TIDMALK

RNS Number : 2531O

Alkemy Capital Investments PLC

29 September 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN OR SOUTH AFRICA OR ANY OTHER JURISDICTION

WHERE SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS

NOT AN OFFER OF SECURITIES IN ANY JURISDICTION.

29 September 2023

Alkemy Capital Investments Plc

Completion of Director Equity Participation at GBP1.40 per

Share

Further to its announcement on 31 May 2023 in relation to its

GBP1.35m fundraise and director participation (the "May

Fundraise"), Alkemy Capital Investments plc ("Alkemy" or the

"Company") (ALK:LSE) (JV2:FRA) announces that on or around 5

October 2023 it will issue 657,711 new ordinary shares to Paul

Atherley in full repayment of the interest free stock loan that was

provided to the Company by Mr Atherley in order to facilitate the

May Fundraise (the "Stock Loan Repayment Shares").

In addition, on the same date, the Company will repay in full

the GBP330,000 unsecured, interest free loan provided to the

Company by Mr Atherley and the GBP100,000 unsecured, interest free

loan provided to the Company by Sam Quinn at the time of the May

Fundraise (noting Mr Atherley and Mr Quinn were unable to

participate directly in the May Fundraise as doing so would have

triggered a mandatory offer for the Company under the City Code on

Takeovers and Mergers).

As agreed at the time, Mr Atherley and Mr Quinn will apply such

amounts to be repaid to them to subscribe for 235,714 new ordinary

shares to be issued by the Company in the case of Mr Atherley and

71,428 new ordinary shares to be issued by the Company in the case

of Mr Quinn, in each case at a price of GBP1.40, being the placing

price of the May Fundraise (the "IFL Repayment Shares" and together

with the Stock Loan Repayment Shares, the "New Shares").

The Company will apply for admission of all such New Shares to

listing on the standard segment of the Official List of the

Financial Conduct Authority (the "FCA") and to trading on the Main

Market of the London Stock Exchange ("Admission"). Admission is

expected to occur at 8.00 a.m. on or around 5 October 2023.

In accordance with the FCA's Disclosure Guidance and

Transparency Rules, the Company confirms that following Admission,

the Company's enlarged issued ordinary share capital will comprise

8,164,851 ordinary shares each with a right to vote and with no

shares held in treasury. Therefore, following Admission, the above

figure may be used by shareholders in the Company as the

denominator for the calculations to determine if they are required

to notify their interest in, or a change to their interest in the

Company, under the FCA's Disclosure Guidance and Transparency

Rules.

Further information

For further information, please visit the Company's website:

www.alkemycapital.co.uk or www.teesvalleylithium.co.uk

-Ends-

Alkemy Capital Investments Plc Tel: 0207 317 0636

info@alkemycapital.co.uk

SI Capital Limited Tel: 0148 341 3500

VSA Capital Limited Tel: 0203 005 5000

NOTES TO EDITORS

Alkemy is seeking to establish the world's leading independent

and sustainable lithium hydroxide production by developing

state-of-the-art lithium sulphate and lithium hydroxide facilities

in Australia and the UK.

Alkemy, through its wholly owned UK subsidiary Tees Valley

Lithium, has secured a 9.6 ha brownfields site with full planning

permission at the Wilton International Chemicals Park in Teesside,

a major UK Freeport, to build the UK's first and Europe's largest

lithium hydroxide processing facility. Tees Valley Lithium has

completed a Class 4 Feasibility Study for its proposed lithium

hydroxide refinery which will process feedstock imported from

various sources to produce 96,000 tonnes of premium, low-carbon

lithium hydroxide annually, representing around 15% of Europe's

projected demand.

Alkemy, through its wholly owned Australian subsidiary Port

Hedland Lithium, has secured a 43.7 ha site near Port Hedland,

Western Australia to build a world-class sustainable lithium

sulphate refinery that will provide reliable feedstock for Tees

Valley Lithium's refinery. Port Hedland Lithium has completed a

Class 4 Feasibility Study for its proposed lithium sulphate

refinery, each train of which will process spodumene concentrate to

produce 40,000 tonnes of lithium sulphate annually.

IMPORTANT NOTICES

THIS ANNOUNCEMENT IS RESTRICTED AND IS NOT FOR PUBLICATION,

RELEASE, TRANSMISSION, FORWARDING OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES OF

AMERICA, ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED

STATES OR THE DISTRICT OF COLUMBIA (COLLECTIVELY, THE "UNITED

STATES"), AUSTRALIA, CANADA, JAPAN OR SOUTH AFRICA OR ANY OTHER

JURISDICTION IN WHICH SUCH PUBLICATION, RELEASE OR DISTRIBUTION

WOULD BE UNLAWFUL. FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION

PURPOSES ONLY AND IS NOT AN OFFER OF SECURITIES IN ANY

JURISDICTION.

This Announcement or any part of it does not constitute or form

part of any offer to issue or sell, or the solicitation of an offer

to acquire, purchase or subscribe for, any securities in the United

States, Canada, Australia, Japan or South Africa or any other

jurisdiction in which the same would be unlawful.

No action has been taken by the Company or any of its

affiliates, or any person acting on its behalf that would permit an

offer of the New Shares or possession or distribution of this

Announcement or any other offering or publicity material relating

to such New Shares in any jurisdiction where action for that

purpose is required. Persons into whose possession this

Announcement comes are required by the Company to inform themselves

about, and to observe, such restrictions.

No prospectus, offering memorandum, offering document or

admission document has been or will be made available in connection

with the matters contained in this Announcement and no such

prospectus is required (in accordance with Regulation (EU) No

2017/1129 (as amended) (the "EU Prospectus Regulation") or the EU

Prospectus Regulation as it forms part of UK domestic law by virtue

of the European Union (Withdrawal) Act 2018) to be published.

Persons needing advice should consult a qualified independent legal

adviser, business adviser, financial adviser or tax adviser for

legal, financial, business or tax advice.

The New Shares have not been and will not be registered under

the US Securities Act of 1933, as amended (the "Securities Act"),

or with any securities regulatory authority of any State or other

jurisdiction of the United States, and may not be offered, sold or

transferred, directly or indirectly, in or into the United States

except pursuant to an exemption from, or in a transaction not

subject to, the registration requirements of the Securities Act and

in compliance with the securities laws of any State or any other

jurisdiction of the United States. Accordingly, the New Shares are

being offered and sold only outside of the United States in

"offshore transactions" (as such term is defined in Regulation S

under the Securities Act ("Regulation S")) pursuant to Regulation S

and otherwise in accordance with applicable laws. No public

offering of the New Shares will be made in the United States or

elsewhere.

This Announcement has not been approved by the FCA, the London

Stock Exchange, BaFin or the Frankfurt Stock Exchange.

Certain statements contained in this Announcement constitute

"forward-looking statements" with respect to the financial

condition, results of operations and businesses and plans of the

Company and its subsidiaries (the "Group"). Words such as

"believes", "anticipates", "estimates", "expects", "intends",

"plans", "aims", "potential", "will", "would", "could",

"considered", "likely", "estimate" and variations of these words

and similar future or conditional expressions, are intended to

identify forward-looking statements but are not the exclusive means

of identifying such statements. These statements and forecasts

involve risk and uncertainty because they relate to events and

depend upon future circumstances that have not occurred. There are

a number of factors that could cause actual results or developments

to differ materially from those expressed or implied by these

forward-looking statements and forecasts. As a result, the Group's

actual financial condition, results of operations and business and

plans may differ materially from the plans, goals and expectations

expressed or implied by these forward-looking statements. No

representation or warranty is made as to the achievement or

reasonableness of, and no reliance should be placed on, such

forward-looking statements. The forward-looking statements

contained in this Announcement speak only as of the date of this

Announcement. The Company, its directors, affiliates and any person

acting on its or their behalf each expressly disclaim any

obligation or undertaking to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, unless required to do so by applicable

law or regulation, the FCA, the London Stock Exchange, BaFin or the

Frankfurt Stock Exchange.

This Announcement does not constitute a recommendation

concerning any investor's investment decision with respect to the

ordinary shares. Any indication in this Announcement of the price

at which ordinary shares have been bought or sold in the past

cannot be relied upon as a guide to future performance. The price

of shares and any income expected from them may go down as well as

up and investors may not get back the full amount invested upon

disposal of the shares. Past performance is no guide to future

performance. This Announcement does not identify or suggest, or

purport to identify or suggest, the risks (direct or indirect) that

may be associated with an investment in any ordinary shares. The

contents of this Announcement are not to be construed as legal,

business, financial or tax advice. Each investor or prospective

investor should consult their or its own legal adviser, business

adviser, financial adviser or tax adviser for legal, financial,

business or tax advice.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into or forms part of this Announcement.

This Announcement has been prepared for the purposes of

complying with applicable law and regulation in the United Kingdom

and the information disclosed may not be the same as that which

would have been disclosed if this Announcement had been prepared in

accordance with the laws and regulations of any jurisdiction

outside the United Kingdom.

Notification of PDMR Dealings

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Paul Atherley

------------------------------------- -----------------------------

2 Reason for Notification

--------------------------------------------------------------------

a) Position/status Chairman

------------------------------------- -----------------------------

b) Initial notification/amendment Initial notification

------------------------------------- -----------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

--------------------------------------------------------------------

a) Name Alkemy Capital Investments

Plc

------------------------------------- -----------------------------

b) LEI 213800NW5GVIRMXSRL48

------------------------------------- -----------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

--------------------------------------------------------------------

a) Description of the financial Ordinary shares

instrument, type of instrument

Identification code GB00BMD6C023

------------------------------------- -----------------------------

b) Nature of the transaction Repayment of stock loan

------------------------------------- -----------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

N/A 657,711

----------

------------------------------------- -----------------------------

d) Aggregated information

- Aggregated volume 657,711

- Price N/A

------------------------------------- -----------------------------

e) Date of the transaction 29 September 2023

------------------------------------- -----------------------------

f) Place of the transaction Outside a trading venue

------------------------------------- -----------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

--------------------------------------------------------------------

a) Description of the financial Ordinary shares

instrument, type of instrument

Identification code GB00BMD6C023

------------------------------------- -----------------------------

b) Nature of the transaction Subscription for shares

------------------------------------- -----------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

1.40 235,714

----------

------------------------------------- -----------------------------

d) Aggregated information

- Aggregated volume 235,714

- Price GBP330,000

------------------------------------------ -----------------------------

e) Date of the transaction 29 September 2023

------------------------------------- -----------------------------

f) Place of the transaction Outside a trading venue

------------------------------------- -----------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Sam Quinn

------------------------------------------ -----------------------------

2 Reason for the notification

-------------------------------------------------------------------------

a) Position/status Non-Executive Director

------------------------------------------ -----------------------------

b) Initial notification /Amendment Initial Notification

------------------------------------------ -----------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------

a) Name Alkemy Capital Investments

Plc

------------------------------------------ -----------------------------

b) LEI 213800NW5GVIRMXSRL48

------------------------------------------ -----------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------------

a) Description of the financial Ordinary shares

instrument, type of instrument

Identification code GB00BMD6C023

b) Nature of the transaction Subscription for shares

------------------------------------------ -----------------------------

c) Price(s) and volume(s)

-------------- -------------

Price(s) Volume(s)

-------------- -------------

GBP1.40 71,428

-------------- -------------

d) Aggregated information

- Aggregated volume 71,428

- Price GBP100,000

e) Date of the transaction 29 September 2023

------------------------------------------ -----------------------------

f) Place of the transaction Outside a trading venue

------------------------------------------ -----------------------------

Notification of major holdings

NOTIFICATION OF MAJOR HOLDINGS (to be sent to the relevant issuer and to the FCA in Microsoft

Word format if possible) (i)

1a. Identity of the issuer or the underlying issuer of existing shares to Alkemy Capital Investments Plc

which voting rights

are attached (ii) :

--------------------------------------------------------------------------------------------------

1b. Please indicate if the issuer is a non-UK issuer (please mark with an "X" if appropriate)

Non-UK issuer

---------------

2. Reason for the notification (please mark the appropriate box or boxes with an "X")

An acquisition or disposal of voting rights X

---------------

An acquisition or disposal of financial instruments

---------------

An event changing the breakdown of voting rights

---------------

Other (please specify) (iii) :

---------------

3. Details of person subject to the notification obligation (iv)

Name Paul Atherley

City and country of registered office (if applicable)

4. Full name of shareholder(s) (if different from 3.) (v)

Name Paul Atherley

--------------------------------------------------------------------------------------------------

City and country of registered office (if applicable)

--------------------------------------------------------------------------------------------------

5. Date on which the threshold was crossed or reached (vi) : 29 September 2023

--------------------------------------------------------------------------------------------------

6. Date on which issuer notified (DD/MM/YYYY): 29 September 2023

--------------------------------------------------------------------------------------------------

7. Total positions of person(s) subject to the notification obligation

% of voting rights attached to shares % of voting rights through financial instruments Total of both in % (8.A + 8.B) Total number of voting

(total of 8. A) (total of 8.B 1 + 8.B 2) rights held in issuer

(8.A + 8.B) (vii)

------------------------------------------- ------------------------------------------------- ---------------------------------- ------------------------

Resulting

situation on the

date on which

threshold was

crossed or

reached 40.6% - 40.6% 40.6%

------------------------------------------- ------------------------------------------------- ---------------------------------- ------------------------

Position of

previous

notification (if

applicable) 33.6% - 33.6%

------------------------------------------- ------------------------------------------------- ---------------------------------- ------------------------

8. Notified details of the resulting situation on the date on which the threshold was crossed

or reached (viii)

A: Voting rights attached to shares

Class/type of Number of voting rights (ix) % of voting rights

shares

ISIN code (if

possible)

Direct Indirect Direct Indirect

(DTR5.1) (DTR5.2.1) (DTR5.1) (DTR5.2.1)

---------------------------------

GB00BMD6C023 3,313,714 - 40.6% -

------------------------------------------- --------------------------------- -------------------------------------------------- ------------------------

SUBTOTAL 8. A 3,313,714 40.6%

------------------------------------------------------------------------------ ----------------------------------------------------------------------------

B 1: Financial Instruments according to DTR5.3.1R (1) (a)

Type of financial Expiration Exercise/ Number of voting rights that may be acquired if the % of voting rights

instrument date (x) Conversion Period (xi) instrument is

exercised/converted.

------------------------- ------------------------------------------ ----------------------------------------------------------- ------------------------

SUBTOTAL 8. B 1

------------------------------------------ ----------------------------------------------------------- ------------------------

B 2: Financial Instruments with similar economic effect according to DTR5.3.1R (1) (b)

Type of Expiration Exercise/ Physical or cash Number of voting % of voting rights

financial date (x) Conversion Period (xi) Settlement (xii) rights

instrument

----------------------------- ----------------------------- ----------------------------------------------- -----------------------

SUBTOTAL 8.B.2

----------------------------------------------- -----------------------

9. Information in relation to the person subject to the notification obligation (please mark

the

applicable box with an "X")

Person subject to the notification obligation is not controlled by any natural person or legal X

entity and does not control any other undertaking(s) holding directly or indirectly an interest

in the (underlying) issuer (xiii)

Full chain of controlled undertakings through which the voting rights and/or the

financial instruments are effectively held starting with the ultimate controlling natural

person or legal entity (please add additional rows as necessary) (xiv)

Name (xv) % of voting rights if it equals or is % of voting rights through financial instruments if it Total of both if it equals or is

higher than the notifiable threshold equals or is higher than the notifiable higher than the notifiable

threshold threshold

------------------------------------------ ------------------------------------------------------------- -----------------------------------

10. In case of proxy voting, please identify:

Name of the proxy holder

--------------------------------------------------------------------------------------------------

The number and % of voting rights held

--------------------------------------------------------------------------------------------------

The date until which the voting rights will be held

--------------------------------------------------------------------------------------------------

11. Additional information (xvi)

Place of completion Outside a trading venue

-----------------------------------------------------------------------------------------------------------------------------------------------------

Date of completion 29 September 2023

-----------------------------------------------------------------------------------------------------------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEDKLFLXKLFBBX

(END) Dow Jones Newswires

September 29, 2023 13:17 ET (17:17 GMT)

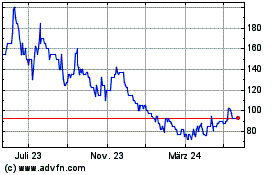

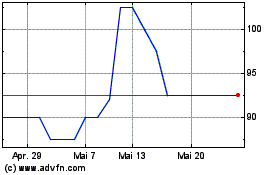

Alkemy Capital Investments (LSE:ALK)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Alkemy Capital Investments (LSE:ALK)

Historical Stock Chart

Von Mai 2023 bis Mai 2024