TIDMAJB

RNS Number : 0659A

AJ Bell PLC

18 January 2024

18 January 2024

AJ Bell plc

Q1 trading update

AJ Bell plc ("AJ Bell" or the "Company"), one of the UK's

largest investment platforms, today issues a trading update in

respect of the three months ended 31 December 2023.

Performance overview

Platform business

-- Customer numbers increased by 8,000 to close at 484,000, up

12% in the last year and 2% in the quarter

o Total advised customers of 161,000, up 8% in the last year

and 1% in the quarter

o Total D2C customers of 323,000, up 13% in the last year and

2% in the quarter

-- Record assets under administration ("AUA") of GBP76.2 billion,

up 15% in the last year and 7% in the quarter

-- A significant year-on-year increase in gross and net inflows

across the platform

o Gross inflows in the quarter of GBP2.7 billion (2023: GBP1.9

billion)

o Net inflows in the quarter of GBP1.3 billion (2023: GBP0.8

billion)

AJ Bell Investments

-- Assets under management ("AUM") of GBP5.2 billion, up

53% in the last year and 11% in the quarter

-- Net inflows in the quarter of GBP0.4 billion, in line

with the prior year (2023: GBP0.4 billion)

Michael Summersgill, Chief Executive Officer at AJ Bell,

commented:

"I am delighted to report an excellent start to the financial

year, with first quarter net inflows across the platform being

higher than in any individual quarter of FY23. Together with

favourable market movements, platform assets under administration

increased by 7% to reach a record GBP76.2 billion.

"Some of the macroeconomic headwinds experienced throughout 2023

showed signs of improving in the quarter, driving global equity

markets higher and easing some of the pressure on household

finances. Platform net inflows of GBP1.3 billion in the quarter

were up 63% on the GBP0.8 billion reported in the prior year,

reflecting increased confidence among retail investors compared to

a year ago.

"AJ Bell Investments continues to perform strongly with AUM up

11% in the quarter through a combination of strong net inflows and

positive market movements, surpassing GBP5 billion for the first

time. The consistently strong growth of our investment business

illustrates the attractiveness of our low-cost, simple

products.

"As we look ahead, our platform will continue to appeal to both

current and potential customers and advisers. We continue to invest

in enhancing our propositions, with a strong focus on ease of use,

whilst also investing in our pricing to ensure we continue to

deliver great value to customers. Following the FCA's recent

clarification of its expectations concerning interest paid on cash

balances held on investment platforms, we announced changes to the

interest rates paid on cash balances whilst also lowering a number

of our charges. These changes will benefit our customers to the

tune of GBP14 million a year, reflecting our longstanding

philosophy of sharing our economies of scale as we grow - an

approach that is very much aligned with the Consumer Duty.

"Our dual-channel model has proven its resilience during a

period of high inflation over the last 18 months, delivering

consistent customer growth and net inflows. Whilst this strong

start to the year provides good momentum as we head into the busy

tax year end period, we remain focused on the long-term growth

opportunity that exists in the platform market and the investments

that we are making into our propositions and pricing will further

strengthen our long-term competitive position."

Three months ended Advised D2C Platform Total Non-platform

31 December 2023 Platform Platform Total

Opening customers (k) 159 317 476 15 491

Closing customers (k) 161 323 484 15 499

AUA and AUM (GBPbillion)

------------------------------- ---------- ------------- ---------- ------------- --------

Opening AUA 48.2 22.7 70.9 5.2 76.1

------------------------------- ---------- ------------- ---------- ------------- --------

Inflows(1) 1.5 1.2 2.7 - 2.7

Outflows(2) (0.9) (0.5) (1.4) - (1.4)

------------------------------- ---------- ------------- ---------- ------------- --------

Net inflows 0.6 0.7 1.3 - 1.3

------------------------------- ---------- ------------- ---------- ------------- --------

Market and other movements(3) 2.2 1.8 4.0 0.2 4.2

------------------------------- ---------- ------------- ---------- ------------- --------

Closing AUA 51.0 25.2 76.2 5.4 81.6

------------------------------- ---------- ------------- ---------- ------------- --------

4.2 1.0

Closing AUM 2.8 1.4 (4) (5) 5.2

Three months ended Advised D2C Platform Total Non-platform

31 December 2022 Platform Platform Total

Opening customers (k) 146 280 426 15 441

Closing customers (k) 149 285 434 15 449

AUA and AUM (GBPbillion)

------------------------------- ---------- ------------- ---------- ------------- --------

Opening AUA 44.8 19.3 64.1 5.1 69.2

------------------------------- ---------- ------------- ---------- ------------- --------

Inflows(1) 1.2 0.7 1.9 - 1.9

Outflows(2) (0.7) (0.4) (1.1) (0.1) (1.2)

------------------------------- ---------- ------------- ---------- ------------- --------

Net inflows/(outflows) 0.5 0.3 0.8 (0.1) 0.7

------------------------------- ---------- ------------- ---------- ------------- --------

Market and other movements(3) 0.7 0.7 1.4 0.2 1.6

------------------------------- ---------- ------------- ---------- ------------- --------

Closing AUA 46.0 20.3 66.3 5.2 71.5

------------------------------- ---------- ------------- ---------- ------------- --------

3.0 0.4

Closing AUM 1.9 1.1 (4) (5) 3.4

(1) Transfers-in, subscriptions, contributions and tax

relief

(2) T ransfers-out, cash withdrawals, benefits and tax

payments

(3) Total i nvestment returns and revaluations, net of charges

and taxes

(4) Platform AUA which is held in AJ Bell's Funds or Managed

Portfolio Service

(5) Assets which are held in AJ Bell's Funds or Managed

Portfolio Service via third-party platforms

Contacts:

AJ Bell

Shaun Yates, Investor Relations

-- Director +44 (0) 7522 235 898

-- Mike Glenister, Head of PR +44 (0) 7719 554 575

Historical customer numbers, AUA and AUM by quarter

Advised Platform Qtr to Qtr to Qtr to Qtr to Qtr to

31 31 30 30 31

December March June September December

2022 2023 2023 2023 2023

Customers (k) 149 153 157 159 161

AUA and AUM

(GBPbillion)

------------------ ---------- ------- ------- ----------- ----------

Opening AUA 44.8 46.0 47.3 47.8 48.2

------------------ ---------- ------- ------- ----------- ----------

Inflows(1) 1.2 1.4 1.2 1.2 1.5

Outflows(2) (0.7) (0.8) (0.8) (0.8) (0.9)

------------------ ---------- ------- ------- ----------- ----------

Net inflows 0.5 0.6 0.4 0.4 0.6

------------------ ---------- ------- ------- ----------- ----------

Market and other

movements(3) 0.7 0.7 0.1 - 2.2

Closing AUA 46.0 47.3 47.8 48.2 51.0

---------- ------- ------- -----------

Closing AUM(4) 1.9 2.1 2.3 2.5 2.8

D2C Platform Qtr to Qtr to Qtr to Qtr to Qtr to

31 31 30 30 31

December March June September December

2022 2023 2023 2023 2023

Customers (k) 285 302 309 317 323

AUA and AUM

(GBPbillion)

------------------ ---------- ------- ------- ----------- ----------

Opening AUA 19.3 20.3 21.3 22.0 22.7

------------------ ---------- ------- ------- ----------- ----------

Inflows(1) 0.7 1.1 1.2 1.3 1.2

Outflows(2) (0.4) (0.5) (0.5) (0.6) (0.5)

------------------ ---------- ------- ------- ----------- ----------

Net inflows 0.3 0.6 0.7 0.7 0.7

------------------ ---------- ------- ------- ----------- ----------

Market and other

movements(3) 0.7 0.4 - - 1.8

------------------ ---------- ------- ------- ----------- ----------

Closing AUA 20.3 21.3 22.0 22.7 25.2

------------------ ---------- ------- ------- ----------- ----------

Closing AUM(4) 1.1 1.2 1.3 1.3 1.4

Non-platform Qtr to Qtr to Qtr to Qtr to Qtr to

31 31 30 30 31

December March June September December

2022 2023 2023 2023 2023

Customers (k) 15 15 15 15 15

AUA and AUM

(GBPbillion)

------------------------ ---------- -------- ------- ----------- ----------

Opening AUA 5.1 5.2 5.2 5.3 5.2

------------------------ ---------- -------- ------- ----------- ----------

Inflows(1) - 0.1 - 0.1 -

Outflows(2) (0.1) - - (0.2) -

------------------------ ---------- -------- ------- ----------- ----------

Net (outflows)/inflows (0.1) 0.1 - (0.1) -

------------------------ ---------- -------- ------- ----------- ----------

Market and other

movements(3) 0.2 (0.1) 0.1 - 0.2

------------------------ ---------- -------- ------- ----------- ----------

Closing AUA 5.2 5.2 5.3 5.2 5.4

------------------------ ---------- -------- ------- ----------- ----------

Closing AUM(5) 0.4 0.6 0.7 0.9 1.0

Total closing

AUA 71.5 73.8 75.1 76.1 81.6

------------------------ ---------- -------- ------- ----------- ----------

Total closing

AUM 3.4 3.9 4.3 4.7 5.2

------------------------ ---------- -------- ------- ----------- ----------

(1) Transfers-in, subscriptions, contributions and tax

relief

(2) T ransfers-out, cash withdrawals, benefits and tax

payments

(3) Total i nvestment returns and revaluations, net of charges

and taxes

(4) Platform AUA which is held in AJ Bell's Funds or Managed

Portfolio Service

(5) Assets which are held in AJ Bell's Funds or Managed

Portfolio Service via third-party platforms

About AJ Bell:

Established in 1995, AJ Bell is one of the largest investment

platforms in the UK, operating at scale in both the advised and

direct-to-consumer markets.

Our purpose is to help people invest by providing them with easy

access to Pensions, ISAs and General investment accounts, great

customer service and competitive charges.

Our two core platform propositions are AJ Bell in the D2C market

and AJ Bell Investcentre in the advised market, which both provide

access to a broad investment range including shares and other

instruments traded on the major stock exchanges around the world,

as well as all mainstream collective investments available in the

UK and our own range of AJ Bell funds.

In the D2C market we also offer AJ Bell Dodl, a low-cost

investment app with a simplified investment range that makes it

easier for customers to choose investments and buy and sell them

without paying any commission.

For D2C cash savers we offer a Cash savings hub which provides

access to a range of competitive savings accounts to help people

manage their long-term cash deposits.

AJ Bell is headquartered in Manchester, UK, with offices in

London and Bristol.

Forward-looking statements

This announcement contains forward-looking statements that

involve substantial risks and uncertainties, and actual results and

developments may differ materially from those expressed or implied

by these statements. These forward-looking statements are

statements regarding AJ Bell's intentions, beliefs or current

expectations concerning, among other things, its results of

operations, financial condition, prospects, growth, strategies, and

the industry in which it operates. By their nature, forward-looking

statements involve risks and uncertainties because they relate to

events and depend on circumstances that may or may not occur in the

future. These forward-looking statements speak only as of the date

of this announcement and AJ Bell does not undertake any obligation

to publicly release any revisions to these forward-looking

statements to reflect events or circumstances after the date of

this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGPUBCGUPCGMM

(END) Dow Jones Newswires

January 18, 2024 02:00 ET (07:00 GMT)

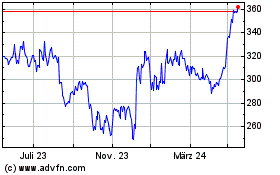

Aj Bell (LSE:AJB)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

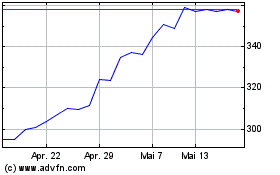

Aj Bell (LSE:AJB)

Historical Stock Chart

Von Apr 2023 bis Apr 2024