UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

December, 2023

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 19th floor

20231-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras informs on Petros Plan equalization

—

Rio de Janeiro, December 22, 2023 - Petróleo

Brasileiro S.A. – Petrobras informs that its Board of Directors approved, at a meeting held today, the Deficit Equalization Plan

for 2022 (PED-2022) of the Non-Renegotiated Petrobras System Petros Plan (PPSP-NR) and its submission for consideration by the Secretariat

for Coordination and Governance of State-Owned Enterprises (SEST).

The PED-2022 provides for the settlement of

the intermediate amount between the Accumulated Technical Deficit and the 2022 Adjusted Technical Deficit in the amount of R$1,557,157,178.80

on December 31, 2022, an amount that best meets the plan's solvency needs, according to studies prepared by the Petros Foundation. This

amount, updated by the actuarial target until August 2023, amounted to R$1,660,404,170.12.

The PPSP-NR is a defined benefit plan and,

according to Petros, the main cause of the increase in the deficit to an equitable level in 2022 was the impact of the economic situation,

especially on the Fixed Income segment, in addition to the sum of actuarial losses relating to components linked to the plan's social

security management.

According to Supplementary Laws 108/2001 and

109/2001, as well as Resolution nº 30/2018 of the National Council for Suplementary Pension (CNPC), the deficit must be equated equally

among the sponsors (Petrobras, Vibra Energia, and Petros), the participants and the PPSP-NR pensioners. Therefore, Petrobras will be responsible

for a total amount of R$ 774,272,207.79, positioned in August 2023.

The obligation will be met by adding extraordinary

monthly contributions to the current funding plan and the disbursements by the sponsors will decrease over the life of the plan, with

an estimated average annual additional flow for the first 5 years of around R$ 60 million.

The PED-2022 must obtain a favorable opinion

from SEST so that Petros can implement the collection of extraordinary contributions in April 2024, which will be added to the normal

and extraordinary contributions already in effect.

The actuarial position of the PPSP-NR plan

was reflected in note 17.3 - Post-employment benefits in the financial statements as at 31.12.2022 and, additionally, the effects of the

implementation of new extraordinary contributions by PED-2022 should be considered in the actuarial revaluation for the year 2023.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

e-mail: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares, 28 – 9th floor

– 20231-030 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes",

"expects", "predicts", "intends", "plans", "projects", "aims", "should,"

and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore,

future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information

included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 22, 2023

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Sergio Caetano Leite

______________________________

Sergio Caetano Leite

Chief Financial Officer and Investor Relations

Officer

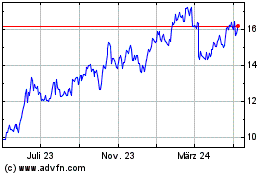

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

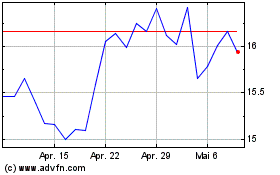

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

Von Mai 2023 bis Mai 2024