Form 424B2 - Prospectus [Rule 424(b)(2)]

15 April 2024 - 11:21PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(2)

Registration No. 333-269514

Pricing Supplement No. 9 dated April 15, 2024

(to Prospectus Supplement dated February 17, 2023

and Prospectus dated February 17, 2023)

WELLS FARGO & COMPANY

Medium-Term Notes, Series W

Senior Redeemable Floating Rate Notes

You should read the more detailed description of the notes provided under “Description of Notes” in the accompanying

prospectus supplement and “Description of Debt Securities” in the accompanying prospectus, as supplemented by this pricing supplement. The notes are unsecured obligations of Wells Fargo & Company (the “Company”),

and all payments on the notes are subject to the credit risk of the Company. If the Company defaults on its obligations, you could lose some or all of your investment. The notes are not savings accounts, deposits or other obligations of any bank or

nonbank subsidiary of the Company and are not insured by the Federal Deposit Insurance Corporation, the Deposit Insurance Fund or any other governmental agency. Certain defined terms used but not defined herein have the meanings set forth in the

accompanying prospectus supplement and prospectus.

|

|

|

| Aggregate Principal Amount

Offered: |

|

$1,000,000,000 |

|

|

| Trade Date: |

|

April 15, 2024 |

|

|

| Original Issue Date: |

|

April 22, 2024 (T+5) |

|

|

| Stated Maturity Date: |

|

April 22, 2028; on the stated maturity date, the holders of the notes will be entitled to receive a cash payment in

U.S. dollars equal to 100% of the principal amount of the notes plus any accrued and unpaid interest. |

|

|

| Price to Public (Issue Price): |

|

100.00%, plus accrued interest, if any, from April 22, 2024 |

|

|

| Agent Discount

(Gross Spread): |

|

0.25% |

|

|

| All-in Price (Net of

Agent Discount): |

|

99.75%, plus accrued interest, if any, from April 22, 2024 |

|

|

| Net Proceeds: |

|

$997,500,000 |

|

|

| Base Rate: |

|

Compounded SOFR |

|

|

| Spread: |

|

+107 basis points |

|

|

| Minimum Interest Rate for

an Interest Period: |

|

0% per annum |

|

|

| Interest Payment Dates: |

|

Each January 22, April 22, July 22 and October 22, commencing July 22, 2024, and at

maturity. |

|

|

|

|

|

|

|

| Calculation Agent: |

|

References to the Calculation Agent shall mean Wells Fargo Securities, LLC, an affiliate of the Company, acting

in its capacity as Calculation Agent, and its successors and assigns or any other calculation agent appointed by the Company. |

|

|

|

| Optional Redemption: |

|

At our option, we may redeem the notes (i) in whole, but not in part, on April 22, 2027 or

(ii) in whole at any time or in part from time to time, on or after March 22, 2028, in each case at a redemption price equal to 100% of the principal amount of the notes being redeemed plus accrued and unpaid interest thereon to, but

excluding, the date of such redemption. |

|

|

|

|

|

Any redemption may be subject to prior regulatory approval and will be effected pursuant to the procedures

described under “Description of Debt Securities—Redemption and Repayment—Optional Redemption By Us” in the accompanying prospectus. |

|

|

|

| Listing: |

|

None |

|

|

|

|

| |

|

|

|

Principal Amount |

|

| Agent (Sole Bookrunner): |

|

Wells Fargo Securities, LLC |

|

|

$809,000,000 |

|

|

|

|

| Agents (Joint Lead Managers): |

|

American Veterans Group, PBC |

|

|

9,500,000 |

|

|

|

CastleOak Securities, L.P. |

|

|

9,500,000 |

|

|

|

Drexel Hamilton, LLC |

|

|

9,500,000 |

|

|

|

Roberts & Ryan, Inc. |

|

|

9,500,000 |

|

|

|

|

| Agents (Senior Co-Managers): |

|

Apto Partners, LLC |

|

|

8,000,000 |

|

|

|

Independence Point Securities LLC |

|

|

8,000,000 |

|

|

|

Penserra Securities LLC |

|

|

8,000,000 |

|

|

|

Samuel A. Ramirez & Company, Inc. |

|

|

8,000,000 |

|

|

|

ABN AMRO Capital Markets (USA) LLC |

|

|

7,000,000 |

|

|

|

ANZ Securities, Inc. |

|

|

7,000,000 |

|

|

|

BBVA Securities Inc. |

|

|

7,000,000 |

|

|

|

Credit Agricole Securities (USA) Inc. |

|

|

7,000,000 |

|

|

|

ING Financial Markets LLC |

|

|

7,000,000 |

|

|

|

Intesa Sanpaolo IMI Securities Corp. |

|

|

7,000,000 |

|

|

|

MUFG Securities Americas Inc. |

|

|

7,000,000 |

|

|

|

Natixis Securities Americas LLC |

|

|

7,000,000 |

|

|

|

Nordea Bank Abp |

|

|

7,000,000 |

|

|

|

SEB Securities, Inc. |

|

|

7,000,000 |

|

|

|

SG Americas Securities, LLC |

|

|

7,000,000 |

|

|

|

Standard Chartered Bank |

|

|

7,000,000 |

|

|

|

Westpac Capital Markets LLC |

|

|

7,000,000 |

|

|

|

|

| Agents (Co-Managers): |

|

Bancroft Capital, LLC |

|

|

5,000,000 |

|

|

|

C.L. King & Associates, Inc. |

|

|

5,000,000 |

|

|

|

Falcon Square Capital LLC |

|

|

5,000,000 |

|

|

|

Mischler Financial Group, Inc. |

|

|

5,000,000 |

|

|

|

Multi-Bank Securities, Inc. |

|

|

5,000,000 |

|

2

|

|

|

|

|

|

|

|

|

Siebert Williams Shank & Co., LLC |

|

|

5,000,000 |

|

|

|

Total: |

|

|

$1,000,000,000 |

|

|

|

| Supplemental Plan of

Distribution: |

|

On April 15, 2024, we agreed to sell to the Agents, and the Agents agreed to purchase, the

notes at a purchase price of 99.75%, plus accrued interest, if any, from April 22, 2024. The purchase price equals the issue price of 100.00% less a discount of 0.25% of the principal amount of the notes. |

|

|

|

|

|

To the extent any Agent that is not a U.S. registered broker-dealer intends to effect any offers or sales of

any notes in the United States, it will do so through one or more U.S. registered broker-dealers in accordance with the applicable U.S. securities laws and regulations. |

|

|

|

| United States Federal

Income Tax Considerations: |

|

Tax considerations are discussed under “United States Federal Income Tax

Considerations” in the accompanying prospectus. |

|

|

|

| Security Registrar and

Paying Agent: |

|

Computershare Trust Company, N.A., acting through its office at CTSO Mail Operations, 1505 Energy

Park Drive, St. Paul, MN 55108, Attn: CCT Administrator for Wells Fargo (or at such other place or places as may be designated from time to time). |

|

|

|

| CUSIP: |

|

95000U3M3 |

|

Risk Factors

See “Risk Factors” in the accompanying prospectus for risk factors regarding the notes, including, in particular,

the risk factors appearing under the heading “Risks Relating To SOFR, Compounded SOFR And A Benchmark Replacement” and “Risks Relating To Our Securities Generally—One Of Our Affiliates May Act As The Calculation Agent With

Respect To Our Securities And, As A Result, Potential Conflicts Of Interest Could Arise.”

3

Exhibit 107

The pricing supplement to which this Exhibit is attached is a final prospectus for the related offering. The maximum aggregate offering price of the related

offering is $1,000,000,000.

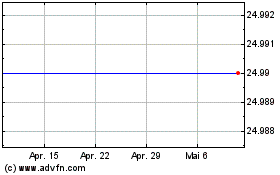

Wells Fargo (NYSE:WFC-Q)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

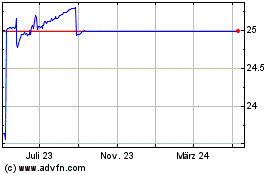

Wells Fargo (NYSE:WFC-Q)

Historical Stock Chart

Von Apr 2023 bis Apr 2024