Black Iron Ranked by CRU as the Lowest Cost Pellet Feed Iron Ore Development Project

02 Mai 2018 - 1:30PM

Black Iron Inc. (“Black Iron” or the “Company”) (TSX:BKI)

(OTC:BKIRF) (FRANKFURT:BIN) is pleased to announce the positive

results of a study commissioned by Black Iron to determine the

Company’s position on the global business cost curve and capital

intensity in the context of new development iron ore projects. CRU

Group (“CRU”), an internationally recognised top global business

intelligence provider and consultancy specializing in commodities,

was commissioned to complete this study. Some of the main

conclusions from this study are:

- Black Iron’s Shymanivske project (the “Project” or

“Shymanivske”) is ranked in the lowest position of the business

cost curve for pellet feed projects currently under development;

and

- the Project’s capital intensity (i.e. construction capital

divided by annual production) of only $95/ tonne, ranked second

lowest out of the projects in CRU’s extensive database.

CRU’s independent study shows that Black Iron’s

projected operating and construction capital costs coupled with the

high-quality product expected to be produced by Black Iron position

the Company well in the global iron ore market. As seen in

the figure below, Black Iron is very strongly positioned on the

pellet feed project business cost curve at the bottom of the first

quartile. Business costs include site costs (i.e. FOB

operating costs) plus freight, marketing, finance, value in use

adjustment and sustaining capital. The site costs for the

Project of $31/ tonne were taken from the Company’s National

Instrument 43-101 Technical Report entitled “Preliminary Economic

Assessment of the Re-scoped Shymanivske Iron Ore Deposit” effective

November 21, 2017 (the “PEA”), with other components calculated and

estimated by CRU to ensure consistency across all assets included

in the curve. Please see the Company’s press release

dated November 21, 2017 for a summary of the assumptions used in

the PEA.

Pellet feed market

report: http://resource.globenewswire.com/Resource/Download/304d817e-9617-4264-bfb8-c4344282255c

The Project is located Kryvyi Rih, Ukraine, a

highly developed iron ore mining region with well-established

infrastructure. The Company’s proximity and access to major

infrastructure including paved roads, railway, powerlines and port

as well as highly skilled low-cost labour force allow for a phased

development approach at significantly reduced initial capital

requirements. As seen in the figure above, Shymanivske’s

capital intensity of US$95/tonne places the Project as one of the

lowest, based on this cost definition, within CRU’s extensive data

base of projects considered. Again, this factor supports the

highly desirable nature of the Project and the top positioning of

Black Iron as compared to other iron ore projects currently under

development.

Matt Simpson, Black Iron’s CEO, commented: “The

CRU Group study confirms the feedback we have received from the

steel industry following the release of our PEA in November 2017.

The Shymanivske project has a very attractive cost structure

and an expected ideal product quality to meet future requirements

of the global steel industry who are facing increasingly stringent

environmental regulation. We are seeing strong interest from around

the world in our project.”

Cautionary Statement

The PEA is preliminary in nature, and it

includes inferred mineral resources that are considered too

speculative geologically to have the economic considerations

applied to them that would enable them to be categorized as mineral

reserves. There is no certainty that the PEA will be realized.

About Black IronBlack Iron is

an iron ore exploration and development company, advancing its 100%

owned Shymanivske project located in Kryvyi Rih, Ukraine. The

Shymanivske project contains a NI 43-101 compliant resource

estimated to be 646 Mt Measured and Indicated mineral resources,

consisting of 355 Mt Measured mineral resources grading 31.6% total

iron and 18.8% magnetic iron, and Indicated mineral resources of

290 Mt grading 31.1% total iron and 17.9% magnetic iron, using a

cut-off grade of 10% magnetic iron. Additionally, the Shymanivske

project contains 188 Mt of Inferred mineral resources grading 30.1%

total iron and 18.4% magnetic iron. Full mineral resource details

can be found in the NI 43-101 compliant technical report entitled

“Preliminary Economic Assessment of the Re-scoped Shymanivske Iron

Ore Deposit” effective November 21, 2017 under the Company's

profile on SEDAR at www.sedar.com. The Shymanivske project is

surrounded by five other operating mines, including ArcelorMittal's

iron ore complex. Please visit the Company's website at

www.blackiron.com for more information.

The technical and scientific contents of this

press release have been prepared under the supervision of and have

been reviewed and approved by Matt Simpson, P.Eng., CEO of Black

Iron, who is a Qualified Person as defined by NI 43-101.

For more information, please contact:

Matt SimpsonChief Executive

OfficerTel: +1 (416) 309-2138 info@blackiron.com

Forward-Looking InformationThis

press release contains forward-looking information. Forward-looking

information is based on what management believes to be reasonable

assumptions, opinions and estimates of the date such statements are

made based on information available to them at that time, including

those factors discussed in the section entitled ‘‘Risk Factors’’ in

the Company’s annual information form for the year ended December

31, 2017 or as may be identified in the Company’s public disclosure

from time to time, as filed under the Company’s profile on SEDAR at

www.sedar.com. Forward-looking information may include, but

is not limited to, statements with respect to the Project, the

accuracy of the findings of CRU’s study, the mineralization

of the Project, the results of the PEA, the realization of the PEA,

the expectations of future cash flows, the expected economics

forecast, the geo-political climate in Ukraine, the Company’s

ability to obtain the requisite land rights for the Project and

other requisite permits or approvals, and future plans for the

Company’s development. Generally, forward looking information can

be identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking information is subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

the Company to be materially different from those expressed or

implied by such forward-looking information, including but not

limited to: general business, economic, competitive, geopolitical

and social uncertainties; the actual results of current exploration

activities; other risks of the mining industry and the risks

described in the annual information form of the Company. Although

the Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward looking information. The Company

does not undertake to update any forward-looking information,

except in accordance with applicable securities laws.

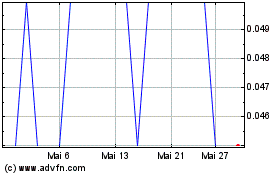

Black Iron (TSX:BKI)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

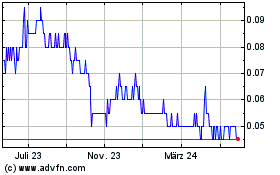

Black Iron (TSX:BKI)

Historical Stock Chart

Von Nov 2023 bis Nov 2024