Paris, 21 March

2017 (6.00 p.m.)

HIGHCO POSTS AN

EXCELLENT PERFORMANCE IN 2016

Outstanding

business growth

-

2016 gross profit of €81.06 M, up 12.6% on

a restated basis1 and 11.8%

LFL2.

-

Digital business up 23.6% LFL, accounting for

46.6% of the Group's total business in 2016.

Dramatic rise in

profitability

-

Adjusted headline PBIT3 of

€14.10 M, up 31.7%.

-

Adjusted operating margin3 of

17.4%, up 250 basis points.

-

Adjusted recurring operating income4

up 37.5% to €13.81 M.

-

Adjusted attributable net income5

up 34.7% to €8.65 M.

-

Dividend of €0.12 per share to be proposed at

the AGM in May 2017, for a 26.3% increase.

Strong cash

capability

-

Operating cash flow of €10.69 M, up

€2.63 M (up 32.5%).

-

Net cash6 of

€49.62 M at 31 December 2016, up €8.85 M.

Sale of POS Media

finalised

| (€ M) |

2016 |

2015 restated1 |

2016/2015

Change restated1 |

| Gross

profit |

81.06 |

71.97 |

+12.6%

(+11.8% LFL2) |

| Adjusted

headline PBIT3 |

14.10 |

10.71 |

+31.7% |

| Adjusted recurring operating income4 |

13.81 |

10.04 |

+37.5% |

| Recurring

operating income |

12.41 |

10.04 |

+23.6% |

| Adjusted attributable net income5 |

8.65 |

6.42 |

+34.7% |

| Net

cash6 |

49.62 |

40.77 |

+€8.85 M |

1 In

application of IFRS 5 Non-current Assets Held for Sale and

Discontinued Operations, the businesses in the United Kingdom were

classified and presented as discontinued operations as of the third

quarter of 2016. For reasons of consistency, the data reported for

2015 and the first half of 2016 have been restated to account for

the impact of the UK businesses. Net income and the loss on the

sale of these businesses will be presented net of tax as a single

item in the consolidated income statement under Net income from

assets held for sale or discontinued operations.

2 Like for

like: Based on a comparable scope (i.e. including CapitalData over

11 months in 2015 and 2016) and at constant exchange rates

(i.e. applying the average exchange rate over the period to data

from the compared period).

3 Adjusted

headline profit before interest & tax: recurring operating

income before restructuring costs and excluding the cost of

performance share plans. Adjusted operating margin: Adjusted

headline PBIT/Gross profit.

4 Recurring

operating income excluding the cost of performance share

plans.

5 Attributable

net income excluding the net after-tax cost of performance share

plans (€0.96 M) and excluding net income from assets held for

sale and discontinued operations (loss of €6.68 M in 2016 as

against income of €0.35 M in 2015; MRM and POS

Media).

6 Net cash (or

net cash surplus): Cash and marketable securities less gross

current and non-current financial liabilities.

Didier Chabassieu, Chairman of the

Management Board, stated, "HighCo had a remarkable

year, both in terms of business growth (11.8% like for like) and

growth in profitability. The excellent performance that we have

achieved in the past three years is the result of the hard work and

dedication from all our teams, which have enabled HighCo to lead

its digital transformation with success. The Group now needs to

step up its development in DATA and MOBILE businesses to maintain

profitable growth in the years to come."

FY 2016 FINANCIAL

PERFORMANCE

Outstanding

business growth

FY 2016 gross

profit amounted to €81.06 M, resulting in a significant

increase of 12.6% on a restated basis and 11.8% like for like.

With this sharp growth in 2016, the Group has posted a fourth

consecutive year of organic growth. Digital business continues to

drive this performance, with a strong rise of 23.6% like for like

in 2016. Offline businesses resumed growth, with a 3.2% increase

like for like over the year.

The steep growth

in France, at 15.7% like for like to €56.22 M (up 7.3% in

2015), is still driven by the growth of digital

business (28.9% like for like), which represented 55.4% of

gross profit in 2016.

International

business continues to grow (up 3.8% like for like to

€24.84 M):

Dramatic rise in

profitability

Adjusted headline

PBIT registered double-digit growth for the third year running in

2016 (up 31.7% to €14.10 M) with:

Adjusted

operating margin (adjusted headline PBIT/gross profit)

rose substantially by 250 basis points,

coming to 17.4% (versus 14.9% in 2015 on a restated basis).

The sharp increase in headline

PBIT, with restructuring costs halved (€0.29 M in 2016 versus

€0.67 M in 2015), led to a robust 37.5% rise

in adjusted recurring operating income to €13.81 M

(€10.04 M in 2015 on a restated basis).

Recurring operating income,

including the cost of performance share plans, amounted to

€12.41 M, up 23.6%.

Adjusted net

income attributable to owners of the parent climbed 34.7%.

HighCo recorded adjusted EPS7 of €0.42

in 2016, up 35.1% (34.5% on a diluted basis) compared with

2015.

As announced, these results take

into account the additional expense net of tax due to the

introduction of new performance share plans and the net loss from

assets held for sale and discontinued operations following the sale

of MRM in the United Kingdom. As a result, attributable net income stood at €1.02 M

(€6.77 M in 2015).

A record dividend

of €0.12 per share, i.e. a 26.3% increase, will be proposed at

the next AGM on 22 May 2017.

7 EPS excluding

the cost of performance share plans and excluding net income from

assets held for sale or and discontinued operations (MRM and POS

Media).

Strong cash

capability

Operating cash flow increased

sharply by 32.5% to €10.69 M, coming in at over €10 M for the

first time since 2008. As such, the net cash

position was up significantly by €8.85 M to €49.62 M

at 31 December 2016. Working capital improved by €4.71 M.

Excluding operating working capital (€51.40 M at 31 December

2016), net debt came to €1.78 M, down by €4.14 M with

respect to 31 December 2015.

HIGHLIGHTS

Digital

strategy

Gross profit in the digital

business soared to reach 23.6% in 2016. Digital business

represented 46.6% of the Group's gross profit in 2016, versus 41.7%

in 2015, thus surpassing the 45% target set for 2016 and moving

closer to the 50% target planned for 2017.

-

100% digital DRIVE-TO-STORE

solutions, still showing sharp growth

The sharp growth in mobile businesses (gross profit up 19% in 2016) was

bolstered by the significant 40% increase in the volume of push SMS

and notifications sent.

Brand content and media targeted

to social networks maintained its strong

performance and grew 17% in 2016.

Two innovations were launched in

2016 to connect the loyalty programme initiated by a brand

with:

-

a chain, through a Load to Card innovation that

received an LSA 2016 award for cross-channel solutions. Members of

the Ma vie en couleurs loyalty programme

(Mondelez and Unilever) can use this new service to download deals

directly onto their Cora loyalty card;

-

a click & collect website, through an

innovation that drives impulse purchases by offering discount

coupons from brands directly on the click & collect website of

the shopper's choice.

With the acquisition of CAPITALDATA, the Group has gained a new performance

driver with the hyper-personalisation of

advertising and promotional messages. In addition to targeting

campaigns developed for advertisers such as Voyageprive.com, Nestlé

and Parc Astérix, the company led a web-to-store programmatic campaign for Franprix,

demonstrating the synergies achieved with the Group to design with

a viable alternative to paper flyers for chains.

In 2016, HighCo also strengthened

its leading position in digital coupon issuing, with an 18% surge

in volumes.

-

Continued fast-pace

digitisation of IN-STORE solutions

Digital services continue to grow

rapidly in the area of IN-STORE solutions that are still

predominantly "paper-based". The proportion increased from 24.3% in

2015 to 28% in 2016.

The point-of-sale paper coupon and media

businesses rose slightly in France and Belgium, primarily

thanks to agreements with the Group's retail partners that were

extended in 2016. Meanwhile, a new project was launched to install

coupon and media terminals in the Carrefour network in Belgium

starting at the end of 2016.

On Click &

Collect websites, HighCo is developing a unique media and

targeted coupon offering deployed across 80% of the market, with

exclusive commercialisation of the inventories of Auchan group.

-

DATA solutions driven by

digital coupon clearing

DATA solutions continue to be

digitised.

The share of digital DATA

solutions rose from 34% in 2015 to 35.8% in 2016.

The volume of paper coupons

cleared remained stable in France and Belgium.

In addition, the volume of

digital coupons cleared with food e-commerce

websites in France increased significantly. With more than 300

campaigns for digital cashback offers launched in 2016 (up 74%),

e-CBO operations maintained their outstanding

growth. Thus, the volume of digital coupons cleared held firm and

rose slightly in 2016 in France and Belgium.

OTHER

HIGHLIGHTS

Disposals and

investments

After announcing in

October 2016 that it had sold MRM in the United Kingdom,

HighCo announced the finalisation of the sale of POS Media in

Central Europe in early March 2017. The deal involved selling

all shares owned in POS Media BV, the parent company of POS

Media, representing 47.55% of its share capital. This move is in

line with the Group's shift in strategy for its international

businesses. The sale will have a virtually neutral impact on

attributable net income for 2016 and 2017.

In early 2017, HighCo participated

in a capital increase launched by Yuzu USA, an innovative

French-American startup specialised in targeting solutions. The

capital increase, reserved for HighCo and the company ZTP (Mulliez

family), has led to HighCo's additional investment in the share

capital, which now amounts to a 32.9% stake. Yuzu USA will be

accounted for by the equity method in 2017.

Governance

HighCo announced that Olivier

Michel is leaving the Group's Management Board for personal reasons

after 17 years in executive management. He will take on other

functions within the Group, in particular as an advisor to the new

Management Board.

After noting this decision, the

Group's Supervisory Board appointed Cécile Collina-Hue as member of

the Management Board as Managing Director. Since she joined HighCo

in 2002, Cécile Collina-Hue has held a number of positions in

administration and finance at the Group.

2017

GUIDANCE

For 2017, HighCo forecasts:

-

Growth in 2017 gross profit of more than 4% like

for like (2016 gross profit: up 11.8% like for like), with the

Group's share of digital business expected to exceed its 50% target

(2016: 46.6%);

-

Increase in adjusted headline PBIT3

equal to or greater than 6% (adjusted 2016 headline PBIT:

€14.10 M);

-

Rise in adjusted operating margin equal to or

greater than 50 bp (2016 operating margin: 17.4%).

The Group's financial resources

will be allocated, as a priority, to:

-

Capital expenditure of between €1.5 M and

€2 M (€1.08 M in 2016);

-

Share buybacks of between €0.5 M and

€1 M (€0.66 M in 2016);

-

Continued acquisitions and investments in

Digital and Data businesses.

The Supervisory Board examined the

financial statements for the year ended 31 December 2016. At the

time of writing, the audit of the consolidated financial statements

has been carried out. The certification reports will be issued once

the required specific verifications have been finalised in order to

file the registration document.

A financial analysts' meeting is

scheduled for 22 March 2017 at 2.30 p.m. at 8 rue de la

Rochefoucauld, 75009 Paris, France. The presentation will be

available online at the beginning of the meeting on the company's

website www.highco.com.

About HighCo

Since its creation, HighCo has placed innovation at the

heart of its values, offering its clients - brands and retailers -

Intelligent Marketing Solutions to influence shopper behaviour with

the right deal, in the right place, at the right time and on the

right channel.

Listed in compartment C of

Euronext Paris, and eligible for the "long only" DSS, HighCo has

more than 700 employees and since 2010 has been included in

the Gaia Index, a selection of 70 responsible Small and Mid

Caps.

Your contacts

Cécile

Collina-Hue

Cynthia Lerat

Managing

Director

Press Relations

+33 1 77 75 65

06

+33 1 77 75 65 16

comfi@highco.com

c.lerat@highco.com

Upcoming events

Publications take place after market close.

Q1 2017 Gross Profit: Wednesday,

26 April 2017

Q2 and H1 2017 Gross Profit: Wednesday, 19 July 2017

2017 Half-year Earnings: Wednesday, 30 August 2017

Conference call on 2017 half-year earnings: Thursday, 31 August

2017

Q3 and 9-month YTD 2017 Gross Profit: Wednesday, 18 October

2017

Q4 and FY 2017 Gross Profit: Wednesday, 24 January 2018

HighCo is a

component stock of the indices CAC® Small (CACS), CAC®

Mid&Small (CACMS) and CAC® All-Tradable (CACT).

ISIN: FR0000054231

Reuters: HIGH.PA

Bloomberg: HCO FP

For further financial information and press

releases, go to www.highco.com

This

English translation is for the convenience of English-speaking

readers. Consequently, the translation may not be relied upon to

sustain any legal claim, nor should it be used as the basis of any

legal opinion. HighCo expressly disclaims all liability for any

inaccuracy herein.

Download the press

release

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: HIGHCO via Globenewswire

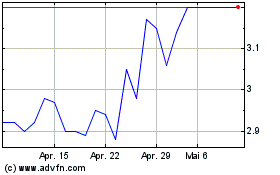

High (EU:HCO)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

High (EU:HCO)

Historical Stock Chart

Von Jul 2023 bis Jul 2024