TIDMCRWN

RNS Number : 9745N

Crown Place VCT PLC

26 February 2009

26 February 2009

Crown Place VCT PLC

Half-yearly Financial Report for the six months ended 31 December 2008.

Crown Place VCT PLC ("the Company"), managed by Albion Ventures LLP, today

announces the half-yearly results for the six months ended 31 December 2008. The

announcement was approved by the Board of Directors on 26 February 2009.

You may view the Half-yearly Financial Report at www.albion-ventures.co.uk by

clicking on the 'Our Funds' section.

Investment Objectives

The investment objective and policy of the Company is to achieve long term

capital and income growth principally through investment in smaller unquoted

companies in the United Kingdom.

Financial Calendar

+----------------------------------------------------------------+-------------------+

| Record date for second dividend (subject to approval from HM | Estimated March |

| Revenue & Customs) | 2009 |

+----------------------------------------------------------------+-------------------+

| Payment of second dividend | Estimated April |

| | 2009 |

+----------------------------------------------------------------+-------------------+

| Financial year end | 30 June 2009 |

+----------------------------------------------------------------+-------------------+

Directors

Patrick Crosthwaite, Chairman

Rachel Beagles

Sir Andrew Cubie

Vikram Lall

Geoffrey Vero

Financial Highlights

+--------------------+--------------------+--------------------+--------------------+

| | Six months to | Six months to | Year to |

| | 31 December 2008 | 31 December 2007 | 30 June 2008 |

+--------------------+--------------------+--------------------+--------------------+

| | (pence per share) | (pence per share) | (pence per share) |

+--------------------+--------------------+--------------------+--------------------+

| Net asset value | 36.29 | 43.56 | 41.11 |

| per share | | | |

+--------------------+--------------------+--------------------+--------------------+

| Dividends paid | 1.25 | 1.25 | 2.50 |

+--------------------+--------------------+--------------------+--------------------+

| Revenue return per | 0.53 | 0.74 | 1.27 |

| share | | | |

+--------------------+--------------------+--------------------+--------------------+

| Capital return per | (4.14) | (0.86) | (2.67) |

| share | | | |

+--------------------+--------------------+--------------------+--------------------+

Shareholder returns and shareholder value

+-------------------------------------------------------------------+----------------+----------------+----------------+

| | Proforma (i) | Proforma (i) | |

| | Murray | Murray | Crown Place |

| | VCT PLC | VCT 2 PLC | VCT PLC* |

+-------------------------------------------------------------------+----------------+----------------+----------------+

| Shareholder returns from launch to April 2005 (date that Albion | | | |

| Ventures (previously Close Ventures) was appointed investment | | | |

| manager): | | | |

+-------------------------------------------------------------------+----------------+----------------+----------------+

| Dividends paid to 6 April 2005 (ii) | 30.36 | 30.91 | 24.93 |

+-------------------------------------------------------------------+----------------+----------------+----------------+

| Decrease in net asset value | (69.90) | (64.50) | (56.60) |

+-------------------------------------------------------------------+----------------+----------------+----------------+

| Total shareholder return to 6 April 2005 | (39.54) | (33.59) | (31.67) |

+-------------------------------------------------------------------+----------------+----------------+----------------+

| | | | |

+-------------------------------------------------------------------+----------------+----------------+----------------+

| Shareholder return from April 2005 to 31 December 2008: | | | |

+-------------------------------------------------------------------+----------------+----------------+----------------+

| Total dividends paid | 6.02 | 7.00 | 8.05 |

+-------------------------------------------------------------------+----------------+----------------+----------------+

| Decrease in net asset value | (4.27) | (4.62) | (7.11) |

+-------------------------------------------------------------------+----------------+----------------+----------------+

| Total shareholder return to 31 December 2008 | 1.75 | 2.38 | 0.94 |

+-------------------------------------------------------------------+----------------+----------------+----------------+

| | | | |

+-------------------------------------------------------------------+----------------+----------------+----------------+

| Shareholder value since launch: | | | |

+-------------------------------------------------------------------+----------------+----------------+----------------+

| Total dividends paid to 31 December 2008 (i) | 36.38 | 37.91 | 32.98 |

+-------------------------------------------------------------------+----------------+----------------+----------------+

| Net asset value as at 31 December 2008 | 25.83 | 30.88 | 36.29 |

+-------------------------------------------------------------------+----------------+----------------+----------------+

| Total shareholder value as at 31 December 2008 | 62.21 | 68.79 | 69.27 |

+-------------------------------------------------------------------+----------------+----------------+----------------+

| | | | |

+-------------------------------------------------------------------+----------------+----------------+----------------+

| Current annual dividend objective*: | | | |

+-------------------------------------------------------------------+----------------+----------------+----------------+

| Pence per share | 1.78 | 2.13 | 2.50 |

+-------------------------------------------------------------------+----------------+----------------+----------------+

| Percentage yield on net asset value | 6.9% | 6.9% | 6.9% |

+-------------------------------------------------------------------+----------------+----------------+----------------+

* Subject to investment performance

(i) The proforma shareholder returns presented above are based on the dividends

paid to shareholders before the merger and the pro-rata net asset value per

share and pro-rata dividends per share paid to 31 December 2008 since the

merger. This pro-forma is based upon the proportion of shares received by Murray

VCT PLC (now renamed CP1 VCT PLC) and Murray VCT 2 PLC (now renamed CP2 VCT PLC)

shareholders at the time of the merger with Crown Place VCT PLC on 13 January

2006.

(ii) Prior to 6 April 1999, venture capital trusts were able to add 20% to

dividends, and figures for the period up until 6 April 1999 are included at the

gross equivalent rate actually paid to shareholders.

* Formerly Murray VCT 3 PLC

In addition to the dividends paid above, the Board has declared a second

dividend for the year ending 30 June 2009, of 1.25 pence per Crown Place VCT PLC

share (0.25 pence to be paid out of revenue profits and 1.00 pence out of

realised capital gains), subject to approval from HM Revenue & Customs. The

record date and payment date for this dividend will be announced on the London

Stock Exchange RNS Service.

Interim Management Report

Results

In the six months to 31 December 2008, the Company's net asset value per share

declined by 12% from 41.1 pence to 36.3 pence. In the same period, the FTSE All

Share Index fell by 22%. The reduction in net asset value was largely due to a

downward revaluation of the investment portfolio, as well as a reduction in

investment income and deposit interest as a result of the sharp fall in interest

rates. During the period, the Company made a revenue profit after tax of

GBP390,000 and a capital loss after tax of GBP3,028,000 resulting in a total

loss after tax of GBP2,638,000 or 3.6 pence per share.

Dividends

The Company's policy is to pay regular and predictable dividends to investors

out of revenue income and realised capital gains. The first dividend in the

current financial year of 1.25 pence per share was paid to shareholders on 8

August 2008. Subject to the performance of the investment portfolio, the Board

aims to maintain the current annualised dividend distribution of 2.5 pence per

share going forward.

The Directors have declared a second dividend of 1.25 pence per Crown Place

VCT PLC share (of which 0.25 pence is to be paid from revenue and 1.00 pence out

of realised capital gains), subject to approval from HM Revenue & Customs. The

record date and payment date for this dividend will be announced on the London

Stock Exchange RNS Service.

Portfolio review

During the half year, the Company made new and follow-on investments totalling

GBP1.3 million. In September 2008, the Company invested GBP250,000 in Prime Care

Holdings Limited, a provider of domiciliary care based in East Sussex. The

domiciliary care sector is a GBP2.4bn industry showing attractive growth rates,

and is very fragmented. Prime Care Holdings has won a number of awards in

recognition of the quality of service it provides. The Company also invested

GBP76,000 in Ivivo Limited, a developer of medical imaging software and

GBP260,000 in Bravo Inns II Limited, an owner and operator of freehold pubs.

Following the period end, an investment of GBP210,000 was made in Forth

Photonics Limited, a medical device company that designs, develops, manufactures

and markets imaging systems for the non-invasive, in-vivo detection of cancerous

and pre-cancerous lesions. No investments were sold during the period.

Overall, the existing investment portfolio, which is well diversified, is

holding up reasonably well against the background of worsening global economic

conditions. An important element of this is that, apart from the investments

made prior to the change in Manager in 2005, which total GBP2 million on current

valuations, the majority of investee companies have no bank gearing. In

addition, many of them are in areas of the economy that still have residual

growth prospects. The slowdown in consumer spending has had some impact on the

hotel and health and fitness investments in the portfolio, which has been

reflected in their valuations, while the cinemas continue to trade well. Several

of the technology investments, such as Blackbay Limited and Rostima Limited,

have made significant progress during the period and are on course to deliver

shareholder value in the longer term.

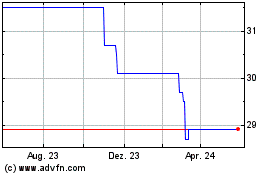

The following is the sector split of the portfolio by valuation as at 31

December 2008:

http://www.rns-pdf.londonstockexchange.com/rns/9745N_-2009-2-26.pdf

As at 31 December 2008, the Group held cash balances and other liquid

investments of GBP9,963,000.

Change of Manager

On 23 January 2009, the business of Close Ventures Limited ("Close Ventures"),

the Manager of Crown Place VCT PLC was acquired by Albion Ventures LLP ("Albion

Ventures") from Close Brothers Group plc ("Close Brothers Group"). Albion

Ventures has been formed by the executive directors of Close Ventures Limited;

Close Brothers Group will continue to have an interest in the business of Albion

Ventures.

Your Board agreed that the Company's management contract should be novated from

Close Ventures to Albion Ventures on the same terms as the current agreement.

The investment approach of Albion Ventures and the investment policy of the

Company remain unchanged, with a continued emphasis on building up a broad

portfolio of investee companies with no bank borrowings and the maintenance of a

strong dividend yield. The Boards of the other VCTs managed by Close Ventures

have similarly agreed that the management contracts of these companies be

novated to Albion Ventures. Albion Ventures currently has funds under management

of approximately GBP220 million.

As a result of this change, the Company Secretary has changed to Albion Ventures

LLP. The Company name will remain unchanged.

Recovery of historic VAT

As a result of intensive lobbying by the Association of Investment Companies,

the welcome review by HM Revenue & Customs in July 2008 of the position

regarding the exemption of management fees from VAT has meant that the Manager

has been able to reclaim VAT that it had previously charged to the VCT.

Following discussions between the Board and the Manager regarding the reclaim of

historic VAT, GBP369,000 has been recognised in the accounts in respect of the

repayment. Further details regarding this claim, and its disclosure, are shown

in note 4 to the Half-yearly Financial Report. With effect from 1 October 2008,

all management and administration fees charged to the VCT are considered exempt

from VAT.

Related Party Transactions

Details of material related party transactions for the reporting period can be

found in note 13 to this Half-yearly Financial Report.

Risks and Uncertainties

The negative outlook for the UK economy continues to be the key risk affecting

your Company and, as mentioned above, we are beginning to see the effects of

this in certain sectors of the portfolio. Nevertheless, the portfolio as a whole

remains cash generative, while only a few investments have external bank

borrowings. This leads the Board to anticipate that, although valuations may

continue to come under further pressure in the short term, over the longer term,

the current reductions in value represent value deferred rather than

value permanently lost. Other key risks and uncertainties remain unchanged and

are as detailed on page 20 of the Annual Report and Financial Statements for the

year ended 30 June 2008. These include investment risk, venture capital trust

approval risk, compliance risk, internal control risk, reliance upon third party

risk and financial risk.

Dividend Reinvestment Scheme

I draw shareholders' attention to the introduction of a Dividend

Reinvestment Scheme whereby shareholders may elect to reinvest future dividends

by subscribing for New Ordinary Shares. Benefits to individual shareholders

arising on participation in the Dividend Reinvestment Scheme include:

? income tax relief on the reinvestment at the rate of 30 per cent. (VCT

investments cannot exceed GBP200,000 in one tax year to be able to obtain this

relief and new shares need to be held for at least five years);

? any gains arising on disposal of shares in a VCT will be exempt from tax (any

loss will not be an allowable capital loss); and

? any future dividends on the new shares are not subject to income tax.

The Circular dated 26 February 2009 which is being sent to shareholders with a

copy of this Half-Yearly Financial Report, 'Introduction of a Dividend

Reinvestment Scheme', details the mechanics of this Scheme.

Discount management and share buy-backs

It is the Board's policy to buy back shares in the market, subject to the

overall constraint that such purchases are in the Company's interest, including

the maintenance of sufficient resources for investment in existing and new

investee companies. The Company bought back 663,650 shares for cancellation

during the period at an average price of 32.8 pence per share. The weighted

average share price discount to net asset value was 13.2%. However, given the

high level of volatility and the adverse movements apparent in all markets, the

discount to net asset value per share at which shares are bought back will widen

from that applied historically.

Outlook

The UK economy is now officially in recession, but the length and severity is

difficult to predict. In the short term, the decline in interest rates to

historically unprecedented low levels will reduce the income generated by the

Company's cash resources. Nevertheless, we believe that your Company's policy

of ensuring that it has a first charge wherever possible over investee

companies' assets, will help to mitigate the adverse effects of the severe

economic downturn. In addition, your Company's substantial cash resources will

enable it to take advantage of attractive investment opportunities driven by the

lower valuations now becoming apparent. The Board views VCTs as a long term

savings product and in this context, despite the near-term pressure caused by

the deterioration in the economy, the Directors consider that the Company

remains well positioned to deliver long term shareholder value.

Patrick Crosthwaite

Chairman

26 February 2009

Responsibility Statement

The Directors have chosen to prepare this Half-yearly Financial Report for the

Group in accordance with International Financial Reporting Standards ("IFRS").

The Directors of the Company as at 26 February 2009 are shown in the Directors

section at the front of this Half-yearly Financial Statement.

In preparing the summarised financial statements for the period to 31 December

2008, we the Directors, confirm that to the best of our knowledge:

(a) the summarised financial statements has been prepared in accordance with

International Accounting Standard (IAS) 34 "Interim Financial Reporting" issued

by the International Accounting Standards Board;

(b) the interim management report includes a fair review of the information

required by DTR 4.2.7R (indication of important events during the first six

months and description of principal risks and uncertainties for the remaining

six months of the year);

(c) the summarised financial statements give a true an fair view in accordance

with IFRS of the assets, liabilities, financial position and of the profit and

loss of the Group for the period and comply with IFRS and Companies Act 1985 and

2006 and;

(d) the interim management report includes a fair review of the information

required by DTR 4.2.8R (disclosure of related parties' transactions and changes

therein).

This Half-yearly Financial Report has not been audited or reviewed by the

auditors.

By order of the Board

Patrick Crosthwaite

Chairman

26 February 2009

Summary Consolidated Income Statement

+------------------+-------+---------+---------+---------+---------+---------+---------+---------+---------+---------+

| | | Unaudited | Unaudited | Audited |

+------------------+-------+-----------------------------+-----------------------------+-----------------------------+

| | | six months to | six months to | year to |

| | | 31 December 2008 | 31 December 2007 | 30 June 2008 |

+------------------+-------+-----------------------------+-----------------------------+-----------------------------+

| | | Revenue | Capital | Total | Revenue | Capital | Total | Revenue | Capital | Total |

+------------------+-------+---------+---------+---------+---------+---------+---------+---------+---------+---------+

| | Notes | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+------------------+-------+---------+---------+---------+---------+---------+---------+---------+---------+---------+

| | | | | | | | | | | |

+------------------+-------+---------+---------+---------+---------+---------+---------+---------+---------+---------+

| Losses on | 2 | - | (3,232) | (3,232) | - | (476) | (476) | - | (1,818) | (1,818) |

| investments | | | | | | | | | | |

+------------------+-------+---------+---------+---------+---------+---------+---------+---------+---------+---------+

| Investment | 3 | 622 | - | 622 | 986 | - | 986 | 1,714 | - | 1,714 |

| income and | | | | | | | | | | |

| deposit interest | | | | | | | | | | |

+------------------+-------+---------+---------+---------+---------+---------+---------+---------+---------+---------+

| Investment | | (63) | (187) | (250) | (87) | (260) | (347) | (167) | (502) | (669) |

| management fees | | | | | | | | | | |

+------------------+-------+---------+---------+---------+---------+---------+---------+---------+---------+---------+

| Recovery of VAT | 4 | 92 | 277 | 369 | - | - | - | - | - | - |

+------------------+-------+---------+---------+---------+---------+---------+---------+---------+---------+---------+

| Other expenses | | (147) | - | (147) | (160) | - | (160) | (307) | - | (307) |

+------------------+-------+---------+---------+---------+---------+---------+---------+---------+---------+---------+

| Profit/(loss) | | 504 | (3,142) | (2,638) | 739 | (736) | 3 | 1,240 | (2,320) | (1,080) |

| before taxation | | | | | | | | | | |

+------------------+-------+---------+---------+---------+---------+---------+---------+---------+---------+---------+

| Taxation | | (114) | 114 | - | (176) | 85 | (91) | (283) | 304 | 21 |

+------------------+-------+---------+---------+---------+---------+---------+---------+---------+---------+---------+

| Profit/(loss) | | 390 | (3,028) | (2,638) | 563 | (651) | (88) | 957 | (2,016) | (1,059) |

| for the period | | | | | | | | | | |

+------------------+-------+---------+---------+---------+---------+---------+---------+---------+---------+---------+

| Basic and | 6 | 0.53 | (4.14) | (3.61) | 0.74 | (0.86) | (0.12) | 1.27 | (2.67) | (1.40) |

| diluted | | | | | | | | | | |

| return/(loss) | | | | | | | | | | |

| per Ordinary | | | | | | | | | | |

| share | | | | | | | | | | |

| (pence)* | | | | | | | | | | |

+------------------+-------+---------+---------+---------+---------+---------+---------+---------+---------+---------+

* (excluding Treasury shares)

This consolidated income statement has been reclassified to show losses on

investments at the top of the income statement.

The total column of this statement represents the Group's income statement,

prepared in accordance with International Financial Reporting Standards

('IFRS'). The supplementary revenue and capital reserve columns are prepared

under guidance published by the Association of Investment Trust Companies.

The consolidated income statements include the results of the subsidiaries CP1

VCT PLC and CP2 VCT PLC.

Comparative figures have been extracted from the interim accounts for the six

month period ended 31 December 2007 and the statutory accounts for the year

ended 30 June 2008.

Summary Consolidated Balance Sheet

+---------------------------------------+-------+--------------+-------------+

| | | Unaudited | Audited |

+---------------------------------------+-------+--------------+-------------+

| | | 31 December | 30 June |

| | | 2008 | 2008 |

+---------------------------------------+-------+--------------+-------------+

| | Notes | GBP'000 | GBP'000 |

+---------------------------------------+-------+--------------+-------------+

| | | | |

+---------------------------------------+-------+--------------+-------------+

| Non-current assets | | | |

+---------------------------------------+-------+--------------+-------------+

| Investments | 7 | 16,057 | 18,211 |

+---------------------------------------+-------+--------------+-------------+

| | | | |

+---------------------------------------+-------+--------------+-------------+

| Current assets | | | |

+---------------------------------------+-------+--------------+-------------+

| Trade and other receivables | | 713 | 308 |

+---------------------------------------+-------+--------------+-------------+

| Current asset investments | | 6,608 | 2,686 |

+---------------------------------------+-------+--------------+-------------+

| Current tax asset | | - | 53 |

+---------------------------------------+-------+--------------+-------------+

| Cash and cash equivalents | | 3,354 | 9,237 |

+---------------------------------------+-------+--------------+-------------+

| | | 10,675 | 12,284 |

+---------------------------------------+-------+--------------+-------------+

| | | | |

+---------------------------------------+-------+--------------+-------------+

| Total assets | | 26,732 | 30,495 |

+---------------------------------------+-------+--------------+-------------+

| | | | |

+---------------------------------------+-------+--------------+-------------+

| Current liabilities | | | |

+---------------------------------------+-------+--------------+-------------+

| Trade and other payables | | (333) | (321) |

+---------------------------------------+-------+--------------+-------------+

| | | | |

+---------------------------------------+-------+--------------+-------------+

| Net assets | | 26,399 | 30,174 |

+---------------------------------------+-------+--------------+-------------+

| | | | |

+---------------------------------------+-------+--------------+-------------+

| Equity attributable to equityholders | | | |

+---------------------------------------+-------+--------------+-------------+

| Ordinary share capital | 8 | 8,000 | 8,066 |

+---------------------------------------+-------+--------------+-------------+

| Share premium | | 14,422 | 14,422 |

+---------------------------------------+-------+--------------+-------------+

| Capital redemption reserve | | 860 | 793 |

+---------------------------------------+-------+--------------+-------------+

| Own shares held | | (2,849) | (2,849) |

+---------------------------------------+-------+--------------+-------------+

| Realised capital reserve | | (17,252) | (17,206) |

+---------------------------------------+-------+--------------+-------------+

| Unrealised capital reserve | | (9,885) | (6,645) |

+---------------------------------------+-------+--------------+-------------+

| Special reserve | | 32,202 | 32,421 |

+---------------------------------------+-------+--------------+-------------+

| Revenue reserve | | 901 | 1,172 |

+---------------------------------------+-------+--------------+-------------+

| Total equity shareholders' funds | | 26,399 | 30,174 |

+---------------------------------------+-------+--------------+-------------+

| Net asset value per share (pence)* | | 36.3 | 41.1 |

+---------------------------------------+-------+--------------+-------------+

*(excluding Treasury shares)

The consolidated balance sheets include the balance sheets of the subsidiaries

CP1 VCT PLC and CP2 VCT PLC.

Comparative figures have been extracted from the statutory accounts for the year

ended 30 June 2008.

These financial statements were agreed by the Board of Directors, and authorised

for issue on 26 February 2009 and were signed on its behalf by

Patrick Crosthwaite

Chairman

Summary Company Balance Sheet

+---------------------------------------+-------+--------------+-------------+

| | | Unaudited | Audited |

+---------------------------------------+-------+--------------+-------------+

| | | 31 December | 30 June |

| | | 2008 | 2008 |

+---------------------------------------+-------+--------------+-------------+

| | Notes | GBP'000 | GBP'000 |

+---------------------------------------+-------+--------------+-------------+

| | | | |

+---------------------------------------+-------+--------------+-------------+

| Fixed assets | | | |

+---------------------------------------+-------+--------------+-------------+

| Fixed asset investments | 7 | 16,057 | 18,211 |

+---------------------------------------+-------+--------------+-------------+

| Investment in subsidiary undertakings | | 15,089 | 15,059 |

+---------------------------------------+-------+--------------+-------------+

| | | 31,146 | 33,270 |

+---------------------------------------+-------+--------------+-------------+

| | | | |

+---------------------------------------+-------+--------------+-------------+

| Current assets | | | |

+---------------------------------------+-------+--------------+-------------+

| Trade and other debtors | | 712 | 302 |

+---------------------------------------+-------+--------------+-------------+

| Current asset investments | | 6,608 | 2,686 |

+---------------------------------------+-------+--------------+-------------+

| Current tax asset | | - | 53 |

+---------------------------------------+-------+--------------+-------------+

| Cash at bank and in hand | | 3,236 | 6,548 |

+---------------------------------------+-------+--------------+-------------+

| | | 10,566 | 9,589 |

+---------------------------------------+-------+--------------+-------------+

| | | | |

+---------------------------------------+-------+--------------+-------------+

| Total assets | | 41,702 | 42,859 |

+---------------------------------------+-------+--------------+-------------+

| | | | |

+---------------------------------------+-------+--------------+-------------+

| Current liabilities | | | |

+---------------------------------------+-------+--------------+-------------+

| Trade and other creditors | | (15,303) | (12,685) |

+---------------------------------------+-------+--------------+-------------+

| | | | |

+---------------------------------------+-------+--------------+-------------+

| Net assets | | 26,399 | 30,174 |

+---------------------------------------+-------+--------------+-------------+

| | | | |

+---------------------------------------+-------+--------------+-------------+

| Equity attributable to equityholders | | | |

+---------------------------------------+-------+--------------+-------------+

| Ordinary share capital | 8 | 8,000 | 8,066 |

+---------------------------------------+-------+--------------+-------------+

| Share premium | | 14,422 | 14,422 |

+---------------------------------------+-------+--------------+-------------+

| Capital redemption reserve | | 860 | 793 |

+---------------------------------------+-------+--------------+-------------+

| Own shares held | | (2,849) | (2,849) |

+---------------------------------------+-------+--------------+-------------+

| Realised capital reserve | | (17,252) | (17,206) |

+---------------------------------------+-------+--------------+-------------+

| Unrealised capital reserve | | (9,885) | (6,645) |

+---------------------------------------+-------+--------------+-------------+

| Special reserve | | 32,202 | 32,421 |

+---------------------------------------+-------+--------------+-------------+

| Revenue reserve | | 901 | 1,172 |

+---------------------------------------+-------+--------------+-------------+

| Total equity shareholders' funds | | 26,399 | 30,174 |

+---------------------------------------+-------+--------------+-------------+

| Net asset value per share (pence)* | | 36.3 | 41.1 |

+---------------------------------------+-------+--------------+-------------+

*(excluding Treasury shares)

The Company balance sheet has been prepared in accordance with UK GAAP.

Comparative figures have been extracted from the statutory accounts for the year

ended 30 June 2008.

These financial statements were approved by the Board of Directors, and

authorised for issue on 26 February 2009 and were signed on its behalf by

Patrick Crosthwaite

Chairman

Summary Consolidated Statement of Changes in Equity (unaudited)

+----------------------+----------+---------+------------+---------+----------+------------+---------+---------+---------+

| | Ordinary | | Capital | Own | Realised | Unrealised | Special | Revenue | Total |

| | share | Share | redemption | shares | capital | capital | reserve | reserve | GBP'000 |

| | capital | premium | reserve | held* | reserve | reserve | * | * | |

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 | * | GBP'000 | GBP'000 | GBP'000 | |

| | | | | | GBP'000 | | | | |

+----------------------+----------+---------+------------+---------+----------+------------+---------+---------+---------+

| As at 30 June 2008 | 8,066 | 14,422 | 793 | (2,849) | (17,206) | (6,645) | 32,421 | 1,172 | 30,174 |

+----------------------+----------+---------+------------+---------+----------+------------+---------+---------+---------+

| Purchase of own | (66) | - | 66 | - | - | - | (219) | - | (219) |

| shares for | | | | | | | | | |

| cancellation | | | | | | | | | |

| (including costs) | | | | | | | | | |

+----------------------+----------+---------+------------+---------+----------+------------+---------+---------+---------+

| Capitalised | - | - | - | - | (73) | - | - | - | (73) |

| management and | | | | | | | | | |

| performance fees | | | | | | | | | |

| (net of tax) | | | | | | | | | |

+----------------------+----------+---------+------------+---------+----------+------------+---------+---------+---------+

| | | | | | | | | | |

+----------------------+----------+---------+------------+---------+----------+------------+---------+---------+---------+

| Capitalised VAT | - | - | - | - | 277 | - | - | - | 277 |

| recoverable on | - | - | - | - | 8 | - | - | - | 8 |

| management and | | | | | | | | | |

| performance fees | | | | | | | | | |

| Net realised gains | | | | | | | | | |

| on investments | | | | | | | | | |

| during the period | | | | | | | | | |

+----------------------+----------+---------+------------+---------+----------+------------+---------+---------+---------+

| Movement in | - | - | - | - | - | (3,240) | - | - | (3,240) |

| unrealised | | | | | | | | | |

| depreciation during | | | | | | | | | |

| the period | | | | | | | | | |

+----------------------+----------+---------+------------+---------+----------+------------+---------+---------+---------+

| Revenue profit for | - | - | - | - | - | - | - | 390 | 390 |

| the period | | | | | | | | | |

+----------------------+----------+---------+------------+---------+----------+------------+---------+---------+---------+

| Dividends paid in | - | - | - | - | (257) | - | - | (661) | (918) |

| the period | | | | | | | | | |

+----------------------+----------+---------+------------+---------+----------+------------+---------+---------+---------+

| As at 31 December | 8,000 | 14,422 | 860 | (2,849) | (17,252) | (9,885) | 32,202 | 901 | 26,399 |

| 2008 | | | | | | | | | |

+----------------------+----------+---------+------------+---------+----------+------------+---------+---------+---------+

| | | | | | | | | | |

+----------------------+----------+---------+------------+---------+----------+------------+---------+---------+---------+

| As at 1 July 2007 | 8,392 | 14,422 | 468 | (2,849) | (11,193) | (9,558) | 33,686 | 1,006 | 34,374 |

+----------------------+----------+---------+------------+---------+----------+------------+---------+---------+---------+

| Purchase of own | (326) | - | 326 | - | - | - | (1,265) | - | (1,265) |

| shares for | | | | | | | | | |

| cancellation | | | | | | | | | |

| (including costs) | | | | | | | | | |

+----------------------+----------+---------+------------+---------+----------+------------+---------+---------+---------+

| Capitalised | - | - | - | - | (197) | - | - | - | (197) |

| management and | | | | | | | | | |

| performance fees | | | | | | | | | |

| (net of tax) | | | | | | | | | |

+----------------------+----------+---------+------------+---------+----------+------------+---------+---------+---------+

| Net realised losses | - | - | - | - | (4,731) | - | - | - | (4,731) |

| on investments | | | | | | | | | |

| during the year | | | | | | | | | |

+----------------------+----------+---------+------------+---------+----------+------------+---------+---------+---------+

| Movement in | - | - | - | - | - | 2,913 | - | - | 2,913 |

| unrealised | | | | | | | | | |

| appreciation during | | | | | | | | | |

| the year | | | | | | | | | |

+----------------------+----------+---------+------------+---------+----------+------------+---------+---------+---------+

| Revenue profit for | - | - | - | - | - | - | - | 957 | 957 |

| the year | | | | | | | | | |

+----------------------+----------+---------+------------+---------+----------+------------+---------+---------+---------+

| Dividends paid in | - | - | - | - | (1,085) | - | - | (791) | (1,876) |

| the year | | | | | | | | | |

+----------------------+----------+---------+------------+---------+----------+------------+---------+---------+---------+

| As at 30 June 2008 | 8,066 | 14,422 | 793 | (2,849) | (17,206) | (6,645) | 32,421 | 1,172 | 30,174 |

+----------------------+----------+---------+------------+---------+----------+------------+---------+---------+---------+

+----------------------+-------+--------+---------+---------+----------+----------+--------+-------+--------+

| As at 1 July 2007 | 8,392 | 14,422 | 468 | (2,849) | (11,193) | (9,558) | 33,686 | 1,006 | 34,374 |

+----------------------+-------+--------+---------+---------+----------+----------+--------+-------+--------+

| Purchase of own | (146) | - | 146 | - | - | - | (581) | - | (581) |

| shares for | | | | | | | | | |

| cancellation | | | | | | | | | |

| (including costs) | | | | | | | | | |

+----------------------+-------+--------+---------+---------+----------+----------+--------+-------+--------+

| Capitalised | - | - | - | - | (175) | - | - | - | (175) |

| management and | | | | | | | | | |

| performance fees | | | | | | | | | |

| (net of tax) | | | | | | | | | |

+----------------------+-------+--------+---------+---------+----------+----------+--------+-------+--------+

| Net realised gains | - | - | - | - | 258 | - | - | - | 258 |

| on investments | | | | | | | | | |

| during the period | | | | | | | | | |

+----------------------+-------+--------+---------+---------+----------+----------+--------+-------+--------+

| Movement in | - | - | - | - | - | (734) | - | - | (734) |

| unrealised | | | | | | | | | |

| depreciation during | | | | | | | | | |

| the period | | | | | | | | | |

+----------------------+-------+--------+---------+---------+----------+----------+--------+-------+--------+

| Revenue profit for | - | - | - | - | - | - | - | 563 | 563 |

| the period | | | | | | | | | |

+----------------------+-------+--------+---------+---------+----------+----------+--------+-------+--------+

| Dividends paid in | - | - | - | - | (340) | - | - | (604) | (944) |

| the period | | | | | | | | | |

+----------------------+-------+--------+---------+---------+----------+----------+--------+-------+--------+

| As at | 8,246 | 14,422 | 614 | (2,849) | (11,450) | (10,292) | 33,105 | 965 | 32,761 |

| 31 December 2007 | | | | | | | | | |

+----------------------+-------+--------+---------+---------+----------+----------+--------+-------+--------+

* Included within these reserves is an amount of GBP12,093,000 (June 2008:

GBP12,620,000; December 2007: GBP18,839,000) which is considered distributable.

The special reserve has been treated as distributable in determining the

reserves available for distribution.

The consolidated statement of changes in equity for the Group also represents

the Company's reconciliation of movements

in shareholders' funds.

Summary Consolidated Cash Flow Statement

+---------------------+----------+---------------+-------------+-----------------------+

| | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| | Note | Unaudited | Unaudited | Audited |

| | | six months to | six | year to |

| | | | months to | 30 June |

| | | 31 December | 31 December | 2008 |

| | | 2008 | 2007 | GBP'000 |

| | | GBP'000 | GBP'000 | |

+---------------------+----------+---------------+-------------+-----------------------+

| | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Operating | | | | |

| activities | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Investment | | 591 | 599 | 1,858 |

| income | | | | |

| received | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Deposit | | 183 | 213 | 396 |

| interest | | | | |

| received | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Administration | | (27) | (29) | (59) |

| fees paid | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Investment | | (288) | (565) | (900) |

| management | | | | |

| fees paid | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Other | | (123) | (89) | (212) |

| cash | | | | |

| payments | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Cash | | 336 | 129 | 1,083 |

| generated | | | | |

| from | | | | |

| operations | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Taxation | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Tax | | 52 | (52) | (52) |

| received/(paid) | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Net cash | 9 | 388 | 77 | 1,031 |

| flows | | | | |

| from | | | | |

| operating | | | | |

| activities | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Cash | | | | |

| flows | | | | |

| from | | | | |

| investing | | | | |

| activities | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Purchase | | (1,282) | (4,949) | (3,434) |

| of | | | | |

| investments | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Disposal | | 25 | 6,690 | 9,122 |

| of | | | | |

| investments | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Net cash | | (1,257) | 1,741 | 5,688 |

| flows | | | | |

| from | | | | |

| investing | | | | |

| activities | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Management | | | | |

| of liquid | | | | |

| resources | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Purchase | | (3,835) | - | (2,718) |

| of | | | | |

| current | | | | |

| investments | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Cash | | | | |

| flows | | | | |

| from | | | | |

| financing | | | | |

| activities | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Equity | | (918) | (944) | (1,876) |

| dividends | | | | |

| paid | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Purchase | | (261) | (612) | (1,255) |

| of | | | | |

| Ordinary | | | | |

| shares | | | | |

| for | | | | |

| cancellation | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Net cash | | (1,179) | (1,556) | (3,131) |

| flows | | | | |

| used in | | | | |

| financing | | | | |

| activities | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| (Decrease)/increase | | (5,883) | 262 | 870 |

| in cash and cash | | | | |

| equivalents | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Cash and | | 9,237 | 8,367 | 8,367 |

| cash | | | | |

| equivalents | | | | |

| at the | | | | |

| start of | | | | |

| the period | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

| Cash and | 10 | 3,354 | 8,629 | 9,237 |

| cash | | | | |

| equivalents | | | | |

| at the end | | | | |

| of the | | | | |

| period | | | | |

+---------------------+----------+---------------+-------------+-----------------------+

Notes to the Summarised Set of Financial Statements

for the six months ended 31 December 2008 (unaudited)

1. Accounting policies

The following policies refer to the Group and the Company except where noted.

References to International Financial Reporting Standards ('IFRS') relate to the

Group financial statements and to Financial Reporting Standards ('FRS') relate

to the Company financial statements.

Basis of accounting

The Half-yearly Financial Report has been prepared in accordance with the

historical cost convention, modified to include the revaluation of investments

and in accordance with International Financial Reporting Standards ('IFRS')

adopted for use in the European Union (and therefore comply with Article 4 of

the EU IAS regulation), in the case of the Group, and in accordance with

Financial Reporting Standards ('FRS') in the case of the Company.

Both the Group and the Company financial statements also apply the Statement of

Recommended Practice: "Financial Statements of Investment Trust Companies"

('SORP') issued by the Association of Investment Trust Companies ("AITC") in

January 2003 and revised in December 2005, in so far as this does not conflict

with IFRS or FRS. The financial statements have been prepared in accordance with

those parts of the Companies Acts 1985 and 2006 applicable to the companies

reporting under IFRS and FRS. The information in this document does not include

all of the disclosures required by IFRS and SORP in full annual financial

statements, and it should be read in conjunction with the consolidated financial

statements of the Group for the year ended 30 June 2008. This Half-yearly

Financial Report has been prepared applying the accounting policies and

presentation that were applied in the preparation of the Group's published

consolidated financial statements for the year ended 30 June 2008.

These financial statements are presented in Sterling to the nearest thousand.

Accounting policies have been applied consistently in current and prior periods.

In order to better reflect the activities of a venture capital trust, and in

accordance with the SORP, supplementary information which analyses the Income

statement between items of a revenue and capital nature has been presented

within the Income statement.

The Directors also consider it more useful to shareholders to separate the

capital returns to shareholders and the Special reserve from within the revenue

reserve and have therefore reclassified the comparative reserves on a consistent

basis.

Gains or losses on investments have also been reclassified and presented at the

top of the Consolidated Income statement. The Directors believe this

presentation is more relevant to the Group's activities as a venture capital

trust.

Basis of consolidation

The Group consolidated financial statements incorporate the financial statements

of the Company for the period ended 31 December 2008 and the entities controlled

by the Company (its subsidiaries), for the same period. Where necessary,

adjustments are made to the financial statements of subsidiaries to bring the

accounting policies into line with those used by the Group. All intra-group

transactions, balances, income and expenses are eliminated on consolidation.

As permitted by Section 230 of the Companies Act 1985, the Company has not

presented its own profit and loss account. The amount of the Company's loss for

the period dealt with in the accounts of the Group is GBP2,669,000 (30 June

2008: loss GBP1,076,000; 31 December 2007: loss GBP107,000).

Segmental reporting

The Directors are of the opinion that the Group and the Company are engaged in a

single segment of business, being investment business. The Group invests in

smaller companies principally based in the UK.

Business combinations

The acquisition of subsidiaries is accounted for using the purchase method in

the Group financial statements. The cost of the acquisition is measured at the

aggregate of the fair values, at the date of exchange, of assets given,

liabilities incurred or assumed, and equity instruments issued by the Group in

exchange for control of the subsidiaries, plus any costs directly attributable

to the business combination. The subsidiary's identifiable assets, liabilities

and contingent liabilities that meet the conditions for recognition under IFRS 3

"Business Combinations" are recognised at their fair value at the acquisition

date.

Estimates

The preparation of the Group and Company's Half-yearly Financial Report requires

estimates, assumptions and judgments to be made, which affect the reported

results and balances. Actual outcomes may differ from these estimates, with a

consequent impact on the results of future periods. These estimates and

assumptions that have a significant risk of causing a material adjustment to the

carrying amounts of assets and liabilities within the next financial year are

those used to determine the fair value of investments at fair value through

profit or loss.

The valuation of investments at fair value through the profit or loss is

determined by using valuation techniques. The Group and the Company use

judgments to select a variety of methods and makes assumptions that are mainly

based on market conditions at each balance sheet date.

Fixed and current asset investments

Quoted and unquoted equity investments

In accordance with IAS 39 'Financial Instruments: Recognition and Measurement',

and FRS 26 'Financial Instruments: Recognition and Measurement', quoted and

unquoted equity investments are designated as fair value through profit or loss

('FVTPL'). Investments listed on recognised exchanges are valued at the closing

bid prices at the end of the accounting period. Unquoted investments' fair value

is determined by the Directors in accordance with the International Private

Equity and Venture Capital Valuation Guidelines (IPEVCV guidelines).

Fair value movements on equity investments and gains and losses arising on the

disposal of investments are reflected in the capital column of the Income

statement in accordance with the AITC SORP. Realised gains or losses on the sale

of investments will be reflected in the Realised capital reserve, and unrealised

gains or losses arising from the revaluation of investments will be reflected in

the Unrealised capital reserve.

Warrants, convertibles and unquoted equity derived instruments

Warrants, convertibles and unquoted equity derived instruments are only valued

if their exercise or contractual conversion terms would allow them to be

exercised or converted as at the balance sheet date, and if there is additional

value to the Company in exercising or converting as at the balance sheet date.

Otherwise these instruments are held at nil value. The valuation techniques used

are those used for the underlying equity investment.

Unquoted loan stock and Euro commercial paper

Unquoted loan stock and Euro commercial paper are classified as loans and

receivables in accordance with IAS 39 and FRS 26 and carried at amortised cost

using the Effective Interest Rate method ('EIR') less impairment. Movements in

the amortised cost relating to interest income are reflected in the revenue

column of the Income statement, and hence are reflected in the Revenue reserve,

and movements in respect of capital provisions are reflected in the capital

column of the Income statement and are reflected in the Realised capital reserve

following sale, or in the Unrealised capital reserve on revaluation.

Loan stocks which are not impaired or past due are considered fully performing

in terms of contractual interest and capital repayments and the Board does not

consider that there is a current likelihood of a shortfall on security cover

for these assets. For unquoted loan stock, the amount of the impairment is the

difference between the asset's cost and the present value of estimated future

cash flows, discounted at the effective interest rate.

Unquoted loan stocks are classified as fixed asset investments in the balance

sheet.

Euro commercial paper is classified as a current asset

investment in the balance sheet.

Floating rate notes

In accordance with IAS 39 and FRS 26, floating rate notes are designated as fair

value through profit or loss ("FVTPL"). Floating rate notes are valued at market

bid price at the balance sheet date and are disclosed as current asset

investments in the balance sheet.

It is not the Group or the Company's policy to exercise control or significant

influence over investee companies. Therefore in accordance with the exemptions

under IAS 28 "Investments in associates" and FRS 9 "Associates and joint

ventures" those undertakings in which the Group or Company holds more than 20

per cent. of the equity are not regarded as associated undertakings.

Investments are recognised as financial assets on legal completion of the

investment contract and are de-recognised on legal completion of the sale of an

investment.

Investment income

Unquoted equity income

Dividend income is not recognised as part of the fair value movement of an

investment, but is recognised separately as investment income through the

Revenue reserve when a share becomes ex-dividend.

Unquoted loan stock and Euro commercial paper income

Fixed returns on debt securities are recognised on a time apportionment basis

using an effective interest rate over the life of the financial instrument. Loan

stock accrued interest is recognised in the Balance sheet as part of the

carrying value of the loans and receivables at the end of each reporting period.

Returns on cash balances are recognised on an accruals basis

using the rate agreed with the bank.

Taxation

Taxation is applied on a current basis in accordance with IAS 12 and FRS 16

"Income taxes". Taxation associated with capital expenses is applied in

accordance with the SORP. Deferred taxation is provided in full on temporary

differences in accordance with IAS 12 and timing differences in accordance with

FRS 16, that result in an obligation at the balance sheet date to pay more tax

or a right to pay less tax, at a future date, at rates expected to apply when

they crystallise based on current tax rates and law. Temporary and timing

differences arise from the inclusion of items of income and expenditure in

taxation computations in periods different from those in which they are included

in the financial statements.

Deferred tax assets are recognised to the extent that it is probable that future

taxable profit will be available against which unused tax losses and credits can

be utilised.

Dividends

In accordance with IAS 10 and FRS 21 "Events after the balance sheet date",

dividends are accounted for in the period in which the dividend has been paid,

or approved by shareholders.

Issue costs

Issue costs associated with the allotment of share capital have

been deducted from the share premium account.

Investment management fees, performance incentive fees and other expenses

All expenses have been accounted for on an accruals basis. Expenses are charged

through the Revenue column of the Income statement, except for management fees

and performance incentive fees which are allocated in part to the capital column

of the Income statement, to the extent that these relate to an enhancement in

the value of the investments and in line with the Board's expectation that over

the long term 75 per cent. of the Group's investment returns will be in the form

of capital gains.

Receivables and payables/debtors and creditors

* Receivables are non-interest bearing, are short term in nature and are

accordingly stated at their nominal value, as reduced by appropriate allowances

for estimated irrecoverable amounts. The Directors consider that the carrying

amount of receivables/debtors is not materially different to their fair value.

* Payables are non-interest bearing and are stated at their nominal value. The

Directors consider that the carrying amount of payables/creditors is not

materially different to their fair value.

Realised capital reserves

The following are disclosed in this reserve:

- gains and losses compared to cost on the realisation

of investments;

- expenses, together with the related taxation effect, charged

in accordance with the above policies; and

- dividends paid to equity holders.

Unrealised capital reserves

Increases and decreases in the valuation of investments held at

the period end are disclosed in this reserve.

Capital redemption reserve

This reserve accounts for amounts by which the issued share capital is

diminished through the repurchase and cancellation of the Company's own shares.

Own shares held reserve

This reserve accounts for the reduction in distributable reserves through the

repurchase of the Company's own shares for Treasury.

Special reserve

The cancellation of the share premium account has created a special reserve that

can be used to fund market purchases and subsequent cancellation of own shares,

to cover gross realised losses, and for other distributable purposes.

2. Losses on investments

+----------------+-----------+--------------+----------+

| | Unaudited | Unaudited | Audited |

| | six | six | year to |

| | months to | months | |

| | 31 | to | 30 June |

| | December | 31 December | 2008 |

| | 2008 | 2007 | GBP'000 |

| | GBP'000 | GBP'000 | |

+----------------+-----------+--------------+----------+

| Unrealised | (2,556) | (1,208) | (3,716) |

| losses on | | | |

| non-current | | | |

| asset | | | |

| investments | | | |

| held at | | | |

| fair value | | | |

| through | | | |

| profit and | | | |

| loss | | | |

| account | | | |

+----------------+-----------+--------------+----------+

| Net | - | 235 | 5,515 |

| unrealised | | | |

| losses | | | |

| transferred | | | |

| to realised | | | |

| losses in | | | |

| the period | | | |

+----------------+-----------+--------------+----------+

| Unrealised | (709) | 243 | 1,145 |

| (losses)/gains | | | |

| on non-current | | | |

| asset | | | |

| investments | | | |

| held at | | | |

| amortised cost | | | |

+----------------+-----------+--------------+----------+

| Unrealised | (3,265) | (730) | 2,944 |

| (losses)/gains | | | |

| on non-current | | | |

| asset | | | |

| investments | | | |

| sub-total | | | |

+----------------+-----------+--------------+----------+

| Unrealised | 25 | (4) | (31) |

| gains/(losses) | | | |

| on current | | | |

| asset | | | |

| investments | | | |

+----------------+-----------+--------------+----------+

| Unrealised | (3,240) | (734) | 2,913 |

| (losses)/gains | | | |

| sub-total | | | |

+----------------+-----------+--------------+----------+

| Realised | 8 | 493 | 784 |

| gains on | | | |

| investments | | | |

| held at | | | |

| fair value | | | |

| through | | | |

| profit and | | | |

| loss | | | |

| account | | | |

+----------------+-----------+--------------+----------+

| Net | - | (235) | (5,515) |

| realised | | | |

| losses | | | |

| transferred | | | |

| from | | | |

| unrealised | | | |

| losses in | | | |

| the year | | | |

+----------------+-----------+--------------+----------+

| Realised | 8 | 258 | (4,731) |

| gains/(losses) | | | |

| sub-total | | | |

+----------------+-----------+--------------+----------+

| Total | (3,232) | (476) | (1,818) |

+----------------+-----------+--------------+----------+

Investments valued on an amortised cost basis are unquoted loan stock

investments and Euro commercial paper.

3. Investment income and deposit interest

+----------------------------------------+------------+-------------+-------------+

| | Unaudited | Unaudited | Audited |

| | six months | six | year to |

| | to | months to | 30 June |

| | 31 | 31 December | 2008 |

| | December | 2007 | GBP'000 |

| | 2008 | GBP'000 | |

| | GBP'000 | | |

+----------------------------------------+------------+-------------+-------------+

| Income recognised on investments held | | | |

| at fair value through profit and loss | | | |

+----------------------------------------+------------+-------------+-------------+

| UK dividend income | 37 | 60 | 69 |

+----------------------------------------+------------+-------------+-------------+

| Management fees received from equity | - | - | 3 |

| investments | | | |

+----------------------------------------+------------+-------------+-------------+

| Floating rate note interest | 85 | 63 | 144 |

+----------------------------------------+------------+-------------+-------------+

| Bank deposit interest | 123 | 210 | 441 |

| Other income | 9 | - | - |

+----------------------------------------+------------+-------------+-------------+

| | 254 | 333 | 657 |

+----------------------------------------+------------+-------------+-------------+

| Income recognised on investments held | | | |

| at amortised cost | | | |

+----------------------------------------+------------+-------------+-------------+

| Return on loan stock investments | 305 | 653 | 1,057 |

+----------------------------------------+------------+-------------+-------------+

| Euro Commercial Paper income | 63 | - | - |

+----------------------------------------+------------+-------------+-------------+

| | 622 | 986 | 1,714 |

+----------------------------------------+------------+-------------+-------------+

4. Recovery of VAT

HM Revenue & Customs issued a business briefing on 24 July 2008 which permitted

the recovery of historic VAT that had been charged on management, performance

and administration fees, and which made these fees exempt from VAT with effect

from 1 October 2008.

The amount of GBP369,000 recoverable from the Manager has been recognised as a

separate item in the Income statement, allocated between revenue and capital

return in the same proportion as that at which the original VAT had been

charged. At 31 December 2008, the amount due to Crown Place VCT PLC from Close

Ventures Limited in respect of this VAT claim was GBP369,000. This has been

received by the Company since the balance sheet date.

It is possible that further amounts may be recoverable in due course, however,

the Directors are at this stage unable to quantify the amounts involved.

5. Dividends

+----------------------+---------+---------+---------+---------+---------+---------+---------+---------+---------+

| | Unaudited | Unaudited | Audited |

| | six months to | six months to | year to |

| | 31 December 2008 | 31 December 2007 | 30 June 2008 |

+----------------------+-----------------------------+-----------------------------+-----------------------------+

| | Revenue | Capital | Total | Revenue | Capital | Total | Revenue | Capital | Total |

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+----------------------+---------+---------+---------+---------+---------+---------+---------+---------+---------+

| First dividend paid | - | - | - | 604 | 340 | 944 | 604 | 340 | 944 |

| on 28 December 2007 | | | | | | | | | |

| (1.25 pence per | | | | | | | | | |

| share) | | | | | | | | | |

+----------------------+---------+---------+---------+---------+---------+---------+---------+---------+---------+

| Second dividend paid | - | - | - | - | - | - | 187 | 745 | 932 |

| on 25 April 2008 | | | | | | | | | |

| (1.25 pence per | | | | | | | | | |

| share) | | | | | | | | | |

+----------------------+---------+---------+---------+---------+---------+---------+---------+---------+---------+

| First dividend paid | 661 | 257 | 918 | - | - | - | - | - | - |

| on 8 August 2008 | | | | | | | | | |

| (1.25 pence per | | | | | | | | | |

| share) | | | | | | | | | |

+----------------------+---------+---------+---------+---------+---------+---------+---------+---------+---------+

| | 661 | 257 | 918 | 604 | 340 | 944 | 791 | 1,085 | 1,876 |

+----------------------+---------+---------+---------+---------+---------+---------+---------+---------+---------+

In addition, the Board has declared a second dividend of 1.25 pence per share

(0.25 pence to be paid out of revenue profits and 1.00 pence out of realised

capital gains). This will be paid subject to HM Revenue & Customs approval. The

record date and payment date of this dividend will be announced on the London

Stock Exchange RNS service.

6. Basic and diluted return per share

The return per share has been based on the following figures:

+--------------------+-----------+----------+------------+---------+---------+------------+---------+---------+------------+

| | Unaudited six months to | Unaudited six months to | Audited year |

| | 31 December 2008 | 31 December 2007 | to |

| | | | 30 June 2008 |

+--------------------+-----------------------------------+--------------------------------+--------------------------------+

| | Revenue | Capital | Total | Revenue | Capital | Total | Revenue | Capital | Total |

+--------------------+-----------+----------+------------+---------+---------+------------+---------+---------+------------+

| | | | | | | | | | |

+--------------------+-----------+----------+------------+---------+---------+------------+---------+---------+------------+

| Return | 390 | (3,028) | (2,638) | 563 | (651) | (88) | 957 | (2,016) | (1,059) |

| attributable to | | | | | | | | | |

| equity shares | | | | | | | | | |

| (GBP'000) | | | | | | | | | |

+--------------------+-----------+----------+------------+---------+---------+------------+---------+---------+------------+

| Weighted average | | | 73,181,241 | | | 76,215,222 | | | 75,364,144 |

| shares in issue | | | | | | | | | |

| (excluding | | | | | | | | | |

| Treasury shares) | | | | | | | | | |

+--------------------+-----------+----------+------------+---------+---------+------------+---------+---------+------------+

| Return | 0.53 | (4.14) | (3.61) | 0.74 | (0.86) | (0.12) | 1.27 | (2.67) | (1.40) |

| attributable per | | | | | | | | | |

| equity share | | | | | | | | | |

| (pence) | | | | | | | | | |

+--------------------+-----------+----------+------------+---------+---------+------------+---------+---------+------------+

There are no convertible instruments, derivatives or contingent share agreements

in issue, and therefore no dilution affecting the return per share.

7. Non-current asset investments

+------------------------------------------------------+-------------+-----------+

| | Unaudited | Audited |

| | 31 December | 30 June |

| | 2008 | 2008 |

| | GBP'000 | GBP'000 |

+------------------------------------------------------+-------------+-----------+

| Investments held at fair value through profit or | 5,399 | 7,307 |

| loss | | |

+------------------------------------------------------+-------------+-----------+

| Investments held at amortised cost | 10,658 | 10,904 |

+------------------------------------------------------+-------------+-----------+

| | 16,057 | 18,211 |

+------------------------------------------------------+-------------+-----------+

8. Ordinary share capital

+------------------------------------------------------+-------------+-----------+

| | Unaudited | Audited |

| | 31 December | 30 June |

| | 2008 | 2008 |

| | GBP'000 | GBP'000 |

+------------------------------------------------------+-------------+-----------+

| Authorised | | |

+------------------------------------------------------+-------------+-----------+

| 140,000,000 Ordinary shares of 10p each | 14,000 | 14,000 |

+------------------------------------------------------+-------------+-----------+

| | | |

+------------------------------------------------------+-------------+-----------+

| Allotted, called up and fully paid | | |

+------------------------------------------------------+-------------+-----------+

| 80,000,740 Ordinary shares of 10p each (30 June | 8,000 | 8,066 |

| 2008: 80,664,390) | | |

+------------------------------------------------------+-------------+-----------+

| | | |

+------------------------------------------------------+-------------+-----------+

| Allotted, called up and fully paid excluding | 7,318 | 7,340 |

| Treasury shares | | |

| 73,181,241 Ordinary shares of 10p each (30 June | | |

| 2008: 73,403,980) | | |

+------------------------------------------------------+-------------+-----------+

The Company repurchased for cancellation 663,650 Ordinary shares during the

period (year to June 2008: 3,256,044; six months to 31 December 2007: 1,456,436)

at a cost of GBP219,000 (year to June 2008: GBP1,265,000; six months to 31

December 2007: GBP581,000). This represented approximately 0.9% of the share

capital (excluding Treasury shares) as at 1 July 2008. The shares purchased for

cancellation were funded from the special reserve. The total number of shares

held in Treasury as at 31 December 2008 was 7,260,410 (30 June 2008: 7,260,410;

31 December 2007: 7,260,410).

9. Reconciliation of revenue return on ordinary activities before taxation to

net cash inflow from operating activities

+----------------------------------+--------------+--------------+-------------+

| | Unaudited | Unaudited | Audited |

| | six months | six months | year to |

| | to | to | 30 June |

| | 31 December | 31 December | 2008 |

| | 2008 | 2007 | GBP'000 |

| | GBP'000 | GBP'000 | |

+----------------------------------+--------------+--------------+-------------+

| | | | |

+----------------------------------+--------------+--------------+-------------+

| Revenue return before tax | 504 | 739 | 1,240 |

+----------------------------------+--------------+--------------+-------------+

| Capitalised expenses and VAT | 90 | (260) | (502) |

| recovery | | | |

+----------------------------------+--------------+--------------+-------------+

| Decrease in accrued amortised | 138 | 232 | 648 |

| loan stock interest | | | |

+----------------------------------+--------------+--------------+-------------+

| Increase in receivables | (372) | (501) | (114) |

+----------------------------------+--------------+--------------+-------------+

| Increase/(decrease) in payables | 28 | (133) | (241) |

+----------------------------------+--------------+--------------+-------------+

| Net cash inflow from operating | 388 | 77 | 1,031 |

| activities | | | |

+----------------------------------+--------------+--------------+-------------+

10. Analysis of changes in cash during the period

+------------------------------------------+-------------------------+--------------------+----------------+

| | Unaudited | Unaudited | Audited |

| | six months to | six months to | year to |

| | 31 December | 31 December 2007 | 30 June |

| | 2008 | GBP'000 | 2008 |

| | GBP'000 | | GBP'000 |

+------------------------------------------+-------------------------+--------------------+----------------+

| Opening cash balances | 9,237 | 8,367 | 8,367 |

+------------------------------------------+-------------------------+--------------------+----------------+

| Net cash (outflow)/inflow | (5,883) | 262 | 870 |

+------------------------------------------+-------------------------+--------------------+----------------+

| | 3,354 | 8,629 | 9,237 |

+------------------------------------------+-------------------------+--------------------+----------------+

11.Contingencies, guarantees and financial commitments

The Company did not have any contingencies or guarantees as at 31 December

2008 (30 June 2008: nil; 31 December 2007: nil).

12.Post Balance Sheet Events

Since 31 December 2008 the Company has completed the following

investments:

- January 2009: Investment in GB Pub Company VCT Limited of GBP4,000

- January 2009: Investment in Forth Photonics Limited of GBP210,000

- February 2009: Investment in Xceleron Limited of GBP15,000

- February 2009: Investment in Vibrant Energy Surveys Limited of

GBP27,000

- February 2009: Investment in the Dunedin Pub Company VCT

Limited of GBP8,000

On 23 January 2009, the business of Close Ventures Limited, the Manager of the

VCT was acquired by Albion Ventures LLP from Close Brothers Group plc. Further

details regarding the change are shown in the Interim Management Report.

13. Related Party Transactions

The Manager, Albion Ventures LLP and its predecessor Close Ventures Limited, are

considered to be related parties by virtue of the fact that they are/were party

to a management agreement from the Company. During the period, investment

management and administration services of a total value of GBP275,000 (June

2008: GBP728,000; December 2007: GBP376,000) were purchased by the Company from

Close Ventures Limited (which was recently acquired by Albion Ventures LLP as

described in the Interim Management Report). At the financial period end, the

amount due to Close Ventures Limited, disclosed as accruals, was GBP236,000

(June 2008: GBP169,000). The amount due to Crown Place VCT PLC from Close

Ventures Limited in respect of historic VAT claims, can be found in note 4.

Buy-backs of Ordinary shares during the period were transacted through

Winterflood Securities Limited, a subsidiary of Close Brothers Group plc, which,

at the time of the transactions, was the ultimate parent company of the Manager.

A total of 663,650 shares were purchased at an average price of 32.8 pence per

share.

14. Other information

The information set out in the Half-yearly Financial Report does not constitute

the Group's statutory accounts for the period ended 31 December 2008 or 31