SOITEC REPORTS FULL-YEAR RESULTS OF FISCAL YEAR 2022

SOITEC REPORTS FULL-YEAR RESULTS OF FISCAL

YEAR 2022

- Revenue reached for the

first time $1 billion, at €863m, up 50% at constant exchange rates

versus FY’21

-

EBITDA1

margin2 at 35.8% of

revenue, up 5.1 pts versus FY’21

- Current operating income

more than doubled versus FY’21 to €195m

- Operating Cash Flow up 46%

versus FY’21 to €255m

- Positive Free Cash flow at

€42m while investments in capacity increased strongly

- FY’23 revenue expected up

around 20% at constant exchange rates and perimeter and

EBITDA1

margin2 expected around

36%

Bernin (Grenoble), France, June

8th, 2022 – Soitec

(Euronext Paris), a world leader in designing and manufacturing

innovative semiconductor materials, today announced its full-year

results for fiscal year 2022 (ended on March 31st, 2022). The

financial statements3 were approved by the Board of Directors

during its meeting today.

Paul Boudre, Soitec’s CEO, commented:

“The sharp 50% revenue growth achieved in our fiscal year

2021-22, setting a new record

above one billion US dollars in revenue, demonstrates our

ability to leverage the decisive role that our substrates are

playing in driving world’s transformation

through our end markets, whether it will be mobile

communications, automotive and industry, or smart devices.

Our products enable more sustainable, and energy efficient

solutions.

We also benefited from the unwavering

commitment of our teams in delivering a strong operating

performance, allowing us to gain more than five points in EBITDA

margin.

In order to keep pace

with our customers’ needs and support their increasing demand, we

are confident in our ability to scale up our organization, further

investing both in our human capital and in our industrial capacity

for which our strong financial position is instrumental. We are

very pleased to announce that we decided the extension of

our Pasir Ris

facility in Singapore that will be dedicated to 300mm SOI

wafers,” added Paul Boudre.

Record revenue and strong increase in

EBITDA1

margin2

Consolidated income statement (part 1)

| (Euros

millions) |

FY’22 |

FY’21 |

% change |

| |

|

|

|

| Revenue |

863 |

584 |

+48% |

| |

|

|

|

| Gross

profit |

316 |

183 |

+72% |

| As a % of

revenue |

36.6% |

31.4% |

|

| |

|

|

|

| Net research

and development expenses |

(57) |

(44) |

+28% |

| Selling,

general and administrative expenses |

(64) |

(49) |

+30% |

| |

|

|

|

| |

|

|

|

| Current

operating income |

195 |

90 |

+117% |

| As a % of

revenue |

22.6% |

15.4% |

|

| |

|

|

|

| EBITDA1 from

continuing operations |

309 |

179 |

+72% |

| As a % of

revenue |

35.8% |

30.7% |

|

Consolidated revenue reached

the all-time record high level of 863 million Euros in FY’22.

Revenue was up 48% compared with 584 million Euros in FY’21. This

reflects the combination of a 50% growth at constant exchange rates

and a negative currency impact of 2%4.

- 150/200-mm wafer

sales reached 344 million Euros in FY’22 (40% of total

revenue), up 26% at constant exchange rates and up 24% on a

reported basis compared to FY’21. This is a combination of i) a

strong increase in sales of 150-mm POI (Piezoelectric-on-Insulator)

wafers for smartphones RF filters, enabled by the good ramp-up in

production following the increase in installed capacity at Bernin

III; ii) higher sales of Power-SOI reflecting the recovery of the

automotive industry from FY’21; and iii) a slight increase in

200-mm RF-SOI wafer sales dedicated to radiofrequency applications

for smartphones.

- 300-mm wafer sales

amounted to 488 million Euros in FY’22 (57% of total revenue), up

79% at constant exchange rates and up 77% on a reported basis

compared to FY’21. 300-mm RF-SOI wafer sales recorded a strong

increase, supported by the deployment of 5G smartphones requiring

more RF-SOI content per smartphone. Increase in sales of FD-SOI

wafers was particularly sharp, reflecting a stronger use of FD-SOI

technology for applications related to Edge-Computing, Automotive

and 5G mmWave modules. Soitec also recorded significantly higher

sales of Photonics-SOI for data centers as well as higher sales of

Imager-SOI dedicated to 3D sensing applications for

smartphones.

- Total Royalties and other

revenue were nearly stable at 30 million Euros (up 2% at

constant exchange rates and up 1% on a reported basis).

Gross profit reached 316

million Euros in FY’22, up 72% from 183 million Euros in FY’21,

reflecting a strong 5.2 points increase in gross margin, from 31.4%

of revenue in FY’21 to 36.6% of revenue in FY’22, despite an

unfavorable currency impact. Soitec benefited from a strong

operating leverage due to the robust increase in activity as well

as from a very good industrial performance across all its

industrial facilities leading to a higher use of its production

capacity. Soitec also maintained a strong control over costs

despite higher energy costs and benefited from a favorable phasing

of its long-term agreements with suppliers regarding bulk material

prices.

Current operating income has

more than doubled to 195 million Euros in FY’22, up from

90 million Euros in FY’21. This is translating into a strong

increase in current operating margin from 15.4% of revenue in FY’21

to 22.6% of revenue in FY’22 despite the intensified efforts in

R&D and higher SG&A aimed at supporting the Group’s

growth:

- Net R&D

expenses increased from 44 million Euros in FY’21 to 57

million Euros in FY’22. Gross R&D expenses increased by 19

million Euros as Soitec continued to invest in its innovation

strategy and the expansion of its product portfolio required to

support each of its three end markets. The increase in net R&D

expenses was however limited to 13 million Euros thanks to higher

subsidies and, as a percentage of revenue, they went down from 7.6%

in FY’21 to 6.6% in FY’22.

- Selling, general and

administrative (SG&A) expenses went up from 49 million

Euros in FY’21 to 64 million Euros in FY’22, essentially reflecting

an increase in expenses related to employee compensation schemes

due to the higher number of staff as well as profit-sharing and

incentive plans. SG&A expenses were however well monitored, as

they went down from 8.4% of revenue in FY’21 to 7.4% in FY’22.

The EBITDA1

from continuing operations amounted to 309 million

Euros in FY’22, up 72% from 179 million Euros in FY’21. Despite

unfavorable currency impact and continuous efforts in R&D and

SG&A, the EBITDA1 margin2 increased by 5.1 points to 35.8% of

revenue in FY’22, compared with 30.7% of revenue in FY’21,

benefitting from a strong operating leverage and a very good

industrial performance.

Depreciation and amortization

expenses went up from 60 million Euros in FY’21 to

81 million Euros in FY’22 as a result of the increased

industrial capacity as well as R&D investments carried out by

the Group in previous years.

Consolidated income statement (part 2)

| (Euros

millions) |

FY’22 |

FY’21 |

% change |

| |

|

|

|

| Current

operating income |

195 |

90 |

+117% |

| |

|

|

|

| Other

operating income and expenses |

10 |

0 |

|

| |

|

|

|

| |

|

|

|

| Operating

income |

205 |

90 |

+126% |

| |

|

|

|

| Net financial

result |

(1) |

(15) |

|

| Income

tax |

(2) |

(1) |

|

| |

|

|

|

| |

|

|

|

| Net profit

from continuing operations |

202 |

74 |

+173% |

| |

|

|

|

| Net profit /

(loss) from discontinued operations |

(0) |

(1) |

|

| |

|

|

|

| |

|

|

|

| Net

profit |

202 |

73 |

+178% |

| |

|

|

|

| Basic earnings

per share (in €) |

5.98 |

2.19 |

+173% |

| |

|

|

|

| Diluted

earnings per share (in €) |

5.63 |

2.16 |

+161% |

| |

|

|

|

| Number of

shares |

33,753,666 |

33,176,570 |

|

| |

|

|

|

| Number of

diluted shares |

37,181,632 |

35,014,307 |

|

The Group recorded a non-recurring income of 10

million Euros in other operating income and

expenses in FY’22. This mainly reflects the full reversal

of an impairment loss related to Singapore industrial building

which had been recognized in FY’16. This reversal, which amounted

to 9 million Euros, was triggered by the good industrial

performance of Singapore facility. Consequently, the

operating income reached 205 million Euros in

FY’22 compared to 90 million Euros in FY’21.

The net financial result was a

loss of 1 million Euros in FY’22 compared to a loss of 15 million

Euros in FY’21. On the one hand, the Group recorded an increase of

2 million Euros in net financial expenses, which reached 13 million

Euros in FY’22. On the other hand, the Group recorded a net foreign

exchange gain of 13 million Euros in FY’22 compared to a foreign

exchange loss of 4 million Euros recorded in FY’21.

Income tax expense amounted to

2 million Euros in FY’22 compared to 1 million Euros in FY’21. As

the Group continues to benefit from tax loss carryforwards, the

FY’22 net income tax expense includes a deferred tax income of 12

million Euros following the recognition of deferred tax assets in

France and in Singapore.

The net profit, Group share

nearly tripled to reach 202 million Euros in FY’22, compared with a

net profit of 73 million Euros recorded in FY’21.

Positive Free Cash Flow while capacity

investments increased strongly

Consolidated cash-flows

| (Euros

millions) |

FY’22 |

FY’21 |

| |

|

|

| Continuing

operations |

|

|

| |

|

|

| EBITDA1 |

309 |

179 |

| |

|

|

| Change in

working capital |

(52) |

9 |

| Tax paid |

(2) |

(14) |

| |

|

|

| |

|

|

| Net cash

generated by operating activities |

255 |

174 |

| |

|

|

| Net cash used

in investing activities |

(213) |

(133) |

| |

|

|

| |

|

|

| Free

Cash Flow |

42 |

42 |

| |

|

|

| Net proceeds

from OCEANEs 2025 issued |

- |

321 |

| Proceeds from

shareholders and other items |

2 |

(1) |

| Drawing on

credit lines, new loans and debt repayment (including finance

leases) |

39 |

94 |

| Financial

expenses |

(4) |

(2) |

| |

|

|

| |

|

|

| Net cash

generated by financing activities |

37 |

412 |

| |

|

|

| Impact of

exchange rate fluctuations |

6 |

(0) |

| |

|

|

| |

|

|

| Net change in

cash |

85 |

454 |

| |

|

|

| Discontinued

operations |

(2) |

(0) |

| |

|

|

| |

|

|

| Group

net change in cash |

83 |

453 |

The cash outflow from working

capital amounted to 52 million Euros in FY’22 as a result

of the strong increase in activity, as evidenced by i) a 31 million

Euros increase in inventories and ii) a 48 million Euros

increase in trade receivables, which were partly offset by iii) a

15 million increase in trade payables, iv) a 6 million Euros

decrease in other receivables and v) a 6 million increase in other

payables. In FY’21, when the activity was flat, the Group had

recorded a cash inflow from working capital of 9 million Euros.

Overall, net cash generated by operating

activities went up 46%, from 174 million in FY’21 to

255 million Euros in FY’22.

The net cash used in investing

activities of continuing operations amounted to 213

million Euros in FY’22, up 61% compared to 133 million Euros in

FY’21. Capital expenditure was mainly related to Bernin (103

million Euros spread between capacity investments and 8 million

Euros of capitalized R&D) and Singapore (91 million Euros spent

in capacity investments, including 300-mm SOI wafer production,

refresh and epitaxy). In addition, the acquisition of NovaSiC

represented an investment of 6 million Euros (net of cash).

According to IFRS, the cash used in investing

activities is calculated net of investments financed through

leasing, which accounted for 16 million Euros in FY’22.

Total cash out related to investing activities

therefore amounted to 229 million Euros.

A positive Free Cash Flow, at

42 million Euros in FY’22, was achieved while continuing to invest

in capital expenditure to support the Group’s expansion and

managing the working capital needs (in FY’21, Free Cash Flow also

stood at 42 million Euros while the activity was flat and the

capital expenditure lower).

Net cash generated by financing

activities of continuing operations amounted to 37 million

Euros in FY’22 essentially reflecting a net increase in borrowings,

including i) a 31 million additional drawdown on the 200 million

Euros IPCEI long-term loan facility granted by Banque des

Territoires (Caisse des Dépôts Group) as part of the “Nano 2022”

project and a net amount of 20 million Euros of bank loans

contracted to finance new industrial equipment in Singapore. These

were partially offset by repayments of leasing contracts over the

period. In comparison, in FY’21, net cash generated by financing

activities of continuing operations amounted to 412 million Euros

including 321 million Euros of net proceeds from the issue of

OCEANEs 2025.

In total, including a 6 million Euros positive

impact of exchange rate fluctuations, net cash generated by

continuing operations reached 85 million Euros in FY’22

compared to 454 million Euros generated in FY’21. Net cash

used by discontinued operations amounted

to 2 million Euros in FY’22.

Overall, Soitec further increased its

cash position, which went up from 644 million

Euros on March 31st, 2021, to 728 million Euros on March 31st,

2022.

Further enhanced balance

sheet

Thanks to the strong performance achieved in

FY’22, Soitec has further strengthened its balance sheet.

Property, plant and equipment

increased by a net amount of 184 million Euros in FY’22 as a result

of capacity investments in Bernin and Singapore.

Shareholders’ equity increased

by 367 million Euros in FY’22 to 1,044 million Euros, mainly thanks

to the net profit generated during the period and the conversion of

the outstanding OCEANEs 2023 convertible bonds.

Financial debt decreased by 63

million Euros to 586 million Euros on March 31st, 2022. The

conversion of 139 million Euros OCEANEs 2023 bonds was partially

offset by a €51m net increase in bank loans, a €16m mark-to-market

increase of financial derivatives and a €4m net increase in leasing

contracts.

Lower financial debt combined with the 83

million Euros increase in cash, led to switch from a 4 million

Euros net debt position5 on March

31st, 2021, to a 142 million Euros positive net cash

position5 on March 31st, 2022.

FY’23 Outlook

Soitec expects FY’23 revenue

growth to reach around 20% at constant exchange rates and

perimeter. Growth will continue to be driven by an increase in

sales in each one of the Group’s three end-markets, as Soitec

expects to continue benefiting from the 5G deployment, from an

increase of the automotive market as well as from sustained market

trends for smart devices.

Soitec expects FY’23

EBITDA1

margin2 to reach around 36%

notably thanks to a strong operating leverage driven by higher

volumes. Soitec expects its industrial performance to remain strong

despite higher bulk material and energy prices.

In addition, Soitec expects FY’23 net

cash out related to capital expenditure to reach around

260 million Euros, essentially reflecting capacity investments

to support first acquisitions of SiC tools (150 & 200-mm) in

Bernin IV, 300-mm SOI refresh capacity in Bernin IV and further

300-mm SOI capacity increase in Singapore facility, including both

refresh and epitaxy capacity.

Key events of FY’22

Early redemption of the bonds convertible into and/or

exchangeable for new or existing shares (OCEANEs) due June 28,

2023

On September 16th, 2021, Soitec announced its

decision to redeem all outstanding OCEANEs due June 28th, 2023, at

a price per OCEANE equal to par (i.e. 104.47 Euros). On October

8th, 2021, all bondholders had opted for the exercise of their

conversion/exchange right at the conversion/exchange ratio of 1

Soitec share per OCEANE. Consequently, 1,319,318 new Soitec shares

were issued, representing 3.90% of Soitec share capital. On October

18th, 2021, following the conversion of all OCEANEs 2023, share

capital amounted to 70,275,148.00 Euros and comprised 34,896,560

ordinary shares, and 241,014 preferred shares, all with a par value

of 2.00 Euros.

Soitec commits to the reduction of its greenhouse gas

emissions to limit climate change to 1.5°C

On December 7th, 2021, Soitec obtained the

approval of its greenhouse gas emission reduction targets by the

Science Based Targets initiative (SBTi) Steering Committee,

attesting that Soitec's targets are in line with the levels

required to limit global warming to 1.5°C. Soitec has committed to

reducing by 2026 its direct greenhouse gas emissions ("scope 1 and

2") by 25.2% in absolute terms compared to 2020 as well as its

indirect greenhouse gas emissions ("scope 3") by 35.3% per million

Euros of added value compared to 2020.

Acquisition of NOVASiC

to strengthen Silicon Carbide wafer technology

On November 30th, 2021, Soitec announced the

signing of a deal to acquire 100 % stake of NOVASiC, an advanced

technology company specialized in polishing and refreshing wafers,

to support its unique silicon carbide based SmartSiC roadmap. The

closing of the transaction has been fully completed on December

29th, 2021.

Soitec to expand its manufacturing

footprint in Bernin to produce

innovative silicon carbide semiconductor wafers and increase its

SOI capabilities

On March 11th, 2022, Soitec announced a new

fabrication facility at its headquarters in Bernin, France,

primarily to manufacture new silicon carbide wafers, which address

key challenges of the electric vehicle and industrial markets. The

extension will also support Soitec’s 300-mm Silicon-on-Insulator

(SOI) activities. The factory is to produce innovative SmartSiC™

engineered wafers developed by Soitec at the Substrate Innovation

Center located at CEA-Leti in Grenoble, using Soitec’s proprietary

SmartCut™ technology. The electronic chips built on this type of

wafers offer compelling performance and energy efficiency gains to

power supply systems. The groundbreaking ceremony took place on

March 31st. The new facility will lead to the creation of up to 400

direct new jobs. Soitec targets to generate first revenues in the

second half of calendar year 2023.

Chief Executive Officer succession

plan

On January 19th, 2022, Soitec’s Board of

Directors announced that Pierre Barnabé will succeed Paul Boudre as

Group CEO at the close of the July 2022 shareholders’ meeting.

Pierre Barnabé joined the company on May 1st, 2022 to work closely

with Paul Boudre on an effective leadership transition. The Board

will also propose the nomination of Pierre Barnabé as a Director at

the ordinary shareholders’ meeting scheduled for July 26th,

2022.

Post-closing events

Power outage of production in

Bernin

At around 2:00 am on Tuesday April 5th, 2022, a

fire broke out at an electricity supply facility outside Soitec's

site in Bernin which led to the power outage of its production

plants. Safety protocols were activated to protect equipment while

waiting for the restoration of the power supply. Soitec's plants

were progressively back in operation as from April 5th at 8:30 pm

and production went fully back to normal on April 9th. Soitec

expects this power outage to have only a very limited impact on

FY’23 operational and financial performance.

CEA, Soitec, GlobalFoundries and

STMicroelectronics to advance next generation FD-SOI roadmap for

automotive, IoT and mobile applications

On April 8th, 2022, leading semiconductor

players CEA, Soitec, GlobalFoundries and STMicroelectronics

announced a new collaboration in which they intend to jointly

define the industry’s next generation roadmap for FD-SOI

technology. Semiconductors and FD-SOI innovation are of strategic

value to France and the EU as well as to customers globally. FD-SOI

offers substantial benefits for designers and customer systems,

including lower power consumption as well as easier integration of

additional features such as connectivity and security, a key

feature for automotive, IoT and mobile applications.

Soitec released its first 200-mm silicon

carbide SmartSiC™

wafer

On May 4th, 2022, Soitec announced the release

of its first 200-mm silicon carbide SmartSiC™ wafer, from the pilot

line at its Substrate Innovation Center. The release enabled Soitec

to demonstrate the quality and performance of 200-mm SmartSiC™

engineered substrates and to conduct a first round of key customer

validations. The addition of 200-mm is enlarging Soitec’s SiC

product portfolio beyond 150-mm to address an even larger variety

of customer requirements, in terms of product quality, reliability,

volume, and energy efficiency.

Soitec announces the extension of

its Pasir Ris

Facility to produce 300mm SOI wafers

On June 8th, 2022, Soitec decided the extension

of its Pasir Ris facility in Singapore, with the objective to add a

new capacity of 1 million wafers per year. Soitec expects the

construction of this extension to start in FY’23, and the fab to

enter into operation by the end of FY’25. The robust level of

customer demand gives Soitec enough visibility to accelerate the

launch of this new fab, which was initially planned for FY’26.

Combining Bernin II, Pasir Ris I and Pasir Ris II, Soitec’s total

300-mm SOI production capacity will ultimately reach 2.7 million

wafers per year. The extension of Pasir Ris is also due to include

additional refresh and epitaxy capacities.

# # #

Soitec will host an analyst and investor

meeting in Paris on June 9th,

2022, at 14:00pm CET to comment its FY’22 results. The meeting will

be held in English.

The live webcast and slide presentation will be

available on:

https://channel.royalcast.com/landingpage/soitec/20220609_1/

# # #

Agenda

Soitec’s Annual General Meeting will be held on

July 26th, 2022.

Q1’23 revenue is due to be published on July

26th, 2022, after market close.

# # #

Disclaimer

This document is provided by Soitec (the

“Company”) for information purposes only.

The Company’s business operations and financial

position are described in the Company’s 2020-2021 Universal

Registration Document (which notably includes the 2020-2021 Annual

Financial Report) which was filed on July 5, 2021 with the French

stock market authority (Autorité des Marchés Financiers, or AMF)

under number D.21-0681 as well as in the Company’s FY’22 half-year

report released on December 2nd, 2021. The French versions of the

2020-2021 Universal Registration Document and of the half-year

report, together with English courtesy translations for information

purposes of both documents are available for consultation on the

Company’s website (www.soitec.com), in the section Company -

Investors - Financial Reports.

Your attention is drawn to the risk factors

described in Chapter 2.1 of the Company’s 2020-2021 Universal

Registration Document.

This document contains summary information and

should be read in conjunction with the 2020-2021 Universal

Registration Document and the FY’22 half-year report.

This document contains certain forward-looking

statements. These forward-looking statements relate to the

Company’s future prospects, developments and strategy and are based

on analyses of earnings forecasts and estimates of amounts not yet

determinable. By their nature, forward-looking statements are

subject to a variety of risks and uncertainties as they relate to

future events and are dependent on circumstances that may or may

not materialize in the future. Forward-looking statements are not a

guarantee of the Company’s future performance. The occurrence of

any of the risks described in Chapter 2.1 of the Universal

Registration Document may have an impact on these forward-looking

statements. In addition, the future consequences of geopolitical

conflicts, in particular the Ukraine / Russia situation, as well as

rising inflation, may result in greater impacts than currently

anticipated in these forward looking statements.

The Company’s actual financial position, results

and cash flows, as well as the trends in the sector in which the

Company operates may differ materially from those contained in this

document. Furthermore, even if the Company’s financial position,

results, cash-flows and the developments in the sector in which the

Company operates were to conform to the forward-looking statements

contained in this document, such elements cannot be construed as a

reliable indication of the Company’s future results or

developments.

The Company does not undertake any obligation to

update or make any correction to any forward-looking statement in

order to reflect an event or circumstance that may occur after the

date of this document. In addition, the occurrence of any of the

risks described in Chapter 2.1 of the Universal Registration

Document may have an impact on these forward-looking

statements.

This document does not constitute or form part

of an offer or a solicitation to purchase, subscribe for, or sell

the Company’s securities in any country whatsoever. This document,

or any part thereof, shall not form the basis of, or be relied upon

in connection with, any contract, commitment or investment

decision.

Notably, this document does not constitute an

offer or solicitation to purchase, subscribe for or to sell

securities in the United States. Securities may not be offered or

sold in the United States absent registration or an exemption from

the registration under the U.S. Securities Act of 1933, as amended

(the “Securities Act”). The Company’s shares have not been and will

not be registered under the Securities Act. Neither the Company nor

any other person intends to conduct a public offering of the

Company’s securities in the United States.

# # #

About Soitec

Soitec (Euronext, Tech 40 Paris) is a world

leader in designing and manufacturing innovative semiconductor

materials. The company uses its unique technologies to serve the

electronics markets. With more than 3,500 patents worldwide,

Soitec’s strategy is based on disruptive innovation to meet its

customers’ needs for high performance, energy efficiency and cost

competitiveness. Soitec has manufacturing facilities, R&D

centers and offices in Europe, the United States and Asia.

Soitec and Smart Cut are registered trademarks

of Soitec.

For more information, please

visit www.soitec.com and follow

us on Twitter: @Soitec_EN

| Investor

Relations: investors@soitec.com |

Media

contacts: Isabelle Laurent+33 1 53 32 61 51

isabelle.laurent@oprgfinancial.fr Fabrice Baron+33 1 53 32 61

27fabrice.baron@oprgfinancial.fr |

# # #

Soitec is a French joint-stock corporation with

a Board of Directors (Société Anonyme à Conseil d’administration)

with a share capital of €70,301,160, having its registered office

located at Parc Technologique des Fontaines - Chemin des Franques -

38190 Bernin (France), and registered with the Grenoble Trade and

Companies Register under number 384 711 909.

# # #

Consolidated financial statements in appendix include:

- FY’22 consolidated income

statement

- Balance sheet at March 31st, 2022

- FY’22 consolidated cash-flows

Consolidated financial statements for FY’22

As previously reported, Soitec’s refocus on

Electronics operations decided in January 2015 was nearly completed

on March 31st, 2016. Consequently, the FY’22 residual income and

expenses relating to Solar and Other activities are reported under

‘Net result from discontinued operations’, below the ‘Operating

income’ line, meaning that down to the line ‘Net result after tax

from continuing operations’, the consolidated income statement

fully and exclusively reflects the Electronics activity as well as

the Group’s corporate functions expenses. This was already the case

in FY’21 financial statements.

Consolidated income statement

| |

FY’22 |

FY’21 |

| (Euro

millions) |

(endedMarch 31,

2022) |

(endedMarch 31,

2021) |

| |

|

|

| |

|

|

| Revenue |

863 |

584 |

| |

|

|

| Cost of

sales |

(547) |

(400) |

| |

|

|

| |

|

|

| Gross

profit |

316 |

183 |

| |

|

|

| Sales and

marketing expenses |

(15) |

(12) |

| Research and

development expenses |

(57) |

(44) |

| General and

administrative expenses |

(49) |

(37) |

| |

|

|

| |

|

|

| Current

operating income |

195 |

90 |

| |

|

|

| Other

operating income / (expenses) |

10 |

0 |

| |

|

|

| |

|

|

| Operating

income |

205 |

90 |

| |

|

|

| Financial

income |

13 |

0 |

| Financial

expenses |

(14) |

(15) |

| |

|

|

| |

|

|

|

Financial income / (expense) |

(1) |

(15) |

| |

|

|

| |

|

|

| Profit before

tax |

204 |

76 |

| |

|

|

| Income

tax |

(2) |

(1) |

| |

|

|

| |

|

|

| Net profit

from continuing operations |

202 |

74 |

| |

|

|

| Net loss from

discontinued operations |

(0) |

(1) |

| |

|

|

| |

|

|

| Consolidated

net profit |

202 |

73 |

| |

|

|

|

Non-controlling interests |

- |

- |

| |

|

|

| |

|

|

| Net profit,

Group share |

202 |

73 |

| |

|

|

| Basic earnings

per share (in €) |

5.98 |

2.19 |

| |

|

|

| Diluted

earnings per share (in €) |

5.63 |

2.16 |

| |

|

|

| Number of

shares |

33,753,666 |

33,176,570 |

| |

|

|

| Number of

diluted shares |

37,181,632 |

35,014,307 |

Balance sheet at March 31st, 2022

|

Assets |

March 31, 2022 |

March 31, 2021(1) |

| (Euro

millions) |

|

|

| |

|

|

| Non-current

assets: |

|

|

| |

|

|

| Intangible

assets |

108 |

99 |

| Property,

plant and equipment |

562 |

378 |

| Non-current

financial assets |

17 |

13 |

| Other

non-current assets |

19 |

15 |

| Deferred tax

assets |

64 |

53 |

| |

|

|

| |

|

|

| Total

non-current assets |

770 |

558 |

| |

|

|

| Current

assets: |

|

|

| |

|

|

|

Inventories |

143 |

124 |

| Trade

receivables |

280 |

157 |

| Other current

assets |

62 |

77 |

| Current

financial assets |

4 |

6 |

| Cash and cash

equivalents |

728 |

644 |

| |

|

|

| |

|

|

| Total current

assets |

1,216 |

1,010 |

| |

|

|

| Total

assets |

1,986 |

1,568 |

(1) 31 March 2021 restated to reflect IFRS IC agenda decision

related to calculation of certain defined employee benefit

obligation

|

Equity and liabilities |

March 31, 2022 |

March 31, 2021(1) |

| (Euro

millions) |

|

|

| |

|

|

| Equity: |

|

|

| |

|

|

| Share

capital |

70 |

67 |

| Share

premium |

230 |

83 |

| Reserves and

retained earnings |

747 |

534 |

| Other

reserves |

(3) |

(8) |

| |

|

|

| |

|

|

|

Equity, Group Share |

1,044 |

677 |

| |

|

|

| |

|

|

| Total

equity |

1,044 |

677 |

| |

|

|

| Non-current

liabilities: |

|

|

| |

|

|

| Long-term

financial debt |

518 |

612 |

| Provisions and

other non-current liabilities |

79 |

42 |

| |

|

|

| |

|

|

| Total

non-current liabilities |

597 |

654 |

| |

|

|

| Current

liabilities: |

|

|

| |

|

|

| Short-term

financial debt |

68 |

36 |

| Trade

payables |

101 |

79 |

| Provisions and

other current liabilities |

177 |

121 |

| |

|

|

| |

|

|

| Total current

liabilities |

346 |

236 |

| |

|

|

| |

|

|

| Total equity

and liabilities |

1,986 |

1,568 |

(1) 31 March 2021 restated to reflect IFRS IC agenda decision

related to calculation of certain defined employee benefit

obligation

Consolidated cash-flows

| |

FY’22 |

FY’21 |

| (Euro

millions) |

(endedMarch 31,

2022) |

(endedMarch 31,

2021) |

| |

|

|

| |

|

|

| Consolidated

net profit |

202 |

73 |

|

of which continuing operations |

202 |

74 |

| |

|

|

| Depreciation

and amortization expense |

81 |

60 |

| Impairment /

(depreciation reversals) of assets |

(10) |

- |

| Provisions /

(reversals of provisions), net |

1 |

6 |

| Provisions /

(reversal of provisions) for retirement benefit obligations,

net |

(4) |

1 |

| (Gains) /

losses on disposals of assets |

2 |

1 |

| Income

tax |

2 |

1 |

| Financial

expense |

1 |

15 |

| Share-based

payments |

20 |

20 |

| Other non-cash

items |

14 |

1 |

| Non-cash items

related to discontinued operations |

0 |

1 |

| |

|

|

| |

|

|

| EBITDA2 |

308 |

179 |

|

of which continuing operations |

309 |

179 |

| |

|

|

| |

|

|

| Increase /

(decrease) in cash relating to: |

|

|

| |

|

|

|

Inventories |

(31) |

(9) |

| Trade

receivables |

(48) |

0 |

| Other

receivables |

6 |

(3) |

| Trade

payables |

15 |

7 |

| Other

liabilities |

6 |

14 |

| Income tax

paid |

(2) |

(14) |

| Change in

working capital requirement and income tax paid relating to

discontinued operations |

0 |

(0) |

| |

|

|

| |

|

|

| Change in

working capital and income tax paid |

(54) |

(5) |

|

of which continuing operations |

(54) |

(5) |

| |

|

|

| |

|

|

| Net cash

generated by operating activities |

254 |

174 |

|

of which continuing operations |

255 |

174 |

|

|

FY’22 |

FY’21 |

| (Euro

millions) |

(endedMarch 31,

2022) |

(endedMarch 31,

2021) |

| |

|

|

| |

|

|

| Net cash

generated by operating activities |

254 |

174 |

|

of which continuing operations |

255 |

174 |

| |

|

|

| Purchases of

intangible assets |

(24) |

(24) |

| Purchases of

property, plant and equipment |

(181) |

(109) |

| Proceeds from

disposals of intangible assets and property, plant and

equipment |

1 |

0 |

| Acquisition of

a subsidiary, net of cash acquired |

(8) |

(1) |

| (Acquisitions)

and disposals of financial assets |

(2) |

1 |

| Interest

received |

0 |

0 |

| (Investment) /

divestment flows related to discontinued operations |

0 |

- |

| |

|

|

| |

|

|

| Net cash used

in investing activities (1) |

(213) |

(133) |

|

of which continuing operations (1) |

(213) |

(133) |

| |

|

|

| Convertible

bonds (net of issuance costs) – OCEANEs 2025 |

- |

321 |

| Capital

increase |

- |

1 |

| Change in

interest in subsidiaries without change of control |

- |

(2) |

| Financing

received from non-controlling interests |

2 |

0 |

| Loans and

drawdowns on credit lines |

64 |

143 |

| Repayment of

borrowings (including leases) |

(25) |

(49) |

| Interest

paid |

(4) |

(2) |

| Financing

flows related to discontinued operations |

(2) |

(0) |

| |

|

|

| |

|

|

| Net cash

generated by financing activities |

36 |

412 |

|

of which continuing operations |

(37) |

412 |

| |

|

|

| Effects of

exchange rate fluctuations |

6 |

(0) |

| |

|

|

| |

|

|

| Change in net

cash |

83 |

453 |

|

of which continuing operations |

85 |

454 |

| |

|

|

| Cash

at beginning of the period |

644 |

191 |

| Cash

at end of the period |

728 |

644 |

(1) According to IFRS, the cash used in investing activities is

calculated net of investments financed through leasing, which

accounted for 16 million Euros in FY’22 and 4 million Euros in

FY’21. Total cash out related to investing activities therefore

amounted to 229 million Euros in FY’22 and 137 million Euros in

FY’21.

[1] The EBITDA represents operating income (EBIT) before

depreciation, amortization, impairment of non-current assets,

non-cash items relating to share-based payments, provisions for

impairment of current assets and for contingencies and expenses,

and disposals gains and losses. This alternative indicator of

performance is a non-IFRS quantitative measure used to measure the

company’s ability to generate cash from its operating activities.

EBITDA is not defined by an IFRS standard and must not be

considered an alternative to any other financial indicator.

[2] EBITDA margin = EBITDA from continuing operations /

Revenue.

[3] Audit procedures were completed and the audit report is in

the process of being issued.

[4] The scope effect related to the acquisition of NOVASiC, the

closing of which took place on December 29, 2021, had no material

impact on Soitec’s revenue.[5] The net cash position represents

cash and cash equivalents less financial debt, a positive net cash

position meaning cash and cash equivalents are higher than

financial debt. A net debt position meaning cash and cash

equivalents are lower than financial debt.

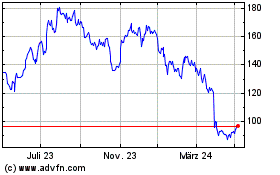

- SOITEC PR FY'22 results VUK

SOITEC (EU:SOI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

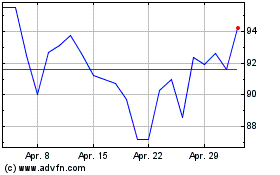

SOITEC (EU:SOI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024