Current Report Filing (8-k)

31 März 2023 - 12:11PM

Edgar (US Regulatory)

0001091907

false

0001091907

2023-03-29

2023-03-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 29, 2023

World Wrestling Entertainment, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-16131 |

|

04-2693383 |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of incorporation) |

|

|

|

Identification No.) |

| 1241 East Main Street, Stamford, CT |

|

06902 |

| (Address of principal executive offices) |

|

(Zip code) |

Registrant’s telephone number, including area

code: (203) 352-8600

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2.):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A Common Stock, par value $0.01 per share |

|

WWE |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR

§240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

On March 28, 2023,

in connection with Nick Khan’s transition to being the sole Chief Executive Officer of the Company following the departure of Stephanie

McMahon, and the appointment of Vincent McMahon as the Company’s Executive Chairman, the Compensation & Human Capital Committee

(the “Committee”) of World Wrestling Entertainment, Inc. (the “Company”) approved an amendment to

Mr. Khan’s employment agreement with the Company and a new employment agreement with Mr. McMahon following a review

of market data with the input of its independent compensation consultant and legal counsel.

Mr.

Khan entered into an employment agreement amendment with the Company, effective as of March 29, 2023 (the “Khan Amendment”),

pursuant to which, retroactive to January 10, 2023 (the date Mr. Khan was appointed the sole Chief Executive Officer of the Company),

Mr. Khan’s (i) annual base salary increased from $1.35 million to $1.5 million; (ii) annual target bonus opportunity (as a percentage

of annual base salary) increased from 160% to 175%; and (iii) annual equity grant date target value increased from $3.575 million to $5.375

million, subject to performance metrics and vesting periods (as determined by the Committee). These changes are being made in connection

with certain changes to narrow the definition of “change of control” and “good reason” in Mr. Khan’s employment

agreement.

Mr. McMahon entered

into an employment agreement with the Company, effective as of March 29, 2023 (the “McMahon Employment Agreement”),

pursuant to which, retroactive to January 9, 2023 (the date Mr. McMahon was appointed Executive Chairman of the Company), he will continue

to serve as Executive Chairman for a term of two years from his start date of January 9, 2023, subject to automatic extension for additional

one-year terms thereafter unless either the Company or Mr. McMahon provides at least 180 days’ notice of non-renewal. The McMahon

Employment Agreement provides that Mr. McMahon will receive (i) an annual base salary of $1.2 million, (ii) an annual target bonus opportunity

(as a percentage of annual base salary) of 175% and (iii) an annual equity grant date target value set at $4.3 million, subject to performance

metrics and vesting periods (as determined by the Committee). In the event the Company terminates his employment without “cause”

(as defined in McMahon Employment Agreement) or he terminates his employment for “good reason” (as defined in the McMahon

Employment Agreement), Mr. McMahon will be eligible to receive as severance (a) base salary continuation through the end of the term (or,

if longer, for one year), (b) a prorated portion of the annual bonus based on target performance for the year in which the termination

occurs and (c) health and welfare continuation through the end of the term in accordance with the Company’s severance policy. In

the event such a termination occurs within the two-year period following a “change in control” (as defined in the McMahon

Employment Agreement), Mr. McMahon will instead be eligible to receive (1) a lump sum cash payment equal to two times Mr. McMahon’s

then-current base salary, (2) a lump sum cash payment equal to two times Mr. McMahon’s annual bonus based on target performance,

(3) a prorated portion of the annual bonus based on target performance for the year in which the termination occurs, (4) full accelerated

vesting of Mr. McMahon’s unvested equity awards (with the payout of performance-based awards determined based on target-level achievement)

and (5) health and welfare continuation for the twenty-four month period following the termination.

As disclosed in our

annual proxy statements, the annual target bonus opportunity is a target opportunity only and the actual bonus paid may be above or below

such amount based on, among other factors, the Company’s performance taking into account performance metrics established by the

Committee. For annual equity grants, the Company’s current practice is to value grants at an average of the closing price of the

Company’s Class A Common Stock on the New York Stock Exchange over the thirty trading days immediately preceding the grant date;

however, the 2023 grants for Messrs. Khan and McMahon are instead valued over the thirty trading days immediately preceding February 7,

2023 (the date on which 2023 annual equity awards were granted to our other named executive officers).

The foregoing descriptions of the Khan Amendment and the McMahon Employment Agreement are qualified in its entirety by reference

to the complete text of the Khan Amendment and the McMahon Employment Agreement, as applicable, copies of which are attached as

Exhibits 10.1 and 10.2 to this Current Report on Form 8-K and incorporated herein by reference. Further

information about the Company’s executive compensation plans and programs, including the incentive plan, is included in the

Company’s proxy statements.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

WORLD WRESTLING ENTERTAINMENT, INC. |

|

| |

|

|

|

| Dated: March 30, 2023 |

By: |

/s/ Maurice Edelson |

|

| |

|

Maurice Edelson |

|

| |

|

Executive Vice President, Chief Legal Officer |

|

World Wrestling Entertai... (NYSE:WWE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

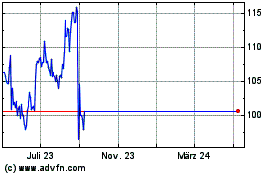

World Wrestling Entertai... (NYSE:WWE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024