National Bank of Canada Announces NVCC Preferred Share Offering

31 Mai 2018 - 3:05PM

Not for distribution to U.S. news wire

services or for dissemination in the United States.

National Bank of Canada (“National Bank”) today announced that it

has entered into an agreement with a group of underwriters led by

National Bank Financial Inc. for the issuance on a bought deal

basis of 10 million non-cumulative 5-year rate reset first

preferred shares series 42 (non-viability contingent capital

(NVCC)) (the “Series 42 Preferred Shares”) at a price of $25.00 per

share, to raise gross proceeds of $250 million.

National Bank has granted the underwriters an

option to purchase, on the same terms, up to an additional 2

million Series 42 Preferred Shares. This option is exercisable in

whole or in part by the underwriters at any time up to two business

days prior to closing. The gross proceeds raised under the offering

will be $300 million should this option be exercised in full.

The Series 42 Preferred Shares will yield 4.95%

annually, payable quarterly, as and when declared by the Board of

Directors of National Bank, for the initial period ending November

15, 2023. The first of such dividends, if declared, shall be

payable on November 15, 2018. Thereafter, the dividend rate will

reset every five years at a level of 277 basis points over the then

5-year Government of Canada bond yield. Subject to regulatory

approval, National Bank may redeem the Series 42 Preferred Shares

in whole or in part at par on November 15, 2023 and on November 15

every five years thereafter.

Holders of the Series 42 Preferred Shares will

have the right to convert their shares into an equal number of

non-cumulative floating rate first preferred shares series 43

(non-viability contingent capital (NVCC)) (the “Series 43 Preferred

Shares”), subject to certain conditions, on November 15, 2023, and

on November 15 every five years thereafter. Holders of the Series

43 Preferred Shares will be entitled to receive quarterly floating

dividends, as and when declared by the Board of Directors of

National Bank, equal to the 90-day Government of Canada Treasury

Bill rate plus 277 basis points.

The net proceeds of the offering will be used

for general corporate purposes and added to National Bank’s capital

base. The expected closing date is on or about June 11, 2018.

National Bank intends to file in Canada a prospectus supplement to

its November 21, 2016 base shelf prospectus in respect of this

issue.

The Series 42 Preferred Shares and Series 43

Preferred Shares have not been and will not be registered under the

U.S. Securities Act of 1933, as amended, or under any state

securities laws, and may not be offered, sold, directly or

indirectly, or delivered within the United States of America and

its territories and possessions or to, or for the account or

benefit of, United States persons except in certain transactions

exempt from the registration requirements of such Act. This press

release shall not constitute an offer to sell or a solicitation to

buy securities in the United States.

Caution Regarding Forward-Looking

StatementsThis press release includes certain

forward-looking statements. These statements are inherently subject

to significant risks, uncertainties and changes in circumstances,

many of which are beyond the control of the Bank. Except as

required by law, the Bank does not undertake to update any

forward-looking statements, whether written or oral, that may be

made from time to time, by it or on its behalf. The forward-looking

information contained in this press release is presented for the

purpose of interpreting the information contained herein and may

not be appropriate for other purposes.

About National Bank of

CanadaWith $256 billion in assets as at

April 30, 2018, National Bank of Canada, together with its

subsidiaries, forms one of Canada's leading integrated financial

groups. It has more than 22,000 employees in

knowledge-intensive positions and has been recognized numerous

times as a top employer and for its commitment to diversity.

Its securities are listed on the Toronto Stock Exchange

(TSX:NA). Follow the Bank’s activities at nbc.ca or via

social media such as Facebook, LinkedIn and Twitter.

For more information:

| Linda Boulanger |

Claude Breton |

| Vice-President,

Investor Relations |

Vice-President, Public

Affairs |

| National Bank of

Canada |

National Bank of

Canada |

| Tel.: 514-394-0296 |

Tel.: 514-394-8644 |

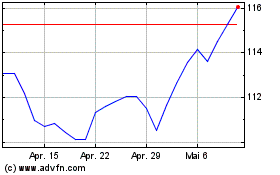

National Bank of Canada (TSX:NA)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

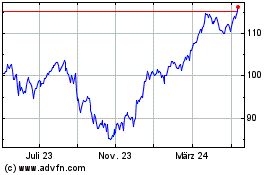

National Bank of Canada (TSX:NA)

Historical Stock Chart

Von Jan 2024 bis Jan 2025