UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

March 24, 2023

AROGO CAPITAL ACQUISITION CORP.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-41179 |

|

87-1118179 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

848 Brickell Avenue, Penthouse 5, Miami, FL

33131

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (786) 442-1482

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which

Registered |

| Units, each consisting of one share of Class A Common Stock and one Redeemable Warrant |

|

AOGOU |

|

The Nasdaq Stock Market LLC |

| Class A Common Stock, $0.0001 par value per share |

|

AOGO |

|

The Nasdaq Stock Market LLC |

| Redeemable Warrants, each warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

AOGOW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.03 Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

Company will deposit no later than March 29, 2023, the amount $191,666 (the “Extension Payment”) into the

trust account of the Company for its public stockholders, representing $0.0345 per

public share, which enables the Company to further extend the period of time it has to consummate its initial business combination

by one month from March 29, 2023, to April 29, 2023, (the “April Extension”). The April Extension is the

first of up to nine monthly extensions permitted under the Certificate of Amendment to the Company’s Amended and Restated

Certificate of Incorporation (the “Charter Amendment”) filed with the Office of the Secretary of State of

Delaware following stockholder approval of the Extension at the Company’s Special Meeting of Stockholders discussed in Items

5.03 and 5.07 of this report.

Item 5.03. Amendments

to Articles of Incorporation or Bylaws.

On

March 24, 2023, Arogo Capital Acquisition Corp. (the “Company”) held a Special Meeting of Stockholders (the “Meeting”).

At the Meeting, the Company’s stockholders approved the Charter Amendment, which extends the date by which the Company must consummate

its initial Business Combination from March 29, 2023 to December 29, 2023, subject to the approval of the Board of Directors of the Company,

provided the sponsor or its designees deposit into the trust account an amount equal to $0.0345 per share for each public share or $191,666,

prior to the commencement of each extension period (the “Extension”). The Company filed the Charter Amendment

with the Office of the Secretary of State of Delaware on March 28, 2023, a copy of which is attached as Exhibit 3.1 to this report and

is incorporated by reference herein.

The

Company also made an amendment to the Company’s investment management trust agreement (the “Trust Agreement”),

dated as of December 23, 2021, by and between the Company and Continental Stock Transfer & Trust Company, allowing the Company to

extend the business combination period from March 29, 2023 to December 29, 2023, and updating certain defined terms in the Trust Agreement.

Item 5.07. Submission

of Matters to a Vote of Security Holders.

At

the Meeting, the Company’s stockholders approved the Charter Amendment extending the date by which the Company must consummate the

initial Business Combination from March 29, 2023 to December 29, 2023, (or such earlier date as determined by the Company’s Board

of Directors) (the “Extension Amendment Proposal”).

The

final voting results for the Extension Amendment Proposal were as follows:

| For | | |

Against | | |

Abstain | |

| | 9,989,610 | | |

| 0 | | |

| 0 | |

Also

at the Meeting, the Company’s stockholders approved the proposal to amend the Company’s Trust Agreement, allowing the Company

to extend the business combination period from March 29, 2023 to December 29, 2023, and updating certain defined terms in the Trust Agreement

(the “ Trust Agreement Proposal”).

The

final voting results for the Trust Agreement Proposal were as follows:

| For | | |

Against | | |

Abstain | |

| | 9,989,610 | | |

| 0 | | |

| 0 | |

Stockholders

holding 5,289,280 shares of common stock exercised their right to redeem their shares for cash at an approximate price of $10.45 per

share of the funds in the Trust Account. As a result, approximately $55,272,976 will be removed from the Trust Account to pay such holders.

Following

the redemption, the Company’s remaining shares of Class A common stock outstanding were 5,552,745. The Company must deposit into

the Trust Account $191,666 for the initial extension period (commencing March 29, 2023 and ending April 29, 2023).

Item

7.01 Regulation FD Disclosure.

On

March 28, 2023, the Company issued a press release announcing the Extension.

A

copy of the Press Release is furnished as Exhibit 99.1 hereto. The information in this Item 7.01 and Exhibit 99.1 hereto shall not be

deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Forward

Looking Statements

This

communication contains certain statements which may be deemed as “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995 and other securities laws. Such statements include, but are not limited to, statements about

future financial and operating results, our plans, objectives, expectations and intentions with respect to future operations, products

and services; and other statements identified by words such as “will likely result,” “are expected to,” “will

continue,” “is anticipated,” “estimated,” “believe,” “intend,” “plan,”

“projection,” “outlook” or words of similar meaning. These forward-looking statements include, but are not limited

to, statements regarding EON Reality’s industry and market sizes, future opportunities for EON Reality and Arogo, EON Reality’s

estimated future results and the proposed business combination between Arogo and EON Reality, including the implied enterprise value,

the expected transaction and ownership structure and the likelihood, timing and ability of the parties to successfully consummate the

proposed transaction. Such forward-looking statements are based upon the current beliefs and expectations of the management and are inherently

subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and

generally beyond the management’s control. Actual results and the timing of events may differ materially from the results anticipated

in these forward-looking statements.

In

addition to factors previously disclosed in Arogo’s reports filed with the SEC and those identified elsewhere in this communication,

the following factors, among others, could cause actual results and the timing of events to differ materially from the anticipated results

or other expectations expressed in the forward-looking statements: inability to meet the closing conditions to the business combination,

including the occurrence of any event, change, legal proceedings instituted against EON Reality or against Arogo related to the business

combination agreement or the management team, or other circumstances that could give rise to the termination of the business combination

agreement; the inability to complete the transactions contemplated by the business combination agreement due to the failure to obtain

approval of Arogo’s stockholders; redemptions exceeding a maximum threshold or the failure to meet The Nasdaq Stock Market’s

initial listing standards in connection with the consummation of the contemplated transactions; costs related to the transactions contemplated

by the business combination agreement; a delay or failure to realize the expected benefits from the proposed business combination agreement

transaction including EON Reality’s ability to effectively develop and successfully market new products, solutions and services,

and to effectively address cost reductions and other changes in its industry; risks related to disruption of management’s time

from ongoing business operations due to the proposed business combination transaction; changes in the virtual reality markets in which

EON Reality competes, including with respect to its competitive landscape, technology evolution or regulatory changes on solutions,

services, labor matters, international economic, political, legal, compliance and business factors; developments and uncertainties in

domestic and foreign trade policies and regulations, and other regulations which may cause contractions or affect growth rates and cyclicality

of markets EON Reality serve; disruptions relating to war, terrorism, widespread protests and civil unrest, man-made and natural disasters,

public health issues and other events; changes in domestic and global general economic conditions; risk that EON Reality may not be able

to execute its growth strategies; security breaches or other disruptions of EON Reality information technology systems or violations

of data privacy laws; EON Reality’s inability to adequately protect its intellectual property; risks related to the ongoing COVID-19

pandemic and response, including new variants of the virus; the pace of recovery in the markets in which EON Reality operates; global

supply chain disruptions and potential staffing shortages at potential customers which may have a trickle-down effect on EON Reality;

risk that EON Reality may not be able to develop and maintain effective internal controls; and other risks and uncertainties indicated

in Arogo’s final prospectus, dated December 23, 2021, for its initial public offering, and those that will be contained in the

proxy statement/prospectus relating to the proposed business combination, including those under “Risk Factors” therein, and

in Arogo’s other filings with the SEC. EON Reality and Arogo caution that the foregoing list of factors is not exclusive. These

forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by

any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability.

Actual results, performance

or achievements may differ materially, and potentially adversely, from any projections and forward-looking statements and the assumptions

on which those forward-looking statements are based. There can be no assurance that the data contained herein is reflective of future

performance to any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor of future performance

as projected financial information and other information are based on estimates and assumptions that are inherently subject to various

significant risks, uncertainties and other factors, many of which are beyond the management’s control. All information set forth

herein speaks only as of the date hereof in the case of information about Arogo and EON Reality or the date of such information in the

case of information from persons other than Arogo or EON Reality, and except to the extent required by applicable law, we disclaim any

intention or obligation to update or revise any forward-looking statements as a result of new information, future events and developments

or otherwise occurring after the date of this communication. Forecasts and estimates regarding EON Reality’s industry and markets

are based on sources we believe to be reliable, however there can be no assurance these forecasts and estimates will prove accurate in

whole or in part. Projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual

results. Neither Arogo nor EON Reality gives any assurance that either Arogo or EON Reality, respectively, will achieve its expectations.

Additional Information and Where to Find It

In connection

with the proposed business combination transaction, Arogo filed relevant materials with the Securities and Exchange Commission (the “SEC”),

including a filed registration statement on Form S-4, which included a draft proxy statement/prospectus of Arogo on October 7, 2022, and

the First Amendment to the Form S-4 on February 13, 2023, and it intends to file other documents regarding the proposed business combination

transaction with the SEC in the future. Arogo’s stockholders and other interested persons are advised to read, when available, the

preliminary proxy statement/prospectus and the amendments thereto and the definitive proxy statement and documents incorporated by reference

therein filed in connection with the proposed business combination transaction, as these materials will contain important information

about EON Reality, Arogo and the proposed business combination transaction. Promptly after the Form S-4 is declared effective by the SEC,

Arogo will mail the definitive proxy statement/prospectus and a proxy card to each stockholder entitled to vote at the meeting relating

to the approval of the business combination and other proposals set forth in the proxy statement/prospectus. Before making any voting

or investment decision, investors and stockholders of Arogo are urged to carefully read the entire registration statement and proxy statement/prospectus,

now that they are available and when they are declared effective, and any other relevant documents filed with the SEC, as well as any

amendments or supplements to these documents, because they will contain important information about the proposed business combination

transaction. The documents filed by Arogo with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov, (Registration

No. 333-259338), or by directing a request to Arogo Capital Acquisition Corp., 848 Brickell Avenue, Penthouse 5, Miami, FL 33131.

No Offer or Solicitation

This Current Report on Form

8-K does not constitute (i) a solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the proposed

business combination, or (ii) an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or

approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior

to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by

means of a prospectus meeting the requirements of the U.S. Securities Act.

Participants in the Solicitation

Arogo and its directors and

executive officers may be deemed participants in the solicitation of proxies from its stockholders with respect to the business combination.

A list of the names of those directors and executive officers and a description of their interests in Arogo will be included in the proxy

statement/prospectus for the proposed business combination when available at www.sec.gov. Information about Arogo’s directors and

executive officers and their ownership of Arogo common stock is set forth in Arogo’s prospectus, dated December 23, 2021, as modified

or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing. Other information regarding the interests of

the participants in the proxy solicitation will be included in the proxy statement/prospectus pertaining to the proposed business combination

when it becomes available. These documents can be obtained free of charge from the source indicated above.

EON Reality and its directors

and executive officers may also be deemed to be participants in the solicitation of proxies from the stockholders of Arogo in connection

with the proposed business combination. A list of the names of such directors and executive officers and information regarding their interests

in the proposed business combination will be included in the proxy statement/prospectus for the proposed business combination.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

AROGO CAPITAL ACQUISITION CORP. |

| |

|

|

| |

By: |

/s/ Suradech Taweesaengsakulthai |

| |

|

Name: |

Suradech Taweesaengsakulthai |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

| Dated: March 28, 2023 |

|

|

5

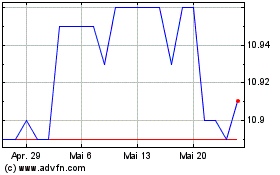

Arogo Capital Acquisition (NASDAQ:AOGO)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Arogo Capital Acquisition (NASDAQ:AOGO)

Historical Stock Chart

Von Nov 2023 bis Nov 2024