Orion Office REIT Inc. Announces Amendment to Credit Agreement

29 Juni 2023 - 10:15PM

Business Wire

Orion Office REIT Inc. (NYSE: ONL) (“Orion” or the “Company”), a

fully-integrated real estate investment trust focused on the

ownership, acquisition and management of single-tenant net lease

mission-critical suburban office properties located across the

U.S., announced today that it has closed an amendment of its credit

agreement.

Under the terms of the amendment, Orion used borrowings from its

currently undrawn $425 million senior revolving credit facility

(the “Revolving Facility”) to repay and retire the outstanding

balance of its $175 million senior term loan facility scheduled to

mature on November 12, 2023. The amendment also provides Orion with

the option to extend the Revolving Facility for an additional 18

months to May 12, 2026 from the current scheduled maturity of

November 12, 2024. The extension option is subject to customary

conditions including the payment of an extension fee.

The amendment also effected certain other modifications to the

credit agreement, including those described in the Company’s Form

8-K filed with the Securities and Exchange Commission today.

Wells Fargo Bank, National Association will remain the

administrative agent for the Company’s credit agreement, and Wells

Fargo Securities, LLC, JPMorgan Chase Bank, N.A., Mizuho Bank, Ltd.

and TD Bank, N.A, acted as joint lead arrangers for the

amendment.

Paul McDowell, Orion’s Chief Executive Officer and President,

commented, “We are very pleased to have concluded this amendment

which will retire our maturing term loan facility while continuing

to provide Orion with access to liquidity and an extended loan term

to continue to execute on the Company’s business plan. We’d like to

thank our lenders for their confidence in Orion and our strategic

direction.”

About Orion Office REIT Inc. Orion Office REIT Inc.

(NYSE: ONL) is an internally-managed real estate investment trust

engaged in the ownership, acquisition and management of a

diversified portfolio of mission-critical and headquarters office

buildings located in high-quality suburban markets across the U.S.

and leased primarily on a single-tenant net lease basis to

creditworthy tenants. The Company was founded on July 1, 2021,

spun-off from Realty Income (NYSE: O) on November 12, 2021 and

began trading on the New York Stock Exchange on November 15, 2021.

The Company is headquartered in Phoenix, Arizona and has an office

in New York, New York. For additional information on the Company

and its properties, please visit onlreit.com.

Forward-Looking Statements

Information set forth in this press release includes

“forward-looking statements” which reflect the Company's

expectations and projections regarding future events and plans,

future financial condition, results of operations, liquidity and

business, including leasing and occupancy, acquisitions,

dispositions, rent receipts, expected borrowings and financing

costs and the payment of future dividends. These forward-looking

statements are based on information currently available to the

Company and involve a number of known and unknown assumptions and

risks, uncertainties and other factors, which may be difficult to

predict and beyond the Company's control, that could cause actual

events and plans or could cause the Company's business, financial

condition, liquidity and results of operations to differ materially

from those expressed or implied in the forward-looking statements.

Factors that may affect future results include: the risk of rising

interest rates, such as that our borrowing costs may increase and

we may be unable to refinance our debt obligations on favorable

terms and in a timely manner or at all; conditions associated with

the global market, including an oversupply of office space, tenant

credit risk and general economic conditions; the extent to which

changes in workplace practices and office space utilization,

including remote work arrangements, will continue and the impact

that may have on demand for office space at our properties; our

ability to comply with the terms of our credit agreement; changes

in the real estate industry and in the performance of financial

markets and interest rates and our ability to effectively hedge

against interest changes; and our ability to renew leases with

existing tenants or re-let vacant space to new tenants on favorable

terms and in a timely manner or at all. Additional factors that may

affect future results are contained in the Company's filings with

the Securities and Exchange Commission (“SEC”), which are available

at the SEC’s website at www.sec.gov. The Company disclaims any

obligation to publicly update or revise any forward-looking

statements, whether as a result of changes in underlying

assumptions or factors, new information, future events or

otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230629148175/en/

Investor Relations: Email: investors@onlreit.com

Phone: 602-675-0338

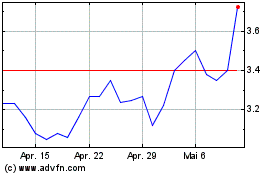

Orion Office REIT (NYSE:ONL)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Orion Office REIT (NYSE:ONL)

Historical Stock Chart

Von Nov 2023 bis Nov 2024