0000879101false00019594720000879101kim:DepositarySharesEachRepresentingOneThousandthOfAShareOf5125ClassLCumulativeRedeemablePreferredStockMember2024-10-312024-10-310000879101kim:KimcoRealtyOPLLCMember2024-10-312024-10-310000879101kim:DepositarySharesEachRepresentingOneThousandthOfAShareOf7250ClassNCumulativeConvertiblePerpetualPreferredStockMember2024-10-312024-10-310000879101kim:DepositarySharesEachRepresentingOneThousandthOfAShareOf5250ClassMCumulativeRedeemablePreferredStockMember2024-10-312024-10-3100008791012024-10-312024-10-310000879101kim:CommonStockParValue01PerShareMember2024-10-312024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) October 31, 2024

KIMCO REALTY CORPORATION

KIMCO REALTY OP, LLC

(Exact Name of registrant as specified in its charter)

|

|

|

|

|

Maryland (Kimco Realty Corporation) |

|

1-10899 |

|

13-2744380 |

Delaware (Kimco Realty OP, LLC) |

|

333-269102-01 |

|

92-1489725 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

500 N. Broadway

Suite 201

Jericho, NY 11753

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (516) 869-9000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[_] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[_] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[_] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[_] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

Kimco Realty Corporation

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on |

which registered |

Common Stock, par value $.01 per share. |

KIM |

New York Stock Exchange |

Depositary Shares, each representing one-thousandth of a share of 5.125% Class L Cumulative Redeemable, Preferred Stock, $1.00 par value per share. |

KIMprL |

New York Stock Exchange |

Depositary Shares, each representing one-thousandth of a share of 5.250% Class M Cumulative Redeemable, Preferred Stock, $1.00 par value per share. |

KIMprM |

New York Stock Exchange |

Depositary Shares, each representing one-thousandth of a share of 7.250% Class N Cumulative Convertible, Preferred Stock, $1.00 par value per share. |

KIMprN |

New York Stock Exchange |

Kimco Realty OP, LLC

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on |

which registered |

None |

N/A |

N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

Kimco Realty Corporation Yes ☐ No ☒ Kimco Realty OP, LLC Yes ☐ No ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Kimco Realty Corporation ☐ Kimco Realty OP, LLC ☐

Item 2.02. Results of Operations and Financial Condition.

On October 31, 2024, Kimco Realty Corporation (the “Company”) issued a press release announcing its financial results for the quarter ended September 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02 and in Exhibit 99.1 is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended. The information in this Item 2.02 and in Exhibit 99.1 shall not be deemed to be incorporated by reference into any filing of the Company whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

99.1 Press Release, dated October 31, 2024 issued by Kimco Realty Corporation

104 Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Date: October 31, 2024 |

|

|

|

|

|

|

|

|

KIMCO REALTY CORPORATION |

|

|

|

By: |

/s/ Glenn G. Cohen |

|

|

Name: |

Glenn G. Cohen |

|

|

Title: |

Chief Financial Officer |

|

|

|

|

|

|

|

|

|

KIMCO REALTY OP, LLC By: KIMCO REALTY CORPORATION, Managing Member |

|

|

|

By: |

/s/ Glenn G. Cohen |

|

|

Name: |

Glenn G. Cohen |

|

|

Title: |

Chief Financial Officer |

Kimco Realty® Announces Third Quarter 2024 Results

– Portfolio Occupancy Matches All-Time High –

– Board Increases Quarterly Cash Dividend on Common Shares by 4.2% –

– Raises 2024 Outlook –

JERICHO, New York, October 31, 2024 - Kimco Realty® (NYSE: KIM), a real estate investment trust (REIT) and leading owner and operator of high-quality, open-air, grocery-anchored shopping centers and mixed-use properties in the United States, today reported results for the third quarter ended September 30, 2024. For the three months ended September 30, 2024 and 2023, Kimco Realty’s net income available to the company’s common shareholders per diluted share was $0.19 and $0.18, respectively.

Third Quarter Highlights

•Grew Funds From Operations* (“FFO”) 7.5% over the same period in 2023 to $0.43 per diluted share.

•Produced 3.3% growth in Same Property Net Operating Income* (“NOI”) over the same period a year ago.

•Increased pro-rata portfolio occupancy to 96.4%, matching the company’s all-time high.

•Reached a new all-time high for pro-rata small shop occupancy at 91.8%.

•Generated pro-rata cash rent spreads of 41.9% on 119 comparable new leases.

•Achieved an “A-” credit rating from Fitch Ratings and a “Positive” outlook from S&P Global Ratings.

•Issued $500 million of 4.850% senior unsecured notes maturing March 2035.

•Subsequent to quarter end, acquired Waterford Lakes Town Center, a 976,000-square-foot signature asset spanning 79 acres in Orlando, Florida, for $322 million as previously reported.

“The ongoing positive supply and demand fundamentals in both the open-air sector and Kimco's portfolio continue to be a cause for optimism and confidence,” stated Conor Flynn, CEO of Kimco. “Our high-quality, grocery-anchored properties continue to deliver outsized growth, record occupancy and advantageous pricing power. Moreover, our recent acquisition of the Waterford Lakes Town Center in Orlando positions us to be a net acquirer in 2024. With a favorable environment, best in class platform and a rock-solid balance sheet, we are again raising our financial outlook for the year.”

Financial Results

Net income available to the company’s common shareholders (“Net income”) for the third quarter of 2024 was $128.0 million, or $0.19 per diluted share, compared to $112.0 million, or $0.18 per diluted share, for the third quarter of 2023. This 5.6% increase per diluted share is primarily attributable to:

•The acquisition of RPT Realty (“RPT”), which was the primary driver of the growth in consolidated revenues from rental properties, net, of $61.1 million, partially offset by higher real estate taxes of $7.1 million and higher operating and maintenance expenses of $12.1 million, as well as increased depreciation and amortization expense of $17.3 million.

•$13.8 million higher other income, primarily due to an increase in mortgage and other financing income, related to Kimco’s Structured Investment Program and an increase due to mark-to-market fluctuations of embedded derivative liability.

Other notable items impacting the year-over-year change include:

•$13.1 million lower gains on marketable securities in 2024 due to the sale of Albertsons Companies Inc. common stock during the first quarter of 2024.

•$15.8 million in increased consolidated interest expense due to higher levels of outstanding debt compared to the third quarter of 2023 driven by the debt associated with the acquisition of RPT which closed in the first quarter of 2024 and the issuance of $500 million senior unsecured notes priced at 6.400% due 2034 in the third quarter of 2023.

*Reconciliations of non-GAAP measures to the most directly comparable GAAP measure are provided in the tables accompanying this press release.

i

500 North Broadway, Suite 201 | Jericho, NY 11753 | (833) 800-4343 kimcorealty.com

FFO was $287.4 million, or $0.43 per diluted share, for the third quarter of 2024, compared to $248.6 million, or $0.40 per diluted share, for the third quarter of 2023. The company excludes from FFO all realized or unrealized marketable securities/derivatives gains and losses, as well as gains and losses from the sales of properties, depreciation and amortization related to real estate, profit participations from other investments, and other items considered incidental to the company’s business.

Operating Results

•Signed 451 leases totaling 2.4 million square feet, generating blended pro-rata cash rent spreads on comparable spaces of 12.3%, with new leases up 41.9% and renewals and options growing 6.8%.

•Increased pro-rata portfolio occupancy to 96.4%, matching an all-time high and representing a sequential increase of 20 basis points and a year-over-year rise of 90 basis points.

•Reached an all-time high for pro-rata small shop occupancy at 91.8%, reflecting a sequential increase of 10 basis points and year-over-year growth of 70 basis points.

•Pro-rata anchor occupancy ended the quarter at 98.2%, an increase of 10 basis points sequentially and 100 basis points year-over-year.

•Produced a 310-basis-point spread between leased (reported) occupancy and economic occupancy at the end of the third quarter, representing approximately $61.2 million in anticipated future annual base rent.

•Generated 3.3% growth in Same Property NOI over the same period a year ago, primarily driven by 3.9% growth from minimum rent.

Investment & Disposition Activities

•Acquired the remaining ownership interest in a grocery-anchored shopping center in West Palm Beach, Florida for $3.3 million.

•Provided an additional $2.6 million of mezzanine financing on a grocery-anchored shopping center from the company’s Structured Investment Program.

•As previously announced in October of 2024, the company acquired Waterford Lakes Town Center, a 976,000-square-foot grocery-anchored, lifestyle center in the Orlando market, for $322 million, including the assumption of a $164.6 million mortgage at a fixed rate of 4.86%.

Capital Market Activities

•Kimco amended and upsized its unsecured term loan to $550 million from $200 million and included five additional banks. The company entered into interest rate swap agreements, fixing the rate on the incremental term loans to a blended rate of 4.664%. The terms, applicable spread, maturity date and credit covenants are unchanged from the January 2, 2024 term loan agreement.

•Issued $500 million of 4.850% senior unsecured notes maturing March 2035.

•Reached full allocation on the company’s $500 million 2.700% Green Bond that was issued in July of 2020.

•Ended the third quarter with $2.8 billion of immediate liquidity, including full availability on the $2.0 billion unsecured revolving credit facility and $790 million of cash and cash equivalents on the balance sheet.

Dividend Declarations

•Kimco’s board of directors declared a cash dividend of $0.25 per common share, representing a 4.2% increase over the quarterly dividend in the corresponding period of the prior year. The quarterly cash dividend on common shares will be payable on December 19, 2024, to shareholders of record on December 5, 2024.

•The board of directors also declared quarterly dividends with respect to each of the company’s Class L, Class M, and Class N series of preferred shares. These dividends on the preferred shares will be paid on January 15, 2025, to shareholders of record on January 2, 2025.

ii

500 North Broadway, Suite 201 | Jericho, NY 11753 | (833) 800-4343 kimcorealty.com

2024 Full Year Outlook

The company has raised its 2024 outlook for Net income and FFO per diluted share as follows:

|

|

|

|

Current |

Previous |

Net income: |

$0.50 to $0.51 |

$0.44 to $0.46 |

FFO: |

$1.64 to $1.65 |

$1.60 to $1.62 |

The company has also updated the assumptions that support its full year outlook for Net income and FFO in the following table (Pro-rata share; dollars in millions):

|

|

|

|

2024 Guidance Assumptions |

YTD @ 09.30.24 |

Current |

Previous |

Total acquisitions & structured investments combined: |

$572** |

$565 to $625 |

$300 to $350 |

Dispositions: |

$256 |

$250 to $300 |

$300 to $350 |

Same Property NOI growth (inclusive of RPT) |

3.3% |

3.25% + |

2.75% to 3.25% |

Credit loss as a % of total pro-rata rental revenues |

(0.73%) |

(0.75%) to (1.00%) |

(0.75%) to (1.00%) |

RPT-related non-cash GAAP income (above & below market rents and straight-line rents) |

$4 |

$5 to $6 |

$4 to $5 |

RPT-related cost saving synergies included in G&A |

Only showing full year impact |

$35 to $36 |

$35 to $36 |

Lease termination income |

$3 |

$3 to $4 |

$2 to $4 |

Interest income – Other income (attributable to cash on balance sheet) |

$16 |

$20 to $22 |

$13 to $15 |

Capital expenditures (tenant improvements, landlord work and leasing commissions) |

$201 |

$225 to $275 |

$225 to $275 |

**Includes the purchase of Waterford Lakes Town Center which occurred on October 1, 2024.

Conference Call Information

When: 8:30 AM ET, October 31, 2024

Live Webcast: 3Q24 Kimco Realty Earnings Conference Call or on Kimco Realty’s website investors.kimcorealty.com (replay available until January 31, 2025)

Dial #: 1-888-317-6003 (International: 1-412-317-6061). Passcode: 1893940

iii

500 North Broadway, Suite 201 | Jericho, NY 11753 | (833) 800-4343 kimcorealty.com

About Kimco Realty®

Kimco Realty® (NYSE: KIM) is a real estate investment trust (REIT) and leading owner and operator of high-quality, open-air, grocery-anchored shopping centers and mixed-use properties in the United States. The company’s portfolio is strategically concentrated in the first-ring suburbs of the top major metropolitan markets, including high-barrier-to-entry coastal markets and rapidly expanding Sun Belt cities. Its tenant mix is focused on essential, necessity-based goods and services that drive multiple shopping trips per week. Publicly traded on the NYSE since 1991 and included in the S&P 500 Index, the company has specialized in shopping center ownership, management, acquisitions, and value-enhancing redevelopment activities for more than 60 years. With a proven commitment to corporate responsibility, Kimco Realty is a recognized industry leader in this area. As of September 30, 2024, the company owned interests in 567 U.S. shopping centers and mixed-use assets comprising 101 million square feet of gross leasable space.

The company announces material information to its investors using the company’s investor relations website (investors.kimcorealty.com), SEC filings, press releases, public conference calls, and webcasts. The company also uses social media to communicate with its investors and the public, and the information the company posts on social media may be deemed material information. Therefore, the company encourages investors, the media, and others interested in the company to review the information that it posts on the social media channels, including Facebook (www.facebook.com/kimcorealty), Twitter (www.twitter.com/kimcorealty) and LinkedIn (www.linkedin.com/company/kimco-realty-corporation). The list of social media channels that the company uses may be updated on its investor relations website from time to time.

Safe Harbor Statement

This communication contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with the safe harbor provisions. Forward-looking statements, which are based on certain assumptions and describe the Company’s future plans, strategies and expectations, are generally identifiable by use of the words “believe,” “expect,” “intend,” “commit,” “anticipate,” “estimate,” “project,” “will,” “target,” “plan,” “forecast” or similar expressions. You should not rely on forward-looking statements since they involve known and unknown risks, uncertainties and other factors which, in some cases, are beyond the Company’s control and could materially affect actual results, performances or achievements. Factors which may cause actual results to differ materially from current expectations include, but are not limited to, (i) general adverse economic and local real estate conditions, (ii) the impact of competition, including the availability of acquisition or development opportunities and the costs associated with purchasing and maintaining assets; (iii) the inability of major tenants to continue paying their rent obligations due to bankruptcy, insolvency or a general downturn in their business, (iv) the reduction in the Company’s income in the event of multiple lease terminations by tenants or a failure of multiple tenants to occupy their premises in a shopping center, (v) the potential impact of e-commerce and other changes in consumer buying practices, and changing trends in the retail industry and perceptions by retailers or shoppers, including safety and convenience, (vi) the availability of suitable acquisition, disposition, development and redevelopment opportunities, and the costs associated with purchasing and maintaining assets and risks related to acquisitions not performing in accordance with our expectations, (vii) the Company’s ability to raise capital by selling its assets, (viii) disruptions and increases in operating costs due to inflation and supply chain disruptions, (ix) risks associated with the development of mixed-use commercial properties, including risks associated with the development, and ownership of non-retail real estate, (x) changes in governmental laws and regulations, including, but not limited to, changes in data privacy, environmental (including climate change), safety and health laws, and management’s ability to estimate the impact of such changes, (xi) the Company’s failure to realize the expected benefits of the merger with RPT Realty (the “RPT Merger”), (xii) the risk of litigation, including shareholder litigation, in connection with the RPT Merger, including any resulting expense, (xiii) risks related to future opportunities and plans for the combined company, including the uncertainty of expected future financial performance and results of the combined company, (xiv) the possibility that, if the Company does not achieve the perceived benefits of the RPT Merger as rapidly or to the extent anticipated by financial analysts or investors, the market price of the Company’s common stock could decline, (xv) valuation and risks related to the Company’s joint venture and preferred equity investments and other investments, (xvi) collectability of mortgage and other financing receivables, (xvii) impairment charges, (xviii) criminal cybersecurity attacks, disruption, data loss or other security incidents and breaches, (xix) risks related to artificial intelligence, (xx) impact of natural disasters and weather and climate-related events, (xxi) pandemics or other health crises, (xxii) our ability to attract, retain and motivate key personnel, (xxiii) financing risks, such as the inability to obtain equity, debt or other sources of financing or refinancing on favorable terms to the Company, (xxiv) the level and volatility of interest rates and management’s ability to estimate the impact thereof, (xxv) changes in the dividend

iv

500 North Broadway, Suite 201 | Jericho, NY 11753 | (833) 800-4343 kimcorealty.com

policy for the Company’s common and preferred stock and the Company’s ability to pay dividends at current levels, (xxvi) unanticipated changes in the Company’s intention or ability to prepay certain debt prior to maturity and/or hold certain securities until maturity, (xxvii) the Company’s ability to continue to maintain its status as a REIT for U.S. federal income tax purposes and potential risks and uncertainties in connection with its UPREIT structure, and (xxviii) other risks and uncertainties identified under Item 1A, “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023. Accordingly, there is no assurance that the Company’s expectations will be realized. The Company disclaims any intention or obligation to update the forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to refer to any further disclosures the Company makes in other filings with the Securities and Exchange Commission (“SEC”).

###

CONTACT:

David F. Bujnicki

Senior Vice President, Investor Relations and Strategy

Kimco Realty Corporation

(833) 800-4343

dbujnicki@kimcorealty.com

v

500 North Broadway, Suite 201 | Jericho, NY 11753 | (833) 800-4343 kimcorealty.com

|

|

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheets |

|

(in thousands, except share data) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

Assets: |

|

|

|

|

|

|

Real estate, net of accumulated depreciation and amortization |

|

|

|

|

|

|

of $4,225,563 and $3,842,869, respectively |

$ |

16,515,749 |

|

|

$ |

15,094,925 |

|

|

Investments in and advances to real estate joint ventures |

|

1,492,211 |

|

|

|

1,087,804 |

|

|

Other investments |

|

106,513 |

|

|

|

144,089 |

|

|

Cash, cash equivalents and restricted cash |

|

790,044 |

|

|

|

783,757 |

|

|

Marketable securities |

|

2,355 |

|

|

|

330,057 |

|

|

Accounts and notes receivable, net |

|

320,361 |

|

|

|

307,617 |

|

|

Operating lease right-of-use assets, net |

|

130,914 |

|

|

|

128,258 |

|

|

Other assets |

|

770,849 |

|

|

|

397,515 |

|

Total assets |

$ |

20,128,996 |

|

|

$ |

18,274,022 |

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

Notes payable, net |

$ |

7,966,940 |

|

|

$ |

7,262,851 |

|

|

Mortgages payable, net |

|

335,275 |

|

|

|

353,945 |

|

|

Accounts payable and accrued expenses |

|

309,272 |

|

|

|

216,237 |

|

|

Dividends payable |

|

6,722 |

|

|

|

5,308 |

|

|

Operating lease liabilities |

|

121,417 |

|

|

|

109,985 |

|

|

Other liabilities |

|

646,619 |

|

|

|

599,961 |

|

Total liabilities |

|

9,386,245 |

|

|

|

8,548,287 |

|

Redeemable noncontrolling interests |

|

73,688 |

|

|

|

72,277 |

|

|

|

|

|

|

|

|

Stockholders' Equity: |

|

|

|

|

|

|

Preferred stock, $1.00 par value, authorized 7,054,000 shares; |

|

|

|

|

|

|

Issued and outstanding (in series) 21,216 and 19,367 shares, respectively; |

|

|

|

|

|

|

Aggregate liquidation preference $576,602 and $484,179, respectively |

|

21 |

|

|

|

19 |

|

|

Common stock, $.01 par value, authorized 1,500,000,000 and 750,000,000

shares, respectively; issued and outstanding 674,082,065 and

619,871,237 shares, respectively |

|

6,741 |

|

|

|

6,199 |

|

|

Paid-in capital |

|

10,917,003 |

|

|

|

9,638,494 |

|

|

Cumulative distributions in excess of net income |

|

(387,067 |

) |

|

|

(122,576 |

) |

|

Accumulated other comprehensive (loss)/income |

|

(13,485 |

) |

|

|

3,329 |

|

Total stockholders' equity |

|

10,523,213 |

|

|

|

9,525,465 |

|

|

Noncontrolling interests |

|

145,850 |

|

|

|

127,993 |

|

Total equity |

|

10,669,063 |

|

|

|

9,653,458 |

|

Total liabilities and equity |

$ |

20,128,996 |

|

|

$ |

18,274,022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Income |

|

(in thousands, except per share data) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

Revenues from rental properties, net |

$ |

502,875 |

|

|

$ |

441,816 |

|

|

$ |

1,498,001 |

|

|

$ |

1,319,162 |

|

Management and other fee income |

|

4,757 |

|

|

|

4,249 |

|

|

|

13,616 |

|

|

|

12,635 |

|

Total revenues |

|

507,632 |

|

|

|

446,065 |

|

|

|

1,511,617 |

|

|

|

1,331,797 |

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

Rent |

|

(4,239 |

) |

|

|

(3,939 |

) |

|

|

(12,744 |

) |

|

|

(12,097 |

) |

Real estate taxes |

|

(64,996 |

) |

|

|

(57,875 |

) |

|

|

(194,538 |

) |

|

|

(173,002 |

) |

Operating and maintenance |

|

(88,744 |

) |

|

|

(76,604 |

) |

|

|

(262,267 |

) |

|

|

(226,919 |

) |

General and administrative |

|

(33,850 |

) |

|

|

(33,697 |

) |

|

|

(103,238 |

) |

|

|

(101,180 |

) |

Impairment charges |

|

(375 |

) |

|

|

(2,237 |

) |

|

|

(4,277 |

) |

|

|

(14,043 |

) |

Merger charges |

|

- |

|

|

|

(3,750 |

) |

|

|

(25,246 |

) |

|

|

(3,750 |

) |

Depreciation and amortization |

|

(144,688 |

) |

|

|

(127,437 |

) |

|

|

(447,555 |

) |

|

|

(382,983 |

) |

Total operating expenses |

|

(336,892 |

) |

|

|

(305,539 |

) |

|

|

(1,049,865 |

) |

|

|

(913,974 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Gain on sale of properties |

|

551 |

|

|

|

- |

|

|

|

944 |

|

|

|

52,376 |

|

Operating income |

|

171,291 |

|

|

|

140,526 |

|

|

|

462,696 |

|

|

|

470,199 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income/(expense) |

|

|

|

|

|

|

|

|

|

|

|

Special dividend income |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

194,116 |

|

Other income, net |

|

22,203 |

|

|

|

8,377 |

|

|

|

39,953 |

|

|

|

19,080 |

|

Gain/(loss) on marketable securities, net |

|

79 |

|

|

|

13,225 |

|

|

|

(27,613 |

) |

|

|

17,642 |

|

Interest expense |

|

(76,216 |

) |

|

|

(60,424 |

) |

|

|

(224,122 |

) |

|

|

(182,404 |

) |

Income before income taxes, net, equity in income of joint

ventures, net, and equity in income from other

investments, net |

|

117,357 |

|

|

|

101,704 |

|

|

|

250,914 |

|

|

|

518,633 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Provision)/benefit for income taxes, net |

|

(128 |

) |

|

|

729 |

|

|

|

(72,355 |

) |

|

|

(61,127 |

) |

Equity in income of joint ventures, net |

|

20,981 |

|

|

|

16,257 |

|

|

|

63,413 |

|

|

|

57,589 |

|

Equity in income of other investments, net |

|

216 |

|

|

|

2,100 |

|

|

|

9,468 |

|

|

|

8,741 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

138,426 |

|

|

|

120,790 |

|

|

|

251,440 |

|

|

|

523,836 |

|

Net income attributable to noncontrolling interests |

|

(2,443 |

) |

|

|

(2,551 |

) |

|

|

(6,693 |

) |

|

|

(9,208 |

) |

Net income attributable to the company |

|

135,983 |

|

|

|

118,239 |

|

|

|

244,747 |

|

|

|

514,628 |

|

Preferred dividends, net |

|

(7,961 |

) |

|

|

(6,285 |

) |

|

|

(23,864 |

) |

|

|

(18,736 |

) |

Net income available to the company's common shareholders |

$ |

128,022 |

|

|

$ |

111,954 |

|

|

$ |

220,883 |

|

|

$ |

495,892 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Per common share: |

|

|

|

|

|

|

|

|

|

|

|

Net income available to the company's common shareholders: (1) |

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.19 |

|

|

$ |

0.18 |

|

|

$ |

0.32 |

|

|

$ |

0.80 |

|

Diluted (2) |

$ |

0.19 |

|

|

$ |

0.18 |

|

|

$ |

0.32 |

|

|

$ |

0.80 |

|

Weighted average shares: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

671,231 |

|

|

|

617,090 |

|

|

|

670,851 |

|

|

|

616,888 |

|

Diluted |

|

671,577 |

|

|

|

617,271 |

|

|

|

671,096 |

|

|

|

619,495 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Adjusted for earnings attributable to participating securities of ($687) and ($641) for the three months ended September 30, 2024 and

2023, respectively. Adjusted for earnings attributable to participating securities of ($2,066) and ($2,460) for the nine months ended

September 30, 2024 and 2023, respectively. |

|

|

|

(2) Reflects the potential impact if certain units were converted to common stock at the beginning of the period. The impact of the

conversion would have an antidilutive effect on net income and therefore have not been included. Adjusted for distributions on

convertible units of $1,919 for the nine months ended September 30, 2023. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Net Income Available to the Company's Common Shareholders |

|

to FFO Available to the Company's Common Shareholders (1) |

|

(in thousands, except per share data) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net income available to the company's common shareholders |

$ |

128,022 |

|

|

$ |

111,954 |

|

|

$ |

220,883 |

|

|

$ |

495,892 |

|

|

Gain on sale of properties |

|

(551 |

) |

|

|

- |

|

|

|

(944 |

) |

|

|

(52,376 |

) |

|

Gain on sale of joint venture properties |

|

(7 |

) |

|

|

(1,130 |

) |

|

|

(1,501 |

) |

|

|

(9,020 |

) |

|

Depreciation and amortization - real estate related |

|

143,482 |

|

|

|

126,291 |

|

|

|

443,836 |

|

|

|

379,294 |

|

|

Depreciation and amortization - real estate joint ventures |

|

21,218 |

|

|

|

16,244 |

|

|

|

64,161 |

|

|

|

48,390 |

|

|

Impairment charges (including real estate joint ventures) |

|

375 |

|

|

|

2,237 |

|

|

|

8,778 |

|

|

|

14,040 |

|

|

Profit participation from other investments, net |

|

377 |

|

|

|

479 |

|

|

|

(5,299 |

) |

|

|

(2,282 |

) |

|

Special dividend income |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(194,116 |

) |

|

(Gain)/loss on marketable securities/derivative, net |

|

(4,849 |

) |

|

|

(6,225 |

) |

|

|

25,922 |

|

|

|

(10,642 |

) |

|

Provision/(benefit) for income taxes, net (2) |

|

59 |

|

|

|

(669 |

) |

|

|

71,706 |

|

|

|

61,463 |

|

|

Noncontrolling interests (2) |

|

(738 |

) |

|

|

(575 |

) |

|

|

(2,367 |

) |

|

|

(68 |

) |

FFO available to the company's common shareholders (4) |

$ |

287,388 |

|

|

$ |

248,606 |

|

|

$ |

825,175 |

|

|

$ |

730,575 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding for FFO calculations: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

671,231 |

|

|

|

617,090 |

|

|

|

670,851 |

|

|

|

616,888 |

|

|

Units |

|

3,293 |

|

|

|

2,562 |

|

|

|

3,245 |

|

|

|

2,555 |

|

|

Convertible preferred shares |

|

4,265 |

|

|

|

- |

|

|

|

4,265 |

|

|

|

- |

|

|

Dilutive effect of equity awards |

|

289 |

|

|

|

124 |

|

|

|

193 |

|

|

|

129 |

|

|

Diluted |

|

679,078 |

|

|

|

619,776 |

|

|

|

678,554 |

|

|

|

619,572 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FFO per common share - basic |

$ |

0.43 |

|

|

$ |

0.40 |

|

|

$ |

1.23 |

|

|

$ |

1.18 |

|

|

FFO per common share - diluted (3) |

$ |

0.43 |

|

|

$ |

0.40 |

|

|

$ |

1.23 |

|

|

$ |

1.18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

The company considers FFO to be an important supplemental measure of its operating performance and believes it is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs, many of which present FFO when reporting results. Comparison of the company's presentation of FFO to similarly titled measures for other REITs may not necessarily be meaningful due to possible differences in the application of the Nareit definition used by such REITs. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) |

Related to gains, impairments, depreciation on properties, gains/(losses) on sales of marketable securities and derivatives, where applicable. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) |

Reflects the potential impact of convertible preferred shares and certain units if converted to common stock at the beginning of the period. FFO available to the company’s common shareholders would be increased by $2,464 and $584 for the three months ended September 30, 2024 and 2023, respectively. FFO available to the company's common shareholders would be increased by $7,370 and $1,752 for the nine months ended September 30, 2024 and 2023, respectively. The effect of other certain convertible securities would have an anti-dilutive effect upon the calculation of FFO available to the company’s common shareholders per share. Accordingly, the impact of such conversion has not been included in the determination of diluted FFO per share calculations. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4) |

Includes merger-related charges of $25.2 million ($0.04 per share, on a diluted basis) for the nine months ended September 30, 2024. Includes merger-related charges of $3.8 million for both the three and nine months ended September 30, 2023. In addition, includes income related to the liquidation of the pension plan of $4.8 million, net and $5.0 million, net for the three and nine months ended September 30, 2023, respectively. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Net Income Available to the Company's Common Shareholders |

|

to Same Property NOI (1)(2) |

|

(in thousands) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net income available to the company's common shareholders |

$ |

128,022 |

|

|

$ |

111,954 |

|

|

$ |

220,883 |

|

|

$ |

495,892 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Management and other fee income |

|

(4,757 |

) |

|

|

(4,249 |

) |

|

|

(13,616 |

) |

|

|

(12,635 |

) |

|

General and administrative |

|

33,850 |

|

|

|

33,697 |

|

|

|

103,238 |

|

|

|

101,180 |

|

|

Impairment charges |

|

375 |

|

|

|

2,237 |

|

|

|

4,277 |

|

|

|

14,043 |

|

|

Merger charges |

|

- |

|

|

|

3,750 |

|

|

|

25,246 |

|

|

|

3,750 |

|

|

Depreciation and amortization |

|

144,688 |

|

|

|

127,437 |

|

|

|

447,555 |

|

|

|

382,983 |

|

|

Gain on sale of properties |

|

(551 |

) |

|

|

- |

|

|

|

(944 |

) |

|

|

(52,376 |

) |

|

Special dividend income |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(194,116 |

) |

|

Interest expense and other income, net |

|

54,013 |

|

|

|

52,047 |

|

|

|

184,169 |

|

|

|

163,324 |

|

|

(Gain)/loss on marketable securities, net |

|

(79 |

) |

|

|

(13,225 |

) |

|

|

27,613 |

|

|

|

(17,642 |

) |

|

Provision/(benefit) for income taxes, net |

|

128 |

|

|

|

(729 |

) |

|

|

72,355 |

|

|

|

61,127 |

|

|

Equity in income of other investments, net |

|

(216 |

) |

|

|

(2,100 |

) |

|

|

(9,468 |

) |

|

|

(8,741 |

) |

|

Net income attributable to noncontrolling interests |

|

2,443 |

|

|

|

2,551 |

|

|

|

6,693 |

|

|

|

9,208 |

|

|

Preferred dividends, net |

|

7,961 |

|

|

|

6,285 |

|

|

|

23,864 |

|

|

|

18,736 |

|

|

RPT same property NOI (3) |

|

- |

|

|

|

42,893 |

|

|

|

610 |

|

|

|

121,761 |

|

|

Non same property net operating income |

|

(10,664 |

) |

|

|

(14,368 |

) |

|

|

(36,620 |

) |

|

|

(43,209 |

) |

|

Non-operational expense from joint ventures, net |

|

28,231 |

|

|

|

23,106 |

|

|

|

85,629 |

|

|

|

61,911 |

|

Same Property NOI |

$ |

383,444 |

|

|

$ |

371,286 |

|

|

$ |

1,141,484 |

|

|

$ |

1,105,196 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

The company considers Same Property NOI as an important operating performance measure because it is frequently used by securities analysts and investors to measure only the net operating income of properties that have been owned by the company for the entire current and prior year reporting periods. It excludes properties under redevelopment, development and pending stabilization; properties are deemed stabilized at the earlier of (i) reaching 90% leased or (ii) one year following a project’s inclusion in operating real estate. Same Property NOI assists in eliminating disparities in net income due to the development, acquisition or disposition of properties during the particular period presented, and thus provides a more consistent performance measure for the comparison of the company's properties. The company’s method of calculating Same Property NOI may differ from methods used by other REITs and, accordingly, may not be comparable to such other REITs. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) |

Amounts represent Kimco Realty's pro-rata share. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) |

Amounts for the respective periods, represent the Same property NOI from RPT properties, not included in the Company's Net income available to the Company's common shareholders. |

|

|

|

|

|

|

|

|

|

|

Reconciliation of the Projected Range of Net Income Available to the Company's Common Shareholders |

|

to Funds From Operations Available to the Company's Common Shareholders |

|

(unaudited, all amounts shown are per diluted share) |

|

|

|

|

|

|

|

|

|

|

Projected Range |

|

|

|

Full Year 2024 |

|

|

|

Low |

|

|

High |

|

Net income available to the company's common shareholders |

$ |

0.50 |

|

|

$ |

0.51 |

|

|

|

|

|

|

|

|

Gain on sale of properties |

|

- |

|

|

|

(0.01 |

) |

|

|

|

|

|

|

|

Gain on sale of joint venture properties |

|

- |

|

|

|

(0.01 |

) |

|

|

|

|

|

|

|

Depreciation & amortization - real estate related |

|

0.87 |

|

|

|

0.88 |

|

|

|

|

|

|

|

|

Depreciation & amortization - real estate joint ventures |

|

0.12 |

|

|

|

0.13 |

|

|

|

|

|

|

|

|

Impairment charges (including real estate joint ventures) |

|

0.01 |

|

|

|

0.01 |

|

|

|

|

|

|

|

|

Profit participation from other investments, net |

|

(0.01 |

) |

|

|

(0.01 |

) |

|

|

|

|

|

|

|

Loss on marketable securities, net |

|

0.04 |

|

|

|

0.04 |

|

|

|

|

|

|

|

|

Provision for income taxes |

|

0.11 |

|

|

|

0.11 |

|

|

|

|

|

|

|

|

FFO available to the company's common shareholders |

$ |

1.64 |

|

|

$ |

1.65 |

|

|

|

|

|

|

|

|

Merger Cost Adjustment |

|

0.04 |

|

|

|

0.04 |

|

|

|

|

|

|

|

|

FFO Excluding Merger Costs |

$ |

1.68 |

|

|

$ |

1.69 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Projections involve numerous assumptions such as rental income (including assumptions on percentage rent), interest rates, tenant defaults, occupancy rates, selling prices of properties held for disposition, expenses (including salaries and employee costs), insurance costs and numerous other factors. Not all of these factors are determinable at this time and actual results may vary from the projected results, and may be above or below the range indicated. The above range represents management’s estimate of results based upon these assumptions as of the date of this press release. |

|

v3.24.3

Document and Entity Information

|

Oct. 31, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 31, 2024

|

| Entity File Number |

1-10899

|

| Entity Registrant Name |

KIMCO REALTY CORPORATION

|

| Entity Central Index Key |

0000879101

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Tax Identification Number |

13-2744380

|

| Entity Address, Address Line One |

500 N. Broadway

|

| Entity Address, Address Line Two |

Suite 201

|

| Entity Address, City or Town |

Jericho

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

11753

|

| City Area Code |

516

|

| Local Phone Number |

869-9000

|

| Entity Emerging Growth Company |

false

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Common Stock, par value $.01 per share [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $.01 per share

|

| Trading Symbol |

KIM

|

| Security Exchange Name |

NYSE

|

| Depositary Shares, each representing one-thousandth of a share of 5.125% Class L Cumulative Redeemable, Preferred Stock [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares, each representing one-thousandth of a share of 5.125% Class L Cumulative Redeemable, Preferred Stock

|

| Trading Symbol |

KIMprL

|

| Security Exchange Name |

NYSE

|

| Depositary Shares, each representing one-thousandth of a share of 5.250% Class M Cumulative Redeemable, Preferred Stock [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares, each representing one-thousandth of a share of 5.250% Class M Cumulative Redeemable, Preferred Stock

|

| Trading Symbol |

KIMprM

|

| Security Exchange Name |

NYSE

|

| Depositary Shares, each representing one-thousandth of a share of 7.250% Class N Cumulative Convertible Perpetual Preferred Stock [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares, each representing one-thousandth of a share of 7.250% Class N Cumulative Convertible, Preferred Stock

|

| Trading Symbol |

KIMprN

|

| Security Exchange Name |

NYSE

|

| Kimco Realty OP, LLC [Member] |

|

| Entity Information [Line Items] |

|

| Entity File Number |

333-269102-01

|

| Entity Registrant Name |

KIMCO REALTY OP, LLC

|

| Entity Central Index Key |

0001959472

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

92-1489725

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=kim_CommonStockParValue01PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=kim_DepositarySharesEachRepresentingOneThousandthOfAShareOf5125ClassLCumulativeRedeemablePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=kim_DepositarySharesEachRepresentingOneThousandthOfAShareOf5250ClassMCumulativeRedeemablePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=kim_DepositarySharesEachRepresentingOneThousandthOfAShareOf7250ClassNCumulativeConvertiblePerpetualPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=kim_KimcoRealtyOPLLCMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

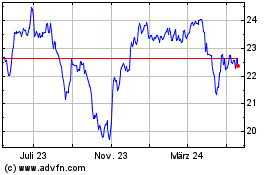

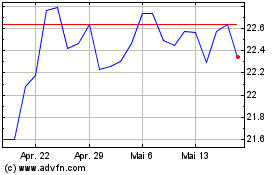

Kimco Realty (NYSE:KIM-M)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Kimco Realty (NYSE:KIM-M)

Historical Stock Chart

Von Jan 2024 bis Jan 2025