Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

02 August 2022 - 1:51PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13 a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2022

Perusahaan Perseroan (Persero)

PT Telekomunikasi Indonesia Tbk

(Exact name of Registrant as specified in its charter)

Telecommunications Indonesia

(A state-owned public limited liability Company)

(Translation of registrant’s name into English)

Jl. Japati No. 1 Bandung 40133, Indonesia

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F þ Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No þ

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No þ

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on behalf by the undersigned, thereunto duly authorized.

| Telekomunikasi Indonesia Tbk |

August 2, 2022 | Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk ----------------------------------------------------- By: /s/ Andi Setiawan ---------------------------------------------------- Andi Setiawan VP Investor Relations |

DISCLOSURE OF INFORMATION TO SHAREHOLDERS |

No: Tel.25/LP 000/COP-E0000000/2022 |

Pursuant to the Regulation of Financial Service Authority (OJK) No. 42/POJK.04/2020 On Affiliated Transaction and Conflict of Interest Transaction |

THE INFORMATION CONTAINED IN THIS DISCLOSURE OF INFORMATION IS OF UTMOST IMPORTANCE AND THEREFORE, MUST BE READ AND CONSIDERED BY THE SHAREHOLDERS OF PERUSAHAAN PERSEROAN (PERSERO) PT TELEKOMUNIKASI INDONESIA Tbk. (the “Company”) |

|

If you encounter any difficulties in understanding any information contained in this Disclosure of Information, you are advised to consult with any broker, investment manager, legal advisor, public accountant or other professional advisors. |

Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk

Business Activities:

Operation of Telecommunication Networks and Services, Informatics Services, and Optimization of Resources Proprietary to the Company

Head Office: Graha Merah Putih Jl. Japati No,1, Bandung 40133, Indonesia Phone: 022-4526417 | Operational Office: Telkom Landmark Tower, 39th floor Jl. Jenderal Gatot Subroto Kav. 52 South Jakarta, DKI Jakarta 12710, Indonesia Phone: 021- 5215109 |

|

Website: www.telkom.co.id Email: investor@telkom.co.id |

|

DIRECTORS AND BOARD OF COMMISSIONERS OF THE COMPANY SHALL BE FULLY RESPONSIBLE FOR THE ACCURACY OF THE WHOLE MATERIAL INFORMATION DISCLOSED IN THIS DISCLOSURE OF INFORMATION AND AFTER CAREFUL INQUIRY ON THE INFORMATION DISCLOSED REGARDING TO THE TRANSACTION, CONFIRM THAT, TO THE BEST OF THE BOARD OF DIRECTORS AND THE BOARD OF COMMISSIONER’S BELIEF, THERE HAS BEEN NO MATERIALLY CRUCIAL FACT OR OTHER MATERIALS REGARDING THIS TRANSACTION WHICH HAVE NOT BEEN DISCLOSED HEREIN WHICH CAN CAUSE THIS DISCLOSURE OF INFORMATION TO BE INNACURATE OR MISLEADING. |

DISCLOSURE OF INFORMATION OF AFFILIATED TRANSACTION

SERIES OF TRANSACTION ACQUISITION AND LEASEBACK TELECOMMUNICATION TOWERS OF

PT TELEKOMUNIKASI SELULAR BY PT DAYAMITRA TELEKOMUNIKASI Tbk

DEFINITION |

|---|

Mitratel | : | PT Dayamitra Telekomunikasi Tbk, a limited liability company that are found and compliant with the Law of Republic of Indonesia |

Financial Service Authority (OJK) | : | Financial Service Authority, an independent body as mentioned in the Law no. 21 year 2011 concerning Financial Service Authority, which its duty and responsibility includes regulating and supervising financial service acitivity in the sector of banking, capital market, insurance, pension fund, financing, and other financial institution |

The Company or Telkom | : | Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk |

POJK 42/2020 | : | Regulation of Financial Service Authority (OJK) No. 42/POJK.04/2020 On Affiliated Transaction and Conflict of Interest Transacation |

POJK 17/2020 | : | Regulation of Financial Service Authority (OJK) No. 17/POJK.04/2020 On Material Transaction and Business Activities Changes |

Affiliated Transaction and Conflict of Interest Procedure | : | Base Procedure for Affiliated Transaction and Conflict of Interest Transaction in Telkom Group through Official Electronic Note from Telkom Group’s President Directors to all Authorized Official No. C.Tel.02/HK 000/TEL-000000000/2021 dated January 11, 2021 |

Telkomsel | : | PT Telekomunikasi Selular, a limited liability company that are found and compliant with the Law of Republic of Indonesia |

Information mentioned in this disclosure is made in relation with Mitratel’s transaction to acquire 6,000 towers owned by Telkomsel, then Mitratel will lease the towers back to Telkomsel, and Mitratel will lease 712 lands from Telkomsel where the towers are located and then Telkomsel will order Built-To-Suit tower lease to Mitratel for building tower in three years period starting January 1, 2023 until December 31, 2025 (“Transaction”).

Related to the aforemention matters above, pursuant to the applicable laws, especially regulation on the POJK 42/2020, with the completion of the transaction marked by the signing of Deed of Transfer and Acquisition Agreement No. 19 dated July 29, 2022 and Deed of Transfer in Relation to The Towers that are being Transferred by Telkomsel and Mitratel No. 20 dated July 29, 2022 in front of Notary Bonardo Nasution S.H., Directors of the Company hereby release this disclosure in order to give explanation, consideration and reason for the transaction to all the Company’s Shareholder as a part of fulfilling provision mentioned in the POJK 42/2020.

| II. | DESCRIPTION OF TRANSACTION | |

| A. | Schedule and Transaction Date |

The Transaction is based on the Deed of Transfer and Acquisition Agreement Agreement No. 19 dated July 29, 2022 and Deed of Transfer in Relation to The Towers that are being Transferred by Telkomsel and Mitratel No. 20 dated July 29, 2022 in front of Notary Bonardo Nasution S.H., in Jakarta.

| B. | Object of Affiliated Transaction |

Transfer of 6,000 telecommunication towers located across Indonesia owned by Telkomsel to Mitratel, Mitratel leaseback 6,000 towers to Telkomsel, and Mitratel will lease 712 lands from Telkomsel where the towers are located.

The transfer of 6,000 towers of Telkomsel by Mitratel in the amount of Rp10,280,000,000,000 (ten trillion two hundred eighty billion Rupiah) including down payment of land lease and land lease of Telkomsel’s land for 10 years.

| D. | Parties Involved in The Transaction |

| | | | |

1. | PT Telekomunikasi Selular | | |

| a. | Name | : | PT Telekomunikasi Selular |

| b. | Adress | : | Telkom Landmark Tower Tower 1 1 – 23rd Floor, Jl. Jend. Gatot Subroto Kav. 52 Kota Jakarta Selatan |

| c. | Phone Number | : | +62215240811 |

| d. | E-Mail | : | corporate_counsel@telkomsel.co.id |

| e. | Business Activity | : | Network provider and moving telecommunication services, also services related to web portal, web hosting, services for organizing trade transactions through electronic systems, advertising services related to Mobile Digital Advertising, data processing activities, consulting in the field of telecommunication, and financial service base on technology (financial technology/fintech). |

| f. | Management | : | Directors a. Hendri Mulya Syam (President Director) b. Nugroho (Director of Network) c. Mohamad Ramzy (Director of Finance and Risk Management) d. Wong Soon Nam (Director of Planning and Transformation) e. Adiwinahyu Basuki Sigit (Director of Sales) f. Bharat Alva (Director of IT) g. Derrick Heng (Director of Marketing) h. R. Muharam Perbawamukti (Director of Human Capital Management) |

| | | | Board of Commissioners a. Wishnutama Kusubandio (President Commissioner) b. Heri Supriadi (Commissioner) c. Yuen Kuan Moon (Commissioner) d. Yose Rizal (Commissioner) e. Anna Yip (Commissioner) f. Nanang Pamuji Mugasejati (Commissioner) |

| g. | Ownership | : | PT Telkom Indonesia (Persero) Tbk (65%) and Singapore Telecom Mobile Pte.Ltd (35%) |

| h | Relation with Telkom | : | Subsidiary |

|

2. | PT Dayamitra Telekomunikasi Tbk | | |

| a. | Name | : | PT Dayamitra Telekomunikasi Tbk |

| b. | Adress | : | Telkom Landmark Tower, 25-27th floor, Jl. Jendral Gatot Subroto Kav. 52, Jakarta Selatan |

| c. | Phone Number | : | +62 21 27933363 |

| d. | E-Mail | : | mitratel@mitratel.co.id |

| e. | Business Activity | : | Telecommunication tower and its ecosystem, including digital support services for mobile infrastructure, also optimalization of Mitratel’s resources. |

| f. | Management | : | Directors a. Theodorus Ardi Hartoko (President Director) b. Ian Sigit Kurniawan (Director of Finance and Risk Management) c. Noorhayati Candrasuci (Director of Business) d. Pratignyo Arif Budiman (Director of Operation & Development) e. Hendra Purnama (Director of Investment) Board of Commissioner a. Herlan Wijanarko (President Commissioner) b. Hadi Prakosa (Commissioner) c. Henry Yosodiningrat (Independent Commissioner) d. Mohammad Ridwan Rizqi Ramadhani Nasution (Independent Commissioner) e. Rico Usthavia Frans (Independent Commissioner) |

| g. | Ownership | : | PT Telkom Indonesia (Persero) Tbk (71.87%) and Public (28.13%). |

| h | Relation with Telkom | : | Subsidiary |

| E. | Nature of the Relationship Between the Parties Involved in The Transaction with Telkom |

Mitratel is a subsidiary of PT Telkom Indonesia (Persero) Tbk which provides telecommunication infrastructure with 71.87% ownership and Telkomsel is also a subsidiary providing cellular telecommunication service which directly controlled by Telkom with 65.00% ownership.

Based on the POJK 42/2020, transaction between Telkomsel and Mitratel is not excluded from the obligation to release Disclosure of Information which means that it has to comply with the provision mentioned in the POJK 42/2020.

| III. | SUMMARY OF APPRAISER’S REPORT REGARDING THE APPRAISAL OF OBJECT OF THE TRANSACTION | |

Summary of Appraisal Report of 6,000 Towers of Telkomsel’s Asset No. 00197/2.0012-00/PP/06/0006/1/VII/2022 dated July 26, 2022 that are made Rengganis, Hamid & Rekan Public Appraisers Office

| A. | Identity of Parties that are Involved in The Transaction | |

Parties that are involved in the Transaction Plan are (i) Mitratel as Asset Tower Buyer and (ii) Telkomsel as Asset Tower Seller.

Assets to be appraised are 6,000 unit of towers that are located in several regions of Indonesia.

This appraisal is conducted to disclose opinion for market value of appraisal object for the purpose of sale and leaseback.

| D. | Assumption and Limiting Conditions | |

This Appraisal is depends on this several things, as follows:

| 1. | Assets equipped with applicable and legally valid ownership documents, can be transferred and independent from any ties, demands, or impediments; | |

| 2. | The data and information on the assets provided, in the form of ownership documents, legal and other permits, are assumed to be correct, including data obtained by sampling; | |

| 3. | The object of the appraisal is assumed to be free from any environmental pollution; | |

| 4. | The inspection date is after the appraisal date, in this appraisal it is assumed that there is no significant change in the appraised property between the inspection date and the appraisal date; | |

| 5. | The tower is appraised as an in-situ/in-place unit and part of an ongoing business; | |

| 6. | The appraiser will use all public records that possibly arise, photos, and information from external sources, both from websites, professionals, property owners, or other verified sources, that are assumed to be correct and reflect the actual conditions. | |

| 7. | The tower is built on land owned by TSEL and leased land owned by a third party and is assumed to be extendable. | |

| 8. | Towers are considered Special Business Properties (PBK), which PBK is an individual property that is a combination of tangible and intangible assets that can be transferred to its business rights. | |

| 9. | The condition of uninspected assets is based on information from the Assignment Provider, which is assumed to be correct. | |

Specific Assumptions:

The pole tower site already has the infrastructure for the construction of 2-3 poles on the same site.

| E. | Approach and Method of Appraisal | |

This appraisal using following methods :

Appraisal Approach | Appraisal Method |

Market Approach | Market Data Comparison |

Revenue Approach | Discounted Cash Flow (DCF) |

Cost Approach | Replacement Cost |

Considering all of the relevant information and real market condition that the market value of 6,000 towers owned by PT Telekomunikasi Selular located in several provinces in Indonesia, on December 31, 2021 in amount of Rp9,209,192,000,000 (nine trillion two hundred and nine billion one hundred ninety two million Rupiah).

Summary of Appraisal Report on Lease Right of the Towers between PT Dayamitra Telekomunikasi Tbk and PT Telekomunikasi Selular in the report No. 00198/2.0012-00/BS/06/0006/1/VII/2022 dated July 26, 2022.

| A. | Identity of Parties that are Involved in The Transaction | |

Parties that are involved in the Transaction are (i) Mitratel as Land Lessee and (ii) Telkomsel as Land Lessor.

Assets to be appraised are lease right of 709 tower’s land locations located in several province in Indonesia.

This appraisal is conducted to disclose market value opinion of appraisal object of land owned by Telkomsel that will be leased to Mitratel.

| D. | Assumption and Limiting Conditions | |

Assumption

| 1. | Assets equipped with applicable and legally valid ownership documents, can be transferred and independent from any ties, demands, or impediments; | |

| 2. | The data and information on the assets provided, in the form of ownership documents, legal and other permits, are assumed to be correct, including data obtained by sampling; | |

| 3. | The object of the appraisal is assumed to be free from any environmental pollution; | |

| 4. | The appraiser will use all public records that possibly arise, photos, and information from external sources, both from websites, professionals, property owners, or other verified sources, that are assumed to be correct and reflect the actual conditions; | |

| 5. | The inspection date is after the appraisal date, in this appraisal it is assumed that there is no significant change in the appraised property between the inspection date and the appraisal date; | |

| 6. | The validity period of land certificates for several Valuation Objects has expired, with details of the Appraisal Objects as follows: | |

No | Site ID | Site Name |

1 | JKB145 | KEMBANGANUTR |

2 | BDG075 | PALEMINDAH |

3 | SMR009 | ERLISA |

In this appraisal, it is assumed that an extension of the validity period can be granted and does not consider the cost allocation in relation to the extension mentioned above.

| 7. | Whereas up to the time this appraisal report was compiled, out of a total of 67 sites, it was mentioned that 9 sites do not receive land documents for as follows: | |

No | Site ID | Site Name |

1 | BOO099 | PARAKANJAYA |

2 | PBR004 | JLKARYABAKTI |

3 | PBR020 | RIAUUJUNG |

4 | PBR058 | LIMBUNGAN |

5 | PBR724 | NARASRAYA |

6 | PLG020 | KALANGANYAR |

7 | LBP088 | TERJUNTEL |

8 | MDN005 | SEIMUSITEL |

9 | SMG036 | KEDUNGMUNDU |

In this appraisal, the certificate type and land area are based on reference to the list of assets and it assumes that the area is correct and accurate.

Specific Assumption:

| | | |

No | Site ID | Site Name | Specific Assumption |

1 | JKB145 | KEMBANGANUTR | That there is a road expansion plan on Jalan Al-Falah. However, this appraisal does not consider the road expansion plan and assesses the Object of the Appraisal in the "As Is" condition. |

2 | JKT018 | LUBANGBUAYA | That the name of the holder of land rights is not registered in the name of the Assignment Provider. Based on information from the Assignment Provider, Salim Hidayatullah was the previous owner of the Object of Appraisal. In this appraisal, it assumes that the title transfer process has been carried out and the Object of the Appraisal is fully owned by the Assignment Provider. |

3 | SMR600 | BRIMOB | That the allotment of the Object of Appraisal is a flood-prone area. However, the Object of Appraisal is assessed as a residential area designation in this appraisal. This is because the conditions around the Object of Appraisal have been built as a residential area. |

| E. | Approach and Method of Appraisal | |

Appraisal Approach | Appraisal Method |

Market Approach | |

Considering all of the relevant information and real market condition that the market value appraisal object, on December 31, 2021 in amount of Rp237,817,000,000 (two hundred and thirty seven billion eight hundred and seventeen million Rupiah).

Summary of Appraisal Report on intangible asset of Built-to-Suit (B2S) contract between PT Dayamitra Telekomunikasi Tbk and PT Telekomunikasi Selular in the report No. 00199/2.0012-00/BS/06/0006/1/VII/2022 dated July 26, 2022.

| A. | Identity of Parties that are Involved in The Transaction | |

Parties that are involved in the Transaction are (i) Mitratel as Land Lessee and (ii) Telkomsel as Land Lessor.

The Appraisal Object is intangible asset of Built-to-Suit (B2S) contract*) regarding order and lease of Base Transceiver Station (BTS) in amount of 1,000 unit with building new tower in accordance to location and specification as planned.

*) The contract is a part of main agreement of tower lease between Telkomsel and Mitratel, and this apprasial is based on that agreement.

| C. | Appraisal Objectives and Purpose | |

This appraisal is intended to give an opinion of fair market value of appraisal object for order and lease BTS tower purpose.

| D. | Assumption and Limiting Conditions | |

Assumption

Assumption

| 1. | The object of the appraisal is assumed to be equipped with an applicable and legally valid agreement document, transferable and independent from any ties, demands or impediment, and has complied with all legal and regulatory aspects that apply generally and specifically to the industry in order to be able to carry out the operational activities; | |

| 2. | The provided data and information on the Object of Appraisal, whether in the form of ownership, legal, agreement or other licensing documents are assumed to be correct and accurate; | |

| 3. | Appraisal is carried out with adequate investigation access; | |

| 4. | For the purpose of the appraisal, data provided by the Company's Management as well as verbal data obtained during the investigation has been completed and the data is assumed to be accurate and correct. | |

Specific Assumptions

| 1. | The price projection and tower construction plan are based on the draft Tower Lease Master Agreement (“MTLA”) and the business plan prepared by management, which has been adjusted and assumed to be achievable; | |

| 2. | Based on the financial projections prepared by management, it is assumed that all B2S towers will be built outside Java with a tower height of 42 meters with a land lease cost of Rp29 million per year. In this appraisal, it is assumed that the assumptions in the projection will be implemented and can be achieved; | |

| 3. | Whereas information on the number of units agreed to in B2S of 1,000 units is only included in the draft Conditional Sale and Purchase Agreement. In this appraisal, the assumption of the number of units is based on the draft Conditional Sale and Purchase Agreement and is assumed to remain unchanged until the signing of the agreement proceeds. | |

| E. | Approach and Appraisal Method | |

Discounted Cash Flow (DCF) method for Revenue Approach is implemented in this appraisal.

Considering all of the relevant information and real market condition that the market value of intangible asset of Built-to-Suit contract, on December 31, 2021 in amount of Rp432,976,000,000 (four hundred and thirty two billion nine hundred and seventy six million Rupiah).

| IV. | SUMMARY OF APPRAISER’S REPORT ON FAIRNESS OF THE TRANSACTION | |

Based on the Fairness Opinion Report of Affiliated Transaction Plan No. 00080/2.0095-00/BS/06/0269/1/VII/2022 dated July 28, 2022 made by Ruky, Safrudin & Rekan Public Appraisers Office (“RSR”)

| A. | Identity of Parties that are Involved in The Transaction | |

Parties that are involved in the Transaction Plan are Mitratel as buyer and lessor of tower as well as building the BTS tower while Telkomsel as seller and lessee of tower as well as ordering the BTS tower.

| B. | Object of Fairness Analysis | |

The object of this fairness analysis is Mitratel's plan to acquire 6,000 Telkomsel's towers. Mitratel will lease back the 6,000 towers to Telkomsel while Mitratel will lease 712 lands from Telkomsel where the BTS towers are built and Telkomsel will lease the BTS towers from Mitratel.

| C. | Objective of Fairness Opinion | |

Objective of this Fairness Opinion Report is to give opinion about the fairness of Mitratel’s plan to acquire 6,000 towers owned by Telkomsel, then Mitratel will lease the tower back to Telkomsel, and Mitratel will lease 712 lands from Telkomsel where the towers are located, and Telkomsel plan to order and lease BTS tower from Mitratel, as defined in this report in order to comply with the Financial Service Authority’s Capital Market Regulations, not for taxation, banking and also not for other transaction plans.

| D. | Assumption and Limiting Condition | |

This Fairness Opinion Report is prepared using Financial Projections by the Company's management by reflecting the fairness of the projections and the ability to achieve them (fiduciary duty).

This Fairness Opinion is prepared based on the principle of information and data integrity. In compiling this Fairness Opinion, it is based on data and information sources as provided by the management of the Company, which based on the nature of fairness is correct, complete, reliable, and not misleading.

| E. | Approach and Method of Fairness Opinion | |

In assessing the fairness of the Proposed Transaction, the following analytical methodology used are:

| ● | Analysis of the Proposed Transaction in the form of identification of the parties involved in the Proposed Transaction, analysis of the terms and conditions of the agreement on the Proposed Transaction, analysis of the benefits and risks of the Proposed Transaction; | |

| ● | Qualitative analysis in the form of analysis of the reasons and background of the Proposed Transaction, a brief history of the Company and its business activities, industry analysis, analysis of the Company's operations and business prospects, advantages and disadvantages of the Proposed Transaction; | |

| ● | Quantitative analysis in the form of historical performance analysis, financial projection analysis, proforma analysis of financial statements, and incremental analysis; | |

| ● | Analysis of other relevant factors, in the form of analysis of relevant costs and revenues, and relevant non-financial information, which can provide confidence for the Appraiser in providing a fairness opinion; | |

| ● | Analysis of the fairness of the Proposed Transaction Price. | |

| F. | Fairness Opinion of The Transaction | |

By considering the fairness analysis of the Proposed Transaction which includes transaction plan analysis, qualitative and quantitative analysis, analysis of the fairness of transaction price and other relevant factors, in RSR's opinion, the Proposed Transaction is fair.

| V. | EXPLANATION, CONSIDERATION AND REASON THE TRANSACTION IS DONE COMPARE TO IF THERE IS A SIMILAR TRANSACTION TO BE DONE WITH NON-AFFILIATED PARTIES | |

Telkomsel as the seller is the only Indonesian cellular operator that still has more than 9,000 telecommunication towers prior to the transaction. Mitratel as the buyer is the largest telecommunications tower company with more than 28,000 telecommunication towers prior to the transaction. Transactions of this scale can only be carried out by Telkomsel and Mitratel.

| VI. | DIRECTORS AND BOARD OF COMMISSIONERS STATEMENT | |

Directors of the Company’s stated that this Transacation has been through Affiliated Transaction and Conflict of Interest Transaction Procedure. Directors and Board of Commissioners of the Company, both by itself and together stated that:

| (1) | This Transaction does not contain any conflict of interest as mentioned in the POJK 42/2020 and is not a Material Transaction either as mentioned in the POJK 17/2020; and | |

| (2) | All material information has been disclosed in this disclosure and this information is not misleading. | |

Jakarta, August 2, 2022

Directors

PT Telkom Indonesia (Persero) Tbk

/s/ Budi Setyawan Wijaya

Budi Setyawan Wijaya

Director of Strategic Portfolio

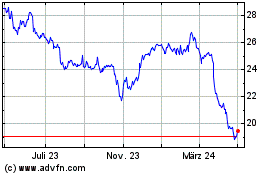

Perusahaan Perseroan Per... (NYSE:TLK)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

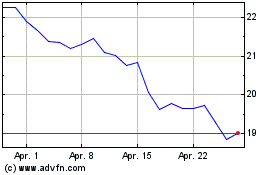

Perusahaan Perseroan Per... (NYSE:TLK)

Historical Stock Chart

Von Apr 2023 bis Apr 2024