the events set forth in Section 12.01 of this Agreement.

“Term Loan Claims” means any Claim for obligations arising under the Term Loan Credit Agreement, including any Claims in respect of all principal amounts outstanding, interest, fees, redemption premiums, expenses, costs and other charges arising thereunder or related thereto, including postpetition interest, as applicable.

“Term Loan Credit Agreement” means that certain Credit Agreement, dated as of December 15, 2023, by and between CalAmp, as borrower, and Lynrock Lake Master Fund LP (as amended, supplemented, amended and restated, or otherwise modified prior to the Agreement Effective Date).

“Term Loans” means the term loans issued under the Term Loan Credit Agreement.

“Transfer” means to sell, resell, reallocate, use, pledge, assign, transfer, loan, grant, hypothecate, participate, donate, or otherwise encumber or dispose of, directly or indirectly (including through derivatives, options, swaps, pledges, forward sales, or other transactions); provided, however, that any pledge in favor of a bank or broker dealer at which a Consenting Lender maintains an account, where such bank or broker dealer holds a security interest or other encumbrance over property in the account generally shall not be deemed a “Transfer” for any purposes hereunder.

1.02.Interpretation. For purposes of this Agreement:

(a)in the appropriate context, each term, whether stated in the singular or the plural, shall include both the singular and the plural, and pronouns stated in the masculine, feminine, or neuter gender shall include the masculine, feminine, and the neuter gender;

(b)capitalized terms defined only in the plural or singular form shall nonetheless have their defined meanings when used in the opposite form;

(c)unless otherwise specified, any reference herein to a contract, lease, instrument, release, indenture, or other agreement or document being in a particular form or on particular terms and conditions means that such document shall be substantially in such form or substantially on such terms and conditions;

(d)unless otherwise specified, any reference herein to an existing document, schedule, or exhibit shall mean such document, schedule, or exhibit, as it may have been or may be amended, restated, amended and restated, supplemented, or otherwise modified or replaced from time to time prior to the Execution Date; provided, that any capitalized terms herein which are defined with reference to another agreement, are defined with reference to such other agreement as of the Execution Date, without giving effect to any termination of such other agreement or amendments to such capitalized terms in any such other agreement following the Execution Date;

(e)unless otherwise specified, all references herein to “Sections” are references to Sections of this Agreement;

(f)the words “herein,” “hereof,” and “hereto” refer to this Agreement in its entirety rather than to any particular portion of this Agreement;

(g)captions and headings to Sections are inserted for convenience of reference only and are not intended to be a part of or to affect the interpretation of this Agreement;

(h)references to “shareholders,” “directors,” and/or “officers” shall also include “members” and/or “managers,” as applicable, as such terms are defined under the applicable limited liability company Laws;

(i)all exhibits attached hereto or referred to herein are hereby incorporated in and made a part of this Agreement as if set forth in full herein;

(j)the use of “include” or “including” is without limitation, whether stated or not; and

(k)unless otherwise specified, when calculating the period of time before which, within which, or following which any act is to be done or step taken pursuant to this Agreement, the date that is the reference date in calculating such period shall be excluded and, if the last day of such period is a non-Business Day, the period in question shall end on the next succeeding Business Day.

2.01.Agreement Effective Date. This Agreement shall become effective and binding upon each of the Parties at 12:01 a.m., prevailing Eastern Standard Time, on the Agreement Effective Date, which is the date on which all of the following conditions have been satisfied or waived in accordance with this Agreement:

(a)the Company Parties shall have executed and delivered counterpart signature pages of this Agreement to counsel to each of the Parties specified in Section 14.11;

(b)the following shall have executed and delivered counterpart signature pages of this Agreement to counsel to each of the Parties specified in Section 14.11:

(i)the Consenting Term Loan Lender; provided, that such signature page shall be (a) treated in accordance with Section 14.22 and (b) delivered to other Consenting Lenders in a redacted form that removes the details of the Consenting Lender’s holdings of Term Loan Claims; and

(ii)holders of at least 67% of the aggregate outstanding principal amount of the Secured Notes Claims; provided, that such signature pages shall be (a) treated in accordance with Section 14.22 and (b) delivered to other Consenting Lenders in a redacted form that removes the details of such holder’s holdings of Secured Notes Claims;

(c)counsel to the Company Parties shall have given written notice to counsel to the Required Consenting Lenders in the manner set forth in Section 14.11 hereof (with e-mail being sufficient) that the other conditions to the Agreement Effective Date set forth in this Section 2 have occurred; and

(d)the Company Parties shall have paid in full the Restructuring Fees and Expenses for which an invoice has been received by the Company Parties on or before two (2) Business Days prior to the Agreement Effective Date.

This Agreement shall be effective from the Agreement Effective Date until validly terminated pursuant to the terms set forth in Section 12. To the extent that a signatory to this Agreement holds, as of the date hereof or thereafter, multiple Company Claims/Interests, such Party shall be deemed to have executed this Agreement in its capacity as a holder of all such Company Claims/Interests, and this Agreement shall apply severally to such Party with respect to each such Company Claim/Interest held by such Party.

Section 3.Definitive Documents.

3.01.The Definitive Documents not executed or in a form attached to this Agreement as of the Execution Date remain subject to negotiation, agreement and completion. Upon completion, the Definitive Documents and every other document, deed, agreement, filing, notification, letter, or instrument related to the Restructuring Transactions shall contain terms, conditions, representations, warranties, and covenants consistent with the terms of this Agreement, as they may be modified, amended, or supplemented in accordance with this Agreement. The Definitive Documents not executed or in a form attached to this Agreement as of the Execution Date shall otherwise be consistent with the Restructuring Term Sheet in all respects and otherwise shall be acceptable in form and substance, including with respect to any amendment, modification, or supplement thereto, to the Company Parties and the Required Consenting Lenders, in the sole discretion of each of the Company Parties and the Required Consenting Lenders, respectively; provided, however, that with respect to the New Corporate Governance Documents, including Organizational Documents, such documents need be acceptable in form and substance only to the Required Consenting Lenders in their sole discretion; provided, further, that the Required Consenting Lenders shall provide draft copies of the New Corporate Governance Documents to the Company Parties, and the Company Parties’ reasonable comments shall be considered by the Required Consenting Lenders in good faith.

Section 4.Milestones. The Milestones set forth in the Restructuring Term Sheet shall apply to this Agreement unless extended, modified, or waived in writing (which may be by e-mail from respective counsel to each of the Parties), as applicable, by the Company Parties and the Required Consenting Lenders:

Section 5.Commitments of the Consenting Lenders.

5.01.General Commitments.

(a)During the Agreement Effective Period, each Consenting Lender (unless otherwise noted), severally, and not jointly, agrees, in respect of all of its applicable Company Claims/Interests, to:

(i)support the Restructuring Transactions on the terms and subject to the conditions of this Agreement and vote or consent to and exercise any powers or rights available to it (including in any tender offer, solicitation, board, shareholders’, or creditors’ meeting or in any process requiring voting or approval to which they are legally entitled to participate), in each case,

in favor of any matter requiring approval to the extent necessary to implement the Restructuring Transactions, subject to finalization of the Definitive Documents in accordance with the terms of this Agreement;

(ii)with respect to the Consenting Noteholders, subject to Section 5.01(c), use commercially reasonable efforts to give any notice, order, instruction, or direction to the Secured Notes Agents to the extent required to give effect to the Restructuring Transactions on the terms and subject to the conditions of this Agreement; provided, that no Consenting Noteholder shall be required to provide an indemnity or incur any potential expense or liability;

(iii)use commercially reasonable efforts to support the Company Parties’ efforts to obtain any and all required regulatory, governmental, and/or third-party approvals to consummate the Restructuring Transactions;

(iv)negotiate in good faith and use commercially reasonable efforts to execute, deliver, and implement the Definitive Documents and any other necessary agreements that are consistent with this Agreement to which it is required to be a party;

(v)to the extent any legal or structural impediment arises that would prevent, hinder, or delay the consummation of the Restructuring Transactions contemplated herein, negotiate in good faith appropriate additional or alternative provisions or alternative implementation mechanics to address any such impediment; and

(vi)to forbear from exercising any rights or remedies that it may have against the Company Parties or their assets and properties under the Term Loan Credit Agreement, Amended and Restated Term Loan Credit Agreement, or Secured Notes Indenture, as applicable, as it relates to any events of default thereunder, notice of which has been provided to the Consenting Lenders prior to the Agreement Effective Date; provided, however, that this agreement to forbear shall not effectuate a waiver of any rights under the applicable Prepetition Facilities Documents, and any non-exercise of rights or remedies as a result of this Section 5.01(a)(vi) shall be effective during the Agreement Effective Period only and shall not be deemed to be a permanent forbearance or waiver of any default or event of default under the Prepetition Facilities Documents; provided, further, that any such default or event of default shall be deemed to have occurred on the date on which such default or event of default first occurred, and such date (and any applicable grace period) will not be tolled by any agreement herein.

(b)During the Agreement Effective Period, each Consenting Lender, severally, and not jointly, agrees, in respect of all of its Company Claims/Interests, that it shall not directly or indirectly:

(i)object to, delay, impede, or take any other action in a manner inconsistent with this Agreement, the intended purpose of which is to interfere with acceptance, implementation, or consummation of the Restructuring Transactions;

(ii)exercise, or direct any other Person to exercise, any right or remedy for the enforcement, collection, or recovery of any Claims against or Equity Interests in any Company Party in a manner inconsistent with this Agreement and the Definitive Documents; or

(iii)initiate, or have initiated on its behalf, any litigation or proceeding of any kind with respect to the Chapter 11 Cases, this Agreement, or the other Restructuring Transactions contemplated herein against the Company Parties or the other Parties other than to enforce this Agreement or any Definitive Document or as otherwise consistent with this Agreement;

(c)Nothing in this Agreement shall: (i) prohibit any Consenting Lender from taking any action that is not inconsistent with this Agreement; (ii) limit the ability of any Consenting Lender to consult with any other Consenting Lender, the Company Parties or any other parties in interest; (iii) prevent any Consenting Lender from enforcing this Agreement or any Definitive Document or contesting whether any matter, fact or thing is a breach of, or is inconsistent with, this Agreement or any Definitive Document; (iv) prevent any Consenting Lender from taking any action that is required by applicable Law or require any Consenting Lender to take any action that is prohibited by applicable Law or to waive or forego the benefit of any applicable legal professional privilege; (v) prevent any Consenting Lender from appearing as a party-in-interest in any matter to be adjudicated in a court of competent jurisdiction, so long as such appearance and the positions advocated in connection therewith are not materially inconsistent with this Agreement and are not for the purpose of delaying, interfering, impeding or taking any other action to delay, interfere or impede, directly or indirectly, the Restructuring Transactions; (vi) other than as provided for in this Agreement, require any Consenting Lender to incur any expenses, liabilities, or other obligations, or to agree to any commitments, undertakings, concessions, indemnities, or other arrangements that could result in expenses, liabilities, or other obligations; (vii) require any Consenting Lender to provide any information that it determines, in its sole discretion, to be commercially sensitive or confidential; (viii) other than as provided for in this Agreement, limit the ability of a Consenting Lender to purchase, sell or enter into transactions regarding the Company Claims/Interests; or (ix) prevent any Consenting Lender by reason of this Agreement or the Restructuring Transactions from making, seeking or receiving any regulatory filings, notifications, consents, determinations, authorizations, permits, approvals, licenses, or the like.

5.02.Commitments with Respect to Chapter 11 Cases.

(a)During the Agreement Effective Period, each Consenting Lender that is entitled to vote to accept or reject the Plan pursuant to its terms severally, and not jointly, agrees that it shall, subject to receipt by such Consenting Lender, whether before or after the commencement of the Chapter 11 Cases, of the Solicitation Materials (including a ballot):

(i)to the extent that it is permitted to vote, vote each of its Company Claims/Interests to accept the Plan by delivering its duly executed and completed ballot accepting the Plan on a timely basis following the commencement of the solicitation of the Plan and its actual receipt of the Solicitation Materials and the ballot, and thereafter, not change its vote during the Agreement Effective Period; and

(ii)to the extent it is permitted to elect whether to opt out of the releases set forth in the Plan, elect not to opt out of the releases set forth in the Plan by timely delivering its duly executed and completed ballot(s) indicating such election.

Section 6.Commitments of the Company Parties.

6.01.Affirmative Commitments. Subject to Section 7, except as set forth in this Section 6, during the Agreement Effective Period, the Company Parties agree to:

(a)support, act in good faith, and take all steps reasonably necessary and desirable to consummate the Restructuring Transactions in accordance with this Agreement, including (i) commencing solicitation on the Plan pursuant to the Disclosure Statement and related Solicitation Materials and (ii) obtaining entry of the Confirmation Order, approval of the applicable Definitive Documents, and consummation of the Restructuring Transactions pursuant to the Plan, in each case, in accordance with the applicable Milestones unless waived or modified in accordance with the terms hereof;

(b)to the extent any legal or structural impediment arises that would prevent, hinder, or delay the consummation of the Restructuring Transactions contemplated herein, negotiate in good faith with the Required Consenting Lenders appropriate additional or alternative provisions or alternative implementation mechanics to address any such impediment;

(c)actively and timely oppose and object to the efforts of any person seeking in any manner to object to, delay, impede, or take any other action to interfere with the acceptance, implementation, or consummation of the Restructuring Transactions (including, if applicable, the Debtors’ timely filing of objections or written responses in the Chapter 11 Cases) to the extent such opposition or objection is reasonably necessary or desirable to facilitate implementation of the Restructuring Transactions after consultation with the Required Consenting Lenders;

(d)(i) stipulate to the allowance and amounts of Term Loan Claims and Secured Notes Claims in accordance with the Restructuring Term Sheet and to the validity of the liens securing any such Claims and (ii) timely file a formal objection to any motion filed with the Bankruptcy Court by a third party challenging the validity, enforceability, perfection, or priority of, or seeking avoidance, disallowance or subordination of, any portion of the Term Loan Claims or the Secured Notes Claims or the liens securing such Claims;

(e)timely file a formal objection to (in consultation with counsel to the Required Consenting Lenders) any motion, application, or proceeding filed with the Bankruptcy Court by any person seeking the entry of an order (i) directing the appointment of a trustee or examiner (with expanded powers), (ii) converting any of the Chapter 11 Cases to a case under chapter 7 of the Bankruptcy Code, (iii) dismissing any of the Chapter 11 Cases, (iv) seeking the entry of an order modifying or terminating the Company Parties’ exclusive right to file and/or solicit acceptances of the Plan or (v) for relief that (A) is inconsistent with this Agreement, or (B) would, or would reasonably be expected to, frustrate the purposes of this Agreement, including by preventing the consummation of one or more of the Restructuring Transactions;

(f)use commercially reasonable efforts to obtain any and all consents and third-party approvals that are necessary and/or advisable for the implementation or consummation of any part of the Restructuring Transactions;

(g)negotiate in good faith and use commercially reasonable efforts to execute, deliver, and implement the Definitive Documents and any other necessary agreements that are consistent with this Agreement to which it is required to be a party;

(h)use commercially reasonable efforts to seek additional support for the Restructuring Transactions from their other material stakeholders to the extent reasonably prudent;

(i)use commercially reasonable efforts to provide the Consenting Lenders with any documentation or information they may reasonably request to facilitate the Restructuring Transactions, including regarding the Company Parties’ business operations and the status of the Restructuring Transactions, subject to any confidentiality restrictions the Company Parties may be subject to;

(j)use commercially reasonable efforts to provide the advisors to the Consenting Lenders with (i) reasonable access to, during regular business hours, the non-privileged, non-confidential books, work papers, records and materials of any Company Party, (ii) reasonable access to, during regular business hours, the personnel and applicable advisors of any Company Party to discuss the status and progress of the Restructuring Transactions, and (iii) timely responses to all reasonable diligence requests provided by any such advisors; it being understood that the foregoing cannot, and should not be construed to, (A) require the disclosure of any work papers, materials, reports, statements, or other information intended to be subject to attorney-client or work-product privilege or any other applicable privilege doctrines available under applicable law, or (B) override any existing confidentiality or other applicable obligations owed with respect to any such information;

(k)(i) provide counsel for the Required Consenting Lenders draft copies of all Definitive Documents, including, but not limited to, all material motions or pleadings, and any drafts or proposed amended version of the Plan and Disclosure Statement that the Debtors intend to file with the Bankruptcy Court, to the extent practicable, no less than three (3) Business Days before the date of filing any such pleading or other document (or such shorter period as is necessary or appropriate under the circumstances), (ii) without limiting any approval or consent rights set forth in this Agreement, consult in good faith with counsel to the Required Consenting Lenders regarding the form and substance of any such proposed filing, (iii) not file, execute, distribute, or use (as applicable) any of the Definitive Documents unless each document is consistent with this Agreement and otherwise in form and substance acceptable to the Required Consenting Lenders, in their sole discretion, and (iv) provide draft copies of any motion or pleading (other than the Definitive Documents subject to clause (i) herein) that materially affects any Consenting Lender to the counsel of such Consenting Lender in no event less than three (3) Business Days prior to the date when the Debtors intend to file such motion or pleading with the Bankruptcy Court; provided, that in the event that not less than three (3) Business Days’ notice is impossible or impracticable under the circumstances, the Debtors shall provide such draft copies to the applicable Consenting Lenders as soon as otherwise practicable before the date when the Debtors intend to file any such motion or other pleading;

(l)inform counsel to the Required Consenting Lenders as soon as practicable after becoming aware of: (A) any event or circumstance that has occurred, or that is reasonably likely to occur (and if it did so occur), that would permit any Party to terminate, or would result in the

termination of, this Agreement; (B) any matter or circumstance which they know, or suspect is likely, to be a material impediment to the implementation or consummation of the Restructuring Transactions; (C) any notice of any commencement of any involuntary bankruptcy, winding up, dissolution, liquidation, administration, moratorium, reorganization or other relief under any federal, state or foreign bankruptcy, insolvency, administrative receivership or similar law now or hereafter in effect, except as provided for in this Agreement, or of any legal suit for payment of debt or securement of security from or by any person in respect of any Company Party; (D) a breach of this Agreement (including a breach by any Company Party); and (E) any representation or statement made or deemed to be made by them under this Agreement which is or proves to have been materially incorrect or misleading in any respect when made or deemed to be made;

(m)maintain the good standing and legal existence of each Company Party under the Laws of the state in which it is incorporated, organized or formed;

(n)conduct its businesses and operations in the ordinary course and in compliance with Law in a manner that is otherwise in compliance in all respects with all of the provisions of the Prepetition Facilities Documents;

(o)regardless of whether the Restructuring Transactions are consummated, pay in full and in cash all of the Restructuring Fees and Expenses; and

(p)(i) take all actions reasonably necessary or desirable to delist the Existing Equity Interests from the Nasdaq Stock Market (“Nasdaq”) and to deregister under the Exchange Act as promptly as practicable in compliance with Securities and Exchange Commission (“SEC”) rules, (ii) file a Form 25 with the SEC to delist the Existing Equity Interests from Nasdaq and to deregister the Existing Equity Interests from Section 12(b) of the Exchange Act (unless Nasdaq has already filed a Form 25 with the SEC providing for such delisting and deregistration), (iii) file post-effective amendments to terminate all of CalAmp’s currently effective registration statements under the Securities Act, (iv) file a Form 15 notifying the SEC of the suspension of CalAmp’s duty to file reports under Section 15(d) of the Exchange Act, and (v) take all actions reasonably necessary or desirable to ensure (A) that the New Equity Interests shall not be listed on a public securities exchange and that Reorganized CalAmp shall not be required to list the New Equity Interests on a recognized securities exchange, except, in each case, as otherwise may be required pursuant to the New Corporate Governance Documents and (B) that Reorganized CalAmp and/or the Reorganized Debtors shall not be voluntarily subjected to any reporting requirements promulgated by the SEC.

6.02.Negative Commitments. Except as set forth in Section 7, during the Agreement Effective Period, the Company Parties shall not, without the prior written consent of the Required Consenting Lenders, directly or indirectly:

(a)take any action or file any motion, pleading, or Definitive Document with the Bankruptcy Court or any other court (including any modifications or amendments thereof) that is inconsistent in any material respect with, or is intended to frustrate or impede approval, implementation, and consummation of, the Restructuring Transactions;

(b)seek to modify the Definitive Documents in whole or in part, in a manner that is not consistent with this Agreement in all material respects;

(c)amend or change, or pose to amend or change, any of the Company Parties’ respective Organizational Documents;

(d)grant, agree to grant, or make any payment on account of (including pursuant to a key employee retention plan, key employee incentive plan, or other similar arrangement) any additional or increase in the wages, salary, bonus, commissions, retirement benefits, pension, severance or other compensation or benefits of any employee or director qualifying as an insider under the Bankruptcy Code, without the prior written consent of the Required Consenting Lenders;

(e)authorize, create, issue, sell or grant any additional equity interests, or reclassify, recapitalize, redeem, purchase, acquire, declare any distribution on, or make any distribution on any equity interests, in each case, without the consent of the Required Consenting Lenders;

(f)(i) seek discovery in connection with, prepare, or commence any proceeding or other action that challenges (A) the amount, validity, allowance, character, enforceability, or priority of any Company Claims/Interests of any of the Consenting Lenders, or (B) the validity, enforceability, or perfection of any lien or other encumbrance securing any Company Claims/Interests of any of the Consenting Lenders or (ii) support any Person in connection with any of the acts described in clause (i) of this Section 6.02(f);

(g)consummate the Restructuring Transactions unless each of the conditions to the consummation of such transactions set forth in this Agreement has been satisfied (or waived by the applicable Persons in accordance with Section 13); or

(h)solicit, initiate, encourage, or propose (in each case, directly or indirectly) any Alternative Restructuring Proposal.

Section 7.Additional Provisions Regarding Company Parties’ Commitments.

7.01.Notwithstanding anything to the contrary in this Agreement, nothing in this Agreement shall require the Company Parties or the board of directors, board of managers, any special committee, or similar governing body of any Company Party, including any director, manager, or officer of any Company Party, after consulting with counsel, to take or refrain from taking any action pursuant to this Agreement (including terminating this Agreement), to the extent the board of directors or managers, or special committee, reasonably determines in good faith, based on the advice of counsel (including counsel to the Company Parties), that taking, or refraining from taking, such action, as applicable, would be inconsistent with its fiduciary obligations or applicable Law, and any such action or inaction pursuant to such exercise of fiduciary duties shall not be deemed to constitute a breach of this Agreement. The Company Parties shall provide prompt written notice (within two (2) days) to counsel to the Required Consenting Lenders of any such determination in accordance with this Section 7.01 to take or refrain from taking any action. This Section 7.01 shall not impede the Consenting Lenders’ right to terminate this Agreement pursuant to Section 12.01 of this Agreement.

7.02.The Company Parties shall notify the Consenting Lenders in writing as promptly as practicable after receipt by any Company Party or its representatives or agents of any proposal or offer from any person or entity to effect an Alternative Restructuring Proposal or any request for confidential information relating to the Company Parties or any request to enter into a Confidentiality Agreement related to a potential Alternative Restructuring Proposal. Such notice shall indicate the identity of the person or entity making the proposal, offer, or request and the material terms of any such proposal, offer, or request to the extent permitted by applicable Law.

7.03.Notwithstanding anything to the contrary in this Agreement (but subject to Sections 6.01, 7.01 and 7.02, the Company Parties and their respective directors, officers, employees, investment bankers, attorneys, accountants, consultants, and other advisors or representatives shall have the right to: (a) consider and respond to, but not solicit, propose, or encourage, an Alternative Restructuring Proposal; provided that the Company Parties must use their reasonable best efforts to (i) provide copies of any such Alternative Restructuring Proposal received to the Required Consenting Lenders’ Advisors no later than one (1) calendar day following receipt thereof; (ii) provide the Required Consenting Lenders’ Advisors with regular updates as to the status and progress of such Alternative Restructuring Proposal; and (iii) respond promptly to information requests and questions from the Required Consenting Lenders’ Advisors relating to such Alternative Restructuring Proposal; (b) provide access to nonpublic information concerning any Company Party to any Entity or enter into confidentiality agreements or nondisclosure agreements with any Entity for the purpose of facilitating such Entity’s participation in the Restructuring Transactions or such Entity’s Alternative Restructuring Proposal; and (c) enter into or continue discussions or negotiations with holders of Company Claims/Interests in a Company Party, any other party in interest or any other Entity regarding the Restructuring Transactions.

7.04.Nothing in this Agreement shall prevent the Company Parties from enforcing this Agreement or contesting whether any matter, fact, or thing is a breach of, or is inconsistent with, this Agreement.

Section 8.Transfer of Company Claims/Interests.

8.01.During the Agreement Effective Period, no Consenting Lender shall Transfer any ownership (including any beneficial ownership as defined in the Rule 13d-3 under the Exchange Act) in any Company Claims/Interests to any Affiliated or un-Affiliated party, including any party in which it may hold a direct or indirect beneficial interest, unless:

(a)the transferee executes and delivers to counsel to the Company Parties and counsel to the Required Consenting Lenders, at or within two (2) Business Days of the date of the proposed Transfer, a Joinder; or

(b)the transferee is a Consenting Lender or an Affiliate, affiliated fund, or affiliated entity with a common investment advisor (which such Affiliate, affiliated fund or affiliated entity shall be bound by the terms of this Agreement pursuant to the agreement of its common investment advisor) thereof and the transferee provides notice of such Transfer (including the amount and type of Company Claims/Interests Transferred) to counsel to the Company Parties and counsel to the Required Consenting Lenders at or within two (2) Business Days of the date of the proposed Transfer.

Notwithstanding anything contained herein to the contrary, a Consenting Lender may Transfer any or all of its Company Claim/Interest to any Affiliate of such Consenting Lender or another Consenting Lender.

8.02.Upon compliance with the requirements of Section 8.01, the transferee shall be deemed a “Consenting Lender” and a “Party” under this Agreement and the transferor shall be deemed to relinquish its rights (and be released from its obligations) under this Agreement to the extent of the rights and obligations in respect of such transferred Company Claims/Interests. Any Transfer in violation of Section 8.01 above shall be null and void ab initio and of no force or effect until such a Joinder is executed and effective.

8.03.This Agreement shall in no way be construed to preclude the Consenting Lenders from acquiring additional Company Claims/Interests; provided, however, that (a) such additional Company Claims/Interests shall automatically and immediately upon acquisition by a Consenting Lender be deemed subject to the terms of this Agreement (regardless of when or whether notice of such acquisition is given to counsel to the Company Parties or counsel to the Required Consenting Lenders), (b) such Consenting Lender must provide notice of such acquisition (including the amount and type of Company Claims/Interests acquired) to counsel to the Company Parties and counsel to the Required Consenting Lenders within five (5) Business Days of such acquisition, and (c) such additional Company Claims/Interests shall be treated as if such Consenting Lender had ownership of such Company Claims/Interests on the date such Consenting Lender first executed this Agreement. For the avoidance of doubt, and notwithstanding anything to the contrary set forth herein, all Transfers of Term Loan Claims and Secured Notes Claims shall remain subject to the terms of the applicable Prepetition Facilities Documents.

8.04.Notwithstanding Section 8.01, a Qualified Marketmaker that acquires any Company Claims/Interests with the purpose and intent of acting as a Qualified Marketmaker for such Company Claims/Interests shall not be required to execute and deliver a Joinder in respect of such Company Claims/Interests if (i) such Qualified Marketmaker subsequently Transfers such Company Claims/Interests (by purchase, sale, assignment, participation, or otherwise) within ten (10) Business Days of its acquisition to a transferee that is an Entity that is not an Affiliate, affiliated fund, or affiliated Entity with a common investment advisor of the Qualified Marketmaker; (ii) the transferee otherwise is a Permitted Transferee under Section 8.01; and (iii) the Transfer otherwise is a permitted Transfer under Section 8.01. To the extent that a Consenting Lender is acting in its capacity as a Qualified Marketmaker, it may Transfer (by purchase, sale, assignment, participation, or otherwise) any right, title, or interests in Company Claims/Interests that the Qualified Marketmaker acquires from a holder of the Company Claims/Interests who is not a Consenting Lender without the requirement that the transferee be a Permitted Transferee.

8.05.The Company Parties understand that the Consenting Lenders are engaged in a wide range of financial services and businesses. In furtherance of the foregoing, the Company Parties acknowledge and agree that the obligations set forth in this Agreement shall only apply to the trading desk(s) and/or business group(s) of the Consenting Lenders that principally manage and/or supervise each Consenting Lender’s investment in the Company Parties, and shall not apply to any other trading desk or business group of each Consenting Lender, so long as they are not acting at the direction or for the benefit of such Consenting Lender or in connection with such Consenting Lender’s investment in the Company Parties.

8.06.Notwithstanding anything to the contrary in this Section 8, the restrictions on Transfer set forth in this Section 8 shall not apply to the grant of any liens or encumbrances on any claims and interests in favor of a bank or broker-dealer holding custody of such claims and interests in the ordinary course of business and which lien or encumbrance is released upon the Transfer of such claims and interests.

Section 9.Representations and Warranties of Consenting Lenders. Each Consenting Lender severally, and not jointly, represents and warrants to the Company Parties that, as of the date such Consenting Lender executes and delivers this Agreement or a Joinder to this Agreement, as applicable:

(a)it is the beneficial or record owner of the face amount of the Company Claims/Interests or is the nominee, investment manager, or advisor for beneficial holders of the Company Claims/Interests reflected in such Consenting Lender’s signature page or Joinder to this Agreement, as applicable (as may be updated pursuant to Section 8);

(b)it has the full power and authority to act on behalf of, vote, and consent to matters concerning, such Company Claims/Interests;