Receives Commitment from Existing Secured

Lenders for up to $19.5 Million in Debtor-in-Possession

Financing

Williams Industrial Services Group Inc. (NYSE American: WLMS)

(the “Company”), a leading provider of infrastructure related

services to blue-chip customers in energy and industrial end

markets, including a broad range of construction maintenance,

modification, and support services, announced today that it and

certain of its subsidiaries have filed voluntary Chapter 11

proceedings in the U.S. Bankruptcy Court for the District of

Delaware (the “Bankruptcy Court”) and agreed to sell substantially

all of the Company and its subsidiaries assets to EnergySolutions

for $60 million.

The Transaction

The Company and EnergySolutions, a global provider of energy and

industrial services headquartered in Salt Lake City, UT, have

entered into a purchase agreement pursuant to which EnergySolutions

will acquire substantially all the assets and assume certain

ordinary course operating liabilities of the Company and its

subsidiaries for $60 million. These assets represent the Company’s

nuclear, fossil, energy delivery, and paper mill operations, which

have continued to perform profitably and have strong prospects for

future growth. EnergySolutions is not acquiring the Company’s

operations connected to its water contracts in Florida and

Texas.

Tracy Pagliara, President and CEO of the Company, stated:

“Having carefully reviewed all available options, our comprehensive

strategic alternatives process has concluded. I am confident that

EnergySolutions will be a great owner for the Williams business it

is acquiring as we stand on the precipice of a global nuclear

renaissance and significant growth in energy and industrial

infrastructure services. EnergySolutions is well capitalized and

positioned to ensure that Williams’ rich history of being a

customer-centric services provider will continue. Obviously, the

Chapter 11 filing is not the outcome we would have wanted for our

stockholders or the stakeholders of our water business, but this

difficult decision was necessary to deliver the primary and

profitable parts of the Williams business to EnergySolutions as a

going concern.”

Ken Robuck, President and CEO of EnergySolutions, added, “We are

very excited to announce this transaction. This is a strategic move

that will allow EnergySolutions to expand our nuclear services

offerings to existing nuclear operating plants and, ultimately, to

support the nuclear industry’s drive to create more clean,

carbon-free energy through nuclear plant life extension work and

the construction of new technologies. We understand that Williams

has been through a difficult time, but we are confident that this

acquisition will be a positive for the Williams’ businesses we are

acquiring. These businesses will gain access to our resources and

expertise, and we will gain access to their talented team and

proven track record in successfully executing nuclear plant

maintenance, modifications and new construction projects. Combined

with our nuclear waste, decommissioning and onsite integrated

services, this acquisition will nicely complement our existing

business lines and provide an excellent platform for future growth

and expansion into other sectors of the nuclear industry.”

DIP Financing

In order to provide necessary funding during the Chapter 11

proceeding, the Company has received commitments for two

debtor-in-possession ("DIP") financing credit agreements with its

prepetition lenders. Upon approval by the Bankruptcy Court, the DIP

financing agreements are expected to provide the Company with the

necessary liquidity to permit the businesses that will be disposed

of to operate in the normal course and meet their obligations to

their employees, vendors and customers throughout the Chapter 11

proceeding while executing on the sale process of the businesses

for which EnergySolutions is the “stalking horse” bidder.

One of the Company’s DIP facilities will be a revolving line of

credit ("RLOC") which will replace the Company’s prepetition RLOC,

allowing for continued credit advances based on the Company's

collateral contributions up to a maximum availability of $12

million. The second facility is a delayed draw term loan ("DDTL")

with the Company’s existing term lenders which will provide up to

$19.5 million of incremental liquidity following the petition

filing.

Chapter 11 Process

The transaction with EnergySolutions is part of a sale process

under Section 363 of the Bankruptcy Code in which EnergySolutions

is the “stalking horse” bidder, meaning that the purchase agreement

between the Company and EnergySolutions contains the terms against

which competing offers will be solicited and evaluated during a

Chapter 11 auction process. The Company is seeking Bankruptcy Court

approval of bidding procedures allowing for the submission of

higher or otherwise better offers, and is seeking to consummate a

sale by September 30, 2023, subject to Bankruptcy Court approval.

The Company will manage the bidding process and evaluate any bids

received, in consultation with its advisors and otherwise in

accordance with the bidding procedures and oversight by the

Bankruptcy Court.

Under the purchase agreement, EnergySolutions will not acquire

the Company’s operations connected to its water contracts in

Florida and Texas. The Company is not currently projecting any

return for its stockholders or for certain creditors of the

retained water business.

Background to the Chapter 11 Filing and Sale

Transaction

The factors that precipitated the Company’s Chapter 11 filing

and sale process included: the loss of customer contracts in early

2022 that comprised 19% and 20% of the Company’s annual revenue and

gross profit, respectively, in 2021 and the accompanying loss of

$361 million in backlog for 2022 and later years; more than $15

million of operating losses associated with the Company’s water

operations from 2021 through 2023 year to date; approximately $8

million of start-up costs and operating losses related to the

Company’s entry into the transmission and distribution market from

early 2021 through the first quarter of 2023; and the inability of

the Company to convert enough pipeline into revenue and to cut

enough costs to overcome these losses and corresponding liquidity

challenges.

As previously announced, the Company undertook actions to

improve the performance of its business, including an aggressive

move to trim operating expenses, the implementation of a plan to

shorten collection times on accounts receivable, and an attempt to

expand into the transmission and distribution market. However,

those moves were insufficient to position the business for

profitability.

Williams Industrial Services Group is advised by Thompson Hine

LLP and Chipman Brown Cicero & Cole, LLP as its legal advisors,

G2 Capital Advisors, LLC as its financial advisor, and Greenhill

& Co., LLC as its investment banker.

EnergySolutions is advised by Ropes & Gray LLP as its legal

advisors.

For additional information about the cases please visit

https://dm.epiq11.com/WilliamsIndustrialServicesGroup.

About Williams

Williams Industrial Services Group has been safely helping plant

owners and operators enhance asset value for more than 50 years.

The Company is a leading provider of infrastructure related

services to blue-chip customers in energy and industrial end

markets, including a broad range of construction maintenance,

modification, and support services. Williams’ mission is to be the

preferred provider of construction, maintenance, and specialty

services through commitment to superior safety performance, focus

on innovation, and dedication to delivering unsurpassed value to

its customers.

Additional information about Williams can be found on its

website: www.wisgrp.com.

About EnergySolutions

EnergySolutions offers customers a full range of integrated

services and solutions, including nuclear operations,

characterization, decommissioning, decontamination, site closure,

transportation, nuclear materials management, processing,

recycling, and disposition of nuclear waste, and research and

engineering services across the nuclear fuel cycle. For additional

information about EnergySolutions visit www.energysolutions.com or

contact Mark Walker at mwalker@energysolutions.com or

801-231-9194.

Forward-looking Statement Disclaimer

This press release contains “forward-looking statements” within

the meaning of the term set forth in the Private Securities

Litigation Reform Act of 1995. Forward-looking statements generally

use forward-looking words, such as “may,” “will,” “could,”

“should,” “would,” “project,” “believe,” “anticipate,” “expect,”

“estimate,” “continue,” “potential,” “plan,” “forecast” and other

words that convey the uncertainty of future events or outcomes.

These forward-looking statements are not guarantees of the

Company’s future performance and involve risks, uncertainties,

estimates and assumptions that are difficult to predict and may be

outside of the Company’s control. Therefore, the Company’s actual

outcomes and results may differ materially from those expressed in

or contemplated by the forward-looking statements. Forward-looking

statements include, but are not limited to, information concerning

the following: expectations regarding risks attendant to the

Chapter 11 bankruptcy process, including the Company’s ability to

obtain court approval from the Bankruptcy Court with respect to

motions or other requests made to the Bankruptcy Court throughout

the course of the Chapter 11 process, including with respect to the

asset sale and DIP credit agreements; the Company’s plans to sell

certain assets pursuant to Chapter 11 of the U.S. Bankruptcy Code,

the outcome and timing of such sale, and the Company’s ability to

satisfy closing and other conditions to such sale; the effects of

Chapter 11, including increased legal and other professional costs

necessary to execute the Company’s wind down, on the Company’s

liquidity and results of operations (including the availability of

operating capital during the pendency of Chapter 11); the length of

time that the Company will operate under Chapter 11 protection and

the continued availability of operating capital during the pendency

of Chapter 11; the Company’s ability to continue funding operations

through the Chapter 11 bankruptcy process, and the possibility that

it may be unable to obtain any additional funding as needed; the

Company’s ability to meet its financial obligations during the

Chapter 11 process and to maintain contracts that are critical to

its operations; the Company’s ability to comply with the

restrictions imposed by the terms and conditions of the DIP credit

agreements and other financing arrangements; objections to the

Company’s wind down process, the DIP credit agreements, or other

pleadings filed that could protract Chapter 11; the effects of

Chapter 11 on the interests of various constituents and financial

stakeholders; the effect of the Chapter 11 filings and any

potential asset sale on the Company’s relationships with vendors,

regulatory authorities, employees and other third parties; possible

proceedings that may be brought by third parties in connection with

the Chapter 11 process or the potential asset sale and risks

associated with third-party motions in Chapter 11; the timing or

amount of any distributions, if any, to the Company’s stakeholders;

expectations regarding future performance of assets expected to be

sold in the bankruptcy process; employee attrition and the

Company’s ability to retain senior management and other key

personnel due to the distractions and uncertainties; the impact and

timing of any cost-savings measures and related local law

requirements in various jurisdictions; the impact of litigation and

regulatory proceedings; expectations regarding financial

performance, strategic and operational plans, and other related

matters; and other factors discussed in the Company’s filings with

the U.S. Securities and Exchange Commission, including the “Risk

Factors” section of the Annual Report on Form 10-K for its 2022

fiscal year. Any forward-looking statement speaks only as of the

date of this press release. Except as may be required by applicable

law, the Company undertakes no obligation to publicly update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise, and you are cautioned not

to rely upon them unduly.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230724130488/en/

Brenda Adrian, of Sitrick and Company, at

brenda_adrian@sitrick.com, or Rich Wilner at

rwilner@sitrick.com

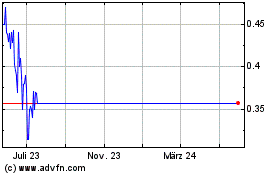

Williams Industrial Serv... (AMEX:WLMS)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Williams Industrial Serv... (AMEX:WLMS)

Historical Stock Chart

Von Jan 2024 bis Jan 2025