(TSXV: FRED) Fredonia Mining Inc. (the “

Company”

or “

Fredonia”) is pleased to announce today the

closing of its previously announced brokered private placement,

consisting of a total of 22,606,779 units of the Company (each, a

“

Unit”, and collectively the

“

Units”), which included the exercise of an option

to increase the size of the Offering from the proposed base

offering size, at a price of $0.18 per Unit for aggregate gross

proceeds to the Company of approximately $4,069,220.22 (the

“

Offering”).

Each Unit consisted of one common share of the

Company (each, a “Common Share”, and collectively

the “Common Shares”) and one Common Share purchase

warrant (each whole warrant, a “Warrant” and

collectively the “Warrants”). Each Warrant

entitles the holder thereof to acquire one Common Share at a price

of $0.28 per Common Share for a period of five years from the

closing date of the Offering.

The Offering was led by Paradigm Capital Inc. as

sole agent and bookrunner (the “Agent”). In

consideration for the Agent’s services, and pursuant to the terms

of an agency agreement entered into on April 27, 2022 between the

Company and the Agent, the Agent received compensation consisting

of 1,485,213 Units (the “Broker Units) in lieu of

cash, representing 7.0% of the Units issued pursuant to the

Offering, other than in respect of sales made by other registered

dealers participating in the Offering for which the Company issued

cash compensation in the amount of the agreed-upon selling

concession. Each Broker Unit consists of one Common Share and one

Warrant. The Company also granted the Agent 1,582,475 broker

warrants (each, a “Broker Warrant” and

collectively the “Broker Warrants”), representing

7.0% of the number of Units issued pursuant to the Offering, with

each such Broker Warrant entitling the Agent to acquire one Common

Share at a price of $0.18 per Common Share for a period of 24

months from the closing date of the Offering.

The Corporation intends to use the net proceeds

of the Offering to fund ongoing exploration, updating technical

studies, and for general corporate purposes.

The securities have not been, and will not be,

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”), or any U.S.

state securities laws, and may not be offered or sold in the United

States without registration under the U.S. Securities Act and all

applicable state securities laws or compliance with the

requirements of an applicable exemption therefrom. This news

release does not constitute an offer to sell or the solicitation of

an offer to buy securities in the United States, nor may there be

any sale of these securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful.

The Units were offered and sold by private

placement in Canada to “accredited investors” within the meaning of

National Instrument 45-106 – Prospectus Exemptions and other exempt

purchasers in each province of Ontario and foreign jurisdictions.

The securities issued in the Offering will be subject to applicable

hold periods imposed under applicable securities legislation,

including a hold period of 4 months and one day from the date of

issuance.

Certain directors and officers of the Company

participated in the Offering. A material change report with respect

to the Offering was filed less than 21 days before the closing

date, which was reasonable and necessary in the circumstances for

the Company to take advantage of available financing

opportunities.

About Fredonia

Fredonia, directly or indirectly, owns a 100%

interest in certain license areas (totaling approximately 18,300

ha.) (collectively, the “Project”), all within the

Deseado Massif geological region in the Province of Santa Cruz,

Argentina, including the following principal areas: El Aguila,

approx. 9,100ha, Petrificados, approx. 3,000ha, and the flagship,

advanced El Dorado-Monserrat (“EDM”) covering

approx. 6,200ha located close to Anglo Gold Ashanti's Cerro

Vanguardia mine, subject to a 1.5% net smelter return royalty on

the EDM project, and a 0.5% net profits interest on Winki II, El

Aguila I, El Aguila II and Petrificados.

For further

information: Please visit the Company

website www.fredoniamanagement.com or contact: Omar

Salas, Chief Financial Officer, Direct: +1-416-846-7807,

Email: omar.salas@icloud.com

Forward-looking Information Cautionary

Statement

This news release contains “forward‐looking

information” within the meaning of the applicable Canadian

securities legislation that is based on expectations, estimates,

projections and interpretations as at the date of this news

release. The information in this news release about the use of the

proceeds from the Offering; the prospects of the Project; and any

other information herein that is not a historical fact may be

“forward-looking information”. Any statement that involves

discussions with respect to predictions, expectations,

interpretations, beliefs, plans, projections, objectives,

assumptions, future events or performance (often but not always

using phrases such as “expects”, or “does not expect”, “is

expected”, “interpreted”, “management's view”, “anticipates” or

“does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”,

“estimates”, “believes” or “intends” or variations of such words

and phrases or stating that certain actions, events or results

“may” or “could”, “would”, “might” or “will” be taken to occur or

be achieved) are not statements of historical fact and may be

forward-looking information and are intended to identify

forward-looking information. This forward-looking information is

based on reasonable assumptions and estimates of management of the

Company, at the time such assumptions and estimates were made, and

involves known and unknown risks, uncertainties or other factors

which may cause the actual results, performance or achievements of

the Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others,

the results of exploration activities, and management’s discretion

with respect to use of proceeds. Although the forward-looking

information contained in this news release is based upon what

management believes, or believed at the time, to be reasonable

assumptions, the Company cannot guarantee that actual results will

be consistent with such forward-looking information, as there may

be other factors that cause results not to be as anticipated,

estimated or intended, and neither Company nor any other person

assumes responsibility for the accuracy and completeness of any

such forward looking information. The Company does not undertake,

and assumes no obligation, to update or revise any such forward

looking statements or forward-looking information contained herein

to reflect new events or circumstances, except as may be required

by law.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

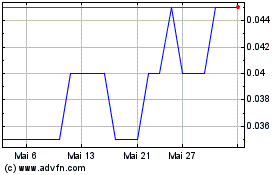

Fredonia Mining (TSXV:FRED)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

Fredonia Mining (TSXV:FRED)

Historical Stock Chart

Von Apr 2024 bis Apr 2025