(all numbers in this release are in Canadian dollars (CDN$) unless

otherwise noted) Alaris Equity Partners Income Trust (the

“Trust”) (TSX: AD.UN) is pleased to announce that

its subsidiary, Alaris Equity Partners USA, Inc. (collectively with

the Trust and its other subsidiaries,

“Alaris”)

has made an investment of US$59.5 million (the

“TSY

Investment”) into The Shipyard, LLC.

(

“TSY” or

“The Shipyard”), with a

commitment to fund an additional US$5.5 million (

“Tranche

2”) if TSY achieves certain financial hurdles.

“We’re very excited to be partnering with the

founders and management of The Shipyard. The Shipyard team has

built a wonderful company that has exhibited the ability to

generate steady free cashflow and high growth without any material

debt or capital expenditure requirements. The most important part

of our investment, though, is the people. From top to bottom,

founder and CEO Rick Milenthal has built a culture of trust and

integrity that we feel will result in a tremendous long-term

partnership for Alaris,” said Steve King, President and Chief

Executive Officer, Alaris.

“The Alaris model of investment is perfect for a

growing successful company like The Shipyard. They back our team

and fuel our growth, fully empowering our management team to do

what is best for our people and our clients,” said Rick Milenthal,

Chief Executive Officer, The Shipyard

TSY Investment

The TSY Investment consists of: (i) US$42.5

million (the “TSY Preferred Contribution”) of

preferred equity, entitling Alaris to an initial annualized

distribution of US$5.95 million (the “TSY

Distribution”); and (ii) US$17.0 million (the “TSY

Common Equity”) for a minority common equity ownership in

The Shipyard. The TSY Distribution is equivalent to a pre-tax yield

of 14% in the first full year after the TSY Contribution. The

Shipyard can elect to defer a portion of the TSY Distribution for

up to 3% (US$1.28 million in the first full year) of the TSY

Preferred Contribution with any such deferred distributions

compounding at the current yield of the TSY Distribution. If The

Shipyard achieves the financial hurdles, Tranche 2 will consist

entirely of additional US$5.5 million of preferred equity and will

have the same initial yield and rights as the initial TSY

Investment.

Commencing on January 1, 2025, the TSY

Distribution will be adjusted annually based on the percentage

change in net revenue over the most recently completed 12-month

period versus the prior 12-month period, subject to a collar of

7%.

Alaris’ management believes that The Shipyard

will have an earnings coverage ratio between 1.2x and 1.5x, based

on: (i) Alaris' review of TSY’s internal pro forma financial

results for the most recent trailing twelve-month period in 2023,

(ii) certain other changes to TSY’s capital structure and (iii) the

TSY Distribution payable to Alaris. Proceeds of the TSY Investment

were used to provide a partial liquidity event to equity

holders.

About The Shipyard

Founded in 2013 and headquartered in Columbus, OH,

The Shipyard is an integrated marketing agency renowned for

“Engineering Brand Love” by uniquely combining data science with

integrated media, creative, and analytical processes. The skilled

employee base of over 160 marketing professionals goal is to

discover and engage all relevant audience segments via omnichannel

marketing campaigns, driving marketing outcomes and accelerating

brand growth. The Company's audience discovery approach, “No

Customer Left Behind”, is supported by a proprietary data

intelligence engine, The Helm, combined with a full-suite of end

to-end, agency of record marketing solutions to drive measurable

and sustainable results for brands. The Shipyard has developed

vertical expertise across highly attractive verticals, including

Travel & Tourism, Financial & Professional Services, Energy

& Sustainability, and Consumer Packaged Goods/Retail, with

significant runway and ongoing initiatives to further penetrate

each.

ABOUT ALARIS:

The Trust, through its subsidiaries, indirectly

provides alternative financing to private companies

("Partners") in exchange for distributions with

the principal objective of generating stable and predictable cash

flows for payment of distributions to unitholders of the Trust.

Distributions from the Partners are adjusted each year based on the

percentage change of a "top line" financial performance measure

such as gross margin and same-store sales and rank in priority to

the owners' common equity position.

NON-IFRS MEASURES:

Earnings Coverage Ratio refers

to the Normalized EBITDA of a Partner divided by such Partner’s sum

of debt servicing (interest and principal), unfunded capital

expenditures and distributions to Alaris. Management believes the

earnings coverage ratio is a useful metric in assessing our

partners continued ability to make their contracted

distributions.

Normalized EBITDA refers to

EBITDA excluding items that are non-recurring in nature and is

calculated by adjusting for non-recurring expenses and gains to

EBITDA. Management deems non-recurring charges to be unusual and/or

infrequent charges that our Partners incur outside of its common

day-to-day operations.

EBITDA refers to earnings

determined in accordance with IFRS, before depreciation and

amortization, net of gain or loss on disposal of capital assets,

interest expense and income tax expense. EBITDA is used by

management and many investors to determine the ability of an issuer

to generate cash from operations.

The terms Run Rate Payout Ratio, Earnings

Coverage Ratio, Normalized EBITDA and EBITDA (the "Non-IFRS

Measure") are not standard measures under IFRS. Alaris' calculation

of the Non-IFRS Measure may differ from those of other issuers and,

therefore, should only be used in conjunction with the Trust’s

annual audited and unaudited interim financial statements, which

are available under the Trust's (and its predecessor's) profile on

SEDAR at www.sedar.com.

FORWARD LOOKING STATEMENTS

This news release contains forward-looking

information, including within the meaning of "safe harbour"

provisions under applicable securities laws (“forward-looking

statements”). Statements other than statements of historical fact

contained in this news release may be forward-looking statements,

including, without limitation, management's expectations,

intentions and beliefs concerning: the financial impact of the TSY

Investment, including the TSY Distribution and adjustments thereto

and the impact on Alaris’ revenue and net cash from operating

activities; TSY’s Earnings Coverage Ratio; and the impact of the

TSY Investment thereon; and the timing and impact of Tranche 2.

Many of these statements can be identified by words such as

"believe", "expects", "will", "intends", "projects", "anticipates",

"estimates", "continues" or similar words or the negative thereof.

Any forward-looking statements which constitute a financial outlook

or future-oriented financial information (including the impact on

revenues, net cash from operating activities and Run Rate Payout

Ratio) were approved by management as of the date hereof and have

been included to explain Alaris' financial performance and are

subject to the same risks and assumptions disclosed above. There

can be no assurance that the plans, intentions or expectations on

which these forward-looking statements are based will occur.

By their nature, forward-looking statements

require Alaris to make assumptions and are subject to inherent

risks and uncertainties. Assumptions about the performance of the

Canadian and U.S. economies over the next 24 months and how that

will affect Alaris’ business and that of its Partners are material

factors considered by Alaris management when setting the outlook

for Alaris. Key assumptions include, but are not limited to,

assumptions that: interest rates will not rise in a matter

materially different from the prevailing market expectations over

the next 12 to 24 months; the businesses of the majority of our

Partners will continue to grow; the businesses of new Partners and

those of existing partners will perform in line with Alaris’

expectations and diligence; more private companies will require

access to alternative sources of capital and that Alaris will have

the ability to raise required equity and/or debt financing on

acceptable terms. Management of Alaris has also assumed that the

Canadian and U.S. dollar trading pair will remain in a range of

approximately plus or minus 15% of the current rate over the next 6

months. In determining expectations for economic growth, management

of Alaris primarily considers historical economic data provided by

the Canadian and U.S. governments and their agencies as well as

prevailing economic conditions at the time of such

determinations.

Forward-looking statements are subject to risks,

uncertainties and assumptions and should not be read as guarantees

or assurances of future performance. The actual results of the

Trust and the Partners could materially differ from those

anticipated in the forward-looking statements contained herein as a

result of certain risk factors, including, but not limited to: the

ability of our Partners and, correspondingly, Alaris to meet

performance expectations for 2023; any change in the senior lenders

under the Facility’s outlook for Alaris’ business; management's

ability to assess and mitigate the impacts of any local, regional,

national or international health crises like COVID-19; the

dependence of Alaris on the Partners; reliance on key personnel;

general economic conditions in Canada, North America and globally;

failure to complete or realize the anticipated benefit of Alaris’

financing arrangements with the Partners; a failure of the Trust or

any Partners to obtain required regulatory approvals on a timely

basis or at all; changes in legislation and regulations and the

interpretations thereof; risks relating to the Partners and their

businesses, including, without limitation, a material change in the

operations of a Partner or the industries they operate in;

inability to close additional Partner contributions in a timely

fashion, or at all; a change in the ability of the Partners to

continue to pay Alaris’ distributions; a change in the unaudited

information provided to the Trust; a failure of a Partner (or

Partners) to realize on their anticipated growth strategies; a

failure to achieve the expected benefits of the third-party asset

management strategy or similar new investment structures and

strategies; a failure to achieve resolutions for outstanding issues

with Partners on terms materially in line with management’s

expectations or at all; and a failure to realize the benefits of

any concessions or relief measures provided by Alaris to any

Partner or to successfully execute an exit strategy for a Partner

where desired. Additional risks that may cause actual results to

vary from those indicated are discussed under the heading "Risk

Factors" and "Forward Looking Statements" in the Trust’s Management

Discussion and Analysis for the year ended December 31, 2021, which

is filed under the Trust’s profile at www.sedar.com and on its

website at www.alarisequitypartners.com.

This news release contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about increases to the Trust's net operating

cash per flow per unit and liquidity, each of which are subject to

the same assumptions, risk factors, limitations, and qualifications

as set forth above. Readers are cautioned that the assumptions used

in the preparation of such information, although considered

reasonable at the time of preparation, may prove to be imprecise

and, as such, undue reliance should not be placed on FOFI and

forward-looking statements. Alaris' actual results, performance or

achievement could differ materially from those expressed in, or

implied by, these forward-looking statements and FOFI, or if any of

them do so, what benefits the Trust will derive therefrom. The

Trust has included the forward-looking statements and FOFI in order

to provide readers with a more complete perspective on Alaris’

future operations and such information may not be appropriate for

other purposes. Alaris disclaims any intention or obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by law.

Readers are cautioned not to place undue

reliance on any forward-looking information contained in this news

release as a number of factors could cause actual future results,

conditions, actions or events to differ materially from the

targets, expectations, estimates or intentions expressed in the

forward-looking statements. Statements containing forward-looking

information reflect management’s current beliefs and assumptions

based on information in its possession on the date of this news

release. Although management believes that the assumptions

reflected in the forward-looking statements contained herein are

reasonable, there can be no assurance that such expectations will

prove to be correct.

The forward-looking statements contained herein

are expressly qualified in their entirety by this cautionary

statement. The forward-looking statements included in this news

release are made as of the date of this news release and Alaris

does not undertake or assume any obligation to update or revise

such statements to reflect new events or circumstances except as

expressly required by applicable securities legislation.

Neither the TSX nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX) accepts responsibility for the adequacy or accuracy of this

release.

For further information please

contact:

ir@alarisequity.comP: (403) 260-1457Alaris Equity

Partners Income TrustSuite 250, 333 24th Avenue S.W.Calgary,

Alberta T2S 3E6www.alarisequitypartners.com

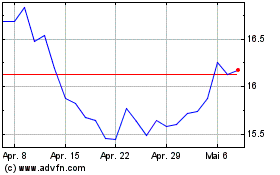

Alaris Equity Partners I... (TSX:AD.UN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Alaris Equity Partners I... (TSX:AD.UN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024