REITs Large Dividends Continue to Benefit From Record Low Interest Rates

15 Mai 2012 - 2:20PM

Marketwired

High yielding mortgage REITs have performed admirably in 2012. The

Vanguard REIT ETF (VNQ) is up more than 12 percent-year-to-date.

REITS have continued to take advantage of low interest rates to

boost earnings and increase dividends for investors. REITs trade

like stocks, but by law, they must pay out 90 percent of their

taxable income to shareholders as dividends. The Paragon Report

examines investing opportunities on diversified REITs and provides

equity research on American Capital Agency Corp. (NASDAQ: AGNC) and

ARMOUR Residential REIT, Inc. (NYSE: ARR).

Access to the full company reports can be found at:

www.ParagonReport.com/AGNC

www.ParagonReport.com/ARR

Continuously low interest rates are boosting earnings throughout

the sector. Dividend returns for Mortgage REITs are partially

dependent on interest rate spreads. Higher interest rates make

borrowing less profitable for REITs. Federal Reserve Chairman Ben

Bernanke last month said that the central bank "would not hesitate"

to purchase more bonds to drive borrowing costs lower if the

economy needed it.

The Federal Reserve has kept its benchmark rate near zero since

December 2008, and last month the Fed's policy panel reiterated

that it does not expect rates to rise until late 2014 at the

earliest. It has also bought $2.3 trillion of bonds in two rounds

of so-called quantitative easing.

Paragon Report releases regular market updates on diversified

REITs so investors can stay ahead of the crowd and make the best

investment decisions to maximize their returns. Take a few minutes

to register with us free at www.paragonreport.com and get exclusive

access to our numerous stock reports and industry newsletters.

American Capital Agency Corp. operates as a real estate

investment trust (REIT). It invests in residential mortgage

pass-through securities and collateralized mortgage obligations for

which the principal and interest payments are guaranteed by

government-sponsored entities or by the United States government

agency. The company currently offers investors an annual dividend

of $5.00 per share for a yield of 15.47 percent.

ARMOUR is a Maryland corporation that invests primarily in

hybrid adjustable rate, adjustable rate and fixed rate residential

mortgage backed securities. These securities are issued or

guaranteed by U.S. Government-chartered entities. ARMOUR is

externally managed and advised by ARMOUR Residential Management

LLC. The company currently offers investors an annual dividend of

$1.20 per share for a yield of 17.29 percent.

Paragon Report provides Market Research focused on equities that

offer growth opportunities, value, and strong potential return. We

strive to provide the most up-to-date market activities. We

constantly create research reports and newsletters for our members.

The Paragon Report has not been compensated by any of the

above-mentioned companies. We act as independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at: www.ParagonReport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

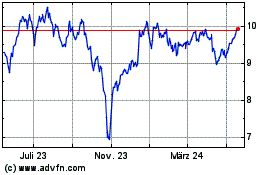

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024