Hudbay Minerals Inc. (“Hudbay” or the “company”) (TSX,

NYSE:HBM) today released its annual mineral reserve and

resource update. All amounts are in U.S. dollars, unless otherwise

noted.

“We have continued to grow our copper and gold

mineral reserves and resources through successful exploration in

Peru, Snow Lake and Arizona,” said Peter Kukielski, Hudbay’s

President and Chief Executive Officer. “While we already have a

solid production growth profile for many years to come, our

exploration efforts over the past year have been successful in

replacing what we have mined, adding reserves to our life of mine

plans and expanding our resource base to position us for additional

long-term reserves growth. This is another example of our proven

track record of delivering value through exploration, and we look

forward to continuing to advance our leading organic pipeline of

copper exploration and development assets for the next stage of

growth at Hudbay.”

Constancia Operations

Mine planning gains and economic re-evaluations

have resulted in additional mineral reserves at Constancia which

have largely offset 2021 mining depletion. Current mineral reserve

estimates at Constancia total 521 million tonnes at 0.31% copper

with over 1.6 million tonnes in contained copper. As a result,

Constancia’s expected mine life has been extended one year to 2038.

The copper contained in inferred mineral resources has also

increased in 2022 due to the inclusion of the Constancia Norte

underground mineral resource estimates.

In 2021, Hudbay completed a positive scoping

study which resulted in an inferred mineral resource estimate of

6.5 million tonnes at 1.2% copper in two high grade skarn lenses

located below the open pit in the Constancia Norte area. The study

concluded these two lenses could be mined by underground methods

starting in 2029 to supplement the open pit production. Please

refer to Figure 1 for a cross-section of the conceptual underground

mine design at Constancia Norte. The company intends to conduct

infill drilling and an internal pre-feasibility study in hopes of

converting the underground mineral resources to mineral reserves

for inclusion in the mine plan for the Constancia operations.

Hudbay released an updated mine plan for

Constancia in 2021 that reflected an increase in copper and gold

production from 2022 to 2025 as the higher grades from the

Pampacancha deposit enter the mine plan. The updated mine plan

incorporates higher-grade reserves including the Constancia Norte

pit extension. With the incorporation of Pampacancha and the

Constancia Norte pit extension, annual production at Constancia is

expected to average approximately 105,000 tonnes of copper and

60,000 ounces of gold over the next seven years, an increase of

approximately 35% and 20%, respectively, from 2021 levels.

Current mineral reserves and resources

(exclusive of reserves) for Constancia and Pampacancha as of

January 1, 2022 are summarized below.

|

Constancia OperationsMineral Reserve and

Resource

Estimates1,2,3,4,5 |

Tonnes |

Cu Grade(%) |

Mo Grade(g/t) |

Au Grade(g/t) |

Ag Grade(g/t) |

|

Constancia Reserves |

|

|

|

Proven |

|

426,200,000 |

0.29 |

82 |

0.042 |

2.90 |

|

Probable |

|

56,800,000 |

0.24 |

69 |

0.043 |

3.06 |

|

Total Proven and Probable - Constancia |

|

483,000,000 |

0.28 |

80 |

0.042 |

2.92 |

|

Pampacancha Reserves |

|

|

|

Proven |

|

36,400,000 |

0.65 |

177 |

0.368 |

5.26 |

|

Probable |

|

1,600,000 |

0.52 |

234 |

0.259 |

6.33 |

|

Total Proven and Probable - Pampacancha |

|

38,000,000 |

0.65 |

179 |

0.364 |

5.30 |

|

Total Proven and Probable |

|

521,000,000 |

0.31 |

87 |

0.065 |

3.09 |

|

Constancia Resources |

|

|

|

Measured |

|

123,800,000 |

0.22 |

64 |

0.038 |

2.07 |

|

Indicated |

|

118,200,000 |

0.22 |

65 |

0.037 |

2.08 |

|

Inferred – Open Pit |

|

51,000,000 |

0.30 |

77 |

0.054 |

2.69 |

|

Inferred – Underground |

|

6,490,000 |

1.20 |

69 |

0.137 |

8.62 |

|

Pampacancha Resources |

|

|

|

Measured |

|

9,200,000 |

0.37 |

63 |

0.293 |

5.71 |

|

Indicated |

|

1,500,000 |

0.39 |

152 |

0.223 |

6.63 |

|

Inferred |

|

6,800,000 |

0.33 |

102 |

0.286 |

5.01 |

|

Total Measured and Indicated |

|

252,700,000 |

0.23 |

65 |

0.048 |

2.23 |

|

Total Inferred |

|

64,300,000 |

0.40 |

79 |

0.087 |

3.53 |

Note: totals may not add up correctly due to

rounding.1 Mineral resources are exclusive of mineral reserves

and do not have demonstrated economic viability.2 Mineral

resources do not include factors for mining recovery or

dilution.3 The open pit mineral reserves and resources are

estimated using a minimum NSR cut-off of $6.40 per tonne and

assuming metallurgical recoveries (applied by ore type) of 86% for

copper on average for the life of mine, while the underground

inferred resources at Constancia Norte are based on a 0.65% copper

cut-off grade.4 Long-term metal prices of $3.45 per pound

copper, $11.00 per pound molybdenum, $1,500 per ounce gold, and

$20.00 per ounce silver were used to estimate mineral reserves and

resources.5 Mineral resources are based on resource pit

designs containing measured, indicated, and inferred mineral

resources.

Peru Regional Exploration

Hudbay controls a large, contiguous block of

mineral rights with the potential to hold mineable deposits within

trucking distance of the Constancia processing facility, including

the past producing Caballito property and the highly prospective

Maria Reyna and Kusiorcco properties. Exploration agreement

discussions with the communities of Uchucarcco and Anahuichi on the

Maria Reyna, Kusiorcco and Caballito properties are in

progress.

Drilling continues at the Llaguen copper

porphyry target in northern Peru with a total of 9,250 metres in 21

holes completed to-date. Assays have been received for eight holes

and all holes have intersected mineralization. Based on the

positive results from the initial drilling, a second phase of

drilling has been initiated aimed at defining an initial inferred

mineral resource estimate for Llaguen in the third quarter of

2022.

Other Constancia Updates

In March 2022, Hudbay obtained approval from

Peru’s National Environmental Certification Service for Sustainable

Investments (SENACE) of a third amendment to the Environmental and

Social Impact Assessment (“ESIA MOD III”) for Constancia. The ESIA

MOD III will allow for the optimization of the water balance and

management plan, an alternate road for concentrate transportation,

improvements to the tailings management facility dam design

criteria and other operational benefits. This approval was obtained

with technical input from the National Water Authority, the

Ministry of Agrarian Development and Irrigation, and the Ministry

of Culture.

The company also signed an addendum to its

framework agreement with the province of Chumbivilcas in March

2022. Under the agreement, Hudbay will contribute to the district

municipalities, assist with the return to classes in the education

sector and continue to provide employment opportunities within the

province.

Snow Lake Operations

As a result of exploration success in 2021,

additional mineral reserves were identified at Lalor and the 1901

deposit, which are expected to extend the mine life of the Snow

Lake operations by one year until 2038, maintaining the 17-year

mine life. Resource to reserve conversion has more than offset 2021

mining depletion with a net gain for all metals, including an

additional 218,000 ounces of gold contained in reserves after

adjusting for 2021 mining depletion.

Refurbishment and commissioning activities at

the New Britannia gold mill were completed in July 2021 and the

construction of the new copper flotation facility at New Britannia

was completed in October 2021, ahead of the original schedule. The

copper facility consists of an innovative and first-of-its-kind

flotation circuit based entirely on Jameson cells, a modern

pneumatic flotation design that offers a compact layout, low-cost

process and flexible flowsheet. Following a brief commissioning

period, the New Britannia mill achieved commercial production on

November 30, 2021. Full design throughput rates and recoveries are

expected to be achieved in the second quarter of 2022, a mere six

months after commissioning.

Hudbay released an updated mine plan for the

Snow Lake operations in 2021 that reflected an increase in annual

gold production to over 180,000 ounces on average during the next

six years due to the incorporation of the New Britannia mill, which

represents an increase of more than 55% from 2021 levels. The

updated mine plan reflects the third phase of the company’s Snow

Lake gold strategy focused on expanding and further optimizing

operations. These expansion and optimization initiatives include

increasing the production rate at Lalor to 5,300 tonnes per day by

the end of 2022 following the closure of the 777 mine, increasing

the throughput rate at the Stall mill to 3,800 tonnes per day,

incorporating mineral reserves from the 1901 deposit into the mine

plan, and implementing a recovery improvement project at the Stall

mill to increase copper and precious metal recoveries. There also

remains potential to further enhance the Snow Lake operations

through exploration opportunities and additional mill processing

projects.

Current mineral reserves and resources

(exclusive of reserves) for Lalor, 1901 and other Snow Lake

satellite deposits as of January 1, 2022 are summarized below.

|

Lalor Mine and 1901 DepositMineral Reserve

and Resource

Estimates1,2,3,4,5,6,7 |

Tonnes |

Zn Grade(%) |

Au Grade(g/t) |

Cu Grade(%) |

Ag Grade(g/t) |

|

Base Metal Zone Reserves |

|

|

|

Proven – Lalor |

|

6,420,000 |

5.57 |

2.6 |

0.47 |

29.5 |

|

Proven – 1901 |

|

1,260,000 |

8.00 |

2.2 |

0.32 |

24.7 |

|

Probable – Lalor |

|

1,300,000 |

4.02 |

3.2 |

0.50 |

32.4 |

|

Probable – 1901 |

|

380,000 |

10.01 |

0.7 |

0.29 |

31.0 |

|

Total Proven and Probable - Base Metal |

|

9,360,000 |

5.86 |

2.6 |

0.45 |

29.3 |

|

Gold Zone Reserves |

|

|

|

Proven – Lalor |

|

3,590,000 |

0.82 |

5.9 |

0.62 |

28.5 |

|

Proven – 1901 |

|

50,000 |

1.22 |

3.8 |

0.78 |

18.7 |

|

Probable – Lalor |

|

4,190,000 |

0.53 |

5.1 |

1.05 |

27.9 |

|

Probable – 1901 |

|

20,000 |

0.51 |

1.6 |

1.89 |

5.3 |

|

Total Proven and Probable - Gold |

|

7,850,000 |

0.67 |

5.4 |

0.85 |

28.1 |

|

Total Proven and Probable (Base Metal and

Gold) |

|

17,200,000 |

3.50 |

3.9 |

0.64 |

28.7 |

|

Base Metal Zone Resources |

|

|

|

Inferred – Lalor |

|

1,960,000 |

5.72 |

1.5 |

0.31 |

30.4 |

|

Inferred – 1901 |

|

670,000 |

6.04 |

1.4 |

0.22 |

27.8 |

|

Total Inferred - Base Metal |

|

2,630,000 |

5.80 |

1.5 |

0.29 |

29.7 |

|

Gold Zone Resources |

|

|

|

Inferred – Lalor |

|

4,170,000 |

0.28 |

5.1 |

1.56 |

29.0 |

|

Inferred – 1901 |

|

1,260,000 |

0.39 |

4.9 |

1.49 |

20.8 |

|

Total Inferred - Gold |

|

5,430,000 |

0.31 |

5.1 |

1.54 |

27.1 |

|

Total Inferred (Base Metal and Gold) |

|

8,060,000 |

2.10 |

3.9 |

1.13 |

28.0 |

Note: totals may not add up correctly due to

rounding.1 Mineral resources are exclusive of mineral reserves

and do not have demonstrated economic viability.2 Mineral

resources do not include factors for mining recovery or

dilution.3 Base metal mineral resources are estimated based on

the assumption that they would be processed at the Stall

concentrator while gold mineral resources are estimated based on

the assumption that they would be processed at the New Britannia

concentrator.4 Long-term metal prices of $1.15 per pound zinc,

$1,500 per ounce gold, $3.45 per pound copper, and $20.00 per ounce

silver with an exchange rate of 1.30 C$/US$ were used to estimate

mineral reserves and resources.5 Lalor mineral reserves and

resources are estimated using a minimum NSR cut-off of C$117 per

tonne for waste filled mining areas and a minimum of C$127 per

tonne for paste filled mining areas.6 Individual stope gold

grades at Lalor were capped at 10 grams per tonne as a prudent

estimate until reserves-to-mill reconciliations can be developed to

support the recovery of higher-grade gold. This capping method

resulted in an approximate 3% reduction in the overall gold reserve

grade at Lalor.7 1901 mineral reserves and resources are

estimated using a minimum NSR cut-off of C$110 per tonne.

|

Snow Lake Regional Deposits - GoldMineral

Reserve and Resource

Estimates1,2,3,4,5,6,7,8 |

Tonnes |

Zn Grade(%) |

Au Grade(g/t) |

Cu Grade(%) |

Ag Grade(g/t) |

|

Probable Reserves |

|

|

|

WIM |

|

2,450,000 |

0.25 |

1.6 |

1.63 |

6.3 |

|

3 Zone |

|

660,000 |

- |

4.2 |

- |

- |

|

Total Probable (Gold) |

|

3,110,000 |

0.20 |

2.2 |

1.28 |

5.0 |

|

Inferred Resources |

|

|

|

Birch |

|

570,000 |

- |

4.4 |

- |

- |

|

New Britannia |

|

2,750,000 |

- |

4.5 |

- |

- |

|

Total Inferred (Gold) |

|

3,320,000 |

- |

4.5 |

- |

- |

Note: totals may not add up correctly due to

rounding.1 Mineral resources are exclusive of mineral reserves

and do not have demonstrated economic viability.2 Mineral

resources do not include factors for mining recovery or

dilution.3 Gold mineral resources are estimated based on the

assumption that they would be processed at the New Britannia

concentrator.4 Long-term metal prices of $1.15 per pound zinc,

$1,500 per ounce gold, $3.45 per pound copper, and $20.00 per ounce

silver with an exchange rate of 1.30 C$/US$ were used to confirm

the economic viability of the mineral reserve estimates.5 WIM

mineral reserves are estimated using a minimum NSR cut-off of C$150

per tonne, assuming processing recoveries of 98% for copper, 88%

for gold and 70% for silver based on processing through New

Britannia mill's flotation and tails leach circuits.6 3 Zone

mineral reserves are estimated using a minimum NSR cut-off of C$150

per tonne, assuming processing recoveries of 85% for gold based on

processing through New Britannia mill's leach circuit.7 New

Britannia mineral resource estimates have been reported at a

minimum true width of 1.5 metres and with a cut-off grade varying

from 2 grams per tonne (at the lower part of New Britannia) to 3.5

grams per tonne (at the upper part of New Britannia).8 Mineral

reserves and resources were initially estimated using metal price

assumptions that vary marginally over the assumptions used to

estimate mineral reserves at Lalor. In the Qualified Person’s

opinion, the combined impact of these small variations does not

have any impact on the mineral reserve and resource estimates.

|

Snow Lake Regional Deposits – Base

MetalMineral Reserve and Resource

Estimates1,2,3,4,5,6,7 |

Tonnes |

Zn Grade(%) |

Au Grade(g/t) |

Cu Grade(%) |

Ag Grade(g/t) |

|

Indicated Resources |

|

|

|

Pen II |

|

470,000 |

8.89 |

0.3 |

0.49 |

7 |

|

Talbot |

|

2,190,000 |

1.79 |

2.1 |

2.33 |

36 |

|

Total Indicated (Base Metals) |

|

2,660,000 |

3.04 |

1.8 |

2.01 |

31 |

|

Inferred Resources |

|

|

|

Watts |

|

3,150,000 |

2.58 |

1.0 |

2.34 |

31 |

|

Pen II |

|

130,000 |

9.81 |

0.3 |

0.37 |

7 |

|

Talbot |

|

2,450,000 |

1.74 |

1.9 |

1.13 |

26 |

|

Total Inferred (Base Metals) |

|

5,730,000 |

2.39 |

1.3 |

1.78 |

28 |

Note: totals may not add up correctly due to

rounding.1 Mineral resources are exclusive of mineral reserves

and do not have demonstrated economic viability.2 Mineral

resources do not include factors for mining recovery or

dilution.3 Base metal mineral resources are estimated based on

the assumption that they would be processed at the Stall

concentrator.4 Watts mineral resources are estimated using a

minimum NSR cut-off of C$150 per tonne, assuming processing

recoveries of 90% for copper, 80% for zinc, 70% for gold and 70%

for silver.5 Pen II mineral resources are estimated using a

minimum NSR cut-off of C$75 per tonne.6 Watts and Pen II

mineral resources were initially estimated using metal price

assumptions that vary marginally over the assumptions used to

estimate mineral resources at Lalor. In the Qualified Person’s

opinion, the combined impact of these small variations does not

have any impact on the mineral resource estimates.7 Includes

100% of the Talbot mineral resources reported by Rockcliff Metals

Corp. in its 2020 NI 43-101 technical report published on SEDAR.

Hudbay currently owns a 51% interest in the Talbot project.

Snow Lake Regional Exploration

Exploration efforts in 2021 increased inferred

mineral resources at Lalor and 1901 by 1.1 million tonnes despite

delays in underground drill programs caused by COVID-19 related

restrictions. This increases the total inferred mineral resources

at Lalor and 1901 to 8.1 million tonnes, which have the potential

to maintain the 5,300 tonnes per day production level beyond 2028

and further extend the mine life.

Hudbay is actively conducting surface and

underground winter drilling activities in the Snow Lake area,

primarily focused on the copper-gold rich feeder zone at the 1901

deposit, the drilling gap between 1901 and lens 17 at Lalor, and a

high-priority geophysical target located immediately north of

Lalor. In addition, the company continues to compile results from

ongoing infill drilling programs at Lalor and 1901.

Rosemont and Copper World

Projects

The Rosemont and Copper World deposits are 100%

owned by Hudbay and are located predominantly on wholly owned

private land in Pima County, Arizona.

Current mineral reserves and resources

(exclusive of reserves) for Rosemont as of January 1, 2022 are

summarized below.

|

Rosemont ProjectMineral Reserve and

Resource

Estimates1,2,3,4,5 |

Tonnes |

Cu Grade(%) |

Mo Grade(g/t) |

Ag Grade(g/t) |

|

Proven |

|

426,100,000 |

0.48 |

120 |

4.96 |

|

Probable |

|

111,000,000 |

0.31 |

100 |

3.09 |

|

Total Proven and Probable |

|

537,100,000 |

0.44 |

116 |

4.57 |

|

Measured |

|

161,300,000 |

0.38 |

90 |

2.72 |

|

Indicated |

|

374,900,000 |

0.25 |

110 |

2.60 |

|

Total Measured and Indicated |

|

536,200,000 |

0.29 |

104 |

2.64 |

|

Inferred |

|

62,300,000 |

0.30 |

100 |

1.58 |

Note: totals may not add up correctly due to

rounding.1 Mineral resources are exclusive of mineral reserves

and do not have demonstrated economic viability.2 Mineral

resources do not include factors for mining recovery or

dilution.3 Blocks were classified as Proven or Probable in

accordance with CIM Definition Standards 2014.4 Mineral

reserves were estimated using metal prices of $3.15 per pound

copper, $11.00 per pound molybdenum and $18.00 per ounce silver.

Metallurgical recoveries of 90% copper, 63% molybdenum and 75.5%

silver were applied. No metallurgical recovery of molybdenum and

silver from oxide ore is projected. An NSR cut-off value of $6.60

per tonne was assumed, based on process recoveries and total

processing and general and administrative operating

costs.5 Mineral resources are constrained within a computer

generated pit using the Lerchs-Grossman algorithm and were

estimated based on the following long-term metals prices: $3.15 per

pound of copper; $11.00 per pound of molybdenum; and $18.00 per

ounce of silver. Metallurgical recoveries of 85% copper, 60%

molybdenum and 75% silver were applied to sulfide material.

Metallurgical recoveries of 40% copper, 30% molybdenum and 40%

silver were applied to mixed material. A metallurgical recovery of

65% for copper was applied to oxide material. NSR was calculated

for every model block and is an estimate of recovered economic

value of copper, molybdenum, and silver combined. Cut-off grades

were set in terms of NSR based on current estimates of process

recoveries and total processing and general and administrative

operating costs of $6.10 per tonne for oxide, mixed and sulfide

material.

The Copper World project consists of seven

deposits extending over seven kilometres, including Bolsa, Broad

Top Butte, Copper World, Peach, Elgin, South Limb and North Limb,

with mineralization closer to surface than at Rosemont.

Current mineral resources for the Copper World

project as of January 1, 2022 are summarized below.

|

Copper World ProjectMineral Resource

Estimates1,2,3,4,5,6 |

Tonnes |

Cu Grade(%) |

CuSS Grade(%) |

Mo Grade(g/t) |

Ag Grade(g/t) |

|

Potential Flotation Processing Method |

|

|

|

Indicated |

|

180,000,000 |

0.37 |

0.07 |

136 |

2.7 |

|

Inferred |

|

91,000,000 |

0.36 |

0.05 |

129 |

3.8 |

|

Potential Leach Processing Method |

|

|

|

Indicated |

|

92,000,000 |

0.34 |

0.27 |

- |

- |

|

Inferred |

|

51,000,000 |

0.35 |

0.27 |

- |

- |

|

Total Resources |

|

|

|

Indicated |

|

272,000,000 |

0.36 |

0.14 |

90 |

1.8 |

|

Inferred |

|

142,000,000 |

0.36 |

0.13 |

83 |

2.4 |

Note: totals may not add up correctly due to rounding.1 CIM

definitions were followed for the estimation of mineral resources.

Mineral resources that are not mineral reserves do not have

demonstrated economic viability.2 Mineral resources are

reported within an economic envelope defined by a pit shell

optimization algorithm and assuming a selective mining unit of

50x50x50 feet. This pit shell is defined by a revenue factor of 1.0

assuming operating costs adjusted and updated from the 2017

Rosemont Feasibility Study.3 Mineral resource estimates were

reported using a cut-off of 0.1% Cu and were separated by potential

processing method into flotation and leach if they respectively had

a CuSS/Cu ratio below or above a threshold of 50%.4 Metal

recovery estimates assume that this mineralization would be

processed at a combination of facilities, including copper and

molybdenum flotation and heap and/or run-of-mine leach pads

followed by solvent extraction and electrowinning.5 CuSS

represents the copper grade in oxides.6 Specific gravity

measurements were estimated from core box weights validated by

industry standard laboratory measurements.

The global resource estimate for Copper World

includes near surface, higher grade indicated mineral resources of

96 million tonnes at 0.57% copper, including 0.27% copper in

oxides, and inferred mineral resources of 31 million tonnes at

0.71% copper, including 0.27% copper in oxides. The higher grade

resource has the potential to be mined earlier in the mine life.

Resources comprise both sulphide and oxide mineralogy that are

potentially amenable to flotation and heap leach processing

methods, respectively.

Potential Synergies Between Copper World and

Rosemont

Approximately 33 million tonnes of inferred

mineral resources at the Bolsa deposit were considered to be waste

in the resource pit shell used for the NI 43-101 Technical Report

Feasibility Study for Rosemont dated March 30, 2017 (“2017 Rosemont

Feasibility Study”). For that study, these tonnes were accounted

for as pre-stripping since there were no mineralized intersections

available at the time. Any ability to convert Bolsa mineral

resources to reserves would be expected to result in less waste

being mined at Rosemont, thereby reducing costs and energy

consumption per tonne of ore mined.

The Rosemont deposit also contains oxide

mineralization that was previously classified as waste, which may

be able to be processed with the oxide mineralization at Copper

World. This would increase metal production while further reducing

costs and energy consumption per tonne mined at Rosemont.

It is expected that additional synergies will be

identified as Hudbay continues to close the drilling gap between

Bolsa and Rosemont.

Continued Regional Exploration Success

The company has increased the number of drill

rigs at Copper World to seven to conduct infill drilling and to

support future economic studies. There remain several opportunities

to further extend economic mineralization within the private land

limits at Copper World and Rosemont. As shown in Figure 2, there is

opportunity to extend the mineralization north and south of Bolsa

through infill drilling to bridge the gaps. There are also

potential marginal extensions to the south of the Copper World

deposit and to the east of the North Limb and South Limb

deposits.

Preliminary Economic Assessment Progressing

Well

The technical studies for Copper World are

well-advanced and the results will be incorporated into a

Preliminary Economic Assessment (“PEA”) contemplating the

development of the Copper World deposits in conjunction with the

Rosemont deposit. The PEA is also expected to reflect preliminary

expectations of potential synergies between Copper World and

Rosemont. Hudbay is on track to publish the PEA results in a NI

43-101 Technical Report in the first half of 2022.

Mason Project

The Mason project is a large greenfield copper

deposit located in the historic Yerington District of Nevada and is

one of the largest undeveloped copper porphyry deposits in North

America. Mason’s measured and indicated mineral resources are

comparable in size to Constancia and Rosemont. Hudbay views the

Mason project as a long-term option for future development and a

strong component of its pipeline of long-term growth opportunities.

Since acquiring Mason, Hudbay has consolidated a prospective

package of patented and unpatented mining claims contiguous to the

Mason project and has advanced a number of technical studies

including a revised resource model and PEA.

The Mason PEA was completed in April 2021 and

contemplates a 27-year mine life with average annual copper

production of approximately 140,000 tonnes over the first ten years

of full production. At a copper price of $3.25 per pound, the

after-tax net present value using a 10% discount rate is $773

million and the internal rate of return is 15%.

There is opportunity to further enhance the

project economics through exploration for higher grade satellite

deposits on Hudbay’s prospective land package in Nevada, including

Mason Valley. The Mason Valley property hosts several historical

underground copper mines that were in production in the early

1900s. Much of the Mason Valley property is located on Hudbay’s

wholly owned private lands and contains highly prospective skarn

mineralization. An initial drill program to test the Mason Valley

skarn properties is planned for late 2022.

Current mineral resource estimates for Mason as

of January 1, 2022 are summarized below.

|

Mason ProjectMineral Resource

Estimates1,2,3,4,5 |

Tonnes |

Cu Grade(%) |

Mo Grade(g/t) |

Au Grade(g/t) |

Ag Grade(g/t) |

|

Measured |

|

1,417,000,000 |

0.29 |

59 |

0.031 |

0.66 |

|

Indicated |

|

801,000,000 |

0.30 |

80 |

0.025 |

0.57 |

|

Total Measured and Indicated |

|

2,219,000,000 |

0.29 |

67 |

0.029 |

0.63 |

|

Inferred |

|

237,000,000 |

0.24 |

78 |

0.033 |

0.73 |

Note: totals may not add up correctly due to

rounding.1 Mineral resource estimates that are not mineral

reserves do not have demonstrated economic viability.2 Mineral

resource estimates do not include factors for mining recovery or

dilution.3 Metal prices of $3.10 per pound copper, $11.00 per

pound molybdenum, $1,500 per ounce gold, and $18.00 per ounce

silver were used to estimate mineral resources.4 Mineral

resources are estimated using a minimum NSR cut-off of $6.25 per

tonne.5 Mineral resources are based on resource pit designs

containing measured, indicated, and inferred mineral resources.

777 Mine

The 777 mine is scheduled to close in June 2022

after more than 17 years of steady operations. The mine is expected

to operate at approximately 2,700 tonnes per day with a continued

focus on mining out the remaining reserves by completing the

necessary ground rehabilitation to access old workings and remnant

stopes. In connection with the depletion of reserves at 777, Hudbay

will be commencing the closure of the Flin Flon complex, including

decommissioning the 777 mine and Flin Flon zinc plant. The Flin

Flon mill and tailings facilities will be put on care and

maintenance. The company expects to spend approximately $25 million

in 2022 on costs related to the closure of the Flin Flon complex

and the transition to care and maintenance. These costs are

expected to be recorded as other operating expenses, and

approximately half of these costs relate to closure and transition

costs in the second and third quarters of 2022, while the remainder

relates to care and maintenance costs in the second half of

2022.

Current mineral reserves for the 777 mine as

of January 1, 2022 are summarized below. There are no

mineral resource estimates exclusive of mineral reserve estimates

for 777.

|

777 MineMineral Reserve

Estimates1 |

Tonnes |

Cu Grade(%) |

Zn Grade(%) |

Au Grade(g/t) |

Ag Grade(g/t) |

|

Mineral Reserves |

|

|

|

Proven |

|

459,000 |

1.24 |

5.01 |

1.78 |

32 |

|

Total Proven Reserves |

|

459,000 |

1.24 |

5.01 |

1.78 |

32 |

Note: totals may not add up correctly due to

rounding.1 Metal prices of $1.32 per pound zinc (includes

premium), $1,800 per ounce gold, $4.00 per pound copper, and $24.00

per ounce silver with an exchange rate of 1.27 C$/US$ were used to

confirm the economic viability of the mineral reserve

estimates.

Flin Flon Tailings Reprocessing

Opportunity

Hudbay is exploring an opportunity to

potentially reprocess the Flin Flon tailings in the future. In

early January 2022, the company commenced a confirmatory drill

program on the tailings facility in Flin Flon. Pending positive

metallurgical results, the company plans to advance the project

with the completion of a PEA. This opportunity could utilize the

Flin Flon concentrator, with modifications, after the closure of

the 777 mine, creating operating and economic benefits in northern

Manitoba and Saskatchewan. It could also provide the opportunity to

redesign the closure plans, increase metal production, defer or

reduce certain closure costs and reduce the environmental impacts

of the tailings facility.

Other Corporate Updates

Hudbay has been experiencing limited rail car

availability in Manitoba due to recent weather-related impacts and

higher-than-normal railcar demand in the rail network in Canada. As

a result, first quarter sales volumes in Manitoba are likely to be

impacted, and any resulting excess copper concentrate and refined

zinc inventory buildup is expected to normalize during the second

quarter of 2022.

Qualified Person and NI

43-101

The technical and scientific information in this

news release related to the company’s material mineral projects has

been approved by Olivier Tavchandjian, P. Geo, Vice President,

Exploration and Geology. Mr. Tavchandjian is a qualified person

pursuant to NI 43‑101. Additional details on the company’s material

mineral projects, including a year-over-year reconciliation of

reserves and resources, is included in Hudbay's Annual Information

Form for the year ended December 31, 2021 (the “AIF”), which is

available on SEDAR at www.sedar.com.

The Mason PEA is preliminary in nature, includes

inferred resources that are considered too speculative to have the

economic considerations applied to them that would enable them to

be categorized as mineral reserves and there is no certainty the

preliminary economic assessment will be realized.

Note to United States

Investors

This news release has been prepared in

accordance with the requirements of the securities laws in effect

in Canada, which differ from the requirements of United States

securities laws. Canadian reporting requirements for disclosure of

mineral properties are governed by the Canadian Securities

Administrators’ National Instrument 43-101 Standards of Disclosure

for Mineral Projects (“NI 43-101”).

For this reason, information contained in this

news release containing descriptions of the company’s mineral

deposits may not be comparable to similar information made public

by United States companies subject to the reporting and disclosure

requirements under the United States federal securities laws and

the rules and regulations thereunder. For further information on

the differences between the disclosure requirements for mineral

properties under the United States federal securities laws and NI

43-101, please refer to the company’s AIF, a copy of which has been

filed under Hudbay’s profile on SEDAR at www.sedar.com and the

company’s Form 40-F, a copy of which will be filed on EDGAR at

www.edgar.com.

Forward-Looking

Information This

news release contains forward-looking information within the

meaning of applicable Canadian and United States securities

legislation. All information contained in this news release, other

than statements of current and historical fact, is forward-looking

information. Often, but not always, forward-looking information can

be identified by the use of words such as “plans”, “expects”,

“budget”, “guidance”, “scheduled”, “estimates”, “forecasts”,

“strategy”, “target”, “intends”, “objective”, “goal”,

“understands”, “anticipates” and “believes” (and variations of

these or similar words) and statements that certain actions, events

or results “may”, “could”, “would”, “should”, “might” “occur” or

“be achieved” or “will be taken” (and variations of these or

similar expressions). All of the forward-looking information in

this news release is qualified by this cautionary note.

Forward-looking information includes, but is not

limited to, production, cost and capital and exploration

expenditure guidance, expectations regarding first quarter sales

volumes in Manitoba and the normalization of the inventory buildup

in the second quarter, expectations regarding the impact of

COVID-19 and inflationary pressures on the cost of operations,

financial condition and prospects, expectations regarding the

Copper World project, including future drill programs, potential

synergies with Rosemont and the timeline for completing a

preliminary economic assessment, expectations regarding the Snow

Lake gold strategy, including anticipated timelines for achieving

target throughput and recoveries at the New Britannia mill,

increasing the mining rate at Lalor to 5,300 tonnes per day and

implementing the Stall mill recovery improvement program,

expectations regarding the Flin Flon closure process and the

transition of personnel and equipment to Snow Lake, expectations

regarding the potential to reprocess Flin Flon tailings in the

future and the possible benefits of such a project, the potential

and Hudbay’s anticipated plans for advancing the mining of its

properties surrounding Constancia and elsewhere in Peru,

anticipated mine plans, anticipated metals prices and the

anticipated sensitivity of the company’s financial performance to

metals prices, events that may affect its operations and

development projects, anticipated cash flows from operations and

related liquidity requirements, the anticipated effect of external

factors on revenue, such as commodity prices, estimation of mineral

reserves and resources, mine life projections, reclamation costs,

economic outlook, government regulation of mining operations, and

business and acquisition strategies. Forward-looking information is

not, and cannot be, a guarantee of future results or events.

Forward-looking information is based on, among other things,

opinions, assumptions, estimates and analyses that, while

considered reasonable by the company at the date the

forward-looking information is provided, inherently are subject to

significant risks, uncertainties, contingencies and other factors

that may cause actual results and events to be materially different

from those expressed or implied by the forward-looking

information.

The material factors or assumptions that Hudbay

has identified and applied in drawing conclusions or making

forecasts or projections are set out in the forward-looking

information include, but are not limited to:

- Hudbay’s ability to continue to

operate safely and at full capacity despite COVID-19 related

challenges;

- the availability, global supply and

effectiveness of COVID-19 vaccines, the effective distribution of

such vaccines in the countries in which the company operates, the

lessening of restrictions related to COVID-19, and the anticipated

rate and timing for each of the foregoing;

- the ability to achieve production

and cost guidance;

- improved railcar availability in

Manitoba in the second quarter;

- no significant interruptions to

operations due to COVID-19 or social or political unrest in the

regions Hudbay operates;

- a positive preliminary economic

assessment in respect of Copper World will present opportunities to

unlock value at Rosemont;

- the successful outcome of the

Rosemont litigation;

- the ability to ramp-up the New

Britannia mill to target throughput and recoveries and achieve the

anticipated production;

- the economic prospects of

reprocessing Flin Flon tailings;

- the success of mining, processing,

exploration and development activities;

- the scheduled maintenance and

availability of Hudbay’s processing facilities;

- the accuracy of geological, mining

and metallurgical estimates;

- anticipated metals prices and the

costs of production;

- the supply and demand for metals

the company produces;

- the supply and availability of all

forms of energy and fuels at reasonable prices;

- no significant unanticipated

operational or technical difficulties;

- the execution of business and

growth strategies, including the success of the company’s strategic

investments and initiatives;

- the availability of additional

financing, if needed;

- the ability to complete project

targets on time and on budget and other events that may affect

Hudbay’s ability to develop its projects;

- the timing and receipt of various

regulatory and governmental approvals;

- the availability of personnel for

exploration, development and operational projects and ongoing

employee relations;

- maintaining good relations with the

labour unions that represent certain of Hudbay’s employees in

Manitoba and Peru;

- maintaining good relations with the

communities in which Hudbay operates, including the neighbouring

Indigenous communities and local governments;

- no significant unanticipated

challenges with stakeholders at various projects;

- no significant unanticipated events

or changes relating to regulatory, environmental, health and safety

matters;

- no contests over title to the

company’s properties, including as a result of rights or claimed

rights of Indigenous peoples or challenges to the validity of

Hudbay’s unpatented mining claims;

- the timing and possible outcome of

pending litigation and no significant unanticipated

litigation;

- certain tax matters, including, but

not limited to current tax laws and regulations, changes in

taxation policies and the refund of certain value added taxes from

the Canadian and Peruvian governments; and

- no significant and continuing

adverse changes in general economic conditions or conditions in the

financial markets (including commodity prices and foreign exchange

rates).

The risks, uncertainties, contingencies and

other factors that may cause actual results to differ materially

from those expressed or implied by the forward-looking information

may include, but are not limited to, risks associated with COVID-19

and its effect on the company’s operations, financial condition,

projects and prospects, uncertainties related to the closure of the

777 mine and the Flin Flon operations, the direct and indirect

impacts of the change in government in Peru, future uncertainty

with respect to the Peruvian mining tax regime and social unrest in

Peru, risks generally associated with the mining industry, such as

economic factors (including future commodity prices, currency

fluctuations, energy prices and general cost escalation in the

current inflationary environment), uncertainties related to the

development and operation of Hudbay’s projects, risks related to

the ongoing Rosemont litigation process and other legal challenges

that could affect Rosemont or Copper World, risks related to the

new Lalor mine plan, including the continuing ramp-up of the New

Britannia mill and the ability to convert inferred mineral resource

estimates to higher confidence categories, risks related to the

technical and economic prospects of reprocessing Flin Flon

tailings, the potential that additional financial assurance will be

required to support the updated Flin Flon closure plan, dependence

on key personnel and employee and union relations, risks related to

political or social instability, unrest or change, risks in respect

of Indigenous and community relations, rights and title claims,

operational risks and hazards, including the cost of maintaining

and upgrading the company's tailings management facilities and any

unanticipated environmental, industrial and geological events and

developments and the inability to insure against all risks, failure

of plant, equipment, processes, transportation and other

infrastructure to operate as anticipated, compliance with

government and environmental regulations, including permitting

requirements and anti-bribery legislation, depletion of Hudbay’s

reserves, volatile financial markets that may affect its ability to

obtain additional financing on acceptable terms, the failure to

obtain required approvals or clearances from government authorities

on a timely basis, uncertainties related to the geology,

continuity, grade and estimates of mineral reserves and resources,

and the potential for variations in grade and recovery rates,

uncertain costs of reclamation activities, the company’s ability to

comply with its pension and other post-retirement obligations, the

company’s ability to abide by the covenants in its debt instruments

and other material contracts, tax refunds, hedging transactions, as

well as the risks discussed under the headings “Financial Risk

Management” and “Outlook” in Hudbay’s Management’s Discussion and

Analysis for the year ended December 31, 2021 and “Risk Factors” in

Hudbay’s most recent Annual Information Form.

Should one or more risk, uncertainty,

contingency or other factor materialize or should any factor or

assumption prove incorrect, actual results could vary materially

from those expressed or implied in the forward-looking information.

Accordingly, you should not place undue reliance on forward-looking

information. Hudbay does not assume any obligation to update or

revise any forward-looking information after the date of this news

release or to explain any material difference between subsequent

actual events and any forward-looking information, except as

required by applicable law.

About Hudbay

Hudbay (TSX, NYSE: HBM) is a diversified mining

company primarily producing copper concentrate (containing copper,

gold and silver), zinc metal and silver/gold doré. Directly and

through its subsidiaries, Hudbay owns three polymetallic mines,

four ore concentrators and a zinc production facility in northern

Manitoba and Saskatchewan (Canada) and Cusco (Peru), and copper

projects in Arizona and Nevada (United States). The company’s

growth strategy is focused on the exploration, development,

operation and optimization of properties it already controls, as

well as other mineral assets it may acquire that fit its strategic

criteria. Hudbay’s mission is to create sustainable value through

the acquisition, development and operation of high-quality,

long-life deposits with exploration potential in jurisdictions that

support responsible mining, and to see the regions and communities

in which the company operates benefit from its presence. The

company is governed by the Canada Business Corporations Act and its

shares are listed under the symbol "HBM" on the Toronto Stock

Exchange, New York Stock Exchange and Bolsa de Valores de Lima.

Further information about Hudbay can be found on

www.hudbay.com.

For further information, please contact:

Candace BrûléVice President, Investor Relations(416)

814-4387candace.brule@hudbay.com

Figure 1: Constancia Norte Underground Mine

DesignAdditional inferred mineral resource estimate of 6.5

million tonnes at 1.2% copper defined in two high grade skarn

lenses (North Skarn and South Skarn) located below the open pit in

the Constancia Norte area. The planned underground access and

surface infrastructure is located entirely outside of the reserves

pit

design.https://www.globenewswire.com/NewsRoom/AttachmentNg/23ea71bf-9ab0-49fe-b6e7-a7b614ad774c

Figure 2: Copper World Continued Exploration

PotentialFurther potential exists to extend economic

mineralization within private land limits at Copper World,

including bridging the gap to the north and south of the Bolsa

deposit and extending mineralization to the south of the Copper

World deposit and to the east of the North Limb and South Limb

deposits.https://www.globenewswire.com/NewsRoom/AttachmentNg/14010b96-aabb-41e7-b3f5-4b78e76de14c

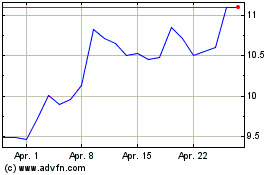

Hudbay Minerals (TSX:HBM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Hudbay Minerals (TSX:HBM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024