Quarterly Schedule of Portfolio Holdings of Registered Management Investment Company (n-q)

25 September 2013 - 6:11PM

Edgar (US Regulatory)

OMB APPROVAL

OMB Number: 3235-0578

Expires: April 30, 2013

Estimated average burden

hours per response.....

10.5

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-Q

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21321

Pioneer Municipal High Income Trust

(Exact name of registrant as specified in charter)

60 State Street, Boston, MA 02109

(Address of principal executive offices) (ZIP code)

Terrence J Cullen, Pioneer Investment Management, Inc.,

60 State Street, Boston, MA 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: (617) 742-7825

Date of fiscal year end: April 30

Date of reporting period: July 31, 2013

Form N-Q is to be used by management investment companies, other than small

business investment companies registered on Form N-5 (239.24 and 274.5 of this

chapter), to file reports with the Commission, not later than 60 days after

close of the first and third fiscal quarters, pursuant to Rule 30b1-5under

the Investment Company Act of 1940 (17 CFR 270.30b-5). The Commission may

use the information provided on Form N-Q in its regulatory, disclosure review,

inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-Q,

and the Commission will make this information public. A registrant is not

required to respond to the collection of information contained in Form N-Q

unless the Form displays a currently valid Office of Management and Budget

("OMB") control number. Please direct comments concerning the accuracy of the

information collection burden estimate and any suggestions for reducing the

burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW,

Washington, DC 20549-0609. The OMB has reviewed this collection of information

under the clearance requirements of 44 U.S.C. ss. 3507.

<PAGE>

ITEM 1. Schedule of Investments.

Pioneer Municipal

High Income Trust

NQ

|

July 31, 2013

Ticker Symbol: MHI

Schedule of Investments | 7/31/2013 (unaudited)

|

|

|

Principal

Amount

USD ($)

|

S&P/Moody's

Ratings

(unaudited)

|

|

Value

|

|

|

|

|

|

|

|

TAX EXEMPT OBLIGATIONS

-

128.8%

of Net Assets

|

|

|

|

|

|

|

Alabama - 2.1%

|

|

|

|

|

2,500,000

|

NR/B2

|

Alabama Industrial Development Authority Solid Waste Disposal Revenue, 6.45%, 12/1/23

|

$ 2,502,675

|

|

|

|

4,500,000

|

NR/NR

|

Huntsville-Redstone Village Special Care Facilities Financing Authority Nursing Home Revenue, 5.5%, 1/1/43

|

3,754,800

|

|

|

|

|

|

|

$ 6,257,475

|

|

|

|

|

|

Arizona - 0.2%

|

|

|

|

|

24,000

|

NR/Baa3

|

Pima County Industrial Development Authority Education Revenue, 6.75%, 7/1/31

|

$ 23,619

|

|

|

|

500,000

|

NR/Baa1

|

Yavapai County Industrial Development Authority Medical Revenue, 6.0%, 8/1/33

|

501,425

|

|

|

|

|

|

|

$ 525,044

|

|

|

|

|

|

California - 9.8%

|

|

|

|

|

3,000,000(a)

|

NR/A1

|

Abag Finance Authority for Nonprofit Corp., Revenue, 5.75%, 7/1/37

|

$ 3,359,460

|

|

|

|

1,450,000

|

NR/NR

|

California Enterprise Development Authority Recovery Zone Facility Revenue, 8.5%, 4/1/31

|

1,577,585

|

|

|

|

5,000,000

|

NR/Baa3

|

California Pollution Control Financing Authority, 5.0%, 7/1/37

|

4,656,800

|

|

|

|

1,400,000

|

NR/NR

|

California Statewide Communities Development Authority, 5.625%, 11/1/33

|

1,249,990

|

|

|

|

568,006(b)

|

NR/NR

|

California Statewide Communities Development Authority Environmental Facilities Revenue, 9.0%, 12/1/38

|

4,936

|

|

|

|

4,000,000

|

BB/NR

|

California Statewide Communities Development Authority Revenue Higher Education Revenue, 7.25%, 10/1/38 (144A)

|

3,906,400

|

|

|

|

15,000,000(c)

|

NR/NR

|

Inland Empire Tobacco Securitization Authority Revenue, 0.0%, 6/1/36

|

2,352,600

|

|

|

|

7,885,000

|

AA-/WR

|

Lehman Municipal Trust Receipts Revenue, RIB, 11.073%, 9/20/28 (144A)

|

8,291,551

|

|

|

|

2,000,000

|

B-/Caa1

|

Tobacco Securitization Authority of Northern California Revenue, 5.375%, 6/1/38

|

1,588,100

|

|

|

|

3,000,000

|

BB+/B3

|

Tobacco Securitization Authority of Southern California Revenue, 5.0%, 6/1/37

|

2,343,450

|

|

|

|

|

|

|

$ 29,330,872

|

|

|

|

|

|

Colorado - 3.6%

|

|

|

|

|

2,000,000

|

BBB+/NR

|

Colorado Health Facilities Authority Revenue, 5.25%, 5/15/42

|

$ 1,936,400

|

|

|

|

1,000,000

|

NR/NR

|

Kremmling Memorial Hospital District Certificate of Participation, 7.125%, 12/1/45

|

1,031,280

|

|

|

|

7,500,000

|

AA+/Aa2

|

Regional Transportation District Revenue, 5.0%, 11/1/31

|

7,985,100

|

|

|

|

|

|

|

$ 10,952,780

|

|

|

|

|

|

Connecticut - 6.0%

|

|

|

|

|

1,000,000

|

NR/NR

|

Hamden Connecticut Facility Revenue, 7.75%, 1/1/43

|

$ 1,026,740

|

|

|

|

10,335,000(d)

|

AAA/WR

|

Lehman Municipal Trust Receipts Revenue, 11.809%, 8/21/35

|

11,948,190

|

|

|

|

5,000,000

|

B/NR

|

Mohegan Tribe of Indians Gaming Authority, 6.25%, 1/1/31

|

5,000,450

|

|

|

|

|

|

|

$ 17,975,380

|

|

|

|

|

|

District of Colombia - 3.8%

|

|

|

|

|

5,000,000

|

BBB/Baa1

|

District of Columbia Tobacco Settlement Financing Corp., 6.5%, 5/15/33

|

$ 5,316,750

|

|

|

|

6,000,000

|

BBB/Baa1

|

District of Columbia Tobacco Settlement Financing Corp., 6.75%, 5/15/40

|

6,075,000

|

|

|

|

|

|

|

$ 11,391,750

|

|

|

|

Principal

Amount

USD ($)

|

S&P/Moody's

Ratings

(unaudited)

|

|

Value

|

|

|

|

|

|

|

|

Florida - 7.1%

|

|

|

|

|

1,500,000

|

NR/NR

|

Alachua County Health Facilities Authority Revenue, 8.125%, 11/15/41

|

$ 1,623,135

|

|

|

|

1,500,000

|

NR/NR

|

Alachua County Health Facilities Authority Revenue, 8.125%, 11/15/46

|

1,618,980

|

|

|

|

1,400,000

|

NR/NR

|

Beacon Lakes Community Development District Special Assessment, 6.9%, 5/1/35

|

1,413,538

|

|

|

|

500,000

|

NR/B1

|

Capital Trust Agency Revenue Bonds, 7.75%, 1/1/41

|

534,160

|

|

|

|

1,000,000

|

NR/NR

|

Florida Development Finance Corp., Educational Facilities Revenue, 6.0%, 9/15/40

|

894,660

|

|

|

|

2,000,000

|

NR/NR

|

Florida Development Finance Corp., Educational Facilities Revenue, 7.625%, 6/15/41

|

2,079,020

|

|

|

|

1,000,000

|

NR/NR

|

Florida Development Finance Corp., Educational Facilities Revenue, 7.75%, 6/15/42

|

1,059,900

|

|

|

|

1,000,000(a)

|

NR/WR

|

Hillsborough County Industrial Development Authority Revenue, 8.0%, 8/15/32

|

1,350,490

|

|

|

|

2,260,000

|

NR/NR

|

Liberty County Subordinate Revenue, 8.25%, 7/1/28

|

1,730,437

|

|

|

|

2,500,000

|

A/A2

|

Miami-Dade County Florida Aviation Revenue, 5.5%, 10/1/41

|

2,594,975

|

|

|

|

1,000,000 (b)

|

NR/NR

|

St. Johns County Industrial Development Authority Revenue, 5.25%, 1/1/26

|

480,000

|

|

|

|

2,000,000 (b)

|

NR/NR

|

St. Johns County Industrial Development Authority Revenue, 5.375%, 1/1/40

|

960,000

|

|

|

|

5,000,000

|

NR/Baa1

|

Tallahassee Health Facilities Revenue, 6.375%, 12/1/30

|

5,003,450

|

|

|

|

|

|

|

$ 21,342,745

|

|

|

|

|

|

Georgia - 3.2%

|

|

|

|

|

4,240,000

|

AA-/WR

|

Atlanta Georgia Water and Wastewater Revenue, RIB, 10.795%, 11/1/43 (144A)

|

$ 4,241,908

|

|

|

|

500,000

|

B/NR

|

Clayton County Development Authority Revenue, 9.0%, 6/1/35

|

539,665

|

|

|

|

2,400,000

|

NR/NR

|

Fulton County Residential Care Facilities Revenue, 5.0%, 7/1/27

|

2,211,768

|

|

|

|

3,100,000

|

NR/NR

|

Fulton County Residential Care Facilities Revenue, 5.125%, 7/1/42

|

2,606,139

|

|

|

|

|

|

|

$ 9,599,480

|

|

|

|

|

|

Idaho - 1.7%

|

|

|

|

|

5,000,000

|

A-/Baa1

|

Power County Industrial Development Corp., Revenue, 6.45%, 8/1/32

|

$ 5,004,250

|

|

|

|

|

|

|

|

|

|

|

|

|

Illinois - 15.0%

|

|

|

|

–

|

1,827,000(c)

|

NR/NR

|

Illinois Finance Authority Revenue, 0.0%, 11/15/52

|

$ 204,441

|

|

|

|

2,087,000(d)

|

NR/NR

|

Illinois Finance Authority Revenue, 4.0%, 11/15/52

|

1,191,406

|

|

|

|

3,865,000

|

BBB+/NR

|

Illinois Finance Authority Revenue, 6.0%, 8/15/38

|

4,054,076

|

|

|

|

2,000,000

|

AA+/Aa2

|

Illinois Finance Authority Revenue, 6.0%, 8/15/39

|

2,239,120

|

|

|

|

2,450,000

|

NR/NR

|

Illinois Finance Authority Revenue, 6.375%, 5/15/17

|

2,451,984

|

|

|

|

2,500,000

|

NR/Baa3

|

Illinois Finance Authority Revenue, 6.5%, 4/1/39

|

2,656,850

|

|

|

|

240,000

|

NR/NR

|

Illinois Finance Authority Revenue, 7.0%, 11/15/17

|

235,630

|

|

|

|

500,000

|

NR/NR

|

Illinois Finance Authority Revenue, 7.0%, 5/15/18

|

500,575

|

|

|

–

|

855,000

|

NR/NR

|

Illinois Finance Authority Revenue, 7.0%, 11/15/27

|

798,170

|

|

|

|

1,700,000

|

NR/NR

|

Illinois Finance Authority Revenue, 7.625%, 5/15/25

|

1,843,837

|

|

|

|

600,000

|

NR/NR

|

Illinois Finance Authority Revenue, 7.75%, 5/15/30

|

645,486

|

|

|

|

Principal

Amount

USD ($)

|

S&P/Moody's

Ratings

(unaudited)

|

|

Value

|

|

|

|

|

|

|

|

Illinois - (continued)

|

|

|

|

|

2,000,000

|

NR/NR

|

Illinois Finance Authority Revenue, 8.0%, 5/15/40

|

$2,149,800

|

|

|

|

3,200,000

|

NR/NR

|

Illinois Finance Authority Revenue, 8.0%, 5/15/46

|

3,430,496

|

|

|

|

4,000,000

|

NR/NR

|

Illinois Finance Authority Revenue, 8.25%, 5/15/45

|

4,006,360

|

|

|

|

2,500,000

|

NR/NR

|

Illinois Finance Authority Revenue, 8.25%, 2/15/46

|

2,514,200

|

|

|

|

16,880,000

|

AAA/Baa1

|

Metropolitan Pier & Exposition Authority Dedicated State Tax Revenue, 5.65%, 6/15/22

|

15,022,356

|

|

|

|

1,425,000

|

NR/NR

|

Southwestern Illinois Development Authority Revenue, 5.625%, 11/1/26

|

1,128,386

|

|

|

|

|

|

|

$ 45,073,173

|

|

|

|

|

|

Indiana - 1.7%

|

|

|

|

|

250,000

|

NR/NR

|

City of Carmel Indiana Nursing Home Revenue, 7.0%, 11/15/32

|

$ 256,305

|

|

|

|

750,000

|

NR/NR

|

City of Carmel Indiana Nursing Home Revenue, 7.125%, 11/15/42

|

765,443

|

|

|

|

500,000

|

NR/NR

|

City of Carmel Indiana Nursing Home Revenue, 7.125%, 11/15/47

|

506,865

|

|

|

|

3,570,000

|

NR/NR

|

Vigo County Hospital Authority Revenue, 5.8%, 9/1/47 (144A)

|

3,516,521

|

|

|

|

|

|

|

$ 5,045,134

|

|

|

|

|

|

Louisiana - 3.0%

|

|

|

|

|

2,260,000

|

BBB-/Baa3

|

Jefferson Parish Hospital Service District No. 2, 6.375%, 7/1/41

|

$ 2,376,526

|

|

|

|

1,500,000

|

BBB-/Baa3

|

Louisiana Local Government Environmental Facilities & Community Development Authority Revenue, 6.75%, 11/1/32

|

1,574,955

|

|

|

|

5,000,000

|

NR/Baa1

|

Louisiana Public Facilities Authority Revenue, 5.5%, 5/15/47

|

5,078,000

|

|

|

|

|

|

|

$ 9,029,481

|

|

|

|

|

|

Maine - 0.6%

|

|

|

|

|

1,500,000

|

NR/Baa3

|

Maine Health & Higher Educational Facilities Authority Revenue, 7.5%, 7/1/32

|

$ 1,791,330

|

|

|

|

|

|

|

|

|

|

|

|

|

Massachusetts - 5.2%

|

|

|

|

|

2,195,000

|

NR/NR

|

Massachusetts Development Finance Agency Revenue, 7.1%, 7/1/32

|

$ 2,191,422

|

|

|

|

7,100,000

|

A/WR

|

Massachusetts Development Finance Agency Revenue, RIB, 5.75%, 1/1/42

|

7,708,967

|

|

|

|

725,000

|

AA/NR

|

Massachusetts Educational Financing Authority Revenue, 6.0%, 1/1/28

|

784,878

|

|

|

|

4,500,000(b)

|

NR/NR

|

Massachusetts Health & Educational Facilities Authority Revenue, 6.5%,

1/15/38

|

17,595

|

|

|

|

5,000,000

|

B+/NR

|

Massachusetts Health & Educational Facilities Authority Revenue, 6.75%, 10/1/33

|

5,006,350

|

|

|

|

|

|

|

$ 15,709,212

|

|

|

|

|

|

Michigan - 3.3%

|

|

|

|

|

935,000

|

NR/NR

|

Doctor Charles Drew Academy Certificate of Participation, 5.7%, 11/1/36

|

$ 619,849

|

|

|

|

2,000,000

|

BB+/NR

|

Kent Hospital Finance Authority Revenue, 6.25%, 7/1/40

|

2,053,320

|

|

|

|

2,640,000

|

AA/Aa1

|

Michigan State University Revenue, 5.0%, 8/15/41

|

2,702,753

|

|

|

|

5,830,000

|

B-/NR

|

Michigan Tobacco Settlement Finance Authority Revenue, 6.0%, 6/1/48

|

4,594,506

|

|

|

|

|

|

|

$ 9,970,428

|

|

|

|

|

|

Minnesota - 0.4%

|

|

|

|

|

1,000,000

|

NR/NR

|

Port Authority of the City of Bloomington, Minnesota Recovery Zone Facility Revenue, 9.0%, 12/1/35

|

$ 1,122,170

|

|

|

|

|

|

|

|

|

|

|

Principal

Amount

USD ($)

|

S&P/Moody's

Ratings

(unaudited)

|

|

Value

|

|

|

|

|

|

|

|

Montana - 0.1%

|

|

|

|

|

1,600,000(b)

|

NR/NR

|

Two Rivers Authority Inc., Project Revenue, 7.375%, 11/1/27

|

$ 233,568

|

|

|

|

|

|

|

|

|

|

|

|

|

New Jersey - 5.9%

|

|

|

|

|

6,500,000

|

NR/NR

|

New Jersey Economic Development Authority Revenue, 10.5%, 6/1/32 (144A)

|

$ 6,415,305

|

|

|

|

3,000,000

|

B/B2

|

New Jersey Economic Development Authority Revenue, 5.25%, 9/15/29

|

2,813,550

|

|

|

|

2,500,000

|

B/B2

|

New Jersey Economic Development Authority Revenue, 5.75%, 9/15/27

|

2,430,775

|

|

|

|

6,150,000 (d)

|

B/B2

|

New Jersey Economic Development Authority Revenue, 7.0%, 11/15/30

|

6,152,829

|

|

|

|

|

|

|

$ 17,812,459

|

|

|

|

|

|

New Mexico - 1.2%

|

|

|

|

|

1,500,000

|

NR/NR

|

Otero County New Mexico Project Revenue, 6.0%, 4/1/23

|

$ 1,273,065

|

|

|

|

2,960,000

|

NR/NR

|

Otero County New Mexico Project Revenue, 6.0%, 4/1/28

|

2,334,315

|

|

|

|

|

|

|

$ 3,607,380

|

|

|

|

|

|

New York - 8.2%

|

|

|

|

|

2,000,000

|

NR/NR

|

Chautauqua County Capital Resource Corp., Revenue, 8.0%, 11/15/30

|

$ 2,075,900

|

|

|

|

3,000,000

|

NR/NR

|

Dutchess County Industrial Development Agency Revenue, 7.5%, 3/1/29

|

3,042,540

|

|

|

|

2,000,000

|

BBB+/NR

|

Hempstead Local Development Corp., Revenue, 5.75%, 7/1/39

|

2,048,160

|

|

|

|

2,000,000

|

BB/B2

|

New York City Industrial Development Agency Revenue, 5.25%, 12/1/32

|

1,875,180

|

|

|

|

2,000,000

|

BB/B2

|

New York City Industrial Development Agency Revenue, 7.625%, 12/1/32

|

2,014,360

|

|

|

|

7,040,000(d)

|

AAA/WR

|

New York State Dormitory Authority Revenue, 13.469%, 5/29/14 (144A)

|

9,644,307

|

|

|

|

1,000,000

|

NR/Ba1

|

New York State Dormitory Authority Revenue, 6.125%, 12/1/29

|

1,055,130

|

|

|

|

3,000,000

|

NR/NR

|

Suffolk County Industrial Development Agency Revenue, 7.25%, 1/1/30

|

2,968,590

|

|

|

|

|

|

|

$ 24,724,167

|

|

|

|

|

|

North Carolina - 3.7%

|

|

|

|

|

4,795,000

|

NR/NR

|

Charlotte North Carolina Special Facilities Revenue, 7.75%, 2/1/28

|

$ 4,799,219

|

|

|

|

6,685,000

|

NR/NR

|

Charlotte Special Facilities Revenue, 5.6%, 7/1/27

|

6,459,181

|

|

|

|

|

|

|

$ 11,258,400

|

|

|

|

|

|

North Dakota - 0.8%

|

|

|

|

|

2,525,000

|

BBB+/NR

|

County of Burleigh ND, 5.0%, 7/1/38

|

$ 2,472,051

|

|

|

|

|

|

|

|

|

|

|

|

|

Oklahoma - 0.4%

|

|

|

|

|

1,225,000

|

NR/WR

|

Tulsa Airports Improvement Trust Revenue, 6.25%, 6/1/20

|

$ 1,225,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Pennsylvania - 4.6%

|

|

|

|

|

1,550,000

|

NR/Baa2

|

Allegheny County Hospital Development Authority Revenue, 5.125%, 5/1/25

|

$ 1,549,891

|

|

|

|

1,280,000(b)

|

NR/WR

|

Langhorne Manor Borough Higher Education Authority Revenue, 7.35%, 7/1/22

|

344,064

|

|

|

|

5,000,000

|

B-/Caa2

|

Pennsylvania Economic Development Financing Authority Solid Waste Disposal Revenue, 6.0%, 6/1/31

|

4,983,250

|

|

|

|

1,000,000

|

BB-/NR

|

Philadelphia Authority for Industrial Development Revenue, 6.5%, 6/15/33 (144A)

|

994,390

|

|

|

|

1,000,000

|

BB-/NR

|

Philadelphia Authority for Industrial Development Revenue, 6.75%, 6/15/43 (144A)

|

994,170

|

|

|

|

5,900,000 (e)

|

BB+/Ba2

|

Philadelphia Hospitals & Higher Education Facilities Authority Revenue, 5.0%, 7/1/34

|

5,036,181

|

|

|

|

|

|

|

$ 13,901,946

|

|

|

|

Principal

Amount

USD ($)

|

S&P/Moody's

Ratings

(unaudited)

|

|

Value

|

|

|

|

|

|

|

|

Rhode Island - 2.1%

|

|

|

|

|

5,950,000(e)

|

NR/NR

|

Central Falls Rhode Island Detention Facility Corp., Revenue, 7.25%, 7/15/35

|

$ 4,638,560

|

|

|

|

1,500,000

|

NR/NR

|

Rhode Island Health & Educational Building Corp., Revenue, 8.375%, 1/1/46

|

1,688,655

|

|

|

|

|

|

|

$ 6,327,215

|

|

|

|

|

|

South Carolina - 1.3%

|

|

|

|

–

|

3,850,000(a)

|

BBB+/Baa1

|

South Carolina Jobs Economic Development Authority Revenue, 6.375%, 8/1/34

|

$ 3,850,000

|

|

|

|

|

|

|

$ 3,850,000

|

|

|

|

|

|

Tennessee - 1.5%

|

|

|

|

|

4,600,000

|

BBB+/NR

|

Sullivan County Health, Educational & Housing Facilities Board Revenue, 5.25%, 9/1/36

|

$ 4,557,266

|

|

|

|

|

|

|

|

|

|

|

|

|

Texas - 17.8%

|

|

|

|

|

2,500,000

|

BB+/Baa3

|

Central Texas Regional Mobility Authority Revenue, 6.75%, 1/1/41

|

$ 2,705,450

|

|

|

|

4,000,000

|

NR/NR

|

Decatur Hospital Authority Medical Revenue, 7.0%, 9/1/25

|

4,141,760

|

|

|

|

725,078(b)

|

NR/NR

|

Gulf Coast Industrial Development Authority Revenue, 7.0%, 12/1/36

|

6,526

|

|

|

|

3,750,000

|

B/B2

|

Houston Airport System Special Facilities Revenue, 5.7%, 7/15/29

|

3,587,213

|

|

|

|

3,000,000

|

NR/NR

|

Jefferson County Industrial Development Corp., Revenue, 8.25%, 7/1/32

|

3,100,800

|

|

|

|

5,340,000

|

NR/NR

|

Lubbock Health Facilities Development Corp., Nursing Home Revenue, 6.625%, 7/1/36

|

5,417,483

|

|

|

|

10,000,000

|

BBB+/A3

|

North Texas Tollway Authority Transportation Revenue, 5.75%, 1/1/33

|

10,564,900

|

|

|

|

2,810,000(d)

|

AAA/Aaa

|

Northside Independent School District, General Obligation, 11.652%, 9/29/12 (144A)

|

3,019,738

|

|

|

|

1,500,000

|

NR/NR

|

Red River Health Facilities Development Corp., Revenue, 8.0%, 11/15/41

|

1,610,430

|

|

|

|

4,000,000

|

NR/NR

|

Sanger Industrial Development Corp., Revenue, 8.0%, 7/1/38

|

4,023,560

|

|

|

|

7,040,000(d)

|

AA+/Aaa

|

State of Texas, General Obligation, 12.646%, 4/1/30

|

8,077,626

|

|

|

|

2,000,000

|

NR/NR

|

Tarrant County Cultural Education Facilities Finance Corp., Revenue, 8.0%, 11/15/34

|

2,147,700

|

|

|

|

1,000,000

|

NR/NR

|

Tarrant County Cultural Education Facilities Finance Corp., Revenue, 8.125%,

11/15/39

|

1,059,400

|

|

|

|

1,500,000

|

NR/NR

|

Tarrant County Cultural Education Facilities Finance Corp., Revenue, 8.25%,

11/15/44

|

1,591,485

|

|

|

|

2,500,000

|

NR/NR

|

Travis County Health Facilities Development Corp., Revenue, 7.125%, 1/1/46

|

2,455,600

|

|

|

|

|

|

|

$ 53,509,671

|

|

|

|

|

|

Vermont - 0.5%

|

|

|

|

|

1,500,000(a)

|

A-/Baa1

|

Vermont Educational & Health Buildings Financing Agency Higher Education Revenue, 6.0%, 10/1/28

|

$ 1,514,325

|

|

|

|

|

|

|

|

|

|

|

|

|

Virginia - 0.3%

|

|

|

|

|

1,000,000

|

BBB/Ba1

|

Peninsula Ports Authority Revenue, 6.0%, 4/1/33

|

$ 1,006,840

|

|

|

|

|

|

|

|

|

|

|

|

|

Washington - 10.8%

|

|

|

|

|

4,710,000(a)

|

A+/A2

|

Spokane Public Facilities District Hotel/Motel Tax & Sales, 5.75%, 12/1/27

|

$ 4,797,371

|

|

|

|

14,315,000(c)

|

AA+/Aa1

|

State of Washington, General Obligation, 0.0%, 6/1/22

|

10,945,535

|

|

|

|

7,025,000

|

BBB/Baa1

|

Tobacco Settlement Authority Revenue, 6.625%, 6/1/32

|

7,110,494

|

|

|

|

3,795,000

|

A/A2

|

Washington State Health Care Facilities Authority Revenue, 6.0%, 1/1/33

|

3,957,540

|

|

|

|

1,150,000

|

NR/NR

|

Washington State Housing Finance Commission Revenue, 6.75%, 10/1/47

|

1,011,954

|

|

|

|

Principal

Amount

USD ($)

|

S&P/Moody's

Ratings

(unaudited)

|

|

Value

|

|

|

|

|

|

|

|

Washington - (continued)

|

|

|

|

|

5,000,000

|

NR/NR

|

Washington State Housing Finance Committee Nonprofit Revenue, 5.625%, 1/1/27

|

$ 4,633,050

|

|

|

|

|

|

|

$ 32,455,944

|

|

|

|

|

|

West Virginia - 0.9%

|

|

|

|

|

2,000,000

|

NR/NR

|

City of Philippi WV, 7.75%, 10/1/44

|

$ 1,901,020

|

|

|

|

745,000

|

NR/NR

|

West Virginia Hospital Finance Authority Hospital Revenue, 9.125%, 10/1/41

|

902,389

|

|

|

|

|

|

|

$ 2,803,409

|

|

|

|

|

|

Wisconsin - 2.0%

|

|

|

|

|

2,320,000(f) (g)

|

NR/NR

|

Aztalan Township, 7.5%, 5/1/18

|

$ –

|

|

|

|

2,500,000

|

NR/NR

|

Wisconsin Public Finance Authority Continuing Care Retirement Community Revenue, 8.25%, 6/1/46

|

2,780,325

|

|

|

|

1,500,000

|

NR/NR

|

Wisconsin State Public Finance Authority Revenue, 8.375%, 6/1/20

|

1,504,350

|

|

|

|

1,500,000

|

NR/NR

|

Wisconsin State Public Finance Authority Revenue, 8.625%, 6/1/47

|

1,567,950

|

|

|

|

|

|

|

$ 5,852,625

|

|

|

|

|

|

TOTAL TAX EXEMPT OBLIGATIONS

|

|

|

|

|

|

|

(Cost $372,192,065)

|

$ 387,232,970

|

|

|

|

|

|

|

|

|

|

|

|

|

MUNICIPAL COLLATERALIZED DEBT OBLIGATION

-

1.8%

of Net Assets

|

|

|

|

|

10,000,000(d)(e)

|

NR/NR

|

Non-Profit Preferred Funding Trust I, 6.75%, 9/15/37 (144A)

|

$ 5,553,400

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL MUNICIPAL COLLATERALIZED DEBT OBLIGATION

|

|

|

|

|

|

|

(Cost $10,000,000)

|

$ 5,553,400

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL INVESTMENTS IN SECURITIES - 130.6%

|

|

|

|

|

|

|

(Cost - $382,192,065) (h) (i)

|

$ 392,786,370

|

|

|

|

|

|

OTHER ASSETS AND LIABILITIES -3.0%

|

$ 8,914,893

|

|

|

|

|

|

PREFERRED SHARES AT REDEMPTION VALUE,

INCLUDING DIVIDENDS PAYABLE - (33.6)%

|

$ (101,000,151)

|

|

|

|

|

|

NET ASSETS APPLICABLE TO

COMMON SHAREOWNERS - 100.0%

|

$ 300,701,112

|

|

|

|

NR

|

|

Security not rated by S&P or Moody's.

|

|

WR

|

|

Rating withdrawn by either S&P or Moody's.

|

|

(144A)

|

|

Security is exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold normally to qualified institutional buyers in a transaction exempt from registration. At July 31, 2013, the value of these securities amounted to $46,577,690, or 15.5% of total net assets applicable to common shareowners.

|

|

RIB

|

|

Residual Interest Bond. The interest rate is subject to change periodically and inversely based upon prevailing market rates. The interest rate shown is the rate at July 31, 2013

|

|

|

|

(a)

|

Prerefunded bonds have been collateralized by U.S. Treasury or U.S. Government Agency securities which are held in escrow to pay interest and principal on the tax exempt issue and to retire the bonds in full at the earliest refunding date.

|

|

(b)

|

Security is in default and is non income producing.

|

|

(c)

|

Security issued with a zero coupon. Income is recognized through accretion of discount.

|

|

(d)

|

The interest rate is subject to change periodically. The interest is shown is the rate at July 31, 2013.

|

|

(e)

|

Indicates a security that has been deemed as illiquid. As of July 31, 2013 the aggregate cost of illiquid securities in the Trust's portfolio was $21,832,292. As of that date, the aggregate value of illiquid securities in the Trust's portfolio of $15,228,141 represented 5.1% of total net assets applicable to common shareowners.

|

|

(f)

|

Security is valued using fair value methods (other than prices supplied by independent pricing services).

|

|

(g)

|

The company is scheduled for approval of a reorganization plan.

|

|

(h)

|

The concentration of investments by type of obligation/ market sector is as follows :

|

|

|

|

|

Insured

|

|

|

NATL-RE

|

5.0

|

%

|

|

|

FSA

|

3.2

|

|

|

|

NATL-RE FGIC

|

2.8

|

|

|

|

AMBAC GO OF INSTN

|

2.0

|

|

|

|

PSF-GTD

|

0.8

|

|

|

|

Revenue Bonds:

|

|

|

Health Revenue

|

18.8

|

|

|

|

Facilities Revenue

|

14.9

|

|

|

|

Other Revenue

|

13.6

|

|

|

|

Development Revenue

|

11.8

|

|

|

|

Tobacco Revenue

|

7.5

|

|

|

|

Education Revenue

|

7.0

|

|

|

|

Airport Revenue

|

4.8

|

|

|

|

Transportation Revenue

|

4.7

|

|

|

|

Pollution Control Revenue

|

1.9

|

|

|

|

Water Revenue

|

1.2

|

|

|

|

Utilities Revenue

|

0.0

|

*

|

|

|

|

|

%

|

|

|

* Amount is less than 0.1%

|

(i)

|

At July 31, 2013, the net unrealized gain on investments based on cost for federal tax purposes of $382,047,137 was as follows:

|

|

|

|

|

|

|

Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost

|

$ 30,465,581

|

|

|

Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value

|

(19,726,348)

|

|

|

|

|

|

Net unrealized appreciation

|

$ 10,739,733

|

|

|

|

|

|

For financial reporting purposes net unrealized gain on investments was

$ 10,594,305 and cost of investments aggregated $382,192,065.

|

|

|

|

Various inputs are used in determining the value of the Trust's investments. These inputs are summarized in the three broad levels below.

|

|

|

|

|

|

Level 1 - quoted prices in active markets for identical securities

|

|

|

Level 2 - other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds

|

|

|

credit risks, etc.)

|

|

|

Level 3 - significant unobservable inputs (including the Trust's own assumptions in determining fair value of investments)

|

|

|

|

|

|

Generally, equity securities are categorized as Level 1, fixed income securities and senior loans are categorized as Level 2, and securities valued using fair value methods (other than prices supplied by independent pricing services) as level 3.

|

|

|

|

|

|

The following is a summary of the inputs used as of July 31, 2013, in valuing the Trust's investments.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Exempt Obligations

|

|

$

|

–

|

|

|

|

387,232,970

|

|

|

$

|

–

|

**

|

|

|

387,232,970

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Municipal Collateralized Debt Obligation

|

|

|

–

|

|

|

|

5,553,400

|

|

|

|

–

|

|

|

|

5,553,400

|

|

|

Total Investments in Securities

|

|

$

|

–

|

|

|

$

|

392,786,370

|

|

|

$

|

–

|

|

|

$

|

392,786,370

|

|

|

|

|

|

The following is a reconciliation of assets valued using significant unobservable inputs (level 3):

|

|

|

|

|

Balance

as of

4/30/13

|

|

|

Realized

gain

(loss)

|

|

|

Change in

Unrealized appreciation

(depreciation)

|

|

|

Purchases

|

|

|

Sales

|

|

|

Accrued

discounts/ premiums

|

|

|

Transfers

in to

Level 3*

|

|

|

Transfers

out of

Level 3*

|

|

|

Balance

as of

7/31/13

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

–

|

|

|

$

|

–

|

|

|

$

|

–

|

|

|

$

|

–

|

|

|

$

|

–

|

|

|

$

|

–

|

|

|

$

|

–

|

|

|

$

|

–

|

|

|

$

|

–

|

**

|

|

|

|

|

|

|

* Transfers are calculated on the end of period value

|

|

|

**Includes security that is fair valued at $0.

|

|

|

At July 31, 2013, there were no transfers between 1, 2 and 3.

|

|

ITEM 2. CONTROLS AND PROCEDURES. (a) Disclose the conclusions of the registrant's principal executive officer or officers and principal financial officer or officers, or persons performing similar functions, about the effectiveness of the registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Act (17 CFR 270.30a-3(c))) as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the Act (17 CFR270.30a-3(b))) and Rule 13a-15(b) or 15d-15(b) under the Exchange Act (17 CFR240.13a-15(b) or 240.15d-15(b)). The registrant's principal executive officer and principal financial officer have concluded that the registrant's disclosure controls and procedures are effective based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report. (b) Disclose any change in the registrant's internal controls over financial reporting (as defined in Rule 30a-3(d) under the Act (17 CFR270.30a-3(d)) that occurred during the registrant's last fiscal quarter that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting. There were no significant changes in the registrant's internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant's internal control over financial reporting. ITEM 3. EXHIBITS. (a) A separate certification for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2 under the Act (17 CFR 270.30a-2). Filed herewith. <PAGE> SIGNATURES [See General Instruction F] Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. (Registrant) Pioneer Municipal High Income Trust By (Signature and Title)* /s/ John F. Cogan, Jr. John F. Cogan, Jr, President Date September 27, 2013 Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. By (Signature and Title)* /s/ John F. Cogan, Jr. John F. Cogan, Jr., President Date September 27, 2013 By (Signature and Title)* /s/ Mark Bradley Mark Bradley, Treasurer Date September 27, 2013 * Print the name and title of each signing officer under his or her signature.

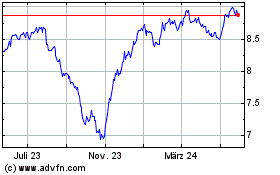

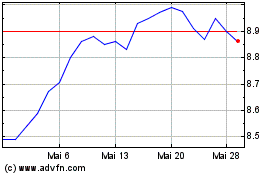

Pioneer Municipal High I... (NYSE:MHI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Pioneer Municipal High I... (NYSE:MHI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024