SEC Threat Takes Allure Away From REIT Dividends

20 September 2011 - 2:16PM

Marketwired

With the VIX volatility index pushing towards record levels over

the last month, long term investors have turned their attention to

safe haven plays. Investors usually count on dividend paying stocks

during hectic times in the market believing in the company's

security and real earnings power. Additionally, when interest rates

get as low as they currently are, the return on dividends can far

exceed that of bonds. The Bedford Report examines the outlook for

diversified REITs and provides equity research on American Capital

Agency Corporation (NASDAQ: AGNC) and Annaly Capital Management,

Inc. (NYSE: NLY). Access to the full company reports can be found

at:

www.bedfordreport.com/AGNC

www.bedfordreport.com/NLY

Real Estate Invest Trusts (REITs) have some of the highest

yields on Wall Street. To be classified as a REIT, a company must

distribute at least 90 percent of its taxable income to

shareholders annually in the form of dividends.

Earlier this month mortgage REITs took a sizeable hit after the

Securities and Exchange Commission launched a review that could

subject these companies to tighter regulation. The SEC announced

that it will solicit public comment to determine if mortgage real

estate investment trusts should be regulated as investment

companies and therefore subject to the Investment Act of 1940. The

SEC noted the Investment Act didn't foresee the explosive growth of

mortgage securities or the flood of other mortgage investors that

have entered the industry. According to The Wall Street Journal a

big concern for mortgage REITs is they will lose their ability to

employ high levels of leverage if they are subject to the

Investment Act. Mortgage REITs have high dividend yields partly

because the managers use high leverage, which can boost

returns.

The Bedford Report releases stock research on REITs so investors

can stay ahead of the crowd and make the best investment decisions

to maximize their returns. Take a few minutes to register with us

free at www.bedfordreport.com and get exclusive access to our

numerous analyst reports and industry newsletters.

Agency Mortgage REITs such as American Capital Agency and Annaly

have portfolios made up principally of mortgages insured by the

federal agencies Fannie Mae, Freddie Mac and Ginnie Mae. They

typically borrow at low rates and lend in the mortgage markets at

higher rates, usually by buying mortgage-backed securities.

Presently Annaly Capital Management pays an annual dividend of

$2.60 for a yield of 14.5 percent. American Capital Agency pays an

annual dividend of $5.60 per share for a hefty yield of around 19

percent.

The Bedford Report provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. The Bedford Report has not been compensated by any of the

above mentioned publicly traded companies. The Bedford Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.bedfordreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: The Bedford Report Email Contact

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

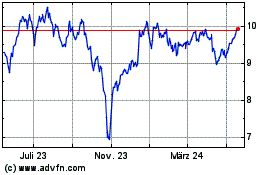

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024