TIDMIGP

RNS Number : 1898T

Intercede Group PLC

23 November 2021

23 November 2021

INTERCEDE GROUP plc

('Intercede', the 'Company' or the 'Group')

Interim Results for the Six Months Ended 30 September 2021

Intercede, the leading specialist in digital identity,

credential management and secure mobility, today announces its

interim results for the six months ended 30 September 2021.

Financial Highlights

-- Revenues for the six months ended 30 September 2021 (H1)

totalling GBP4.9m are approximately 9% higher than last year on a

constant currency basis and 2% higher on a reported basis (2020:

GBP4.8m). This represents a fifth successive year of H1 growth with

compound average growth of 11% over the five corresponding H1

periods to 30 September 2021 .

-- Operating expenses increased by 3% to GBP4.6m (2020: GBP4.4m).

-- Increased revenues and a reduction in finance costs,

following the early retirement of convertible loan notes totalling

GBP5.0m in February 2021, have resulted in an increased profit for

the period of GBP0.5m (2020: GBP0.4m). Basic and fully diluted

earnings per share is 0.9p (2020: basic earnings per share of 0.9p

and a fully diluted earnings per share of 0.8p).

-- Cash balances of GBP8.5m at 30 September 2021 compared to

GBP8.0m held at 31 March 2021. It is worth noting that the 2021

R&D tax claim totalling GBP0.4m had not been received by the

period end and does not form part of the cash balances as at 30

September 2021 (2019: R&D claim totalling GBP0.4m was received

by the period end and formed part of the cash balances as at 30

September 2020).

-- Intercede's Connect Partner Programme has helped to form new

partnerships in Europe, the US, ASEAN, Latin America and Africa.

This has resulted in a record number of eight new customers being

signed up during H1.

Operating Highlights

-- MyID v12 released to plan, introducing a FIDO2 certified

authentication server, an improved operator client and a new MyID

authorisation service, which enables remote transaction approval

from a mobile app using secure multi-factor authentication

including fingerprint, PIN, or facial matching.

-- Phase 2 of the Intercede turnaround plan is underway to push

scalability and accelerate revenue growth. The Company is building

an M&A pipeline to expand its footprint across the

authentication pyramid and to address adjacent market segments.

Chuck Pol, Chairman, said:

"Intercede continues to be cash generative and deliver revenue

growth during a continued period of worldwide social and economic

turbulence. Sales through our Connect Partner Programme are

particularly encouraging, delivering a record number of new

customers in the first half, that are expected to generate

incremental revenues over time

The recent cyber-attack on Colonial Pipeline and the

after-effects of the SolarWinds breach are a strong reminder that

nations and enterprises need to heighten their cyber security

defences in order to maintain the confidence of the public. In our

view, the Intercede product suite is a best in class solution for

those parties looking to gain the highest levels of protection from

malicious and devastating cyber strikes. The MyID platform provides

Intercede's customers with government-grade multi-factor

authentication, whether it is PKI credential management or FIDO for

the Enterprise, allowing them to mix and match technologies and

manage them from a single software solution. B eing the only

provider to offer a PKI and FIDO hybrid solution means that we are

well placed to take market share as it becomes increasingly

accepted that password protection alone is not sufficient to

prevent unwanted attacks.

The Board continues to believe that Intercede is well placed to

benefit from the heightened and global focus on Cyber Security and

will look to strengthen this position going forward. "

ENQUIRIES

Intercede Group plc Tel. +44 (0)1455 558 111

Klaas van der Leest, Chief Executive

Andrew Walker, Finance Director

finnCap Tel. +44 (0)20 7220 0500

Stuart Andrews/Simon Hicks, Corporate Finance

Tim Redfern/Charlotte Sutcliffe, ECM

About Intercede

Intercede is a cybersecurity company specialising in digital

identities, derived credentials and access control, enabling

digital trust in a mobile world.

Headquartered in the UK, with offices in the US, we believe in a

connected world in which people and technology are free to exchange

information securely, and complex insecure passwords become a thing

of the past.

Our vision is to make the highest levels of cybersecurity

available to organizations and consumers alike, solving complexity

and scalability issues by managing high volumes of digital

credentials.

We have been delivering trusted solutions to high profile

customers for over 20 years. Our team of experts has deployed

millions of identities to governments, most of the largest

aerospace and defence corporations, and major financial services

and healthcare organizations, as well as leading

telecommunications, cloud services and information technology

firms, providing industry-leading employee and customer credential

management systems.

For more information visit: www.intercede.com

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law

by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and

is disclosed in accordance with the company's obligations under

Article 17 of MAR.

INTERCEDE GROUP plc

('Intercede', 'the Company' or 'the Group')

Interim Results for the Six Months Ended 30 September 2021

Interim Management Review

Introduction

Despite the COVID-19 pandemic, the previous financial year

demonstrated that Intercede has significant reasons to be

optimistic for the future. The Group completed Phase 1 of its

turnaround after recording its third consecutive year of profit and

cash generation, with 14% growth in revenues in its dominant US

market. The continuing positive trend and momentum gave the Board

the confidence to issue a call notice in respect of the outstanding

convertible loan notes (CLNs) totalling GBP5,005,000. The removal

of this debt from the balance sheet, and the elimination of the

associated interest cost, means Intercede is well placed to pursue

its growth strategy into 2021 and beyond.

Throughout this year, we have seen yet more evidence of the

economic and reputational threat posed to governments and

enterprises by cyber attacks. The first half of this financial year

has given rise to a number of catastrophic cybersecurity breaches

including the recent attack on Colonial Pipeline, whilst many

organisations are also still dealing with the aftereffects of the

SolarWinds breach. The increased instances of such malicious and

targeted strikes led to President Biden's administration issuing an

Executive Order on cybersecurity in May 2021. The Executive Order

is wide ranging, covering enhanced information sharing, replicable

'playbook' style responses to cybersecurity incidents and increased

vendor transparency. One item that stands out is that

username/password combination alone is not a permitted form of

authentication to access government systems and data and instead

secure Multi-factor Authentication (MFA) is mandated.

"Hackers don't break in, they log in"

Vasu Jakkal, Security vice-president Microsoft

Fundamentally, it is time to move on from passwords. Last year,

username/password breaches increased by +450% in the US, according

to ForgeRock's Identity Breach Report 2021. A key learning from the

Colonial attack is that MFA is not enough and the recent Executive

Order requires that authentication is secured with encryption of

data at rest and in transit. MFA is used to ensure that digital

users are who they say they are by requiring that they provide at

least two pieces of evidence to prove their identity. Each piece of

evidence must come from a different category: something they know,

something they have or something they are. Commonly, day-to-day MFA

utilises SMS-based one-time passwords (OTP's) but these are at risk

of phishing via open source and readily available phishing tools or

methods such as SIM swapping that rely on social engineering. This

is not the case with secure MFA, such as Public Key Infrastructure

(PKI) and FIDO (Faster Identity Online), which provide highly

secure crypto-based security that meets the requirements of the

Executive Order and mitigate against the threat of phishing, social

engineering, brute force and password spraying attacks.

In July 2021, Intercede was excited to announce that MyID had

been formally FIDO2 certified. The certification has been awarded

after MyID passed FIDO Alliance interoperability trials

demonstrating its ability to use open authentication standards

backed by technology leaders including Microsoft, Apple, Google,

Intel, Facebook and Amazon. This certification opens up Intercede's

addressable market by both territorial reach and product

breath.

The MyID platform manages deployment and lifecycle events for

both PKI, FIDO and combined PKI/FIDO devices, giving consistency

over policy, reporting and user experience. Intercede is proud to

offer the MyID platform as the first global solution to offer a

truly unified approach to credential management.

Strategy

Intercede continues to focus on its 5C strategy, centred around

Colleagues, Customers, Channels, Code and Cash. In this second

phase of our turnaround, we are adding a new C: Corporate

Development. The Group is actively exploring buy-side M&A

following the appointment of a new full time Head of Corporate

Development. The Board sees the value in taking time to ensure the

right strategic fit(s) to ensure scalability and accelerated

revenue growth, whilst also pursuing a disciplined approach to deal

pricing.

1. Colleagues

Intercede's product innovation roadmap leverages over 1,000

person-years of internal development expertise that would require a

competitor to spend significant time and effort to replicate. Put

very simply, the Group respects its staff and recognises they are

one of its most valuable assets. Two-way communication is promoted

to encourage colleagues to share their views and preferences, be

they positive or negative, so they can be addressed to deliver a

workplace that is enjoyable and productive. In September 2021, all

colleagues were invited to take part in the annual employee survey

which saw a high response of 96% (compared to an industry average

in the mid-60%s). Engagement has increased from 63% in 2017 to 85%

in 2021 (above industry norm) and has held steady compared to 2020,

which is reassuring and a positive indication of colleagues' health

and wellbeing during the pandemic and the switch to remote

working.

2. Customers

A record eight new customers were signed up during the period

and the level of attrition remains very low with renewal rates

above 98%.

Intercede works closely with customers to understand what is

important to them and reflect this in the MyID product roadmap. New

features such as enhanced REST APIs for simpler integration, the

improved user experience of the operator interface and support for

a wider range of authentication mechanisms including FIDO and

mobile ID, help to keep MyID relevant to our customers and ensure

that MyID is the system of choice where both security and

flexibility are essential in ensuring data is protected now and

into the future.

Customer upgrades to the latest release indicate the support for

the new features released as evidenced by the Group's recent

announcement that multiple major customers have chosen to upgrade

their existing MyID deployments including:

-- A major global aerospace and defence manufacturer upgrading

to benefit from enhanced system configuration capabilities and

integration APIs, enabling them to remove customisations and to

achieve greater in-house control of the solution. In addition,

support for the latest device types, such as YubiKey 5s, will allow

the customer to deploy modern authentication devices better suited

to their working environment.

-- A major transportation program wishing to modernise their

supported infrastructure platforms and also benefit from the more

intuitive and faster browser-independent operator interface.

-- A major US government agency choosing to extend their

deployment to overseas workers, benefiting from enhanced

self-service via kiosk interfaces, reducing operational costs while

maintaining compliance with government security standards.

One important communication channel we have with our customers

is the annual Customer Advisory Board (CAB). Virtual CABs were held

during October and November for Customers and partners in the RoW

and US respectively. They have followed a different format this

year, starting with a Product Roadmap and Customer Success

initiative session, then followed by non-concurrent workshops that

allowed customers to attend all sessions including: FIDO for the

Enterprise, Mobile Authentication & Transaction Signing and

Upgrading MyID.

There are encouraging signs that our efforts to increase and

improve customer interaction are paying off as evidenced by the

increase in participation of the Customer Satisfaction Survey, the

low churn rate and an increased NPS.

3. Channels

The deep focus on strengthening relationships with reseller and

technical alliance partners underlies Intercede's go-to-market

strategy, namely:

Additional Partners = increased addressable market = more

customer deployments

A key element of the Group's growth strategy is therefore

focused on increasing the number of partner relationships via

Intercede's Connect Partner Programme. There is a vast and

ever-growing number of Public Key Infrastructure (PKI) technologies

in global circulation and the business is continually assessing

them to identify those hardware and software vendors which meet

Intercede's criteria for providing a successful partnership.

We are pleased to report that excellent progress has been made

on this front with new partnerships formed in Europe, the US,

ASEAN, Latin America and Africa. The strength of these new

relationships has resulted in a record number of eight new

customers being signed up during H1, with orders received totalling

in excess of GBP700,000, most of which will be recognised in the

current fiscal year.

Intercede continues to focus on technical alliances so that

customers benefit from their digital infrastructure being

seamlessly joined by the secure credential issued by the MyID

platform. In Europe we continue to work with the likes of Cryptas

and ESYSCO to embed MyID in their solution offerings. This enables

enterprises to benefit from a single and secure source of identity

to access centralised systems, such as HR and Finance, and provide

strong authentication to eIDAS (electronic identification and trust

services) signing services.

There has been interest from app developers in Latin America who

wish to issue a secure credential with MyID to act as a vaccine

passport, which would utilise relevant experience that Intercede

has from working on the Kuwait National ID scheme. In our core US

market, we were pleased to announce that MyID v12.1 supports the

Entrust CA gateway using REST APIs and continue to be part of their

Entrust technology Alliance Program.

We are also looking forwarding to sponsoring and speaking at

Sailpoint's annual ID.gov event later this month and demonstrating

MyID working with SailPoint to help organisations automate the

process of onboarding employees and issuing digital

credentials.

4. Code

During this financial year, Intercede has continued to invest in

the MyID platform in accordance with its core development

principles:

-- Create and maintain a modern platform based upon market

leading technology;

-- Broaden the addressable market with new functionality;

and

-- Meet constantly evolving Customer and Partner needs.

April 2021 saw the announcement of the release of MyID v12 which

introduced the following significant new features:

-- FIDO - MyID can now operate as a FIDO server, supporting a

wide range of FIDO2 authenticators and delivering the ability to

manage issuance policy and lifecycle management, providing

organisations with the control they need to ensure that only the

right people can access protected systems and resources.

-- Authentication Server - an easy to operate method of

authentication that enables a customer to use mobile devices within

their existing PKI to secure access to the applications, such as

Office 365, that they need as part of their role using fingerprint,

PIN, or facial matching.

-- Operator Client - additional features have now been migrated

to the new operator client to improve performance and user

experience. The operator client is now supported on Google Chrome,

Microsoft Edge (Chromium) and Mozilla Firefox browsers.

The imminent release of MyID v12.2 will remove any dependency on

Internet Explorer whilst adding more options to authenticate users

for self-service features and further operations to the new

Operator Client including the ability to embed it within an

existing end user portal. As mentioned in the 'Customer' section

above, some of our largest customers are choosing to upgrade MyID

to benefit from these new features and capabilities.

5. Cash

The Group remains in a healthy financial position, with gross

cash balances of GBP8,491,000 as at 30 September 2021 compared to

GBP8,029,000 held at 31 March 2021. Following the early retirement

of all convertible loan notes in February 2021, the Group has no

long-term debt or external financing.

Financial Results

Revenues for the six months ended 30 September 2021 totalling

GBP4,855,000 are approximately 9% higher than last year on a

constant currency basis and 2% higher on a reported basis (2020:

GBP4,762,000 on a reported basis). It is also pleasing to note the

longer-term trend of Intercede's revenue as t his represents a

fifth successive year of H1 growth with compound average growth of

11% over the five corresponding H1 periods to 30 September 2021

.

Revenue highlights for the period include:

- A new MyID Enterprise deployment sale to the US Air Force to

support an overseas forward deployment.

- As previously mentioned, multiple major customers have chosen

to upgrade their existing MyID deployments including, but not

limited to, a major global aerospace and defence manufacturer, a

major transportation program and a major US government agency.

- A new MyID Enterprise deployment sale to a photonics

technology business based in the UK to help them automate the issue

of virtual smart cards (VSCs) at scale.

- A new MyID Enterprise deployment sale and order for

professional services to assist a new partner based in South

America to set up a pilot ID Provider for the service network of a

multinational financial service corporation.

- A new MyID Enterprise deployment sale to a shared service

provider for a major US government defence agency.

- Two new MyID PIV deployment sales to an existing US Air Force

base customer. This customer now operates six similarly sized MyID

PIV deployments.

All of these wins are expected to generate incremental revenue

over the next 12 months from a combination of support &

maintenance plus professional services, development and/or

follow-on license sales.

Compared to the corresponding period last year, operating

expenses have increased by 3% to GBP4,589,000 (2020: GBP4,446,000).

Underlying costs are very consistent and reflect continued tight

control over all areas of expenditure. Travel expenses continue to

be very low and comparable to the almost complete cessation of

travel during the COVID-19 pandemic in the first half of 2020.

Staff costs continue to represent the main area of expense

representing 85% of total operating costs (2020: 87%). The Group

continues to recognise the achievements of its staff with pay rises

and performance-related rewards. Intercede had 82 employees and

contractors as at 30 September 2021 (30 September 2020: 83). The

average number of employees and contractors during the period was

84 (2020: 83).

A GBP416,000 taxation credit for the period (2020: GBP438,000

taxation credit) primarily reflects the 2021 Research &

Development ("R&D") claim which results from the Group's

strategic investment activities. The Group is a beneficiary of the

UK Government's efforts to encourage innovation by allowing 130% of

qualifying R&D expenditure to be offset against taxable profits

and 14.5% of the lower of R&D losses or taxable losses to be

paid as tax credit s.

The increase in operating expenses exceeds the increase in

revenue, resulting in a small reduction in operating profit to

GBP171,000 (2020: GBP295,000). However, the fall in finance costs

following the elimination of the convertible loan notes produces an

increased profit for the period of GBP539,000 (2020: GBP441,000)

and has resulted in a basic and fully diluted earnings per share of

0.9p (2020: basic earnings per share of 0.9p and a fully diluted

profit per share of 0.8p).

Cash balances as at 30 September 2021 totalled GBP8,491,000

which compares with GBP8,029,000 as at 31 March 2021. It is worth

noting that the 2021 R&D tax claim totalling GBP433,000 had not

been received by the period end and does not form part of the cash

balances as at 30 September 2021 (2019: R&D claim totalling

GBP447,000 was received by the period end and formed part of the

cash balances as at 30 September 2020).

Retirement of Finance Director

Intercede also announces that after 21 years with the Company,

Andrew Walker, Finance Director, has informed the Board of his

intention to retire and step down from the Board. He will continue

in the role during his notice period of up to 12 months or until an

orderly handover can take place. As a result, the Board has begun a

recruitment process to identify his successor.

Andrew has been instrumental in the growth of Intercede

throughout his 21 years at the Company and his contributions during

the last three years have been critical to the success of the Phase

1 turnaround plan. We wish Andrew the very best for his

retirement.

Outlook

Whilst the nature of Intercede's business and customer profile

is such that the precise timing of orders is difficult to predict,

the first half of this year gives us several reasons to be

cautiously optimistic. We have continued to demonstrate the

strength of our product suite in our core market (PKI), which

offers our Blue Chip client base the highest levels of

authentication technology available. We are encouraged by the

long-term nature of these customer relationships, which remain

sticky and grow incrementally over time and provide us with a solid

sales pipeline to support management's revenue target.

At the same time, Intercede has ambitions to generate further

top line growth and we have identified various avenues to achieve

this in the medium-term. We have expanded our TAM (Total

Addressable Market) by moving into the FIDO space, which requires a

rigorous but lower level of authentication technology and makes our

products more relevant to a wider customer base. Initial

indications from the proof of concept phase are promising and we

look forward to rolling this new solution out to both existing and

new customers. With a renewed focus on growth, we have also

implemented an M&A strategy which will concentrate on gaining

exposure to adjacent and attractive markets.

With various positive structural growth drivers in play and

expansion into new markets, the Board remains positive about the

medium and long-term prospects for Intercede. As a such, whilst we

remain cautious of the effects of COVID-19, the Board can confirm

that the outlook for the second half of FY22 continues to remain in

line with management's expectations.

By order of the Board

Klaas van der Leest Andrew Walker

Chief Executive Officer Finance Director

23 November 2021 23 November 2021

Consolidated Statement of Comprehensive

Income

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2021 2020 2021

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 4,855 4,762 10,961

Cost of sales (95) (21) (235)

__________ __________ __________

Gross profit 4,760 4,741 10,726

Operating expenses (4,589) (4,446) (9,137)

__________ __________ __________

Operating profit 171 295 1,589

Finance income 5 3 9

Finance costs (53) (295) (494)

__________ __________ __________

Profit before tax 123 3 1,104

Taxation 416 438 425

__________ __________ __________

Profit for the period 539 441 1,529

__________ __________ __________

Total comprehensive income attributable

to owners of the parent company 539 441 1,529

__________ __________ __________

Profit per share (pence)

- basic 0.9p 0.9p 3.0p

- diluted 0.9p 0.8p 2.8p

__________ __________ __________

Consolidated Balance Sheet

As at As at As at

30 September 30 September 31 March

2021 2020 2021

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 134 109 154

Right of use assets 553 851 725

___________ ___________ __________

687 960 879

___________ ___________ __________

Current assets

Trade and other receivables 2,187 1,315 4,098

Cash and cash equivalents 8,491 8,067 8,029

___________ ___________ __________

10,678 9,382 12,127

___________ ___________ __________

Total assets 11,365 10,342 13,006

___________ ___________ __________

Equity

Share capital 572 505 571

Share premium 5,138 673 5,138

Equity reserve - 66 -

Merger reserve 1,508 1,508 1,508

Accumulated deficit (1,989) (3,597) (2,471)

___________ ___________ __________

Total equity 5,229 (845) 4,746

___________ ___________ __________

Non-current liabilities

Convertible loan notes - 4,879 -

Lease liabilities 566 1,001 762

Deferred revenue 240 370 420

___________ ___________ __________

806 6,250 1,182

___________ ___________ __________

Current liabilities

Lease liabilities 352 328 350

Trade and other payables 1,444 1,663 1,920

Deferred revenue 3,534 2,946 4,808

___________ ___________ __________

5,330 4,937 7,078

___________ ___________ __________

Total liabilities 6,136 11,187 8,260

___________ ___________ __________

Total equity and liabilities 11,365 10,342 13,006

___________ ___________ __________

Consolidated Statement of

Changes in Equity

Share Share Equity Merger Accumulated Total

capital premium reserve reserve deficit equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2021 571 5,138 - 1,508 (2,471) 4,746

Purchase of own shares - - - - (128) (128)

Issue of new shares 1 - - - - 1

Employee share option plan

charge - - - - 58 58

Employee share incentive

plan charge - - - - 13 13

Profit for the period and

total comprehensive income - - - - 539 539

________ ________ ________ ________ __________ _______

At 30 September 2021 572 5,138 - 1,508 (1,989) 5,229

At 1 April 2020 505 673 66 1,508 (4,133) (1,381)

Purchase of own shares - - - - (14) (14)

Proceeds from recycling

of own shares - - - - 26 26

Employee share option plan

charge - - - - 45 45

Employee share incentive

plan charge - - - - 38 38

Profit for the period and

total comprehensive income - - - - 441 441

________ ________ ________ ________ _________ _______

At 30 September 2020 505 673 66 1,508 (3,597) (845)

At 1 April 2020 505 673 66 1,508 (4,133) (1,381)

Purchase of own shares - - - - (29) (29)

Issue of new shares on conversion

of convertible loan notes 66 4,465 (60) - - 4,471

Reversal of equity component

following redemption of

convertible loan notes - - (6) - - (6)

Proceeds from recycling

of own shares - - - - 26 26

Employee share option plan

charge - - - - 88 88

Employee share incentive

plan charge - - - - 48 48

Profit for the period and

total comprehensive income - - - - 1,529 1,529

________ ________ ________ ________ __________ _______

At 31 March 2021 571 5,138 - 1,508 (2,471) 4,746

Consolidated Cash Flow Statement

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2021 2020 2021

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit for the period 539 441 1,529

Taxation (416) (438) (425)

Finance income (5) (3) (9)

Finance costs 53 295 494

Depreciation of property, plant &

equipment 35 31 60

Depreciation of right of use assets 115 129 255

Exchange losses / (gains) on foreign

currency lease liabilities 10 (31) (74)

Employee share option plan charge 58 45 88

Employee share incentive plan charge 13 38 48

Employee unit incentive plan charge 24 25 30

Decrease in trade and other receivables 2,313 3,810 1,078

(Decrease) / increase in trade and

other payables (500) 5 357

(Decrease) / increase in deferred

revenue (1,454) (1,035) 877

____________ ____________ __________

Cash generated from operations 785 3,312 4,308

Finance income 8 6 12

Finance costs on convertible loan

notes - (199) (445)

Finance costs on leases (32) (48) (65)

Tax (paid) / received (17) 438 425

____________ ____________ __________

Net cash generated from operating

activities 744 3,509 4,235

____________ ____________ __________

Investing activities

Purchases of property, plant and

equipment (15) (21) (95)

____________ ____________ __________

Cash used in from investing activities (15) (21) (95)

____________ ____________ __________

Financing activities

Purchase of own shares (128) (14) (29)

Proceeds from recycling of own shares - 26 26

Principal elements of lease payments (168) (163) (338)

Repayment of convertible loan notes - - (450)

____________ ____________ __________

Cash used in financing activities (296) (151) (791)

____________ ____________ __________

Net increase in cash and cash equivalents 433 3,337 3,349

Cash and cash equivalents at the

beginning of the period 8,029 4,758 4,758

Exchange gain / (loss) on cash and

cash equivalents 29 (28) (78)

____________ ____________ __________

Cash and cash equivalents at the

end of the period 8,491 8,067 8,029

____________ ____________ __________

Notes to the Consolidated Accounts

For the period ended 30 September 2021

1 Preparation of the interim financial statements

These interim financial statements have been prepared in

accordance with International Accounting Standards in conformity

with the requirements of the Companies Act 2006 and with those

parts of the Companies Act 2006 applicable to companies reporting

under International Financial Reporting Standards (IFRS).

The basis of preparation and accounting policies used in

preparation of these interim financial statements have been

prepared in accordance with the same accounting policies set out in

the Group's Annual Report for the year ended 31 March 2021, which

provides full details of significant judgements and estimates used

in the application of the Group's accounting policies. There have

been no significant changes to these judgements and estimates

during the period which included an assessment that the going

concern basis continues to be appropriate in preparing the interim

financial statements.

These interim financial statements have not been audited and do

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. Statutory accounts for the year ended 31 March

2021 have been delivered to the Registrar of Companies. The

Auditors' Report on those accounts was unqualified and did not

contain any statement under Section 498 (2) or (3) of the Companies

Act 2006.

The Interim Report will be mailed to shareholders within the

next few weeks and copies will be available on the website

(www.intercede.com) and at the registered office: Intercede Group

plc, Lutterworth Hall, St Mary's Road, Lutterworth, Leicestershire,

LE17 4PS.

2 Revenue

All of the Group's revenue, operating profits and net assets

originate from operations in the UK. The Directors consider that

the activities of the Group constitute a single business

segment.

The split of revenue by geographical destination of the end

customer can be analysed as follows:

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2021 2020 2021

GBP'000 GBP'000 GBP'000

UK 69 66 115

Rest of Europe 503 509 1,061

Americas 3,872 3,867 9,095

Rest of World 411 320 690

___________ ___________ __________

4,855 4,762 10,961

___________ ____________ __________

3 Taxation

Taxation represents the net effect of amounts receivable from

HMRC in respect of R&D claims and US corporation tax

payable.

4 Earnings per share

The calculations of earnings per ordinary share are based on the

profit for the period and the weighted average number of ordinary

shares in issue during each period.

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2021 2020 2021

GBP'000 GBP'000 GBP'000

Profit for the period 539 441 1,529

___________ ___________ __________

Number Number Number

Weighted average number of shares

- basic 57,107,449 50,482,281 51,359,410

- diluted 59,760,815 53,183,844 54,049,938

___________ ___________ __________

Pence Pence Pence

Earnings per share

- basic 0.9p 0.9p 3.0p

- diluted 0.9p 0.8p 2.8p

___________ ___________ __________

The weighted average number of shares used in the calculation of

basic and diluted earnings per share for each period were

calculated as follows:

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2021 2020 2021

Number Number Number

Issued ordinary shares at start

of period 57,143,357 50,523,926 50,523,926

Effect of treasury shares (93,285) (41,645) (41,645)

Effect of issue of ordinary

share capital 57,377 - 877,129

___________ ___________ __________

Weighted average number of shares

- basic 57,107,449 50,482,281 51,359,410

___________ ___________ __________

Add back effect of treasury

shares 93,285 41,645 41,645

Effect of share options in issue 2,560,081 2,659,918 2,648,883

Effect of convertible loan notes

in issue - - -

___________ ___________ __________

Weighted average number of shares

- diluted 59,760,815 53,183,844 54,049,938

___________ ___________ __________

The effect of issue of ordinary share capital reflects the issue

of 100,000 shares to facilitate the exercise of options by senior

managers in June 2021 and the issue of 6,619,431 shares during the

period 5 January to 19 February 2021 to facilitate the conversion

of convertible loan notes into ordinary shares.

The convertible loan notes were anti-dilutive and therefore

excluded from the calculation of diluted profit per share. Had the

convertible loan notes been dilutive in nature, this would have

increased the comparative 2021 and 2020 weighted average number of

shares by 6,295,925 and 7,273,387 respectively.

5 Dividend

The Directors do not recommend the payment of a dividend.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VLLFLFFLZFBZ

(END) Dow Jones Newswires

November 23, 2021 02:00 ET (07:00 GMT)

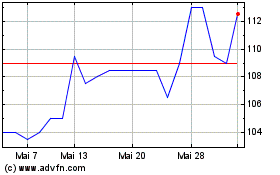

Intercede (LSE:IGP)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Intercede (LSE:IGP)

Historical Stock Chart

Von Jul 2023 bis Jul 2024