REGAL-BELOIT First Quarter Earnings Per Share Increase 76%

01 Mai 2006 - 3:30PM

PR Newswire (US)

BELOIT, Wis., May 1 /PRNewswire-FirstCall/ -- REGAL-BELOIT

CORPORATION (NYSE:RBC) today reported strong increases in net sales

and earnings for the first quarter ended April 1, 2006. Net sales

increased 17.9% to $398.3 million from $337.8 million in the first

quarter of 2005. Net income increased 93.6% to $23.8 million as

compared to $12.3 million in the comparable period of 2005. Diluted

earnings per share increased 75.6% to $.72 as compared to $.41 for

the first quarter of 2005. The first quarter of 2006 contained one

additional day as compared to the first quarter of 2005. In the

Electrical Segment, sales increased 19.4%, primarily driven by

strong channel demand in commercial and industrial motors,

generators, and HVAC motors. Sales in the Mechanical Segment

increased 9.0%, with sales strength noted in many of the Company's

diverse end markets. Sales for the first quarter of 2005 included

$1.8 million of sales for the Illinois Gear business sold in May

2005. The gross profit margin for the first quarter of 2006 was

23.4%, which is a 310 basis point improvement over the gross profit

margin in the first quarter of 2005, as a result of higher volume,

improved productivity and positive product mix. Income from

operations was $43.6 million, or 11.0% of sales, a 68.6% increase

over the $25.9 million or 7.7% of sales reported for the first

quarter of 2005. Operating expenses for the first quarter of 2006

included $.7 million of expense related to the expensing of equity

compensation as compared to $.3 million in the first quarter of

2005. The Company's total debt increased to $420.3 million at the

end of the first quarter of 2006 from $412.0 million at the end of

2005. This increase was primarily driven by an increase in accounts

receivable resulting from the higher volume and timing of customer

payments. "We are extremely pleased with another strong performance

by our business units evidenced by the results announced today and

the recently announced 7.7% increase in the quarterly dividend,"

said Henry W. Knueppel, CEO. "Our business units did an outstanding

job of responding to the strong customer demand and in the

launching of new products." "As we look into the second quarter, we

continue to expect a positive sales environment in all of our

business units. The recent unprecedented increases in the prices of

copper and aluminum will, however, provide difficult and

challenging cost hurdles. While we continue to leverage

productivity initiatives to offset normal inflation, these

unprecedented commodity increases will force us to evaluate

additional price increases. Moving into the future, we expect

continued contributions from the execution of our strategic

initiatives: Innovation, Lean Six Sigma, Globalization,

Digitization and Customer Centricity, to further assist us in

battling commodity inflation and improve our operating performance.

We are projecting second quarter diluted earnings per share to be

in the range of $.92 to $.99 per share." REGAL-BELOIT will be

holding a telephone conference call pertaining to this news release

at 1:00 PM CDT (2:00 PM EDT) on Monday, May 1, 2006. Interested

parties should call 866-868-1109, access code 14499515. A replay of

the call will be available through May 10, 2006 at 877-213-9653,

access code 14499515. REGAL-BELOIT CORPORATION is a leading

manufacturer of mechanical and electrical motion control and power

generation products serving markets throughout the world.

REGAL-BELOIT is headquartered in Beloit, Wisconsin, and has

manufacturing, sales, and service facilities throughout North

America, and in Mexico, Europe and Asia. CAUTIONARY STATEMENT The

following is a cautionary statement made under the Private

Securities Litigation Reform Act of 1995: With the exception of

historical facts, the statements contained in this press release

may be forward looking statements. Forward-looking statements

represent our management's judgment regarding future events. We

cannot guarantee the accuracy of the forward-looking statements,

and you should be aware that results and events could differ

materially and adversely from those contained in the

forward-looking statements due to a number of factors, including:

unexpected issues and costs arising from the integration of

acquired companies and businesses, such as our recent acquisitions

of the HVAC motors and capacitors businesses and the Commercial AC

motors business from General Electric Company; marketplace

acceptance of our recent acquisitions, including the loss of, or a

decline in business from, any significant customers; unanticipated

fluctuations in commodity prices and raw material costs and issues

affecting our ability to pass increased costs on to our customers;

cyclical downturns affecting the markets for capital goods;

substantial increases in interest rates that impact the cost of our

outstanding debt; the impact of capital market transactions that

the Company may effect; unanticipated costs associated with

litigation matters; the success of our management in increasing

sales and maintaining or improving the operating margins of our

businesses; actions taken by our competitors; difficulties in

staffing and managing foreign operations; our ability to satisfy

various covenant requirements under our credit facility; and other

risks and uncertainties described from time to time in our reports

filed with U.S. Securities and Exchange Commission. All subsequent

written and oral forward-looking statements attributable to us or

to persons acting on our behalf are expressly qualified in their

entirety by the applicable cautionary statements. The

forward-looking statements included in this press release are made

only as of the date of this release, and we undertake no obligation

to update these statements to reflect subsequent events or

circumstances. STATEMENTS OF EARNINGS In Thousands of Dollars

Unaudited Three Months Ended April 1, 2006 March 31, 2005 Net Sales

$398,326 $337,822 Cost of Sales 305,046 269,378 Gross Profit 93,280

68,444 Operating Expenses 49,662 42,579 Income From Operations

43,618 25,865 Interest Expense 4,795 5,454 Interest Income 120 48

Income Before Taxes & Minority Interest 38,943 20,459 Provision

For Income Taxes 14,342 7,642 Income Before Minority Interest

24,601 12,817 Minority Interest in Income, Net of Tax 813 531 Net

Income $ 23,788 $12,286 Per Share of Common Stock: Earnings Per

Share - Basic $.77 $.42 Earnings Per Share - Assuming Dilution $.72

$.41 Cash Dividends Declared $.13 $.12 Average Number of Shares

Outstanding - Basic 30,700,533 29,033,901 Average Number of Shares

Outstanding - Assuming Dilution 32,957,209 30,244,393 CONDENSED

BALANCE SHEETS In Thousands of Dollars ASSETS (Unaudited) (Audited)

Current Assets: April 1, 2006 Dec. 31, 2005 Cash and Cash

Equivalents $ 26,207 $32,747 Receivables and Other Current Assets

279,264 230,217 Inventories 231,731 224,316 Total Current Assets

537,202 487,280 Net Property, Plant and Equipment 244,625 244,329

Goodwill 546,173 546,168 Purchased Intangible Assets, Net 44,080

45,674 Other Noncurrent Assets 18,958 19,103 Total Assets

$1,391,038 $ 1,342,554 Liabilities and Shareholders' Investment

Current Liabilities $240,275 $218,791 Long-Term Debt 389,038

386,332 Other Noncurrent Liabilities 92,711 89,435 Shareholders'

Investment 669,014 647,996 Total Liabilities and Shareholders'

Investment $1,391,038 $ 1,342,554 SEGMENT INFORMATION In Thousands

of Dollars (Unaudited) Mechanical Segment Electrical Segment Three

Months Ended Three Months Ended April 1, March 31, April 1, March

31, 2006 2005 2006 2005 Net Sales $52,961 $ 48,601 $345,365 $

289,222 Income from Operations $3,707 $2,738 $39,911 $23,127

DATASOURCE: REGAL-BELOIT CORPORATION CONTACT: David A. Barta, Vice

President, Chief Financial Officer, REGAL-BELOIT CORPORATION,

+1-608-364-8808, Ext. 106 Web site: http://www.regal-beloit.com/

Copyright

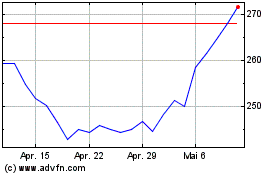

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

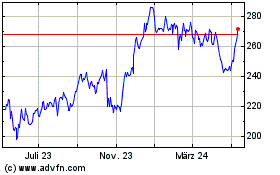

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024