(CJ:TSX) Cardinal Energy Ltd. ("Cardinal" or the "Company") is

pleased to announce that its Board of Directors has approved a base

operating budget for 2019 that will focus on a sustainable

dividend, long-term operating cost reduction initiatives, debt

repayment and maintaining our production volumes at 2018 levels.

Highlights of 2019 Budget

- Operating cost reduction

initiatives targeting an 8% reduction in operating costs within

2019;

- Forecasting debt repayment of 10%

to 15% of total debt by year-end;

- Low corporate decline rate allows

for a conservative capital program to maintain production levels

which are currently curtailed by the Alberta Government; and

- As oil prices stabilize, dividend

level to be re-evaluated in April 2019.

As the Company's ability to increase production

is limited by the Government of Alberta's oil production

curtailment initiative, Cardinal's 2019 capital budget focuses on

operating cost reduction projects and proactively reducing our

environmental impact to ensure long-term sustainable development of

our properties. In addition, with production growth limited during

2019, the budget forecasts a 10% to 15% reduction in total debt by

the end of 2019. Pursuant to the Company's normal course issuer bid

announced in December 2018, Cardinal confirms that in 2019, it has

purchased and cancelled the maximum allowable of 10% of the

outstanding balance of debentures, below par redemption value,

saving approximately $0.3 million of future interest and redemption

costs.

2019 Budget

Cardinal's 2019 base budget is expected to

produce adjusted funds flow of approximately $90 to $100 million,

assuming a royalty rate of 17%, a West Texas Intermediate ("WTI")

oil price of US$55/bbl, US/CAD exchange rate of 0.76 and a

$1.47/mcf AECO natural gas price. With the Company's operating cost

reduction initiatives, Cardinal is forecasting to reduce operating

costs per boe throughout 2019 by approximately 8% comparing first

quarter to fourth quarter 2019 estimated operating expenses.

Cardinal's capital program is structured to take

advantage of our top tier low decline rate and contemplates

drilling eight wells to sustain our current level of mandated

curtailed oil production and fulfill previous drilling commitments

on our lands. Approximately 20% of our capital budget is allocated

to long-term operating costs reduction initiatives which include

reducing our electricity and facility costs. The remainder of our

$47 million capital budget is directed to well optimization,

drilling, facility upgrades and continuing the expansion of

enhanced oil recovery projects at Midale.

Our base capital program includes the drilling

of six (6.0 net) oil wells in the Company's Bantry, Alberta area to

take advantage of a land earning farm-in opportunity. Cardinal also

expects to drill two (1.5 net) wells in our Midale, Saskatchewan

area where provincially mandated production curtailments are not in

place.

The base capital program results in adjusted

funds flow net of development capital expenditures of approximately

$43 to $53 million to fund dividend payments and for debt

repayment. Cardinal's total payout ratio, which is represented by

the capital program plus dividend payments divided by adjusted

funds flow is expected to be 65%. As production growth is expected

to be limited by the Alberta oil curtailment program, production is

forecasted to average 20,400 to 20,800 boe/d for 2019.

| |

|

|

|

2019 Budget Assumptions |

|

|

|

|

|

|

| US$

WTI |

|

$55 |

|

US/CAD Exchange Rate |

|

0.76 |

| US$

WTI-WCS Basis Differential |

|

$15.50 |

|

Operating costs |

|

$20.75 - $21.25 |

|

G&A |

|

$2.25

- $2.50 |

|

|

|

|

Risk Management

During the first quarter of 2019, with

significantly narrower Canadian oil price differentials as compared

with late 2018, in order to protect the capital program and the

dividend, Cardinal has been opportunistic with its hedging

activity. For the remainder of 2019, we have hedged approximately

73% of forecasted medium oil production including 3,225 bbl/d of

Western Canadian Select ("WCS") hedged at an average price of

CAD$52 and WCS basis differential fixed on 3,500 bbl/d at an

average differential price of US$16.94/bbl which is approximately

US$27/bbl better than the average differential experienced in

December 2018. Cardinal has also protected the downside of oil

price fluctuations on approximately 40% of its light oil by hedging

the WTI on production of 3,600 bbl/d hedged at an average floor

price over CAD$70/bbl. The Company has also retained most of the

upside on WTI pricing as 62% of our WTI hedges are collared with a

ceiling average of approximately CAD$85/bbl and 38% of the light

oil hedges do not have a ceiling on the WTI price. Cardinal also

has fixed the price of 16% of its natural gas at an average AECO

price of $1.55/gj.

ARO

Cardinal has budgeted $5.0 million for

abandonments and reclamations in 2019 and has opted into an area

based program approach implemented by the Alberta Government and

plans to focus its 2019 abandonment and reclamation activities in

our Southern Alberta areas.

We are committed to the environmentally

responsible development of our resources and will continue to

manage our abandonment and reclamation obligations with a view of

long-term sustainability.

| |

|

|

|

Sensitivities |

|

|

|

|

|

|

|

Input |

|

Effect on adjusted funds flow |

| US$1

change in WTI |

|

$4.0

million |

| CAD$1

MSW basis |

|

$1.2

million |

| CAD$1

WCS basis |

|

$0.9

million |

| FX

$0.01 |

|

$2.6

million |

|

|

|

|

Outlook

With Canadian oil differentials narrowing

significantly in the first quarter of 2019, Cardinal is cautiously

optimistic about the coming year. Although not a long-term

solution, the Alberta oil curtailment program has provided a much

needed boost to Canadian oil prices in 2019. There are positive

signs within the industry with recent approvals and ongoing

projects which should help the Canadian oil and gas industry with

additional safe and reliable egress options. Cardinal has taken a

conservative approach with our 2019 budget and has locked in a

portion of our adjusted funds flow with our risk management program

which is intended to protect our capital program and dividend

payment. Our conservative budget gives us the flexibility to

increase our capital program, pay down additional debt and/or

increase our dividend if commodity prices increase.

At our budgeted simple dividend payout ratio of

approximately 15%, we are now in a position where the dividend

level allows us to strengthen the Company with projects that

improve both the short-term cash flows as well as improving the

long-term viability of the business.

As stated in our December 6, 2018 press release,

the Company's Board of Directors will review the dividend level in

April, 2019 to determine the appropriate level for the remainder of

the year.

We are excited about our operating cost

reduction initiatives which we expect will reduce our long-term

operating cost levels to ensure sustainability through a

fluctuating commodity price environment. Although growth will be

muted by the curtailment program, our 2019 budget gives us the

ability to solidify our balance sheet and set the Company up for

future growth.

We would like to thank our employees and Board

of Directors for their ongoing contributions to the success of

Cardinal and our shareholders for their support through challenging

times.

Cardinal's annual reserve results will be

released on March 5, 2019 with the financial and operating results

to be released on March 19, 2019.

Note Regarding Forward Looking

Statements

This press release contains forward-looking

statements and forward-looking information (collectively

"forward-looking information") within the meaning of applicable

securities laws relating to Cardinal's plans and other aspects of

Cardinal's anticipated future operations, management focus,

objectives, strategies, financial, operating and production

results. Forward-looking information typically uses words such as

"anticipate", "believe", "project", "expect", "goal", "plan",

"intend", "may", "would", "could" or "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement.

Specifically, this press release contains

forward-looking statements relating to our dividend policy, hedging

plans, total payout ratio, capital expenditure plans including the

2019 capital expenditure budget and the allocation thereof and

results therefrom, future operating costs, future debt repayment

and total debt, expected development capital, future average

production volumes, adjusted funds flow, adjusted funds flow net of

development capital expenditures, total payout ratio, development

capital required to maintain production, free cash flow, future

drilling, completion and optimization plans and results,

abandonment and reclamation obligations and plans, the matters set

forth under "Outlook", commodity prices and differentials,

anticipated dividend re-investment plan and stock dividend

participation, Cardinal's asset base and future prospects for

development and growth therefrom.

Forward-looking statements regarding Cardinal

are based on certain key expectations and assumptions of Cardinal

concerning anticipated financial performance, business prospects,

strategies, regulatory developments, including production

curtailments, current and future commodity prices and exchange

rates, applicable royalty rates, tax laws, future well production

rates and reserve volumes, future operating costs, the performance

of existing and future wells, the success of its exploration and

development activities, the sufficiency and timing of budgeted

capital expenditures in carrying out planned activities, the

availability and cost of labor and services, the impact of

increasing competition, conditions in general economic and

financial markets, availability of drilling and related equipment,

effects of regulation by governmental agencies, the ability to

obtain financing on acceptable terms which are subject to change

based on commodity prices, market conditions, drilling success and

potential timing delays.

These forward-looking statements are subject to

numerous risks and uncertainties, certain of which are beyond

Cardinal's control. Such risks and uncertainties include, without

limitation: the impact of general economic conditions; volatility

in market prices for crude oil and natural gas; industry

conditions; currency fluctuations; imprecision of reserve

estimates; liabilities inherent in crude oil and natural gas

operations; environmental risks; incorrect assessments of the value

of acquisitions including the Acquisition and exploration and

development programs; competition from other producers; the lack of

availability of qualified personnel, drilling rigs or other

services; changes in income tax laws or changes in royalty rates

and incentive programs relating to the oil and gas industry;

hazards such as fire, explosion, blowouts, and spills, each of

which could result in substantial damage to wells, production

facilities, other property and the environment or in personal

injury; and ability to access sufficient capital from internal and

external sources.

Management has included the forward-looking

statements above and a summary of assumptions and risks related to

forward-looking statements provided in this press release in order

to provide readers with a more complete perspective on Cardinal's

future operations and such information may not be appropriate for

other purposes. Cardinal's actual results, performance or

achievement could differ materially from those expressed in, or

implied by, these forward-looking statements and, accordingly, no

assurance can be given that any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of

them do so, what benefits that Cardinal will derive there from.

Readers are cautioned that the foregoing lists of factors are not

exhaustive. These forward-looking statements are made as of the

date of this press release and Cardinal disclaims any intent or

obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

This press release contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about our prospective results of operations,

cash flows, payout ratios and components thereof, all of which are

subject to the same assumptions, risk factors, limitations, and

qualifications as set forth in the above paragraphs. FOFI contained

in this press release were made as of the date hereof and is

provided for the purpose of describing our anticipated future

business operations. We disclaim any intention or obligation to

update or revise any FOFI contained in this press release, whether

as a result of new information, future events or otherwise, unless

required pursuant to applicable law. Readers are cautioned that the

FOFI contained in this press release should not be used for

purposes other than for which it is disclosed herein.

Advisory Regarding Oil and Gas

Information

Where applicable, oil equivalent amounts have

been calculated using a conversion rate of six thousand cubic feet

of natural gas to one barrel of oil. Boes may be misleading,

particularly if used in isolation. A boe conversion ratio of six

thousand cubic feet of natural gas to one barrel of oil is based on

an energy equivalency conversion method primarily applicable at the

burner tip and does not represent a value equivalency at the

wellhead. Utilizing a conversion ratio at 6 Mcf: 1 Bbl may be

misleading as an indication of value.

Non-GAAP measures

This press release contains the terms

"development capital expenditures", "adjusted funds flow",

"adjusted funds flow per share", "total payout ratio", "net bank

debt" and "net bank debt to adjusted funds flow" which do not have

a standardized meaning prescribed by International Financial

Reporting Standards ("IFRS" or, alternatively, "GAAP") and

therefore may not be comparable with the calculation of similar

measures by other companies. Cardinal uses adjusted funds flow,

free cash flow and total payout ratio to analyze operating

performance. Cardinal feels these benchmarks are key measures of

profitability and overall sustainability for the Company. Adjusted

funds flow is not intended to represent operating profits nor

should it be viewed as an alternative to cash flow provided by

operating activities, net earnings or other measures of performance

calculated in accordance with GAAP. Adjusted funds flow is

calculated as cash flow from operating activities adjusted for

changes in non-cash working capital and decommissioning

expenditures. "Development capital expenditures" represent

expenditures on property, plant and equipment (excluding corporate

and other assets and acquisitions) to maintain and grow the

Company's base production. "Total payout ratio" represents the

ratio of the sum of dividends declared plus development capital

expenditures divided by adjusted funds flow. Total payout ratio is

a key measure to assess our ability to finance operating

activities, capital expenditures and dividends.

About Cardinal Energy Ltd.

Cardinal is a junior Canadian oil focused

company built to provide investors with a stable platform for

dividend income and growth. Cardinal's operations are focused in

low decline light and medium quality oil in Alberta and

Saskatchewan.

For further information:M.

Scott Ratushny, CEO or Shawn Van Spankeren, CFO or Laurence Broos,

VP FinanceEmail: info@cardinalenergy.caPhone: (403)

234-8681Website: www.cardinalenergy.caAddress: 600, 400 – 3rd

Avenue SW, Calgary, AB, T2P 4H2

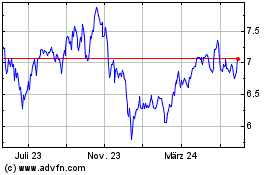

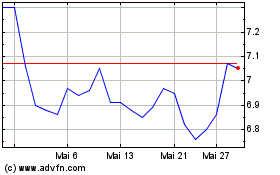

Cardinal Energy (TSX:CJ)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Cardinal Energy (TSX:CJ)

Historical Stock Chart

Von Nov 2023 bis Nov 2024