With Treasury rates still near historic lows, many investors are

still avoiding T-bills for their current income needs. This trend

could continue well into the future as well, as the Fed seems ready

to buy more bonds if the economy stays in the doldrums, suggesting

that low rates—or possibly even more depressed levels—could be here

for quite some time to come.

As a result, many investors have looked to the top stocks in the

S&P 500 for their dividend exposure in this uncertain time.

However, many indexes of dividend payers in the American market

probably leave many investors wanting more.

After all, the broad S&P 500 yields just under 2%, while the

SPDR S&P Dividend ETF (SDY) offers up a 3.2%

annual yield. Meanwhile, other popular dividend-focused ETFs like

VIG or VYM don’t do any better as

these two products, respectively, pay out 2.1% and 2.8% on an

annual basis (See Closed End ETFs for Forgotten 7% Yield?).

Due to this, investors have a few options in terms of looking

for yield while staying in broad indexes. They can apply a more

targeted approach to sectors that are famous for being high

yielders or they can look internationally.

Surprisingly, there are a number of countries that have

benchmarks with incredible yields. There are actually several ETFs

tracking countries that have payouts in excess of 5%.

In other words, there are some nations out there that see their

main benchmarks paying out levels that are more than double the

S&P 500 index. For this reason it could be a good idea to look

abroad for payouts while still gaining exposure to a wide basket of

companies (see These 2 ETFs Are Up More than 140% YTD).

For these investors, we have highlighted three country ETFs

below that pay out shockingly high yields on a regular basis. Many

have likely overlooked these nations as yield destinations, but

hopefully the analysis below will help give investors a few new

ideas for regions that are still sporting truly impressive yields

with broad market funds:

iShares MSCI-Belgium ETF (EWK) - annual dividend

5.7%

Surprisingly, the tiny nation of Belgium is actually a popular

yield spot for investors. The country’s main ETF, EWK, pays out a

robust 5.7% on an annual basis by tracking the MSCI Belgium

Investable Market Index.

This benchmark produces a fund that charges investors 52 basis

points a year in fees, although it does see low levels of assets--

$25 million—yet volume is pretty good at 57,000 shares a day. This

suggests that total costs shouldn’t be too bad in this fund and

that bid ask spreads will not reach into intolerable levels (see

Three Forgotten Ways to Play Europe with ETFs).

A closer look at some of the fund’s components should probably

shed some light on why the fund is such a high yielder as

Am-Bev (ABV) takes the top spot at a whopping 27%

of assets. Beyond this hefty allocation, financials, basic

materials, and telecoms take the rest of the top four, suggesting a

heavy tilt to traditionally high yielding segments.

Additionally, investors should note that large caps comprise the

majority of the fund, while growth securities do account for about

40% of assets. Still, this has proven to not be such a big deal as

the holdings are almost exclusively in a couple high yielding

sectors as low yielders like technology only account for a small

portion of the total assets in the fund.

iShares MSCI New Zealand Index Fund (ENZL) - annual

dividend of 6.9%

A nation that is often overlooked from an investment perspective

is New Zealand, as the small island country is overshadowed by the

much larger market of Australia. However, New Zealand could still

be a great pick for investors thanks to the high yield of its main

ETF, ENZL.

The product tracks the MSCI new Zealand Investable Market Index,

giving investors exposure to two dozen New Zealand firms while

charging investors 51 basis points a year in fees. While the

AUM is impressive at $100 million, trading volumes are relatively

light, although the real focus of the fund should be the nearly 7%

yield (read The Five Minute Guide to New Zealand ETF

Investing).

Much like its Belgian counterpart, this fund is heavily

concentrated in a few securities although they are in traditional

high yield segments as well. For ENZL, the focus is on telecoms,

basic materials, and consumer stocks, although industrials,

utilities and real estate all make up at least 10% of assets as

well.

Investors should also note that Telecom Corp of New Zealand and

Fletcher building both make up over 15% of the portfolio suggesting

a heavy dependence on both of these firms. This also gives the fund

a focus on large cap blend stocks which are well-known for their

high yields, suggesting that this ETF will probably have a high

dividend focus for years to come.

iShares MSCI Spain Index Fund (EWP) – annual dividend of

5.9%

Although Spain might not traditionally be the location that

investors think of for high yields, EWP is a top fund for payouts

with a yield approaching six percent a year. Clearly, the fund’s

incredible loss over the past one year period—down nearly 18% in

the time frame—has helped to boost the dividend yield for EWP, but

the focus on the MSCI Spain Index Fund has also assisted this ETF

in being a great yield destination.

That is because this benchmark offers exposure to just over two

dozen firms including over 40% in financials, 17% in telecoms, and

12% in utilities. Obviously, these are some usual hideouts for high

dividend payers, and this appears to be no different in the case of

Spain (Read Spain ETF: Here We Go Again).

Furthermore, since the fund is so heavily concentrated in the

underperforming financials market, investors have likely seen many

of these securities sport truly impressive payouts, although it

should be noted that if the market turns around these yields will

probably decline back to more normal levels.

Nevertheless, the fund is easily the most popular and liquid

fund of the three on the list with over $185 million in AUM and

more than half a million in shares changing hands every day. The

expense ratio on this fund is also in line with others on the list

coming at 52 basis points a year.

Bottom Line

Clearly, all three of these products are relatively unloved by

U.S. investors despite the ongoing search for yield. Any of the

three—while they each have their own risks—could make for

interesting choices for yield starved investors, and especially for

those seeking some more international diversification in this

uncertain market climate, while still tapping into a broad market

approach.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

Author is long ENZL.

ISHARS-MSCI NZ (ENZL): ETF Research Reports

ISHARS-BELGIUM (EWK): ETF Research Reports

ISHARS-SPAIN (EWP): ETF Research Reports

SPDR-SP DIV ETF (SDY): ETF Research Reports

VANGD-DIV APPRC (VIG): ETF Research Reports

VANGD-HI DV YLD (VYM): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

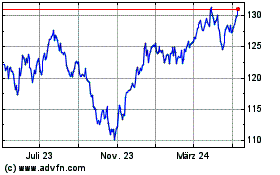

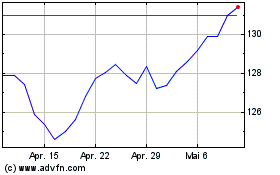

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Dez 2023 bis Dez 2024