Allied Properties Real Estate Investment Trust (“Allied”) (TSX:

“AP.UN”) today announced that it has entered into an agreement to

sell its network-dense, carrier-neutral, urban-data-centre (UDC)

portfolio in Downtown Toronto (the “Portfolio”) to KDDI Corporation

(“KDDI”) for $1.35 billion, $118 million above IFRS net asset

value.

The Portfolio is comprised of freehold interests

in 151 Front Street West (“151 Front”) and 905 King Street West

(“905 King”) and a leasehold interest in 250 Front Street West

(“250 Front”). Allied has connected the properties through

high-count, diverse fibre, enabling the Portfolio to support more

telecommunication, cloud and content networks than any other

data-centre portfolio in Canada. The Portfolio is unencumbered and

does not include 20 York Street and Skywalk, the 2.5-acre site for

Union Centre that is now zoned for just over 1.3 million square

feet of urban workspace.

KDDI is a Japanese telecommunications provider

and Fortune Global 500 company that owns and operates data-centres

in Asia, Europe and the United States through its subsidiary,

Telehouse. As a carrier-neutral data-centre provider, Telehouse

hosts more than 1,000 connectivity partners, including leading

internet exchanges, Tier 1 carriers, major mobile, cloud and

content providers, as well as enterprise and financial services

companies.

“With global data-centre operating capability,

KDDI is an ideal successor owner-operator for our UDC portfolio,”

said Michael Emory, Allied’s Founder and Executive Chair. “We’ll

work closely with KDDI over the next 18 months to transition local

expertise in relation to the portfolio. We’ll also work

collaboratively with KDDI as the site for Union Centre continues to

evolve toward the large-scale development of urban workspace in the

coming decade.”

The Sale

Allied acquired 151 Front in 2009 and has driven

significant earnings and value growth since then, both organically

and through the addition of 905 King and 250 Front. Over the past

five years, Allied has successfully propelled the Portfolio toward

earnings and value optimization.

Allied explored a variety of monetization

alternatives for the Portfolio through Scotiabank in the second

half of last year and determined that the best course of action

financially and operationally was to sell the Portfolio in its

entirety. As announced on January 16 of this year, Allied initiated

a comprehensive sale process through Scotiabank and CBRE Limited

(“CBRE”) as exclusive selling agents. Scotiabank and CBRE contacted

97 potential buyers worldwide and conducted a multi-round process

that culminated in final bids on June 2.

Use of Proceeds

The sale is expected to close before the end of

the third quarter this year, subject only to Competition Act

approval and customary closing conditions. The sale proceeds will

be payable in cash. Allied will use approximately $1 billion of the

proceeds to retire debt and the balance to fund its upgrade and

development activity over the remainder of 2023 and into 2024.

The sale will result in a significant increase

in taxable income for fiscal 2023, requiring Allied to declare and

pay a special distribution to all Unitholders of record as at

December 31, 2023. Allied will determine how best to make the

special distribution as the year unfolds.

Reaffirmation of Mission

Allied is first, foremost and above all an

owner-operator of distinctive urban workspace in Canada’s major

cities. Allied’s mission is to serve knowledge-based organizations

ever more successfully over time. The sale of the Portfolio will

enable Allied to reaffirm its mission and to pursue continued

growth in NOI and IFRS value in a more focused and prudent

manner.

Over the past two decades, Allied assembled the

largest and most concentrated portfolio of economically-productive,

underutilized urban land in Canada, one that affords extraordinary

mixed-use intensification potential in major cities going forward.

Allied believes deeply in the continued success of Canadian cities

and has the operating platform and the breadth of funding

relationships necessary to drive value in the coming years and

decades for the benefit of its constituents.

“As a public real estate entity committed to

distributing a large portion of free cash flow regularly, we’ve

funded growth primarily through equity issuance,” said Mr. Emory.

“The sale proceeds will enable us to fund near-term growth,

primarily in the form of upgrade and development completions, while

maintaining unprecedented levels of liquidity and targeted

debt-metrics. In the longer-term, we plan to take advantage of a

broader range of funding opportunities than we have in the past.

Regardless of how we fund growth going forward, we’ll remain fully

committed to our distribution program.”

Commitment to the Balance

Sheet

Allied has demonstrated commitment to the

balance sheet over its life as a public real estate entity. Allied

utilized its balance sheet flexibility in the past three years to

fund upgrade and development activity and to take advantage of

strategic in-fill acquisition opportunities that would not have

arisen in a stable economic environment, pushing its debt-metrics

to the high end of Management’s target ranges.

On completion of the sale and utilization of

approximately $1 billion of the proceeds to retire indebtedness,

Allied expects the following at the end of the fourth quarter of

this year:

(i) that its total indebtedness

ratio will be approximately 32.7%;

(ii) that its net debt as a multiple

of Annualized Adjusted EBITDA will be approximately 8.0x; and

(iii) that its interest-coverage

ratio will be approximately 3.0x.

Allied also expects that its net debt as a

multiple of Annualized Adjusted EBITDA will decline steadily over

the next three years as the large-scale developments in its

pipeline are completed.

“Our debt-metrics will be back within targeted

ranges and will continue to improve as our upgrade and development

activity drives EBITDA growth,” said Cecilia Williams, Allied’s

President and Chief Executive Officer. “The transaction will also

be accretive to FFO and AFFO per unit, as the interest savings will

more than offset the decline in NOI resulting from the sale of the

portfolio.”

Advisors

Scotiabank, CBRE and Aird & Berlis LLP are

acting as advisors to Allied in connection with the

transaction.

BofA Securities, Borden Ladner Gervais LLP and

Nishimura & Asahi are acting as advisors to KDDI in connection

with the transaction.

Cautionary Statements

NOI, total indebtedness ratio, net debt as a

multiple of Annualized Adjusted EBITDA, interest-coverage ratio,

FFO and AFFO are not financial measures defined by International

Financial Reporting Standards (“IFRS”). Non-IFRS measures do not

have any standardized meaning prescribed under IFRS, and therefore,

may not be comparable to similarly titled measures presented by

other publicly traded entities, and should not be construed as

alternatives to net income or cash flow from operating activities

calculated in accordance with IFRS. Refer to the Non-IFRS Measures

section in Allied’s most recent MD&A for an explanation of the

non-IFRS measures used in this press release, their usefulness for

readers in assessing Allied’s performance and their reconciliation

to financial measures defined by IFRS as presented in Allied’s most

recent financial statements. Such explanation is incorporated by

reference herein. These statements, together with accompanying

notes and MD&A, have been filed on SEDAR, www.sedar.com, and

are also available on Allied’s website, www.alliedreit.com.

This press release may contain forward-looking

statements with respect to (i) Allied, (ii) its operations,

strategy, financial performance and condition and (iii) the closing

and expected impact of the transactions contemplated in this press

release. These statements generally can be identified by use of

forward-looking words such as “may”, “will”, “expect”, “estimate”,

“anticipate”, “intends”, “believe” or “continue” or the negative

thereof or similar variations. The actual results and performance

of Allied discussed herein could differ materially from those

expressed or implied by such statements. Such statements are

qualified in their entirety by the inherent risks and uncertainties

surrounding future expectations, including that the transactions

contemplated herein are completed and have the expected impact on

funding and earnings. Important factors that could cause actual

results to differ materially from expectations include, among other

things, general economic and market conditions, competition,

changes in government regulations and the factors described under

“Risk Factors” in Allied’s Annual Information Form, which is

available at www.sedar.com. These cautionary statements qualify all

forward-looking statements attributable to Allied and persons

acting on Allied’s behalf. Unless otherwise stated, all

forward-looking statements speak only as of the date of this press

release and Allied has no obligation to update such statements.

About Allied

Allied is a leading owner-operator of

distinctive urban workspace in Canada’s major cities. Allied’s

mission is to provide knowledge-based organizations with workspace

that is sustainable and conducive to human wellness, creativity,

connectivity and diversity. Allied’s vision is to make a continuous

contribution to cities and culture that elevates and inspires the

humanity in all people.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

Michael EmoryFounder and Executive Chair(416)

977-9002memory@alliedreit.com

Cecilia WilliamsPresident and Chief Executive Officer(416)

977-9002cwilliams@alliedreit.com

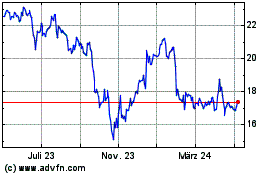

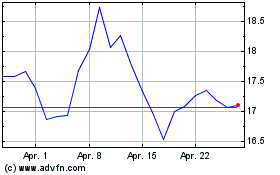

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024