- Business combination transaction with ARYA Sciences Acquisition

Corp IV, a special purpose acquisition company sponsored by an

affiliate of Perceptive Advisors, closed on July 31, 2024

- Publicly traded company renamed Adagio Medical Holdings, Inc.,

with Adagio Medical as an operating subsidiary

- Common stock expected to commence trading under ticker symbol

“ADGM” on the Nasdaq Capital Market on August 1, 2024

Adagio Medical, Inc. (“Adagio Medical”), a leading innovator in

catheter ablation technologies for treatment of cardiac

arrhythmias, announced today the completion of its business

combination with ARYA Sciences Acquisition Corp IV (Nasdaq: ARYD;

or “ARYA IV”), a special purpose acquisition company sponsored by

an affiliate of Perceptive Advisors, LLC (“Perceptive Advisors”).

Upon closing the transaction, the shares of common stock of the

combined company, Adagio Medical Holdings, Inc., are expected to

commence trading under the ticker symbol “ADGM” on the Nasdaq

Capital Market on August 1, 2024, with Adagio Medical operating

under its current management team as a subsidiary of the combined

company.

The business combination was approved by the requisite number of

ARYA IV’s shareholders on July 26, 2024. The transaction had been

previously approved by the requisite number of Adagio Medical’s

stockholders. In connection with the business combination, the

combined company raised financing valued at approximately $84.2

million, which consisted of funds held in ARYA IV’s trust account,

a concurrent equity and warrant private placement (including $29.5

million of bridge financing used by Adagio Medical prior to closing

and funds from ARYA IV’s trust account not redeemed) led by, among

others, affiliates of Perceptive Advisors, RA Capital Management

and RTW Investments, and a concurrent convertible security

financing (including $7 million of bridge financing used by Adagio

Medical prior to closing) led by, among others, an institutional

investor and an affiliate of Perceptive Advisors.

“Adagio Medical was founded in 2011 with the vision to improve

ablation outcomes in patients with complex cardiac arrhythmias,”

said Olav Bergheim, Chief Executive Officer of Adagio Medical and

Adagio Medical Holdings, Inc. “Today’s transaction starts a new

chapter in this journey. Our principal focus will be on

commercialization of the vCLAS™ ultra-low temperature cryoablation

(ULTC) catheter for treatment of ventricular tachycardia (VT) which

we launched in Europe in Q2 this year, and on the execution of

FULCRUM-VT Pivotal IDE trial which was recently approved by the

U.S. Food and Drug Administration. We are grateful to all

participants in this business combination for sharing our vision

and for their trust in our technology and our team.”

“We are excited to partner with Adagio Medical to support the

development of its innovative ablation technologies for the

treatment of ventricular tachycardia and other cardiac

arrhythmias,” said Adam Stone, Chief Investment Officer of

Perceptive Advisors and CEO of ARYA IV. “We believe that their

ability to create deep and durable cardiac lesions is poised to

result in enhanced effectiveness and outcomes, as exemplified by

the promising data from its European and Canadian CRYOCURE-VT

trial, in a patient population that is underserved, and look

forward to working with the Adagio Medical team as they advance

their technology.”

Note Regarding Summary of Transaction

The description of the business combination of Adagio Medical

and ARYA IV (the “Business Combination”) contained herein is only a

high-level summary and is qualified in its entirety by reference to

the underlying documents filed with the U.S. Securities and

Exchange Commission (“SEC”). A more detailed description of the

terms of the transaction has been provided in a registration

statement on Form S-4 filed with the SEC by Adagio Medical

Holdings, Inc. (“New Adagio”), which the SEC declared effective on

July 12, 2024 and contains a definitive proxy/final prospectus

relating to the transaction.

Advisors

Stifel, Nicolaus & Company, Incorporated (“Stifel”) acted as

financial advisor to Adagio Medical. Jefferies LLC (“Jefferies”)

acted as financial and capital markets advisor to ARYA IV, as well

as sole private placement agent. Chardan Capital Markets, LLC

(“Chardan”) acted as sole placement agent for the convertible debt

and as capital markets advisor to ARYA IV. Reed Smith LLP acted as

legal counsel to Adagio Medical. Kirkland & Ellis LLP acted as

legal counsel to ARYA IV. White & Case LLP acted as legal

counsel to Jefferies, Stifel and Chardan.

About Adagio Medical

Adagio Medical is a developmental stage medical device company

located in Laguna Hills, California and focuses on developing

innovative cryoablation technologies that create contiguous,

transmural lesions to treat cardiac arrhythmias, including

paroxysmal and persistent atrial fibrillation, atrial flutter, and

ventricular tachycardia.

No Offer or Solicitation

This communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such

jurisdiction.

Special Note Regarding Forward-Looking Statements

Certain statements in this press release (this “Press Release”)

may be considered “forward-looking statements” within the meaning

of the “safe harbor” provisions of the United States Private

Securities Litigation Reform Act of 1995. Forward-looking

statements generally relate to future events or future financial or

operating performance of ARYA IV, Adagio Medical or New Adagio. For

example, any statements that refer to expectations, projections or

other characterizations of future events or circumstances,

including the estimated or anticipated future results and benefits

of the combined company following the Business Combination,

including future opportunities for the combined company, are

forward-looking statements. In some cases, you can identify

forward-looking statements by terminology such as “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “forecast,”

“future,” “intend,” “may,” “might,” “plan,” “possible,”

“potential,” “predict,” “project,” “propose,” “seek,” “should,”

“strive,” “will,” or “would” or the negatives of these terms or

variations of them or similar terminology. Such forward-looking

statements are subject to risks, uncertainties, and other factors

which may be beyond the control of Adagio Medical or New Adagio and

could cause actual results to differ materially from those

expressed or implied by such forward-looking statements. These

forward-looking statements are based upon estimates and assumptions

that, while considered reasonable by Adagio Medical and its

management and New Adagio and its management, as the case may be,

are inherently uncertain. Each of Adagio Medical and New Adagio

cautions you that these statements are based on a combination of

facts and factors currently known and projections of the future,

which are inherently uncertain. There are risks and uncertainties

described in the definitive proxy/final prospectus relating to the

Business Combination, which has been filed by New Adagio with the

SEC, and described in other documents filed by ARYA IV or New

Adagio from time to time with the SEC. These filings may identify

and address other important risks and uncertainties that could

cause actual events and results to differ materially from those

contained in the forward-looking statements. Neither ARYA IV nor

New Adagio can assure you that the forward-looking statements in

this communication will prove to be accurate.

In addition, new risks and uncertainties may emerge from time to

time, and it may not be possible to identify and accurately predict

the potential impacts of any such risks and uncertainties that may

arise in the future. Factors that may cause actual results to

differ materially from current expectations include, but are not

limited to: (1) the outcome of any potential litigation, government

or regulatory proceedings that may be instituted against Adagio

Medical, New Adagio or others; (2) the ability to meet stock

exchange listing standards following the consummation of the

Business Combination; (3) the risk that the Business Combination

disrupts current plans and operations of Adagio Medical or New

Adagio as a result of the announcement and consummation of the

Business Combination; (4) Adagio Medical’s ability to remain

compliant with the covenants of its existing debt, including any

convertible or bridge financing notes; (5) New Adagio’s ability to

remain compliant with the covenants of, and other obligations

under, the senior secured convertible notes that were issued in

connection with the closing of the Business Combination; (6) the

ability to recognize the anticipated benefits of the Business

Combination, which may be affected by, among other things,

competition, the ability of New Adagio to grow and manage growth

profitably, maintain relationships with customers and suppliers and

retain its management and key employees; (7) costs related to the

Business Combination; (8) risks associated with changes in

applicable laws or regulations and Adagio Medical’s or New Adagio’s

international operations and operations in a regulated industry;

(9) the possibility that Adagio Medical or New Adagio may be

adversely affected by other economic, business, and/or competitive

factors; (10) Adagio Medical’s or New Adagio’s use of proceeds,

post-Business Combination fully diluted equity value or fully

diluted enterprise value, expected pro forma cash, expected cash

runway or funding gap, estimates of expenses and profitability; and

(11) the other risks and uncertainties set forth in the sections

entitled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements” in other documents to be filed with the

SEC by New Adagio. The foregoing list of factors is not exhaustive.

There may be additional risks that Adagio Medical or New Adagio

does not presently know or that Adagio Medical or New Adagio

currently believes are immaterial that could also cause actual

results to differ from those contained in the forward-looking

statements. Actual events and circumstances are difficult or

impossible to predict and may materially differ from assumptions.

Many actual events and circumstances are beyond the control of

Adagio Medical and New Adagio. You should not place undue reliance

on any forward-looking statements, which are based only on

information currently available to Adagio Medical, New Adagio or

ARYA IV.

Nothing in this Press Release should be regarded as a

representation or warranty by any person that the forward-looking

statements set forth herein will be achieved or that any of the

contemplated results of such forward-looking statements will be

achieved, in any specified time frame, or at all. You should not

place undue reliance on forward-looking statements, which speak

only as of the date they are made in this Press Release. Subsequent

events and developments may cause those views to change. Neither

ARYA IV, Adagio Medical nor New Adagio undertake any duty to update

these forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731222906/en/

Media Ilya Grigorov Vice President, Global Marketing and

Product Management of Adagio Medical, Inc.

igrigorov@adagiomedical.com Investor

IR@adagiomedical.com

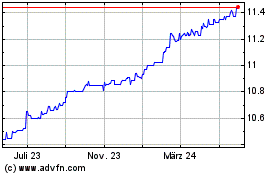

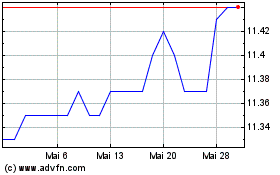

ARYA Sciences Acquisitio... (NASDAQ:ARYD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

ARYA Sciences Acquisitio... (NASDAQ:ARYD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024